Professional Documents

Culture Documents

Accounting Solution 2

Uploaded by

MahaGul KaziOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Solution 2

Uploaded by

MahaGul KaziCopyright:

Available Formats

Question P2-2A Page 82

Journal

Date Apr 1 Apr 2 Apr 3 Apr 10 Apr 11 Apr 20 Apr 30 Apr 30 Account Titles and Explanation Cash Capital (Being invested) Rent expenses Cash (Pay for rent) Supplies Account Payable (Purchase supplies on account) Account receivable Revenue (Provide service on account) Cash Unearned revenue (receive cash for an unearned service) Cash Service revenue (provide service) Salary expenses Cash (Pay for salaries) Account payable Cash (pay for account payable) Ledger Accounts Cash Capital Rent expenses Unearned revenue Service revenue Salaries expenses Account payable Debit 40000 1000 2100 2400 1600 Debit 38100 Credit 1000 Amount 40000 39000 40000 42100 39700 38100 Debit 40000 1000 1000 4000 4000 5100 5100 1000 1000 2100 2100 2400 2400 1600 1600 Credit 40000

Capital Debit Cash Credit 40000 Ledger Accounts Rent expenses Debit 1000 Debit 1000 Credit Amount 1000 Credit 40000 Amount 40000

Cash

Ledger Accounts Supplies Debit 4000 Debit 4000 Account receivable Debit 5100 Debit 5100 Service revenue Debit Account receivable Cash Credit 7200 Unearned revenue Debit Cash Credit 1000 Salaries expenses Debit 2400 Debit 2400 Credit Amount 4000

Account payable

Credit

Service revenue

Amount 5100

Credit 5100 2100

Amount 5100 7200

Credit 1000

Amount 1000

Credit

Cash

Amount 2400

Account payable Debit Supplies Cash 1600 Credit 2400 Trial Balance Debit Cash 3800 Rent expenses 1000 Salaries expenses 4000 Supplies 4000 Account receivable 5100 50600

Credit 4000

Amount 4000 2400

Credit Service revenue 7200 Capital 40000 Unearned revenue 1000 Account payable 2400 Total 50600

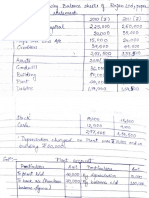

Question P2-3A Page 84

Journal

Date May 1 May 1 May 1 Account Titles and Explanation Cash Capital (Being Cash invested in business) Prepaid rent Cash (Pay for 1 year rent in advance) Equipment Cash Account payable (Purchase equipment paying 10000 cash and 20000 on account) Prepaid insurance Cash (Paid one year policy) Office supplies Cash (Purchase office supplies) Office supplies Account payable (Purchase office supplies on account) Cash Account receivable Revenue (Receive 28000 on service provided and 12000 on account) Account payable Cash (Pay for supplies on account payable) Cash Account receivable (Received on account receivable) Expenses Cash (pay salaries for the month) Debit 50000 Credit 50000 24000 24000 30000 10000 20000 1800 1800 500 500 1500 1500 28000 12000 40000 400 400 3000 3000 5600 5600

May 1 May May May

May May May

Ledger Accounts Cash Capital Prepaid rent Equipment Prepaid insurance Office supplies Revenue Account payable Account receivable Expenses Debit 50000 Credit 24000 10000 1800 500 28000 400 3000 5600 Debit 38700 Capital Debit Cash Credit 50000 Prepaid rent Debit 24000 Debit 24000 Equipment Debit 10000 20000 Debit 30000 Prepaid insurance Debit 1800 Debit 1800 Office supplies Debit 500 1500 Credit 50000 Amount 50000 Amount 50000 26000 16000 14200 13700 41700 41300 44300 38700

Credit

Cash

Amount 24000

Credit

Cash Account payable

Amount 10000 30000

Credit

Cash

Amount 1800

Credit

Cash Account payable

Amount 500 2000

Debit 2000 Account payable Debit Equipments Office supplies Cash

Credit 20000 1500

400 Credit 22100 Account receivable Debit 12000 Debit 9000 Expenses Debit 5600 Debit 5600 Revenue Debit

Amount 20000 22500 21100

Credit 3000

Revenue Cash

Amount 12000 9000

Credit

Cash

Amount 5600

Cash Account receivable Credit 40000 Trial Balance Debit Cash 38700 Prepaid rent 24000 Equipment 30000 Prepaid insurance 1800 Office supplies 2000 Account receivable 9000 Expenses 5600 111100

Credit 28000 12000

Amount 28000 40000

Credit Capital 50000 Account payable 21100 Revenue 40000

Total 111100

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- CAC Learner GuideDocument61 pagesCAC Learner GuideMahaGul Kazi100% (1)

- Why Hollywood Loves Tenerife's Scenic Beauty and Year-Round SunshineDocument1 pageWhy Hollywood Loves Tenerife's Scenic Beauty and Year-Round SunshineMahaGul KaziNo ratings yet

- Active Packaging of FoodDocument12 pagesActive Packaging of FoodMahaGul KaziNo ratings yet

- Class IX Excel & Access Practice QuestionsDocument6 pagesClass IX Excel & Access Practice QuestionsMahaGul KaziNo ratings yet

- 15 REASONS TO VISIT THE COSTA DEL SOL VILLAGE OF MIJASDocument2 pages15 REASONS TO VISIT THE COSTA DEL SOL VILLAGE OF MIJASMahaGul KaziNo ratings yet

- Walmart's Retail System and Growth Through Efficient SCMDocument12 pagesWalmart's Retail System and Growth Through Efficient SCMMahaGul KaziNo ratings yet

- Lincoln Hospital IntroDocument2 pagesLincoln Hospital IntroMahaGul KaziNo ratings yet

- Urdu NovelDocument6 pagesUrdu NovelMahaGul KaziNo ratings yet

- Directors Report 07-08Document4 pagesDirectors Report 07-08MahaGul KaziNo ratings yet

- Directors Report 07-08Document4 pagesDirectors Report 07-08MahaGul KaziNo ratings yet

- Sampling ProceduresDocument2 pagesSampling ProceduresMahaGul KaziNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Southworth Company SelfDocument3 pagesSouthworth Company SelfJoan RecasensNo ratings yet

- Financial Analysis of Unilever PakistanDocument7 pagesFinancial Analysis of Unilever Pakistanzainab malikNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- Heads and Sub Heads (Water Mark)Document10 pagesHeads and Sub Heads (Water Mark)AnimeeNo ratings yet

- 2010 08 21 - 142723 - P11 2aDocument3 pages2010 08 21 - 142723 - P11 2aJessica DragonIvyNo ratings yet

- Ia2 16 Accounting For Income TaxDocument55 pagesIa2 16 Accounting For Income TaxJoyce Anne Garduque100% (1)

- FABM2 1st Half of 1st Quarter Reviewer ACRSDocument2 pagesFABM2 1st Half of 1st Quarter Reviewer ACRSAfeiyha Czarina SantiagoNo ratings yet

- Ch12 Harrison 8e GE SMDocument87 pagesCh12 Harrison 8e GE SMMuh BilalNo ratings yet

- Multiple Choice Questions AccountsDocument3 pagesMultiple Choice Questions AccountsSanchit Taksali0% (1)

- Annual Report 2010 70 89Document1 pageAnnual Report 2010 70 89Manik SahaNo ratings yet

- Case - Ragan Engines Group 9Document9 pagesCase - Ragan Engines Group 9Ujjwal BatraNo ratings yet

- Corporate Valuation A Guide For Analysts Managers and Investors PDFDocument358 pagesCorporate Valuation A Guide For Analysts Managers and Investors PDFMalcomNo ratings yet

- Numbers Tables BallsDocument5 pagesNumbers Tables BallsKia Khyte FloresNo ratings yet

- Capital Budgeting: R.KasilingamDocument71 pagesCapital Budgeting: R.Kasilingamvijayadarshini vNo ratings yet

- Shoba LTD PDFDocument72 pagesShoba LTD PDFkasperNo ratings yet

- Operations Management-Cost Measurement Methods & TechniquesDocument6 pagesOperations Management-Cost Measurement Methods & TechniquesjbphamNo ratings yet

- تمرين 1Document4 pagesتمرين 1نجم الدين طه الشرفيNo ratings yet

- Construction ContractsDocument9 pagesConstruction ContractsShiela Dimaun100% (3)

- Incremental AnalysisDocument32 pagesIncremental AnalysisLindaLindy0% (1)

- Paper 4 Financial ManagementDocument321 pagesPaper 4 Financial ManagementExcel Champ0% (2)

- Question and Answer - 28Document30 pagesQuestion and Answer - 28acc-expert33% (3)

- ACCT 210-Fall 21-22-Revision Sheet - FinalDocument3 pagesACCT 210-Fall 21-22-Revision Sheet - FinalAndrew PhilipsNo ratings yet

- Accounting in Action: Assignment Classification TableDocument53 pagesAccounting in Action: Assignment Classification Tablenasir khalidNo ratings yet

- TS Grewal Solutions For Financial Statements of Not-for-Pro T Organisations Class 11 AccountancyDocument39 pagesTS Grewal Solutions For Financial Statements of Not-for-Pro T Organisations Class 11 AccountancyVills GondaliyaNo ratings yet

- Econ F315 1923 CM 2017 1Document3 pagesEcon F315 1923 CM 2017 1Abhishek GhoshNo ratings yet

- Annex - 25 - Life Cycle Cost Comparison of Different STP ProcessesDocument10 pagesAnnex - 25 - Life Cycle Cost Comparison of Different STP ProcessesDien NoelNo ratings yet

- Penguin Corporation Acquired 80 Percent of The Outstanding Voting StockDocument1 pagePenguin Corporation Acquired 80 Percent of The Outstanding Voting Stocktrilocksp SinghNo ratings yet

- VISHAL Business PlanDocument30 pagesVISHAL Business PlanNagarjuna FeliNo ratings yet

- Solutions of Cash Flow Statement QuestionsDocument7 pagesSolutions of Cash Flow Statement QuestionsSuvana YasminNo ratings yet

- Breakaway Bicycle Company, Inc. Balance Sheet - December 31, 2000Document12 pagesBreakaway Bicycle Company, Inc. Balance Sheet - December 31, 2000SyAeRaNNo ratings yet