Professional Documents

Culture Documents

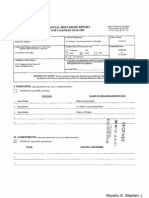

John Feikens Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

John Feikens Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

[

~olo gev. 112OLO

FINANCIAL DISCLOSURE REPORT

FOR CALENDAR YEAR 2009

2. Court or Organization US District Ct/ED of Michigan 5a. Report Type (check appropriate type) [] N~minafion, [] Initial Date [] Annual [] Final

ReportRcquiredbytt~eEthiCS Government Act of 1978

0 u.s.c, app. ff 101-111)

3. Date of Report 04/09/2010 6. Reporting Period 01/01/2009 to 12131/2009

1. Person Reporting (las~. name. first, middle initial) Feikens, John 4. Title (Article Ill judges ir~dicate active or senior status; magistrate judges indicate full- or part-time) US DistrictJudge/Sr. Status

7. Chambers or Office Address "Fheodor~ Levin US Courthouse 231 W. Lafayette, Rm 851 Detroit, M148226

i 5b. [] Amended Report 8. On the basis of the information contained in this Report and any modilications pertaining thereto, it is, In my opinion, In compliance with applicable laws and regulations. Re~lewlng Officer Date

IMPORTANT NOTES: The instruction~ accompanying this form must be fotlowetL Complete all parts,

checking the NONE box for each part where )~u have no reportable information. Sign on last pag~

I. POSITIONS. ~,~oni,~g i.~via,a o~y: scow. ~-t J of p,~ instructions.)

NONE (No reportable positions.) POSITION

1.

NAME OF ORGANIZATION/ENTITY

5. CL- :..

II. AG~EMENTS. (gepo,ing individual only; ,,pp. 14-16 of ~ng instruction~)

~ NONE ~o reportable agreements.)

C3

~

1.

pARTIES AND TE~S

Feikens, John

FINANCIAL DISCLOSURE REPORT Page 2 of 6

I

[

Nameof Per~iOll Reporting

DateofRcporl

04/09/2010 Feikens, John

Ill. NON-INVESTMENT INCOME. ~R,poni.g individual and spouse; xee pp. 17-24 of filing instructions)

A. Fliers Non-Investment Income NONE (No reportable nonoinvestment income.) DATE

I.

2.

SOURCE AND TYPE

INCOME

(you~, not spouses)

3.

4.

B. Spouses Non-Investm ent Income - tf ~,ou wert married during an), portion of the reporting year, complete this section.

(Dollar amount not required exccpt for honoraria.)

~-]

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

I.

2. 3.

4.

IV. REIMB URSEMENTS - t,,nsport,tio,. Iodu~.g,ood. e~t,i,me,~

(Includes those to spouse and dependent children," see pp. 2.$-27 of filing instructions.)

[]

NONE (No reportable reimbursements.)

SO[JRC~ ~

LOCATION

pURPOSE

ITEMS PAID OR PROVIDED

1.

2. 3.

4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting

Date of Report

o4/ognmo

I Feikens, John V. GIFTS. ana.des those to spouse and dc,pende~l children; see pp. 28-31 of JTling instru~:tior~)

[] NONE (No reportable gifts.) SOURCE

1.

DESCRIPTION

VALUE

2. 3. 4. 5.

~-]

NONE (No reportable liabilities.) CRED|TOR DESCRIPTION VALUE CODE

1. 2. 3.

4.

5.

FINANCIAL DISCLOSURE REPORT

[ N,m, ofP~,,on R,pon~ng

~/09/2010

Page 4 of 6 [

NONE (No reportable income, ~sets, or tramactions.)

D~cfiption of As~e~ (including t~st a~ets) ] In.me d~g ~i~ p~i~ Gross value at end

Feikens, John

VII. INVESTMENTS and TRUSTS -~o~ ~. ~,~o~ a~#~ ~o~ o~,~o~,~ ~ ~, ~d,~: ~, r~.

of r~o~ing p~

Value

~de 2

0)

Place "(X)" aRer ~h as~t

cxempt from prior disclo~r

~)

T~ (e.g.,

div,,

0)

Amount

Code 1

] (~)

Mc~

Val~

Code3

0)

T~ (e.g.,

buy, ~ll,

I

Date

m~d~

V~u~ G~n

Co~

ld~ of (ifpfivme

] (A-H)

1. Comcrica Bank C

oriat.)

Int,rest

(J-P) ]

M

~demption)

(J-P) (A-~ ~

2.

3,

Bank One/Chase!JP Morgan

Franklin MI Ins Fund

C

D

Interest

Interest

M

M

T

T

4.

Ann Arbor Properties XllI (Ann Arbor, Michigan)

C A

Rent Dividend

K J

U T

5, Ford Motor Company Stock

10. 11.

12. 13. 14.

15. 16. 17.

I. Income Gain Codes: (Se Columns BI and D4) 2. Value Codes (Set: Columns Cl and D J) ~. Value Method Coder ($e Colurrm C2)

A =$1,000 or less F -$50.001 - $100.000 J -$ I 5,000 ot less N =$250,001 - $50~.000 P3 ~ $25.000,001 - $50,0~0,000 Q =Appraisa] U =Book. Value

B -$1,001 - $2.51~ 13 =$100.001 - $1,000,000 K ~$ IJ.001 - $50,000 O =$500,0OI - $1,000,000 P. =Cost (Real Esaate Onl)) V ,=Other

C =$2,501 . $~,000 HI -$1,00O,001. $5,000,000 L =$50.001 - $100,000 Pl =$1,000,001 - $5,000,000 P4 ~More than $50.000,000 $ =Assessment W =E~-timaled

D =$5,001 - $15,000 H2 ~Ao~ than $5.000.000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000.000 T ,,-Cash Market

E =$15,001 . $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

] Feikens, John

04/09/2010

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Indlc~tepartofRepor)

FINANCIAL DISCLOSURE REPORT

N~me of Per, on Reporting

Date of Report

Pago 6 of 6

IX. CERTIFICATION.

Feikens, John

04/09/2010

1 certify that all information given above (Including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are In compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: ANY INDIVIDUAL \VItO KNO\VINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Donald J Stohr Financial Disclosure Report For 2010Document7 pagesDonald J Stohr Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Spencer J Letts Financial Disclosure Report For 2009Document6 pagesSpencer J Letts Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joel Pisano Financial Disclosure Report For 2010Document6 pagesJoel Pisano Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kenneth M Karas Financial Disclosure Report For 2010Document7 pagesKenneth M Karas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kevin M Moore Financial Disclosure Report For 2010Document6 pagesKevin M Moore Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John R Smoak Financial Disclosure Report For 2010Document7 pagesJohn R Smoak Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Legrome D Davis Financial Disclosure Report For 2010Document6 pagesLegrome D Davis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Paul J Barbadoro Financial Disclosure Report For 2010Document7 pagesPaul J Barbadoro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John P Bailey Financial Disclosure Report For 2010Document7 pagesJohn P Bailey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen J Murphy III Financial Disclosure Report For 2009Document8 pagesStephen J Murphy III Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John W Darrah Financial Disclosure Report For 2010Document6 pagesJohn W Darrah Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Maurice M Paul Financial Disclosure Report For 2010Document22 pagesMaurice M Paul Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- George C Smith Financial Disclosure Report For 2010Document6 pagesGeorge C Smith Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gregory M Sleet Financial Disclosure Report For 2010Document6 pagesGregory M Sleet Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Clarence A Beam Financial Disclosure Report For 2010Document7 pagesClarence A Beam Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph E Irenas Financial Disclosure Report For 2010Document11 pagesJoseph E Irenas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lawrence E Kahn Financial Disclosure Report For 2009Document6 pagesLawrence E Kahn Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MDocument7 pagesTanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MJudicial Watch, Inc.No ratings yet

- Patrick J Duggan Financial Disclosure Report For 2009Document7 pagesPatrick J Duggan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Rosemary S Pooler Financial Disclosure Report For 2010Document7 pagesRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carol E Jackson Financial Disclosure Report For 2009Document6 pagesCarol E Jackson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Brian S Miller Financial Disclosure Report For 2010Document6 pagesBrian S Miller Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard A Schell Financial Disclosure Report For 2010Document7 pagesRichard A Schell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert C Jones Financial Disclosure Report For 2010Document6 pagesRobert C Jones Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James E Kinkeade Financial Disclosure Report For 2010Document6 pagesJames E Kinkeade Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph A Greenaway JR Financial Disclosure Report For 2010Document7 pagesJoseph A Greenaway JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kevin T Duffy Financial Disclosure Report For 2010Document7 pagesKevin T Duffy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Fortunato P Benavides Financial Disclosure Report For 2010Document12 pagesFortunato P Benavides Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard D Bennett Financial Disclosure Report For 2010Document7 pagesRichard D Bennett Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2010Document7 pagesRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Orlando L Garcia Financial Disclosure Report For 2010Document7 pagesOrlando L Garcia Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ronald L Buckwalter Financial Disclosure Report For 2010Document6 pagesRonald L Buckwalter Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ricardo M Urbina Financial Disclosure Report For 2010Document6 pagesRicardo M Urbina Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William B Enright Financial Disclosure Report For 2010Document6 pagesWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roslynn R Mauskopf Financial Disclosure Report For 2010Document6 pagesRoslynn R Mauskopf Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Betty B Fletcher Financial Disclosure Report For 2010Document7 pagesBetty B Fletcher Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Janis L Sammartino Financial Disclosure Report For Sammartino, Janis LDocument6 pagesJanis L Sammartino Financial Disclosure Report For Sammartino, Janis LJudicial Watch, Inc.No ratings yet

- Anthony Battaglia Financial Disclosure Report For Battaglia, AnthonyDocument7 pagesAnthony Battaglia Financial Disclosure Report For Battaglia, AnthonyJudicial Watch, Inc.No ratings yet

- Stanley T Anderson Financial Disclosure Report For 2010Document6 pagesStanley T Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ancer L Haggerty Financial Disclosure Report For 2010Document7 pagesAncer L Haggerty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- George P Murphy Financial Disclosure Report For 2010Document6 pagesGeorge P Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Eric F Melgren Financial Disclosure Report For 2010Document6 pagesEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Royce C Lamberth Financial Disclosure Report For 2010Document6 pagesRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- George C Steeh Financial Disclosure Report For 2010Document6 pagesGeorge C Steeh Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Claudia Wilken Financial Disclosure Report For 2010Document7 pagesClaudia Wilken Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ralph K Winter Financial Disclosure Report For 2010Document7 pagesRalph K Winter Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thomas N ONeill JR Financial Disclosure Report For 2009Document6 pagesThomas N ONeill JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Henry F Floyd Financial Disclosure Report For 2010Document6 pagesHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Vining JR Financial Disclosure Report For 2010Document7 pagesRobert L Vining JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Vanessa D Gilmore Financial Disclosure Report For 2010Document6 pagesVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold D Vietor Financial Disclosure Report For 2010Document6 pagesHarold D Vietor Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alan B Johnson Financial Disclosure Report For 2010Document7 pagesAlan B Johnson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael A Telesca Financial Disclosure Report For 2009Document6 pagesMichael A Telesca Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Michael A Chagares Financial Disclosure Report For 2010Document6 pagesMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- Province of Camarines Sur, Represented by Governor Luis Raymund F. Villafuerte, JR.Document30 pagesProvince of Camarines Sur, Represented by Governor Luis Raymund F. Villafuerte, JR.Rain Agdeppa CatagueNo ratings yet

- Credit Transactions - Cases Assigned June 16, 2014 DigestedDocument5 pagesCredit Transactions - Cases Assigned June 16, 2014 DigestedMaria Reylan GarciaNo ratings yet

- Augusto Gomez Vs Gomez DigestDocument3 pagesAugusto Gomez Vs Gomez DigestCherith MonteroNo ratings yet

- Evidence Case DigestsDocument4 pagesEvidence Case DigestsjilliankadNo ratings yet

- Copyright and Fair Dealing: Guidelines For Documentary FilmmakersDocument24 pagesCopyright and Fair Dealing: Guidelines For Documentary FilmmakersmillrickNo ratings yet

- Code of ComunidadesDocument215 pagesCode of ComunidadesVividh PawaskarNo ratings yet

- Hearsay Evidence Rule and Its Exception CompilationDocument46 pagesHearsay Evidence Rule and Its Exception CompilationShine Billones100% (2)

- Seven Lamps of Advocacy-1Document12 pagesSeven Lamps of Advocacy-1ShohanNo ratings yet

- Deposition of David J SternDocument277 pagesDeposition of David J SternJusticeForAmericansNo ratings yet

- LawpptDocument24 pagesLawpptBadens DgNo ratings yet

- Custom and DutiesDocument4 pagesCustom and DutiesDanica Irish RevillaNo ratings yet

- Bloche Settlementagreementandrelease Ausexample 2 503 1929Document8 pagesBloche Settlementagreementandrelease Ausexample 2 503 1929ghilphilNo ratings yet

- 2017 LHC 4506Document45 pages2017 LHC 4506haseeb_javed_9No ratings yet

- De Knecht v. BautistaDocument1 pageDe Knecht v. BautistaLeyardNo ratings yet

- Stat Con CasesDocument292 pagesStat Con CasesMarjorieBaltazarNo ratings yet

- Noriega v. SisonDocument3 pagesNoriega v. Sisoniaton77No ratings yet

- Co Tiamco Vs DiazDocument10 pagesCo Tiamco Vs DiazVienna Mantiza - PortillanoNo ratings yet

- Revised Radio Laws PPT 3846 NTCDocument62 pagesRevised Radio Laws PPT 3846 NTCMelric Lamparas0% (1)

- Prudential Bank V CA and Valenzuela GR#125536 Mar 16, 2000Document4 pagesPrudential Bank V CA and Valenzuela GR#125536 Mar 16, 2000Ina VillaricaNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Renato Orpilla at ATONG, Accused-AppellantDocument7 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Renato Orpilla at ATONG, Accused-AppellantMatthew DiazNo ratings yet

- Alunan Vs Mirasol G.R. No. 108399 CASE DIGEST PDFDocument1 pageAlunan Vs Mirasol G.R. No. 108399 CASE DIGEST PDFJoannMarieBrenda delaGenteNo ratings yet

- Adderley V State of Fla - Effect of An Ignorant PublicDocument129 pagesAdderley V State of Fla - Effect of An Ignorant PublicgoldilucksNo ratings yet

- Immigration Geopolitics Beyond The Mexico-US BorderDocument23 pagesImmigration Geopolitics Beyond The Mexico-US Bordererodriguez101No ratings yet

- CHAPTER 1 (Sections 2 and 3) Nature of Registration Proceedings, JurisdictionDocument12 pagesCHAPTER 1 (Sections 2 and 3) Nature of Registration Proceedings, JurisdictionJoseph GabutinaNo ratings yet

- Ismael Mathay Vs Court of AppealsDocument2 pagesIsmael Mathay Vs Court of AppealsEarl LarroderNo ratings yet

- Lucman vs. Malawi Gr159794Document18 pagesLucman vs. Malawi Gr159794albemartNo ratings yet

- Baker v. Carr Case DigestDocument2 pagesBaker v. Carr Case DigestJuvial Guevarra BostonNo ratings yet

- Paredes Miguel Federal Habeas Rule 60 Cert Pet FILED.20141027Document108 pagesParedes Miguel Federal Habeas Rule 60 Cert Pet FILED.20141027Tasneem NNo ratings yet

- G.R. No. 183947, September 21, 2016 - RIZAL COMMERCIAL BANKING CORPORATION, Petitioner, v. TEODORO G. BERNARDINO, Respondent.: September 2016 - Philipppine Supreme Court DecisionsDocument28 pagesG.R. No. 183947, September 21, 2016 - RIZAL COMMERCIAL BANKING CORPORATION, Petitioner, v. TEODORO G. BERNARDINO, Respondent.: September 2016 - Philipppine Supreme Court DecisionsElie IbarretaNo ratings yet

- Case Digest: Banco de Oro Universal Bank V. Court of APPEALS, Et AlDocument1 pageCase Digest: Banco de Oro Universal Bank V. Court of APPEALS, Et AlBoyong HachasoNo ratings yet