Professional Documents

Culture Documents

George A OToole Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

George A OToole Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

1. Person Reporting (last name, first, middle initial) OToole, George A.

4. Title (Article IlI judges indicate active or senior status; magistrate judges indicate full- or part-time)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

2. Court or Organization U.S. District Court

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

3. Date of Report 05/12/2011

6. Reporting Period 01/01/2010 to 12/31/2010

District Judge (Active)

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

John Joseph Moakley United States Courthouse 1 Courthouse Way, Suite 4-730 Boston, MA 02210

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts, checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. ~Reponlnginaivlduat on~y; seepS. 9-13 off!ling instructions.)

D

NONE ~o reportable positions.)

POSITION NAME OF ORGANIZATION/ENTITY

Trust # 1

1. 2.

Trustee

4. 5.

II. AGREEMENTS. m~,o~ing inaiviauat o,ty; see pp. 14-16 of filing instructions.)

~] NONE (No reportable agreements.) DATE PARTIES AND TERMS

OToole, Geor.qe A.

FINANCIAL DISCLOSURE REPORT Page 2 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

III. NON-INVESTMENT INCOME. (Reporting individual andspouse; seepp. 17-24 of filing instructions.)

A. Filers Non-lnvestment Income

~] NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

B. Spouses Non-lnvestment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

[]

NONE (No reportable non-investment income.)

DATE

1.2010 2.2010 3. 4.

SOURCE AND TYPE Enterprise Bank, Lowell MA (directors fees) Raytheon Company (employment)

IV. REIMBURSEMENTS --transportation, lodging, food, entertainmenL

(Includes those to spouse and dependent children," see pp. 25-27 off!ling instructions.)

NONE (No reportable reimbursements.)

SOURCE American Conference Institute DATES February 25-26,2010 LOCATION New York, New York PURPOSE Employment Discrimintation Seminar

ITEMS PAID OR PROVIDED Transportation, lodging and meals

3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 1 5

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

V. GIFTS. aneludes ,hose to spouse and dependent children; see pp. 28-3l of filing instructions.)

NONE (No reportable gifts.)

SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. aneludes those of spouse and dependent children; seepp. 32-33 of f!ling instructions.)

NONE (No reportable liabilities.)

CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

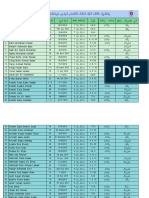

VII. INVESTMENTS and TRUSTS - income, va~ue, t ...... tions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A Description of Assets (including t~st assets) Place "(X)" after each asset exempt from prior disclosure B. income during reporting period C. " Gross value at end of reporting period D~ Transactions during reporting period (2) (3) (4) Date Value Gain mm/dd/yy Code2 Code I (J-P) (A-H) (5) Identity of bu~,er/seller (if private

(1) Amount Code I (A-H)

(2) Type (e.g., div., rent, or int.)

(1) Value Code 2

(J-P) ....

(2) (13 Value Type Method : buy sll~ Code 3: ied~inptib~) (Q-W) T T T T T T T T T T T T T Sold Buy Sold Buy Buy Buy Buy Buy Buy

transaction) See note 2 in Part VIII. 12/23/10 04/07/10 J J

I. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17.

3M Company common Same Same Absolute Strategies Fund Same Same Allianz NFJ Intl Valaue Fund Same Same Apache Corp. common Same Same Apple common Artio Intl Equity Bank of America deposit accounts BHP Billiton ADR Same

A A A A A A A A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend None None

J J J J J J K J J J J J J

07/01/10

12/23/10 12/23/10 12/27/10

J J J

(part)

07/01/10 12/27/10 04/07/10

J J J

A A A

Interest Dividend Dividend

K J J

T T T

il i~me Gain codes: (SeeColunmsBlandlM) 2. ValueCodes (See Columns C} and D3) 3. value Method Codes (See Column C2)

A ~$11000 6r less

B =$1~01, $2~500

C =$2,501 ~ $5;000 HiL~ilbbOib~i~$~;600i0b:o L~536~ ~ 00000 PI=$1 000 001 - 55 000000 P4 --Mbr~ than, $50,000,000 S --Assessment W =Estimated

D =55,001 - $1S,000 ; H2=Morethan$5;ooo, ooo M=5~0000~ -$250000 P2 =$5,000i001 "$25,000~000 T --Cash Market

E =$15,001- 550,000

F=$50,001-$I00,000 ..... .... G=$1601001:$1,0001000 J =$15,000 or less K~$~5,00~ -550,000 N =$250,001 - $500,000 O =$500,001 ~ $1,000,000 P3 =525,000,001 - 550,000,000 R =Cost (Reai Estate Only) Q =Appraisal V =Other U =Book Value

FINANCIAL DISCLOSURE REPORT Page 5 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRUSTS -i.eome, valae, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (includ ng trust asset~) Income during Gross value at end .... Transactions during reporting period

Place "(X)" after each asset exempt from prior disclosure

reporting perird~ (1)(2) Aniountl Type (e.g., Code I div.~ rent, (A-H) or int.)

of reporting period (1) (2) Value ValUe Method Code 2 (Q-W)

(1) (2) (3) (4) Date Value Gain Type (e.g., : buy, sell, .... mrrddd/yy Code 2 Code 1 (J-P) (A-H)

(5) Identity of buyer/seller (if private transaction)

18. Same

Dividend None None

J J

T T

Buy

04/07/I 0

19. 20, 21. 22. 23. 24. 25. 26. 27. 128. 29. 30, 31. 32. 33. ,34.

BMC Software common BP PLC

Buy Sold

04/07/10 06/02/10

J J J J J J J J J A B B C B See note 3 in Part VIII.

CF Industries common Cisco Systems common CVS Caremark common Same

Dividend None

Spinoff 04/05/10 (from line 134) Sold 12/27/10 07/01/10 07/01/10 12/23/10 04/07/10 07/01/10

A A

Dividend Dividend

Sold

(part)

Sold (part) Sold

Same

Dividend

Sold (part) Sold

(part)

Dentsply Int common Diageo ADR Dreyfus Instl. Cash Adv Fund Same Same Enterprise Bank & Trust Co. common A A A A A B Dividend Dividend Interest Interest Interest Dividend J J L K J L T T T T T T Sold

(part)

04/07/I 0

I. lncom~ Gain codes: (See Columns Bl and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Colurrm C2)

A=$1i000 or les~ F =$50,001 - $100,000 3 =$15,000 or tess N =$250,001 - $500,000 P3 =$25,000,001 ~ $50,000,000 Q =Appraisal U =Bo0k Value

: B~$1,001. $2i500 G =$100,001 - $1,000,000 K --S] 5;00i ~ $S0,000 O =$500 001 - $1 000 000 R =Cost (Real Estate Only) V--0ther

C =$2,501 - $5,000 HI =$1;000,00i ~ $3,060,000 L :$5o,oo] - $~oo;ooo Pi--$1,O00,OoI - $5~000~000 P4 =More than $50,000,000 S --Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5~000~000 M =$~00,00~ - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRU STS - i.co~e, vulue, tru.sue,io.s a.cludes those of sp ....

and dependent children; see

pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

35. 36. 37. 38. 39. 140. 41. 142. 43. 44. 45. 46. 47. 48. 49. 50. 51.

Same EQT Corp. common Equity Residential SBI Same Same Exelon Corp. common Same Expeditors Intl of Washington common Exxon Mobile common Fidelity Inst Money Market fund Same Franklin Intl Small Cap Growth Fund Same Same Frontegra Netols Small Cap Value Fund Same General Dynamics common

B A A A A A A A A A A A A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Interest Interest Dividend Dividend Dividend Dividend Dividend Dividend

L J J J J J J J J J J J J J J J J

T T T T T T T T T T T T T T T T T Buy Buy Buy Buy Buy Buy 03/04/10 03/04/10 04/07/10 03/04/10 04/07/10 04/07/10 J J J J J J Sold (part) 07/01/10 J

(See Columns BI and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 -$50,000,000 Q =Appraisal U =Book Value

G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1,000,00 t - $5,000,000 L =$50,001 - $ I00,000 P 1 =$ 1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 t-12 =More than $5,000,000 M =$100,001 - $250~000 P2 =$5,000,001 - $25,000,000 T =Cash Market :

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

and VII. INVESTMENTS and TRU S TS - i, come, valae, transactions (Includes those of sp .... dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" aider each asset exempt from prior disel0sure B. Income during reporting period (1) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) C Gross value at end of reporting period (1) (2) Value Value Code 2 Method Code 3 (J-P)

(Q-W)

(1) Type (e.g,, buy, sell,

redemption)

(2) .... (3) (4) Date, .., Value Gain mm/dd/~ Code 2 Code 1

O:P) (A-I-Y)

(5) Identity of buyer/seller

(if private transaction)

52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68.

Hussman Strategic Growth Fund Same Illinois Tool Works common IBM common Same iShares Barclays 7-10 yr Treas Bond Fund

A A A A A A

Dividend Dividend Di~,idend Dividend Dividend Dividend

J J J

Sold Sold

12/16/10

12/16/10

T T

T

Buy

04/07/10

(part)

Buy

Sold

Sold

07/01/10 07/01/10 10/08/10 03/04/10 07/01/10 10/08/10 07/01/10 10/08/10 07/01/10 04/07/10

J K K J K K J J K L A

A See note 4 in Part VIII. B A

Same

Dividend

Sold

Buy

Sold

Same

Dividend

Buy

Sold

iShares Barclays 1-3 yr Treas Bond Fund Same iShares Barclays 1-3 yr Credit Bond Fund Same iShares Nasdaq Biotech Fund

A A A A A

Dividend Dividend Dividend Dividend Dividend L

J T

Sold

Buy

K J

Sold

07/01/10

(part)

1 ifi~ome Gai~ C~d~: (See Columns B 1 and 1)4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1~000 or less F =$50,001 - $ 100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1,001- $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R Cost (Real Estate Only) V =Other

D =$5,001 - $15,000 C =$2,501 - $5,000 H~ --More than $5~000~000 HI =$1,000,00i ; $510001000 L :$50 001 - $100 000 M =$ 100,001 ~ $250,000 PI =$1,000,001 - $51000;000 : P2 =$5;000,001- $25,000,000 P4 =More than $50,000,000 T--Cash Market S =Asscssmcnt W =Estimated

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 8 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 3"4-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

69.

Same

A

A

Dividend

Dividend

T

Sold 04/07/10 K C A A A

70. iShares Russell 2000 Value Index Fund

71. 72. 73. 74. 75. 76. 77, 78. 79.

80.

iShares Barclays TIPS Fund

Dividend

Sold (part) Sold (part) Sold

03/04/10 03/05/10 03/08/10 03/04/10 03/05/10 03/08/10

J J J J J J

Same

Dividend

(pm) (part).

Sold Sold

Sold

A A A

Johnson & Johnson common Same Same

A A A

Dividend Dividend Dividend

J Sold Sold

(part) Sold 07/O1/lO

12/23/10 04/07/10

J

J J J

B C A B

(part)

81. Sold 12/27/10

82. 83. 84. 85.

JP MOrgan Research Mkt. Neutral fund Manulife Financial common Matthews Asian Growth fund Matthews Pacific Tiger fund A

None Dividend None None

J K J J

Buy

12/27/10

T T

Buy Buy

12/27/10 12/23/10

J J

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250,00I - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$L001 - $21500 G =$100~001 - $1,000,000 K =$15;001 -$50;000 O -$500,00I - $1;000i000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$ i 000 00i ~$5 000,000 L =$50i001 ~ $100,000 Pl =$I,000,001 - $5;000;000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000~000 M =$I00,001 -$250,000 P2 =$5;000,001 - $25;000 000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 9 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRU S TS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

~ NONE

(No reportable income, assets, or transactions.)

86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99.

Same MA St. Water Poll Abatement, 4.2%, due 8/1/2010 Merger Fund Same Same Mettler-Toledo Intl. common Microsoft common Same Novartis AG spnsrd ADR Same Oakmark Intl Fund CI I Occidental Petroleum Peabody Energy Corp. (See note 5 in Part VIII.) Same A A A A A A A A A B A A A

None Interest Dividend Dividend Dividend None Dividend Dividend None Dividend Dividend Dividend

Buy Matured

12/23/10 08/02/10 12/23/10 12/23/10 12/27/10

J K J J J

J J J J J J J J

T T T T T T T T

Buy Buy Buy

Buy

12/23/10

Sold J T Buy

12/27/10 04/07/10

J J

Dividend Dividend Dividend Dividend J J J T T T

Sold Sold Buy Buy

04/07/10 07/01/10 03/05/10 03/08/10

J J J J

A A

100. Pepsico common 101. PIMCO 1-5 yr US TIPS index fund 102. Same

(pa~)

t. Income Gain codeS: (See Colunms 131 and D4) 2. Value Codes (See Colunms C 1 and D3) 3. Value Method Codes (See Column C2)

~ ~$ii000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25i000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1;001 - *2,500 G =$100,001 - $I,000,000 K --$15,001 = $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

FINANCIAL DISCLOSURE REPORT Page 10 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRU STS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of fillng instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets

(including trust assets)

Place "(X)" after each asset exempt from prior disclosure

reporting period (1) (2) Amoun) Type (e.g., Code I div~ rent~ (A-H) or ira:):

of reporting period (1) Value Code 2 (J-P) (2) Value. : Me~hrd:: Code 3 (Q-W) T (1) (2) (3) (4) Value Type (e.g., Date ::.,.buy~ selt~i: .... mtrgdd/yy Code 2 (J-P) ::rrde~P~on) Ga~ Code 1 (A-H) ~5) Identity of :buyer/seller (i~private transaction)

103. Same 104. Praxair, Inc. common 105. Same 106. Procter & Gamble common 107. Same 108. 109. Raytheon common 110. Raytheon options 111. Raytheon Savings and Investment Plan 112. -Raytheon Stock Fund

113. -Real Estate Securities Fund

None

Buy

12/27/10

A A A A

Dividend Dividend Dividend Dividend

J J J J

T T T T

(part)

Sold

07/01/10

Sold (part)

07/01/10 04/07/10 07/01 / 10

J K J

C D A

(part) (part)

Sold

Sold

Dividend None C Int./Div.

L K N

114. -BGI US Debt Index Fund 115. -PIMCO Total Return Inst 116. --Fidelity Inst Money Mkt 117. Regency Centers 118. Royal Dutch Shell plc spnsrd ADR 119. Sempra Energy common A A A Dividend Dividend Dividend J J J T T T

I. lncome Gain COdes: (See Cotunms B 1 artd I24) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Colunm C2)

A ~$i;000 0gte~ ........ $100,000 F =$50,~1 - : J =$15,000 or less N =$250,001 - $5~,000 P3 =$25,000,001-$50,000,000 Q =App~sal U =Book Val~

B--$ii00i ~ $2~500 G =$100;001 =$i ;000,000 K =$15,001 - $50~000 O ~$500,00 ~ $ 000 000 R =Cost ~al Estate only) V =Other

C =$2,501-$5,000 : ~i ~$ii000;00i ~ $3;0001000 L =$50;001 ~ $100;000 Pi ~$i~00~00i ~$5 ~0 000 P~ ~More than $50~000,000 S ~s~eSS~h~ W ~Estimated

D =$5,001 - $15,000 H2 =MOre thfin $5;000i000 M ~$100~001 - $250;000 ~ ~$5~000,001 =$25,000,000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 11 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRUSTS - i.co,.e, v.lne, trn.s.caoos aoclnd~s ,hose ol spons~ n.d dependent children; see pp. 34-60 of f!ling instructions.)

NONE

(No reportable

income, assets, or transactions.)

120. Same 121. Same 122. SPDR Gold Trust 123. Same 124. State Street Corp. common 125. Stericycle,Inc. common 126. Same 127. Same 128. Suncor Energy (New) common

129. Templeton Global Bond Fund 130. Same 13 I. 132. Same 133. 134. Terra Industries common

A A

Dividend Dividend None None

J J J J

T T T T Buy Buy Sold 03/04/10 J 03/04/10 04/07/10 07/01/10 107/01/10 07/01/10 04/14/10

12/23/10 04/07/10 12/23/10 04107/10 12/27110 04/05/10

J J

J J J J J J J J J J

Dividend None None None J J J T T T

C C C A

Sold (part) Sold

(paa) (part)

Sold

K K T T Buy (addl) Buy (addl) Buy (addl)

Sold

A

A A

Dividend

Dividend Dividend

Dividend

Buy (addl) Buy (addl)

Dividend

See note 3 in Part VIII.

135. Teva Pharmaceuticals ADR 136. Same

A A

Dividend Dividend

J J

T T Sold (part) 07/01/10

(See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (see Column c2)

F =$50,001 ~ $100;000 J =$15;000 or less N =$250,001 ~ $500,000 P3 =$25;000 001 - $50 000,000 Q =Appraisai u ~Book Value

G =$100,001 - $1 000 000 K --$15~00I - $50,000 0--$500,001 - $1,000,000 R =Cost (Real Estate Only) V =other

C =$2,501 - $5,000 Hi A$i !000;001:$5;000;000 L =$50~001 - $100,000 PI =$1~000,001 .-$5,000,000 P4 =More !han $50,000,000 s =Assessment W =EStimated

D=$5,001- $15,000 H2 =Morethan $5,000,000 M=$100,001 - $250,000 P2 =$5,000,001- $25~000i000 T =cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 12 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VII. INVESTMENTS and TRUSTS -incorae, value, t ......

tions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE

(No reportable

A.

income, assets, or transactions.) B.

Income during reporting period (1) Amount Code i (A-H) (2) Type (e.g. div ret, or int )

C.

Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) (!) Type (e.g., buy, sell, redemption) (2) (3) (4) Date Value Gain mm/dd/yy Code 2 I Code 1 (J-l~) (A-H) (5) Identity of buyer/seller (if private transaction)

Description of Assets (including trust assets) Place "tX)" after each asset exempt from prior disclosure

137. Thermo Fisher common 138. Same 139. Thomas White Intl Fund 140. Same 141. 142. Thornburg Intl Value Fund 143. Same 144. Same 145. 146. Tortoise Energy Infrastructure Corp. 147. Same 148. Same 149. Vanguard Emerging Mkts. Index Fund 150. Same 151. Same 152. Vanguard GNMA Fund 153. Same A A A A A A A A A A

None None Dividend Dividend

J J J J

T T T T Buy Buy Buy (addl) 03/04/10 04/07/10 12/23/10 12/23/10 J J J J

Dividend Dividend Dividend

K J J

T T T

Buy (addl)

Buy Buy (addl)

04/07/10 12/27/10 03/04/10 03/04/10 04/07/10 12/23/10 12/23/10 12/27/10 03/04/10 12/27/10

J J J J J J J J J J A

Dividend Dividend Dividend None None None Dividend Dividend

J J J J J J J J

T T T T T T T T

Buy Buy Buy Buy Buy Buy Sold (part) Buy (addl)

i lne~ G~inC0des: (See Colunms B 1 and D4) 2. Value Codes (See Col unms C1 and D3) 3. Value Method Codes (See Column C2)

i ~ ~$li00~ ~r iesS F =$50,001 - $100,000 J =$15;000 or less N =$250,001 - $500,000 P3 =$25,000,00! - $50,000,000 Q =Appraisal U =Book Vatue

B =$1;001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 : $50,000 O =$500,001 - $I,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1,000,001 - $5,000;000 L -$50,001 - $ 100,000 P I =$1 ;000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000

E =$15,001 - $50,000

H2 =More than $5i000~000 ...... M =$100,001 - $250,000 P2 =$5,000,001 - $25;000,000 T =Cash Market

FINANCIAL DISCLOSURE REPORT Page 13 of 15 VII. INVESTMENTS and TRUSTS - i .....

e,

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets)

Place "(X)" after each asset exempt from prior disclosure

Income during reporting period (I) (2) Amount Type (e.g., Code 1 div., rent, (A-H) or int.)

Gross value at end of reporting period (1) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W)

Transactions during reporting period (1) Type (e.g., buy; self; redemption) (2) ..... (3) Value Date mmidd/yy= C0de2 C6de I (J~P) (A-H)

buyer/seller (if private transaction)

154. Vanguard High Yield Corp. Bond Fund 155. Same 156. Same 157. Vanguard Ltd Term Tax Exempt Fund 158. Vanguard Short-Term Inv Grade Fund 159. Same 160. 161. Same 162. Verizon Communications common 163. Same 164. Wal-Mart common 165. Walthausen Small Cap Value 166. Same 167. Wells Fargo common 168. Same 169. Wisdomtree Intl Small Cap Fund

170.

A A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend J J K T T T

Sold Sold Sold

04/19/10 04/19/10

K J

B B B

04/19/10 J

Buy Buy Buy (addl)

03/04/10 03/04/10

J J

12/27/10 J

Dividend

A A

Dividend Dividend None None None

J J J J J

T T T T T Buy Buy Buy

Sold

12/23/10 03/04110 04/07/10

07101/10 J

J J J

A

A A A

Dividend Dividend Dividend

Sold Sold

07/01/10 J 07/01 / 10 J

1 : lncOm~ Gain Codes: (See Columns B 1 and 104) 2. Value Codes (See Columns Cl and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50,000.000 Q =Appraisal U =Book Value

B =$1,001- $2;500 G =$100,001- $1,000,000 K =$15,001 -$50,000 0 -$500~01- $l,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000

D =$5;001 - $15,000

E =$15,001 - $50,000

m =$t;oo0~ooi ~ $~1660~00o

L =S50~00i ~ si00~0

H~ --~6re tha, $~;ooo,ooo

M =Sl00;001 ~ $250;000

~ =~,ooo,0oi ~ s5~0oo;0oo

P4 =MOre than $50,000,000 S =Assessment W =Estimated

P2 ~,~,oo0,oo~ : s~5;o00,o0o

T ~Cash Market

FINANCIAL DISCLOSURE REPORT Page 14 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicatepart of report.)

1. The trust identified in Part I is a~ trust. All the assets are reported individually in Part VII but are not specifically identified in that Part to the trust. 2. General comment regarding reporting in Part VII: As in past years, most of the ~ssets reported are held in three separate accounts managed by an investment adviser. For convenience in tracking year-to-year changes, the assets are reported by reference to the separate accounts, resulting in some cases (as in lines I-3, for example) in multiple reports for the same identified asset. The designation "Same" is used to indicate a separate account. If there were multiple transactions within the same account during the year, the designation "Same" is used for the first, but not subsequent transactions within that account. See, for example, the entries for CVS Caremark at lines 24-28. 3. CF Industries (Part VII, line 22) acquired the stock of Terra Industries (Part VII, line 134) and Terra was merged into CF Industries. Shareholders of Terra received cash and CF Industries stock. I have used the term"spinoff as the most applicable term available for selection in the drop-down menu. 4. Each of the three investment accounts held the asset iShares Barclays 7-10 year Treasury Bond Fund (Part VII, lines 57-63) at some point during the year. In each of the first and third accounts, the asset was bought and sold within the year. In the second account, the asset was owned in the prior year and that holding was sold in March. That same account thereafter acquired and disposed of the asset within the year, similar to the other two accounts. Accordingly, while there were several transactions during the year, the net effect was that none of the accounts held the asset at year end. 5. Last years report stated that the Peabody Energy (Part VII, lines 98-99 in this years report) asset held in one investment account had only been sold in part (2009 Report, Part VII, line 77). That was an error. All the Peabody Energy held in the indicated account was sold on 12/21/2009 at a price J with a gain A.

FINANCIAL DISCLOSURE REPORT Page 15 of 15

Name of Person Reporting OToole, George A.

Date of Report 05/12/2011

IX. CERTIFICATION.

1 certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S[ George A. OToole

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- PMP PDFDocument334 pagesPMP PDFJohan Ito100% (4)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Turnaround ManagementDocument16 pagesTurnaround Managementpaisa321No ratings yet

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- International Introduction To Securities and Investment Ed6 PDFDocument204 pagesInternational Introduction To Securities and Investment Ed6 PDFdds50% (2)

- Introduction To Anglo-Saxon LiteratureDocument20 pagesIntroduction To Anglo-Saxon LiteratureMariel EstrellaNo ratings yet

- BCLTE Points To ReviewDocument4 pagesBCLTE Points To Review•Kat Kat's Lifeu•No ratings yet

- DLF New Town Gurgaon Soicety Handbook RulesDocument38 pagesDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaNo ratings yet

- (Bloom's Modern Critical Views) (2000)Document267 pages(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- Starmada House RulesDocument2 pagesStarmada House Ruleshvwilson62No ratings yet

- Architecture AsiaDocument84 pagesArchitecture AsiaBala SutharshanNo ratings yet

- Glossary of Important Islamic Terms-For CourseDocument6 pagesGlossary of Important Islamic Terms-For CourseibrahimNo ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- Depreciation, Depletion and Amortization (Sas 9)Document3 pagesDepreciation, Depletion and Amortization (Sas 9)SadeeqNo ratings yet

- Pre-Qualification Document - Addendum 04Document4 pagesPre-Qualification Document - Addendum 04REHAZNo ratings yet

- Budo Hard Style WushuDocument29 pagesBudo Hard Style Wushusabaraceifador0% (1)

- Financial Amendment Form: 1 General InformationDocument3 pagesFinancial Amendment Form: 1 General InformationRandolph QuilingNo ratings yet

- Biology 31a2011 (Female)Document6 pagesBiology 31a2011 (Female)Hira SikanderNo ratings yet

- Chapter 1 Introduction To Quranic Studies PDFDocument19 pagesChapter 1 Introduction To Quranic Studies PDFtaha zafar100% (3)

- (BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeDocument5 pages(BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeMiklós GrécziNo ratings yet

- Unit Test 11 PDFDocument1 pageUnit Test 11 PDFYONo ratings yet

- DocumentDocument2 pagesDocumentHP- JK7No ratings yet

- EAD-533 Topic 3 - Clinical Field Experience A - Leadership AssessmentDocument4 pagesEAD-533 Topic 3 - Clinical Field Experience A - Leadership Assessmentefrain silvaNo ratings yet

- All Region TMLDocument9 pagesAll Region TMLVijayalakshmiNo ratings yet

- Open Quruan 2023 ListDocument6 pagesOpen Quruan 2023 ListMohamed LaamirNo ratings yet

- HDFC Bank Summer Internship Project: Presented By:-Kandarp SinghDocument12 pagesHDFC Bank Summer Internship Project: Presented By:-Kandarp Singhkandarp_singh_1No ratings yet

- TDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Document9 pagesTDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Sumukh TemkarNo ratings yet

- Power of Attorney UpdatedDocument1 pagePower of Attorney UpdatedHitalo MariottoNo ratings yet

- Jurisdiction and Kinds of JurisdictionDocument3 pagesJurisdiction and Kinds of JurisdictionANUKULNo ratings yet

- Literature ReviewDocument11 pagesLiterature ReviewGaurav Badlani71% (7)

- "If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsDocument21 pages"If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsIsadora Mandarino OteroNo ratings yet

- In-CIV-201 INSPECTION NOTIFICATION Pre-Pouring Concrete WEG Pump Area PedestalsDocument5 pagesIn-CIV-201 INSPECTION NOTIFICATION Pre-Pouring Concrete WEG Pump Area PedestalsPedro PaulinoNo ratings yet

- Integrative Assessment OutputDocument2 pagesIntegrative Assessment OutputRonnie TambalNo ratings yet