Professional Documents

Culture Documents

Denominator Effect

Uploaded by

Tomas TurekOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Denominator Effect

Uploaded by

Tomas TurekCopyright:

Available Formats

Denominator effect (hLLp//wwwcarrledlnLeresLcom/2008/12/LhedenomlnaLoreffecLhLml)

O nstItutIons that commIt capItal to prIvate equIty funds have strIct guIdelInes for asset

allocatIon. ( 5 allocatIon to prIvate equIty, 60 to lIsted equItIes, 10 to real estate)

O prIces of lIsted assets have collapsed, and the value of each Investor's total

portfolIo, the denomInator, has shrunk

O prIvate equIty Investments have often held theIr value. ThIs doesn't necessarIly

reflect the IntrInsIc value of these assets, but rather the fact that they are unlIsted

O %he resuIt! A 5 prIvate equIty allocatIon may have suddenly blown out to 20 or

more

O %hIs forces the IImIted partner to decrease the vaIue of the prIvate equIty In hIs

portfoIIo by seIIIng (wIth a Ioss ussuaIIy) some beIoved hoIdIngs. %hIs has caused

some major reguIated InstItutIonaI Investors to offIoad huge portIons of PE.

O $Ide effect Is Improvement of secondary market, Increase In share of non

InstItutIonaI non reguIated Investors as of totaI share of PrIvate EquIty Investors.

O %he bottom IIne Is however that totaI amount of funds raIsed for prIvate equIty Is

decreasIng and wIII not pIck up before eIther

4 the vaIue of other hoIdIng InstItutIons have wIII Increase so the PE can

regaIn Its orIgInaI aIIortment.

4 aIIocatIon ruIes wIII change to refIect the denomInator effect

4 PrIvate equIty wIII vaIue Its portfoIIo companIes on the basIs off faIr vaIue

and comparIsons to comparabIe pubIIc companIes and theIr deprecIatIon

and subsequentIy mark to market thIs vaIue on more frequent basIs

(coherent wIth InstItutIonaI ruIes for the aIIocatIon adjustments)

1ypes of rlvaLe LqulLy flrms ln Lerms of fund ra|s|ng source

venLre caplLal LhaL lnvesL ln prlvaLe busless by purchaslng lLs equlLy mosL commonly ln Lerms of shares

PeLerogenous organlzaLlons LhaL defflr ln Lhelr resources ob[ecLlves and sLraLegles

uependlng on Lhe sLraLegy venLure CaplLal can aLLempL Lo lmprove orghanlzaLlons managemenL

operaLlons efflclency can make use of lLs conLacLs aLLempL Lo creaLe synergles eLc

CfLen lnvesL ln secLor wlLh hlgh growLh opporLunlLles ussually rlsky lnvesLmenLs LhaL however are on

rlsk ad[usLed basls aLLracLlve reLurn lnvesLmenLs

Independent L f|rms work separaLe of Lhelr llmlLed parLners 1hese flrms Lake Lhe largesL markeL

share ln Lerms of LoLal caplLal ralsed for prlvaLe equlLy (CorporaLe flnanclal sLraLegy by 8uLh 8ender)

source fundlng from lnsLlLuLlonal and hlgh neL worLh lndlvlduals

kk8 Apax arLners 8aln CaplLal

1he mosL of rlvaLe LqulLy flrms are lndependenL (Lhe SML flnanclng Cap)

apt|ve pr|vate equ|ty ralse caplLal from prlamry sharehodlers or parenL company )lnsurance

companles lnvesLmeLn banks) ManagemenL sLracLure ls characLerlzed by greaL degree of effecLlve

conLrol and lnvolvmenL of Lhe prlamry shareholder (8arclays rlvaLe LqulLy Alllanz rlvaLe LqulLy

arLners Morgan sLanley caplLal parLners

Sem| capt|ve LC1 Lhe wallenberg famlly rasles caplLal form Lhls prlmary shareholder and from Lhe

exLernal lnvesLors

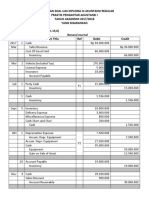

ey PE metrics in Europe EVCA yearbook

Funds raised

AmounL

LlmlLed parLners sLrucLure

Ceogrpahy

30 of domesLlc llmlLed parLners 24 of non dopmesLlc Lurpean LlmlLed arLners 12 of non

european lnvesLors (very low compared Lo hlsLorlcal levels even Lhough lL has lncrease from 300 mllllon

Lo 128n european lnvesLmenLs lncreased more) 94 of non domesLlc lnvesLmenLs was done by

canadlan *48 and uS *46 prlvaLe equlLy flrms

MosL slgnlflcanL european lnvesLor lnLo non domesLlc non european equlLles ls uk (28n 32 companles)

lrance 102m 13 companles Cermany 62m 46 companles

O 111 mllllons ln dry powder (end of 2009)

O mproved debL avalllblLllLy lmproved buy ouL markeL (decreaslng avg equlLy raLlo 313 Lo 306

O Accordlng Lo LvCA Lhe number of companles LhaL geL Lhe fundlng from L funds ls decreaslng

sLeadlly Lhls ls wlLh very low correlaLlon Lo Lhe overall amounL of funds realsed Whlle ln 2000

almosL 10000 companles were flnanced Loday lLs less Lhan half even Lhough Lhe amounL of Lhe

funds ralsed ls hlgher Loday

Fund stage focus 9 v {funds raised, favourite industries]

O uyout lnvesLmenL 110 yoy lncrease Lo 318n lollowlnd wlLh slgnlflcanL lncrease ln mega large

and mld markeL deals number

O rowth cap|ta| yoy lncrease 42 Lo 68n nearly 1000 companles 28lncrease

O Ienture cap|ta| lLLL Lo 338n as boLh sLarL up and laLer sLage lnvesLmenL decreased by 7

O 1hroughouL perlod 2007 Lo 2010 leasL affecLed seemed Lo be expanslon or growLh parL of Lhe

rlvaLe LqulLy 1hroughouL 2010lnvesLmenLs ln all secLors come closer LogeLher ln Lerms of

amounLs lnvesLed before crlsls (p4)

O venLure 196 Lo 166 buyouL aL round 38 CrowLh caplLl lncrease from 38 Lo 128 and

CenerallsL decreased from 138 Lo 83

O 1he proporLlon of lnlLlal vs follow on lnvesLmenLs has changed wlLh Lhe flnaclal markeL crlsls

lnvesLors seemed Lo sllgLly prefer lnvesLlng ln already lnvesLed companles (Lhls could also be an

effecL of decreased deslre of enLrepreneurs Lo ralse money aL Llmes where Lhelr companles

value ls bellow whaL Lhelr expecLaLlons are

O Looklng aL lnvesLmeLn Lrends leadlng four secLors of venLure caplLal

4 Llfe Sclences CompuLere and Consumer elecLronlcs CommunlcaLlons Lnergy and

LnvlronemnL

O Looklng aL lnvesLmeLn Lrends leadlng four secLors of buyouL and growLh caplLal

4 1hls segmenL ls more equal ln Lerms of share of lndlvldual secLors Lhe only ouLsLandlng

lndusLry ls Consumer Codds and reLall oLher secLors worLh Lo menLlon are Llfe sclences

lndusLrlal producLs and servlces and communlcaLlon

O 80 of LargeL companles are SMLs and 70 of Lhose were LargeLed by venLure caplLal

companles venLure CaplLal are Lhus very slgnlflcanL ln Lerms of soclal and economlc lmpacL on

Lurope

O Whlle ln venLure CaplLal lL seems LhaL over 90 of caplLal ls lnveLed ln companles wlLh less Lhan

100 employees 8oyouL and growLh lnvesLmenLs are mosL concenLraLed Lo 200 employees / 37

O AmounL of funds ralsed across europe has lncreased by 127 allLogeLher form 2009 Lo 2010

O rlvaLe equlLy ln Lurope has ralsed 3108n beLween 20062010 (compare Lo uS Asla) look aL lL as

percenLage of Lu aggregaLe Cu 1hls ls around 023 of Lu Cu LhaL for Lhls perlod averages

123008n

O

Divestments

1he exlL markeL

O Cs lncreased four fold ln Lurope Lo 200 per 2010 19 bllllon was reallsed aL cosL of 2086

companles

O Lu based flrms exlLed 81 non Lu companles wlLh LoLal amounL dlvesLed aL 118n

O 1rade sales ralsed 438n and remalned second mosL lucraLlve exlL meLhod

O 1he Lhlrd opLlon ls a sale Lo anoLher prlvaLe equlLy lnvesLor

O n Lerms of lndusLrles 8uyouL and CrowLh consumre goods and reLall were mosLly dlvesLed and

ln vC where ln llfe sclences and compuLer and consumer elecLronlcs

O Clean1ech companles seem no Lo flnd Lhemselve currenLly ln good poslLlon ln Lerms of markeL

demand for such lnvesLmenLs (vlew as Loo rlksy Loo uncerLaln Loo many compeLlLlon subsldles

LhaL make unclear whaL ls Lhe besL Lechnologles golng Lo be whlch have Lhe poLenLlal Lo galn

market acceptance NC1 IN the stage where sat|sfactory cap|uta| cou|d be ra|sed through

pub||c offer|ng Its st||| v|ewed as sector for spec|a||sts

O WrlLe off dlvesLmenL

Private equity country of origin v country of management {table]

Final closing in by independent funds

O Cne of Lhe lndlcaLors LhaL can help us predlcL where are we headlng ln Lerms of secLro focus ls

by looklng aL Lhe f|na| c|os|ngs at 2010 84 new funds were closed where 84 where generallsL 6

llfe sclences 3 C1s and 4 energy and env|ronemnt focused

1he beauLy of Lhe CleanLech secLor ls lLs slgnlflcance LhaL reaches across almosL every parL of our llfes

and has some relaLlonshlp wlLh Lhe ma[or lndusLrles LhaL elLher can make use of Clean1ech or are one of

Lhe subsecLors wlLhln Clean1ech 8esearch Lnergy 1ransporLaLlon compuLer consumer goods llfe

sclences lndusLrlal servlces and producLs (pracLlcally all L favourlLe lndusLrles)

ingle countries exposure to Private Equities

Whlle we know whaL counLrles are Lhe mosL common for fund locaLlon and whaL counLrles mosLly

manage Lhe funds closer look aL Lhe lnvesLmenLs ln 2010 can Lell us whaL counLrles are mosL acLlve ln

cerLaln lndusLrles (whlch could lead us Lo assumpLlon LhaL Lhe lndusLry aL LhaL counLry ls more

developed or aL leasL Lhe knowledge of Lhe secLor exlsLs wlLhln Lhose counLrles (also assumlng Lh fund

allocaLlon ls prlmarlly domesLlc)

Looklng ln Lerms of amounnumber of deals wlLhln energy and envlronmenL leadlng counLrles are

norway Sweden Spaln and AusLrla each closlng one fund ln energy and envlronmenL secLor

Investments Energy and environment v. overall

Lnergy and envlronmenL has aLLracLed 18138n(7) ln 2009 and 13038n(33) ln 2010

Comparlng Lhe amounL of resources lnvesLed over pasL flve years 264338n wlLh Lhe amounL ralsed

3108n we can see LhaL rlvaLe equlLles qulLe slgnlflcanL parL of Lhelr porLfollo ln dry powder

nLeresLlngly whlle funds ralsed ln 2010 reached roughly 208n lnvesLmenLs reached 42338n whlch

seem as a slgn of recovery for Lhe prlvaLe equlLy markeL as new opporLunlLes emerge or more llkely Lhe

economlc condlLlons enable L funds Lo lnvesL Lhelr resources effecLlvely

Lven Lhough lL seems LhaL Lhe energy and envlronmenL ls raLher lnslgnlflcanL secLor ln Lerms of L secLor

allocaLlon lL ls lmporLanL Lo noLe LhaL Lhe decrease beLween 2009 and 2010 lnLo energy and

envlronmenL has dropped largely due Lo decrease lnmore slgnlflcanL buyouL deasl (61 29) amounL

slze LhaL halved venLure CaplLal lnvesLmenLs are sLlll arounf 11(119 107) whlch puLs Lhls secLor

Lo be Lhe 4

Lh

mosL aLLracLlve by vCs afLer llfe sclences CompuLer and Consumer LlecLronlcs and

CommunlcaLlon 1hls ls even Lhough Lhe dlfflculL Llmes CleanLech ls golng Lhrough aL Lhe momenL

(sublsldles halLed unceraLlnLy abouL fuLure fundlng eLc) Cnce Lhe L condlLlons lmprove and cleanL

ech envlronmenL sLablllzes reasonably lLs share should grow slgnlflcanLly as lLs growLh poLenLll and rlsk

ad[usLed reLurn prospecL wlll lncrease Also unllke CommunlcaLlons and CompuLer secLors CleanLech ls

new and ls far from maLurlng sLage

O funds ralsed for venLure caplLal ln 2009 and 2010 are abouL 23 of overall funds ralsed whlle

lnvesLmenLs ln venLure caplLal seem Lo be ln range beLween 10 Lo 20 of Lhe overall

lnvesLmenLs

O especlally ln 2010 lnvesLmenLs ln buyouL sLage are slgnlflcanLly larger Lhen Lhe funds ralsed for

Lhe same perlod whlle ln venLure CaplLal Lhese Loo are more coherenL 1hls ls probably due Lo

buyouL funds ralslng money before Lhe crlsls and lnvesLlng agaln ln only recenLly as debL markeLs

became more avallable

O venLure caplLal flrms were less hlL by Lhe crlsls Lhan Lhe buyouL funds slnce Lhe caplLal Lo ralse

was easler Lo obLaln and lnvesLmenLs were noL halLed by debL lnavalllblllLy Powever succesful

buyouL funds have used less debL ln Lhelr flnanclng for Lhls perlod whlch however has negaLlve

effecL on Lhelr reLurns as more equlLy ls used and Lhan lower reLurn on equlLy ls achleved

You might also like

- Loose Coarse Pitch Worms & Worm Gearing World Summary: Market Sector Values & Financials by CountryFrom EverandLoose Coarse Pitch Worms & Worm Gearing World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Mineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryFrom EverandMineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryNo ratings yet

- IntercoDocument7 pagesIntercoyunikepuspitaNo ratings yet

- Budgeting For Change and Jobs: 24 February 2014Document40 pagesBudgeting For Change and Jobs: 24 February 2014api-26287609No ratings yet

- AbstractDocument52 pagesAbstractBhavya BhatnagarNo ratings yet

- z3250927 Tsuro GBAT9122 11s2 Ass1Document13 pagesz3250927 Tsuro GBAT9122 11s2 Ass1tmtsuroNo ratings yet

- Verizon - Economic LandscapeDocument8 pagesVerizon - Economic LandscapevickymagginasNo ratings yet

- C CC C CC C C C CC CC CCC C: CCCC C CCC C C C C C C C C C C C C C C C C C CCDocument26 pagesC CC C CC C C C CC CC CCC C: CCCC C CCC C C C C C C C C C C C C C C C C C CCAhmed FarazNo ratings yet

- Pricing StrategyDocument9 pagesPricing StrategyPankti ParikhNo ratings yet

- Status Paper On India PakistanDocument88 pagesStatus Paper On India Pakistansauvagya2No ratings yet

- Dollar TreeDocument12 pagesDollar TreebarryuanNo ratings yet

- ProjectSynopsis AparnaMVDocument6 pagesProjectSynopsis AparnaMVAjit KumarNo ratings yet

- ACF Case1-MoGen FinalDocument8 pagesACF Case1-MoGen Finalbrj75219100% (1)

- Ib ProjjectDocument23 pagesIb ProjjectRaja AdilNo ratings yet

- Biz PPT InfyDocument48 pagesBiz PPT InfyPramod TakNo ratings yet

- Valbs NewDocument54 pagesValbs NewVallabh Lotliker100% (1)

- BP Technology StrategyDocument6 pagesBP Technology StrategyAmol KasbekarNo ratings yet

- Summary Boek Bodie Kane MarcusDocument46 pagesSummary Boek Bodie Kane Marcusrodian50100% (6)

- UMESH0002Document19 pagesUMESH0002royalking_02No ratings yet

- Lecture 9 - Marketing Mix ModellingDocument62 pagesLecture 9 - Marketing Mix Modellinggagan4790100% (1)

- Comparative Study of ULIP & Traditional PlansDocument39 pagesComparative Study of ULIP & Traditional PlansbawamatharooNo ratings yet

- IntroductionDocument11 pagesIntroductionOrxan JavadovNo ratings yet

- BE FinalDocument9 pagesBE FinalMohan RajuNo ratings yet

- Free Cash Flows ComputationDocument2 pagesFree Cash Flows ComputationAziki AbdellatifNo ratings yet

- ContentsDocument16 pagesContentsjisha1808No ratings yet

- Third PointDOWDocument5 pagesThird PointDOWlon1747No ratings yet

- Overhead AllocationDocument3 pagesOverhead AllocationLavanya SaraswathiNo ratings yet

- Adidas Vs NikeDocument25 pagesAdidas Vs NikeViraja D VakadaNo ratings yet

- Business Activity Expected To Lift in 2014Document9 pagesBusiness Activity Expected To Lift in 2014economicdelusionNo ratings yet

- SBUDocument2 pagesSBUNisar KhanNo ratings yet

- 87097-19840-Money MarketDocument14 pages87097-19840-Money MarketrwrautNo ratings yet

- 4Q13 Earnings PresentationDocument16 pages4Q13 Earnings PresentationmadavahegdeNo ratings yet

- Marketing Finance: Sales RevenueDocument16 pagesMarketing Finance: Sales Revenueabhi02021989No ratings yet

- Euro CrisisDocument4 pagesEuro Crisisblue_hawkNo ratings yet

- Terms Related To EconomicsDocument8 pagesTerms Related To EconomicsBruno ROnaldNo ratings yet

- Silver RevolutionDocument4 pagesSilver Revolutionshashankppt100% (1)

- Ryan AirDocument4 pagesRyan AirDiana E BedoyaNo ratings yet

- Balance of PaymentDocument14 pagesBalance of Paymenttyrose88No ratings yet

- Moogfest 2014 Economic Impact AnalysisDocument10 pagesMoogfest 2014 Economic Impact AnalysisKyle KirkpatrickNo ratings yet

- EconomicsDocument5 pagesEconomicsIvy Dianne MartinNo ratings yet

- LS Retail NAV 2009 OverviewDocument59 pagesLS Retail NAV 2009 OverviewJeena SangeethNo ratings yet

- Harvard Management Company CaseDocument5 pagesHarvard Management Company Casetrololol1234567No ratings yet

- CrisilDocument2 pagesCrisilRuby JainNo ratings yet

- A O ! G GDocument4 pagesA O ! G GPankaj JunejaNo ratings yet

- Yyy Yy Yyyyyyyyy Y Yyyyyy Yyyyyyyyyyy YyyyyyDocument6 pagesYyy Yy Yyyyyyyyy Y Yyyyyy Yyyyyyyyyyy YyyyyyRamesh NallamalliNo ratings yet

- ©CCC CCC CCCCCCCCC CDocument15 pages©CCC CCC CCCCCCCCC CNiharika MazumdarNo ratings yet

- AirlinesDocument10 pagesAirlinesViraja D VakadaNo ratings yet

- Accenture Analyst DaysDocument3 pagesAccenture Analyst DaysaliecrawfordNo ratings yet

- International Entrepreneurship OpportunitiesDocument19 pagesInternational Entrepreneurship OpportunitiesRaul Suvera100% (1)

- Research Report On VGCL - Vietnam General Confederation of Labor - November 2011a AllJPGsDocument28 pagesResearch Report On VGCL - Vietnam General Confederation of Labor - November 2011a AllJPGsfransiskus bambangNo ratings yet

- Move New York - Transit Investment Proposals - 090813Document47 pagesMove New York - Transit Investment Proposals - 090813jrmatzNo ratings yet

- Logistics EuropeDocument1 pageLogistics EuropeGeorge Undebah100% (1)

- California Choppers 1Document3 pagesCalifornia Choppers 11z2x3c4vNo ratings yet

- Deficit Panel FindingsDocument24 pagesDeficit Panel FindingsMatt KelleyNo ratings yet

- FinalhwDocument5 pagesFinalhwJB Iba-ocNo ratings yet

- The Investment Principle: Risk and Return ModelsDocument22 pagesThe Investment Principle: Risk and Return ModelsaftabasadNo ratings yet

- CCCCCCCCCCCCCCCCCCCCCCCCCCCCCC C CC CDocument21 pagesCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC C CC CAnuj MannNo ratings yet

- Customer Relationship ManagementDocument7 pagesCustomer Relationship ManagementSantoshkumar YandamuriNo ratings yet

- Evaluating The UBC Transit Line Alternatives From A Public Health and Co - Benefits PerspectiveDocument39 pagesEvaluating The UBC Transit Line Alternatives From A Public Health and Co - Benefits PerspectiveaoolajideNo ratings yet

- Drycleaning Plant Revenues World Summary: Market Values & Financials by CountryFrom EverandDrycleaning Plant Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Provisions: B22 Major Changes in TaxDocument9 pagesProvisions: B22 Major Changes in TaxasdjkfnasdbifbadNo ratings yet

- Statement Oct 20 XXXXXXXX1430 PDFDocument3 pagesStatement Oct 20 XXXXXXXX1430 PDFPhanikaoNo ratings yet

- Macy's Store Closings News ReleaseDocument6 pagesMacy's Store Closings News ReleaseJim KinneyNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Suri SlidesDocument46 pagesSuri Slidesseehari100% (2)

- Executive Summary: About InvestosureDocument2 pagesExecutive Summary: About InvestosureISHPREET KAUR50% (2)

- Declaration 3520228712048Document5 pagesDeclaration 3520228712048hinamuzammil.acaNo ratings yet

- Asc380 Topic 2 PDFDocument52 pagesAsc380 Topic 2 PDFZaffrin ShahNo ratings yet

- Nov 2018 RTP PDFDocument21 pagesNov 2018 RTP PDFManasa SureshNo ratings yet

- Lahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18SinpaoNo ratings yet

- Broadway Industrial Group: Singapore Company Flash NoteDocument3 pagesBroadway Industrial Group: Singapore Company Flash NoteTerence Seah Pei ChuanNo ratings yet

- BRM-choice of Subjects in 2nd Year of MBADocument18 pagesBRM-choice of Subjects in 2nd Year of MBANikita SinghaniaNo ratings yet

- Intercompany TransactionsDocument5 pagesIntercompany TransactionsJessica IslaNo ratings yet

- Perspectives Paper Automated Valuation Models Nov 2022 PrintDocument24 pagesPerspectives Paper Automated Valuation Models Nov 2022 PrintPembelajaran esapNo ratings yet

- Controller in Hamilton Ontario Canada Resume Brian ShangrowDocument3 pagesController in Hamilton Ontario Canada Resume Brian ShangrowBrianShangrowNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- DHL EXPRESS Credit Application: CustomerDocument1 pageDHL EXPRESS Credit Application: CustomerpowerNo ratings yet

- Study On Empowerment of Women in Self Help Groups in Rural Part of ChennaiDocument0 pagesStudy On Empowerment of Women in Self Help Groups in Rural Part of ChennaiDrKapil JainNo ratings yet

- Particulars: Report FinalDocument12 pagesParticulars: Report FinaldananjNo ratings yet

- 2 - Chapter 1 - Banking Operations OverviewDocument29 pages2 - Chapter 1 - Banking Operations OverviewNgô KhánhNo ratings yet

- Micro Fridge Case Study-VaibDocument5 pagesMicro Fridge Case Study-VaibVaibhav Maheshwari50% (2)

- Mining Services: An Overview of SRK's Services To The Global Mining IndustryDocument40 pagesMining Services: An Overview of SRK's Services To The Global Mining IndustryUmesh Shanmugam100% (1)

- Letter Pad KabilDocument20 pagesLetter Pad KabilHiralal TharuNo ratings yet

- Republic V Del Monte G.R. No. 156956 October 9, 2006Document6 pagesRepublic V Del Monte G.R. No. 156956 October 9, 2006Angela B. LumabasNo ratings yet

- J. P Morgan - New Bank Licenses - Picking The WinnersDocument9 pagesJ. P Morgan - New Bank Licenses - Picking The WinnersProfitbytesNo ratings yet

- Name: - Score: - Grade & Section: - DateDocument2 pagesName: - Score: - Grade & Section: - DateAngelo DimacuhaNo ratings yet

- Dar Al Arkan, 6.875% 26feb2027, USDDocument14 pagesDar Al Arkan, 6.875% 26feb2027, USDshahzadahmadranaNo ratings yet

- Philippine Deposit Insurance CorporationDocument43 pagesPhilippine Deposit Insurance CorporationRepolyo Ket CabbageNo ratings yet

- CH 03Document60 pagesCH 03Hiền AnhNo ratings yet