Professional Documents

Culture Documents

Mergers & Acquisitions Course at IMT Nagpur

Uploaded by

Neeraj JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mergers & Acquisitions Course at IMT Nagpur

Uploaded by

Neeraj JainCopyright:

Available Formats

INSTITUTE OF MANAGEMENT TECHNOLOGY NAGPUR Batch: 5 Course: MERGERS, ACQUISITIONS AND CORPORATE RESTRUCTURING (Elective Finance) Course Instructor:

: Prof J S Matharu (Email: jsmatharu@imtnag.ac.in, Phone Ext: 152) Objectives of the course: To provide students with knowledge of 1. what corporate restructuring is and why it occurs; 2. the impact of the regulatory environment on the M&A environment; 3. commonly used business valuation techniques 4. how value is created (or destroyed) as a result of corporate mergers, acquisitions, divestitures, spin-offs, etc., through an analysis of how to do a deal; 5. commonly used takeover tactics and defenses; 6. the importance of understanding assumptions underlying business valuations; 7. challenges and issues associated with each phase of the M&A process from developing acquisition plans through post-closing integration; and 8. advantages and disadvantages of alternative deal structures. Course Outline: 1. Corporate Restructuring 2. Mergers and Acquisitions 3. Takeover tactics and anti-takeover measures 4. Legal Issues 5. Due Diligence 6. Valuation 7. Post-merger Issues 8. Methods of Payment 9. Financing Acquisitions 10.Cross Border Acquisitions 11.Alternatives to Mergers and Acquisitions Pedagogy: This course will be delivered through a mix of lectures and cases. Basic Text Book: Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and Solutions, 5th edition, by Donald M. DePamphilis, Academic Press Reference Books: 1. Mergers, Restructuring, and Corporate Control, by Weston, Chung and Hoag (PHI) 2. Valuation for Mergers, Buyouts, And Restructuring by Arzac (Wiley) 3. Mergers and Acquisitions, by Aurora, Shetty, and Kale (Oxford) 2010-2012 Term:

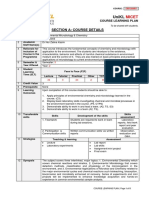

E-resources/databases: - Capitaline Plus and CMIEs Prowess databases will be used to source data for assignments and projects. Ebsco will be used to source articles for the research report on various issues related to mergers and acquisitions. Session Plan: Session No 1 2,3 4 5 6 7,8 Pedagogy (Lecture/Case/ Presentation etc.) Lecture and Presentation Lecture and Case Lecture and Case Presentation Presentation Lecture and Case Pre class preparation details for students

Topic Corporate Restructuring Mergers and Acquisitions Common Takeover Tactics and Defenses Legal Issues M&A Process (Due Diligence) Valuation Methodologies: Discounted Cash Flow and Relative Valuation Guest Lecture Mid Term Exam Analyzing Privately Held Companies Post Merger Issues Financing M&As Cross Border Acquisitions Alternatives to M&As Guest Lecture Presentations by students Wrap up

Chapter 1, DePamphilis and Case Chapter 3, DePamphilis and Case SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1997 Chapter 4, and 5, DePamphilis Chapter 7, and 8, DePamphilis, and Case

9 10 11 12 13 14 15, 16 17 18, 19 20

Lecture and Case Presentation and Case Lecture and Case Lecture and Case Presentation

Chapter Case Chapter Case Chapter Case Chapter Case

10, DePamphilis, and 6, DePamphilis, and 11, DePamphilis, and 17, DePamphilis, and

Evaluation Scheme: Component Financial Analysis of an actual merger or acquisition and its Presentation Research Report Mid Term Examination (Case Analysis)

Weightage 25% 15% 20%

End - Term Examination Class Participation

30% 10%

Any other remarks: Cases will be distributed in the prior session. Students are required to regularly look at the course folder in the handouts folder in the intranet. This will be available under handouts / jsmatharu / macr 2010-12

You might also like

- Financial Analysis and Decision Making OutlineDocument8 pagesFinancial Analysis and Decision Making OutlinedskymaximusNo ratings yet

- Investment & Portfolio Mgt. SyllabusDocument7 pagesInvestment & Portfolio Mgt. SyllabusEmi YunzalNo ratings yet

- Fundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsFrom EverandFundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsNo ratings yet

- ACC414 Financial Manageent For Accountants 2Document3 pagesACC414 Financial Manageent For Accountants 2Victor JonesNo ratings yet

- 15-445 Mergers & Buyouts Course Information and Syllabus: Preliminary & Subject To ChangeDocument9 pages15-445 Mergers & Buyouts Course Information and Syllabus: Preliminary & Subject To ChangeBrijNo ratings yet

- Toefl Writing TemplatesDocument4 pagesToefl Writing TemplatesRay & Lacie Saunders100% (1)

- Strategy ExecutionDocument6 pagesStrategy ExecutionAbhishekNo ratings yet

- Case 51 - SolDocument20 pagesCase 51 - SolArdian Syah75% (4)

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- Strategy - Mergers and Acquisitions - AnandDocument14 pagesStrategy - Mergers and Acquisitions - AnandAnil Kumar Singh100% (1)

- Sample Curricula Bachelor of Science in Interior DesignDocument32 pagesSample Curricula Bachelor of Science in Interior DesignSeaShell_6No ratings yet

- Torque 3D 1 - 2 Syllabus ExampleDocument10 pagesTorque 3D 1 - 2 Syllabus Examplealexd_dNo ratings yet

- Managerial Judgement and Strategic Investment DecisionsFrom EverandManagerial Judgement and Strategic Investment DecisionsRating: 4 out of 5 stars4/5 (2)

- Professional Ethics 2019 Course Outline-2Document14 pagesProfessional Ethics 2019 Course Outline-2Benjamin Brian NgongaNo ratings yet

- CO-MBAX9141-Term 3-MBAX9141 Mergers and Acquisitions - 2021Document8 pagesCO-MBAX9141-Term 3-MBAX9141 Mergers and Acquisitions - 2021naveed azeemNo ratings yet

- Mergers and AcquisionDocument5 pagesMergers and AcquisionN-aineel DesaiNo ratings yet

- Techniques of Ship FinanceDocument5 pagesTechniques of Ship FinanceAndry Hernawan PrihanantoNo ratings yet

- Thesis On Maintenance PracticesDocument5 pagesThesis On Maintenance PracticesCollegePapersWritingServiceWashington100% (2)

- Corporate RestructuringDocument6 pagesCorporate Restructuringrgrgupta001No ratings yet

- Course Outlines of Elective Courses - PGPPMDocument61 pagesCourse Outlines of Elective Courses - PGPPMBinoj GulalkaiNo ratings yet

- Alpha University Colleg1Document8 pagesAlpha University Colleg1Wedi FitwiNo ratings yet

- Student Study Guide PrefaceDocument5 pagesStudent Study Guide PrefacePuneet MittalNo ratings yet

- Bachelor Thesis IpoDocument6 pagesBachelor Thesis Ipolanatedrummondfortwayne100% (2)

- BUS 102 Fundamentals of Buiness II 2022Document4 pagesBUS 102 Fundamentals of Buiness II 2022Hafsa YusifNo ratings yet

- MBA Elective Course on Mergers & AcquisitionsDocument5 pagesMBA Elective Course on Mergers & AcquisitionstenalkalNo ratings yet

- k4115 Syllabus Spring 2012Document4 pagesk4115 Syllabus Spring 2012api-22218014No ratings yet

- Project Feasibility StudyDocument2 pagesProject Feasibility StudyMARK ANGELO PARAISONo ratings yet

- Uitm Master Eng SyllabusDocument7 pagesUitm Master Eng SyllabusJesse KaufmanNo ratings yet

- Course Outline Summer 2014 4SF3Document6 pagesCourse Outline Summer 2014 4SF3LamontNo ratings yet

- Global Operations Strategy Singapore 5-6 September, 2009: WelcomeDocument11 pagesGlobal Operations Strategy Singapore 5-6 September, 2009: WelcomeTanuj NandanNo ratings yet

- MBA 250 - Strategy Syllabus 04-05Document21 pagesMBA 250 - Strategy Syllabus 04-05Dit HantirNo ratings yet

- Investment SyllabusDocument6 pagesInvestment SyllabusAshish MakraniNo ratings yet

- Mgmt3347 2015Document7 pagesMgmt3347 2015DoonkieNo ratings yet

- Course Brochure M&A 2024Document6 pagesCourse Brochure M&A 2024Himanshu MishraNo ratings yet

- FM OutlineDocument3 pagesFM OutlineTejas ChaudhariNo ratings yet

- Thesis Implementation SampleDocument4 pagesThesis Implementation SampleDaniel Wachtel100% (2)

- ENGINEERING ECONOMY MIDTERM EXAMDocument5 pagesENGINEERING ECONOMY MIDTERM EXAMabcNo ratings yet

- Technical Analysis of Securities ExplainedDocument5 pagesTechnical Analysis of Securities ExplainedVenu Gopal VegiNo ratings yet

- Strategic Planning for Infrastructure Projects (28-0-0Document5 pagesStrategic Planning for Infrastructure Projects (28-0-0Arun TanwarNo ratings yet

- IAM - Risk MathematicsDocument7 pagesIAM - Risk MathematicswirdinaNo ratings yet

- Journal of Behavioral and Experimental Finance: Kevin Mak, Thomas H. MccurdyDocument11 pagesJournal of Behavioral and Experimental Finance: Kevin Mak, Thomas H. MccurdyHannah NazirNo ratings yet

- Equity Portfolio Construction and Selection Using Multiobjective Mathematical ProgrammingDocument25 pagesEquity Portfolio Construction and Selection Using Multiobjective Mathematical ProgrammingHeni AgustianiNo ratings yet

- FINN 400 Outline Fall 2020Document8 pagesFINN 400 Outline Fall 2020Zahra EjazNo ratings yet

- Applied Value Investing (Duggal) FA2016Document3 pagesApplied Value Investing (Duggal) FA2016darwin12No ratings yet

- Muhammad Amir Mushtaq Ex-Mba-F12-058 Leon F. Mcginnis,: and William KesslerDocument13 pagesMuhammad Amir Mushtaq Ex-Mba-F12-058 Leon F. Mcginnis,: and William KesslerFahad MushtaqNo ratings yet

- Jaipuria Institute of Management, Lucknow Post Graduate Diploma in Management THIRD TRIMESTER (2013-2014)Document6 pagesJaipuria Institute of Management, Lucknow Post Graduate Diploma in Management THIRD TRIMESTER (2013-2014)saah007No ratings yet

- Module Descriptions for Business Policy DepartmentDocument30 pagesModule Descriptions for Business Policy DepartmentManan VoraNo ratings yet

- Christine Cromarty Business ProposalDocument16 pagesChristine Cromarty Business Proposaljazy12No ratings yet

- Mba Thesis GuidelinesDocument6 pagesMba Thesis Guidelinesandrealeehartford100% (2)

- Revised OultlineDocument4 pagesRevised OultlineSarose ThapaNo ratings yet

- Unit Information Form (UIF) : Page 1 of 5Document5 pagesUnit Information Form (UIF) : Page 1 of 5Radha ThakurNo ratings yet

- Micro EconomicsDocument11 pagesMicro Economicsanurag anandNo ratings yet

- Master Thesis Business StrategyDocument8 pagesMaster Thesis Business StrategyBuyThesisPaperVirginiaBeach100% (2)

- Managerial Accounting Course SyllabusDocument7 pagesManagerial Accounting Course SyllabusgsdeeepakNo ratings yet

- Knowledge & Innovation Management PDFDocument15 pagesKnowledge & Innovation Management PDFalvaro_massimoNo ratings yet

- Dissertation Examples Events ManagementDocument5 pagesDissertation Examples Events ManagementCustomCollegePaperCanada100% (1)

- Sila BusDocument19 pagesSila BusTry DharsanaNo ratings yet

- CF Decisions & Recent DevelopmentsDocument2 pagesCF Decisions & Recent DevelopmentsDedi SupiyadiNo ratings yet

- Course Descriptions: MsmotDocument15 pagesCourse Descriptions: MsmotNani NRajNo ratings yet

- Managerial Economics Course SyllabusDocument6 pagesManagerial Economics Course SyllabusTimothy SungNo ratings yet

- FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedDocument7 pagesFINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedYou VeeNo ratings yet

- FINN 200 - Intermediate Finance-Bushra NaqviDocument4 pagesFINN 200 - Intermediate Finance-Bushra NaqviazizlumsNo ratings yet

- Building Options at Project Front-End Strategizing: The Power of Capital Design for EvolvabilityFrom EverandBuilding Options at Project Front-End Strategizing: The Power of Capital Design for EvolvabilityNo ratings yet

- TCM Practice QuestionsDocument8 pagesTCM Practice QuestionsNeeraj JainNo ratings yet

- CDBM WorkbookDocument58 pagesCDBM WorkbookGourav SahaNo ratings yet

- SAP SD Frequently Asked Questions - ERP Operations - SCN WikiDocument6 pagesSAP SD Frequently Asked Questions - ERP Operations - SCN WikiNeeraj JainNo ratings yet

- ICICI Lombard 2010 Interview QuestionsDocument7 pagesICICI Lombard 2010 Interview Questionsvarun0787No ratings yet

- MILESTONE COMMITTEE APPLICATIONDocument2 pagesMILESTONE COMMITTEE APPLICATIONNeeraj JainNo ratings yet

- Creativity - Lateral ThinkingDocument17 pagesCreativity - Lateral ThinkingNeeraj JainNo ratings yet

- For Session On 21.10.11 Watermill Case Suggested QuestionsDocument1 pageFor Session On 21.10.11 Watermill Case Suggested QuestionsNeeraj JainNo ratings yet

- Transformational Leadership in The Context of Organizational ChangeDocument9 pagesTransformational Leadership in The Context of Organizational ChangeNeeraj JainNo ratings yet

- 72255Document5 pages72255avanishkumar_007No ratings yet

- RDB Rasayans Limited: Corporate FinanceDocument4 pagesRDB Rasayans Limited: Corporate FinanceNeeraj JainNo ratings yet

- Income Statement ModelDocument11 pagesIncome Statement ModelNeeta MossesNo ratings yet

- 72255Document5 pages72255avanishkumar_007No ratings yet

- MODR 1730 B 2021-22 SyllabusDocument17 pagesMODR 1730 B 2021-22 SyllabusBryanna MillsNo ratings yet

- TVET Trainer Session PlanDocument26 pagesTVET Trainer Session PlanRocz RocoNo ratings yet

- 3.teaching Methods Any 5Document18 pages3.teaching Methods Any 5Veena DalmeidaNo ratings yet

- PDFDocument183 pagesPDFSuresh Senanayake100% (1)

- BMED 3510 Systems Biology ModelingDocument4 pagesBMED 3510 Systems Biology ModelingSulaiman SomaniNo ratings yet

- Is 107 Fundamentals of Business and ManagementDocument8 pagesIs 107 Fundamentals of Business and ManagementHarold Jay OrdenizaNo ratings yet

- Syllabus 2210 Summer 2020Document7 pagesSyllabus 2210 Summer 2020Joe AskNo ratings yet

- The Effective Use of Youtube Videos For Teaching English Language in Classrooms As Supplementary Material at Taibah University in AlulaDocument16 pagesThe Effective Use of Youtube Videos For Teaching English Language in Classrooms As Supplementary Material at Taibah University in AlulaNovia Amisbahur Riza IINo ratings yet

- UGC API Proforma for Academic PositionsDocument4 pagesUGC API Proforma for Academic PositionsLekh RajNo ratings yet

- Outcomes Intermediate VocabBuilder Unit7Document7 pagesOutcomes Intermediate VocabBuilder Unit7LaurafltiNo ratings yet

- ISIT212-Corporate Network Planning and DesignDocument7 pagesISIT212-Corporate Network Planning and DesignjadelamannaNo ratings yet

- Dramatic Lit. SyllabusDocument7 pagesDramatic Lit. SyllabusCasNo ratings yet

- GECH119 Chemistry and SocietyDocument26 pagesGECH119 Chemistry and Societyayu mauliraNo ratings yet

- NothingDocument5 pagesNothingisahhhNo ratings yet

- Geog 3 Syll Fall 2016Document6 pagesGeog 3 Syll Fall 2016Crystal EshraghiNo ratings yet

- Group 1 Leader: Darren Luklukan MembersDocument5 pagesGroup 1 Leader: Darren Luklukan MembersRoselyn RebañoNo ratings yet

- National workshop invitation for keynote lectureDocument2 pagesNational workshop invitation for keynote lectureSanthosh PraveenNo ratings yet

- Research Methods for Humanitarian InterventionsDocument14 pagesResearch Methods for Humanitarian InterventionsKareem NabilNo ratings yet

- Course Outline HRD2016Document4 pagesCourse Outline HRD2016Usama MalikNo ratings yet

- Lecture Method: K - Abirami 1 Year B.Ed Biological ScienceDocument13 pagesLecture Method: K - Abirami 1 Year B.Ed Biological ScienceAbiramiNo ratings yet

- Active LearningDocument5 pagesActive LearningmashauriNo ratings yet

- Get Videos Ready To Go and Pause!!!!: Seminar ScriptDocument8 pagesGet Videos Ready To Go and Pause!!!!: Seminar ScriptMelissa MerrittNo ratings yet

- Teamwork and Archaeology: Developing Teambuilding Skills in Archaeology StudentsDocument8 pagesTeamwork and Archaeology: Developing Teambuilding Skills in Archaeology StudentsDavid Connolly100% (2)

- ANTH 100-Introduction To Cultural Anthropology-Sadaf AhmadDocument9 pagesANTH 100-Introduction To Cultural Anthropology-Sadaf AhmadAli Abbas GilaniNo ratings yet

- E 1Document9 pagesE 1AsadNo ratings yet

- Social Science Cluster: Obe Subject Syllabus Subject Title Subject Code Subject PrerequisiteDocument4 pagesSocial Science Cluster: Obe Subject Syllabus Subject Title Subject Code Subject PrerequisiteMarlon SilvozaNo ratings yet