Professional Documents

Culture Documents

Qlctr-M4135a-C62-10 09 2011

Uploaded by

Thanh TrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Qlctr-M4135a-C62-10 09 2011

Uploaded by

Thanh TrCopyright:

Available Formats

Khu Ti ch FFK

Khu Ti ch FFK

FFK Recycling Park for Ho Chi Minh City

Relevant Financial Figures

- Excerpt of Feasibility Study

FFK environment GmbH

4th of November 2007

Gim dn lng cht thi chn lp

FFK Recycling Park for HCMC

Relevant Financial Figures

Khu Ti ch FFK

-1-

Khu Ti ch FFK

FFK Recycling Park for HCMC

Relevant Financial Figures

-2-

Production Process

Khu Ti ch ti thnh ph H Ch Minh

My tip nhn v phn tch

My sn xut RDF

My sn xut gas sinh hc

My sn xut phn compot

T my pht Nh my in

FFK Recycling Park for HCMC

Relevant Financial Figures

-3-

FFK Recycling Park for HCMC

Relevant Financial Figures

-4-

FFK Recycling Park for HCMC

Relevant Financial Figures

-5-

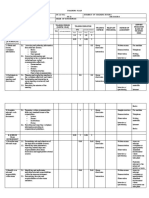

Material Balance Sheet

Assumptions 1/7

Material Balance Sheet on Annual Basis

Input (Waste Composition & Energy Premise)

Type of Waste

Organic from leftovers

Glass

PET/PVC/Gummi

Plastic/Nylon

Metal

Wood

Textile

Paper

Ash I

Mineralic

Other

n.a.

n.a.

Total

Fraction of

total waste

Tonnes per

year

67,00%

0,50%

4,00%

4,00%

2,00%

3,00%

5,50%

4,00%

0,00%

2,00%

8,00%

0%

0%

100,00%

268.000,00

2.000,00

16.000,00

16.000,00

8.000,00

12.000,00

22.000,00

16.000,00

8.000,00

32.000,00

0

0

400.000,00

Output (Products & Energy)

Output Product

RDF (to)

Compost (to)

Mineralic (to)

Pet/PVC (to)

Plastic/Nylon (to)

Metal (to)

Glass

Textile

Wood (to)

Paper (to)

Ash (to)

Not recyclable material

Mass decrease (due to evapor.)

Total

Energy calculation factors

m of gas per ton organic waste

Output kwh electric per m of biogas

Output kwh thermal per m of biogas

Energy Output

Energyel (KWh)

Energyth (KWh)

Total

175

2,20

1,87

FFK Recycling Park for HCMC

Relevant Financial Figures

Fraction of

Output

Tonnes per

year

11,15%

49,33%

0,00%

2,56%

2,08%

1,90%

0,34%

3,12%

0,92%

1,92%

0,00%

4,26%

22,42%

100,00%

44.609

197.302

10.240

8.320

7.600

1.360

12.496

3.671

7.680

17.024

89.698

400.000

Fraction of

Energy

kWh per year

54,05%

45,95%

100,00%

100.084.600

85.071.910

185.156.510

Assumptions 3/7

5

5.1

5.2

5.3

5.4

5.5

5.6

6

6.1

6.2

6.3

6.4

6.5

6.6

6.7

6.8

6.9

6.10

6.11

6.12

6.13

6.14

6.15

6.16

6.17

Data

1

1.1

1.2

1.3

1.4

1.5

1.6

Input volumes (t/yr)

Domestic Waste (t/yr)

Quota of annual input volume in 1st yr in %

Quota of annual input volume in 2nd yr in %

Industrial Waste (t/yr)

Commercial Waste (t/yr)

Hazardous Waste (t/yr)

Data

400.000

0%

50%

n.a.

n.a.

n.a.

2

2.1

2.2

2.3

2.4

2.5

Input prices (/t) 1st yr

Domestic Waste (/t)

Domestic Waste price increase factor (%/yr)

Industrial Waste (/t)

Commercial Waste (/t)

Hazardous Waste (/t)

Data

Output volumes

RDF (t/yr)

Compost (t/yr)

Energyel (MWh/yr)

Energyth (MWh/yr)

Mineralic (t/yr)

Pet/PVC (t/yr)

Plastic/Nylon (t/yr)

Metal (t/yr)

Wood (t/yr)

Paper (t/yr)

Ash (t/yr)

Not recyclable material (t/yr)

Carbon credits factor in 1st yr of 2nd trading period

Carbon credits factor in 2nd yr of 2nd trading period

Carbon credits factor in 3rd yr of 2nd trading period

Carbon credits factor in 4th yr of 2nd trading period

Carbon credits forward quota

Carbon credits factor beyond 2012

Data

44.609

197.302

100.085

85.072

0

10.240

8.320

7.600

3.671

7.680

0

17.024

14%

26%

36%

45%

50%

0%

3

3.1

3.2

3.3

3.4

3.5

3.6

3.7

3.8

3.9

3.10

3.11

3.12

3.13

3.14

3.15

3.16

3.17

3.18

4

4.1

4.2

4.3

4.4

4.5

4.6

4.7

4.8

4.9

4.10

4.11

4.12

4 13

4.13

4.14

4.15

4.16

4.17

4.18

4.19

4.20

4.21

4.22

4.23

4.24

4.25

4.26

4.27

4.28

10

2,8%

n.a.

n.a.

n.a.

Data

40.515

3.500

1.222.750

23.908

2

24,55

Operative cost base 1st yr

Electricity (/MWh)

annual increase factor (%)

Water (/m)

annual increase factor ((%))

Diesel (/l)

annual increase factor (%)

Lubricants (/l)

annual increase factor (%)

Analysis (/pcs./1000t)

annual increase factor (%)

Spare Parts/Wearing Parts (/yr)

annual increase factor (%)

Leasehold / ha of land in

annual increase factor (%)

Insurance (%/yr of total invest)

annual increase factor (%)

Insurance quota 1st year

Data

-55

2%

-2

2%

-1

2%

-5

2%

-100

2%

-1.211.983

2%

0

2%

1%

2%

25%

-9-

7

7.1

7.2

7.3

7.4

7.5

7.6

7.7

7.8

7.9

7.10

7.11

7.12

7.13

7.14

8

8.1

8.2

8.3

8.4

8.5

Data

20

2%

30

2%

60

2%

0

2%

0

2%

60

2%

50

2%

80

2%

5

2%

70

2%

0

2%

0

2%

10

2%

15

2%

-8-

Assumptions 5/7

Maintenance cost base 1st year (external cost)

Main.-costs Splitting Unit

Main.-costs Sorting Unit

Main.-costs Biogas Unit

Main.-costs Compost Unit

Main.-costs Power Plant

Main.-costs RDF Unit

Main.-costs Costr. Waste Unit

Main.-costs Special Incin. Unit

Main.-costs Infrastructure

Main.-costs Admin. Unit

Total maintenance costs

annuall increase ffactor (%)

( )

Quota of maintenance costs in 1st yr

Quota of maintenance costs in 2nd yr

Headcount from beginning of 3rd year (serial production)

Unskilled

Skilled local

Skilled foreign

Management local

Management foreign

FFK Recycling Park for HCMC

Relevant Financial Figures

Output price base 1st year

RDF (/t)

annual increase factor (%)

Compost (/t)

annual increase factor (%)

Energyel Biogas (/Mwh)

annual increase factor (%)

Energyth (/Mwh)

annual increase factor (%)

Mineralic (/t)

annual increase factor (%)

Pet/PVC (/t)

annual increase factor (%)

Plastic/Nylon (/t)

annual increase factor (%)

Metal (/t)

annual increase factor (%)

Wood (/t)

annual increase factor (%)

Paper (/t)

annual increase factor (%)

Ash (/t)

annual increase factor (%)

Disturbing Material (/t)

annual increase factor (%)

Carbon certificates forward (/t)

annual increase factor (%)

Carbon certificates spot (/t)

annual increase factor (%)

FFK Recycling Park for HCMC

Relevant Financial Figures

-7-

Assumptions 4/7

Commodity demand

Electricity (MWh/yr)

Water (m/yr)

Diesel (l/yr)

Lubricants (l/yr)

No. of analysis every 5000 to of input

Demanded land in ha

FFK Recycling Park for HCMC

Relevant Financial Figures

Assumption (Input parameter)

FFK Recycling Park for HCMC

Relevant Financial Figures

-6-

Assumptions 2/7

No.

- 10 -

Data

-27.000

-1.600

-442.750

-19.500

-462.000

-300.000

0

0

-22.500

-3.000

-1.278.350

1%

0%

50%

Data

218

71

26

3

2

9

9.1

9.2

9.3

9.4

9.5

Headcount 1st year (quota of serial production)

Unskilled

Skilled local

Skilled foreign

Management local

Management foreign

Data

10

10.1

10.2

10.3

10.4

10.5

Headcount 2nd year (quota of serial production)

Unskilled

Skilled local

Skilled foreign

Management local

Management foreign

Data

11 P

Personnell expenditures

dit

(/ /

(/yr/employee)

l

)

11.1

Unskilled (/yr)

11.2

annual increase factor

11.3

Skilled local (/yr)

11.4

annual increase factor

11.5

Skilled foreign (/yr)

11.6

annual increase factor

11.7

Management local (/yr)

11.8

annual increase factor

11.9

Management foreign (/yr)

11.10

annual increase factor

11.11

Management local success in % (mgmt. wage)

11.12

Operation management and services % of turno.

11.13

Pension plan payments in % of wages

11.14

Travel expenses per manager (/yr)

11.15

annual increase factor

FFK Recycling Park for HCMC

Relevant Financial Figures

10%

30%

30%

50%

75%

50%

70%

70%

100%

100%

Data

D

t

-6.000

2%

-12.000

2%

-50.000

2%

-75.000

2%

-120.000

2%

10%

-2%

5%

-10.000

2%

- 11 -

Assumptions 6/7

Assumptions 7/7

12 Investment in fixed assets (machinery)

12.1

Splitting Unit

12.2

Sorting Unit

12.3

Biogas Unit

12.4

Composting Unit

12.5

RDF Unit

12.6

Construction Waste Unit

12.7

Power plant

12.8

Special incineration

12.9

Infrastructure

12.10

Administration Unit

12.11 Total investment in fixed assets (machinery)

13

13.1

13.2

13

2

13.3

13.4

Equipment payment plan

Payment machinery quota

P

Payment

t machinery

hi

quota

t

Payment machinery quota

Payment machinery quota

Data

-900.000

-80.000

-12.650.000

-1.950.000

-5.000.000

0

-7.700.000

0

-1.500.000

-30.000

-29.810.000

for suppliers

beginning of 1st year "order placement"

beginning

b i i

off 2nd

2 d year "delivery"

"d li

"

beginning of 3rd year "acceptance"

in 4th and following years

Data

Data

-900.000

-150.000

-25.000.000

-3.500.000

-900.000

0

-500.000

0

-700.000

-250.000

-31.900.000

FFK Recycling Park for HCMC

Relevant Financial Figures

FFK Recycling Park for HCMC

Relevant Financial Figures

Data

16

16.1

16.2

16.3

16.4

16.5

16.6

Depreciation values

Asset depreciation range for fixed assets machinery (yrs)

1st yr LIA quota fixed assets machinery (%)

Residual value for fixed assets machinery ()

Asset depreciation range for fixed assets buildings (yrs)

1st yr LIA quota fixed assets buildings (%)

Residual value for fixed assets buildings ()

Data

FFK Recycling Park for HCMC

Relevant Financial Figures

- 12 -

Profit and Loss Account

Profit & Loss

Turnover value /yr

Input

Input Gate fee total

Output

RDF

Compost

Energy el. Biogas

Energy th.

Mineralic

Pet/PVC

Plastic/Nylon

Metal

Wood

Paper

Ash

Disturbing Material

Carbon certificates forward

Carbon certificates spot

Output-products total

Total turnover value

Flexible costs

Electricity

Water

Diesel

Lubricants

Analysis

Spare parts / wearing parts

Flexible cost total

Fi costs

Fix

t

Maintenance external

Leasehold

Insurance

Travel expenses

Operation mgmt. and services (% of turno.)

Personnel expenditures

Unskilled

Skilled local

Skilled foreign

Management local

Management foreign

Local mgmt. success bonuses (% of mgmt w

Pension plan payments

Personnel expenditures total

Fix cost total

Total fix and flexible cost

Profit & Loss

Ebitda

Depreciation fixed asstes machinery

Residual value of machinery asset at end of

Depreciation fixed assets buidlings

Residual value of building asset at end of p.

Depreciation total

Ebit

Interest debt capital

Interest equity related debt

Ebt

Reserve

Tax

Result from operational business

Result from operational business(accum.)

Building payment plan with suppliers

Payment f. a. building quota beginning of 1st year "order placement"

Payment f. a. building quota beginning of 2nd year "delivery"

Payment f. a. building quota beginning of 2nd year "acceptance"

Payment f. a. building quota in 4th and following years

40%

50%

10%

0%

Price & cost development

Price and cost value /yr

Input value

Gate fee (price/t)

Output values

RDF (price/t)

Compost (price/t)

Energy el. Biogas (price/Mwh)

Energy th. (price/Mwh)

Mineralic (price/t)

Pet/PVC (price/t)

Plastic/Nylon (price/t)

Metal (price/t)

Wood (price/t)

Paper (price/t)

Ash (price/t)

Disturbing Material (price/t)

Carbon certificates forward (price/t)

Carbon certificates spot (price/t)

Flexible cost values

Electricity (cost/Mwh)

W t (cost/m)

Water

(

t/ )

Diesel (cost/ltr.)

Lubricants (cost/ltr.)

Analysis (cost/pc.)

Spare parts / wearing parts (total/yr)

Fix costs values

Maintenance external (total)

Leasehold (cost/ha)

Insurance (% of total investment)

Travel expenses (cost/mangt.)

Personnel expenditures values

Unskilled (wage/pers/yr)

Skilled local (wage/pers/yr)

Skilled foreign (wage/pers/yr)

Management local (wage/pers/yr)

Management foreign (wage/pers/yr)

10

0%

0

20

0%

0

17 Capital assumptions

17.1

Interest rate debt capital (%)

17.2

Term of loan (yrs)

17.3

Issuance of long-term debt at beginning of 1st yr ()

17.4

Issuance of long-term debt at beginning of 2nd yr ()

17.5

Targeted debt capital ratio (%)

17.6

Targeted equity ratio (%)

17.7

Interest rate equity related debt capital (%)

17.8

Issuance of equity capital 1st yr ()

17.9

Issuance of equity capital 2nd yr ()

17.10

Sign if additional external financing demand in 3rd or following yrs occurs

17.11

Investors RoE expectation in %

17.12

Investors RoE quota in 1st year (%)

17.13

Tax bracket (%)

17.14

Tax holiday (years)

17.15

Reserve quota of Ebt (%)

17.16

Dividend quota of net cash before shareholder activ. (%)

17.17

Hurdle cash amount for dividend payments ()

40%

50%

10%

0%

14 Fixed assets (buildings)

14.1

Splitting Unit

14.2

Sorting Cabin

14.3

Biogas Unit

14.4

Compost Unit

14.5

RDF Unit

14.6

Construction Waste Unit

14.7

Power plant

14.8

Special incineration

14.9

Infrastructure

14.10

Administration Unit

14.11 Fixed assets total (buildings)

Price and Cost Development

15

15.1

15.2

15.3

15.4

Data

8%

10

20.500.000

28.500.000

75%

25%

0%

9.500.000

10.500.000

!

20%

50%

25%

0

5%

10%

1.000.000

2009

2010

2011

2012

2013

2014

2015

2016

03

04

05

06

07

08

09

10

10,28

10,57

10,86

11,17

11,48

11,80

12,13

12,47

12,82

20,40

30,60

61,20

0,00

0,00

61,20

51,00

81,60

5,10

71,40

0,00

0,00

10,20

15,30

20,81

31,21

62,42

0,00

0,00

62,42

52,02

83,23

5,20

72,83

0,00

0,00

10,40

15,61

21,22

31,84

63,67

0,00

0,00

63,67

53,06

84,90

5,31

74,28

0,00

0,00

10,61

15,92

21,65

32,47

64,95

0,00

0,00

64,95

54,12

86,59

5,41

75,77

0,00

0,00

10,82

16,24

22,08

33,12

66,24

0,00

0,00

66,24

55,20

88,33

5,52

77,29

0,00

0,00

11,04

16,56

22,52

33,78

67,57

0,00

0,00

67,57

56,31

90,09

5,63

78,83

0,00

0,00

11,26

16,89

22,97

34,46

68,92

0,00

0,00

68,92

57,43

91,89

5,74

80,41

0,00

0,00

11,49

17,23

23,43

35,15

70,30

0,00

0,00

70,30

58,58

93,73

5,86

82,02

0,00

0,00

11,72

17,57

23,90

35,85

71,71

0,00

0,00

71,71

59,75

95,61

5,98

83,66

0,00

0,00

11,95

17,93

-55,00

-2,00

2 00

-1,00

-5,00

-100,00

-1.211.982,80

-56,10

-2,04

2 04

-1,02

-5,10

-102,00

-1.236.222,46

-57,22

-2,08

2 08

-1,04

-5,20

-104,04

-1.260.946,91

-58,37

-2,12

2 12

-1,06

-5,31

-106,12

-1.286.165,84

-59,53

-2,16

2 16

-1,08

-5,41

-108,24

-1.311.889,16

-60,72

-2,21

2 21

-1,10

-5,52

-110,41

-1.338.126,94

-61,94

-2,25

2 25

-1,13

-5,63

-112,62

-1.364.889,48

-63,18

-2,30

2 30

-1,15

-5,74

-114,87

-1.392.187,27

-64,44

-2,34

2 34

-1,17

-5,86

-117,17

-1.420.031,02

-65,73

-2,39

2 39

-1,20

-5,98

-119,51

-1.448.431,64

-1.278.350,00 -1.291.133,50 -1.304.044,84 -1.317.085,28 -1.330.256,14 -1.343.558,70 -1.356.994,28 -1.370.564,23 -1.384.269,87 -1.398.112,57

0,00

0,00

0,00

0,00

0,00

0,00

0,00

0,00

0,00

0,00

0,25%

1,00%

1,02%

1,04%

1,06%

1,08%

1,10%

1,13%

1,15%

1,17%

-10.000,00

-10.200,00

-10.404,00

-10.612,08

-10.824,32

-11.040,81

-11.261,62

-11.486,86

-11.716,59

-11.950,93

-6.000,00

-12.000,00

-50.000,00

-75.000,00

-120.000,00

-6.120,00

-12.240,00

-51.000,00

-76.500,00

-122.400,00

-6.242,40

-12.484,80

-52.020,00

-78.030,00

-124.848,00

-6.367,25

-12.734,50

-53.060,40

-79.590,60

-127.344,96

-6.494,59

-12.989,19

-54.121,61

-81.182,41

-129.891,86

-6.624,48

-13.248,97

-55.204,04

-82.806,06

-132.489,70

-6.756,97

-13.513,95

-56.308,12

-84.462,18

-135.139,49

-6.892,11

-13.784,23

-57.434,28

-86.151,43

-137.842,28

-7.029,96

-14.059,91

-58.582,97

-87.874,45

-140.599,13

-7.170,56

-14.341,11

-59.754,63

-89.631,94

-143.411,11

- 14 -

Cash Flow Account

2017

2.056.000

4.227.136

4.345.496

4.467.170

4.592.250

4.720.833

4.853.017

4.988.901

5.128.590

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

455.015

3.018.714

3.062.589

0

0

313.344

212.160

310.080

9.361

274.176

0

0

142.800

214.200

8.012.440

10.068.440

928.232

6.158.178

6.247.681

0

0

639.222

432.806

620.160

19.097

559.319

0

0

541.008

811.512

16.957.214

21.184.350

946.796

6.281.341

6.372.635

0

0

652.006

441.463

632.563

19.479

570.505

0

0

764.070

1.146.105

17.826.962

22.172.458

965.732

6.406.968

6.500.087

0

0

665.046

450.292

645.214

19.868

581.916

0

0

974.189

1.461.283

18.670.596

23.137.766

985.047

6.535.107

6.630.089

0

0

678.347

459.298

658.119

20.266

593.554

0

0

0

0

16.559.826

21.152.077

1.004.748

6.665.809

6.762.691

0

0

691.914

468.484

671.281

20.671

605.425

0

0

0

0

16.891.023

21.611.856

1.024.843

6.799.126

6.897.945

0

0

705.752

477.853

684.707

21.084

617.533

0

0

0

0

17.228.843

22.081.860

1.045.340

6.935.108

7.035.904

0

0

719.868

487.410

698.401

21.506

629.884

0

0

0

0

17.573.420

22.562.321

1.066.246

7.073.810

7.176.622

0

0

734.265

497.159

712.369

21.936

642.482

0

0

0

0

17.924.888

23.053.479

0

0

0

0

0

0

0

-1.136.446

-3.570

-623.603

-60.964

-8.160

-618.111

-2.450.854

-2.318.349

-7.283

-1.272.149

-124.367

-16.646

-1.260.947

-4.999.741

-2.364.716

-7.428

-1.297.592

-126.854

-16.979

-1.286.166

-5.099.736

-2.412.011

-7.577

-1.323.544

-129.391

-17.319

-1.311.889

-5.201.731

-2.460.251

-7.729

-1.350.015

-131.979

-17.665

-1.338.127

-5.305.766

-2.509.456

-7.883

-1.377.015

-134.619

-18.019

-1.364.889

-5.411.881

-2.559.645

-8.041

-1.404.555

-137.311

-18.379

-1.392.187

-5.520.118

-2.610.838

-8.202

-1.432.647

-140.057

-18.747

-1.420.031

-5.630.521

-2.663.055

-8.366

-1.461.299

-142.858

-19.121

-1.448.432

-5.743.131

0

0

-154.275

-50.000

0

-645.567

0

-617.100

-51.000

-201.369

-1.304.045

0

-629.442

-52.020

-423.687

-1.317.085

0

-642.031

-53.060

-443.449

-1.330.256

0

-654.871

-54.122

-462.755

-1.343.559

0

-667.969

-55.204

-423.042

-1.356.994

0

-681.328

-56.308

-432.237

-1.370.564

0

-694.955

-57.434

-441.637

-1.384.270

0

-708.854

-58.583

-451.246

-1.398.113

0

-723.031

-59.755

-461.070

-130.800

-255.600

-390.000

-112.500

-180.000

-11.250

-53.445

-1.133.595

-1.337.870

-1.337.870

-667.080

-608.328

-928.200

-229.500

-244.800

-22.950

-133.895

-2.834.753

-4.349.789

-6.800.643

-1.360.843

-886.421

-1.352.520

-234.090

-249.696

-23.409

-204.179

-4.311.158

-6.720.351

-11.720.093

-1.388.060

-904.149

-1.379.570

-238.772

-254.690

-23.877

-208.262

-4.397.381

-6.853.006

-11.952.743

-1.415.821

-922.232

-1.407.162

-243.547

-259.784

-24.355

-212.427

-4.485.328

-6.987.333

-12.189.064

-1.444.138

-940.677

-1.435.305

-248.418

-264.979

-24.842

-216.676

-4.575.035

-7.064.808

-12.370.574

-1.473.020

-959.490

-1.464.011

-253.387

-270.279

-25.339

-221.009

-4.666.536

-7.193.403

-12.605.284

-1.502.481

-978.680

-1.493.291

-258.454

-275.685

-25.845

-225.430

-4.759.866

-7.324.457

-12.844.575

-1.532.530

-998.254

-1.523.157

-263.623

-281.198

-26.362

-229.938

-4.855.064

-7.458.017

-13.088.538

-1.563.181

-1.018.219

-1.553.620

-268.896

-286.822

-26.890

-234.537

-4.952.165

-7.594.133

-13.337.264

-1.337.870

0

29.810.000

0

31.900.000

0

-1.337.870

-1.640.000

0

-2.977.870

0

0

-2.977.870

-2.977.870

3.267.797

-2.981.000

26.829.000

-1.595.000

30.305.000

-4.576.000

-1.308.203

-3.806.792

0

-5.114.994

0

0

-5.114.994

-8.092.864

9.464.257

-2.981.000

23.848.000

-1.595.000

28.710.000

-4.576.000

4.888.257

-3.544.011

0

1.344.247

-67.212

-336.062

940.973

-7.151.892

10.219.716

-2.981.000

20.867.000

-1.595.000

27.115.000

-4.576.000

5.643.716

-3.260.207

0

2.383.508

-119.175

-595.877

1.668.456

-5.483.436

10.948.702

-2.981.000

17.886.000

-1.595.000

25.520.000

-4.576.000

6.372.702

-2.953.700

0

3.419.002

-170.950

-854.751

2.393.302

-3.090.134

8.781.503

-2.981.000

14.905.000

-1.595.000

23.925.000

-4.576.000

4.205.503

-2.622.672

0

1.582.832

-79.142

-395.708

1.107.982

-1.982.152

9.006.572

-2.981.000

11.924.000

-1.595.000

22.330.000

-4.576.000

4.430.572

-2.265.161

0

2.165.411

-108.271

-541.353

1.515.788

-466.364

9.237.285

-2.981.000

8.943.000

-1.595.000

20.735.000

-4.576.000

4.661.285

-1.879.050

0

2.782.235

-139.112

-695.559

1.947.565

1.481.200

9.473.784

-2.981.000

5.962.000

-1.595.000

19.140.000

-4.576.000

4.897.784

-1.462.050

0

3.435.734

-171.787

-858.934

2.405.014

3.886.214

9.716.215

-2.981.000

2.981.000

-1.595.000

17.545.000

-4.576.000

5.140.215

-1.011.689

0

4.128.526

-206.426

-1.032.131

2.889.968

6.776.182

- 15 -

02

10,00

20,00

30,00

60,00

0,00

0,00

60,00

50,00

80,00

5,00

70,00

0,00

0,00

10,00

15,00

FFK Recycling Park for HCMC

Relevant Financial Figures

- 13 -

Turnover and Cost Break-down per processed Tonne of Waste

2008

01

Turnover - and Cost Break-Down/processed tonne

Turnover Break Down

Turnover total/t ()

Turnover/t input ()

Turnover/t input (% of total turnover/t)

Turnover/t output ()

Turnover/t output (% of total turnover/t)

Cost Break Down

Total cost/t

Total cost/t (% of total turnover/t)

Cost fix&flex. total/t ()

Cost fix&flex. total (% of total cost/t)

Flexible costs/t ()

Flexible costs/t (% of total cost/t)

Fix costs/t ()

Fix costs/t (% of total cost/t)

Depreciation

p

total/t

/

Depreciation total (% of total cost/t)

Depreciation fixed asstes machinery ()

Depreciation fixed asstes machinery (% of total

Depreciation fixed asstes buildings ()

Depreciation fixed asstes buildings (% of total c

Capital expenditures/t

Capital expenditures (% of total cost/t)

Interest debt capital ()

Interest debt capital (% of total cost/t)

Interest equity related debt ()

Interest equity related debt (% of total cost/t)

Earnings before tax/t ()

Operating margin before tax/t (% of total turno

01

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

02

50,34

10,28

20%

40,06

80%

03

52,96

10,57

20%

42,39

80%

04

55,43

10,86

20%

44,57

80%

05

57,84

11,17

19%

46,68

81%

06

52,88

11,48

22%

41,40

78%

07

54,03

11,80

22%

42,23

78%

08

55,20

12,13

22%

43,07

78%

09

56,41

12,47

22%

43,93

78%

10

57,63

12,82

22%

44,81

78%

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

/

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

-75,92

151%

-34,00

45%

-12,25

16%

-21,75

29%

-22,88

,

30%

-14,91

20%

-7,98

11%

-19,03

25%

-19,03

25%

0,00

0%

-25,57

-51%

-50,26

95%

-29,30

58%

-12,50

25%

-16,80

33%

-11,44

,

23%

-7,45

15%

-3,99

8%

-9,52

19%

-8,86

18%

0,00

0%

2,35

4%

-50,18

91%

-29,88

60%

-12,75

25%

-17,13

34%

-11,44

,

23%

-7,45

15%

-3,99

8%

-8,86

18%

-8,15

16%

0,00

0%

4,17

8%

-50,06

87%

-30,47

61%

-13,00

26%

-17,47

35%

-11,44

,

23%

-7,45

15%

-3,99

8%

-8,15

16%

-7,38

15%

0,00

0%

5,98

10%

-49,75

94%

-30,93

62%

-13,26

27%

-17,66

36%

-11,44

,

23%

-7,45

15%

-3,99

8%

-7,38

15%

-6,56

13%

0,00

0%

2,77

5%

-49,51

92%

-31,51

64%

-13,53

27%

-17,98

36%

-11,44

,

23%

-7,45

15%

-3,99

8%

-6,56

13%

-5,66

11%

0,00

0%

3,79

7%

-49,21

89%

-32,11

65%

-13,80

28%

-18,31

37%

-11,44

,

23%

-7,45

15%

-3,99

8%

-5,66

12%

-4,70

10%

0,00

0%

4,87

9%

-48,86

87%

-32,72

67%

-14,08

29%

-18,65

38%

-11,44

,

23%

-7,45

15%

-3,99

8%

-4,70

10%

-3,66

7%

0,00

0%

6,01

11%

-48,44

84%

-33,34

69%

-14,36

30%

-18,99

39%

-11,44

,

24%

-7,45

15%

-3,99

8%

-3,66

8%

-2,53

5%

0,00

0%

7,22

13%

Cash Flow

Cash flow from operating activities

Result from operational business

Depreciation

Increase/Decrease of reserves

Net Cash from operating activities

01

-2.977.870

0

0

-2.977.870

02

-5.114.994

4.576.000

0

-538.994

03

940.973

4.576.000

67.212

5.584.185

04

1.668.456

4.576.000

119.175

6.363.631

05

2.393.302

4.576.000

170.950

7.140.252

06

1.107.982

4.576.000

79.142

5.763.124

07

1.515.788

4.576.000

108.271

6.200.058

08

1.947.565

4.576.000

139.112

6.662.676

09

2.405.014

4.576.000

171.787

7.152.801

Cash flow from investing activities

Fixed assets (machinery)

Fixed assets (buildings)

Net Cash from investing activities

-11.924.000

-12.760.000

-24.684.000

-14.905.000

-15.950.000

-30.855.000

-2.981.000

-3.190.000

-6.171.000

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

External financing demand

New financing demand generated in period

New external financing demand

Demand for debt cash

Demand for equity cash

27.661.870

27.661.870

20.746.403

6.915.468

31.393.994

30.470.969

22.853.227

7.617.742

586.815

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Cash flow from financing activities

Net Cash before financing activities

Issuance of long-term debt at beginning of period

Amortization

Issuance of equity at beginning of period

Net Cash from financing activities

-27

27.661.870

661 870

20.500.000

-1.415.105

9.500.000

28.584.895

-30

30.470.969

470 969

28.500.000

-3.284.761

10.500.000

35.715.239

4 133 028

4.133.028

0

-3.547.542

0

-3.547.542

6 949 117

6.949.117

0

-3.831.345

0

-3.831.345

9 946 247

9.946.247

0

-4.137.853

0

-4.137.853

10 990 678

10.990.678

0

-4.468.881

0

-4.468.881

12 069 676

12.069.676

0

-4.826.392

0

-4.826.392

13 181 632

13.181.632

0

-5.212.503

0

-5.212.503

14 325 017

14.325.017

0

-5.629.503

0

-5.629.503

15 498 357

15.498.357

0

-6.079.863

0

-6.079.863

20.500.000

-3.055.105

-1.640.000

19.084.895

-1.415.105

47.584.895

-7.091.553

-3.806.792

44.300.134

-3.284.761

44.300.134

-7.091.553

-3.544.011

40.752.593

-3.547.542

40.752.593

-7.091.553

-3.260.207

36.921.247

-3.831.345

36.921.247

-7.091.553

-2.953.700

32.783.395

-4.137.853

32.783.395

-7.091.553

-2.622.672

28.314.513

-4.468.881

28.314.513

-7.091.553

-2.265.161

23.488.122

-4.826.392

23.488.122

-7.091.553

-1.879.050

18.275.619

-5.212.503

18.275.619

-7.091.553

-1.462.050

12.646.116

-5.629.503

12.646.116

-7.091.553

-1.011.689

6.566.252

-6.079.863

923.025

0

0

5.244.270

-524.427

-524.427

585.486

0

0

3.117.772

-311.777

-311.777

5.808.394

-580.839

-580.839

6.521.797

-652.180

-652.180

7.243.284

-724.328

-724.328

7.969.129

-796.913

-796.913

8.695.514

-869.551

-869.551

9.418.493

-941.849

-941.849

30.000.000

923.025

923.025

4.719.843

4.719.843

585.486

585.486

2.805.995

2.805.995

5.227.555

5.227.555

5.869.617

5.869.617

6.518.956

6.518.956

7.172.216

7.172.216

7.825.962

7.825.962

8.476.644

Debt capital service

Total debt at beginning of period

Annuity debt capital

Interest debt capital

Residual value at end of period

Amortization

Cash flow from shareholder activities

Net Cash before shareholder activities

Dividends

Net Cash from shareholder activities

Net in-/decrease in cash and cash equivalents

Cash and cash equivalents at beginning of period

Cash and cash equivalents at end of period

FFK Recycling Park for HCMC

Relevant Financial Figures

- 16 -

FFK Recycling Park for HCMC

Relevant Financial Figures

10

2.889.968

4.576.000

206.426

7.672.394

- 17 -

Balance Sheet and Relevant Figures

Balance sheet

Assets

Cash

Accounts receivable

Fixed assets machinery

Fixed assets buildings

Assets total

Liabilities

Accounts payable

Longterm debts

Reserve pot. liabilities

Equity

Profit/loss from period

Shareholder activities

Shareholder capital

Liabilities total

Analysis

Figure/Period

Return on assets

Return on equity

Profit-turnover ratio

Equity ratio

Contact

start

01

02

03

04

05

06

07

08

09

10

30.000.000

923.025

4.719.843

585.486

2.805.995

5.227.555

5.869.617

6.518.956

7.172.216

7.825.962

8.476.644

0

0

0

0

0

0

0

0

0

0

0

0 29.810.000 26.829.000 23.848.000 20.867.000 17.886.000 14.905.000 11.924.000

8.943.000

5.962.000

2.981.000

0 31.900.000 30.305.000 28.710.000 27.115.000 25.520.000 23.925.000 22.330.000 20.735.000 19.140.000 17.545.000

30.000.000 62.633.025 61.853.843 53.143.486 50.787.995 48.633.555 44.699.617 40.772.956 36.850.216 32.927.962 29.002.644

FFK environment GmbH

Am Bahnhof 1c

03185 Peitz

Germany

0 37.026.000

6.171.000

0

0

0

0

0

0

0

0

20.500.000 19.084.895 44.300.134 40.752.593 36.921.247 32.783.395 28.314.513 23.488.122 18.275.619 12.646.116

6.566.252

0

0

0

67.212

186.388

357.338

436.479

544.750

683.862

855.648

1.062.075

9.500.000

6.522.130 11.382.709 12.323.681 13.680.360 15.492.822 15.948.625 16.740.084 17.890.735 19.426.198 21.374.317

0

-2.977.870

-5.114.994

940.973

1.668.456

2.393.302

1.107.982

1.515.788

1.947.565

2.405.014

2.889.968

0

0

-524.427

0

-311.777

-580.839

-652.180

-724.328

-796.913

-869.551

-941.849

9.500.000

9.500.000 10.500.000

0

0

0

0

0

0

0

0

30 000 000 62

30.000.000

62.633.025

633 025 61

61.853.843

853 843 53

53.143.486

143 486 50

50.787.995

787 995 48

48.633.555

633 555 44

44.699.617

699 617 40

40.772.956

772 956 36

36.850.216

850 216 32

32.927.962

927 962 29

29.002.644

002 644

start

n.a.

n.a.

n.a.

32%

01

-2%

-46%

#DIV/0!

10%

FFK Recycling Park for HCMC

Relevant Financial Figures

02

-2%

-45%

-51%

18%

03

04

8%

8%

4%

23%

05

10%

12%

8%

27%

- 18 -

06

11%

15%

10%

32%

07

8%

7%

5%

36%

08

9%

9%

7%

41%

09

10%

11%

9%

49%

Florian Tetzlaff

Phone: +49-35601-297-637

Fax: +49-35601-297-617

Mail: tetzlaff@ffk.de

Web: www.ffk.de

10

12%

12%

11%

59%

13%

14%

13%

74%

FFK Recycling Park for HCMC

Relevant Financial Figures

- 19 -

You might also like

- Ex-Ante Carbon-Balance Tool for Value Chains: EX-ACT VC – GuidelinesFrom EverandEx-Ante Carbon-Balance Tool for Value Chains: EX-ACT VC – GuidelinesNo ratings yet

- Best Available Techniques (BAT) For Pulp and PaperDocument900 pagesBest Available Techniques (BAT) For Pulp and PaperHuy NguyenNo ratings yet

- Industrial Waste Treatment HandbookFrom EverandIndustrial Waste Treatment HandbookRating: 5 out of 5 stars5/5 (1)

- Salinization PDFDocument9 pagesSalinization PDFMauro FerrareseNo ratings yet

- Reuse of Glass Thermoset FRP Composites in The Construction Industry - A Growing OpportunityDocument6 pagesReuse of Glass Thermoset FRP Composites in The Construction Industry - A Growing OpportunityMatheus AlmeidaNo ratings yet

- Module Sectoral MeetingDocument2 pagesModule Sectoral MeetingJed L. SawyerNo ratings yet

- E Waste Management (India) : Prepared byDocument13 pagesE Waste Management (India) : Prepared byvikrant987No ratings yet

- Energy Use in Produciont of MicrochipsDocument7 pagesEnergy Use in Produciont of MicrochipsJai KrishnaNo ratings yet

- Recycled Aggregates Case Study (Production From Construction and Demolition Debris)Document8 pagesRecycled Aggregates Case Study (Production From Construction and Demolition Debris)Tsakalakis G. KonstantinosNo ratings yet

- Polyfunctional Plants For Industrial Waste Disposal - A Case Study For Small EnterprisesDocument9 pagesPolyfunctional Plants For Industrial Waste Disposal - A Case Study For Small EnterprisesFelipe TavaresNo ratings yet

- WTbref 1812Document1,030 pagesWTbref 1812francerossi77No ratings yet

- Environmental Statement Report For Year 2008-09Document4 pagesEnvironmental Statement Report For Year 2008-09ashuchemNo ratings yet

- EPD ECOPact Prime AGILIA SUELO C and ARTEVIADocument19 pagesEPD ECOPact Prime AGILIA SUELO C and ARTEVIALou VreNo ratings yet

- Philippines: Energy Efficiency/CO2 Indicators Units 1980 1990 2000 2005Document1 pagePhilippines: Energy Efficiency/CO2 Indicators Units 1980 1990 2000 2005Rave Christian Pangilinan ParasNo ratings yet

- NFM - 12 - 14-05-2010 BatDocument969 pagesNFM - 12 - 14-05-2010 BatTaeu YuNo ratings yet

- 2.1-1 Rubber Tires Chemical CompositionDocument7 pages2.1-1 Rubber Tires Chemical CompositionRamon LlonaNo ratings yet

- Carbon Footprint Workshop SlidesDocument51 pagesCarbon Footprint Workshop SlidesJohn ByrdNo ratings yet

- Waste ExchangeDocument24 pagesWaste Exchangeminorona2409No ratings yet

- Study E Waste Assessment Report LesothoDocument117 pagesStudy E Waste Assessment Report Lesothobalki123No ratings yet

- The GTZ-Holcim Strategic Alliance On Co-Processing Waste Material in Cement ProductionDocument12 pagesThe GTZ-Holcim Strategic Alliance On Co-Processing Waste Material in Cement ProductionNicko MendozaNo ratings yet

- Integrated Pollution Prevention and Control Reference Document On Best Available Techniques For The Waste Treatments Industries Dated August 2005Document626 pagesIntegrated Pollution Prevention and Control Reference Document On Best Available Techniques For The Waste Treatments Industries Dated August 2005WellfroNo ratings yet

- 4) Industrial + Agricultural WasteDocument32 pages4) Industrial + Agricultural WasteMitch Panganiban TogniNo ratings yet

- Waste Plastics Management: Conversion To Fuels and ChemicalsDocument34 pagesWaste Plastics Management: Conversion To Fuels and Chemicalshariprasadr5199No ratings yet

- Basalt CostDocument9 pagesBasalt CostAnand ThiyagarajanNo ratings yet

- Form 5 For The Year 2017 18Document20 pagesForm 5 For The Year 2017 18rooftopsolarpower08No ratings yet

- Research Papers On E-Waste PDFDocument5 pagesResearch Papers On E-Waste PDFgz8qs4dn100% (1)

- Thermal Conversion of Plastic-Containing Waste-A ReviewDocument77 pagesThermal Conversion of Plastic-Containing Waste-A ReviewVishal BhagwatNo ratings yet

- Feasibility Study of Diphenyl Carbonate ProductionDocument4 pagesFeasibility Study of Diphenyl Carbonate ProductionIntratec SolutionsNo ratings yet

- Form V - Env. StatementDocument4 pagesForm V - Env. StatementCitizen Matters100% (1)

- 2 67 1626781633 25ijmperdaug202125Document22 pages2 67 1626781633 25ijmperdaug202125TJPRC PublicationsNo ratings yet

- Best Available Techniques (BAT) For Waste Water and Waste GasDocument667 pagesBest Available Techniques (BAT) For Waste Water and Waste GasHuy NguyenNo ratings yet

- Carbon Fibre Manufacturing CostsDocument8 pagesCarbon Fibre Manufacturing CostsGabriel Piñana NaharroNo ratings yet

- Reqno jrc64207 jrc64207 PDFDocument118 pagesReqno jrc64207 jrc64207 PDFDarren WayneNo ratings yet

- IPCC Emission Factor Database (EFDB) : Nalin Srivastava Technical Support Unit, IPCC TFIDocument23 pagesIPCC Emission Factor Database (EFDB) : Nalin Srivastava Technical Support Unit, IPCC TFImANOJNo ratings yet

- Ref Bref 2015Document754 pagesRef Bref 2015Anonymous nw5AXJqjdNo ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- The Role of Cryogenics in Machining ProcessesDocument8 pagesThe Role of Cryogenics in Machining Processesiskricaman7No ratings yet

- Energies 13 02045 v2Document11 pagesEnergies 13 02045 v2Willey MottaNo ratings yet

- Eu RICCallfor Recycled Plastic Contentin CarsDocument4 pagesEu RICCallfor Recycled Plastic Contentin CarsSiyyadula Chandra SekharNo ratings yet

- Emission Factor For Stainless SteelDocument2 pagesEmission Factor For Stainless Steelrvalles011No ratings yet

- Global Perspectives On E-WasteDocument23 pagesGlobal Perspectives On E-WastedocongnguyenNo ratings yet

- About Us Nstedb Events Feedback Contact Us: Fly Ash BricksDocument6 pagesAbout Us Nstedb Events Feedback Contact Us: Fly Ash BricksShantanu.s.deshpandeNo ratings yet

- Cryogenic Ball Milling - A Key For Elemental Analysis of Plastic-Rich Automotive Shedder ResidueDocument9 pagesCryogenic Ball Milling - A Key For Elemental Analysis of Plastic-Rich Automotive Shedder ResidueyeisonNo ratings yet

- Selective Collection Costs: Waste Plastics Recycling A Good Practices Guide by and For Local & Regional AuthoritiesDocument2 pagesSelective Collection Costs: Waste Plastics Recycling A Good Practices Guide by and For Local & Regional AuthoritiesMBA103003No ratings yet

- Import of Lead ScrapUsed Lead Acid Batteries - Requirements and Standard Operating ProcedureDocument16 pagesImport of Lead ScrapUsed Lead Acid Batteries - Requirements and Standard Operating ProcedureRanveer Singh MahwarNo ratings yet

- Best Available Techniques (BAT) Reference Document For Common Waste Water and Waste Gas Treatment/Management Systems in The Chemical SectorDocument664 pagesBest Available Techniques (BAT) Reference Document For Common Waste Water and Waste Gas Treatment/Management Systems in The Chemical SectorAdios ANo ratings yet

- Module GDocument58 pagesModule GNodge HolandaNo ratings yet

- Plastic Industry PakistanDocument50 pagesPlastic Industry PakistanhelperforeuNo ratings yet

- Climate and Atmosphere - Philippines: Carbon Dioxide (CO2) Emissions (A) (In Thousand Metric Tons of CO2)Document7 pagesClimate and Atmosphere - Philippines: Carbon Dioxide (CO2) Emissions (A) (In Thousand Metric Tons of CO2)Suiko22No ratings yet

- Eia ReportDocument305 pagesEia ReportSyed Ali Raza100% (1)

- New Cement QuestionnaireDocument8 pagesNew Cement QuestionnaireSunil Meena100% (1)

- Global Anthroponegic Non-CO2 Greenhouse Gas Emissions 1990-2020Document274 pagesGlobal Anthroponegic Non-CO2 Greenhouse Gas Emissions 1990-2020ricardoNo ratings yet

- Iron and Steel ProductionDocument623 pagesIron and Steel ProductionMustafa BoyrazliNo ratings yet

- DOMAINS - EconomicDocument2 pagesDOMAINS - Economicvictoria kairooNo ratings yet

- EST MicroprojectDocument12 pagesEST MicroprojectRohan ChavanNo ratings yet

- MMC 1Document51 pagesMMC 1Sana MerNo ratings yet

- Best Practices On Electronic Scrap ManagementDocument28 pagesBest Practices On Electronic Scrap ManagementChinmay RoutNo ratings yet

- Efficiency Indicators DocumentationDocument53 pagesEfficiency Indicators DocumentationDanish HameedNo ratings yet

- Alternate Detergent BuildersDocument186 pagesAlternate Detergent BuildersSangita SangamNo ratings yet

- BAT Mineral Oil and Gas RefineriesDocument516 pagesBAT Mineral Oil and Gas RefineriesalbertoperezroblesNo ratings yet

- Pro-Cryl Universal PrimerDocument3 pagesPro-Cryl Universal PrimerjaunNo ratings yet

- Lux Flakes 2013Document5 pagesLux Flakes 2013Aditya Angga WiratmaNo ratings yet

- Tailings Management: PasteDocument17 pagesTailings Management: PasteLMNo ratings yet

- Educ 211 Midterm ExamDocument13 pagesEduc 211 Midterm ExamMishell AbejeroNo ratings yet

- Evid Hearing Transcript 2016 08 15 DR Walter ChunDocument68 pagesEvid Hearing Transcript 2016 08 15 DR Walter Chunapi-278596279No ratings yet

- Canada Stormwater Management Guidelines - HalifaxDocument282 pagesCanada Stormwater Management Guidelines - HalifaxFree Rain Garden Manuals100% (1)

- Ajeet Project Report Neycer India Ltd. M.B.A. 3rd Sem.Document52 pagesAjeet Project Report Neycer India Ltd. M.B.A. 3rd Sem.sataynam100% (1)

- Training Plan ACP NCIIDocument21 pagesTraining Plan ACP NCIIDezzelyn BalletaNo ratings yet

- ExamNotes - Disaster Management Keypoints From ARC ReportDocument36 pagesExamNotes - Disaster Management Keypoints From ARC ReportRamakadrama100% (1)

- Textile Recycling Udyami - Org.inDocument19 pagesTextile Recycling Udyami - Org.inAndreea Deea100% (1)

- Revision (Word Formation) - Past PapersDocument3 pagesRevision (Word Formation) - Past PapersHạo TăngNo ratings yet

- Experimental Study On Axial Compressive Strength and Elastic Modulus of The Clay and Fly Ash Brick MasonryDocument12 pagesExperimental Study On Axial Compressive Strength and Elastic Modulus of The Clay and Fly Ash Brick MasonryjayanthNo ratings yet

- Freeze-Tag® Indicator (10 Minutes) : DescriptionDocument1 pageFreeze-Tag® Indicator (10 Minutes) : DescriptionYunis MirzeyevNo ratings yet

- Capstone Research Project - Presentation - Walid Abou Hassan 10-05-2018Document15 pagesCapstone Research Project - Presentation - Walid Abou Hassan 10-05-2018Walid Abou HassanNo ratings yet

- Chapter 2 - Boiler & Thermal Fluid HeaterDocument62 pagesChapter 2 - Boiler & Thermal Fluid HeaterFaisal FarabiNo ratings yet

- Floclog 702aa Water Clarifier MsdsDocument2 pagesFloclog 702aa Water Clarifier MsdsSouth Santee AquacultureNo ratings yet

- EQ Tank 2016-02-01 2Document4 pagesEQ Tank 2016-02-01 2zulgay.zakey0624No ratings yet

- Constitutional Provision of Environmental LawDocument27 pagesConstitutional Provision of Environmental LawSurbhi Gupta100% (1)

- 013 Emr en - 6Document82 pages013 Emr en - 6harendraNo ratings yet

- Battery Replacement GuideDocument4 pagesBattery Replacement Guidest_vasuNo ratings yet

- Barangay Structure, Powers and Services - Day1 - Topic2Document29 pagesBarangay Structure, Powers and Services - Day1 - Topic2Christopher MontebonNo ratings yet

- 12-16-2013 Mon EditionDocument32 pages12-16-2013 Mon EditionSan Mateo Daily JournalNo ratings yet

- Just in TimeDocument13 pagesJust in TimeSiddharth PatelNo ratings yet

- Production and Trade of BeeswaxDocument9 pagesProduction and Trade of BeeswaxThang TranNo ratings yet

- Plumbing EstimateDocument6 pagesPlumbing EstimateLester CabungcalNo ratings yet

- Model Question Paper - PDFDocument5 pagesModel Question Paper - PDFRohith Das MNo ratings yet

- Week-1 Material - Introduction To SWMDocument126 pagesWeek-1 Material - Introduction To SWMSandeep MahajanNo ratings yet

- English at Work: Episode 3: The Crisis Making SuggestionsDocument3 pagesEnglish at Work: Episode 3: The Crisis Making SuggestionsladamariNo ratings yet

- HUAWEI P20 Lite Quick Start Guide (ANE-L01&L21,01, WEU) PDFDocument92 pagesHUAWEI P20 Lite Quick Start Guide (ANE-L01&L21,01, WEU) PDFRUIALMEIDASANo ratings yet

- Solid Waste Management Opportunities Challenges GujaratDocument14 pagesSolid Waste Management Opportunities Challenges GujaratRahul Kumar AwadeNo ratings yet