Professional Documents

Culture Documents

Q &a NSC

Uploaded by

Rana WaseemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q &a NSC

Uploaded by

Rana WaseemCopyright:

Available Formats

ORGANIZATIONAL CHART

CENTRAL DIRECTORATE

I. Training Institute

II. Directorate of Insp. & Acctt

III Regional Directorates

Sub TINS

Zonal Insp. & Accts

Regional Accts Offices

Karachi

Peshawar Islamabad Lahore Multan Gujranwala Hyderabad karachi

Peshawar Islamabad Lahore Multan Sukkar karachi

Abbottabad Gujranwala Faislabad Bahalwalpur Hyderabad Quetta

Peshawar Islamabad Lahore Multan Sukkar karachi

Abbottabad Gujranwala Faislabad Bahalwalpur Hyderabad Quetta

Q.1

Can I deposit profit cheque into my account with any scheduled bank? If not, then how can I withdraw my profit without coming to the Centre? No. Unlike cheques of banks, the Profit coupons/withdrawal slips of NSS are not negotiable instruments, hence not acceptable by banks. The profit accrued on BSC only may, however, be collected through an agent duly authorized by the certificate holder at his/her own risk and subject to the satisfaction of the officer in charge. What is the standard procedure for encashment of certificate(s) in case of death of certificate holder(s)? Subject to the rules of the respective schemes, the nominee may opt for encashment of the certificates or transfer of the same in his/her name, however, in the former case the nominee shall be required to furnish;

Ans:

Q.2

Ans:

a. an application on plain paper containing three specimen signatures of himself/herself duly verified to the satisfaction of the officer in charge. b. death certificate of the deceased holder. c. attested photocopies of CNICs of both the deceased holder and himself. d. in case the certificates are intended to be transferred to nominee, an application on SC-4 supported by relevant documents shall be required in addition to above requirements. e. Original Certificates. Q.3 Do the revised rates of profit on National Savings Scheme automatically apply to the investment made prior to such revision? No. Are new rates automatically made applicable on the existing investments? All National Savings Schemes (NSS) except Savings Account are term/fixed deposits; hence, the agreement made at the time of investment remains valid upto the

Ans: Q.4 Ans:

maturity of that particular deposit. Any change in profit either upwards or downwards on later issues doesnt affect the existing investments. However, if any investor intends to avail new rates, he/she can withdraw the investment and on payment of subject to nominal service charges (if applicable) and then invest the same on new rates. Q.5 Ans: Can widowers invest in Bahbood Savings Certificates? No, at present the widowers cannot invest in Bahbood Savings Certificates. However, after attaining 60 years of age, they become automatically eligible being senior citizens. Who are eligible to invest in Bahbood Savings Certificates? The widows and the senior citizens aged 60 years or above can invest in Bahbood Savings Certificates. Is investment made in National Savings Schemes secure? Yes, the investment made in National Savings Schemes (NSS) is fully guaranteed by the Government of Pakistan. What is the difference between Joint-A and Joint-B type investment? The National Savings Schemes provide the facility of joint investment upto two persons. There are two different types i.e. Joint-A and Joint-B. In case of Joint-A deposits, the encashment is given only after having the signatures of both the investors; while in case of Joint-B, either of the investors can withdraw/encash the principal under his/her own signatures only. I am presently out of the country and want to withdraw the profit of my investment made in NSS in Pakistan, can I do this? If yes, what are the steps?

Q.6 Ans: Q.7 Ans:

Q.8 Ans:

Q.09.

Ans:

As per rules a purchaser can nominate an agent for collection of profit of the principal at his personal risk after issuing a power of attorney duly attested by the Pakistani missions working in that country subject to entire satisfaction of the Officer Incharge of National Savings Centre concerned. What is the procedure to invest in National Savings Schemes from abroad? In which scheme(s) I can invest, and what documents are required? Investment from abroad can be made through Bank Draft/Cheque in any foreign currency in favour of any of our office(s), alongwith the application form duly filled in and the copies of Passport and National identity Card. The Bank Drafts got prepared in Pak rupee from abroad are cleared much earlier than those in foreign currency. It would be more proper if these are payable at the same city where the investment is intended to be made. The investment in the National Savings Schemes is maintained and expressed in Pak rupee only. Amount received in foreign currency is converted into Pak rupee on the prevailing official exchange rate through normal Banking channels for investment in National Savings Schemes. Moreover, the principal and profit accrued on a certificate issued against foreign exchange received through remittance shall be payable abroad to the purchaser in foreign exchange if so desired by the investor. For the purpose, the payable amount shall be converted into the desired currency at the official exchange rate prevailing at the time of conversion/payment.

Q.10

Ans:

Q.11 Ans:

What is the maximum period for claiming the prize money? The prize on any prize winning Prize Bond can be claimed within six years reckoned from the date of that particular draw result. No claim, after the said period of six years is entertained.

Q.7

Is there any deduction on encashment of prize bonds?

Ans:

The prize bonds can be redeemed on the face value and there is no deduction whatsoever on the encashment of a prize bond itself irrespective of the amount involved.

Q.12

What is the procedure to claim a prize on a Prize Bond? Ans: The prize money upto Rs.1,250/- can be claimed from any National Savings Centre, branches of authorized scheduled banks or branches of State Bank of Pakistan. Prize money exceeding Rs.1000/- can be claimed only from the branches of State Bank of Pakistan. To claim the prize money, a duly filled application form (PB-1) along with a photo copy of the CNIC, a photo copy of the winning prize bond duly signed on the back is to be presented in the concerned office. However, the prize money is subject to 10% withholding tax. Q.13 Ans: On which schemes, the withholding tax is applicable and under which law? With the exception of BSC and PBA, profit on all NSS is subject to deduction of withholding tax @ 10 in case the investment exceeds Rs.150,000/- under the Income Tax Law for the time being in force except Regular Income Certificate wherein no such exemption is available. If two persons are holding joint investment, what is the limit of tax exemption what will be the investment limit either Rs.150, 000/or Rs.300,000/-? For the purpose of withholding tax deduction, presently Rs.150,000/- shall be deemed to be the limit. As soon as this limit is exceeded the profit shall become liable to withholding tax beyond which tax shall apply irrespective of whether the investment is in single or joint names. Is there any tax applicable on the prizes won on Prize Bonds, if so, what is the ratio? The tax at the rate of 10% of the prize is deducted at source at the time of payment of prize money in accordance with the Income Tax Ordinance, 2001 as amended from time to time.

Q.14

Ans:

Q.15 Ans:

Q.16

I am a non-resident Pakistani and want to make some investment in National Savings Schemes (NSS), whether, the profit earned will be exempt from tax or not? The investment received through the branches of Habib Bank Ltd. and United Bank Ltd. operating abroad and profit paid abroad is exempt from deduction of withholding tax.

Ans:

Q.17

On which scheme(s), the Zakat is applicable and how? Ans: Zakat is collected from investment made in Defence Savings Certificates, Special Savings Certificates (Regd), Savings Account and Special Savings Account. In case of Defence Savings Certificates, the Zakat is collected @ 2.50% on the accumulated value of the certificate(s) (i.e. principal + profit) as on the Zakat valuation date preceding the date of encashment. Whereas, in case of Special Savings Certificates (Regd), Savings Account and Special Savings Account the Zakat is collected @ 2.50% of the principal of that particular maturity. Is there any time constraint for submitting a Zakat Declaration seeking exemption from collection of Zakat? Yes, there is definitely a time limit. The said declaration can easily be submitted at the time of investment or after that, but it should be furnished before 1st Shabban so as to make it effective for the coming Ramadan. Any declaration submitted after the 1st Shabban will be applicable for the next year and not for the current Islamic calendar year. I am a non-resident Pakistani and want to make some investment in National Savings Schemes (NSS), whether, the said investment will be exempt from Zakat or not? Any assets acquired against payment in foreign currency or maintained in foreign currency are to be treated as exempt from compulsory collection of Zakat. An account, which is opened with foreign currency and out of which an account can be withdrawn in foreign currency or local currency does not change the nature of the account.

Q.18

Ans:

Q.19

Ans:

Q.20 Ans:

Is there any Zakat collection reinvestment of existing Certificates?

in

case

of

No. Zakat is only collected at the time of actual encashment

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Personal Banking: Consumer Pricing InformationDocument5 pagesPersonal Banking: Consumer Pricing InformationSteph BryattNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

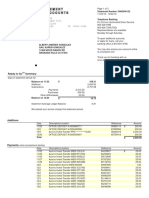

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino Rivas100% (1)

- Taxation Microsoft Philippines Inc. Vs CIRDocument9 pagesTaxation Microsoft Philippines Inc. Vs CIRHazel BatuegasNo ratings yet

- Travel Claim - Appendix A, B Etc - DotolloDocument6 pagesTravel Claim - Appendix A, B Etc - DotolloHanzelkris CubianNo ratings yet

- Quimpo V MendozaDocument7 pagesQuimpo V Mendozadar0800% (1)

- Muhammad Yousuf: Account StatementDocument5 pagesMuhammad Yousuf: Account StatementYOUSUFNo ratings yet

- Factory Ledger and General Ledger-1Document9 pagesFactory Ledger and General Ledger-1gull skNo ratings yet

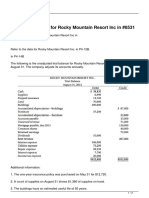

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- Direct Tax Interview Questions For ArticleshipDocument15 pagesDirect Tax Interview Questions For ArticleshipAayush GamingNo ratings yet

- Tl11a 15eDocument1 pageTl11a 15esmian08No ratings yet

- Ninso Global SDN BHD: Official PayslipsDocument1 pageNinso Global SDN BHD: Official Payslipsahmad zakwanNo ratings yet

- C7021-22-2717923 30-03-2023 30-03-2023 Sold by (Pharmacy) Bill To / Ship To (Patient) Healthsaverz Medical LLP UshaDocument1 pageC7021-22-2717923 30-03-2023 30-03-2023 Sold by (Pharmacy) Bill To / Ship To (Patient) Healthsaverz Medical LLP UshaViraj DobriyalNo ratings yet

- Exercise 3: Bank of The Philippine IslandDocument4 pagesExercise 3: Bank of The Philippine IslandKim FloresNo ratings yet

- Case StudyDocument7 pagesCase StudyRintan Agitya UmamiNo ratings yet

- Tax Amnesties - Impact On Development of TaxDocument32 pagesTax Amnesties - Impact On Development of TaxA QNo ratings yet

- Taxation (Vietnam) : Thursday 8 June 2017Document11 pagesTaxation (Vietnam) : Thursday 8 June 2017annarosaNo ratings yet

- Materi Publik 1 Taxation Sesi 12 2021 - 13882 - 0Document33 pagesMateri Publik 1 Taxation Sesi 12 2021 - 13882 - 0Dzochra Miltaz YaoumielNo ratings yet

- Vehenq Bwua0201 1 2223 00186Document1 pageVehenq Bwua0201 1 2223 00186Lovish VatwaniNo ratings yet

- Tax Management SyllabusDocument2 pagesTax Management Syllabusbs_sharathNo ratings yet

- Chapter 8: Tax Management: Planning, Avoidance and EvasionDocument16 pagesChapter 8: Tax Management: Planning, Avoidance and EvasionCharlesNo ratings yet

- PM Reyes Notes On Taxation Ii: Local Taxation: 1. General Principles, Definitions, and LimitationsDocument9 pagesPM Reyes Notes On Taxation Ii: Local Taxation: 1. General Principles, Definitions, and LimitationsMich FelloneNo ratings yet

- Chapter 16 Problem SolutionsDocument6 pagesChapter 16 Problem SolutionsAnila ANo ratings yet

- ACT 183 (Handout 4) - Co-Ownership Estates and TrustsDocument3 pagesACT 183 (Handout 4) - Co-Ownership Estates and TrustsHafida TOMAWISNo ratings yet

- 47-Article Text-521-1-10-20221208Document6 pages47-Article Text-521-1-10-20221208Henry DP SinagaNo ratings yet

- Sample PayrollDocument6 pagesSample PayrollDeborah Fajardo ManabatNo ratings yet

- 2.5 Cash Books: Two Column Cash BookDocument6 pages2.5 Cash Books: Two Column Cash Bookwilliam koechNo ratings yet

- Final ReitDocument5 pagesFinal Reitchris_yvonneNo ratings yet

- Tameer 3R sp1 02.11.22Document1 pageTameer 3R sp1 02.11.22aliNo ratings yet

- Application: Type of AccountDocument2 pagesApplication: Type of AccountL&R WingNo ratings yet

- RRB Recruitment 130000-Posts (WWW - Majhinaukri.in)Document2 pagesRRB Recruitment 130000-Posts (WWW - Majhinaukri.in)Ashish SalviNo ratings yet