Professional Documents

Culture Documents

Financial Model - Infrastructure

Uploaded by

bang bebetOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Model - Infrastructure

Uploaded by

bang bebetCopyright:

Available Formats

Project Assumptions

1. Model Parameters Except for the growth in potential demand, this is a constant cost model. It is estimated that all inflationary trends in costs and exchange rate fluctuations will be offset by way of making necessary adjustments to the fare.

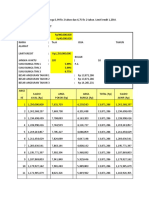

Base Case Growth in Model Incorporate (Constant Cost Assumptions) Output Currency Currency Conversion Rates 2. General Number of Years Projected Financial Year End Number of Work Days per Month Number of Weekend/ Public Holidays per Month Number of Months per Year Operational Days per Year Off days Corporate Tax Rate (Private Limited Company) 3. Revenue Assumptions Ticket Revenue Fare per Passenger (PKR)* Fare per Passenger (US$) Total Number of Stations Depot Number of Marshalling Area Total

No US$ PKR 60.00

Yes/ No

USD ($) 1.00

30 30-Jun 25 5 12 300 60 35%

*A typical work week is assumed to be Mon-Sat

25 0.42 17 1 1 2.00

*as a percentage of daily weekday traffic

Assumptions

Page 1

Project Assumptions

Advertising & Sponsorship Revenue Annual Revenue per Station (PKR) 2,500,000 Annual Revenue per Station (USD) 41,667 *Based on advertising of stations and vehicles at an estimated Rs 2.5 million per station. Power Consumption Average Power Tariff (Rs/ kWh) Monthly Power Consumption per Vehicle (kW) Annual Power Consumption per Sq. Meter (kW) Annual Power Consumption per station Annual Power consumption per Marshalling Area in K Insurance (as a % of Project Cost) General and Administration O&M Cost Marketing/ Advertising (as % of Revenues) Other Expenses

5.5 35,000 0.1728 324,000 3,888,000 0.75% 1,000,000 1,000,000 1.0% 500,000

Assumptions

Page 2

Project Assumptions

5. Payroll Assumptions (US$) Benefits (as a % of Compensation) 25% Number of Employees CEO Systems and Operations General Manager Systems Senior Platform Managers Platform Managers Platform Vending Machine Helpers System Internal Security Personnel Platform Helpers Platform Security Platform Cleaning Safety and Technical Support GM Safety/Technical AGM Safety/Technical Technical /Safety Officers Support Staff Safety Finance GM Finance AGM Finance Finance Officers Support Staff Finance Marshalling Areas Cleaning Staff Marshalling Areas Cleaning Staff-Supervisors Human Resources & Admin GM Human Resources AGM Human Resources HR Officers Support Staff HR & Admin 1 *Includes EOBI, Social Security etc.

Daily Shifts 1

Monthly Salary (Rs) 250,000

1 3 17 34 184 68 34 34

1 1 2.4 2.4 2.4 2.4 2.4 2.4

150,000 80,000 40,000 8,000 7,000 6,000 7,000 4,000

1 3 7 5

1 2.4 2.4 2.4

150,000 80,000 20,000 8,000

1 2 5 5 10 3

1 1 1 1 1 1

150,000 80,000 40,000 10,000 4,000 5,000

1 1 1 10

1 1 1 1

150,000 80,000 50,000 7,000

Assumptions

Page 3

Project Assumptions

Marketing GM Marketing Marketing Officers Support Staff Marketing

1 3 5

1 1 1

150,000 50,000 7,000

6. Working Capital Assumptions (US$) Prepaid Expenses and Other Current Assets (% of Operating Expenses) Spare Parts Inventory (% of Project Cost) Accounts Receivable (% of Other Income) Accounts Payable (% of Operating Expenses) Short-Term Finance (5-Year) 7. Summary Capital Expenditure Cost (US$) 115,000,000 200,000,000 20,000,000 15,000,000 350,000,000 Depreciation (Years) 30 20 5 *Based on estimates from Income Tax Ordinance, updated July 2004

2% 1% 3% 10%

1. Cost of Elevated Bridge and Stations 2. Vehicles and Guide Rail, Sensors and Control 3.Engineering and Development 4. Contingencies Total Project Cost

Assumptions

Page 4

Project Assumptions

Capital Structure Debt Equity

% of Total 80% 20% 100% % of Total Debt 100% 100%

Amount (US$) 280,000,000 70,000,000 350,000,000 Amount (US$) 280,000,000 280,000,000

Amount (Rs '000) 16,800,000 4,200,000 21,000,000 Amount (Rs '000) 16,800,000 16,800,000

Debt

Discount Rate/ Hurdle Rate Debt Parameters Rate for Short-term Financing Rate for Long-term Financing Tenor for Short-term Financing (Years) Tenor for Long-term Financing (Years) Grace Period (Years) Pre-Operating Interest? Commitment Fee Country Exposure Fee Other Processing Charges (US$) Interest During Construction(US$)

10% Foreign 0% 10% 12 2 Yes 0.5% 1.5% 25,000 Local (Project Financing) 5% 10% 4 12 2 Yes/ No *As a percentage of undrawn loan balance *As a percentage of total debt Local (Capacity Enhancement) 0% 10% 8 1

35,000,000

Assumptions

Page 5

You might also like

- Rencana Kuliah1Document1 pageRencana Kuliah1TamaNo ratings yet

- Skala Angsuran AnnuitetDocument3 pagesSkala Angsuran Annuitetbang bebetNo ratings yet

- Jensen & MeckingDocument3 pagesJensen & Meckingbang bebetNo ratings yet

- Basics of Discounted Cash Flow ValuationDocument11 pagesBasics of Discounted Cash Flow Valuationgagan585No ratings yet

- CVP AnalysisDocument6 pagesCVP Analysisbang bebetNo ratings yet

- G3520C Performance DataDocument4 pagesG3520C Performance Databang bebetNo ratings yet

- KPMG - Indonesian TaxDocument13 pagesKPMG - Indonesian Taxbang bebetNo ratings yet

- Balance-Sheet US GAAPDocument1 pageBalance-Sheet US GAAPvishnuNo ratings yet

- The Cogeneration PrincipleDocument1 pageThe Cogeneration Principlebang bebetNo ratings yet

- FCFEDocument7 pagesFCFEbang bebetNo ratings yet

- 11 SureshKolamalaDocument17 pages11 SureshKolamalaAhmad ZikriNo ratings yet

- Capital BudgetingDocument50 pagesCapital Budgetingbang bebetNo ratings yet

- Firm's ValueDocument1 pageFirm's Valuebang bebetNo ratings yet

- Finance and Accounting ManagerDocument3 pagesFinance and Accounting Managerbang bebetNo ratings yet

- Financial Model - InfrastructureDocument5 pagesFinancial Model - Infrastructurebang bebetNo ratings yet

- Coal Conversion FactsDocument2 pagesCoal Conversion FactsJagadish PatraNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cash Flow AnalysisDocument24 pagesCash Flow AnalysisBindu Gaire SharmaNo ratings yet

- Deloitte NL Fsi Fintech Report 1Document30 pagesDeloitte NL Fsi Fintech Report 1ANIRBAN BISWASNo ratings yet

- Cash Flow StatementDocument53 pagesCash Flow StatementRadha ChoudhariNo ratings yet

- Indian Commodity Market: Derivatives and Risk ManagementDocument6 pagesIndian Commodity Market: Derivatives and Risk ManagementVasantha NaikNo ratings yet

- Bank of Punjab Internship UOGDocument36 pagesBank of Punjab Internship UOGAhsanNo ratings yet

- DRR-CCA Integration in Local Development PlanningDocument10 pagesDRR-CCA Integration in Local Development PlanningJEnny RojoNo ratings yet

- Trasnport TotalDocument37 pagesTrasnport Totaldds0% (1)

- Aswath Damodaran - Valuation of SynergyDocument60 pagesAswath Damodaran - Valuation of SynergyIvaNo ratings yet

- Revista AbbDocument84 pagesRevista Abbenrique zamoraNo ratings yet

- Targeting Israeli Apartheid A Boycott Divestment and Sanctions Handbook.Document383 pagesTargeting Israeli Apartheid A Boycott Divestment and Sanctions Handbook.john_edmonstoneNo ratings yet

- Trắc Nghiệm English Tài Chính Doanh Nghiệp Chương 2Document34 pagesTrắc Nghiệm English Tài Chính Doanh Nghiệp Chương 2Dương Viên NguyễnNo ratings yet

- Training Pajak Introduction To WP&B and AFEDocument48 pagesTraining Pajak Introduction To WP&B and AFEIndra Siallagan100% (1)

- Chapter 3 SolutionsDocument5 pagesChapter 3 Solutionshanh4tran-1No ratings yet

- Opportunities and Challenges in Rural MarketingDocument6 pagesOpportunities and Challenges in Rural MarketingMohammad Syafii100% (1)

- Hyperinflation and Current Cost Accounting ProblemsDocument4 pagesHyperinflation and Current Cost Accounting ProblemsMaan CabolesNo ratings yet

- Measuring Financial Inclusion Mumbai QuestionnaireDocument5 pagesMeasuring Financial Inclusion Mumbai QuestionnaireHemant Vyas100% (2)

- Form AR01 Annual ReturnDocument14 pagesForm AR01 Annual Returnaglondon100No ratings yet

- Assess Key Concepts in Technology Valuation and Negotiation CourseDocument6 pagesAssess Key Concepts in Technology Valuation and Negotiation CourseClaudia Janeth Rivera FuentesNo ratings yet

- Accounting Principles I: ACCT 111Document72 pagesAccounting Principles I: ACCT 111Me7aNo ratings yet

- WK 3 Tutorial 4 Is LM Model (Solution)Document3 pagesWK 3 Tutorial 4 Is LM Model (Solution)Ivan TenNo ratings yet

- Banking Regulation Act 1949 Key ProvisionsDocument26 pagesBanking Regulation Act 1949 Key Provisionszafrinmemon100% (1)

- Bogleheads Forum Discussion on Buying Precious Metals from APMEXDocument18 pagesBogleheads Forum Discussion on Buying Precious Metals from APMEXambasyapare1No ratings yet

- Business CombinationDocument40 pagesBusiness CombinationJack AlvarezNo ratings yet

- CMA Blank FormDocument34 pagesCMA Blank FormbipinNo ratings yet

- Statement of Financial PositionDocument14 pagesStatement of Financial PositionLeomar CabandayNo ratings yet

- 2011 Kenya Budget NewsletterDocument9 pages2011 Kenya Budget NewsletterImran OsmanNo ratings yet

- Param Mitra Coal Resources Secures US$7.5M Investment From Tembusu PartnersDocument3 pagesParam Mitra Coal Resources Secures US$7.5M Investment From Tembusu PartnersWeR1 Consultants Pte LtdNo ratings yet

- Capital Budgeting: Exhibit 1-58: Parmit Cycles Cash Flows StatementDocument2 pagesCapital Budgeting: Exhibit 1-58: Parmit Cycles Cash Flows StatementarainjnNo ratings yet

- Trade AND Capital MovementsDocument16 pagesTrade AND Capital MovementsVert ResterioNo ratings yet

- Question (Apr 2012)Document49 pagesQuestion (Apr 2012)Monirul IslamNo ratings yet