Professional Documents

Culture Documents

131.deemed Sale - ICN.02.18.10

Uploaded by

Jun MojicaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

131.deemed Sale - ICN.02.18.10

Uploaded by

Jun MojicaCopyright:

Available Formats

BDB Laws Tax Law For Business appears in the opinion section of BusinessMirror every

Thursday.

Deemed Sale

It seems that words can make us millionaires. That is the beauty of the law and the art by which it is crafted. The Supreme Court (SC) justly refunded P246 Million to a taxpayer by giving life to the enigmatic world of deemed sale as used under the Tax Code of 1997. The Court of Tax Appeals (CTA) denied several claims for refund on the ground that a taxpayer failed to establish that it had incurred zero rated sales or effectively zero-rated sales or because the taxpayer failed to declare zero-rated sales in its VAT return to which creditable input taxes may be attributed. In a rare instance, the SC reversed the CTA in the case of San Roque Power Corporation versus Commissioner of Internal Revenue (GR No. 180345, promulgated on November 25, 2009). The main issue that is resolved by the SC is whether San Roque has zero-rated or effectively zero-rated sales, to which creditable input taxes may be attributed. After reviewing the records of the case, the SC found that in 2002 (the year that is the subject of the claim), San Roque carried out a sale of electricity to the National Power Corporation (NPC). Although the VAT returns for the 1st, 2nd, and 3rd quarters of 2002 did not state a zero-rated sale, the 4th quarter VAT return for 2002 reported a zero-rated sale. This sale is not a commercial sale but this sale arose from San Roques production and transfer of electricity to NPC during the testing period in exchange for the amount of P42.5 Million. According to the SC, it is not unmindful of the fact that the transaction was not a commercial sale. In granting the tax benefit to the VAT-registered zero-rated or effectively zero-rated taxpayers, Section 112 (A) of the Tax Code of 1997 does not limit the definition of sale to commercial transactions. The SC related Section 112(A) with

Section 106(B), which does not limit the term sale to commercial sales, rather it extends the term to transactions that are deemed sale. The SC finds it an equitable construction of the law that when the term sale is made to include certain transactions for the purpose of imposing a tax, these same transactions should be included in the term sale when considering the availability of an exemption or tax benefit. It is undisputed that during the 4th quarter of 2002, San Roque transferred to NPC all the electricity that was produced during the trial period. The fact that it was not transferred through a commercial sale or in the normal course of business does not deflect from the fact that such transaction is deemed a sale under the law. It is also important to discuss another doctrine laid down by the SC in this case. It is observed that San Roque seasonably filed its claim for refund for the 1st to 3rd quarters of 2002, i.e., within 2 years after the close of the taxable quarter when sales were made. The SC however noted that for the period April 2002 to May 2002, San Roque filed its claim prematurely on October 2002, before the last quarter had closed on December 31, 2002. As discussed above, it was on the 4th quarter of 2002 when San Roque made its sale to NPC. This has serious implications since for the first time a claim for refund may now be prematurely filed. It appears that the SC in this case reckons the running of the 2 year period at the end of the quarter when the sales were actually made, i.e., December 31, 2002. In other words, San Roque should have filed its claim for refund for the period April to May 2002 only after the close of December 31, 2002 (the taxable quarter when the sales were made). Stated differently, San Roque should have filed its claim within January 1, 2003 to December 31, 2004. The SC has once again enriched jurisprudence which our tax laws badly need. It not only enlightened us on the mystery of deemed sale and its power to grant refund in millions of pesos if just, but also educated us to follow the clear provision of the law on the seasonable filing of a claim for VAT refund if we do not want to lose the millions that we may be entitled to.

The author is a senior associate of Du-Baladad and Associates Law Offices (BDB Law). If you have any comments or questions concerning the article, you can e-mail the author at irwin.c.nideajr@bdblaw.com.ph or call 403-2001 local 330.

You might also like

- San Roque Power Corp Vs CIRDocument4 pagesSan Roque Power Corp Vs CIRC.J. EvangelistaNo ratings yet

- Northern Mindanao Power CorporationDocument10 pagesNorthern Mindanao Power CorporationKG FernandezNo ratings yet

- ATT Communications Services Philippines Inc. Vs CIR CABUSBUSANDocument2 pagesATT Communications Services Philippines Inc. Vs CIR CABUSBUSANNes MejiNo ratings yet

- Chamber Challenges Minimum Corporate Income Tax, Withholding Tax RulesDocument13 pagesChamber Challenges Minimum Corporate Income Tax, Withholding Tax RulesAngelie Fei CuirNo ratings yet

- Presumption of regularity does not apply to tax delinquency salesDocument10 pagesPresumption of regularity does not apply to tax delinquency salesMelody Lim DayagNo ratings yet

- National Lead Company v. Commissioner of Internal Revenue, 336 F.2d 134, 2d Cir. (1964)Document11 pagesNational Lead Company v. Commissioner of Internal Revenue, 336 F.2d 134, 2d Cir. (1964)Scribd Government DocsNo ratings yet

- Magsaysay Lines VS. CIR Tax RulingDocument13 pagesMagsaysay Lines VS. CIR Tax RulingVictor LimNo ratings yet

- Slump SaleDocument5 pagesSlump SaleSanjna VijhNo ratings yet

- CASE-DIGEST-Pasia-Taxation-Law (Edited)Document10 pagesCASE-DIGEST-Pasia-Taxation-Law (Edited)Pamela Gutierrez PasiaNo ratings yet

- CIR V SAN MIGUEL CORPORATIONDocument3 pagesCIR V SAN MIGUEL CORPORATIONMareja ArellanoNo ratings yet

- 2004 BIR Ruling on Property TransferDocument2 pages2004 BIR Ruling on Property TransferPhoebe SpaurekNo ratings yet

- CIR v. Aichi ForgingDocument5 pagesCIR v. Aichi Forgingamareia yapNo ratings yet

- Factual Antecedents: Custom SearchDocument9 pagesFactual Antecedents: Custom SearchJerome CasasNo ratings yet

- VAT Refund Requirements for Zero-Rated Power SalesDocument3 pagesVAT Refund Requirements for Zero-Rated Power SalesAngelique Padilla UgayNo ratings yet

- Taxation Digest SummaryDocument365 pagesTaxation Digest SummarytakyousNo ratings yet

- Taxation Digest on VAT LiabilityDocument27 pagesTaxation Digest on VAT LiabilityBer Sib JosNo ratings yet

- Commission of Internal Revenue V. San Miguel Corp. (G.R. No. 205045, January 25, 2017)Document2 pagesCommission of Internal Revenue V. San Miguel Corp. (G.R. No. 205045, January 25, 2017)Digna LausNo ratings yet

- CTA VAT Refund Claim RejectedDocument2 pagesCTA VAT Refund Claim RejectedJemima FalinchaoNo ratings yet

- Tax Rev Cases 1Document169 pagesTax Rev Cases 1arvindominicNo ratings yet

- Cir vs. Aichi Forging G.R. No. 184823Document14 pagesCir vs. Aichi Forging G.R. No. 184823Eiv AfirudesNo ratings yet

- NIPPON EXPRESS (PHILIPPINES) CORPORATION v. CIRDocument3 pagesNIPPON EXPRESS (PHILIPPINES) CORPORATION v. CIRlucky50% (2)

- Takenaka Corp vs. CIRDocument1 pageTakenaka Corp vs. CIRJASON BRIAN AVELINONo ratings yet

- CIR v. San Miguel Corporation G.R. No. 180740/G.R. No. 180910, November 11, 2019Document3 pagesCIR v. San Miguel Corporation G.R. No. 180740/G.R. No. 180910, November 11, 2019Ezi AngelesNo ratings yet

- Republic Vs GST Philippines, Inc GR # 190870, October 17, 2013Document5 pagesRepublic Vs GST Philippines, Inc GR # 190870, October 17, 2013leslansanganNo ratings yet

- BDB Law Tax Article Analyzes Conflicting VAT Refund DoctrineDocument2 pagesBDB Law Tax Article Analyzes Conflicting VAT Refund DoctrineKarlo Marco CletoNo ratings yet

- Where Two Provisions of The Law of The Same Hierarchy Conflicts One Another The...Document9 pagesWhere Two Provisions of The Law of The Same Hierarchy Conflicts One Another The...LDC Online ResourcesNo ratings yet

- La TondenaDocument15 pagesLa TondenaJae LeeNo ratings yet

- Belleza - San Roque Power Corp. vs. Cir G.R. No. 180345, Nov. 25, 2009Document4 pagesBelleza - San Roque Power Corp. vs. Cir G.R. No. 180345, Nov. 25, 2009Noel Christopher G. BellezaNo ratings yet

- Taxation Q&ADocument18 pagesTaxation Q&AZsazsaNo ratings yet

- General Electric Credit Corporation v. Strickle Properties, Ray Lyle and T.P. Strickland, 861 F.2d 1532, 11th Cir. (1988)Document8 pagesGeneral Electric Credit Corporation v. Strickle Properties, Ray Lyle and T.P. Strickland, 861 F.2d 1532, 11th Cir. (1988)Scribd Government DocsNo ratings yet

- San Roque v. CIR, GR 180345Document6 pagesSan Roque v. CIR, GR 180345amareia yapNo ratings yet

- Tax DigestDocument6 pagesTax DigestjoyfandialanNo ratings yet

- Tax - Mindanao II Geothermal Partnership vs. Cir DigestDocument4 pagesTax - Mindanao II Geothermal Partnership vs. Cir DigestMaria Cherrylen Castor Quijada100% (1)

- CIR V AquafreshDocument6 pagesCIR V AquafreshGilbertNo ratings yet

- Supreme Court Rules on Input VAT Refund CaseDocument31 pagesSupreme Court Rules on Input VAT Refund CasejemezzNo ratings yet

- Case Digest For GR 184823Document1 pageCase Digest For GR 184823Ren PiñonNo ratings yet

- 2 Cir V Aichi Forging Company of Asia, IncDocument9 pages2 Cir V Aichi Forging Company of Asia, IncShanne Sandoval-HidalgoNo ratings yet

- Tambunting PawnshopDocument8 pagesTambunting PawnshopNika RojasNo ratings yet

- DigestDocument21 pagesDigestJessica DaluyenNo ratings yet

- CIR Assessment Prescription DisputeDocument162 pagesCIR Assessment Prescription DisputeJN CE100% (1)

- Tax Lates JurisprudenceDocument19 pagesTax Lates JurisprudenceJoni PurayNo ratings yet

- Commissioner v. United Cadiz Sugar Farmers Assoc Multi-Purpose CooperativeDocument7 pagesCommissioner v. United Cadiz Sugar Farmers Assoc Multi-Purpose CooperativeKit FloresNo ratings yet

- Unique Dyeworks V CirDocument1 pageUnique Dyeworks V Circmv mendozaNo ratings yet

- G.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.Document156 pagesG.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.roa yusonNo ratings yet

- G.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.Document9 pagesG.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.Mike HamedNo ratings yet

- Ances Tax 1,11,21Document3 pagesAnces Tax 1,11,21Joshua JovenNo ratings yet

- BCDA Exempt from CWT on Global City Property SalesDocument2 pagesBCDA Exempt from CWT on Global City Property SalesChariNo ratings yet

- Summary of Significant SC Decisions (September-December 2013)Document3 pagesSummary of Significant SC Decisions (September-December 2013)anorith88No ratings yet

- CIR vs Aichi Forging Company: Timely filing of tax refund claimsDocument3 pagesCIR vs Aichi Forging Company: Timely filing of tax refund claimsMaiti LagosNo ratings yet

- CIR vs Applied Food IngredientsDocument6 pagesCIR vs Applied Food IngredientsAlvin HalconNo ratings yet

- Central Cuba Sugar Co. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Central Cuba Sugar Co, 198 F.2d 214, 2d Cir. (1952)Document6 pagesCentral Cuba Sugar Co. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Central Cuba Sugar Co, 198 F.2d 214, 2d Cir. (1952)Scribd Government DocsNo ratings yet

- Tax 2 Case Digests Complete PDFDocument278 pagesTax 2 Case Digests Complete PDFrobertoii_suarezNo ratings yet

- BIR Ruling on Deferred Payment Sales Tax RequirementsDocument4 pagesBIR Ruling on Deferred Payment Sales Tax RequirementsSGNo ratings yet

- Tax 2 Case Digests CompleteDocument282 pagesTax 2 Case Digests CompleteG-one Paisones0% (1)

- Tax 2Document281 pagesTax 2Astrid Gopo BrissonNo ratings yet

- Teruel - Luzon Hydro Corporation vs. CirDocument3 pagesTeruel - Luzon Hydro Corporation vs. CirNoel Christopher G. BellezaNo ratings yet

- Cir Vs AichiDocument1 pageCir Vs AichijeandpmdNo ratings yet

- Cir Vs LancasterDocument8 pagesCir Vs LancasterToni Gabrielle Ang EspinaNo ratings yet

- CadLink Flyer 369044 937 Rev 00Document2 pagesCadLink Flyer 369044 937 Rev 00ShanaHNo ratings yet

- Take Private Profit Out of Medicine: Bethune Calls for Socialized HealthcareDocument5 pagesTake Private Profit Out of Medicine: Bethune Calls for Socialized HealthcareDoroteo Jose Station100% (1)

- The SAGE Handbook of Digital JournalismDocument497 pagesThe SAGE Handbook of Digital JournalismK JNo ratings yet

- 50TS Operators Manual 1551000 Rev CDocument184 pages50TS Operators Manual 1551000 Rev CraymondNo ratings yet

- OBHR Case StudyDocument8 pagesOBHR Case StudyYvonne TanNo ratings yet

- Okuma Osp5000Document2 pagesOkuma Osp5000Zoran VujadinovicNo ratings yet

- Aci 207.1Document38 pagesAci 207.1safak kahraman100% (7)

- People vs. Ulip, G.R. No. L-3455Document1 pagePeople vs. Ulip, G.R. No. L-3455Grace GomezNo ratings yet

- Venturi Meter and Orifice Meter Flow Rate CalculationsDocument2 pagesVenturi Meter and Orifice Meter Flow Rate CalculationsVoora GowthamNo ratings yet

- Tata Group's Global Expansion and Business StrategiesDocument23 pagesTata Group's Global Expansion and Business Strategiesvgl tamizhNo ratings yet

- Customer Satisfaction and Brand Loyalty in Big BasketDocument73 pagesCustomer Satisfaction and Brand Loyalty in Big BasketUpadhayayAnkurNo ratings yet

- Project The Ant Ranch Ponzi Scheme JDDocument7 pagesProject The Ant Ranch Ponzi Scheme JDmorraz360No ratings yet

- Learning HotMetal Pro 6 - 132Document332 pagesLearning HotMetal Pro 6 - 132Viên Tâm LangNo ratings yet

- StandardsDocument3 pagesStandardshappystamps100% (1)

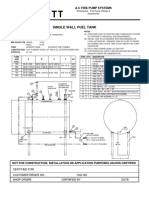

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDocument1 pageSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNo ratings yet

- DHPL Equipment Updated List Jan-22Document16 pagesDHPL Equipment Updated List Jan-22jairamvhpNo ratings yet

- Peter Wilkinson CV 1Document3 pagesPeter Wilkinson CV 1larry3108No ratings yet

- Planning For Network Deployment in Oracle Solaris 11.4: Part No: E60987Document30 pagesPlanning For Network Deployment in Oracle Solaris 11.4: Part No: E60987errr33No ratings yet

- Welding MapDocument5 pagesWelding MapDjuangNo ratings yet

- SE Myth of SoftwareDocument3 pagesSE Myth of SoftwarePrakash PaudelNo ratings yet

- 13-07-01 Declaration in Support of Skyhook Motion To CompelDocument217 pages13-07-01 Declaration in Support of Skyhook Motion To CompelFlorian MuellerNo ratings yet

- DSA NotesDocument87 pagesDSA NotesAtefrachew SeyfuNo ratings yet

- SAP ORC Opportunities PDFDocument1 pageSAP ORC Opportunities PDFdevil_3565No ratings yet

- Lec - Ray Theory TransmissionDocument27 pagesLec - Ray Theory TransmissionmathewNo ratings yet

- Elementary School: Cash Disbursements RegisterDocument1 pageElementary School: Cash Disbursements RegisterRonilo DagumampanNo ratings yet

- ContactsDocument10 pagesContactsSana Pewekar0% (1)

- Chapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationDocument16 pagesChapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationSarmila MahendranNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsGrant LiNo ratings yet

- CAP Regulation 20-1 - 05/29/2000Document47 pagesCAP Regulation 20-1 - 05/29/2000CAP History LibraryNo ratings yet

- SyllabusDocument4 pagesSyllabusapi-105955784No ratings yet