Professional Documents

Culture Documents

Kabelokgakololo Plan

Uploaded by

Otsile JohnsonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kabelokgakololo Plan

Uploaded by

Otsile JohnsonCopyright:

Available Formats

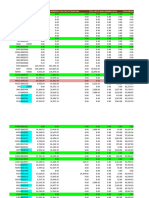

PROJECTED INCOME STATEMENT

2010

0.00

2011

0.00

2012

776,103.80

2013

838192.10

2014

905247.47

25,742.00

32,500.00

-58,242.00

27029.10

34125.00

-61,154.10

59180.56

35831.25

681,091.99

62139.59

37622.81

738,429.70

65246.57

39503.95

800,496.95

3,200.00

6,651.60

14,400.00

600.00

0.00

27,368.00

720.00

4,500.00

54,239.60

4339.17

58,578.77

3360.00

6984.18

15120.00

630.00

0.00

25,000.00

756.00

0.00

48,490.18

3879.21

52,369.39

3528.00

7333.39

15876.00

661.50

0.00

23,000.00

793.80

0.00

47,664.69

3813.18

51,477.86

3704.40

7700.06

16669.80

694.58

0.00

21,500.00

833.49

0.00

47,397.92

3791.83

51,189.76

3889.62

8085.06

17503.29

729.30

0.00

20,000.00

875.16

0.00

47,192.82

3775.43

50,968.25

Finance expenses

Depreciation

Ceda Loan- Interest

73,035.02

273,926.64

73,035.02

263,106.44

73,035.02

251,446.23

73,035.02

238,880.81

73,035.02

225,339.91

Profit Before Tax

Income Tax @ .25 %

-463,782.43

0

-449,664.95

0

305,132.88

76283.22

375,324.12

93831.03

451,153.78

112788.44

Profit After Tax

-463,782.43

-449,664.95

228,849.66

281,493.09

338,365.33

TURNOVER

DIRECT COSTS/PRIME COSTS

Direct Expenses

Direct wages and salaries

GROSS PROFIT/LOSS

OTHER INCOME

EXPENSES

Accounting fees

Animal vaccines & solutions

fuel and oil

Communication

Marketing & stationery

insurance

Bank charges

Mentoring & consultancy

Total operating

Contigency 5% of total Expenses

Roll over adjustment/Relief possible

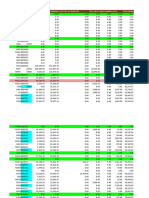

CASH FLOW STATEMENT PROJECTED IN YEARS

2009/10

2010/11

2011/12

Cash inflow

Sales

Other income [ower:s contribution

CEDA Loan

Total cash Inflow

0.00

0.00

1,300,638.06

1,300,638.06

431,664.00

50,000.00

0.00

481,664.00

633,420.00

0.00

0.00

633,420.00

Cash Outflow

Direct Costs

Factory overheads and admin expenses

Contigency 8%

Net Cashoutflow total after contigiency

45,107.64

1,105,809.06

88,464.72

1,239,381.42

48,716.25

#REF!

95,541.90

#REF!

52,613.55

#REF!

103,185.26

#REF!

Financing costs

Interest on overdraft

Loan repayment

Total cash outflow

0.00

0.00

1,239,381.42

0.00

0.00

#REF!

0.00

164,696.04

#REF!

#REF!

61,256.64

#REF!

#REF!

#REF!

#REF!

Net cash in/out flow

Balance from previous year

Balance c/f

61,256.64

0.00

61,256.64

2012/13

2013/14

684093.60

0.00

0.00

684,093.60

738821.09

0.00

0.00

738,821.09

56,822.64

#REF!

111,440.08

#REF!

61,368.45

#REF!

120,355.28

#REF!

0.00

164,696.04

#REF!

0.00

164,696.04

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

PROJECTED BALANCE SHEET

2010/11

Non Current Assets

Land and Buildings

1,900,000.00

Well accessories

131,708.00

Motor van

108,000.00

TOTAL FIXED ASSETS(Historic cost)

2,139,708.00

Less; Accmulated deprecia

36,850.00

Net fixed Assets

2,102,858.00

2011/12

2012/13

2013/14

2014/15

1,900,000.00 1,900,000.00 1,900,000.00 1,900,000.00

131,708.00

131,708.00

131,708.00

131,708.00

108,000.00

108,000.00

108,000.00

108,000.00

2,139,708.00 2,139,708.00 2,139,708.00 2,139,708.00

73,700.00

110,550.00

147,400.00

184,250.00

2,066,008.00 2,029,158.00 1,992,308.00 1,955,458.00

Investments

Current assets

Inventory

Accounts receivable

Cash and Bank

TOTAL CURRENT ASSETS

Current Liabilities

Accounts payable

Taxation

Loans-curren Portion

1,848,027.73 2,567,411.57 2,835,703.01 2,447,707.83 2,243,083.79

641,560

0

0.00

0.00

0.00

93,275.24

27,306.00

212,000.00

254,908.00

116,980.00

2,582,862.97 2,594,717.57 3,047,703.01 2,702,615.83 2,360,063.79

0.00

0

0.00

0.00

0.00

0

0.00

0

0

413,303.76

413303.76

0.00

0

413,303.76

413303.76

0.00

0

413,303.76

413303.76

TOTAL CURRENT LIABILITIES

Net current assets

2,582,862.97 2,594,717.57 2,634,399.25 2,289,312.07 1,946,760.03

TOTAL NET ASSETS

4,685,720.97 4,660,725.57 4,663,557.25 4,281,620.07 3,902,218.03

Capital Employed

Owner's contribution

Retained Earnings/Reserve

Loan-CEDA

TOTAL EMPLOYED CAPITAL

1,243,529.33 1,243,529.33 1,243,529.33 1,243,529.33 1,243,529.33

-273,182.46 -298,177.86

117,957.58

149,324.16

183,225.88

3,715,374.10 3,715,374.10 3,302,070.34 2,888,766.58 2,475,462.82

4,685,720.97 4,660,725.57 4,663,557.25 4,281,620.07 3,902,218.03

PROJECTED CASHFLOW STATEMENT FOR FIRST 12 MONTHS

YEAR 2010/11

1

0.00

0.00

3,715,374.10

3,715,374.10

0

0

0

0.00

0.00

0.00

0.00

4,961.16

4,961.16

4,961.16

4,961.16

4,961.16

266.67

2,200,000.00

1,084,500.00

71,896.00

0.00

1,200.00

50.00

7,368.00

60.00

0.00

266.67

266.67

266.67

266.67

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

60.00

0.00

60.00

0.00

60.00

0.00

800.00

60.00

0.00

4,500.00

3,374,801.83

168,740.09

3,543,541.92

6,537.83

326.89

6,864.72

6,537.83

326.89

6,864.72

7,337.83

366.89

7,704.72

6,537.83

326.89

6,864.72

0.00

0.00

3,543,541.92

0.00

6,864.72

0.00

6,864.72

0.00

7,704.72

0.00

6,864.72

Cash inflow

Sales

Other income [ower:s contribut

CEDA Loan

Total cash Inflow

Cash Outflow

Direct Costs

Other operating Cost

Accounting Fees

Purchase of farm

Purchase of livestock

Transport

Quality accreditation

Fuel and Oil

Communication

Insurance

Bank Charges

Marketing & stationery

Maintenance/Repairs

Mentoring

Sub total

Contigency @ 5%

Cashoutflow total

Financing costs

Interest on overdraft

Loan repayment

Total cash outflow

Net cash in/out flow

Balance from previous month

Balance c/f f

171,832.18 -6,864.72 -6,864.72 -7,704.72 -6,864.72

0.00 171,832.18 164,967.46 158,102.74 150,398.01

171,832.18 164,967.46 158,102.74 150,398.01 143,533.29

10

11

12 TOTAL

0

0.00

0.00

0.00

0.00

0.00

0.00

0.00

4,961.16

4,961.16

4,961.16

4,961.16

4,961.16

4,961.16

4,961.16

59,533.92

266.67

266.67

266.67

266.67

266.67

266.67

266.67

3,200.04

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

1,200.00

50.00

60.00

0.00

60.00

0.00

60.00

0.00

800.00

60.00

0.00

60.00

0.00

60.00

0.00

60.00

0.00

1,300.00

6,537.83

326.89

6,864.72

6,537.83

326.89

6,864.72

7,337.83

366.89

7,704.72

6,537.83

326.89

6,864.72

6,537.83

326.89

6,864.72

6,537.83

326.89

6,864.72

7,837.83

391.89

8,229.72

0.00

14,400.00

600.00

7,368.00

720.00

0.00

2,900.00

4,500.00

93,221.96

4,661.10

97,883.06

0.00

6,864.72

0.00

6,864.72

0.00

7,704.72

0.00

6,864.72

0.00

6,864.72

0.00

6,864.72

0.00

8,229.72

0.00

157,416.98

0.00

0.00

3,715,374.10

0.00 3,715,374.10

-6,864.72 -6,864.72 -7,704.72 -6,864.72 -6,864.72 -6,864.72 -8,229.72

143,533.29 136,668.57 129,803.85 122,099.13 115,234.41 108,369.69 101,504.96

136,668.57 129,803.85 122,099.13 115,234.41 108,369.69 101,504.96 93,275.24

You might also like

- Cartera - Zona 5 - Jefferson OrtizDocument294 pagesCartera - Zona 5 - Jefferson OrtizFernando Garcia FigueroaNo ratings yet

- Option Chain ED NIFTY 28 Sep 2023Document3 pagesOption Chain ED NIFTY 28 Sep 2023tonnypaul01071976No ratings yet

- Dec ClearedDocument11 pagesDec ClearedAra FeiNo ratings yet

- June - ClearedDocument13 pagesJune - ClearedAra FeiNo ratings yet

- Cartera Zona 6 Maria (1) - Asignada 13.07.2023Document262 pagesCartera Zona 6 Maria (1) - Asignada 13.07.2023Fernando Garcia FigueroaNo ratings yet

- Mar 2022 - ClearedDocument11 pagesMar 2022 - ClearedAra FeiNo ratings yet

- Calculo de CTS y L. MayorDocument10 pagesCalculo de CTS y L. MayorVíctor MioNo ratings yet

- Feb 2022 - ClearedDocument17 pagesFeb 2022 - ClearedAra FeiNo ratings yet

- Data Luis TimanáDocument139 pagesData Luis TimanáFernando Garcia FigueroaNo ratings yet

- Howard CorporationDocument2 pagesHoward CorporationZayuri CRNo ratings yet

- Kelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountDocument5 pagesKelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountJanaelaNo ratings yet

- Kelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountDocument5 pagesKelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountThelma PelaezNo ratings yet

- Aug 2022 - ClearedDocument11 pagesAug 2022 - ClearedAra FeiNo ratings yet

- Balance Sheet - Apr16Document6 pagesBalance Sheet - Apr16abhisheksaurabh2001No ratings yet

- Cuadro Formulado120713Document26 pagesCuadro Formulado120713Magda RodriguezNo ratings yet

- New Microsoft Excel WorksheetDocument9 pagesNew Microsoft Excel WorksheetSneha JadhavNo ratings yet

- Cartera Zona 1 y 2 Katty (Actualizado 31 - 08)Document676 pagesCartera Zona 1 y 2 Katty (Actualizado 31 - 08)Fernando Garcia FigueroaNo ratings yet

- Cartera Zona 1 y 2 Katty (Actualizado 31 - 08)Document676 pagesCartera Zona 1 y 2 Katty (Actualizado 31 - 08)Fernando Garcia FigueroaNo ratings yet

- Inver 2Document51 pagesInver 2Ougoust DrakeNo ratings yet

- Fungsi 2005 2006 2007 2008 2009: Anggaran Pendapatan Dan Belanja Negara (Miliar Rupiah)Document3 pagesFungsi 2005 2006 2007 2008 2009: Anggaran Pendapatan Dan Belanja Negara (Miliar Rupiah)Berta Westi PanjaitanNo ratings yet

- Cuadre 5% Retenido: No. Factura Subtotal Itbis Total 5% Retenido NCFDocument11 pagesCuadre 5% Retenido: No. Factura Subtotal Itbis Total 5% Retenido NCFLisset CáceresNo ratings yet

- Saldos 2021Document152 pagesSaldos 2021Robinson Ascencio PeñaNo ratings yet

- Apr 2022 - ClearedDocument21 pagesApr 2022 - ClearedAra FeiNo ratings yet

- Vlsrepayment AccessDocument6 pagesVlsrepayment AccessAde ToluNo ratings yet

- Audit 1414Document3 pagesAudit 1414gocedelceva10No ratings yet

- 352 RDocument4 pages352 Rmac pcpNo ratings yet

- ASJ Ponzi SchemeDocument2 pagesASJ Ponzi SchemeKim VisperasNo ratings yet

- Nov ClearedDocument13 pagesNov ClearedAra FeiNo ratings yet

- July 2022 - ClearedDocument9 pagesJuly 2022 - ClearedAra FeiNo ratings yet

- Report Monika 29 Okt SD 13 Nov 2018Document1,219 pagesReport Monika 29 Okt SD 13 Nov 2018Aindra BudiarNo ratings yet

- Balance de Prueba: ALITAS COLOMBIANAS SAS (Nit: 900,908,028-9)Document26 pagesBalance de Prueba: ALITAS COLOMBIANAS SAS (Nit: 900,908,028-9)LauraLorenaMarentesNo ratings yet

- New India Mediclaim Policy Premium Chart-1Document2 pagesNew India Mediclaim Policy Premium Chart-1saiNo ratings yet

- Oct ClearedDocument12 pagesOct ClearedAra FeiNo ratings yet

- Fty RTG GHHH HHHHDocument7 pagesFty RTG GHHH HHHHaudicontableNo ratings yet

- Jan 2023 - ClearedDocument9 pagesJan 2023 - ClearedNics ValdrezNo ratings yet

- Amount Per Check (Semi-Monthly)Document2 pagesAmount Per Check (Semi-Monthly)Kevin EnerioNo ratings yet

- Rekapitulasi Perubahan Anggaran Blud Puskesmas Tahun 2018Document2 pagesRekapitulasi Perubahan Anggaran Blud Puskesmas Tahun 2018ridwanNo ratings yet

- Stock Analysis ITDocument5 pagesStock Analysis ITAshish AcharjiNo ratings yet

- Cartera Zona 8 - Juan - ActualizadoDocument368 pagesCartera Zona 8 - Juan - ActualizadoFernando Garcia FigueroaNo ratings yet

- Days Deposit Unit Per Lot Lost ValueDocument2 pagesDays Deposit Unit Per Lot Lost ValueMthunzi MthunziNo ratings yet

- Feb 2023 - ClearedDocument8 pagesFeb 2023 - ClearedNics ValdrezNo ratings yet

- Feb 2023 - ClearedDocument8 pagesFeb 2023 - ClearedNics ValdrezNo ratings yet

- Journal Detail 2019Document19 pagesJournal Detail 2019cacaNo ratings yet

- Micron Technology, Inc. (MU) - Data-AnnualDocument13 pagesMicron Technology, Inc. (MU) - Data-AnnualwillyNo ratings yet

- Data Ekonomi 1Document3 pagesData Ekonomi 1Kristina ManaluNo ratings yet

- Dec 2022 - ClearedDocument10 pagesDec 2022 - ClearedAra FeiNo ratings yet

- Tabel Pembacaan Debit RechboxDocument5 pagesTabel Pembacaan Debit RechboxAis(y)ahNo ratings yet

- Motorola Six Sigma Conversion TableDocument1 pageMotorola Six Sigma Conversion TableMars HNo ratings yet

- Utm E UTM N Elevation: Au As Mo SB Te THDocument18 pagesUtm E UTM N Elevation: Au As Mo SB Te THYanpaul B ChNo ratings yet

- Utm E UTM N Elevation: Au As Mo SB Te THDocument18 pagesUtm E UTM N Elevation: Au As Mo SB Te THYanpaul B ChNo ratings yet

- Portafolio de Inversion Parte 1Document23 pagesPortafolio de Inversion Parte 1Nicol valeria Patiño villadaNo ratings yet

- Rekap BcaDocument4 pagesRekap BcaManyol RFJNo ratings yet

- Bank ReconDocument52 pagesBank ReconJehiel ImbocNo ratings yet

- Công ty Chi phí phải trả ngắn hạn 2000 2001 2002 2003Document120 pagesCông ty Chi phí phải trả ngắn hạn 2000 2001 2002 2003Tuấn Phạm Nguyễn ĐìnhNo ratings yet

- Taller 1 Gradientes-Jessica HenaoDocument9 pagesTaller 1 Gradientes-Jessica HenaojessicaNo ratings yet

- Volumes TerrassementDocument4 pagesVolumes TerrassementSHAMI KHALILNo ratings yet

- Monedas Con Buen PotencialDocument1 pageMonedas Con Buen PotencialDanny Daniel MatosNo ratings yet

- Gestao de BancaDocument25 pagesGestao de BancaMichaell GabrielNo ratings yet

- Cubature Piste ZANFAN OMRAN AL GHADEDocument3 pagesCubature Piste ZANFAN OMRAN AL GHADEJaouad CherradNo ratings yet

- I-Lt-Cyclomax 3.7-3Document10 pagesI-Lt-Cyclomax 3.7-3Luis Fernando OrtigozaNo ratings yet

- Harmonic Distortion CSI-VSI ComparisonDocument4 pagesHarmonic Distortion CSI-VSI ComparisonnishantpsbNo ratings yet

- Management Thoughts Pramod Batra PDFDocument5 pagesManagement Thoughts Pramod Batra PDFRam33% (3)

- SamanthavasquezresumeDocument1 pageSamanthavasquezresumeapi-278808369No ratings yet

- FEDocument20 pagesFEKenadid Ahmed OsmanNo ratings yet

- Cronbach's AlphaDocument4 pagesCronbach's AlphaHeide Orevillo Apa-apNo ratings yet

- ECON 202 Optional Problem SetDocument3 pagesECON 202 Optional Problem SetAnthony SabarilloNo ratings yet

- AMEM211 Lab2 PotentiometerDocument10 pagesAMEM211 Lab2 PotentiometerB.s. BhosleNo ratings yet

- Lynette Hawkins, BMG Awesome InsightDocument2 pagesLynette Hawkins, BMG Awesome Insightawesomei100% (1)

- Basic Principles of Immunology: Seminar OnDocument43 pagesBasic Principles of Immunology: Seminar OnDr. Shiny KajalNo ratings yet

- Opposition To Motion For Judgment On PleadingsDocument31 pagesOpposition To Motion For Judgment On PleadingsMark Jaffe100% (1)

- Claims Reserving With R: Chainladder-0.2.10 Package VignetteDocument60 pagesClaims Reserving With R: Chainladder-0.2.10 Package Vignetteenrique gonzalez duranNo ratings yet

- Vol 17 No 3 and No 4 Fort Laramie and The Sioux War of 1876Document19 pagesVol 17 No 3 and No 4 Fort Laramie and The Sioux War of 1876Лазар СрећковићNo ratings yet

- Motorola Droid 2Document11 pagesMotorola Droid 2Likith MNo ratings yet

- How To Apply For The UpcatDocument3 pagesHow To Apply For The UpcatAaron ReyesNo ratings yet

- Contoh CV Pelaut Untuk CadetDocument1 pageContoh CV Pelaut Untuk CadetFadli Ramadhan100% (1)

- Lease Contract AddendumDocument1 pageLease Contract AddendumjasonNo ratings yet

- List of MarketingDocument78 pagesList of MarketingMohamad IchwanNo ratings yet

- Emailing Prime - Brochure - DigitalDocument32 pagesEmailing Prime - Brochure - DigitalCASA VALLINo ratings yet

- Malik Tcpdump FiltersDocument41 pagesMalik Tcpdump FiltersombidasarNo ratings yet

- Section 8 33KVDocument13 pagesSection 8 33KVMuna HamidNo ratings yet

- M.Tech VLSI SyllabusDocument10 pagesM.Tech VLSI SyllabusAshadur RahamanNo ratings yet

- BF2207 Exercise 6 - Dorchester LimitedDocument2 pagesBF2207 Exercise 6 - Dorchester LimitedEvelyn TeoNo ratings yet

- Ultrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedDocument2 pagesUltrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedhaujesNo ratings yet

- Sustainability and Economy - A Paradigm For Managing Entrepreneurship Towards Sustainable DevelopmentFDocument21 pagesSustainability and Economy - A Paradigm For Managing Entrepreneurship Towards Sustainable DevelopmentFArmando Tarupí MontenegroNo ratings yet

- UNDCO Disability Inclusion Strategy 2022 - 2025Document28 pagesUNDCO Disability Inclusion Strategy 2022 - 2025Nelson MichmeNo ratings yet

- T BeamDocument17 pagesT BeamManojNo ratings yet

- Aerated Static Pile Composting (ASP) VS Aerated (Turned) Windrow CompostingDocument2 pagesAerated Static Pile Composting (ASP) VS Aerated (Turned) Windrow CompostingRowel GanzonNo ratings yet

- Vol II - PIM (Feasibility Report) For Resort at ChorwadDocument42 pagesVol II - PIM (Feasibility Report) For Resort at Chorwadmyvin jovi denzilNo ratings yet

- Jurnal PedodontiaDocument8 pagesJurnal PedodontiaAndreas WallaceNo ratings yet