Professional Documents

Culture Documents

Market Outlook 23rd December 2011

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 23rd December 2011

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

December 23, 2011

Dealers Diary

Indian markets are expected to open on a positive note following a gap up opening in most of the Asian markets today. The domestic bourses rose for the second day in a row, primarily due to data on easing of domestic food inflation, and partly due to firming up of European stocks in early trade. Global cues firmed up slightly. European bourses closed on a firm note as Italy's Senate passed sweeping austerity measures. US markets too ended with mild gains after economic data indicated gradual improvement in the economy. The number of Americans filing new claims for jobless benefits hit a 3-1/2 year low last week, bolstering the views of economy gaining momentum. The surge in the domestic markets is mainly attributable to positive investor sentiment mood buoyed by falling inflation which has been on the rising spree since past several months. Food inflation fell sharply to a near four-year low as prices of essential commodities declined. The markets will closely track the developments on the domestic front; RBI is likely be more watchful now as moderating inflation is likely to resolve the predicament of trimming interest rates in order to support growth. Nonetheless, one cannot rule out the pessimism surrounding the policy paralysis on the macro front which, in tandem with weakening of global cues, can reverse the market directions.

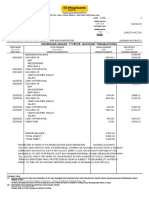

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%) 0.8 0.9 0.8 0.7 0.7 1.7 2.3 1.7 0.5 1.1 (1.2) Chg (%) 0.5 0.8 1.3 (0.8) (0.2) (0.3) (0.2)

(Pts) 40.7 40.3 38.7 37.8 110.0 213.5 133.8 50.4 85.1 (69.3) (Pts) 61.9 21.5 67.2 (64.8) (38.2) (8.5) (4.9)

(Close) 4,734 5,182 5,556 5,879 6,464 9,630 8,263 9,572 8,011 5,680 (Close) 12,170 2,599 5,457 8,395 18,378 2,665 2,186

128.2 15,813

Markets Today

The trend deciding level for the day is 15,707 / 4,702 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 15,941 16,069 / 4,772 4,810 levels. However, if NIFTY trades below 15,707 / 4,702 levels for the first half-an-hour of trade then it may correct up to 15,579 15,345 / 4,664 4,595 levels.

Indices SENSEX NIFTY S2

15,345 4,595

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank

Chg (%) 3.5 1.6 4.5 0.9

(Pts) 1.7 0.2 1.2 0.2

(Close) $51.1 $10.0 $27.1 $26.2

S1

15,579 4,664

R1

15,941 4,772

R2

16,069 4,810

News Analysis

Euro update - ECB lends 489bn to EU for three years Govt. asks Bharti, Vodafone, Idea to stop 3G roaming pacts Yes Bank raises savings rate to 7% for balances above `1lakh

Refer detailed news analysis on the following page

Advances / Declines Advances Declines Unchanged

BSE 1,547 1,149 147

NSE 880 591 75

Net Inflows (December 21, 2011)

` cr FII MFs ` cr Index Futures Stock Futures Purch

2,214 637

Sales

2,251 436

Net

(37) 202

MTD

(297) (81)

YTD

(4,321) 5,864

Volumes (` cr) BSE NSE 2,039 9,551

FII Derivatives (December 22, 2011)

Purch

2,646 4,414

Sales

2,348 4,746

Net

298 (332)

Open Interest

11,194 26,930

Gainers / Losers

Gainers Company

Hindustan Copper JP Infratech Ashok Leyland MMTC Apollo Tyres

Losers Company

Mphasis REC Aditya Birla Nuvo Shriram Trans. Glenmark Pharma

Price (`)

172 38 23 497 61

chg (%)

15.7 11.4 11.2 10.9 9.6

Price (`)

313 154 746 448 273

chg (%)

(4.9) (3.9) (3.7) (3.6) (2.7)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Euro update - ECB lends 489bn to EU for three years

The ECB, in a bold move, has came out to lend Eurozone banks and offered 489bn for three years in its latest attempt to keep credit flowing into the economy during the sovereign debt crisis. Europes debt crisis has increased the risk of government and bank defaults, making institutions wary of lending to each other and driving up the cost of credit. Hence, the ECB is trying to ensure that banks have access to cheap cash for the medium term so that they can keep lending to companies and households. In addition to long-term loans, the ECB has widened a pool of collateral, which banks can use to secure these funds.

Govt. asks Bharti, Vodafone, Idea to stop 3G roaming pacts

The Telecom Ministry has asked service providers to discontinue their 3G roaming agreements and is contemplating imposing penalty on them. The decision comes after the unanimous view of telecom regulator TRAI, Law Ministry and DoT that such roaming agreement was in violation of the telecom licenses. Leading operators like Bharti Airtel, Vodafone and Idea Cellular had entered into an agreement with one another to offer 3G mobile services in circles in which they could not succeed in getting spectrum in the auction held last year. The issue pertains to the pact among major service providers, including Bharti Airtel, Vodafone and Idea Cellular, for providing 3G roaming network on a pan-India basis. Other service providers like Tata Teleservices and Aircel had also entered into similar agreements to offer services in six circles. However, they have already discontinued the arrangement. The DoT had sought a legal opinion on this matter and the Law Ministry had supported the DoT's view. In an internal note, the DoT had said the roaming agreement among telecom companies for 3G services would lead to a significant loss of revenue to the government. Telecom players continue to remain haunted by the regulatory issue on the sector. We maintain our Neutral view on the sector.

Yes Bank raises savings rate to 7% for balances above `1lakh

Private sector lender Yes Bank has raised the saving account interest rate for balance above `1 lakhs to 7% from 6%. Yes bank, had earlier hiked saving deposit rates to 6% from 4% on October 25, on a day when the Reserve Bank of India announced to deregulate saving deposit rates. Kotak Mahindra Bank had also hiked saving deposit rates to 6%. We do not expect larger banks to follow suit since Yes banks smaller distribution risk does not pose threat to the bigger banks market share. However the development is positive for Yes Bank as it will help garner CASA deposits which will be at cheaper cost anyways as compared to its wholesale borrowings. At the CMP, Yes Bank is trading at 1.6x FY2013E ABV. We maintain our Buy recommendation on the stock with a target price of `314.

December 23, 2011

Market Outlook | India Research

Economic and Political News

Food inflation plunges to four-year low of 1.81% Current account deficit may widen more, says RBI RBI may lower GDP projection for FY2012 says RBI chief Parliamentary panel for options trading in commodity mkt NHAI to launch `10,000cr tax-free bonds issue on Dec 28

Corporate News

Banking system stable, weak spots in economy, says RBI Expert panel for cap on future mining activity in Goa Coal Ministry seeks report on progress of captive blocks in 3QFY2012 New telcos join hands, seek spectrum up to 6.2 MHz Strides gets USFDA nod for facility, cancer drug Punj Lloyd bags `285cr road project in Kenya

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint,

December 23, 2011

Market Outlook | India Research

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

December 23, 2011

You might also like

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook 20th December 2011Document4 pagesMarket Outlook 20th December 2011Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 16th February 2012Document4 pagesMarket Outlook 16th February 2012Angel BrokingNo ratings yet

- Market Outlook 29th December 2011Document3 pagesMarket Outlook 29th December 2011Angel BrokingNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Market Outlook 10th January 2012Document4 pagesMarket Outlook 10th January 2012Angel BrokingNo ratings yet

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Market Outlook 27th March 2012Document4 pagesMarket Outlook 27th March 2012Angel BrokingNo ratings yet

- Market Outlook 6th January 2012Document4 pagesMarket Outlook 6th January 2012Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 13th December 2011Document4 pagesMarket Outlook 13th December 2011Angel BrokingNo ratings yet

- Market Outlook 2nd September 2011Document4 pagesMarket Outlook 2nd September 2011anon_8523690No ratings yet

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 7th March 2012Document4 pagesMarket Outlook 7th March 2012Angel BrokingNo ratings yet

- Market Outlook 17th August 2011Document4 pagesMarket Outlook 17th August 2011Angel BrokingNo ratings yet

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 22nd December 2011Document4 pagesMarket Outlook 22nd December 2011Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 7th December 2011Document4 pagesMarket Outlook 7th December 2011Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangeNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 24th February 2012Document4 pagesMarket Outlook 24th February 2012Angel BrokingNo ratings yet

- Market Outlook 19th August 2011Document3 pagesMarket Outlook 19th August 2011Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingNo ratings yet

- Market Outlook 17th February 2012Document4 pagesMarket Outlook 17th February 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 4th August 2011Document4 pagesMarket Outlook 4th August 2011Angel BrokingNo ratings yet

- Market Outlook 30th September 2011Document3 pagesMarket Outlook 30th September 2011Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Why Moats Matter: The Morningstar Approach to Stock InvestingFrom EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingRating: 4 out of 5 stars4/5 (3)

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Sample Statement of Account For Travel AgencyDocument3 pagesSample Statement of Account For Travel AgencyKJ S Bee100% (1)

- Approved Resolution No. 2016 102Document1 pageApproved Resolution No. 2016 102ELVIENo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 23Document12 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 23Advance KnowledgeNo ratings yet

- XXXXXXXXXX1191 20230728113715988340..Document6 pagesXXXXXXXXXX1191 20230728113715988340..MOHAMMAD IQLASHNo ratings yet

- Turtle Diagram of Cash Flow PDFDocument1 pageTurtle Diagram of Cash Flow PDFherikNo ratings yet

- Investment Operations Analyst in Chicago IL Resume Michael FreasDocument1 pageInvestment Operations Analyst in Chicago IL Resume Michael FreasMichaelFreasNo ratings yet

- Effects of ""Susu"" - A Traditional Micro-Finance Mechanism On Organized and Unorganized Micro and Small Enterprises (Mses) in GhanaDocument8 pagesEffects of ""Susu"" - A Traditional Micro-Finance Mechanism On Organized and Unorganized Micro and Small Enterprises (Mses) in GhanaMoses DumayiriNo ratings yet

- CV - Ca. Vaibhav GattaniDocument2 pagesCV - Ca. Vaibhav GattaniCA Vaibhav GattaniNo ratings yet

- Negotiable Instruments Act 1881Document47 pagesNegotiable Instruments Act 1881SupriyamathewNo ratings yet

- Cara Goldenberg - Permian IP - DecDocument6 pagesCara Goldenberg - Permian IP - DecazharaqNo ratings yet

- Ing Mt940 Structured Format DescriptionDocument61 pagesIng Mt940 Structured Format DescriptionDHL123No ratings yet

- Kim Gilbert 2018 PDFDocument25 pagesKim Gilbert 2018 PDFKim Gilbert50% (2)

- Uniform Commercial Code - Discharge and PaymentDocument43 pagesUniform Commercial Code - Discharge and Paymentmo100% (1)

- Final GK Power Capsule 2016Document70 pagesFinal GK Power Capsule 2016Vishnu KumarNo ratings yet

- Disbursement VoucherDocument1 pageDisbursement VoucherGeorgina Intia100% (1)

- Commercial Bank of Ethiopia List of Candidates For The Position of Bank Trainee Under Megenagna DistrictDocument40 pagesCommercial Bank of Ethiopia List of Candidates For The Position of Bank Trainee Under Megenagna DistrictBelay BayuNo ratings yet

- Article Review: M-Pesa in IndiaDocument3 pagesArticle Review: M-Pesa in IndiaSoham SamantaNo ratings yet

- Ibs Merlimau 1 30/06/20Document1 pageIbs Merlimau 1 30/06/20Fakhrurr HamdanNo ratings yet

- 02audit of CashDocument12 pages02audit of CashJeanette FormenteraNo ratings yet

- Display PDFDocument3 pagesDisplay PDFMartin SabahNo ratings yet

- KOTAK CORRECTIONfiDocument75 pagesKOTAK CORRECTIONfiNicy JoyNo ratings yet

- 43 Indian - Capital - MarketDocument40 pages43 Indian - Capital - MarketNiladri MondalNo ratings yet

- Consumer Awareness ProjectDocument30 pagesConsumer Awareness ProjectJNV_DVG38% (21)

- The Intelligent InvestorDocument7 pagesThe Intelligent InvestorAlethea AineNo ratings yet

- Financially Yours: Assignment IDocument3 pagesFinancially Yours: Assignment IDevesh Prasad MishraNo ratings yet

- Unit IV Fire InsuranceDocument7 pagesUnit IV Fire InsuranceEswaran LakshmananNo ratings yet

- Banking IMCDocument7 pagesBanking IMCVishu ShahNo ratings yet

- Economic SurveyDocument5 pagesEconomic SurveyRyan Compala Lictag100% (1)

- Bihar State Cooperative Bank Assistant RecruitmentDocument15 pagesBihar State Cooperative Bank Assistant RecruitmentTopRankersNo ratings yet

- UK-060 (Bank and Cash Management)Document13 pagesUK-060 (Bank and Cash Management)Ashok KumarNo ratings yet