Professional Documents

Culture Documents

Nibl

Uploaded by

Bikash ChaudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nibl

Uploaded by

Bikash ChaudharyCopyright:

Available Formats

COMPARATIVE ANALYSIS OF FINANCIAL PERFORMANCE ON

NIBL (Nepal Investment Bank Limited) and HBL (Himalayan Bank Limited)

Submitted By: Bikramaditya Dahal KFA Business School Roll No.:304 MBA

Submitted To: Preeti Raj Adhikari Faculty of Financial Management KFA Business School

KFA Business School

1

TABLE OF CONTENTS

Introduction General introduction of Banks Objectives Methodology

Analysis of the study Nepal Investment Bank Limited

Summary Conclusion Recommendation Bibliography Appendices

CHAPTER 1

BANK OVERVIEW

Introduction of Nepal Investment Bank Nepal Investment bank Ltd (NIBL) was established in 1986. Previously, it was known as Nepal Indosuez Bank Ltd. It was established as a joint venture between Nepalese and French Partners. The French partner (holding 50% of the capital of NIBL) was credit Agricole Indosuez, a subsidiary one of the largest banking group in the world. With the decision of Agricole Indosuez to divest, a group of companies comprising of bankers, professionals, industrialists and businessman has acquired on April 2002 the 50% shareholding of credit Agricole Indosuez in Nepal Indosuez Bank Ltd. The name of the bank has been changed to Nepal Investment Bank Ltd, upon approval of banks Annual General Meeting, Nepal Rastra Bank and company Registers Office with the following shareholding structures:

A group of companies holding 50% of the capital Rastriya Banijya Bank 15% of the capital. Rastiya Beema Sansthan 15% of the capital. The remaining 20% being held by the general public.

Using Financial Ratios and Other Analytical Tools to Track Bank Performance

They are the bank, in which people trust to deposit their wealth to safeguard them from risks. In another side, banks provide loans to trade and industries. In this way bank are assumed to be as the backbone of the national economy. Therefore effective performance of the bank is the interest of all including the government and creditors. During the 1980s banks analysts received important new tools to aid them in analyzing a banks financial condition. This new tool was developed by the cooperative efforts of the three federal banking agencies of America. This tool is called Uniform bank Performance Report.

3

These new tools have supplementary items including breakdowns of loans and lease commitments. They analyze the problem regarding loans and loan losses. They also analyze the profile of each banks exposure to risk and source of capital. To track down the performance, bank can also obtain peer group reports, which allow them compare their bank with other banks of comparable size.

Introduction of Himalayan Bank Limited

Himalayan Bank was established in 1993 in joint venture with Habib Bank Limited of Pakistan. Despite the cut-throat competition in the Nepalese Banking sector, Himalayan Bank has been able to maintain a lead in the primary banking activities- Loans and Deposits. HBL stand for the innovation that helps to bring about in this country to help our Customers besides modernizing the banking sector. With the highest deposit base and loan portfolio amongst private sector banks and extending guarantees to correspondent banks covering exposure of other local banks under our credit standing with foreign correspondent banks, we believe we obviously lead the banking sector of Nepal. The most recent rating of HBL by Bankers Almanac as countrys number 1 Bank easily confirms theirs claim.

Objectives:

The main objectives of this report is to present financial analysis is that explain various facts related to the past performance of business and predict the aptitudes for realizing desired results. o To compare the liquidity position. o To examine the efficiency. o To analyze the solvency. o To trace out the financial strength and weakness.

Methodology

In this study, two commercial banks have been selected for the analysis. Analysis is being done between Nepal Investment Bank Limited and Himalayan Bank Limited. Compare and contrast have been used for the analysis. Though, the nature and characteristics of both bank may not be similar, but, however being Nepals top rank bank it could be analyzed.

4

CHAPTER TWO

ANALYSIS OF STUDY

Ratio analysis The discussion and analysis section is the heart of the report. This is the section in which data are presented and analyzed. The discussion of finding will normally be the longest section of the report to get desired objectives of the study several analytical tools had been employed and used research methodology and research design. This chapter is basically concerned with the presentation, comparison, and analysis of data. In this chapter the effort had been made to evaluate the performance of Nepal Investment Bank and to evaluate Himalayan Bank Limited. Every presentation of the data follows its analysis so that can be drawn out and future prediction can be initiated. For the purposed of the analysis simple method of financial tools, ratio analysis is used. Ratio analysis is widely used as a tool of financial analysis. It is defined as a systematic use of ratios to interpret the financial statement so that the strength and weakness of firms well as its historical performance and current financial condition can be defined. The main kinds of tools to measure the performance are

Earning Per Share (EPS) It simply shows the profitability of the firm of a per share basis. It is calculated from the point of view of the ordinary shareholder. It is calculated by dividing the profit after tax by the total number of ordinary share outstanding.

EPS =

Net profit after Tax ____________________ No. of common share

The EPS trend is fluctuating, but it is clear that the EPS of Nepal Investment Bank is substantially high than other competitors. The average EPS of Nepal Investment Bank is 44.74. The highest and lowest EPS of Nepal Investment Bank are 59.35 and 33.59 respectively in the fiscal year 2062/2063 and 2058/2059. Therefore from above analysis we can say that the earning power of Nepal Investment Bank is in good condition.

Return on Asset (ROA) It measures the firms return on investment of financial resources. It also helps us to provide the information of proper utilization of the resources. It is the relation between profit and total assets. Lower ROA means lower profit and higher ROA means higher profit. In the present study, this ratio is examined to measure the profitability of all financial resources in the bank assets.

Net profit after tax (NPAT) ROA= __________________________________ Total Assets

The trend of ROA is also fluctuation; it rises in the year 2059/2060. The highest ROA was 1.61% in the fiscal year 2062/2063 and lowest ROA was 1.13% in the fiscal year 2060/2061. The above table shows that the ROA is satisfactory. However the management of Nepal Investment Bank must keep their eyes toward the situation and mobilize their working assts more efficiently to earn more profit. The Average ROA is 1.312

Price Earnings Ratio (PE ratio) In the fiscal year 2059/2060, the PE ratio was 20.10. And decreases up to 18.18 in the year 2060/2061 but it continuously increases in the year 2061/2062 and2062/2063. The PE ratio is 21.23 Ratio of Net Profit to Gross Income In the fiscal year 2060/2061 the ratio of Net Profit to Gross Income is 16.71% but it increases up to 20.26 in the year 2061/2062. In current year 2062/2063 its ratio is 23.99. Findings: In the fiscal year 2061/2062 the ratio of Net Profit to Gross Income is 20.26 which are greater than last year and this year ratio was 23.99 which is more than last year.

Exchange Gain to Total Income Ratio In the fiscal year 2059/2060 the ratio of Exchange Gain to Total Income is 8.80 but it increases up to 9.63 in the year 2060/2061, after 2060/2061 it was decreasing continuously. Findings: In the year 2060/2061 the ratio was 9.63 which were higher than previous year and this year 2062/2063 (i.e. 8.60)

Net profit to Loan and Advances Ratio In the fiscal year 2058/2059 the ratio of net profit to loan and advances is 2.10% but it decreases by 0.13% and became 1.97% in the fiscal year and after that it continuously increases up to 2062/2063(i.e. 2.66%)

Cash and Bank balance to current deposit ratio

In the fiscal year 2061/2062 the ratio was 84.68% which is less than previous year and in fiscal year 2058/2059 the ratio was 43.14% which was the lowest ratio during 5 year. Thus the bank has less liquidity in 2058/2059. Cash and bank balance include cash in hand and total bank balance.

Findings: In the fiscal year 2061/2062 the ratio was 84.68% which is less than previous year (i.e. 84.78%) and in fiscal year 2062/2063 it is 136.92 which is higher than last year. The average ratio is 88.83%.

Cash and Bank balance to Total deposit Ratio (CRR) Cash Reserve Ratio In the fiscal year 2058/2059 the cash reserve ratio is 8.12 and later become 11.70 in 2059/2060. The trend line is fluctuating it goes up and down. However cash reserve ratio should be minimum. In current year cash reserve ratio is 12.33% Findings: In the fiscal year 2059/2060 the cash reserve ratio is 11.70% that were higher than previous year i.e. 8.12% and this year it is higher than previous year i.e. 12.33%. The average cash reserve ratio is 10.63%

Saving Deposit to Total Deposit Ratio The ratio of Saving Deposit to Total Deposit are 30.83%, 30.72%, 42.40%, 47.03% and 42.70% in fiscal year 2058/2059, 2059/2060, 2060/2061, 2061/2062 and 2062/2063 respectively. Saving Deposit is sorts of short term liquidity, which can be withdrawn by the depositors. Lower the ratio of saving deposit to total deposit, higher the liquidity ratio. Findings: In the fiscal year 2060/2061 ratio is 42.40% which is greater than the fiscal year 2059/2060. And this year ratio is 42.70% which is lesser than previous year which indicate liquidity has increased this year.

Fixed Deposit to Total Deposit Ratio The ratio of Fixed Deposit to Total Deposit are 22.65%, 21.11%, 19.92%, 22.53% and 28.60% in fiscal year 2058/2059, 2059/2060, 2060/2061, 2061/2062 and 2062/2063 respectively. The highest ratio for the five year is 28.60% in the fiscal year 2062/2063 and the lowest ratio is 19.92% in 2060/2061.

Findings: In the fiscal year 2061/2062 the ratio is 22.53% which is greater than previous year. This year ratio is 28.60% which is higher than previous year, which means liquidity is higher than previous year.

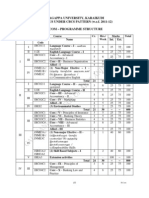

APPENDICES Appendix I Share holding pattern of NIBL S.no 1 1.1 1.2 1.3 1.4 1.5 1.6 2 Name Local Ownership His Majestys Government Commercial Banks Financial Institution Organized Institution General Public Others Foreign Ownership Total Percentage 100 15 15 50 20 100 Share Capital 59,50,86,000 8,85,88,000 8,85,88,000 29,52,93,000 11,81,17,000 59,05,86,000

Source: Annual Report (2062/2063) Fig 1: Shareholding pattern of NIBL

Capital Structure of NIBL Authorized Share Capital 10000000 numbers of ordinary shares of Rs 100 Issued Share Capital 5905860 numbers of ordinary shares of Rs.100 (Of which 3519545 right and1786315 bonus share) Paid-up Share Capital 5905860 numbers of ordinary shares of Rs.100 (Of which 3519545 right and1786315 bonus share) 1,000,000,000 590,868,000

590,868,000

Appendix II Earning Per share Year

Net Profit Tax

After No. of common EPS share (In no.)

10

2058/2059 2059/2060 2060/2061 2061/2062 2062/2063

57.10 116.80 152.60 232.10 350.53

169.98 295.30 295.30 557.74 590.59 Average

33.59 39.56 51.70 39.50 59.35 44.74

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix III Return On Assets Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063

Net Profit Tax 57.10 116.80 152.60 232.10 350.53

After Total Assets 4947 9014 13255 16274 21330 Average

Ratio 1.15 1.27 1.13 1.40 1.61 1.312

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix IV Price earning ratio Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063 Market Value Per Earning Per Share Share 760 33.59 795 39.56 940 51.70 800 39.50 1260 59.35 PE Ratio 22.62 20.10 18.18 20.25 21.23

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix V Ratio of Net Profit to Gross Loan

11

Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063

Ratio (%) 14.54 20.12 16.71 20.26 23.99

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063) Appendix VI Exchange Gain to total income ratio Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063 Ratio (%) 10.91 8.80 9.63 8.95 8.60

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix VII Net Profit to Loan and Advances Ratio Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063 Ratio (%) 2.10 1.97 2.08 2.22 2.66

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix VIII Cash and bank balance to current deposit rate

12

Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063

Cash and balance 338.90 926.60 1226.90 1340.50 2335.53

bank Current deposit 785.4 979 1500.10 1583.03 1705.70 Average

Ratio 43.14 94.65 84.78 84.68 136.92 88.83

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix IX Saving deposit to total deposit ratio Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063 Saving deposit 1278.8 2434.1 4886.1 6703.5 8082 Total Deposit 4174.8 7922.8 11524.7 14254.57 18927 Average Ratio 30.83 30.72 42.40 47.03 42.70 38.73

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

Appendix X Fixed deposit to total deposit

Year 2058/2059 2059/2060 2060/2061 2061/2062 2062/2063

Fixed deposit 945.9 1672.80 2294.68 3212.27 5413

Total Deposit 4174.8 7922.8 11524.7 14254.57 18927 Average

Ratio 22.65 21.11 19.92 22.53 28.60 22.96

Source: Annual report of Nepal Investment Bank (2058/2059-2062/2063)

13

Bibliography

Acharya, Pramod 2010. Institution Analysis, Fieldwork assignment, Nepal Commerce Campus Dahal, Rewan Kumar, 2011, Management Accounting, KFA Business school http://www.himalayanbank.com/contents/contents.php?PageID=annual_reports www.nibl.com.np

14

You might also like

- Financial Ratio Analysis Final-No in TextDocument32 pagesFinancial Ratio Analysis Final-No in TextMini8912No ratings yet

- Global QuickBooks Online User Guide 2019635Document76 pagesGlobal QuickBooks Online User Guide 2019635Lynoj Abang100% (3)

- Camel Analysis of BOMDocument11 pagesCamel Analysis of BOMashuboy006No ratings yet

- Share NumerologyDocument24 pagesShare NumerologyDeepak SolankiNo ratings yet

- Radnet, Inc.: Financing An Acquisition: Rev. May 20, 2014Document22 pagesRadnet, Inc.: Financing An Acquisition: Rev. May 20, 2014Luisa FernandaNo ratings yet

- Sources of Short-Term and Long-Term FundsDocument13 pagesSources of Short-Term and Long-Term FundsZybel Rosales100% (1)

- Financial Ratios of Major Commercial Banks SSRNDocument61 pagesFinancial Ratios of Major Commercial Banks SSRNobp51No ratings yet

- Term 2 Workbook 2020Document24 pagesTerm 2 Workbook 2020api-29528487783% (12)

- Factors Affecting Money SupplyDocument3 pagesFactors Affecting Money Supplyananya50% (2)

- HDFC Bk. - RAR 2015Document32 pagesHDFC Bk. - RAR 2015Moneylife FoundationNo ratings yet

- Stock Market Cycles A Practical ExplanationDocument184 pagesStock Market Cycles A Practical ExplanationNur Zhen67% (3)

- Preethi Rao: Chit Funds - A Boon To The Small EnterprisesDocument19 pagesPreethi Rao: Chit Funds - A Boon To The Small EnterprisesNisha UchilNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Performance Evaluation of Eastern Bank LTDDocument15 pagesPerformance Evaluation of Eastern Bank LTDMehedi HasanNo ratings yet

- Capital AdequacyDocument12 pagesCapital Adequacypapa oforiNo ratings yet

- Advance Analysis of Financial Statement AssignmentDocument17 pagesAdvance Analysis of Financial Statement AssignmentWaqas Ur RehmanNo ratings yet

- Ratio Analysis of HDFC FINALDocument10 pagesRatio Analysis of HDFC FINALJAYKISHAN JOSHI100% (2)

- Publication 1 Seid MDocument9 pagesPublication 1 Seid Mseid100% (1)

- CHAPTERDocument25 pagesCHAPTERBikesh DahalNo ratings yet

- Impact of Liquidity On Profitability of Nepalese Commercial BanksDocument8 pagesImpact of Liquidity On Profitability of Nepalese Commercial BanksWelcome BgNo ratings yet

- A Comparative Study On Financial Performance of Public, Private and Foreign Banks in IndiaDocument21 pagesA Comparative Study On Financial Performance of Public, Private and Foreign Banks in IndiaMINESHNo ratings yet

- Revised)Document31 pagesRevised)Farhad SyedNo ratings yet

- Impact of Liquidity On Profitability of Joint Venture Commercial Banks in Nepal (With Reference To EBL, HBL and NBB)Document16 pagesImpact of Liquidity On Profitability of Joint Venture Commercial Banks in Nepal (With Reference To EBL, HBL and NBB)Welcome BgNo ratings yet

- Executive Summary: Exchange (DSE) Library, Used The Report of Condition and The Profit-LossDocument55 pagesExecutive Summary: Exchange (DSE) Library, Used The Report of Condition and The Profit-LossWasim HassanNo ratings yet

- An Analysis of Financial Performance of BRAC Bank LTD - Al SukranDocument31 pagesAn Analysis of Financial Performance of BRAC Bank LTD - Al SukranAl SukranNo ratings yet

- Performance Evaluation of AB BankDocument28 pagesPerformance Evaluation of AB BankSaidurNo ratings yet

- Ratio Analysis of Bank Alfalah LimitedDocument22 pagesRatio Analysis of Bank Alfalah LimitedAnonymous uDP6XEHs100% (1)

- Sample - Team ProjectDocument10 pagesSample - Team ProjectDiyaNo ratings yet

- Eastern Bank AnalysisDocument44 pagesEastern Bank AnalysisSamiul AhsanNo ratings yet

- The Analysis of Financial Performance Factors of Bank Bri SyariatDocument10 pagesThe Analysis of Financial Performance Factors of Bank Bri SyariatHaibara Novelia PuspitaNo ratings yet

- Analysis of The Effect of Bank Financial Performance Characteristics On Bank Profitability Book 4 On IDXDocument10 pagesAnalysis of The Effect of Bank Financial Performance Characteristics On Bank Profitability Book 4 On IDXInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Performance Evaluation of BanksDocument6 pagesPerformance Evaluation of BanksAroop Kumar MohapatraNo ratings yet

- Superiority of Conventional Banks & Islamic Banks of Bangladesh: A Comparative StudyDocument9 pagesSuperiority of Conventional Banks & Islamic Banks of Bangladesh: A Comparative Studytazim07No ratings yet

- 108-Article Text-277-1-10-20190306Document11 pages108-Article Text-277-1-10-20190306AnNo ratings yet

- Conclusion of EblDocument4 pagesConclusion of Eblrk shahNo ratings yet

- Determinnt of Banking Profitability - 2Document5 pagesDeterminnt of Banking Profitability - 2thaonguyenpeoctieuNo ratings yet

- 580 ArticleText 1652 1 10 20211013Document11 pages580 ArticleText 1652 1 10 20211013Yoya LoyaNo ratings yet

- Financial Calculation of EBLDocument38 pagesFinancial Calculation of EBLAbdullah Al-RafiNo ratings yet

- CAMEL AnalysisDocument11 pagesCAMEL AnalysisChirag AbrolNo ratings yet

- Methodology of The Study FinalDocument5 pagesMethodology of The Study FinalMohammad KurshedNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Dutch Bangla Bank 10720015Document11 pagesDutch Bangla Bank 10720015ABIDUZ ZAMANNo ratings yet

- An Analysis of The Financial Performance of National Bank Limited Using Financial RatioDocument9 pagesAn Analysis of The Financial Performance of National Bank Limited Using Financial RatioKathryn TeoNo ratings yet

- Ijm 11 10 081-2Document14 pagesIjm 11 10 081-2MINESHNo ratings yet

- Performance Evaluation of DBBLDocument16 pagesPerformance Evaluation of DBBLacidreign100% (2)

- Fundamentals of BankingDocument21 pagesFundamentals of BankingSheikh Shahariar AlamNo ratings yet

- Project Work FinalDocument7 pagesProject Work Finalshushilpoudel1No ratings yet

- PNB Analysis 2012Document14 pagesPNB Analysis 2012Niraj SharmaNo ratings yet

- Comparative Financial Performance AnalysDocument83 pagesComparative Financial Performance Analyssps fetrNo ratings yet

- Synopsis of Financial Analysis of Indian Overseas BankDocument8 pagesSynopsis of Financial Analysis of Indian Overseas BankAmit MishraNo ratings yet

- Proposal MBSDocument15 pagesProposal MBSPrashun ShresthaNo ratings yet

- Chapter 1Document17 pagesChapter 1Mitesh RajbhandariNo ratings yet

- Analyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachDocument6 pagesAnalyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachAshebirNo ratings yet

- Banking Sector (Afifc)Document12 pagesBanking Sector (Afifc)Punam PandeyNo ratings yet

- Project Work On Banking & InsuranceDocument13 pagesProject Work On Banking & InsuranceKR MinistryNo ratings yet

- Yes Bank Equity AnalysisDocument4 pagesYes Bank Equity AnalysisShaloo MinzNo ratings yet

- Impact of Liquidity On Profitability of Commercial Banks in Nepal Bijaya Prakash Shrestha Page27-38Document12 pagesImpact of Liquidity On Profitability of Commercial Banks in Nepal Bijaya Prakash Shrestha Page27-38Rajesh ShresthaNo ratings yet

- Analysis of Financial Statements of Commercial Bank of Ceylon PLC Based On Annual Report 2011/2012Document12 pagesAnalysis of Financial Statements of Commercial Bank of Ceylon PLC Based On Annual Report 2011/2012star_man201No ratings yet

- AFBRupd PDFDocument9 pagesAFBRupd PDFhasan mdNo ratings yet

- FIN410.5 Team 2 Fall 2022 1Document6 pagesFIN410.5 Team 2 Fall 2022 1Mohammad Fahim HossainNo ratings yet

- Financial Performance AnalysisDocument6 pagesFinancial Performance AnalysisBishu BiswasNo ratings yet

- NPA Management, Canara BankDocument36 pagesNPA Management, Canara BankShashank Madimane0% (1)

- Thesis of BBS 4 Year - OriginalDocument42 pagesThesis of BBS 4 Year - Originalशुन्य बिशालNo ratings yet

- Financial Evaluation of Co Operative Credit SocietyDocument48 pagesFinancial Evaluation of Co Operative Credit SocietyGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- AlmDocument5 pagesAlmNitish JoshiNo ratings yet

- Financial Performance Analysis of Selected Commercial Banks in EthiopiaDocument32 pagesFinancial Performance Analysis of Selected Commercial Banks in EthiopiaMk FisihaNo ratings yet

- Research Paper On Financial Performance AnalysisDocument7 pagesResearch Paper On Financial Performance AnalysisxfeivdsifNo ratings yet

- The Effect of Non-Performing Loans (NPL) and Capital Adequacy Ratio (CAR) On Profitability (ROA) at PT. Bank Central Asia (BCA), TBKDocument6 pagesThe Effect of Non-Performing Loans (NPL) and Capital Adequacy Ratio (CAR) On Profitability (ROA) at PT. Bank Central Asia (BCA), TBKSelvi OktapiyantiNo ratings yet

- Debt Vs EquityDocument27 pagesDebt Vs EquitynisakardryNo ratings yet

- ch07 Cash - StudentDocument9 pagesch07 Cash - StudentNhật TâmNo ratings yet

- Central Bank - WikipediaDocument143 pagesCentral Bank - WikipediaDaxesh BhoiNo ratings yet

- Third Party Funds Transfer: To Other Bank (NEFT)Document2 pagesThird Party Funds Transfer: To Other Bank (NEFT)Yashvanth ShettyNo ratings yet

- Alagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Document26 pagesAlagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Mathan NaganNo ratings yet

- Full Download Financial Accounting 4th Edition Kemp Test BankDocument14 pagesFull Download Financial Accounting 4th Edition Kemp Test Bankelizabethrotner100% (23)

- Listening Log 1 (Banking Transaction)Document4 pagesListening Log 1 (Banking Transaction)Gitaaf AFNo ratings yet

- Human Rights and Chinese Business Activities in Latin AmericaDocument5 pagesHuman Rights and Chinese Business Activities in Latin AmericaFIDHNo ratings yet

- Women Entrepreneur in Beauty Industry: JASC: Journal of Applied Science and Computations ISSN NO: 1076-5131Document7 pagesWomen Entrepreneur in Beauty Industry: JASC: Journal of Applied Science and Computations ISSN NO: 1076-5131Priyadharshini ANo ratings yet

- DSP Sip FormDocument3 pagesDSP Sip Formvipin sharmaNo ratings yet

- Model Green BankDocument51 pagesModel Green BankAzraNo ratings yet

- Panel 2 - Sesi 4 Maria Market Conduct Super (Tech) Vision - PTDocument54 pagesPanel 2 - Sesi 4 Maria Market Conduct Super (Tech) Vision - PTJadik VasNo ratings yet

- Business of Investment BankingDocument35 pagesBusiness of Investment BankingHarsh SudNo ratings yet

- Nguyễn Huy Hoàng - 2112153062 - Bản thảo 2 BCGKDocument31 pagesNguyễn Huy Hoàng - 2112153062 - Bản thảo 2 BCGKNguyễn Huy HoàngNo ratings yet

- Central BankDocument24 pagesCentral BankShailesh RathodNo ratings yet

- Ponente: Carpio-Morales, JDocument15 pagesPonente: Carpio-Morales, JCristelle Elaine ColleraNo ratings yet

- CURRENT FIN. YEAR FormatDocument8 pagesCURRENT FIN. YEAR Formatarora4140No ratings yet

- Challan PrintDocument2 pagesChallan PrintshraddhaNo ratings yet

- Revised Corporation Code - Books Merger and Appraisal RightDocument29 pagesRevised Corporation Code - Books Merger and Appraisal RightVenziel PedrosaNo ratings yet

- International Financial ManagementDocument46 pagesInternational Financial ManagementmaazNo ratings yet

- Study Guide 1Document11 pagesStudy Guide 1ambitchous19No ratings yet