Professional Documents

Culture Documents

Bit Current Cloud Survey 2011 BC BCCS 0311

Uploaded by

Parth ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bit Current Cloud Survey 2011 BC BCCS 0311

Uploaded by

Parth ShahCopyright:

Available Formats

BITCURRENT CLOUD COMPUTING SURVEY 2011

Cloud adoption, concerns, and motivations

March 4, 2011

Cloud performance from the end user

INTRODUCTION

This survey looks at the cloud providers people are using today, their main reasons for using utility computing, and their main concerns around ondemand infrastructure. It was collected and processed by Bitcurrents team in February, 2011 and is distributed under a Creative Commons attribution license.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|2

Bitcurrent cloud computing survey 2011

TABLE OF CONTENTS

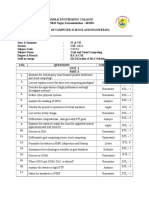

Introduction................................................................................................. 2 Survey methodology ................................................................................... 5 Survey results .............................................................................................. 6 Respondents ............................................................................................ 6 Current usage ............................................................................................ 10 Overall usage .......................................................................................... 10 Usage by company type ......................................................................... 10 Usage by vertical industry ...................................................................... 11 Usage by company size .......................................................................... 12 Which public cloud providers are you using?......................................... 13 Concerns about clouds .............................................................................. 15 Overall concerns..................................................................................... 15 Concerns by company type .................................................................... 16 Concerns by company size ..................................................................... 17 Concerns by vertical industry ................................................................. 18 Concerns by job title .............................................................................. 19 Motivations for cloud use.......................................................................... 21 Overall motivations ................................................................................ 21 Motivations by industry vertical............................................................. 22 Motivations by company size ................................................................. 23 Motivations by company type ................................................................ 24 Motivations by job title .......................................................................... 25 Conclusions ............................................................................................... 27 About Bitcurrent........................................................................................ 28 Distribution license ................................................................................ 28 Appendix A: Individual responses ............................................................. 29

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|3

Bitcurrent cloud computing survey 2011

TABLE OF FIGURES

Figure 1: Respondents by company type .............................................................6 Figure 2: Respondents by company type .............................................................7 Figure 3: Respondents by industry.......................................................................8 Figure 4: Respondents by job title .......................................................................9 Figure 5: Level of adoption by cloud type ..........................................................10 Figure 6: Cloud adoption by company type .......................................................11 Figure 7: Cloud adoption by industry vertical ....................................................12 Figure 8: Cloud adoption by company size ........................................................13 Figure 9: Cloud providers used ..........................................................................14 Figure 10: Tag cloud of providers used ..............................................................14 Figure 11: Relative importance of concerns about cloud adoption...................16 Figure 12: Heat table of cloud concerns about clouds by type of company......16 Figure 13: Radar chart of concerns by type of company ...................................17 Figure 14: Heat table of cloud concerns by company size .................................18 Figure 15: Radar chart of cloud concerns by company size ...............................18 Figure 16: Heat table of cloud concerns by vertical industry.............................19 Figure 17: Heat table of cloud concerns by job description ..............................20 Figure 18: Overall motivators for cloud adoption ..............................................21 Figure 19: Heat table of motivations for cloud adoption by industry vertical ...22 Figure 20: Radar diagram of motivations by industry vertical ...........................23 Figure 21: Heat table of motivations for cloud adoption by company size .......24 Figure 22: Bar graph of motivations for cloud adoption by company size ........24 Figure 23: Heat table of cloud motivations by company type ...........................25 Figure 24: Bar graph of motivations for cloud adoption by company type .......25 Figure 25: Heat table of motivations by job title ...............................................26

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|4

Bitcurrent cloud computing survey 2011

SURVEY METHODOLOGY

Respondents were recruited via Twitter mentions over a period of five days. In all, roughly 150 people responded to the survey; several worked for cloud providers directly and their responses, while interesting, were excluded from the study because of their bias towards a specific platform. Despite the extremely unscientific recruitment process, however, respondents came from a relatively wide cross-section of industries, company types, and company sizes. The survey was a set of questions administered through a Google Docs form, consisting of multiple-choice and range-based questions. Individual responses to each question are available in Appendix A, below. We offered a free Flexpass to the Cloud Connect conference to one participant as an incentive. While the average responses are instructive, our goal was really to understand how different segments of the market view the cloud: Did smaller companies use SaaS more than bigger ones? Did public companies have different concerns about the cloud than startups? Did companies in a health vertical see different benefits from clouds than those in finance? To understand this, we analyzed the responses in a Pivot Table format, and then tried to find visualizations that would convey these differences. Given the many possible segmentscompany size, vertical, company type, concerns, motivators, and providersits not always easy to display the information, so in each case we also created a heat table of responses, where red cells are worse and green cells are better. In other words, if something is a serious concern, its red; if something is a significant motivator, its green.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|5

Bitcurrent cloud computing survey 2011

SURVEY RESULTS

Well now review the results of the study. For individual responses, please refer to Appendix A; here, were more concerned with patterns and differences among segments.

Respondents

We asked each respondent a few questions about their background in order to segment their answers, and to understand who was responding. The sample is heavily biased towards Twitter users and the clouderatithe social graph surrounding Bitcurrent and participants in Techwebs Cloud Connect and Interop events. What kind of company do you work for? We intentionally tried to lump companies into a relatively small set of company structures, from private start-ups to global giants. Unfortunately, a significant number of respondents didnt understand the categorization, or were eager to tell us more about themselves, providing answers such as Hybrid Global Consultant and Event Company or A technology journal. If we repeat this study, we need to break this segmentation down into several categories (is your company private or public? and are you profitable?, for example) to avoid having people unable to fit themselves into a specific group.

Respondents by company type

A startup (pre-breakeven, self- or VC-funded) A large web business (breakeven, around for more than 3 years) A public company Other A government or nonprofit organization A Global 2000 company operating in several countries A private non-tech company operating regionally 11 10 10 7 19 28 45

Figure 1: Respondents by company type

In many cases, the companies that didnt classify themselves as one of these were, in fact, cloud providers; we eliminated them from the clouds, concerns, and motivators sections. When possible, we modified some

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|6

Bitcurrent cloud computing survey 2011

respondents when they fit into a category (for example, we put Research university into government or nonprofit organization.) Number of employees We also asked people to tell us how many employees worked at their company. No ambiguity here.

Respondents by number of employees

11 to 100 32

Less than 10

30

101 to 1000

27

1001 to 10000

18

10000 or more

16

Just me

Figure 2: Respondents by company type

What industry do you work in? The question about industry sector was also badly categorized. While we chose the list of industry verticals from a reasonably broad public list (http:// en.wikipedia.org/wiki/Vertical_market#Examples), many respondents added their own categories and in some cases expressed frustration that their industry, as they defined it, wasnt listed (Hosting - how is this not on this list?). We tried to strike a balance between a relatively small number of verticalsto make analysis and visualization possible, and get a reasonably large sample of respondents in each verticalwhile still encompassing most industries.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|7

Bitcurrent cloud computing survey 2011

Respondents by industry

Other Telecommunications R&D Entertainment, media Finance, banking, or insurance Education Law, management consulting Manufacturing Health & medicine Retail sales Energy Logistics, transportation Real estate, construction Gaming Travel & leisure Food & beverage Automotive 11 9 7 6 6 5 4 4 2 2 2 2 2 1 1 17 49

Figure 3: Respondents by industry

Again, we made some heroic assumptions about where certain job titles belonged in our initial list, and added a few. Many people were in IT consulting or business consulting in the endagain, this is likely due to where we solicited respondents. Whats your job? We also posted a list of possible jobs, and respondents were predominantly in technical vocations, or leaders of their companies. None of the respondents worked in shipping, legal services, HR, or accounting. In many cases, respondents tried to be more specific about their job title, rather than picking a broader title from the list (for example, Mgr., Info design & dev or solutions architect and practice lead.) While its great that respondents

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|8

Bitcurrent cloud computing survey 2011

were trying to be helpful here, we had to make some assumptions about aggregating these kinds of responses into the right category.

Respondent by job title

Software engineering, development Other CEO Operations, production Marketing, communications, PR Sales, business development QA and testing Shipping, logistics Legal & contracts HR Finance, accounting 3 0 0 0 0 8 12 21 20 30 36

Figure 4: Respondents by job title

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

|9

Bitcurrent cloud computing survey 2011

CURRENT USAGE

The first area we wanted to investigate was what respondents were using today.

Overall usage

Overall, public IaaS and SaaS, along with other on-demand services, are the clear winners.

Level of adoption by cloud type

1="Not At All", 5="Heavy adoption" 4 3.5 3 2.5 2 1.5 1

Figure 5: Level of adoption by cloud type

Usage by company type

We then split these results based on the kind of company someone worked for.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 10

Bitcurrent cloud computing survey 2011

Cloud adoption by company type

1="not at all", 5="heavy adoption" 5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00

A Global 2000 A government company or nonprofit operating in organization several countries 3.10 2.00 2.50 2.10 3.00 2.30 1.91 2.00 3.55 2.27 4.00 3.73 A large web business (breakeven, around for more than 3 years) 2.62 2.14 3.17 2.59 3.28 3.10 A private non-tech company operating regionally 2.67 2.33 3.67 3.67 3.83 3.83 A public company A startup (prebreakeven, self-or VC-funded) 2.27 1.88 3.20 2.45 3.49 3.18

Average of Private IaaS Average of Private PaaS Average of Public IaaS Average of Public PaaS Average of Public SaaS Average of Other services

2.88 2.35 3.12 2.59 3.88 3.53

Figure 6: Cloud adoption by company type

Governments and public companies were the largest users of SaaS; Global 2000 and public companies also led in private Infrastructure as a Service. The largest users of PaaS were non-technical, regionally operated companies.

Usage by vertical industry

Breaking adoption down by industry, we see some differences in how each kind of cloud is being adopted. Unfortunately, as with many of the responses that are widely segmented, the number of responses per vertical is small enough that its dangerous to make generalizations.

WHAT INDUSTRY DO YOU WORK IN? Aerospace/DoD Automotive Business Services Education Energy Engineering & Construction Entertainment, media Finance, banking, or insurance Private IaaS 5.00 2.00 3.13 2.43 2.00 1.00 3.44 2.86 Private PaaS 2.00 2.00 3.00 2.43 1.50 1.00 2.67 1.86 Public IaaS 4.00 1.00 3.50 3.86 1.50 1.00 3.56 2.43 Public PaaS 4.00 1.00 3.13 2.29 3.00 4.00 2.89 1.86 Public SaaS 4.00 1.00 3.38 4.14 3.00 1.00 4.00 3.57 Other services 4.00 1.00 3.13 4.00 1.50 1.00 3.56 4.43

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 11

Bitcurrent cloud computing survey 2011

WHAT INDUSTRY DO YOU WORK IN? Food & beverage Gaming Health & medicine Horizontal IT services Law, management consulting Logistics, transportation Management Consulting Manufacturing Media R&D Real estate, construction Retail sales Software development Telecommunications Travel & leisure

Private IaaS 1.00 1.00 1.00 1.00 2.29 4.14 3.00 2.00 3.40 1.33 2.10 3.00 1.00 3.14 2.06 2.50

Private PaaS 1.00 1.50 1.75 1.00 2.18 3.43 1.50 2.00 1.80 1.00 1.90 3.00 1.00 2.43 1.41 1.50

Public IaaS 5.00 3.50 4.25 1.00 2.94 3.43 3.00 5.00 2.40 2.00 4.00 3.50 2.00 3.14 3.24 4.50

Public PaaS 1.00 4.00 1.50 1.00 2.47 3.14 4.00 3.00 1.60 2.00 2.50 2.00 3.25 3.43 1.76 5.00

Public SaaS 1.00 2.50 4.25 1.00 3.59 4.29 3.00 5.00 3.80 4.33 4.00 3.00 2.25 3.43 3.29 3.00

Other services 1.00 4.00 4.50 1.00 3.18 4.29 3.50 5.00 1.80 4.00 3.40 3.50 1.50 3.29 2.65 3.50

Figure 7: Cloud adoption by industry vertical

There are some interesting outliers here: travel organizations, engineering and construction firms, and logistics companies use public PaaS; telecommunications firms do on.

Usage by company size

When we compare adoption by size of company, we see that very small companies strongly favor SaaS, while larger ones use private Infrastructure as a Service. The clear leader for public IaaS is small firms with less than 10 people.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 12

Bitcurrent cloud computing survey 2011

Cloud adoption by company size

5.00 1="Not at all", 5="Heavy adoption" 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 Average of Private IaaS Average of Private PaaS Average of Public IaaS Average of Public PaaS Average of Public SaaS Average of Other services 10000 or more 2.80 2.40 3.13 2.60 3.13 3.00 1001 to 10000 3.35 2.12 2.47 2.29 3.24 2.71 101 to 1000 2.60 2.12 3.16 2.44 3.64 3.60 Less than 10 2.41 2.00 3.62 2.69 3.62 3.34

11 to 100 2.03 1.93 3.45 2.45 3.66 3.38

Just me 1.57 1.57 2.14 2.71 3.57 2.43

Figure 8: Cloud adoption by company size

Which public cloud providers are you using?

We also asked respondents which providers they used. This was a multipleanswer question, so people could select several providers. Some people named one-off SaaS providers, or said, none. Since this was an open text field we had to aggregate the responses by provider.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 13

Bitcurrent cloud computing survey 2011

Cloud providers used by respondents

Amazon Web Services Google App Engine Rackspace Cloud Salesforce Force.com Microsoft Azure public cloud Terremark Cloud Joyent Gogrid Savvis Symphony 5 5 4 2 12 28 26 40 69

Figure 9: Cloud providers used

The following tag cloud shows the relative popularity of clouds from the many responses we received.

Figure 10: Tag cloud of providers used

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 14

Bitcurrent cloud computing survey 2011

CONCERNS ABOUT CLOUDS

We then turned to peoples concerns about clouds. We had our own list, based on discussions with end users, analysts, and vendors, so the goal here wasnt to build a catalog of concerns, but rather, to rate the ones wed heard over and over again.

Overall concerns

Our list of concerns included: Data privacy: Concerns over the leakage of information when its managed by someone else. Infrastructure control: Inability to dictate what happens to infrastructure, who can disable it, and who ultimately controls it. Reliable uptime: Inability of a provider to deliver the same availability that a company can offer itself. High costs: Higher overall cost for recurring utility bills than the cost of in-house infrastructure and operations. Lock-in: Being stuck with a provider, and unable to move, because of some dependency. Poor performance: Slow application performance, particularly because of the fact that resources are shared with others. Architectural needs: Existing applications have specific requirements that wont work in the cloud. Networking costs: Compared to the cost of moving bytes around, everything else is cheap. As clouds are elsewhere, networking costs will be high. Job security: Concerns that private IT will lose its jobs to public providers Escalation concerns: Inability to escalate problems to someone who can fix them; not having one throat to choke. Just don't like it: A general feeling of danger and ennui about clouds.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 15

Bitcurrent cloud computing survey 2011

Concerns about clouds

1="Not a concern", 5="Showstopper" 3.5 3 2.5 2 1.5 1

Figure 11: Relative importance of concerns about cloud adoption

Concerns by company type

We then broke this information down by the segments wed collected.

A Global 2000 company operating in several countries 2.90 2.70 2.10 2.10 2.60 2.70 2.10 2.50 1.70 2.80 1.40 A government or nonprofit organization 2.73 2.18 1.64 1.73 2.36 2.27 2.45 2.36 1.00 2.55 1.00 A large web business (breakeven, around for more than 3 years) 3.03 2.48 1.90 2.03 2.41 2.38 1.97 1.97 1.10 2.17 1.00 A private non-tech company operating regionally 3.50 2.67 2.00 2.00 3.00 3.00 2.50 2.33 1.33 2.17 1.17 A public company A startup (prebreakeven, self- or VCfunded) 2.78 2.49 1.71 2.08 2.39 2.35 1.86 2.02 1.33 2.29

DATA

Data privacy Infrastructure control Reliable uptime High costs Lock-in Poor performance Architectural needs Networking costs Job security Escalation concerns Just don't like it

3.24 2.35 1.35 1.71 2.29 1.94 2.12 2.00 1.12 2.35 1.06

1.16

Figure 12: Heat table of cloud concerns about clouds by type of company

Employees of Global 2000 companies worried more about intangible, nontechnical things like job security and a general dislike; private, non-technical companies worried more about privacy, lock-in, and poor performance; public companies worried less about uptime and cost; and everyone worried about privacy.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 16

Bitcurrent cloud computing survey 2011

Concerns by company type

Data privacy 3.50 Just don't like it

3.00 2.50

Infrastructure control

Escalation concerns

2.00 1.50 1.00

Reliable uptime

Job security

High costs

Networking costs Architectural needs

Lock-in Poor performance

G2000 Large web business Public company

Gov or nonprofit Private regional non-tech Startup

Figure 13: Radar chart of concerns by type of company

In Figure 13, we display this data as a radar chart. This is one way to look at how several segments view the relative importance of the concerns weve outlined above.

Concerns by company size

We then analyzed concerns by size of company.

DATA Data privacy Infrastructure control Reliable uptime High costs Lock-in Poor performance Architectural needs Networking costs Job security Escalation concerns 10000 or more 3.80 2.47 1.73 2.00 2.33 2.47 2.20 2.33 1.60 2.47 1001 to 10000 3.41 2.41 1.94 2.18 2.82 2.41 2.12 2.35 1.65 2.35 101 to 1000 2.88 2.36 1.76 2.04 2.36 2.52 2.24 2.16 1.16 2.08 11 to 100 2.76 2.59 1.86 1.79 2.52 2.45 2.21 2.03 1.03 2.34 Less than 10 2.48 2.38 1.59 2.00 2.31 2.24 1.69 1.83 1.14 2.34 Just me 2.86 2.86 1.43 2.00 2.00 1.43 1.29 2.00 1.14 2.71

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 17

Bitcurrent cloud computing survey 2011

DATA Just don't like it

10000 or more 1.00

1001 to 10000 1.29

101 to 1000 1.12

11 to 100 1.14

Less than 10 1.07

Just me

1.00

Figure 14: Heat table of cloud concerns by company size

Here, we see that the bigger the company, the more they care about privacy, and the non-technical issues of job security and general dislike. Smaller companies are also concerned about their ability to get attention and have things resolved properly.

4.00

Just don't like it Data privacy Infrastructure control

3.50 3.00 2.50 2.00 1.50 1.00

Escalation concerns

Reliable uptime

Job security

High costs

Networking costs Architectural needs Poor performance

Lock-in

10000 or more 1001 to 10000 101 to 1000

11 to 100 Less than 10 Just me

Figure 15: Radar chart of cloud concerns by company size

We also generated this as a radar chart.

Concerns by vertical industry

We then looked at concerns by vertical. Since there is a long list of verticals and concerns, we didnt represent the data as a radar chart in this case.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 18

Bitcurrent cloud computing survey 2011

Figure 16: Heat table of cloud concerns by vertical industry

Remember that the number of segments in these responses make it unwise to rely on them for general conclusions about a particular industry. That said, Figure 16 shows us that the automotive, horizontal, and manufacturing industries are the most concerned; and that health and medicine, real estate, energy, and software development seem relatively unconcerned.

Concerns by job title

Because we had the wide range of job titles, we also generated a table of concerns by the raw job description respondents supplied, as shown in Figure 17.

Infrastructure control Escalation concerns 3.0 1.0 2.6 3.0 1.8 4.0 1.0 3.0 3.0 1.8 Architectural needs Poor performance Networking costs Reliable uptime Just don't like it 3.0 1.0 1.0 1.0 1.0 2.0 1.0 1.0 1.0 1.0

Data privacy

WHAT'S YOUR JOB?

Architect Business Strategy CEO Consultant / Cloud Computing Service Offering Development CTO Information management Infrastructure Engineering IT Architect IT Management Marketing, communications, PR

3.0 2.0 2.6 2.0 3.3 4.0 4.0 3.0 3.5 3.0

3.0 2.0 2.6 1.0 2.5 4.0 2.0 2.0 2.0 1.9

3.0 1.0 1.5 1.0 2.0 3.0 2.0 1.0 1.5 1.6

3.0 2.0 1.7 2.0 1.3 3.0 2.0 4.0 2.0 1.9

3.0 3.0 2.3 2.0 2.0 4.0 4.0 3.0 2.5 2.5

3.0 2.0 1.8 1.0 3.0 3.0 2.0 2.0 2.0 1.9

3.0 2.0 1.6 1.0 2.3 4.0 1.0 4.0 2.5 1.9

3.0 2.0 1.7 1.0 2.0 3.0 1.0 4.0 2.5 2.1

3.0 1.0 1.2 1.0 1.3 1.0 3.0 1.0 1.0 1.2

Job security

High costs

Lock-in

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 19

Bitcurrent cloud computing survey 2011

Infrastructure control

Escalation concerns 5.0 2.4 2.0 2.0 3.0 1.0 2.7 1.0 1.0 2.5 2.4 3.0 2.0 1.0 3.0 2.0 1.0 2.0 2.0 2.0 3.0

Architectural needs

Poor performance

Networking costs

Reliable uptime

WHAT'S YOUR JOB?

Mgr., Info design & dev Operations, production Partner, COO practice manager msft Product Manager Professional Services & consulting QA and testing Research analyst Researcher Sales, business development Software engineeering, development solutions architect and practice lead Solutions Architecture Sr. Mgmt student Systems Architect systems manager Technical consultant Technical Support VP R&D VP Technology

3.0 3.0 3.0 4.0 2.0 3.0 3.7 2.0 1.0 3.0 2.8 4.0 2.0 4.0 3.0 4.0 4.0 5.0 3.0 4.0 3.0

3.0 2.5 2.0 2.0 3.0 4.0 3.3 1.0 1.0 2.4 2.4 4.0 3.0 4.0 3.0 3.0 1.0 3.0 4.0 3.0 4.0

2.0 2.0 1.0 1.0 2.0 1.0 2.0 1.0 1.0 1.9 1.7 2.0 3.0 1.0 3.0 2.0 1.0 3.0 2.0 2.0 2.0

3.0 2.3 1.0 1.0 3.0 2.0 1.7 1.0 1.0 1.6 2.1 2.0 3.0 1.0 3.0 1.0 2.0 3.0 2.0 2.0 2.0

2.0 2.6 1.0 2.0 2.0 4.0 2.0 1.0 2.0 2.8 2.3 3.0 3.0 2.0 3.0 2.0 2.0 4.0 4.0 2.0 2.0

4.0 2.8 2.0 1.0 3.0 3.0 2.7 1.0 1.0 2.6 2.4 3.0 3.0 2.0 3.0 2.0 1.0 2.0 3.0 2.0 4.0

5.0 2.1 1.0 2.0 2.0 4.0 1.0 1.0 3.0 2.3 1.8 4.0 3.0 1.0 3.0 4.0 4.0 2.0 2.0 3.0 2.0

3.0 2.2 1.0 1.0 3.0 4.0 2.0 1.0 1.0 2.6 2.0 3.0 2.0 1.0 3.0 3.0 2.0 3.0 2.0 3.0 2.0

2.0 1.1 1.0 1.0 2.0 1.0 1.0 1.0 1.0 1.5 1.3 1.0 1.0 1.0 3.0 1.0 1.0 1.0 1.0 1.0 1.0

1.0 1.1 1.0 1.0 2.0 1.0 1.0 1.0 1.0 1.0 1.1 3.0 1.0 1.0 3.0 1.0 1.0 1.0 2.0 1.0

1.0

Figure 17: Heat table of cloud concerns by job description

Just don't like it

Data privacy

Job security

High costs

Lock-in

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 20

Bitcurrent cloud computing survey 2011

MOTIVATIONS FOR CLOUD USE

Having measured concerns, we now looked at the motivators encouraging cloud adoption. These included: Lower costs: Saving money through lower total costs and reduced upfront investment. Elasticity: The ability to grow and shrink capacity with demand. Speed to deploy: Time to develop, test, deploy, and procure components goes down with clouds. Better security: Access to a cloud providers security infrastructure. Arm's-length employees: Third-party providers separation from the day-to-day business, which is good for security and fraud. Wide set of services: Cloud providers offering additional services such as message busses, mailing and payment systems, image manipulation, and large-scale storage. Access to talent: Ability to use a cloud providers employees expertise rather than having to hire internally. Just like clouds: Generally positive feeling about utility computing.

Overall motivations

Overall, lower costs, elasticity, and deployment speed were the clear winners.

Motivators for cloud adoption

1="Couldn't care less", 5="Main motivator" 4.5 4 3.5 3 2.5 2 1.5 1

Figure 18: Overall motivators for cloud adoption

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 21

Bitcurrent cloud computing survey 2011

Motivations by industry vertical

We then segmented motivations by industry vertical.

Figure 19: Heat table of motivations for cloud adoption by industry vertical

There were some consistent patterns herebut its important to remember that the volume of respondents and number of segments makes this data not representative of industry patterns without further study.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 22

Bitcurrent cloud computing survey 2011

Just like clouds

Access to talent

5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00

Lower costs Elasticity

Speed to deploy

Wide set of services Arm's-length employees

Aerospace/DoD Business Services Energy Entertainment, media Food & beverage Health & medicine IT services Logistics, transportation Manufacturing R&D Retail sales Telecommunications

Better security

Automotive Education Engineering & Construction Finance, banking, or insurance Gaming Horizontal Law, management consulting Management Consulting Media Real estate, construction Software development Travel & leisure

Figure 20: Radar diagram of motivations by industry vertical

We also mapped the motivations to a radar diagram in Figure 20.

Motivations by company size

We then looked at motivations by company size. While theres general agreement, there are some distinctions: mid-sized companies (101 to 1000 employees) like the wide set of services cloud providers offer, and elasticity matters more to the very small and the very big.

DATA Lower costs Elasticity Speed to deploy Better security Arm's-length employees Wide set of services Access to talent 10000 + 3.47 4.20 3.53 2.80 1.93 3.13 2.20 1001 to 10000 3.47 4.12 3.88 2.88 2.35 3.00 2.82 101 to 1000 3.44 3.80 3.76 2.80 2.04 3.48 2.96 11 to 100 3.45 3.97 3.66 2.79 1.72 2.83 2.21 Less than 10 3.66 3.97 3.90 3.14 2.03 3.24 2.45 Just me 4.00 4.43 3.71 4.00 1.57 3.29 3.00

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 23

Bitcurrent cloud computing survey 2011

DATA Just like clouds

10000 + 1.33

1001 to 10000 2.00

101 to 1000 1.96

11 to 100 2.07

Less than 10 2.31

Just me

1.71

Figure 21: Heat table of motivations for cloud adoption by company size

We also visualized these results as a bar graph, making it easier to see the relative distribution of importance by each size of organization, in Figure 22.

Cloud motivators by company size

5.00 1="Couldn't care less" 5="Main reason I use clouds" 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00

Lower costs Elasticity Speed to Better deploy security Wide Access Just like set of to talent clouds employees services Arm'slength

10000 + 1001 to 10000 101 to 1000 11 to 100 Less than 10 Just me

3.47 3.47 3.44 3.45 3.66 4.00

4.20 4.12 3.80 3.97 3.97 4.43

3.53 3.88 3.76 3.66 3.90 3.71

2.80 2.88 2.80 2.79 3.14 4.00

1.93 2.35 2.04 1.72 2.03 1.57

3.13 3.00 3.48 2.83 3.24 3.29

2.20 2.82 2.96 2.21 2.45 3.00

1.33 2.00 1.96 2.07 2.31 1.71

Figure 22: Bar graph of motivations for cloud adoption by company size

Motivations by company type

We then applied the same analysis to each type of company.

A startup (prebreakeven, self- or VCfunded) 3.45 4.06 3.76 A private non-tech company operating regionally 2.67 3.50 3.33 A large web business (breakeven, around for more than 3 years) 3.38 3.83 3.86 A government or nonprofit organization A Global 2000 company operating in several countries 3.70 4.20 3.70

DATA

A public company

Lower costs Elasticity Speed to deploy

3.64 4.27 3.82

4.18 4.06 3.71

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 24

Bitcurrent cloud computing survey 2011

DATA

A startup (prebreakeven, self- or VCfunded)

A private non-tech company operating regionally

A large web business (breakeven, around for more than 3 years) 2.97 1.86 3.14 2.48 1.97

A government or nonprofit organization

A Global 2000 company operating in several countries

A public company

Better security Arm's-length employees Wide set of services Access to talent Just like clouds

3.02 2.00 3.10 2.61 2.00

2.50 2.00 4.00 2.67 2.33

2.45 1.91 3.18 2.64 1.73

2.60 2.20 2.70 2.60 2.20

3.47 1.94 3.24 2.35

1.88

Figure 23: Heat table of cloud motivations by company type

We also displayed this as a bar graph in Figure 24.

Motivations for cloud by company type

1="Couldn't care less" 5="Main reason I use clouds" 5.00 4.00 3.00 2.00 1.00 Lower costs Elasticity Speed to deploy Better security Arm'sWide set Access to length of services talent employees Just like clouds

A startup (pre-breakeven, self- or VC-funded) A private non-tech company operating regionally A large web business (breakeven, around for more than 3 years) A government or nonprofit organization

Figure 24: Bar graph of motivations for cloud adoption by company type

Motivations by job title

Once again, armed with all of the job descriptions our respondents provided, we generated a heat table showing how they scored the relative benefits. As with the data segmented by industry vertical, there arent enough responses for each job description to make this statistically significant.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 25

Bitcurrent cloud computing survey 2011

Speed to deploy

Access to talent

WHAT'S YOUR JOB?

Architect Business Strategy CEO Consultant / Cloud Computing Service Offering Development CTO Information management Infrastructure Engineering IT Architect IT Management Marketing, communications, PR Mgr., Info design & dev Operations, production Partner, COO practice manager msft Product Manager Professional Services & consulting QA and testing Research analyst Researcher Sales, business development Software engineeering, development solutions architect and practice lead Solutions Architecture Sr. Mgmt student Systems Architect systems manager Technical consultant Technical Support VP R&D VP Technology

3.00 3.00 3.94 5.00 3.75 4.00 5.00 3.00 2.50 3.64 5.00 3.15 5.00 5.00 2.00 4.00 3.67 5.00 5.00 3.88 3.27 4.00 3.00 4.00 2.00 3.00 5.00 4.00 2.00 4.00 2.00

3.00 3.00 3.89 4.00 4.25 3.00 5.00 4.00 3.50 4.36 4.00 4.05 5.00 5.00 3.00 5.00 4.33 3.00 5.00 4.13 3.97 4.00 5.00 2.00 3.00 4.00 4.00 2.00 4.00 4.00 5.00

3.00 4.00 4.00 4.00 3.25 4.00 2.00 2.00 4.00 4.18 5.00 3.85 5.00 5.00 2.00 4.00 3.33 3.00 5.00 4.25 3.73 4.00 3.00 1.00 2.00 4.00 5.00 1.00 2.00 3.00 2.00

3.00 3.00 3.44 4.00 2.75 3.00 1.00 3.00 3.50 3.45 4.00 2.20 4.00 5.00 3.00 4.00 3.67 5.00 5.00 3.00 2.79 4.00 2.00 1.00 4.00 2.00 2.00 2.00 2.00 4.00 2.00

3.00 1.00 2.06 2.00 1.75 2.00 1.00 2.00 1.50 2.45 1.00 1.55 4.00 3.00 2.00 1.00 2.67 2.00 5.00 2.13 1.88 4.00 2.00 1.00 3.00 1.00 2.00 1.00 2.00 2.00 1.00

3.00 4.00 3.39 4.00 4.00 3.00 1.00 3.00 2.50 3.18 3.00 2.95 4.00 4.00 2.00 5.00 2.67 1.00 5.00 2.75 3.15 4.00 2.00 2.00 4.00 2.00 4.00 3.00 4.00 4.00 3.00

3.00 3.00 2.94 4.00 3.50 4.00 1.00 2.00 2.50 3.36 3.00 1.80 3.00 4.00 3.00 5.00 1.67 1.00 5.00 2.75 2.21 4.00 1.00 2.00 3.00 2.00 5.00 3.00 2.00 1.00 2.00

3.00 3.00 2.61 5.00 2.25 2.00 1.00 1.00 1.00 2.00 3.00 1.80 1.00 1.00 2.00 1.00 2.33 1.00 2.00 1.88 1.76 4.00 2.00 1.00 4.00 3.00 1.00 1.00 2.00 1.00 1.00

Figure 25: Heat table of motivations by job title

Just like clouds

Better security

Arm's-length employees

Lower costs

Wide set of services

Elasticity

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 26

Bitcurrent cloud computing survey 2011

CONCLUSIONS

This kind of analysis is very useful for marketers and analysts to understand how to position their products, and for end users to understand their industries concerns and biases. It also shows, overall, that some motivators (cost, elasticity, and speed) are common across most industries, and some concerns (privacy, loss of control, lock-in) are common; but that industries disagree significantly on certain motivators and concerns. Unfortunately, the relative small volume of respondents, and the unscientific way in which they were recruited, means that the highly segmented data should not be relied on without further verification and a more controlled selection process. It is, however, a good model for how to conduct further research into the adoption of on-demand computing technologies. The research suggests that there is significant variance in opinion about cloud adoption, motivations, and concerns across types of organizations, sizes, job descriptions, and industries. Whats clear, however, is that the top concerns about clouds are data privacy, loss of control over infrastructure, lock-in to a cloud platform, poor performance, and an inability to properly escalate problems. At the same time, lower costs, elasticity, speed of deployment, and access to a wide set of services are the main factors drawing companies into the cloud.

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 27

Bitcurrent cloud computing survey 2011

ABOUT BITCURRENT

Since 2006, Bitcurrent has been researching emerging technologies. We work with startups, enterprises, and governments to separate hype from reality, putting new technology to work. We also write and present on topics such as cloud computing, web performance, analytics, and enterprise collaboration. In 2010, Bitcurrent became the consulting arm of CloudOps, a service provider that migrates, optimizes, and runs applications in the cloud, helping companies take advantage of on-demand infrastructure.

www.bitcurrent.com info@bitcurrent.com 1-888-796-8364

Distribution license

This report is distributed under a Creative Commons Attribution/No Derivative license. You are free to to copy, distribute and transmit the work provided that you provide attribution to Bitcurrent, and that you do not create derivative works from it without the express written permission of the author.

BC_BCCS_0311

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 28

Bitcurrent cloud computing survey 2011

APPENDIX A: INDIVIDUAL RESPONSES

These are the actual survey questions, and response counts, for the survey.

Kind of company

Type of company A startup (pre-breakeven, self- or VC-funded) A large web business (breakeven, around for more than 3 years) A government or nonprofit organization A private non-tech company operating regionally A public company A Global 2000 company operating in several countries Other Count 45 28 10 7 19 10 11 Percent 35% 22% 8% 5% 15% 8% 8%

Number of employees

Number of employees Just me Less than 10 11 to 100 101 to 1000 1001 to 10000 10000 or more Count 7 30 32 27 18 16 Percent 5% 23% 25% 21% 14% 12%

What industry do you work in?

Industry vertical Retail sales Travel & leisure Gaming Real estate, construction Law, management consulting Finance, banking, or insurance Manufacturing R&D Logistics, transportation Entertainment, media Health & medicine Energy Automotive Food & beverage Telecommunications Count 4 2 2 2 6 7 5 11 2 9 4 2 1 1 17 Percent 3% 2% 2% 2% 5% 5% 4% 8% 2% 7% 3% 2% 1% 1% 13%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 29

Bitcurrent cloud computing survey 2011

Industry vertical Education Other

Count 6 49

Percent 5% 38%

Whats your job?

Job title CEO Finance, accounting HR Legal & contracts Software engineeering, development Operations, production QA and testing Marketing, communications, PR Sales, business development Shipping, logistics Other Count 21 0 0 0 36 20 3 12 8 0 30 Percent 16% 0% 0% 0% 28% 15% 2% 9% 6% 0% 23%

How much are you using Private Infrastructure as a Service (IaaS)

How much use Not at all Looking into it Currently testing Some use Heavy adoption Count 50 23 13 24 20 Percent 38% 18% 10% 18% 15%

How much are you using Private Platform as a Service (PaaS)

How much use Not at all Looking into it Currently testing Some use Heavy adoption Count 61 30 14 17 8 Percent 47% 23% 11% 13% 6%

How much are you using Public IaaS i.e. Amazon EC2, Rackspace, Terremark, Gogrid

How much use Not at all Looking into it Count 30 16 Percent 23% 12%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 30

Bitcurrent cloud computing survey 2011

How much use Currently testing Some use Heavy adoption

Count 15 33 36

Percent 12% 25% 28%

How much are you using Public PaaS i.e. Heroku, Google App Engine, Force.com

How much use Not at all Looking into it Currently testing Some use Heavy adoption Count 48 26 15 25 16 Percent 37% 20% 12% 19% 12%

How much are you using Public Software as a Service (SaaS) i.e. Salesforce, Taleo, Basecamp, Rightnow, Freshbooks

How much use Not at all Looking into it Currently testing Some use Heavy adoption Count 26 13 2 50 39 Percent 20% 10% 2% 38% 30%

How much are you using Other cloud services (Storage, CDN, etc.)

How much use Not at all Looking into it Currently testing Some use Heavy adoption Count 25 19 14 39 33 Percent 19% 15% 11% 30% 25%

Which public cloud providers are you using?

Cloud provider Amazon Web Services Google App Engine Microsoft Azure public cloud Terremark Cloud Joyent Gogrid Count 69 40 12 5 5 4 Percent 53% 31% 9% 4% 4% 3%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 31

Bitcurrent cloud computing survey 2011

Cloud provider Savvis Symphony Salesforce Force.com Rackspace Cloud Other

Count 2 26 28 41

Percent 2% 20% 22% 32%

People may select more than one checkbox, so percentages may add up to more than 100%.

INDIVIDUAL CONCERNS ABOUT CLOUD

Data privacy in a public location?

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 16 30 39 40 5 Percent 12% 23% 30% 31% 4%

Lack of control over your own infrastructure

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 31 40 31 27 1 Percent 24% 31% 24% 21% 1%

Cloud reliability and uptime

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 64 39 23 4 0 Percent 49% 30% 18% 3% 0%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 32

Bitcurrent cloud computing survey 2011

Cost versus owning infrastructure yourself

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 54 41 21 11 3 Percent 42% 32% 16% 8% 2%

Cloud lock-in

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 28 47 29 25 1 Percent 22% 36% 22% 19% 1%

Shared nature of clouds undermining performance

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 30 46 34 16 4 Percent 23% 35% 26% 12% 3%

Special architectural needs for my applications

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 60 29 23 15 3 Percent 46% 22% 18% 12% 2%

High networking costs

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Count 49 31 36 14 Percent 38% 24% 28% 11%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 33

Bitcurrent cloud computing survey 2011

Degree of concern Showstopper. I will never use them because of this.

Count 0

Percent 0%

Outsourcing and job security

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 108 14 6 1 1 Percent 83% 11% 5% 1% 1%

Lack of a clear way to escalate problems

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 33 40 38 17 2 Percent 25% 31% 29% 13% 2%

Concerned about clouds, for no particular reason

Degree of concern Not an issue. This doesn't factor into my decisions. Mildly concerned Concerned Serious issue Showstopper. I will never use them because of this. Count 119 8 3 0 0 Percent 92% 6% 2% 0% 0%

Lower cost than buying and running it in-house

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 6 21 25 52 26 Percent 5% 16% 19% 40% 20%

Elastic capacity on demand

Amount this is a motivator I couldn't care less about this Count 1 Percent 1%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 34

Bitcurrent cloud computing survey 2011

Amount this is a motivator This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds

Count 10 19 61 39

Percent 8% 15% 47% 30%

Speed of deployment from avoiding procurement and management

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 4 15 22 54 35 Percent 3% 12% 17% 42% 27%

Security and uptime of the cloud

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 15 32 34 40 9 Percent 12% 25% 26% 31% 7%

Third-party security and cloud trustworthiness

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 54 37 27 10 2 Percent 42% 28% 21% 8% 2%

The set of services clouds have built-in

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 14 25 35 40 16 Percent 11% 19% 27% 31% 12%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 35

Bitcurrent cloud computing survey 2011

Access to IT talent through a provider

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 37 27 34 18 14 Percent 28% 21% 26% 14% 11%

General positive attitude towards clouds

Amount this is a motivator I couldn't care less about this This is a slight advantage Somewhat important This is a major benefit This is the main reason I use clouds Count 67 19 26 11 7 Percent 52% 15% 20% 8% 5%

Copyright 2011 Bitcurrent Inc. All rights reserved.

www.bitcurrent.com

| 36

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cloud ComputingDocument27 pagesCloud ComputingNehal GuptaNo ratings yet

- HTI Exam QuestionsDocument7 pagesHTI Exam QuestionsMatt Linkie100% (2)

- Future Generation Computer Systems: Wazir Zada Khan Ejaz Ahmed Saqib Hakak Ibrar Yaqoob Arif AhmedDocument17 pagesFuture Generation Computer Systems: Wazir Zada Khan Ejaz Ahmed Saqib Hakak Ibrar Yaqoob Arif AhmedShahasane MadhuraNo ratings yet

- Case Study On Software As A Service (SaaS) Based Emergency Healthcare in IndiaDocument12 pagesCase Study On Software As A Service (SaaS) Based Emergency Healthcare in IndiaIcaro CameloNo ratings yet

- Hype Cycle For Erp 2012 226953Document91 pagesHype Cycle For Erp 2012 226953krismmmmNo ratings yet

- Presentation On: MR - Amit KapadiaDocument65 pagesPresentation On: MR - Amit KapadiaHarsh RoyNo ratings yet

- Paranthaman Jithin FormatDocument2 pagesParanthaman Jithin FormatParanthamanNo ratings yet

- Enterprise Integration Reference CardDocument31 pagesEnterprise Integration Reference Cardhitesh_29100% (2)

- Review Questions - Chapter One Introduction To DatabaseDocument24 pagesReview Questions - Chapter One Introduction To DatabaseKrkr DonNo ratings yet

- Notes 2023Document43 pagesNotes 2023selvabharathiNo ratings yet

- A Framework For Private Cloud Infrastructure Monitoring - Selamawit BeleteDocument112 pagesA Framework For Private Cloud Infrastructure Monitoring - Selamawit BeleteMikatechNo ratings yet

- AZ-104: Microsoft Azure AdministratorDocument14 pagesAZ-104: Microsoft Azure Administratorit's AKB 2.0No ratings yet

- Google App EngineDocument12 pagesGoogle App Enginevinayjn7No ratings yet

- Grid and Cloud Question BankDocument10 pagesGrid and Cloud Question BankPabitha ChidambaramNo ratings yet

- Cloud Computing in AgricultureDocument10 pagesCloud Computing in AgricultureJaydip RanaNo ratings yet

- 11p What Is Cloud ComputingDocument46 pages11p What Is Cloud ComputingSai TrilokNo ratings yet

- Availability Cloud WPDocument8 pagesAvailability Cloud WPEmanuel DutraNo ratings yet

- All1 7ForMidTerm PDFDocument97 pagesAll1 7ForMidTerm PDFBavneet KaurNo ratings yet

- Azure Security and Compliance BlueprintDocument13 pagesAzure Security and Compliance BlueprintP SridharNo ratings yet

- Ksa Cloud First Policy enDocument20 pagesKsa Cloud First Policy enRey Eduard Q. Umel100% (1)

- Automation For DevOps White Paper PDFDocument18 pagesAutomation For DevOps White Paper PDFMauricio Cadavid PérezNo ratings yet

- Capitalization of Costs atDocument27 pagesCapitalization of Costs atAshleyNo ratings yet

- Cloud Computing MCQ (Multi Choice Questions) - JavatpointDocument60 pagesCloud Computing MCQ (Multi Choice Questions) - JavatpointLoL CluBNo ratings yet

- JHVJHVDocument6 pagesJHVJHVSalman AslamNo ratings yet

- Chapter - 1: Introduction To Cloud ComputingDocument36 pagesChapter - 1: Introduction To Cloud ComputingPreet ChahalNo ratings yet

- Resource Allocation and Scheduling in Cloud Computing - Policy and AlgorithmDocument14 pagesResource Allocation and Scheduling in Cloud Computing - Policy and Algorithmsumatrablackcoffee453No ratings yet

- Deloitte - Capital Projects in The Digital AgeDocument20 pagesDeloitte - Capital Projects in The Digital AgeGary VNo ratings yet

- SAP HANA Supports The Following Backup and Recovery CapabilitiesDocument5 pagesSAP HANA Supports The Following Backup and Recovery CapabilitiesIrshad RatherNo ratings yet

- Amazon MarketingDocument18 pagesAmazon MarketingSourabh ChavanNo ratings yet

- Cloud ComputingDocument8 pagesCloud Computingflyingjatt0000No ratings yet