Professional Documents

Culture Documents

Revised SCH VI

Uploaded by

Paras ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revised SCH VI

Uploaded by

Paras ShahCopyright:

Available Formats

BALANCE SHEET Balance Sheet as at 31st March, 2011 Particulars I.

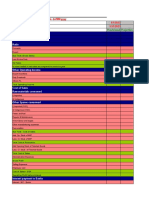

EQUITY AND LIABILITIES (1) Shareholders' Funds (a) Share Capital (b) Reserves and Surplus (c) Money received against share warrants (2) Share application money pending allotment (3) Non-Current Liabilities (a) Long-term borrowings (b) Deferred tax liabilities (Net) (c) Other Long term liabilities (d) Long-term provisions (4) Current Liabilities (a) Short-term borrowings (b) Trade payables (c) Other current liabilities (d) Short-term provisions Total II.Assets (1) Non-current assets 1 2 Note No Figures for the Figures for the current reporting previous reporting period period

3 4 5 6 7 8

(a) Fixed assets

(i) Tangible assets (ii) Intangible assets (iii) Capital work-in-progress (iv) Intangible assets under development (b) Non-current investments (c) Deferred tax assets (net) (d) Long term loans and advances (e) Other non-current assets (2) Current assets (a) Current investments (b) Inventories (c) Trade receivables (d) Cash and cash equivalents (e) Short-term loans and advances (f) Other current assets Total

9 10

11 12 13 14 15 16 17 18

As per our report of even date for and on behalf of M/s

Directors

Dated:

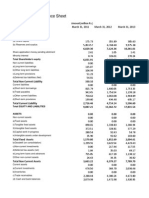

STATEMENT OF PROFIT AND LOSS Profit and Loss statement for the year ended 31st March, 2011 Note No 20 23 Figures for the Figures for the current reporting previous reporting period period -

Particulars I. Revenue from operations II. Other Income Total Revenue (I +II) III. IV. Expenses: Cost of materials consumed Purchase of Stock-in-Trade Changes in inventories of finished goods, work-in-progress and Stock-in-Trade Employee benefit expense Financial costs Depreciation and amortization expense Other expenses Total Expenses V. Profit before exceptional and extraordinary items and tax (III IV)

24 22 25

VI. Exceptional Items VII. Profit before extraordinary items and tax (V - VI) VIII. Extraordinary Items IX. Profit before tax (VII - VIII) X. Tax expense: (1) Current tax (2) Deferred tax -

XI. Profit/(Loss) from the perid from continuing operations (VII VIII) XII. Profit/(Loss) from discontinuing operations XIII. Tax expense of discounting operations XIV. Profit/(Loss) from Discontinuing operations (XII - XIII) XV. Profit/(Loss) for the period (XI + XIV) XVI. Earning per equity share: (1) Basic (2) Diluted

As per our report of even date

for and on behalf of M/s

Directors

Dated:

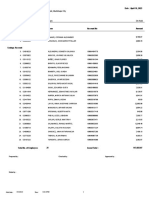

Note No 1 1 2 Share Capital Equity Share Capital Authorised Share capital Issued, subscribed & fully paid share capital Calls unpaid Forfeited shares Preference Share Capital Authorised Share capital Issued, subscribed & fully paid share capital Calls unpaid Forfeited shares Total 2 Reserves and Surplus Capital Reserves Capital Redemption Reserves Securities Premium Reserves Debenture Redemption Reserves Revaluation Reserves Other Reserve / fund Surplus Total 3 Long-term borrowings Secured Bonds/Debentures Term Loans Deferred payment liabilities Deposits Unsecured Bonds/Debentures Term Loans Deferred payment liabilities Deposits Total 4 Other long term liabilities Trade payables Others Total 5 Long-term provisions Provision for employee benefits Others Total

Figures for the current reporting period 3

Figures for the previous reporting period 4

Note No 1 2

Figures for the current reporting period 3

Figures for the previous reporting period 4

Short-tems borrowings Secured Loans repayable on demand Loans and advances from related parties Deposits Other loand and advances Unsecured Loans repayable on demand Loans and advances from related parties Deposits Other loand and advances Total

Other current liabilities Current maturities of long term debt Current maturities of finance lease obligation Interest accrued but not due on borrowings Interest accrued and due on borrowings Income received in advance Unpaid dividends Refundable share application money Unpaid matured deposits and interest accrued thereon Unpaid matured debentures and interest accrued thereon Other payables Total

Short-term provisions Provision for employee benefits Others Total

Tangible Assets Land/ Building/ Plant & Equipment/ Furniture & fixtures/ Vehicles/ Office Equipment/ Others (individually) Opening Balance Add: acquisition through business combination Other Adjustments Sub total Less: Disposals Gross Block at year end (a) Less: Depreciation Opening Depreciation Depreciation for the year Total accumulated depreciation (b) Net carrying value (a) - (b) Total

Note No 1 10 2 Intangible Assets Goodwill Brands/ Trademarks/ Computer Software/ Mastheads and publishing titles/ Mining rights/ Copyrights/ Patents/ Licenses, etc (individually) Opening Balance Add: acquisition through business combination Other Adjustments Sub total Less: Disposals Gross Block at year end (a) Less: Depreciation Opening Amortization Amortization for the year Total accumulated Amortization (b) Net carrying value (a) - (b) Total 11 Non-current investments Trade Investments Investment property Investments in Equity instruments Investments in Peference shares Investments in Government and Trust securities Investments in Debentures or bonds Investments in Mutual funds Investments in Partnership firms Other non-current investments Total 12 Long Term Loans and Advances Secured considered good Capital Advances Security Deposits Loans and advances to related parties Other loans and advances Sub Total Unsecured considered good Capital Advances Security Deposits Loans and advances to related parties Other loans and advances Sub Total Doubtful Capital Advances Security Deposits Loans and advances to related parties Other loans and advances Sub Total Total

Figures for the current reporting period 3

Figures for the previous reporting period 4

Note No 1 13 Other non-current assets Long term trade receivables Secured considered good Unsecured considered good Doubtful Others Total 14 Current Investments Investments in Equity instruments Investments in Peference shares Investments in Government and Trust securities Investments in Debentures or bonds Investments in Mutual funds Investments in Partnership firms Other current investments Total 15 Inventories Raw materials Work in progress Finished goods Stock in trade Stores and spares Loose Tools Others Total 16 Trade receivables Secured/ Unsecured/ Doubtful Less: Allowance for Bad debts Total 17 Cash and cash equivalents Balances with banks Cheques, drafts on hands Cash on hand Othes Total 18 Short term loans and advances Loans and advances to related parties (Secured/ Unsecured/ Doubtful) Others Total 2

Figures for the current reporting period 3

Figures for the previous reporting period 4

Note No 1 19 2 Contingent liabilities and commitments (to the extent not provided for) Contingent liabilities Claims against the company not acknowledged as debt Guarantees Other money for which the company is contingently liable Sub Total Commitments Estimated amount of contracts unexecuted on capital account Uncalled liability on shares and other investments partly paid Other commitments Sub Total Total Revenue from Operations (for companies other than a finance company) Revenue from - Share of products Sale of services Other operating revenues Less: Excise Duty Total 21 Revenue from Operations (for finance companies) Interest Other financial services Total 22 Finance Costs Interest expenses Other borrowing costs Applicable net gain/ loss on foreign currency transactions/ traslation Total 23 Othe Income Interes income Divident income Net gain/ loss on sale of investments Other non-operating income (net of expenses directly attributable to such income) Total

Figures for the current reporting period 3

Figures for the previous reporting period 4

20

Note No 1 24 2 Employee Benefits Expense Salaries and wages Contribution to provident and other funds Expense on Employees stock option scheme (ESOP) and Employee stock purchase plan (ESPP) Staff welfare expenses Total Other Expenses Consumption of stores and spare parts Power and fuel Rent Repairs to buildings Repairs to machinery Insurance Rates and Taxes, excluding taxes on income Miscellaneous expenses Total

Figures for the current reporting period 3

Figures for the previous reporting period 4

25

You might also like

- Cma AFSDocument14 pagesCma AFSvijayNo ratings yet

- Revised Schedule VI Balance Sheet FormaDocument14 pagesRevised Schedule VI Balance Sheet FormaArj SharmaNo ratings yet

- of Revised Schdule Vi1Document43 pagesof Revised Schdule Vi1Jay RoyNo ratings yet

- Format of Revised Schedule Vi To The Companies Act 1956 in ExcelDocument11 pagesFormat of Revised Schedule Vi To The Companies Act 1956 in Excelanshulagarwal62No ratings yet

- Particulars: Form II Operating StatementDocument26 pagesParticulars: Form II Operating StatementvineshjainNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Mamta Fasshion Balnc SheetDocument7 pagesMamta Fasshion Balnc SheetSusruth DamodaranNo ratings yet

- Cma Format - 29.08.2022 - 12.13PMDocument12 pagesCma Format - 29.08.2022 - 12.13PMShreeRang ConsultancyNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating StatementDocument12 pagesAssessment of Working Capital Requirements Form Ii - Operating Statementsluniya88No ratings yet

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDocument16 pagesICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementbalajeenarendraNo ratings yet

- Welcome To Presentation On Preparation of Financial Statements Under Revised Schedule VIDocument61 pagesWelcome To Presentation On Preparation of Financial Statements Under Revised Schedule VIJigar MehtaNo ratings yet

- Financial Statements & Analysis 2024 SPCCDocument29 pagesFinancial Statements & Analysis 2024 SPCCSaturo GojoNo ratings yet

- Format of Statement of Profit & Loss and Balance SheetDocument2 pagesFormat of Statement of Profit & Loss and Balance SheetShalak JoshiNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- IPTC CMA Bank FormatDocument12 pagesIPTC CMA Bank FormatRadhesh BhootNo ratings yet

- Theory For Financial Statements of A Company 2nd Puc AccountancyDocument5 pagesTheory For Financial Statements of A Company 2nd Puc Accountancykakashihatake371No ratings yet

- Revised Schedule VIDocument3 pagesRevised Schedule VIRohit BhallaNo ratings yet

- Profit and Loss AccountDocument5 pagesProfit and Loss AccountLanston PintoNo ratings yet

- Format of Revised Schedule VI To The Companies Act 1956 in ExcelDocument2 pagesFormat of Revised Schedule VI To The Companies Act 1956 in ExcelAman ThindNo ratings yet

- Appendix-I Disclosure Index: A. Company Profile ItemsDocument9 pagesAppendix-I Disclosure Index: A. Company Profile ItemsBin AhmedNo ratings yet

- Accounts of Banking Co-1Document41 pagesAccounts of Banking Co-1Rutuja KulkarniNo ratings yet

- Eer - 8 - Guideline For Detailed Budget and Financial Forecast - BgcrogrroDocument14 pagesEer - 8 - Guideline For Detailed Budget and Financial Forecast - BgcrogrroofeliaNo ratings yet

- Patriculars Equity and LiabilitiesDocument12 pagesPatriculars Equity and LiabilitiesSanket PatelNo ratings yet

- ACCTG3-CH5 Financial Accounting Valix 2014 Volume 1Document19 pagesACCTG3-CH5 Financial Accounting Valix 2014 Volume 1Brevin Perez67% (6)

- Balance Sheet and P&L SummaryDocument56 pagesBalance Sheet and P&L SummaryRohit SinghNo ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Particulars Rs. Rs. RS.: Total CapitalDocument3 pagesParticulars Rs. Rs. RS.: Total CapitalMAHEK_KHAN81No ratings yet

- Ifrs 3Document17 pagesIfrs 3onlinetest 2020No ratings yet

- Preparation of Financial StatementsDocument3 pagesPreparation of Financial StatementsMarc Eric Redondo0% (1)

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAbhishek RawatNo ratings yet

- Apple Inc.: Form 10-QDocument55 pagesApple Inc.: Form 10-QdsafoijoafjoasdNo ratings yet

- CH - 24 PPT FMDocument33 pagesCH - 24 PPT FMnishulalwaniNo ratings yet

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- Company AccountsDocument77 pagesCompany AccountsNamish GuptaNo ratings yet

- PT B Acc NotesDocument7 pagesPT B Acc Notesfathima hamnaNo ratings yet

- Cash Flow Statements Exercises and AnswersDocument39 pagesCash Flow Statements Exercises and Answersszn189% (9)

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAchal GuptaNo ratings yet

- Study Unit 1 FAC1601Document18 pagesStudy Unit 1 FAC1601andreqwNo ratings yet

- Cash Flow StatementsDocument4 pagesCash Flow StatementsUnbeatable 9503No ratings yet

- Final Accounts of CompaniesDocument32 pagesFinal Accounts of CompaniesbE SpAciAlNo ratings yet

- SBI branch operating statement analysisDocument62 pagesSBI branch operating statement analysisKartik DoshiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Statement - E VersionDocument20 pagesFinancial Statement - E VersionHpl Ti AmoNo ratings yet

- PAS 1 Financial Statements OverviewDocument57 pagesPAS 1 Financial Statements Overviewsean lawrenceNo ratings yet

- CashFlow With SolutionsDocument82 pagesCashFlow With SolutionsHermen Kapello100% (2)

- Final PPT of Balance SheetDocument23 pagesFinal PPT of Balance SheetShailesh SatarkarNo ratings yet

- Tybcom Management AccoutingDocument6 pagesTybcom Management AccoutingavtaranNo ratings yet

- Financial StatementsDocument20 pagesFinancial StatementsOmnath BihariNo ratings yet

- Apple Inc.: Form 10-QDocument53 pagesApple Inc.: Form 10-QSeiha ChhengNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument105 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinVKrishna Kilaru100% (2)

- Accounting Policies Some Important Concepts: Group 7:-Neha Jainy SanjitDocument60 pagesAccounting Policies Some Important Concepts: Group 7:-Neha Jainy SanjitTanay SamantaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Engineering Economics & Finance: Niladri Das Associate Professor Department of Management StudiesDocument33 pagesEngineering Economics & Finance: Niladri Das Associate Professor Department of Management StudiesAayush VardhanNo ratings yet

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboNo ratings yet

- Reformulating Financial StatementsDocument17 pagesReformulating Financial Statementsteguh100% (1)

- Ak Hotel Sap 4Document7 pagesAk Hotel Sap 4aniNo ratings yet

- Balance Sheet Analysis PPT at Bec Doms BDocument25 pagesBalance Sheet Analysis PPT at Bec Doms BAARTI GUPTANo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- FAQ On FDIDocument14 pagesFAQ On FDIParas ShahNo ratings yet

- M A Tax Alert 280316Document5 pagesM A Tax Alert 280316Paras ShahNo ratings yet

- Co-founder & Director at KAMAP ConsultancyDocument2 pagesCo-founder & Director at KAMAP ConsultancyParas ShahNo ratings yet

- PAN Change Request FormDocument6 pagesPAN Change Request FormAlok ShahNo ratings yet

- Advance Tax CalculationDocument10 pagesAdvance Tax CalculationParas ShahNo ratings yet

- New Pan Card Form 49aDocument7 pagesNew Pan Card Form 49aParas ShahNo ratings yet

- TDS RATE CHART 2012-13Document3 pagesTDS RATE CHART 2012-13jeet2211No ratings yet

- Form 15G TDS waiverDocument2 pagesForm 15G TDS waiverPalaniappan Meyyappan83% (6)

- Form 49 AADocument8 pagesForm 49 AASunil KumarNo ratings yet

- Labour Laws in ShortDocument42 pagesLabour Laws in ShortParas ShahNo ratings yet

- TDS RATE CHART 2012-13Document3 pagesTDS RATE CHART 2012-13jeet2211No ratings yet

- Bhiwandi - Diva - Vasai Train Time TableDocument1 pageBhiwandi - Diva - Vasai Train Time TableParas Shah78% (9)

- 46 46 Sample First Board Meeting MinutesDocument4 pages46 46 Sample First Board Meeting MinutesDeepak Sharma0% (1)

- Profession Tax Registration ProcedureDocument9 pagesProfession Tax Registration ProcedureParas ShahNo ratings yet

- Due Diligence - Flat/Home PurchasesDocument17 pagesDue Diligence - Flat/Home PurchasesParas ShahNo ratings yet

- DiaryDocument14 pagesDiarynehavijay09No ratings yet

- India Foriegn Trade Policy Handbook of Procedures - HandbookYear2007 - 2014Document142 pagesIndia Foriegn Trade Policy Handbook of Procedures - HandbookYear2007 - 2014JoyNo ratings yet

- Marketing TipsDocument6 pagesMarketing TipsParas ShahNo ratings yet

- Companies Act 1956 Bare Act New 29.11Document700 pagesCompanies Act 1956 Bare Act New 29.11dsrinivasacsNo ratings yet

- Top 20 Finance CompanyDocument2 pagesTop 20 Finance CompanyParas ShahNo ratings yet

- Lecture 14 - Mutual Fund Theorem and Covariance Pricing TheoremsDocument16 pagesLecture 14 - Mutual Fund Theorem and Covariance Pricing TheoremsLuis Aragonés FerriNo ratings yet

- Chapter 13Document25 pagesChapter 13Clarize R. Mabiog50% (2)

- Brief History of RBI: Hilton Young CommissionDocument24 pagesBrief History of RBI: Hilton Young CommissionharishNo ratings yet

- Study of Corporate Governance in Bangladesh Through The Impact of Ownership Structure On Firms PerformanceDocument32 pagesStudy of Corporate Governance in Bangladesh Through The Impact of Ownership Structure On Firms PerformanceEngineerKhandaker Abid Rahman80% (5)

- DO 18A Checklist of RequirementsDocument2 pagesDO 18A Checklist of RequirementsRobin RubinaNo ratings yet

- Tender For Garbage Collection ServicesDocument41 pagesTender For Garbage Collection ServicesMoses Karanja Mungai50% (2)

- Sample MOADocument8 pagesSample MOAAndre CruzNo ratings yet

- Segmental AnalysisDocument2 pagesSegmental AnalysisEsmeldo MicasNo ratings yet

- Tata Steel Key Financial Ratios, Tata Steel Financial Statement & AccountsDocument3 pagesTata Steel Key Financial Ratios, Tata Steel Financial Statement & Accountsmohan chouriwarNo ratings yet

- Monthly Registration Stats 2015 - DecemberDocument3 pagesMonthly Registration Stats 2015 - DecemberBernewsAdminNo ratings yet

- Forms of Business Organization: Sole Proprietorship, Partnership & CorporationDocument31 pagesForms of Business Organization: Sole Proprietorship, Partnership & CorporationCindy ConstantinoNo ratings yet

- Topic 8, Mutural Funds AnswersDocument2 pagesTopic 8, Mutural Funds AnswersTan KaihuiNo ratings yet

- Annual Report On Annual Reports 2005Document24 pagesAnnual Report On Annual Reports 2005Dat NguyenNo ratings yet

- Loyola Villas HOA disputeDocument10 pagesLoyola Villas HOA disputeJames TanNo ratings yet

- G.R. No. 137321Document6 pagesG.R. No. 137321Weddanever CornelNo ratings yet

- Facilities Managers, Inc.: UBIX Compound Km21 East Service Road Barangay Buli, Muntinlupa City Union Bank E CreditingDocument1 pageFacilities Managers, Inc.: UBIX Compound Km21 East Service Road Barangay Buli, Muntinlupa City Union Bank E CreditingChristian MabiniNo ratings yet

- VMCI's Struggle to Overcome Financial DistressDocument7 pagesVMCI's Struggle to Overcome Financial DistressivankingbachoNo ratings yet

- TF - Aud TheoDocument3 pagesTF - Aud TheoCarl Bryan AberinNo ratings yet

- Notre Dame Educational Association: Mock Board Examination Financial Accounting and ReportingDocument17 pagesNotre Dame Educational Association: Mock Board Examination Financial Accounting and Reportingirishjade100% (1)

- 11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFDocument18 pages11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFVigneshNo ratings yet

- R41 Valuation of Contingent Claims IFT Notes PDFDocument28 pagesR41 Valuation of Contingent Claims IFT Notes PDFZidane Khan100% (1)

- Punyak SatishDocument1 pagePunyak Satish45Punyak SatishPGDM RMIIINo ratings yet

- The Effects of Management Buyouts On Operating Per PDFDocument38 pagesThe Effects of Management Buyouts On Operating Per PDFASbinance ASbinanceNo ratings yet

- Pengaruh Economic Value Added, Market Value Added Dan Profitabilitas Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Di BeiDocument18 pagesPengaruh Economic Value Added, Market Value Added Dan Profitabilitas Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Di Beisiska wulandariNo ratings yet

- FRIA ruling on insolvency court approval for extrajudicial foreclosureDocument14 pagesFRIA ruling on insolvency court approval for extrajudicial foreclosureCleinJonTiuNo ratings yet

- Consolidated Financial Statements for Purchase-Type Business CombinationsDocument158 pagesConsolidated Financial Statements for Purchase-Type Business CombinationsSassy OcampoNo ratings yet

- Tax Rate TABLE F.Y. 2010-11Document2 pagesTax Rate TABLE F.Y. 2010-11gautam_np12No ratings yet

- Us DPP Manuals Icofr RGMDocument284 pagesUs DPP Manuals Icofr RGMsharonNo ratings yet

- Become Debt Free Now by Gregory Mannarino.Document20 pagesBecome Debt Free Now by Gregory Mannarino.momentumtrader100% (1)

- FIN 3331 Risk and Return AssignmentDocument2 pagesFIN 3331 Risk and Return AssignmentHelen Joan BuiNo ratings yet