Professional Documents

Culture Documents

As-17 Segment Reporting: Segment Revenue: SR - Includes Excludes

Uploaded by

Rajesh BhatiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As-17 Segment Reporting: Segment Revenue: SR - Includes Excludes

Uploaded by

Rajesh BhatiaCopyright:

Available Formats

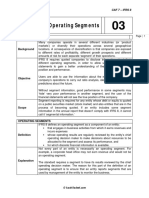

AS-17 SEGMENT REPORTING

1. Applicability:- Enterprises who are listed on a recognized listed or in the process of listing. - All other enterprises turnover exceeding 50 crores. 2. If a single financial report contains both consolidated financial statements and separate financial statements of the Parent, segment information need be presented only on the basis of the consolidated financial statements. 3. Segment Revenue: Sr . 1. 2. Includes The portion of enterprises revenue that is directly attributable to the segment. Relevant portion of enterprises revenue that can be allocated on a reasonable basis to segment and Excludes Extraordinary per AS-5 items as

3.

Interest on dividend, including interest earned on advances or loans to other segments unless the operations are primarily of a financial nature and Revenue from transactions Gains on sales of with other segments of the investments or on enterprise extinguishment of debt unless the operations of the segment are primarily of a financial nature.

4. Segment Expense: Sr . 1. Includes Excludes items as

Expenses resulting from Extraordinary operating activity directly per AS-5 attributable to segment.

2.

Relevant portion of enterprises expenses that can be allocated on a reasonable basis to segment and

3.

4. 5.

Interest expenses, including interest incurred on advances or loans from other segments, unless the operations of the segment are primarily of a financial nature. Expenses from transactions Losses on sales of with other segments of the investments or losses on enterprise. extinguishment of debt unless the operations of the segment are primarily of a financially nature. Income tax exp. 1. General admin. Exp. 2. H.O. exp. 3. Other expenses that arise at enterprise level and relate to enterprise as a whole.

5. Segment Assets:are those operating assets that are employed by a segment in its operating activities and that either are directly attributable to the segment or can be allocated to the segment on a reasonable basis. If segment result includes interest on dividend income, its segment assets include the related receivables, loans, investments, or other interest or dividend generating assets. Segment assets do not include income tax assets (deferred tax assets). Determined after deducting related allowances / provisions that are reported as direct offsets in the B/s. of the enterprise.

6. Segment Liabilities:-

are those liabilities that arise from the operating activities of the segment and that either are directly attributable to the segment or can be allocated to the segment on a reasonable basis. Segment liabilities do not include income tax assets (deferred tax liabilities).

7. In case interest is included as a part of cost of inventories where it is so required as per AS-16 and those inventories are part of segment assets of a particular segment, such interest should be considered as a segment expense. In addition to this the fact that the segment result has been arrived after considering such interest should be disclosed by way of a note to the segment result. 8. Identifying reportable segments: A business segment or geographical segment should be identified as a reportable segment if: - its revenue from sales to external customers and from transactions with other segments is 10 percent or more of the total revenue, external and internal of all segments or - its segment result, whether profit or loss, is 10 percent or more ofi. the combined result of all segments in profit or ii. the combined result of all segment in loss, iii. whichever is greater in absolute amount; or its segment assets are 10 percent or more of the total assets of all segments. if total external revenue attributable to reportable segments constitutes less than 75 percent of the total enterprise revenue, additional segments should be identified as reportable segments, even if they do not meet the 10 percent thresholds, until at least 75 percent of total enterprise revenue is included in reportable segments. A segment identified as a reportable segment in the immediately preceding period because it satisfied the

relevant 10 percent thresholds should continue to be a reportable segment for the current period. If a segment is identified as a reportable segment in the current period, preceding-period segment data that is presented for comparative purpose.

9. Primary Reporting Format (Business Segment):An enterprise should disclose the following for each reportable segment1. segment revenue, classified into revenue from sales to external customers and segment revenue from transactions with other segments; 2. segment result; 3. total carrying amount of segment assets; 4. total amount of segment liabilities; 5. total cost incurred during the period to acquire segment assets that are expected to be used during more than one period (tangible or intangible) 6. total amount of expenses included in the segment result for depreciation and amortization in respect of segment assets for the period; and 7. total amount of significant non-cash expenses, other than depreciation and amortization in respect of segment assets, that were included in segment expenses and, therefore deducted in measuring segment result. 10. Secondary Reporting Format(Geographical Segment):1. segment revenue from external customers by geographical area based on the geographical location of its customers; 2. carrying cost of segment assets; 3. additions to fixed and intangible assets

You might also like

- Segment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)Document32 pagesSegment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)AmolNo ratings yet

- Segment Reporting-As17: Ca. Pankaj AgrwalDocument41 pagesSegment Reporting-As17: Ca. Pankaj AgrwalV ArvindNo ratings yet

- Chapter-08-Ideas On Operating SegmentsDocument12 pagesChapter-08-Ideas On Operating Segmentsmdrifathossain835No ratings yet

- Segment Reporting - As17Document41 pagesSegment Reporting - As17nikitsharmaNo ratings yet

- Ifrs 8Document11 pagesIfrs 8TasminNo ratings yet

- Ifrs 8Document3 pagesIfrs 8Samantha IslamNo ratings yet

- Segment Reporting: Meaning, Terminology, Need and DisclosuresDocument5 pagesSegment Reporting: Meaning, Terminology, Need and DisclosuresIMRAN ALAMNo ratings yet

- AS 17 Segment Reporting - Objective Type Question PDFDocument44 pagesAS 17 Segment Reporting - Objective Type Question PDFrsivaramaNo ratings yet

- SegmentDocument11 pagesSegmentSiva SankariNo ratings yet

- FA Vol.3 Operating SegmentsDocument7 pagesFA Vol.3 Operating SegmentsRyan SanitaNo ratings yet

- Accounting Standard 17Document8 pagesAccounting Standard 17Aram SivaNo ratings yet

- #6 PFRS 8Document2 pages#6 PFRS 8Shara Joy B. ParaynoNo ratings yet

- Segment ReportingDocument1 pageSegment ReportingCharry RamosNo ratings yet

- As 17 - Segment ReportingDocument11 pagesAs 17 - Segment Reportinglegendstillalive4826No ratings yet

- Ifrs-8 Operating SegmentsDocument8 pagesIfrs-8 Operating SegmentsniichauhanNo ratings yet

- SEGMENT REPORTING AS 17 Presentation DuDocument18 pagesSEGMENT REPORTING AS 17 Presentation DuNamit AroraNo ratings yet

- Segment ReportingDocument2 pagesSegment ReportingDhan MarkNo ratings yet

- Understand Operating Segments with this Accounting GuideDocument3 pagesUnderstand Operating Segments with this Accounting GuideChinchin Ilagan DatayloNo ratings yet

- Operating SegmentDocument24 pagesOperating SegmentGelaNo ratings yet

- PFRS 8-Operating SegmentsDocument20 pagesPFRS 8-Operating Segmentsrena chavezNo ratings yet

- Reporting and SegmentsDocument3 pagesReporting and SegmentsHortanNo ratings yet

- Operating Segments PDFDocument4 pagesOperating Segments PDFAvi MartinezNo ratings yet

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathNo ratings yet

- BY DR - Pranav SaraswatDocument18 pagesBY DR - Pranav SaraswatsaraswatpranavNo ratings yet

- AS 17 Segment Reporting StandardDocument34 pagesAS 17 Segment Reporting Standardkrish bhatiaNo ratings yet

- AS 17 Segment Reporting OverviewDocument31 pagesAS 17 Segment Reporting OverviewAthira100% (1)

- IAS 14 Segment Reporting SummaryDocument2 pagesIAS 14 Segment Reporting Summarylinda_nardoNo ratings yet

- Pfrs 8 Operating SegmentsDocument2 pagesPfrs 8 Operating SegmentsJimuel ImbuidoNo ratings yet

- Segment ReportingDocument4 pagesSegment ReportingAlex FungNo ratings yet

- PAS 14 Segment Reporting GuideDocument15 pagesPAS 14 Segment Reporting GuideJoyce Ann Agdippa BarcelonaNo ratings yet

- Operating SegmentDocument6 pagesOperating SegmentsubupooNo ratings yet

- Chapter 19 - Operating SegmentsDocument11 pagesChapter 19 - Operating Segmentsjr7mondo7edoNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Segment Reporting RequirementsDocument4 pagesSegment Reporting RequirementsSHIENA TECSONNo ratings yet

- 31 Pfrs 8 - Operating Segments: Scope 1. What Is The Scope of The Standards?Document6 pages31 Pfrs 8 - Operating Segments: Scope 1. What Is The Scope of The Standards?Chris Sevilla BurhamNo ratings yet

- Kings College of The PhilippinesDocument6 pagesKings College of The PhilippinesIzza Mae Rivera KarimNo ratings yet

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- As 17 Segment ReportingDocument5 pagesAs 17 Segment ReportingcalvinroarNo ratings yet

- Operating Segments PDFDocument12 pagesOperating Segments PDFZahidNo ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsAANo ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsMohammad BaratNo ratings yet

- Chapter 37 IntaccDocument23 pagesChapter 37 IntaccShiela DimaculanganNo ratings yet

- Ca - Bharat Bhushan B-Com, ACA: Presented byDocument23 pagesCa - Bharat Bhushan B-Com, ACA: Presented byEshetieNo ratings yet

- IFRS8Document11 pagesIFRS8Elaine MateoNo ratings yet

- Operating SegmentsDocument3 pagesOperating SegmentsPaula De RuedaNo ratings yet

- Ias 14Document5 pagesIas 14Khalida UtamiNo ratings yet

- Operating Segment Reporting Key Financial DataDocument19 pagesOperating Segment Reporting Key Financial DataRainNo ratings yet

- PAS 14 SEGMENT REPORTDocument3 pagesPAS 14 SEGMENT REPORTrandyNo ratings yet

- ACTIVITY 8 - Intermediate AccountingDocument2 pagesACTIVITY 8 - Intermediate AccountingMicky BernalNo ratings yet

- Operating Segments: International Financial Reporting Standard 8Document10 pagesOperating Segments: International Financial Reporting Standard 8Tanvir PrantoNo ratings yet

- PAS 8 Operating SegmentsDocument4 pagesPAS 8 Operating SegmentsAlex OngNo ratings yet

- Useful To The Users of The Financial StatementsDocument3 pagesUseful To The Users of The Financial StatementsBrian VillaluzNo ratings yet

- Operating Segments: International Financial Reporting Standard 8Document9 pagesOperating Segments: International Financial Reporting Standard 8Imran MustafaNo ratings yet

- SECTION 5Document15 pagesSECTION 5Abata BageyuNo ratings yet

- 07 Segment ReportingDocument5 pages07 Segment ReportingHaris IshaqNo ratings yet

- 07 Segment Reporting 1Document4 pages07 Segment Reporting 1Irtiza AbbasNo ratings yet

- CA B. Hari Gopal: AS 17 - Segment ReportingDocument54 pagesCA B. Hari Gopal: AS 17 - Segment Reportingvarunmonga90No ratings yet

- MFRS 8Document31 pagesMFRS 8Anas AjwadNo ratings yet

- Far 3 (Final Topics) - Ma'Am JannaDocument68 pagesFar 3 (Final Topics) - Ma'Am JannaAndrea FernandoNo ratings yet

- 2022 ICT Mentorship 5Document50 pages2022 ICT Mentorship 5dcratns dcratns100% (21)

- Skills 360 - Negotiations 2: Making The Deal: Discussion QuestionsDocument6 pagesSkills 360 - Negotiations 2: Making The Deal: Discussion QuestionsTrần ThơmNo ratings yet

- Corporate Provisional Voter ListDocument28 pagesCorporate Provisional Voter ListtrueoflifeNo ratings yet

- 3 AL Banin 2021-2022Document20 pages3 AL Banin 2021-2022Haris HaqNo ratings yet

- Valve SheetDocument23 pagesValve SheetAris KancilNo ratings yet

- Database of Success Indicators (Dilg Central Office) : Major Final Output/Ppas Success Indicators Standard Rating Due DateDocument13 pagesDatabase of Success Indicators (Dilg Central Office) : Major Final Output/Ppas Success Indicators Standard Rating Due DateFender Boyang100% (1)

- UGC Project FormatDocument19 pagesUGC Project FormatAmit GautamNo ratings yet

- Management: Standard XIIDocument178 pagesManagement: Standard XIIRohit Vishwakarma0% (1)

- Ignorantia Juris Non ExcusatDocument3 pagesIgnorantia Juris Non ExcusatXymon Bassig0% (1)

- Signs in The Gospel of JohnDocument3 pagesSigns in The Gospel of JohnRandy NealNo ratings yet

- API Technical Document 10656Document19 pagesAPI Technical Document 10656NazmulNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- STP Analysis of ICICI BANK vs SBI for Savings AccountsDocument28 pagesSTP Analysis of ICICI BANK vs SBI for Savings AccountsUmang Jain0% (1)

- AZ 104 - Exam Topics Testlet 07182023Document28 pagesAZ 104 - Exam Topics Testlet 07182023vincent_phlNo ratings yet

- UNIT 4 Lesson 1Document36 pagesUNIT 4 Lesson 1Chaos blackNo ratings yet

- March 3, 2014Document10 pagesMarch 3, 2014The Delphos HeraldNo ratings yet

- Social Media Audience Research (To Use The Template, Click The "File" Tab and Select "Make A Copy" From The Drop-Down Menu)Document7 pagesSocial Media Audience Research (To Use The Template, Click The "File" Tab and Select "Make A Copy" From The Drop-Down Menu)Jakob OkeyNo ratings yet

- The Slave Woman and The Free - The Role of Hagar and Sarah in PaulDocument44 pagesThe Slave Woman and The Free - The Role of Hagar and Sarah in PaulAntonio Marcos SantosNo ratings yet

- Simple Present: Positive SentencesDocument16 pagesSimple Present: Positive SentencesPablo Chávez LópezNo ratings yet

- Static pile load test using kentledge stackDocument2 pagesStatic pile load test using kentledge stackHassan Abdullah100% (1)

- Supply Chain Management PepsiDocument25 pagesSupply Chain Management PepsivenkateshNo ratings yet

- The Adams Corporation CaseDocument5 pagesThe Adams Corporation CaseNoomen AlimiNo ratings yet

- What Does The Bible Say About Hell?Document12 pagesWhat Does The Bible Say About Hell?revjackhowell100% (2)

- ASEAN-Maybank Scholarship - Parents Income Declaration Form v1Document1 pageASEAN-Maybank Scholarship - Parents Income Declaration Form v1hidayanti.ridzuanNo ratings yet

- Tata Securities BranchesDocument6 pagesTata Securities BranchesrakeyyshNo ratings yet

- Course Syllabus International Business Strategy: Ho Chi Minh City, .Document12 pagesCourse Syllabus International Business Strategy: Ho Chi Minh City, .Ngan NguyenNo ratings yet

- Nursing PhilosophyDocument3 pagesNursing Philosophyapi-509420416No ratings yet

- MSA BeijingSyllabus For Whitman DizDocument6 pagesMSA BeijingSyllabus For Whitman DizcbuhksmkNo ratings yet

- The Paombong Public MarketDocument2 pagesThe Paombong Public MarketJeonAsistin100% (1)

- HRM-4211 Chapter 4Document10 pagesHRM-4211 Chapter 4Saif HassanNo ratings yet