Professional Documents

Culture Documents

Tax Rates in Nepal

Uploaded by

Sai SandeepOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rates in Nepal

Uploaded by

Sai SandeepCopyright:

Available Formats

Nepal Tax Rates

Page 1 of 4

TAX RATES > Nepal Tax Rates ALBANIA ALGERIA ANDORRA ANGOLA ANGUILLA ANTIGUA & BARBUDA ARGENTINA ARUBA AUSTRALIA AUSTRIA AZERBAIJAN BAHAMAS BAHRAIN BANGLADESH BARBADOS BELARUS BELGIUM BELIZE BENIN BERMUDA BOSNIA & HERZEGOVINA BOTSWANA BRAZIL BRITISH VIRGIN ISLANDS BRUNEI BULGARIA BURKINA FASO BURMA BURUNDI CAMBODIA CAMEROON CANADA CAPE VERDE CAYMAN ISLANDS CENTRAL AFRICAN REP. CHAD CHILE CHINA COLOMBIA COMOROS CONGO, DEM. REPUBLIC CONGO, REPUBLIC OF COOK ISLANDS COSTA RICA COTE D'IVOIRE CROATIA CUBA CURAAO CYPRUS CZECH REPUBLIC DENMARK DJIBOUTI DOMINICA DOMINICAN REPUBLIC ECUADOR EGYPT EL SALVADOR EQUATORIAL GUINEA ESTONIA FIJI FINLAND FRANCE FRENCH POLYNESIA GAMBIA GEORGIA GERMANY GHANA GIBRALTAR GREECE GRENADA GUATEMALA GUERNSEY GUYANA HONDURAS HONG KONG HUNGARY ICELAND INDIA INDONESIA IRAN IRELAND ISLE OF MAN ISRAEL ITALY

Go to Tax Rates Home Page

NEPAL TAX RATES

Nepal Income Tax Rate Nepal Corporate Tax Rate Nepal Sales Tax / VAT Rate

25% 20-30% 13%

Last Update: Nov 2010

(This page may show previous year's tax rates. Always check last update time)

NEPAL INCOME TAX RATES FOR INDIVIDUALS

Nepal individual income tax rates are progressive to 25%. Tax exemption limit is Rs.160,000 for individuals and Rs.200,000 for couples: Tax rates for resident individuals Income (Rs.) Tax Rate 0 - 160,000 1% 160,001 - 260,000 15% (+ Rs. 1,600) Above Rs. 260,000 25% (+ Rs. 16,600) Tax rates for Married (including widow & widower) Income (Rs.) Tax Rate 0 - 200,000 1% 200,001 - 300,000 15% (+ Rs. 2,000) Above Rs. 300,000 25% (+ Rs. 17,000) Tax rates for Proprietorship Firm - single Income (Rs.) Tax Rate 0 - 160,000 0% 160,001 - 260,000 15% Above Rs. 260,000 25% (20% for Export Income and Income from Special Industry) + Rs. 15,000 Tax rates for Proprietorship Firm - married Income (Rs.) Tax Rate 0 - 200,000 0% 200,001 - 300,000 15% Above Rs. 300,000 25% (20% for Export Income and Income from Special Industry) + Rs. 15,000 Having only Business Income with Annual Turnover up to Rs 20 Lacs and Annual Income up to Rs. 2 Lacs - In the Metropolitan or Sub Metropolitan Cities Rs. 5000 - In the Municipalities Rs. 2500 - In the rest of Nepal Rs. 1500 Tax Rate for Non Resident Natural Person: Taxable income of a non resident natural person shall be taxed at 25%. Notes - Resident Disabled Individual shall get an additional 50% of Exemption Limit (i.e. 50% of Rs. 200,000 in case of couple & Rs. 160,000 in case of single). - Resident Woman, having only Remuneration Income, shall be entitled to a Tax Rebate of 10%. - Individual having Life Insurance Policy shall get an additional exemption from hid Taxable - Income to the extent of Rs. 20,000 or Premium Amount, whichever is lower. 4. Husband and Wife, having separate income source, are given option either to get assessed separately or jointly as family. - Annual Remote Area Allowance up to Rs. 30,000 is exempted from tax. - Employees working in Nepalese Mission abroad are allowed 75% exemption on Foreign Allowances. - There is no levy of any Additional Income Tax Rebate on Tax Liability for Resident Female with only employment income - A female resident natural person having only remuneration income from employment shall be provided with a rebate of 10% on the tax liability on tax calculated as above. Tax on Non Business Chargeable Assets - Gain from disposal of Non Business Chargeable Assets are taxed at 10% after taking into consideration exemption limit (i.e Rs.1,60,000 for individual and Rs.2,00,000 for couples). In case of land and buildings, if the disposed land & buildings has been owned for more than 5 years, tax rate of 5% shall apply.

http://www.taxrates.cc/html/nepal-tax-rates.html

4/21/2011

Nepal Tax Rates

Page 2 of 4

IVORY COAST JAMAICA JAPAN JERSEY JORDAN KAZAKHSTAN KENYA KUWAIT LATVIA LEBANON LIBYA LITHUANIA LUXEMBOURG MACAU MADAGASCAR MADEIRA MALAWI MALAYSIA MALDIVES MALTA MAURITIUS MEXICO MOLDOVA MONACO MONTENEGRO MOROCCO MOZAMBIQUE MYANMAR NAMIBIA NEPAL NETHERLANDS NETHERLANDS ANTILLES NEW ZEALAND NICARAGUA NIGERIA NORWAY OMAN PAKISTAN PALESTINE PANAMA PAPUA NEW GUINEA PARAGUAY PERU PHILIPPINES POLAND PORTUGAL PUERTO RICO QATAR ROMANIA RUSSIA RWANDA SAUDI ARABIA SENEGAL SERBIA SIERRA LEONE SINGAPORE SLOVAKIA SLOVENIA SOUTH AFRICA SOUTH KOREA SPAIN SRI LANKA SWAZILAND SWEDEN SWITZERLAND SYRIA TAIWAN TANZANIA THAILAND TUNISIA TURKEY TURKS AND CAICOS UGANDA UKRAINE UNITED ARAB EMIRATES UNITED KINGDOM UNITED STATES URUGUAY UZBEKISTAN VANUATU VENEZUELA VIETNAM WEST BANK YEMEN ZAMBIA ZIMBABWE

Gain from Non Business Chargeable Assets includes - gain from sale of shares of companies, - gain from sale of land and building owned and resided for less than 10 years and disposed for more than Rs.50 lakhs. Special Tax Rates for Natural Persons Particulars For incomes earned from operating special industries For incomes earned from export business Tax Deductions and Facilities for Resident Persons Life Insurance Premium - While calculating taxable income, life Insurance premium paid by a resident natural person is deductible up to the limit of Rs 20,000. Employees working in Diplomatic Agencies - 75% of foreign allowance is deducted from taxable income in case of an employee employed at diplomatic agencies of Nepal situated at foreign countries. Incapacitated natural persons - In case of incapacitated natural persons, the minimum exemption limit (Rs.1,60,000 for individual and Rs.2,00,000 for couples) is increased by additional 50%. Remote Area Benefit - In case of resident natural persons working in remote areas, minimum exemption limit shall be increased by Rs 30,000, Rs 24,000, Rs 18,000, Rs 12,000 or Rs 6,000 depending on remote area category of A, B, C, D and E prescribed in Income Tax Rules 2059. Additional limit for pension income - If income of a resident natural person includes pension income, the taxable income is first reduced by additional 25% or pension amount included in income whichever is lower and then tax liability is calculated on balance income. Tax Credits for Resident Persons Medical Tax Credit - In case of approved medical expenses, medical tax credit is available to resident natural persons as deduction from tax liabilities. The limit prescribed is Rs.750 or 15% of Approved medical expense or actual approved medical expense incurred whichever is lower. Any unutilized expenses can be carried forward to next year. Foreign Tax Credit - If foreign income is included in taxable income of a resident person, foreign tax credit for tax paid in foreign country in respect of that income. The foreign tax paid can either be deducted as expense or tax liability in Nepal can be reduced by such tax paid up to average rate of tax applicable in Nepal, depending on the option of tax payer. Applicable Tax Rates 20% where 25% tax rate applies 20% where 25% tax rate applies

NEPAL CORPORATE TAX RATES

The standard rate of corporate tax in Nepal is 25%. However, different entities are taxed at different rates: Particulars / Tax Rate - Bank, Finance Company, General Insurance Company, Petroleum Entities: 30% - Cigarette, Tobacco, Beer and Alcohol Company: 30% - Special Industries & IT Industries: 20% - Entities engaged in construction & operation of Road, Bridge, Tunnel, Ropeway, Trolley Bus and Tram: 20% - Co-operative Institution registered under Co-operative Act, 2048 (other than co- operatives dealing in except dealers in Exempted Transaction): 20% - Entity wholly engaged in the (BOOT) projects conducted so as to build public infrastructure, own, operate and transfer it to the HMG & in power generation, transmission, or distribution: 20% - Non-resident person Providing Shipping, Air Transport or Telecommunications Services in Nepal: 5% - Private Limited Co., Limited Co., Partnership Firm not specifically mentioned above: 25% - Airline Services having office in and business in Nepal but not operating flights to and within Nepal: 2% - All Export Entities: 20% - Repatriation of income of a Foreign Permanent Establishment of a Non-Resident situated in Nepal: 5% Reduced Tax Rates Corporate Groups Applicable tax rate - Information Technology industries: 22.5% - Special Industries and Information Technology Industries providing direct employment to 300 or more Nepalese citizens during a period: 90% of applicable rate - Special Industries providing direct employment to 1200 or more Nepalese citizens during a period: 80% of applicable rate - Special Industries providing direct employment to more than 100 Nepalese citizens during a period 33% of which are women, incapacitated and dalits: 80% of applicable rate - Special Industries operating in very undeveloped area: 50% of applicable rate - Special Industries operating in undeveloped area: 70% of applicable rate - Special Industries operating in underdeveloped area: 75% of applicable rate - Industries established in Special Economic Zone of mountain district as specified by the government and hilly district: 0% for 10 years & 50% thereafter - Industries established in Special Economic Zone of other areas: 0% for 5 years and 50% thereafter (In case of dividend of such industries, dividend tax is exempt for first five years of operation and 50% concession is provided for dividend tax in next three years) - Income from foreign technology, management fee and royalty earned by foreign investor from industries established in special economic zone: 50% of applicable rate - Industries established in remote areas: 0% for 10 years - Information Technology based industries established at prescribed Information Technology park: 75% of Normal Rate - Licensed Industries engaged in production and distribution of electricity, if the production and distribution is completed by the end of Chaitra 2075: 100% exemption for first 7 years, 50% for next 3 years. Tax Rates for Non Residents Particulars / Applicable Tax Rates - For incomes earned from operation of water transport, charter service or air transport or by operating a cable, radio, optical fiber or earthsatellite communication business from the transmission of news or information through the equipments installed in Nepal: 5% - For incomes earned from providing air transport, water transport or telecommunication services within the territory of Nepal: 2% - On repatriation of income by Foreign Permanent Establishment: 5%

http://www.taxrates.cc/html/nepal-tax-rates.html

4/21/2011

Nepal Tax Rates

Page 3 of 4

Advance Income Tax Income Tax for fiscal year should be paid in 3 installments as follows: Instalment First Second Third Time Period Up to Mid-January (Poush end) Up to Mid- April (Chaitra end) Up to Mid-July (Ashadh end) Amount 40% 70% 100%

Where an instalment of tax paid by a person is less than 80% of Tax Payable, interest shall be levied @ 10% for each month and part of month from the date of first installment on the amount to the excess of 80% of the instalment that would have paid over the installment paid. The presumptive tax-payers need not require paying any advance tax as above. Further if the Tax Amount for the fiscal year is less than Rs 5000, installment is not required to be paid. Carry Forward of Loss - Carry Forward of Loss from Business and Investment can be made up to 7 years. - Carry Forward of Loss can be made up to 12 years in case of Projects building, operating & transferring public infrastructure to the Nepal Government, Projects building Electricity Production House, generating & transmitting electricity and entities dealing in petroleum products under Nepal Petroleum Act, 2040. - Loss incurred in business or investment where assessee enjoys full / partial tax exemption cannot be carried forward. Penalty for Non-Filing of Income Tax Return on Time - Non-Filing of Estimated Income Tax Return Income u/s 95 within due date shall attract penalty of Rs. 2000 per Return. - Non-Filing of Income Tax Return Income u/s 96 within due date shall attract penalty of @ 0.10% of Annual Turnover or Rs. 100 per month whichever is higher. Tax Concession and Rebates - 10 Years Tax Holiday from date of operation and 50% Tax Rebate thereafter to industries established in Special Economic Zone (SEZ) of Himalayan Districts and other prescribed Hilly District. - 5 Years Tax Holiday from date of operation and 50% Tax Rebate thereafter to industries established in other Special Economic Zone (SEZ). - 100% Rebate for first 5 Years from date of operation and then 50% Rebate for next 3 Years on dividend distributed by industries established in Special Economic Zone (SEZ). - 50% Rebate on Income Tax on income from Foreign Technology or Management Consultancy or Royalty earned by foreign investors of industry established in SEZ. - 10 Years Tax Holiday from date of operation to industries established in remote areas. - 25% Tax Rebate to IT Industries established in prescribed Information Technology Park. - Entities having license for Electricity generation, transmission & distribution, if commences generation / generation & transmission / generation & distribution / generation, transmission & distribution of Hydro-electricity commercial manner by Chaitra end, 2075; such entities shall have Tax Holiday for a period of first 7 Years and 50% Tax Rebate thereafter for 3 Years, from date of such commencement of generation, transmission & distribution. Such facilities shall also be applicable for Electricity generated from Solar/Wind/Organic Materials. However, entities already having started commercial production of electricity before Shrawan 01, 2066 shall be eligible for facility as prevalent at the time of obtaining license - 50%, 30% & 25% Rebate on Income Tax for 10 Years including the year of operation to Special Industries operating in Highly Undeveloped, Undeveloped & Under-developed areas respectively. - 10 % Rebate on Income Tax to Special Industries and IT Industries which provide direct employment to 300 Nepalese nationals throughout the year. [Earlier, it was 500 Nepalese]. - 20 % Rebate on Income Tax to Special Industries which provide direct employment to 1200 Nepalese nationals throughout the year. - 20 % Rebate on Income Tax to Special Industries which provide direct employment to 100 Nepalese nationals including 33 percent women, dalits (the downtrodden) or the handicapped, throughout the year Tax Deduction at Source (TDS) rates Resident employer should withhold tax while making employment income payment with sources in Nepal to an employer as follows. (Monthly TDS = Annual Tax calculated as per schedule 1 on annual employment income divided by 12) Particulars / Tax Rates - On Interest, Royalty, Service Charge, Retirement Payment having source in Nepal, except mentioned otherwise: 15% - Payment made to resident person on Service Charge invoiced in VAT bill: 1.5% - On Nepal sourced Interest by Banks and financial institutions and/or listed companies to a natural person. Such payment should not be made in connection with operation of any business: 5% - On payment made by a resident person for rent having source in Nepal: 10% - On payment of gain from Investment Insurance: 5% - On payment of gain from retirement fund: 5% - On payment of commission by resident employer company to a non resident person: 5% - On payment of lease rental of aircraft: 10% - On payment of premium to non-resident insurance companies: 1.5% - On gain from transaction on commodity future market: 10% - On windfall gains except national and international level prizes as prescribed by Nepal Government: 25%

NEPAL VAT (VALUE ADDED TAX)

Standard rate of Value Added Tax in Nepal is 13%. Certain goods/services are exempt. Entity having turnover of Rs.2.0 million or more is required to get registered with Valu Added Tax Office and 13% VAT shall be applicable to it.

http://www.taxrates.cc/html/nepal-tax-rates.html

4/21/2011

Nepal Tax Rates

Page 4 of 4

Disclaimer

TaxRates.cc intends to provide general information about tax rates around the world. Taxation is a quite complex subject and TaxRates.cc does not claim tax information on this web site is error free. It is your own risk and you have full responsibility resulting from the use of general tax subject on this web site. Therefore, we recommend you to obtain professional tax advice before taking any decision. We are not intended to provide professional tax advice, investment, consulting or other professional accounting, legal or tax services. Tax information on this web site should not be regarded as offering a complete and detailed explanation of the taxation. Before taking any action which can affect your business or personal finance, you should consult a professional and qualified tax adviser. Tax Rates can not be held responsible from risks taken, or for any loss due to use of any tax advice on this web site. Related resources about taxation can be found on these web sites: IRS | Deloitte | PKF | KPMG | Doing Business | PricewaterhouseCoopers | Ernst & Young | OECD

2009-2010 TaxRates.cc 2009 - 2010 Tax Rate Guide and Tax Help Website

Disclaimer | Site Map | Contact | Privacy Policy

http://www.taxrates.cc/html/nepal-tax-rates.html

4/21/2011

You might also like

- Nepal TaxationDocument19 pagesNepal TaxationVijay AgrahariNo ratings yet

- Tax RateDocument10 pagesTax Rateusha chimariyaNo ratings yet

- How Do You See It?: East Africa Quick Tax Guide 2012Document11 pagesHow Do You See It?: East Africa Quick Tax Guide 2012Zimbo KigoNo ratings yet

- 61a38d5c7b74a - INcome Tax and ETA HandwrittenDocument15 pages61a38d5c7b74a - INcome Tax and ETA HandwrittenAnuska ThapaNo ratings yet

- Synopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.Document33 pagesSynopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.knmodiNo ratings yet

- Type Rate of Tax: Value-Added Tax (VAT) Donations Tax Unemployment Insurance ContributionsDocument2 pagesType Rate of Tax: Value-Added Tax (VAT) Donations Tax Unemployment Insurance Contributionsdiefenbaker13No ratings yet

- Nepal Budget 2070 Tax Prespective: NBSM & AssociatesDocument9 pagesNepal Budget 2070 Tax Prespective: NBSM & AssociatesrameshneupaneNo ratings yet

- Income TaxDocument10 pagesIncome TaxSojan MaharjanNo ratings yet

- Tax Code of BangladeshDocument5 pagesTax Code of Bangladeshsouravsam100% (2)

- International Tax: Bangladesh Highlights 2020Document8 pagesInternational Tax: Bangladesh Highlights 2020Mehadi HasanNo ratings yet

- Tax Assignment 1Document16 pagesTax Assignment 1Tunvir Islam Faisal100% (2)

- Taxation Under the Local Government CodeDocument14 pagesTaxation Under the Local Government Codelem002117No ratings yet

- RA 7160 - Local Government Code of 1991: Taxation Shall Be UniformDocument6 pagesRA 7160 - Local Government Code of 1991: Taxation Shall Be UniformChad FerninNo ratings yet

- NBSM Nepal Budget 2073 PDFDocument20 pagesNBSM Nepal Budget 2073 PDFnabin shresthaNo ratings yet

- Chapter 13 Part 1Document11 pagesChapter 13 Part 1Danielle Angel MalanaNo ratings yet

- Tanzania Tax GuideDocument13 pagesTanzania Tax GuideVenkatesh GorurNo ratings yet

- Fiscal Guide TanzaniaDocument12 pagesFiscal Guide TanzaniaVenkatesh GorurNo ratings yet

- Taxes in IndiaDocument31 pagesTaxes in IndiaAnand PattedNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesShaheen MahmudNo ratings yet

- Corporate Income Tax Rates and CalculationsDocument2 pagesCorporate Income Tax Rates and CalculationsPines MacapagalNo ratings yet

- Lebanon TaxationDocument5 pagesLebanon TaxationShashank VarmaNo ratings yet

- Nature and Concept: OF IncomeDocument193 pagesNature and Concept: OF IncomeFranchise AlienNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- A Guide To Taxation in The PhilippinesDocument3 pagesA Guide To Taxation in The PhilippinesPhia CustodioNo ratings yet

- Taxation ProjectDocument23 pagesTaxation ProjectAkshata MasurkarNo ratings yet

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- Publication TaxationMYSDocument2 pagesPublication TaxationMYSsitinorasmat7275No ratings yet

- 2017/2018 Year of AssessmentDocument23 pages2017/2018 Year of AssessmentSaddhatissa RajawasamNo ratings yet

- Quick Tax Guide-2012Document9 pagesQuick Tax Guide-2012Paul MaposaNo ratings yet

- TaxDocument6 pagesTaxBirs BirsNo ratings yet

- Tax System SriLankaDocument44 pagesTax System SriLankamandarak7146No ratings yet

- Income Tax Note 02Document4 pagesIncome Tax Note 02Hashani Anuttara AbeygunasekaraNo ratings yet

- Withholding Tax Bureau of Internal RevenueDocument10 pagesWithholding Tax Bureau of Internal RevenueFunnyPearl Adal GajuneraNo ratings yet

- Budget 2070-71 HighlightsDocument6 pagesBudget 2070-71 Highlightsme_mdjocNo ratings yet

- Income Tax AuthoritiesDocument12 pagesIncome Tax Authoritiesroni286No ratings yet

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- Ethiopia Fiscal Guide 2015 2016Document11 pagesEthiopia Fiscal Guide 2015 2016nefassilk branchNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonNo ratings yet

- Corporate Income Taxes and Tax RatesDocument38 pagesCorporate Income Taxes and Tax RatesShaheen ShahNo ratings yet

- F6rom Jun 2011 QuDocument13 pagesF6rom Jun 2011 Qusorin8488No ratings yet

- Tax GuideDocument10 pagesTax GuideossymbengwaNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- Deminimis BenefitsDocument24 pagesDeminimis Benefitsdaryl canoza100% (1)

- Uganda Tax Guide: Income, VAT, Excise, Stamp Duty RatesDocument9 pagesUganda Tax Guide: Income, VAT, Excise, Stamp Duty RatesJeff QueiroNo ratings yet

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- DTTL Tax Kazakhstanhighlights 2016Document3 pagesDTTL Tax Kazakhstanhighlights 2016Máté Bence TóthNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- A Guide To Taxation in The PhilippinesDocument5 pagesA Guide To Taxation in The PhilippinesNathaniel MartinezNo ratings yet

- Fiscal Guide ZambiaDocument9 pagesFiscal Guide ZambiaVenkatesh GorurNo ratings yet

- Budget Tax Guide 2022Document18 pagesBudget Tax Guide 2022PoesNo ratings yet

- This SARS Pocket Tax Guide Has Been Developed To Provide A Synopsis of The Most Important Tax, Duty and Levy Related Information For 2015/16Document2 pagesThis SARS Pocket Tax Guide Has Been Developed To Provide A Synopsis of The Most Important Tax, Duty and Levy Related Information For 2015/16singhjpNo ratings yet

- WITHHOLDING TAX OBLIGATIONSDocument152 pagesWITHHOLDING TAX OBLIGATIONSemytherese100% (2)

- Income Tax MannualDocument6 pagesIncome Tax MannualMuhammad Ammar KhanNo ratings yet

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- Chapter 2Document38 pagesChapter 2Alyssa Camille DiñoNo ratings yet

- Expanded Withholding TaxDocument3 pagesExpanded Withholding TaxCordero TJNo ratings yet

- 20% 7.5% Exemp T 10% 20% 10% 6%: ExemptDocument7 pages20% 7.5% Exemp T 10% 20% 10% 6%: Exemptgoateneo1bigfightNo ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mola SubseaDocument10 pagesMola Subseashahbaz akramNo ratings yet

- 3.SAFA AOCS 4th Ed Ce 2-66 1994Document6 pages3.SAFA AOCS 4th Ed Ce 2-66 1994Rofiyanti WibowoNo ratings yet

- The Motive Journal (3rd Edition)Document42 pagesThe Motive Journal (3rd Edition)Shubham Sharma0% (1)

- Healthcare Financing in IndiADocument86 pagesHealthcare Financing in IndiAGeet Sheil67% (3)

- Jee Main Sample Paper 5Document19 pagesJee Main Sample Paper 5DavidNo ratings yet

- Rice Research: Open Access: Black Rice Cultivation and Forming Practices: Success Story of Indian FarmersDocument2 pagesRice Research: Open Access: Black Rice Cultivation and Forming Practices: Success Story of Indian Farmersapi-420356823No ratings yet

- TFN Declaration FormDocument6 pagesTFN Declaration FormTim DunnNo ratings yet

- Consider Recycled Water PDFDocument0 pagesConsider Recycled Water PDFAnonymous 1XHScfCINo ratings yet

- El Bill PDFDocument2 pagesEl Bill PDFvinodNo ratings yet

- Guide To Admissions 2024-25Document159 pagesGuide To Admissions 2024-25imayushx.inNo ratings yet

- Almond Milk Case Study Executive SummaryDocument19 pagesAlmond Milk Case Study Executive Summarygauthamsindia307No ratings yet

- Schneider - Cptg010 en (Print)Document16 pagesSchneider - Cptg010 en (Print)el_koptan00857693No ratings yet

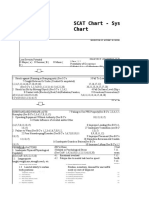

- SCAT Chart - Systematic Cause Analysis Technique - SCAT ChartDocument6 pagesSCAT Chart - Systematic Cause Analysis Technique - SCAT ChartSalman Alfarisi100% (1)

- CV Dang Hoang Du - 2021Document7 pagesCV Dang Hoang Du - 2021Tran Khanh VuNo ratings yet

- Nursing Care of ElderlyDocument26 pagesNursing Care of ElderlyIndra KumarNo ratings yet

- Steps of Repertorization - 5e097dab9ad98Document18 pagesSteps of Repertorization - 5e097dab9ad98Sowjanya JyothsnaNo ratings yet

- Final Profile Draft - Zach HelfantDocument5 pagesFinal Profile Draft - Zach Helfantapi-547420544No ratings yet

- Limetas Maximos ResidualesDocument27 pagesLimetas Maximos ResidualesXjoelx Olaya GonzalesNo ratings yet

- 4-Week Weight Loss ChallengeDocument6 pages4-Week Weight Loss ChallengeTammy JacksonNo ratings yet

- Seguridad Boltec Cable PDFDocument36 pagesSeguridad Boltec Cable PDFCesar QuintanillaNo ratings yet

- Ionic Equilibrium - DPP 01 (Of Lec 02) - Arjuna JEE 2024Document2 pagesIonic Equilibrium - DPP 01 (Of Lec 02) - Arjuna JEE 2024nrashmi743No ratings yet

- Vacuum Conveyin 5.0Document56 pagesVacuum Conveyin 5.0Mostafa AtwaNo ratings yet

- RCF's Market Analysis of Dealer NetworkDocument70 pagesRCF's Market Analysis of Dealer NetworkAshok KushwahaNo ratings yet

- 2022 TESAS PublicationDocument103 pages2022 TESAS PublicationNathan LakaNo ratings yet

- To 1 BUMN 2023 Bahasa Inggris StructureDocument5 pagesTo 1 BUMN 2023 Bahasa Inggris StructureKukuh Perkasa WirayudaNo ratings yet

- Mole Concept: Chemfile Mini-Guide To Problem SolvingDocument18 pagesMole Concept: Chemfile Mini-Guide To Problem SolvingNaren ParasharNo ratings yet

- Ficha Tecnica StyrofoamDocument2 pagesFicha Tecnica StyrofoamAceroMart - Tu Mejor Opcion en AceroNo ratings yet

- S6MT 1Q w1 3 MELC1 SLM MIXTURES FinalCopy09082020Document26 pagesS6MT 1Q w1 3 MELC1 SLM MIXTURES FinalCopy09082020Rona Dindang100% (1)

- Build Size and Aesthetics with the 6-Week Hype Gains Hypertrophy ProgramDocument21 pagesBuild Size and Aesthetics with the 6-Week Hype Gains Hypertrophy ProgramDanCurtis100% (1)

- Microbiology of Ocular InfectionsDocument71 pagesMicrobiology of Ocular InfectionsryanradifanNo ratings yet