Professional Documents

Culture Documents

2.introduction To Debt and Equity

Uploaded by

JJWGOURAVOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.introduction To Debt and Equity

Uploaded by

JJWGOURAVCopyright:

Available Formats

An introduction to debt and equity

Susan Thomas

10 August 2010

Susan Thomas

An introduction to debt and equity

Recap

Finance is about designing contracts to smooth future consumption using present cashows. Every asset is a series of cashows that are xed (dependent on time) or uncertain (contingent promises) with a nal maturity that is xed or uncertain. Three different entities that participate in the nance game: individuals, rms, governments. Different kinds of rms: proprietership, partnership, limited liability. More recently, limited liability partnership rms.

Susan Thomas

An introduction to debt and equity

Recap of nancial contract categories

We talked about parameterising different assets wrt cashows (time dependent, contingency-dependent), maturity. We get: Cashow Time Uncertain Fixed Uncertain Equity Derivatives Fixed Insurance Debt

Debt and equity contrast on both the cashows and on time. We will use these two assets to understand pricing and risk measurement principles rst.

Susan Thomas

An introduction to debt and equity

Placing debt and equity in a rm

Susan Thomas

An introduction to debt and equity

Debt vs. Equity

Capital in a rm come from both debt and equity. Both are possible sources of funding for a rm.

Susan Thomas

An introduction to debt and equity

Debt vs. Equity

Debt: Contract to borrow money for a xed period, vs. Equity: Contract to borrow money with no promise on repayment. Debt is in the form of loans or bonds, vs. Equity is in the form of internal equity or external equity (shares). Debtholders are called creditors, vs. Equityholders are called shareholders. Debt: Creditors have to be repaid irrespective of whether the project succeeds, vs. Equity: Repayment is conditional on whether the project succeeds. If it is successful, the shareholders get a part of the prot. Debt: Creditors hope to get a xed return from investing in the rm, irrespective of how successful the rm is, vs. Equity: Shareholders get a return that is a function of how successful the rm is.

Susan Thomas

An introduction to debt and equity

Fundamental relationships in the corporation

Debt is the senior claimant on the prots of the rm: If the rm produces any cash, the debt gets paid rst. Equity is the junior claimant: If there is cash leftover after debt has been serviced, it goes to equity. Debt has claims on the assets of the rm, when under dispute. Equity has control about how the rm is run.

Susan Thomas

An introduction to debt and equity

Data sources to understand debt and equity of a rm

Susan Thomas

An introduction to debt and equity

Measurement of debt and equity

The corporation as the rm is now the backbone of production in the modern economy. Data about individuals and their preferences: Household survey datasets. Here, we depend up on the sincerity of the person lling out the form. Data about rms: Balance Sheet (BS) and Prot&Loss (PL) accounts published by rms. These are mandated by the government for a limited liability company. When a company lists on an exchange, there are disclosure norms that it has to follow. Accounting standards inuence the minimum quality of the data. With all these checks and balances in place today, there could be wilful obfuscation, but random errors will be seldom.

Susan Thomas An introduction to debt and equity

Example of understanding the accounts of a rm

Suppose we setup our rm with Rs.100 of equity and Rs.100 of debt. Specically, we issued 100 bonds at Rs.1 each and 1000 shares at Rs.0.1 each. (These counts are mere numeraire). Now our rm has liabilities (of two kinds) of Rs.200. We use this war-chest of Rs.200 to build a factory. The factory is our asset. Accounting identity: Total assets = total liabilities.

Susan Thomas

An introduction to debt and equity

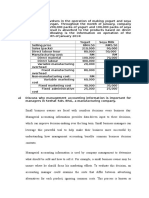

Example: starting point Assets & Liabilities

Assets Factory 200 Total 200

Liabilities Equity 100 Debt 100 Total 200

Susan Thomas

An introduction to debt and equity

Example: The balance sheet

This table is called the balance sheet, or BS. It is a statement about stocks. It uses the valuation at the time the assets/liabilities were contracted. It is true at a point in time. In principle, you could make the BS every day or every minute. In India, the BS is disclosed on 31 March every year. Internationally, the BS is disclosed every quarter. There is a move towards Indian rms disclosing their BS every quarter as well.

Susan Thomas

An introduction to debt and equity

Example: Accounting for the rm at the end of a year

Suppose, in the rst year of operation of this factory, we spend Rs.20 on salaries and Rs.50 on raw materials. Suppose we pay out Rs.10 as interest on debt. Total expenditure = Rs.80. Suppose we manage to sell the goods for Rs.100 This yields prot of Rs.20. This is the prot & loss or PL sheet.

Susan Thomas

An introduction to debt and equity

Example: What happens to the prot?

First, income tax has to be paid - e.g. Rs.7 out of Rs.20 goes away. The managers of the rm have to decide what to do with the remaining Rs.13. If the rm has bright prospects, they may choose to reinvest into the company. If the rm has bad prospects, they may choose to pay out the money to the owners personal accounts. Or some mixture of payout and retention.

Susan Thomas

An introduction to debt and equity

Example: From P&L to BS

Suppose the managers decide to payout Rs.3 and reinvest Rs.10. Then a dividend of Rs.3 gets paid out to the shareholders. There are 1000 shares, which means a dividend of Rs.0.003 per share. Rs.10 goes back into the BS.

Susan Thomas

An introduction to debt and equity

Example: The BS one year out

Assets Factory 200 Cash 10 Total 210

Liabilities Equity 110 Debt 100 Total 210

Susan Thomas

An introduction to debt and equity

BS vs. P&L

The BS is about stocks. The P&L is about ows. The BS holds at a point in time. The P&L is about any time interval. In India, the BS is disclosed at the end of every nancial year (March end of every year). The P&L is disclosed at the end of every nancial quarter (end June, end September, end December).

Susan Thomas

An introduction to debt and equity

HW: Adopting a rm of your own

Familiarise yourself with the CMIE Prowess database. Pick a non-nancial rm with market value (market capitalisation) in excess of Rs.1000 crore. Make a simplied BS for 2008-09 and 2009-10. Make a simplied P&L for 2009-10. Trace the ow of resources between the two nancial years. Note: Try to ensure that you pick a unique rm among you.

Susan Thomas

An introduction to debt and equity

You might also like

- Postscripts On The Fundamentals of Corporate FinanceDocument6 pagesPostscripts On The Fundamentals of Corporate FinancebehcetNo ratings yet

- BM Finance Notes PDFDocument10 pagesBM Finance Notes PDFApurva SunejaNo ratings yet

- The Cost of Capital: OutlineDocument10 pagesThe Cost of Capital: OutlineNikhil GandhiNo ratings yet

- Ernest and Young Interview QuestionsDocument57 pagesErnest and Young Interview QuestionsPratyush Raj Benya100% (2)

- Rangkuman Struktur Modal 1Document4 pagesRangkuman Struktur Modal 1Nor MaulidaNo ratings yet

- Sem Fin Case I - Finance Sem Fin Case I - FinanceDocument20 pagesSem Fin Case I - Finance Sem Fin Case I - FinanceMubarrach MatabalaoNo ratings yet

- Financial Distress - Meaning, Causes, and Evaluation of Financial Distress Using Different ModelsDocument19 pagesFinancial Distress - Meaning, Causes, and Evaluation of Financial Distress Using Different ModelsRajeev RanjanNo ratings yet

- The ABC of Financial ManagementDocument2 pagesThe ABC of Financial ManagementPabloNo ratings yet

- Capital Structure PlanningDocument5 pagesCapital Structure PlanningAlok Singh100% (1)

- Leverage Unit 4 FMDocument12 pagesLeverage Unit 4 FMSHIVANSH ARORANo ratings yet

- Understanding Balance Sheets & Profit & Loss Statements: InsightsDocument5 pagesUnderstanding Balance Sheets & Profit & Loss Statements: Insightsrahulme43No ratings yet

- Debt Vs EquityDocument10 pagesDebt Vs EquityKedar ParabNo ratings yet

- Financial Leverage and Capital Structure PolicyDocument21 pagesFinancial Leverage and Capital Structure PolicyRashid HussainNo ratings yet

- Introduction To Corporate Finance - Mcgraw-HillDocument18 pagesIntroduction To Corporate Finance - Mcgraw-Hilldelifinka100% (2)

- Week 3Document17 pagesWeek 3shreyaNo ratings yet

- Unit 4 - RevisionDocument19 pagesUnit 4 - Revisionhalam29051997No ratings yet

- Chapter 26Document6 pagesChapter 26Nguyễn TâmNo ratings yet

- Bond ValuationDocument24 pagesBond ValuationFadhlanMuhtadiNo ratings yet

- FIN3212 Lecture (Topic 1)Document10 pagesFIN3212 Lecture (Topic 1)Ooi Kean SengNo ratings yet

- Topic 9 Lecture Additional NotesDocument28 pagesTopic 9 Lecture Additional NotesNguyễn Mạnh HùngNo ratings yet

- The Cost of Capital: OutlineDocument11 pagesThe Cost of Capital: OutlineVelmuruganKNo ratings yet

- Answers To Review QuestionsDocument16 pagesAnswers To Review QuestionsNGỌC MAI PHANNo ratings yet

- Cost of Structure - Yudit OktaneldanoraDocument52 pagesCost of Structure - Yudit OktaneldanorayuditoktanelNo ratings yet

- BD SM01 Final SN GeDocument3 pagesBD SM01 Final SN GeSharon Huang ZihangNo ratings yet

- Accounting 202 Notes - David HornungDocument28 pagesAccounting 202 Notes - David HornungAvi Goodstein100% (1)

- BA Outline - Shepherd Spring 09Document61 pagesBA Outline - Shepherd Spring 09ttonkanggNo ratings yet

- Dividend Policy and Capital StructureDocument9 pagesDividend Policy and Capital StructureMasud IslamNo ratings yet

- Questions DuresDocument25 pagesQuestions DuresAnna-Maria Müller-SchmidtNo ratings yet

- Leverage RatioDocument5 pagesLeverage RatiopeptideNo ratings yet

- Capitolo 5 Financial - StatementDocument15 pagesCapitolo 5 Financial - StatementAlessandro LucianiNo ratings yet

- ClusterDocument51 pagesClusterErrol LuceroNo ratings yet

- Slide 1Document17 pagesSlide 1Vishal BhadaneNo ratings yet

- Optimal Capital StructureDocument7 pagesOptimal Capital StructureAshley Charles Jenner100% (1)

- Ratio Analysis: Objectives: After Reading This Chapter, You Will Be Able ToDocument19 pagesRatio Analysis: Objectives: After Reading This Chapter, You Will Be Able ToDanish KhanNo ratings yet

- Finance Dossier FinalDocument90 pagesFinance Dossier FinalHarsh GandhiNo ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- 1 - Financial DecisionsDocument9 pages1 - Financial DecisionsByamaka ObedNo ratings yet

- Capital Structure and Dividen PolicyDocument23 pagesCapital Structure and Dividen PolicyChristian DavidNo ratings yet

- Acct 504 Exam Question GuideDocument15 pagesAcct 504 Exam Question Guideawallflower1100% (1)

- Finance Interview QuestionsDocument40 pagesFinance Interview QuestionsOmkar JangamNo ratings yet

- Financial AccountingDocument47 pagesFinancial Accountinghuu nguyenNo ratings yet

- Transcription+Document +Balance+Sheet +Structure+and+AnalysisDocument7 pagesTranscription+Document +Balance+Sheet +Structure+and+AnalysisShafa IzwanNo ratings yet

- Complete FinanceDocument5 pagesComplete FinanceKappala AbhishekNo ratings yet

- Topic 8 - CH 11 Answer Guides JNDocument6 pagesTopic 8 - CH 11 Answer Guides JNEunice WongNo ratings yet

- Corporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationDocument255 pagesCorporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationAnisha GanguliNo ratings yet

- MODUL 11 Capital StructureDocument24 pagesMODUL 11 Capital StructureMentally Ill SinnerNo ratings yet

- Debt Reckoning: Importance of Looking at DebtDocument3 pagesDebt Reckoning: Importance of Looking at Debthafis82No ratings yet

- Lec 6 AFM Fin Statement AnalDocument44 pagesLec 6 AFM Fin Statement AnalHaroon Rashid100% (1)

- Financial ManagementDocument8 pagesFinancial ManagementManjeet SinghNo ratings yet

- Corporate Finance 1Document5 pagesCorporate Finance 1kmandeepkumar1994No ratings yet

- Case StudyDocument13 pagesCase StudyRaenessa FranciscoNo ratings yet

- DCF Caveats in ValuationDocument23 pagesDCF Caveats in Valuationricoman1989No ratings yet

- A Money-Making Machine: Partnership Net AssetsDocument2 pagesA Money-Making Machine: Partnership Net AssetsRoberto TanakaNo ratings yet

- CHAP.-1 BASIC ACCOUNTING TERMINOLOGY FinalDocument17 pagesCHAP.-1 BASIC ACCOUNTING TERMINOLOGY FinalPurva ChaudhariNo ratings yet

- Aefman Module 1 5Document28 pagesAefman Module 1 5TUGADE, AMADOR EMMANUELLE R.No ratings yet

- 6th Sem FM Capital Structure by Sandip Bhattacharya-15-4-15Apr2020Document19 pages6th Sem FM Capital Structure by Sandip Bhattacharya-15-4-15Apr2020rehan husainNo ratings yet

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsFrom EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsNo ratings yet

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- BFMSDocument2 pagesBFMSRajat SinghNo ratings yet

- First Resources Initiating Coverage CIMBDocument27 pagesFirst Resources Initiating Coverage CIMBLee Jie YangNo ratings yet

- BBAP2103 Management AccountingDocument4 pagesBBAP2103 Management AccountingTeam JobbersNo ratings yet

- Kelloggs PLCDocument2 pagesKelloggs PLCManish KalamkarNo ratings yet

- A Study On Investment Planning and Fund RaisingDocument16 pagesA Study On Investment Planning and Fund RaisingAnonymous XP1PwdXNo ratings yet

- Republic v. COCOFED (G.R. No. 147062-64) CASE DIGESTDocument3 pagesRepublic v. COCOFED (G.R. No. 147062-64) CASE DIGESTEricha Joy GonadanNo ratings yet

- R&R 2014 AccountsDocument78 pagesR&R 2014 AccountsBadGandalfNo ratings yet

- Matlab Real-Time Trading PresentationDocument25 pagesMatlab Real-Time Trading Presentationloafer555No ratings yet

- As Level Accounting Topic 1 OddDocument45 pagesAs Level Accounting Topic 1 OddShoaib AslamNo ratings yet

- The Bank of Nova ScotiaDocument18 pagesThe Bank of Nova Scotiakash32192No ratings yet

- BUSINESS FINANCE - BDO BankDocument11 pagesBUSINESS FINANCE - BDO BankCarmela Isabelle DisilioNo ratings yet

- Trust Document ExampleDocument5 pagesTrust Document Examplemakintoch1100% (3)

- SALWA Business PlanDocument62 pagesSALWA Business Planسلوئ اءزواني عبدالله سحىمىNo ratings yet

- New Venture Development Process-TruefanDocument34 pagesNew Venture Development Process-Truefanpowerhanks50% (2)

- Subprime Mortgage CrisisDocument35 pagesSubprime Mortgage CrisisParaggNo ratings yet

- Teece Et Al-1997-Strategic Management JournalDocument25 pagesTeece Et Al-1997-Strategic Management JournalAsna UswatunNo ratings yet

- Thesis On System Analysis and DesignDocument68 pagesThesis On System Analysis and DesignAnna Rose Mahilum LintagNo ratings yet

- Oman Business GuideDocument17 pagesOman Business GuideZadok Adeleye50% (2)

- Trade During The Industrial Revolution - EditedDocument3 pagesTrade During The Industrial Revolution - EditedJames YangNo ratings yet

- Company Analysis Siemens AgDocument17 pagesCompany Analysis Siemens Agfriend_foru2121No ratings yet

- Securities Regulation OutlineDocument27 pagesSecurities Regulation OutlineWaseem Barazi100% (2)

- CIMA Financial Accounting Fundamentals Past PapersDocument107 pagesCIMA Financial Accounting Fundamentals Past PapersAnonymous pwAkPZNo ratings yet

- Financial Institutions and Markets - Foreign Exchange MarketsDocument19 pagesFinancial Institutions and Markets - Foreign Exchange MarketsSiddhartha saiNo ratings yet

- Using Excel For Business AnalysisDocument5 pagesUsing Excel For Business Analysis11armiNo ratings yet

- ESSIDocument9 pagesESSIUpendra RaoNo ratings yet

- Export Consultancy Services Slides by Sandeep GourDocument28 pagesExport Consultancy Services Slides by Sandeep Goursss.sss100% (2)

- ACT349 F13 Assignment and Solutions For Sep 25 Tutorial v12Document10 pagesACT349 F13 Assignment and Solutions For Sep 25 Tutorial v12Crystal B. WongNo ratings yet

- Cat Level Di (Solution) Www.Document25 pagesCat Level Di (Solution) Www.aravind174No ratings yet

- ITC Report of AuditorsDocument3 pagesITC Report of AuditorsRajavati NadarNo ratings yet