Professional Documents

Culture Documents

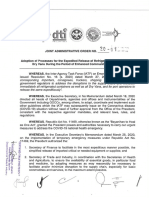

Port Special Breakbulk Eng

Uploaded by

marineconsultantOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Port Special Breakbulk Eng

Uploaded by

marineconsultantCopyright:

Available Formats

Port

o C to B e R 2 0 0 9

special

Rot teRda m BReaKBULK poRt

A varied impression of how the Port of Rotterdam anticipates the near and distant future

Rot te R da m S te e L p o Rt! J Um Bo C R e ateS ItS oW N m a R K e t FRU It o N tH e m oV e

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

CoLopHoN

CoNteNtS

Port Special is a business-to-business publication of the Port of Rotterdam Authority. Please contact our Marketing Communication Department with any questions or suggestions you may have regarding the contents. Copy Rob Wilken (editor-in-chief), Rob Schoemaker Translation Dean Harte, Niall Martin Photography Eric Bakker Layout Smidswater Printing Nieuwsblad Transport Chief editor Port of Rotterdam Moni Otte Port of Rotterdam Authority The aim of the Port of Rotterdam Authority is to enhance the port of Rotterdams competitive position as a logistics hub and world-class industrial complex. Not only in terms of size, but also quality. The core tasks of the Port Authority are to develop, manage and run the port in a sustainable way and to maintain a speedy and safe service for shipping. Facts and figures for the Port Authority and the port of Rotterdam: Port Authority: 1200 employees, turnover approx. 450 million euro. www.portofrotterdam.com Port area: approx. 10,500 ha (5,000 ha of which commercial sites, 3,500 ha water and 2,000 ha rail lines, roads, service corridors and greenery).

04

Rotterdam Steel Port!

The global transport of steel is expected to considerably grow in the future.

06 07 08 09 12 16 18 19 22 23 24

Open in autumn 2009! Full steam ahead for Stena Wonder Wheels Specialist in exeptional projects Market leader in forest products Breakbulk and RoRo terminals Non-ferrous metals are serious business For now and in the future All encompassing steel and metal logistics Service menu full of added value Antwerp has the reputation, Rotterdam the possibilities Matchmaker for supply & demand New lan in old port erea At your service! Trump card inland shipping Your partners in business

10

Fruit on the move

Fruit terminal operator Seabrex is undergoing major changes.

INtRodUCtIoN

Does the vessel call at the port because of the cargo, or do cargoes come to the port because of the ship? Its the old chicken & egg dilemma that features prominently in this Breakbulk Special. As so often, the truth will no doubt lie somewhere in between. Whatever the outcome, it makes no difference to us at the Port of Rotterdam Authority. Our mission is to pull together with port companies to make Rotterdam as attractive as possible for all the logistical chains in the breakbulk sector. From the North Sea into the European interior and vice versa: our aim is to always be the port of choice for every player, offering clear added value. Although maybe breakbulk doesnt spring into mind first when Rotterdam is mentioned, a lot has happened in the past few years which clearly puts the port on the map as a breakbulk port. For a number of years now we have been working flat out on upgrading our offering for steel, non-ferrous metals, fruit, forest products, automotive, heavy lift and project cargoes. This magazine features many of the successful cases so far. Of course the current economic crisis has also hit the port. These are difficult times for everyone. But Rotterdams strength is in part due to the willingness of the Port Authority and private port enterprises to continue to invest - even now. The companies featured in this magazine are excellent examples of this, but theyre certainly not the only ones. Together we are readying Rotterdam breakbulk port for a sustainable future with optimal services provision at all times. Emile Hoogsteden Director Containers, Breakbulk & Logistics, Port of Rotterdam Authority

14

The future of breakbulk lies in Rotterdam

About a quarter of a century ago, the future of breakbulk seemed far from rosy in the port of Rotterdam.

The length of the port area is approx. 40 km. Direct employment: over 70,000 jobs. Goods throughput: over 400 million tonnes of goods per annum. Shipping: approx. 34,000 ocean-going vessels and 133,000 inland vessels per annum. No rights can be derived from this publication. For more information: P.O.Box 6622, 3002 AP Rotterdam, The Netherlands T +31 (0)10 2521010 F +31 (0)10 2521020 E info@portofrotterdam.com www.portofrotterdam.com

26 27 28 30 31

20

Jumbo creates its own market

Jumbo has added a new dimension to the provision of logistics services.

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

RotteRdam SteeL poRt!

The global transport of steel is expected to considerably grow in the future. In anticipation of this, Rotterdam is investing substantially in new facilities and services. With that, the port is explicitly gaining a foothold as an alternative European steel hub.

pHoto

Full speed ahead Its full speed ahead for Rotterdam Steel Port. Eric Oosterom, General Manager of DFDS Multi Terminal, Yvonne Kagchelland, Director Stevedoring & Logistics Operations at C. Steinweg Handelsveem and Frank van der Gevel, Managing Director of Broekman Distriport (from left to right) are ready to in mutual competition direct as much steel as possible through Rotterdam.

Eric Oosterom, Yvonne Kagchelland and Frank van der Gevel

Rot te R da mS Ste e L StR ate gY

According to the vision of Rotterdam, there are three major trends which will fuel the global transport of steel. Globalisation is the first one. Yvonne Kagchelland, director Stevedoring & Logistics Operations at C. Steinweg Handelsveem: The production of steel will increasingly shift from Europe to emerging countries where the costs are lower and environmental legislation is less stringent. Major new production countries are China currently already responsible for 50 percent of all global production India and Brazil; Turkey and Russia are also gaining ground in this respect. From Brazil, for example, so-called slabs a semi-finished steel product will soon be transported to ThyssenKrupp in Germany via the new Steinweg Deepsea Steel Terminal in Rotterdam (see page 6). This kind of steel transport, which partially replaces the transport of iron ore, also holds an additional benefit in terms of shipping. Kagchelland: Where bulk carriers are more limited to find return cargo, the multi-purpose ships can flexible be used for general export cargo.

The three trends combined will in the future inevitably result in the further growth of cargo flows. In 2005, this spurred the Port of Rotterdam Authority to designate steel as a spearhead within the breakbulk sector. In conjunction with the business community, a strategy has been developed aimed at globally promoting Rotterdam as a steel port. The two-stage rocket launched to this extent consisted of the acquisition of new cargo to fuel the already existing port capacity of 5 million tonnes and, with the future in mind, the creation of new space. Each from their own visions and strengths, companies have picked up this challenge, with the Steinweg Deepsea Steel Terminal, Broekman Distriport and DFDS Multi Terminal being the most prominent examples. With a strong focus on the long term, Rotterdam is ready to annually handle 8 million tonnes of steel extra.

Lo g IS tI C a L H U B S peC I a L ISatI o N a N d Co N S o L I datI o N

A second trend in the steel industry is specialisation. In order to achieve higher margins in relation to the low-value mass production from China, steel producers are focusing on specific niche markets such as high-end products (SSAB), the automotive industry (Thyssen Krupp) and pipes and tubes (Valourec Mannesmann). Eric Oosterom, General Manager of DFDS Multi Terminal. For the foreseeable future, quality will continue to be one of Europes distinguishing strengths. The trends of globalisation and specialisation will subsequently lead to consolidation as well. Due to historical reasons, the steel industry is pretty fragmented. For strategic reasons, each country used to have its own steel production. Through the acquisition of a large number of these national darlings Arcelor Mittal has by now developed into a real and by far the largest steel multinational. A further consolidation among steel producers, for example in China, can be expected.

An additional advantage for Rotterdam in this current economically difficult climate is that companies in the steel industry are even more critically scrutinising their logistics costs. The port offers clear advantages in this respect. Rotterdam is situated directly on the North Sea, which saves hours of sailing time compared to ports which are situated more inland. With a depth along the quay of up to 16.65 metres, the terminal operators can receive the largest steel carriers without any restrictions related to locks or tides. Furthermore, the port has a highly extensive feeder system. This makes Rotterdam an ideal hub for the onward European distribution of, for example, Asian steel to the UK, Scandinavia, the Baltic, Iceland, etc. In terms of transport across the European continent, inland shipping constitutes an unbeatable trump card. With one single inland barge, substantial volumes of steel can be taken deep into Europe. And thanks to the new dedicated Betuweroute cargo railway line to Germany, rail is also offering increasingly more possibilities. Frank van der Gevel, Managing Director of Broekman Distriport: It is the overall scale of Rotterdam that makes us strong.

e x tR a e FFo RtS

In addition, the Port Authority is exercising extra efforts to bind shipping lines, cargo owners and traders to Rotterdam and to match them to one another, also in terms of imports and exports (also see page 26). As a quality port, the ambition is to provide each of the many players in the steel chain with the best possible logistics solutions. An additional plus in that respect is that the leading London Metal Exchange (LME) has now also certified Rotterdam for the storage of steel. Van der Gevel: Partially because of the economic crisis, purchasing patterns are

changing. Companies are more critical as regards their stocks and they are to a greater degree turning to third parties for storage. From there, it is important that the steel can quickly and flexibly be moved to the customer. Furthermore, companies in Rotterdam are continuously investing in the education and training of their people. After all, the treatment of steel is truly a specialised field that should be done properly and safely. People make the difference, says Oosterom about this. Recently, we therefore once again offered all our staff on the quay a ten-day course. The flexibility with which dock workers can be deployed makes Rotterdam even more attractive in that respect. They wont tell you no in Rotterdam.

tHeY WoNt teLL YoU No IN RotteRdam

6 The Steinweg Deepsea Steel Terminal does justice to its name. With a depth along the quay of 16.65 metres, mini Capesize vessels of up to 130,000 tonnes dwt will be able to call at the terminal 24 hours a day without being hampered by tidal restrictions and locks. In addition, it takes a ship a mere hour and a half to get from the North Sea to the quay. That is significantly shorter than in other ports in Western Europe. After a long period of preparation, Steinwegs Yvonne Kagchelland is therefore eagerly anticipating the opening of the terminal. As a steel port, Rotterdam will soon be able to offer required capacity.

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

opeN IN aUtUmN 2009!

Steinweg Deepsea Steel Terminal ~ 12 hectares in size ~ 500 metres of quay ~ 16.65 metres depth along the quay ~ 5 million tonnes of handling capacity

FULL Steam aHead FoR SteNa

From Rotterdam, Stena Line maintains three services to the UK. Two of these services (Harwich and Killingholme) have the terminal on the north bank of the port at Hoek van Holland as their starting point and terminus; the third service sails between the terminal on the south bank in Europoort and Harwich. The latter has been a full member of the Stena family since the autumn of 2008. Although Stena already took over the route Europoort Felixstowe from P&O Ferries in 2002 (and changed the port of call to Harwich), the stevedoring services at Europoort were still carried out by this fellow ferry operator until last year. De Lange: With the Europoort terminal under our own management, we can operate more flexibly and cost-efficiently. We invested 8 million euros in taking over and upgrading the facilities. In 2010, the Port of Rotterdam Authority will in addition start with the necessary renewal of the quay walls. This investment, involving approximately 20 million euros, will be implemented in such a manner that Stena will have the option of adding a second berth here from 2013 on.

L aU N C H I N g C US tom e R

In November 2009, the Steinweg Deepsea Steel Terminal at the Maasvlakte will come on stream. From that moment on, the port company C. Steinweg - Handelsveem will hold a major new deep-water trump for the state-of-the-art handling of steel products. Director of Stevedoring & Logistics Operations Yvonne Kagchelland: Rotterdam will soon be able to offer sufficient capacity for the steel industry.

When all is said and

The new Steinweg Deepsea Steel Terminal is a joint greenfield investment of the Port of Rotterdam Authority and C. Steinweg - Handelsveem, which was established in Rotterdam in 1847. Thyssen Krupp Steel will serve as the launching customer and has committed itself for a period of ten years. To provide its steel mills in Germany with additional raw materials, the steel producer will use the new terminal to import slabs a semi-finished steel product from Brazil.

done, the location of Rotterdam in relation to the UK simply cannot be beaten

FU L LY I Nte g R ate d

Thyssen Krupp will fully integrate the Steinweg Deepsea Steel Terminal in its logistics chain. In Brazil each slab will be fitted with a tag containing all relevant data. This tag can subsequently be read by means of RFID at each critical point up to the steel mill in Germany. The new Rotterdam terminal will be fully equipped with RFID technology for this as well. Its not the only innovation though. Kagchelland: On the waterside, we will work with four gantry cranes which will discharge the slabs, with a maximum weight of 36 tonnes, from the vessels using magnets. The trains bound for Germany are also loaded with fork-lift trucks fitted with these magnets.

U N SU R pa SS e d Lo C atI o N

e N V I Ro N m e Nt- FR I e N d LY

pHoto

Pim de Lange

IN ItS CapaCItY aS a SteeL poRt, RotteRdam WILL SooN Be aBLe to oFFeR ReqUIRed CapaCItY

In terms of hinterland transport, the slabs will be moved by inland shipping and by rail, adds Kagchelland to the list of unique features. This has been contractually established with the Port of Rotterdam Authority. To this extent, the Steinweg Deepsea Steel Terminal will have an own rail connection with direct access to the Betuweroute to Germany.

Shore-side electrical power for clean environment Stena Line and the Port of Rotterdam Authority are working together in a project to supply the future ferries with shore-side electrical power in the port instead of using the ship generators for electricity. This saves a lot of fuel and is good for the environment. De Lange: We have just approved the necessary additional investments to the ships for this.

5 m I L L I o N to N N eS

With the initial Thyssen Krupp volumes, the Steinweg Deepsea Steel Terminal has far from reached its maximum handling capacity of 5 million tonnes per year. Kagchelland: Taking our comprehensive customer-oriented service as our starting point, we as Steinweg will actively focus on the acquisition of new import and export volumes.

Sooner or later, the market will invariably pick up again, says Pim de Lange, Area Director North Sea of Stena Line, with firm conviction. By means of new ferries and an upgrade of one of its two Rotterdambased RoRo terminals, the ferry operator will be fully ready for this market recovery. When all is said and done, the location of Rotterdam in relation to the UK simply cannot be beaten.

Whether Stena Line will immediately utilise this option for a second berth depends on how the market develops. RoRo transport to the UK has been severely affected by the economic crisis. De Lange: Nobody knows exactly when, but at some point the market will recover. The UK is home to some 65 million consumers. Because of the crisis and the weak pound, they have started to drastically economise. But that will not be the case forever. In addition, I expect that the Olympic Games of 2012 in London will have a positive impact; a lot still needs to be constructed for that. The Area Director North Sea has no doubt whatsoever that Rotterdam still is and will continue to be the ideal RoRo port for the UK. Especially for RoRo cargo to and from London and everything north of this city, the geographic location of Rotterdam is unsurpassed; also in relation to Germany, for example, where a lot of cargo originates from.

N e W Fe R R I eS

In anticipation of that future growth, Stena has four ferries on order to replace current capacity: two in Germany, whereby the delivery date is uncertain at the moment due to problems with the shipbuilding yard, and two in Korea, which will be delivered in 2011. Combined, an investment of more than 600 million euros is involved. In view of the current market situation, the new vessels however are not really necessary at the moment. De Lange: But when the market picks up again and that will happen we will definitely need them.

pHoto

The new Steinweg Deepsea Steel Terminal

8 RHBs owner-director Peter van der Pluijm isnt one to hog the limelight. But when the talks turns to his Liebherr LHM 600 S mobile crane acquired last year, he beams with pride. And rightly so. The 78 metres high yellow crane is an imposing sight. Whats more, with its 13 axles and 104 wheels the crane is also extremely mobile. It can shift position on the quay in no time. And despite its enormous size and weight it tips the scales at no less than 600 tonnes this giant works with centimetre precision, irrespective of what its carrying. Impressive statistics, but of course, ultimately, its the added value that counts. Van der Pluijm: Alongside our eight multi-purpose cranes capable of hoisting 55 tonnes we have plenty of work for this crane. Theres a great range of project cargoes of up to 200 tonnes. At RHB were now able to handle those kinds of cargoes quickly and flexibly ourselves. However, the easy availability of floating sheerleg cranes with a hoist capacity of up to 1500 tonnes is still also an important plus point for Rotterdam port, Van der Pluijm emphasises. Of course we happily hire those cranes when necessary.

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

specialist in exceptional projects

Effectively the name says it all: Broekman Project Services offers a complete service for special and unusual cargoes. For many customers, its combination of a multipurpose terminal with a heavy-lift centre offers significant added value. Thats why talks are underway with the Port of Rotterdam Authority on further expansion.

WoNdeR WHeeLS

For close on eighty years RHB Stevedoring & Warehousing in Rotterdams Waalhaven has specialised in breakbulk, heavy lift and project cargoes. The acquisition in 2008 of a mobile port crane capable of lifting up to 208 tonnes has added a further dimension to the range of services that the family-owned concern offers its international clientele.

10 0 pe RC e Nt Ste V e d o R e

RHB concentrates exclusively on handling and storage. Prior and onward transport is left to the customers via RHBs own rail link, inland barge or truck. Van der Pluijm: That makes us attractive to forwarding companies. We are no way a competitor. In the small world of heavy lift and project cargoes RHB is a well-known name for many of them. The same holds true for heavy lift shipping companies such as BigLift, Spliethoff, SAL, Beluga and Coli. Broekman Project Services is located at the entrance to the Waalhaven. Using the facilities of the former shipyard and machinery factory RDM, the company offers a unique combination of maritime and highquality semi-industrial services. Commercial manager Hans Kriek explains: We operate a multi-purpose terminal which is flanked by a heavy lift centre equipped with a 750 tonne overhead crane for the execution of all possible operations with regard to heavy lift and project cargoes. This could be components for a power station, ships engines... You name it. they have all the materials they require and will even book accommodation for them if necessary as well as taking care of the paperwork.

B I g I N Sto R ag e

Broekman Project Services Multi-purpose terminal with 280 metres of quay, draught of 10.5 metres, four cranes (max. 45 tonnes) and 4000 m of covered storage; Heavy lift centre with close on 23,000 m of hall and overhead cranes (max. 750 tonnes).

Heavy lift and project cargoes constitute around 50 percent of the volumes handled by RHB. The other half comprises mainly steel and non-ferrous metals. Our warehouses are LME-certified to store such cargoes, says Van der Pluijm. All in all, we have more than 15,000 square metres of covered storage and a further 30,000 square metres in the open air. Of that weve strengthened a part specially in order to store heavy loads.

e xC e L Le Nt Co o pe R atI o N

FRom a to Z 80 Y e a R S

Broekman Project Services regards each cargo to be handled as a work of art in itself. The challenge every time is to realise the clients specific wishes at the best possible price. Broekmans clients are diverse, and include many major heavy lift shipping companies such as Rotterdams Jumbo, which is a frequent visitor.

Founded by Van der Pluijms grandfather, RHB is due to celebrate its 80th anniversary in 2010. This venerable old age doesnt prevent the company from constantly updating and improving its services provision. The multimillion euro purchase of the mobile crane is visible proof of that, but theres more: In consultation with the Port of Rotterdam Authority we have been able to expand the site flanking our 730 metres of quay by 10 percent to create extra space for the storage of heavy loads, Van der Pluijm explains. Next year we also plan to demolish one of our older warehouses and replace it with a new one that will be much taller and larger.

A random example Kriek recalls is the skid for offshore measuring 14 by 8 by 12 metres (length, breadth, height), that was put together in the heavy lift centre over a period of ten months as part of a bigger project (see photo). This morning the colossus was transported to the terminal and hoisted by a floating sheerleg crane onto a pontoon for onward transport to the client. Kriek: All the facilities pertaining to these sorts of projects and often much bigger ones we can execute or organise, such as on and offloading, storage, assembly, packaging and onward transport. We dont have any technical staff in house for the assembly activities, theyre most of the times despatched by the customer. However, we do ensure

e x pa N S I o N o N tH e C a R dS

Broekman Project Services hopes to further expand on the unique opportunities offered by the heavy lift centre in the future. The current facilities are flanked by several more old factory buildings. Under Rotterdams ambitious urban renewal scheme the sites designation however remained uncertain for quite some time. Meanwhile the municipal authorities have decided to develop the so-called RDM East site as a maritime industrial zone. Kriek: Talks are well underway with the Port of Rotterdam Authority on how we can further extend our services provision here.

pHoto

Peter van der Pluijm

10

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

11

eaCH tYpe oF FRUIt ReqUIReS ItS oWN optImaL tempeRatURe

FRUIt oN tHe moVe

pHoto

Herman de Knijf

Fruit terminal operator Seabrex is undergoing major changes. Increasingly fruit and vegetables are being shipped in containers, the company has recently come under new ownership and it is also conducting talks aimed at relocating the existing fruit cluster on the ports north bank to the south bank within the next few years. For a successful future we need further economies of scale.

Of the 800,000 tonnes of overseas fruit and vegetables we handle annually, more than half now arrives by container, calculates Seabrex Managing Director Herman de Knijf. As in other sectors, the company is seeing more and more containerisation. Broadly speaking we receive fruit and vegetables in three different ways: either by conventional reefer with breakbulk in the hold and containers on deck, or by small container vessels purpose-fitted for reefers, or via the major deep-sea container shipping lines. For the latter we fetch the reefer containers from the container terminals by truck or inland barge. In a good year, well handle some 20,000 to 25,000 containers. But we too have been hit by the downturn. De Knijf sees containers continuing to grow their share of the fruit logistics market in the future. And then Im talking about several tens of percent more, he says. Prior to onward distribution Seabrex stores all incoming fruit and vegetables in one of its many climate controlled warehouses, which together account for a total area of 270,000 square metres. De Knijf: Each type of fruit requires its own optimal temperature.

Rot te R da mS m a J o R StR e N gtH

Rotterdams major strength is that it offers the possibility of combining the various fruit and vegetable flows here in the region, De Knijf adds. Imports from overseas, local produce and incoming produce by road from southern Europe: it all gets shipped out in a single package to European supermarkets. The region numbers a large concentration of traders. An estimated 1500 trucks leave here daily, of which eighty percent are bound for destinations over the Dutch border. Not one of those trucks leaves half-empty. A truck loading local produce in the Westland or in Barendrechts trade centre (both on Rotterdams outskirts, ed.) in the morning will go on to load up overseas produce at our terminal or vice versa.

FR eS H Co R R I d o R

The rise of the container in fresh logistics is one of the most important reasons to think about a new concept for handling fresh fruit and vegetables in the port of

Rotterdam in the near future. De Knijf: A further argument is that we will have to make room on the north bank for housing. That said, relocation will above all offer new opportunities, the managing director emphasises. In one step we can convert from the current, first generation fruit terminal to a third generation facility thats purpose built to handle container flows. The concept for this is currently being worked out by Fresh Corridor, a multi-faceted project to improve Dutch logistics for fresh produce. De Knijf chairs the working group which is shaping Rotterdams future fruit centre. The chosen location is a yet to be determined site in the Waal-/Eemhaven area on the south bank. That means proximity to deep-sea and shortsea terminals for container handling so that we can take advantage of existing intermodal connections into the hinterland. As examples he cites the rail shuttles that leave daily from the Rail Service Center Rotterdam bound further inland in Europe and the many container barges calling at the Waal-/Eemhaven. Its a utopia to think that we could fully load a complete ship or train bound for the German Ruhr region with only reefer cargo. But in the Waal-/Eemhaven area we can easily add to existing transports using these modalities. Shortsea also offers new opportunities. De Knijf predicts that imports of fresh produce from southern Europe wont always continue to come by road. Road transport is facing too many restrictions and that makes a switch to shortsea more likely, he says. Outbound this modality also presents opportunities. Instead of vegetables and fruit travelling to Scandinavia by truck, we can top up cargoes on shortsea vessels bound in that direction.

R e Lo C atI o N I N 2 012 o R 2 013

De Knijf believes that a relocation to the south bank can become a reality as early as 2012 or 2013 due in part to the economic crisis that has resulted in greater flexibility on matters normally requiring protracted and tough negotiations. Weve managed to round off two years worth of talks in just twelve months, De Knijf says. However, the green light has yet to be given for the move. For De Knijfs working group, that poses no obstacle. Were still in the conceptual phase to determine how the new fruit centre could look. There are major technological challenges. The idea is based on extensively automated storage in a high-rise warehouse. In working out the design we have to take into account the various temperature requirements per type of fruit and so on, and so forth.

N e W oW N e R

De Knijf expects the new-build terminal on the south bank will require a substantial investment. As such its a good thing that Seabrex was acquired by the Belgian Sea-Invest Group at end-July this year. We have become part of their Belgian New Fruit Wharf (BNFW) division. Theyre committed to our sector, see Rotterdams strength in the field of European fruit logistics and realize that to build a successful future we need further economies of scale.

12

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

13

It is over four decades ago that the Swedish paper giant SCA selected Rotterdam as a logistical hub for its graphic, hygienic and packaging paper products, thus marking the start of Interforest Terminal Rotterdam. The reasons at the heart of this decision excellent maritime access to a substantial market and highquality hinterland connections still hold true forty years later. Over the last decade or so, the paper products have however no longer just been arriving by means of conventional paper ships and RoRo vessels, but also by container. This increasing containerisation has made Rotterdam extra attractive to SCA. The port offers a large range of transhipment possibilities for export to the rest of the world. The long-standing reputation of Rotterdam as regards the treatment of sensitive cargo flows also plays a role, adds director Bob de Lange of Interforest Terminal Rotterdam.

CoSt R e d U C tI o N

Furthermore, cost reduction is always a relevant factor, says De Lange. For the customer, for ourselves. It did not take an economic crisis for us to realise this. What helps is that we have a flexible workforce with which we can absorb both short-term and long-term fluctuations. The entire terminal is geared to efficiency. ITR has adjusted its two container cranes in such a manner that they can also handle conventional cargo. In addition, the terminal is investing heavily in IT support for efficient warehouse management and the integration of data throughout the entire chain. Cost reduction furthermore goes hand in hand with intensive cooperation with customers. Thinking along with them, emphasises De Lange. For example by in consultation with the client and the recipient optimising the shipping units in such a manner that only full trucks and wagons leave the terminal. A lot can be earned and saved by doing this, also at the carbon footprint level a very hot topic in the paper sector. What certainly helps, notes De Lange, is that the increasing containerisation has made the logistics chain more manageable. The cargo can after all arrive in phases and not in an overwhelming flow as is the case with conventional paper ships.

The challenge as regards the handling of paper products is to minimise the chance of damages and to enhance efficiency levels through the rendering of integrated services

The handling of paper products is a specialised field that makes high demands on personnel, equipment and data flows. The physical aspect is still relevant, but our employees also know about information technology and have insight in the specific quality requirements of our customers. Customisation is key.

I Nte R mo da L o pp o RtU N ItI eS

V U L N e R a BL e

SCA Parent company SCA is a vertically integrated enterprise that manufactures paper products for personal hygiene, the graphic arts sector and the packaging industry: from tree to semi-finished and finished product. SCA has 52,000 employees worldwide and a turnover of 13 billion euros.

Market leader in forest products

For the last forty years, Interforest Terminal Rotterdam (ITR) has already been serving as the logistical outpost of Swedish parent company SCA for the handling and distribution of paper products in various stages of processing. Increasingly, other customers are now also appreciating the strategic location, sustainable technological solutions and customised approach.

pHoto

Interforest Terminal Rotterdam ~ 3 million tonnes of handling capacity ~ 18 hectares in size ~ 700 metres of quay ~ Own rail connection ~ Six warehouses with 72,000 m of storage space

Bob de Lange

Within the SCA chain, ITR functions as a logistical hub for raw materials and semi-finished and finished products from Sweden as well as from other parts of the world. The terminal discharges pulp and rolls of paper from conventional paper ships and RoRo vessels, stores containers, takes care of stuffing and stripping them, arranges customs formalities and ensures that the products arrive at their correct destination on time and in the right quantity. Particularly rolls of paper and hygienic paper products are quite vulnerable. Paper rolls are sensitive to bumping, grazing, moisture and temperature fluctuations. This sensitivity has only further increased over time; modern printing presses are making ever greater demands. Hygienic paper products, a growth market for SCA, are a different story. ITR has recently taken a new warehouse into operation to prevent contamination by dust, dirt, birds (!) and weather influences. De Lange: The challenge as regards the handling of paper products is to minimise the chance of damages and to enhance efficiency levels through the rendering of integrated services. With the help of all sorts of innovations, such as smart paper fasteners on fork lift trucks which can pick up a paper roll with exactly the right amount of minimal pressure and special loading and discharging cassettes for conventional ships, ITR has succeeded in substantially reducing damages.

In addition, intermodal transport by rail and barge (now still 6 to 7 percent) offers sustainable opportunities, although there is still a lot of room for improvement in this respect. Initiatives to Italy and Poland are encouraging. De Lange: By now, we are having a block train run from Rotterdam to Poland; in the tender, we have beaten ports which are closer by such as Bremen and Gdynia. What helps is that any return cargo Polish exports can optimally be conveyed via Rotterdam. From a logistics point of view, the expansion of SCA and other customers such as International Paper in the direction of Eastern Europe is presenting us with completely new prospects. And Rotterdam fits in perfectly with this.

mo R e C US tom e R S

Although ITR is a full subsidiary of SCA, 40 percent of the terminals handling activities are carried out for third parties, even competitors. That share is growing. Clearly other parties are also catching on to the benefits of handling their cargo through ITR. The Lange concludes: In addition, we are very keen to broaden our scope by making our terminal more multi-purpose. We have a fully equipped container terminal, complete with reefer connections, but we are also well equipped to handle larger volumes of project cargo and other breakbulk. That of course is very attractive to multipurpose vessels, which only need one stop at our terminal. There are hardly any limitations.

14

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

15 The guarantees the steel company has offered in terms of cargo have made investing in dedicated facilities appealing to everyone, including us. We strive for more of these forms of cooperation in the chain. The logistics chain is constantly coming under more pressure. Instead of just being a cost centre, the port is increasingly becoming of strategic value to parties. Take the added value of the car terminal in Rotterdam, for example, which regularly prepares special promotions for dealers. In this way the car manu-facturer can ship standard cars to Rotterdam and dealers can decide on the last moment what kind of special promotion they want to do. The challenge is committing customers through long term contracts. Customers, be it shippers, receivers or other parties in the supply chain, are increasingly sensitive to such offers as demands regarding the quality and reliability of transportation services and value adding activities further down the supply chain increase. For the breakbulk sector, quality handling in partnership with customers definitely has a lot of potential.

tHe FUtURe oF BReaKBULK LIeS IN RotteRdam

About a quarter of a century ago, the future of breakbulk seemed far from rosy in the port of Rotterdam. Today, the situation however is completely different: full attention is being paid to steel, heavy lift and project cargo, forest products, roll-on roll-off, fresh products, automotive as well as nonferrous metals. Jouke Schaap, Manager of the Breakbulk Department of the Port of Rotterdam Authority, explains why the port is so attractive for these types of breakbulk cargo nowadays. In addition, the future still holds plenty more opportunities.

pHoto

In partnership with our customers, I foresee a bright future

WHat SHoULd I tHINK oF IN teRmS oF LoCatIoN FaCtoRS?

Of course, room for new locations and expansion of existing ones. In addition jointly realising good connections, both within and beyond the port. But also knowledge, for example, which is something that we as the Port of Rotterdam Authority substantially invest in. We are always ready to share the data and information gathered by our research department with the business sector. Furthermore, we support the establishment of specific trainings and education, are at the cradle of a state-of-the-art broadband network throughout the port and encourage entrepreneurs to work together on certain issues. One example of this can be found at the Waalhaven Zuid business park, where entrepreneurs are jointly arranging such matters as security and maintenance.

Jouke Schaap

peRHapS Some HIStoRY to BegIN WItH?

Some 25 years ago, Rotterdam was under the impression that in the future virtually all cargo would be transported in containers. Today, we know better though: containerisation also has its limits; there will always be breakbulk cargo. Some years ago, we as the Port of Rotterdam Authority realised this and accordingly adjusted our policies. The eight-personstrong Breakbulk Department which I head is actively working on giving breakbulk the position in the port which it rightfully deserves. In conjunction with the private business sector, many investments have already been initiated.

There seem to be two main reasons for this combining of cargo types. To start with, there can be advantages of scale from a product point of view. Handling the same kind of product both conventionally and containerised can yield operational efficiencies. A prerequisite for this is that most containers have to be opened and value has to be added to the cargo in one way or another. The second reason is the full service concept that a terminal or shipping line can offer its customers. The future of a large number of breakbulk terminal operators to a certain extent depends on how successfully they manage to combine breakbulk and containers.

BUt ISNt SpaCe a SCaRCe CommodItY IN tHe poRt?

That is true, but in spite of this we do see a lot of opportunities for breakbulk. Activities of this kind do not involve mega-sites and fit in well with environmental standards. Next to reclaiming land and expanding existing locations, we also try to reposition some companies to focus on breakbulk and to redevelop certain areas in the port to become new breakbulk hubs. A prime example is the project we have launched to redevelop the RDM-East site as a metals and project cargo hub. In addition, the direct hinterland of Rotterdam also offers possibilities in this respect. Dordrecht for example would be a perfect location for breakbulk activities and for project cargo which needs prolonged storage, such as parts for a wind farm. All in all, it should be clear that Rotterdam has rediscovered breakbulk. In partnership with our customers, I foresee a bright future.

WHat doeS tHe poRt oF RotteRdam HoW CaN BReaKBULK Compete WItH tHe CoNtaINeR?

The real question here is: how can breakbulk companies offer solutions to customers that outweigh the increasing economies of scale offered by the container? The answer is simple: offer quality handling services that the container sector cannot. Quality handling in this context means offering added value services and customer-dedicated solutions for specific types of products like steel, pulp and paper as well as fruit and vegetables. At the same time, I also think that the traditional barriers between the conventional and containerised handling of cargo are fading. Although breakbulk cargo on a container terminal can often be an operational nightmare, breakbulk terminals are increasingly equipping themselves for the handling of containerised cargo. A similar development can be observed as regards breakbulk and roll-on roll-off vessels.

aUtHoRItY do to maKe tHe poRt expLICItLY moRe attRaCtIVe to tHe BReaKBULK SeCtoR?

The creation of attractive location factors, offering support in the realisation of new hinterland connections, matchmaking between different parties, the promotion of Rotterdam as a breakbulk port and much more. Through business intelligence, business development, acquisition, account management and marketing communications, we offer every company a tailor-made approach. As a port we want to be as competitive as possible in terms of quality and cost. Thats not the same as being a discounter though. Such cargo tends to fall away again just like that. We endeavour to look at the long term. A good example is the construction of the Steinweg Deepsea Steel Terminal (see page 6, ed.). Steinweg Handelsveem and Thyssen Krupp Steel have jointly approached us for space for a new terminal.

16

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

17

BReaKBULK aNd RoRo teRmINaLS IN tHe RotteRdam poRt aRea

's-Gravenzande Naaldwijk

Rotterdam Airport

Toekomstig HSL trac

Hoek van Holland

Maasmond

Ho

la

Rotterdam

Algera bridge

Nie uw e

6

Wa terw eg

Ma esl keri ant ng

Willemsbridge

Nieuwe

Eras m us brid ge

as

Van Brienenoord bridge

Ma

Breekwater

Beerkanaal

Yangtzeha ven

4e Petroleu mhaven

World Port Center

'Maasvlakte 2' under construction

1

en hav pa Euro

Maasvlakte

Am neh azo n ave

6e P

etr ole um

5e Petroleu mhaven

Schiedam

Cala ndk

Fruitport

14

18 18

18

Nieuwe

aas

Maastunnel

h as Ma

en av

Stadion De Kuip

nd sc he

l

Krimpen a/d IJssel

IJ

North Sea

el ss

n ve iha pp ssi ssi Mi

8e m leu t ro Pe n ve ha

n uxhave Benel

n lhave Dinte

Ridderkerk

ha ve n

en av e telh ridg Din ayb w rail Din

Eu

telhaven bridg e

rop oo rt

ana al

20

21

22 23 25 24 26

27

lh aa W

en av

Beergat

Suurhoffbridge

Hartelkanaal

Maassluis

7e Petroleumhaven

Oo st e rla nds

Vlaardingen

12

13

Beneluxtunnel

19

16

e els Bri

er Me

eR

ak

Sche ur

Eem- & Waalhaven

17

Wa l Wa l

ven lha rt e Ha

t es W

Em nt me ce pla

m Ee n ve ha

2

rn s oo st v Oo

eer eM

Rozenburg

dge dbri lan Ca

Hart elka naa l

Ha rm sen

P 2e

um ole etr

n ve ha

15

kte vla as Ma

P 1e leum etro

Slufter

11 8 7

tSin

have n

Oostvoorne Brielle

Brielse Meer

Bri els e

bri dg e

bri dg e

Brittannihaven

a a

te Trac Kortsluitrou

Chemiehaven

nsse ma Tho nel tun

Botlek

10

La n ure sha ven

k t le Bo

3e m leu tro Pe

n ve ha

Van Uden Stevedoring

Botlekrailwaytunnel

P 3e h um ole etr n ave

Botlekbridge & tunnel

Interforest Arcelor Mittal Steinweg Beatrixhaven Seabrex

Spijkenisser bridge

RHB Stevedoring Steinweg Waalhaven P1 Metaaltransport Rhenus Logistics Steinweg Waalhaven P2 Westerstuw

Beerenplaat

aas de M Ou

Stena Line Hoek v. Holland

Ga t Brie lse

Sein

ehav en

P&O Ferries Steinweg Deepsea Steel Terminal DFDS Deepsea Multi Terminal Stena Line Europoort Steinweg Beneluxhaven

Steinweg Seinehaven Broekman Car Terminal

Steinweg Botlek

Hartelkering Hartelbridge

Metaaltransport J.C. Meijers Broekman Special Products

Oude Maas

l Broekman Distriport/ All Weather Terminal lkanaa Harte

Norfolkline Mammoet

Cobelfret

Gat van Hawk

The Port of Rotterdam Authority has tried to include all the correct information and is not responsible for any direct or indir ect damage which might be caused by incorrect or outdated information on this map.

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

DFDS Deepsea Multi Terminal www.dfdstorline.com 500 metres 16 metres about 20 ha 15,000 m2 2 mobile cranes (max. 100 tons)

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

P&O Ferries www.poferries.com 3 RoRo ramps 7.65 metres about 30 ha not relevant not relevant

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Broekman Car Terminal www.rotterdamcarterminal.nl 800 metres 11 - 12 metres about 45 ha (+ 40 ha cardecks) not relevant not relevant

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Mammoet Heavy Lift Terminal www.mammoet.com about 900 metres 7 - 10 metres about 13 ha 20,000 m2 (2,000 m2 covered) 1 (railcrane 250 tons, aux. 45 tons) 1 (floating up to 300 tons)

13

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Beatrixhaven www.steinweg.com 1,950 metres 9.5 - 11.65 metres about 40 ha total about 60,000 m2 19 (max. 60 tons)

COMPANY

17

INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Broekman Project Services/ Heavy Lift Center www.broekman-group.nl 280 metres 9.3 metres about 2 ha 16,000 m2 4 (max. 45 tons, mobile or floating)

21

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Rhenus Logistics www.rhenus.nl 600 metres 10 metres about 3.5 ha 5 sheds, total 16,000 m2 6 (38.5 tons)

Independent floating crane companies

25

Bonn & Mees:

Matador 3 - 1,500 tons Matador 2 - 400 tons Matador - 400 tons

GPS marine:

Apollo - 400 tons Atlas - 400 tons Ajax - 300 tons

Mammoet Maritime:

Amsterdam - 300 tons Phoenix - 160 tons Gazelle - 130 tons

Smit:

Taklift 1 Taklift 4 Taklift 6 Taklift 7 - 800 tons - 1,600 tons - 1,200 tons - 1,200 tons

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Deepsea Steel Terminal www.steinweg.com 580 metres 16 metres 13.2 ha terminal will be operational in 2009 4 (max. 75 tons)

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Stena Line Hoek van Holland www.stenaline.com 455 metres 8 metres about 10 ha not relevant not relevant

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Seinehaven www.steinweg.com 340 metres 6.8 metres about 12 ha total 78,000 m2 4 (max. 30 tons)

10

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Van Uden Stevedoring www.van-uden.nl 650 metres 9.65 metres about 3.5 ha 15,000 m2 covered 6 (max. 40 tons)

14

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Seabrex www.seabrex.nl 2,300 metres 10.5 metres about 30 ha 600,000 m3 cold storage 21 (8 - 35 tons)

18

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Westerstuw B.V. www.westerstuw.com 360 metres 9.6 metres about 2.5 ha 6,000 m2 covered 1 (max. 35 tons), 1 (max. 17.5 tons), 2 (max. 8 tons)

22

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Waalhaven P1 www.steinweg.com 850 metres 10.65 metres about 4.2 ha 21,000 m2 6 (max. 30 tons)

Incoming

Outgoing

8,185 34,781 54,134 8,654 2,357 108,111

Total

94,935 194,003 106,999 17,331 7,830 421,098

26

Dry bulk Liquid bulk Containers RoRo Breakbulk Total throughput 2008 ( x 1,000 tons)

86,750 159,222 52,865 8,677 5,473 312,987

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Beneluxhaven www.steinweg.com 170 metres 8.0 metres about 13.5 ha 23,000 m2 4 (max. 20 tons)

COMPANY

INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Broekman Distriport/ All Weather Terminal www.broekman-group.nl 720 metres 12.65 metres about 20 ha 35,500 m2 3 (max. 104 tons)

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Botlek www.steinweg.com 1,175 metres 9.65 - 13 metres about 30 ha total 75,000 m2 11 (max. 40 tons)

11

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Interforest www.interforest.nl 680 metres 7 - 12.6 metres about 20 ha 5 sheds, total 75,000 m2 2 ship-shore (max. 60 tons) 2 (max. 8 tons)

15

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Metaaltransport B.V. www.metaaltransport.nl 570 metres 10 metres 2 ha 20,000 m2 7 (max. 50 tons)

19

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Metaaltransport Waalhaven N.Z. www.metaaltransport.nl 335 metres 9.5 metres about 2 ha 10,000 m2 3 (max. 50 tons)

23

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

RHB Stevedoring www.rhb.nl 730 metres 10.65 metres about 5 ha 15,000 m2 9 (max. 203 tons)

27

1 RoRo company 2 Breakbulk company

2 km

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Stena Line Europoort www.stenaline.com 440 metres 8.5 metres about 14 ha not relevant not relevant

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Cobelfret www.cobelfret.com 850 metres 12.65 metres about 25 ha 25,000 m2 1 (max. 60 tons)

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Norfolkline www.norfolkline.nl 900 metres 10 metres about 11 ha 4,200 m2 not relevant

12

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Arcelor Mittal www.arcelormittal.com 500 metres 3 metres about 6.6 ha 60,000 m2 30 (2.5 - 10 tons)

16

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

J.C. Meijers www.jcmeijers.com 275 metres 9.3 metres about 2 ha 3,000 m2 8 (max. 50 tons)

20

COMPANY INTERNET QUAY LENGTH DRAUGHT PLOT SURFACE OF WAREHOUSES CRANE(S)

Steinweg Waalhaven P2 www.steinweg.com 875 metres 9.65 - 10.65 metres about 10 ha about 60,000 m2 11 (max. 30 tons)

24

18

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt breakbulk sector stands to benefit too. Various port activities will relocate to the new industrial zone, boosting capacity for breakbulk operators in the existing port area.

19

NoN-FeRRoUS metaLS aRe SeRIoUS BUSINeSS

Metaal Transport ~ 4.5 hectares terminal area ~ 30,000 m of warehousing ~ 550 m of quay ~ 35 staff, of whom 20 operational LME approved Rotterdam is the number one European handling and storage location for non-ferrous metals traded on the London Metal Exchange (LME). The port numbers a total of 143 warehouses which meet the strict requirements of this leading raw materials exchange.

pHoto Willem-Jan

Metaal Transport is a logistical services provider through and through. Since 1964 the company in the Waalhaven has acted as a logistics hub for globally operating producers, traders and end-users of non-ferrous metals such as copper, aluminium, zinc, tin, lead and nickel. Non-ferrous scrap is being handled as well. Metaal Transport does not only offer storage, but also a complete logistic service that includes handling and forwarding. Obviously the company is LME-certified (see box), so that producers and traders know their way to its storage capacity. Right now thats an important factor, because the recession has undermined industrial demand for non-ferrous metals. Its really quite an anti-cyclical market though, De Geus says. The president sees the market clearly changing. A growing number of producers are now doing business directly with end-users. Thats undoubtedly linked to the rise of information technology, which makes it easier for parties to find one another. At the same time end-users are inclined to keep stocks as low as possible, so just-in-time delivery coupled with cost-efficient transport are key requirements the logistics partner us, in other words needs to fulfil. That in turn demands experience, speed and flexibility. And its not just a happy coincidence that those are the characteristics we highlight in the companys profile. But, he adds, these are promises the company can also keep because Metaal Transport has been working with the same transporters for years. Family-run firms like us that only need a few words from our clients to understand the urgency of a request and to act accordingly.

FoR NoW aNd IN tHe FUtURe

e x pa N S I o N a15

Ahead of the expected pick-up in the growth of cargo volumes in the future, Rotterdam is currently working hard to improve its accessibility. For road traffic, the A15 motorway represents a major artery, running directly through the port from west to east. Investment totalling 1.3 billion euros is being pumped into substantially boosting the capacity of this motorway in the period 2010 - 2015. During construction work the roads capacity will temporarily be reduced, however, a negative effect that the Port Authority and a number of government parties try to minimise through the Traffic Management Company. This project organisation aims to redirect 20 percent of rush hour traffic away from the A15. A range of bigger and smaller projects have been set up to realise this target, including the organisation of corporate public transport, incentives to commute outside peak hours, dynamic traffic management and much more. Rotterdam is also lobbying for the construction of a second westerly cross-river connection, making for better connections to the north, improved road traffic distribution as well as rendering access to the port more robust.

mo R e BY tR a I N a N d Ba Rg e

d e d I C atI o N

Rotterdam ranks as the non-ferrous metals port of Europe. Despite the dynamism of the non-ferrous metals market, the nature of the product requires that serious parties trade with one another within long-standing business relationships. Thats the view of Willem-Jan de Geus, president of family-owned Metaal Transport, one of Rotterdams three specialists in non-ferrous metals.

de Geus

De Geus sees the same experience, know-how and dedication in his own workforce. Its absolutely essential if youre to handle non-ferrous metals responsibly, he says. The non-ferrous metals are delivered to the company in bundles on palettes and each type of metal has its own handling requirements. Over the past few years containerisation has become more popular, particularly as a result of the increased demand from emerging countries such as China and India. For these destinations the container represents the most efficient form of packaging. De Geus: We are ideally situated to anticipate this trend. No other port has so many sailings as Rotterdam, and the container terminals are just around the corner.

For decades Rotterdam has ranked as Europes leading port. However, that status cant be taken for granted. In order to maintain the ports attractiveness for its customers, theres constant investment in creating extra capacity in and around the port and improving its accessibility. In all this sustainability is a key factor.

The Port of Rotterdam Authority is also actively working to engineer changes in cargoes modal split in favour of barge and rail. In a growing number of its leasing contracts with port companies the Port Authority has inserted binding agreements on the share of both these modalities in hinterland transport (see article page 6). Its a win-win situation: cargo throughput is improved and at the same time the rising use of rail and inland shipping reaps environmental benefits. With its 160 kilometre dedicated Betuweroute freight link to Germany and the rivers Rhine and Maas for inland shipping, Rotterdam numbers distinct advantages as regards transport into the European interior via these modalities.

pHoto Artist

impression Maasvlakte 2

Without doubt the largest and most important project in the port is the construction of the new Maasvlakte 2. At an investment of nearly three billion euros, a new port area is currently being created off the Dutch coast. With the help of 240 million cubic metres of sand it will increase the countrys size by 2 square kilometres. For the customers of Rotterdam port this will represent a net gain of 1000 hectares of additional industrial terrain directly flanking deepsea water with a depth of 19.65 metres. The first companies are slated to start operations on Maasvlakte 2 in 2013. Envisaged clients are in the first instance container terminal operators and the chemical industry. But the

SUS ta I N a BL e BUS I N eSS C L I m ate

pRoS peC tS

The non-ferrous metal sector has only a few players everyone knows everyone else but it is a highly competitive market. Therefore De Geus wont go into too much detail about his business other than to say: Metaal Transport is looking forward with interest to what the future brings. Recession or not, were always keen to invest certainly if that improves our service to clients. We would like, for example, to expand our business and are in talks with the Port of Rotterdam Authority to see how we can accomplish this together in the future.

A notable example of breakbulks commitment to sustainability are the plans to use shore-side power at Stena Lines RoRo-terminal in Hoek van Holland (see page 7). In addition policy is being formulated to award additional incentives to environmentally friendly ocean-going vessels in Rotterdam on top of the existing Green Award programme. These are only a few examples which show that the Port of Rotterdam Authority takes sustainability seriously. Sustainable innovation leads to a better business climate, the Port Authority firmly believes. An ambition Rotterdam will continue to develop, together with the individual companies active in the port.

20

JUmBo CReateS ItS oWN maRKet

Jumbo, the global market leader in heavy lift cargo, has added a new dimension to the provision of logistics services: not just from door to door, but also from door to seabed. Through innovations and investments, the Rotterdambased, family-owned business has been creating its own markets for more than forty years.

pHoto

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

Internal training The education of Jumbo

21

employees really kicks off with the companys internal training programme. Jumbo has developed its own crane simulator for imitating all possible situations and weather conditions that may occur in the handling of project cargo. In addition, there is a strong R&D department which is in close contact with the crew and which constantly works on small and big innovations. Kahn: After all, you can come up with all sorts of ingenious ideas, but they must be practical and feasible in terms of day-to-day operations. Furthermore, safety is a hot item for Jumbo. The Stay Well Program extensively trains people in the prevention of accidents. Kahn: If something goes wrong with heavy lift cargo, it goes very wrong. And after all, we are talking about our people, people, people ...

Micheal Kahn

My father has always been a strong-willed man, says managing director Michael Kahn, who took over the company some years ago. When the container became the trend in the sixties, he swam against the stream and invested in breakbulk solutions, the underlying thought being that there would always be cargo that would not fit in a box and that this cargo deserved a better status than that of additional cargo. Four decades later, it is safe to say that this focus on and specialisation in heavy lift was visionary. The company has grown steadily over the years and has enriched the market with various innovations. Examples of this are the stabiliser, which increases the lifting capability of a ship by temporarily making it wider, and the introduction of the Huisman mast crane, with its unprecedented outreach, as an integral part of the hull. In terms of heavy lift cargo, Jumbo is now the global market leader in the top segment of 1800 tonnes and occupies a comfortable position in the middle segment of 500 to 800 tonnes. Its fleet comprises fourteen ships, including the four largest heavy lift vessels in the world.

FRom tU R K m e N ISta N to tH e a N d eS

Examples of heavy lift cargo are dredging equipment, locomotives and equipment for power stations and the (offshore) petrochemical sector. Jumbo Shipping offers transport and engineering services from door to door, in which the final door may also be situated in parched regions like Turkmenistan or at an altitude of 4000 metres in the Andes. Five years ago, the core business was expanded with the offshore-related Transport & Installation division which offers these services worldwide to the oil & gas industry from door to seabed. For this purpose, Jumbo has equipped two of its four J-class vessels (each with an 1800 tonnes lifting capacity) with Dynamic Positioning-2. One of them, the Fairplayer, has an additional Huisman deepwater winch system as well, capable of lowering large structures to 3000 metres water depth. What is unique is that we are not a liner or a semi-liner company, but a tramp fleet operator, albeit one with very

long-running commitments to customers, says Kahn. Our fleet sails to any destination in need of cargo transport, which means that from one day to the next we can shift our focus from the Atlantic to the Pacific or Indian Ocean. We have a network of offices and agents throughout the world. The fleet is footloose in the sense that Jumbo does not have a quay of its own in its home port of Rotterdam, but makes use of the quays and storage facilities of friendly companies such as Broekman Project Services. However, the company is thoroughly anchored in Rotterdam. Kahn: This is where our roots are, and of course our headquarters; after all, the distance between ships and office should be small. All our ships sail under the Dutch flag, the majority of our officers is Dutch and the atmosphere on board is Dutch. This has to do with the high quality standards that we set ourselves and our customers. We need to organise things in such a manner that we are the best there is and there is no better place for doing this than the Rotterdam port and industrial region. I am not just referring to the seamanship of our people in this respect, but also to the whole mentality, the entire cluster of highly specialised suppliers such as Huisman Equipment and electrical installation company Alewijnse and knowledge institutes such as the Delft University of

Technology where we recruit our engineers. Without the right people, I cannot pursue our strategy to excel.

Jumbo Shipping & Jumbo Offshore ~ 14 ships ~ 350 crewmembers ~ 130 employees at the company headquarters ~ Offices and agents in 26 countries

Lo N g -te R m StR ate gY

Despite the economic crisis, with numerous projects being postponed or cancelled, and the influx of additional tonnage in the heavy lift market, Jumbos long-term perspectives are good. Everything revolves around our long-term vision, states Kahn. And in that respect, a family-owned business offers great advantages. Financially, our company is very sound and we can invest from a long-term vision on the market. That is also a very good basis for entering into long-term commitments with customers. Five years ago, for example, we commissioned the construction of ships with an 1800-tonne lifting capacity, even though there was no market for these vessels at the time. Normally, one cannot write a business plan for that, but we believed in this. The fact that we can transport it means our customers can fabricate it, an interesting case of the chicken and the egg. In this sense, we created our own market.

22

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

23

aLL eNCompaSSINg SteeL aNd metaL LogIStICS

Wa R e H o US e Fo R paCo R I N I

20,000 covered parking spaces In the last ten years, Broekman Automotive has heavily invested in the expansion of its car terminal by means of four four-storey parking garages. Van Ooijen: We now have a total of 40,000 parking spaces at the terminal, 20,000 of which are covered. This is an important advantage in terms of damage prevention from hail and such. No other car terminal in Europe can store cars in a protected environment on such a scale.

SeRVICe meNU FULL oF added VaLUe

Due to the economic crisis, the automotive sector is obviously not the most flourishing branch around at the moment. For the car handler of the Rotterdam port, Broekman Automotive, this however is no reason to sit back and just wait for the market to start picking up again. In fact, the exact opposite holds true: the company is continuously adding new items to its service menu. Managing director Ton van Ooijen: We are for example heavily investing in knowledge pertaining to hybrids and electric cars. That is the future.

pHoto Ton

Around the All Weather Terminal however theres much more going on. At end-2008 an additional warehouse of 15,000 square metres was opened on the 20 hectare terminal site and leased long-term to non-ferrous metal logistics specialist Pacorini. Managing Director Frank van der Gevel of Broekman Distriport: We take care of all the physical activities for them on the terminal. Broekman Distriport looks to achieve this kinds of intensive co-operation with its other clients too. Good examples are steel producers Rautaruukki and Swedish Steel.

With Rotterdam Car Terminal and Rotterdam Car Center as its best-known divisions, Broekman Automotive offers its car customers a highly comprehensive menu of services. Fourteen car makes currently use the terminal as their transhipment and storage point en route to the consumer. Van Ooijen: More than 80 percent of all cars also receive some form of additional treatment here to make them customer-ready. This however is not obligatory. As a multi-user terminal, we are optimally able to provide a very broad range of value-added activities which range from pre-delivery inspections and the installation of LPG systems to the addition of accessories and much more. Depending on their needs, customers can choose exactly what they want from this menu.

e x te N d I N g tH e q UaY

Com pR e H e N S I V e Lo g IStI CS Co N C e p tS

pHoto

Broekman Distriport

Broekman Distriport ~ 20 hectares in size ~ 550 metres quay with draught of 12.5 metres ~ 32,000 m covered storage ~ 175,000 m open storage ~ 3 million tonnes handling capacity

Construction vehicles ply a steady stream to and from Broekman Distriport. The specialist logistics terminal for steel and non-ferrous metals is expanding at full speed. Following the opening of a new warehouse of 15,000 square metres at end-2008, the terminals quay is now being extended to create a second berth. Whats more, the terminal still has several hectares available for more value-added activities.

The jewel in the crown of Broekman Distriports services provision in the Botlek is its All Weather Terminal opened in 2004, equipped with four overhead cranes and connecting warehouse for the conditioned storage of steel and non-ferrous metals. Ships with a deadweight of up to 9000 tonnes can be handled under cover at this terminal. It enables the company to provide just that extra bit of service not available elsewhere in the port.

To future-proof itself for the anticipated strong growth in world steel transport, Broekman Distriport is currently extending the terminal with a second berth for deep-sea vessels of up to 50,000 tonnes dwt. Work by the Port of Rotterdam Authority to extend the quay wall is in full swing, thanks to an investment of 13 million euro. Van der Gevel: From the beginning of 2010 we will be able to offer customers 550 metres of quay with a draught of 12.5 metres. In addition to the two existing quay cranes and the mobile crane (maximum lift load 104 tonnes, ed.) we plan to add another mobile crane as volumes grow. In this way Broekman Distriport will be able to steadily grow its handling capacity to 3 million tonnes.

van Ooijen

Ba Rg e a N d R a I L

Thanks to its exceptional access via the water, the terminal favours inland barges and shortsea as the most obvious modalities for efficient inward and outward transport. But Broekman Distriport also offers sophisticated rail facilities. Van der Gevel: Around 15 percent of the cargo leaves via rail. We have our own rail connection which runs through to the warehouse of the All Weather Terminal. We can load and unload trains undercover.

The distribution of cars is also among the services provided by Broekman Automotive. Depending on the make, vehicles are moved to destinations throughout Europe by road, rail, inland waterway and/or short-sea shipping. Van Ooijen is convinced that Rotterdam can especially be an ideal central European port of entry for brands which produce at multiple locations around the world. A fact which Broekman Automotive is currently actively bringing to the attention of logistics decision makers together with the Port of Rotterdam Authority. Day in, day out, we are proving that we are capable of efficiently serving the whole of Europe; a good example of this is our direct rail shuttle which currently runs between our terminal, Switzerland, Hungary and Austria. In addition, Rotterdam is strategically situated on the estuary of the Rhine and Maas, two rivers which run deep into the European hinterland. Inland shipping still holds much more potential as far as automotive is concerned, says the managing director with conviction. A single RoRo barge can carry up to 500 cars.

o FFe R I N g a d d e d Va LU e

FU RtH e R e x te N S I o N p oSS I BL e

Broekman Distriport has enough room to expand services to clients even further in the future. Van der Gevel points on the map to several hectares of terrain behind the quay. There has long been talk that a steel cutting business would be set up here. But thats not going ahead. This gives us the opportunity to develop alternative value-added activities together with partners.

We constantly aim to be as inventive and innovative as possible for our customers, concludes Van Ooijen. Currently, we are for example heavily investing in knowledge pertaining to hybrids and electric cars. That is the way of the future. Recently, we also equipped our entire terminal with RFID technology. Using tags, this technology enables us to track each vehicle in real-time. Its a distinctive and convenient tool which allows us to guide the cars of our customers across our terminal en route to the consumer with as few actions as possible.

24

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

25

DFDS Multi Terminal

aNtWeRp HaS tHe RepUtatIoN, RotteRdam tHe poSSIBILItIeS

pHoto

Eric Oosterom

Since the spring of 2008, DFDS Multi Terminal at the Maasvlakte has been explicitly expanding its operations to the breakbulk sector. The company has the space, knowledge and capacity to annually handle 1 million tonnes of this type of cargo.

~ 20 hectares in size ~ 500 metres of quay ~ 16.65 metres depth along the quay ~ Annual handling capacity of 1 million tonnes (breakbulk) ~ 15,000 m of covered storage ~ 2 quay cranes with 100 tonnes lifting capacity each ~ 2 RoRo ramps ~ 400 metres of rail track

Of all the terminals in Rotterdam which rightfully claim to be situated very close to the North Sea, DFDS Multi Terminals claim is probably the strongest. From the entrance to the port, ships are just one bend away from being moored at DFDS at the Maasvlakte. The terminal has been situated here since 2003. Initially, DFDS primarily focused on RoRo but since a year and a half it has been targeting breakbulk as well. General Manager Eric Oosterom joined the company in August 2008 with the task of turning DFDS Multi Terminal into a success. We are in for any kind of breakbulk: steel, forest products, non-ferrous metals and project cargo. And that for any type of customer, be it a shipping line, freight forwarder or shipper.

issue at the 20-hectare terminal. The terminal currently boasts 15,000 m of covered storage. The moment new customers enter the picture, we can however immediately expand this warehouse capacity. But most important of course is the fact that Rotterdam is 100 percent guaranteed more attractive in terms of costs.

FL e x I BL e L a Bo U R

FI R St SU CC eSS eS

Another important advantage of DFDS Multi Terminal is the flexibility it offers in terms of labour. The combination with RoRo-activities means the terminal has long opening hours: Mondays to Fridays from 07.00 to 23.00 hours and Saturdays from 07.00 to 15.00 hours. The handling of breakbulk in addition does not require the scheduling of a complete team for a full shift.

In spite of the bad economic climate, DFDS Multi Terminal has already been able to achieve quite some successes. Oosterom for example cites the launch of a combined breakbulk/container service by Hugo Trumpy in Rhoon as an agent for BroIntermed to Algeria and Libya and a dedicated breakbulk service to North, Central and South America by Onego Shipping & Chartering. In addition, the terminal has become the landing point for several new consignments of steel and forest products as well as increasing volumes of project cargo.

Ro Ro a S mo d e o F H I Nte R L a N d tR a N S p o Rt

The own daily RoRo service to Immingham in the UK also presents additional possibilities for organising the hinterland transport of breakbulk. Oosterom: Steel from China, for example, arrives here by ship and is then stored in our warehouse. On demand, any desired quantity can next be moved aboard the ferry using mafis and taken to the customer in the UK.

m a N Y a dVa Ntag eS

g o o d R a I L aCC eSS

The enthusiastic Oosterom is convinced that DFDS Multi Terminal really does have something to offer the market. Many parties tend to overlook Rotterdam. Antwerp has a strong reputation as a breakbulk port, but we also offer numerous possibilities in this respect. His list of advantages starts with the location of the terminal directly on the North Sea and the depth of up to 16.65 meters. This yields substantial time savings. The two Gottwald cranes of DFDS can each lift 100 tonnes or 150 tonnes combined. Furthermore, space is not an

With the railway company DB Schenker (previously Railion), DFDS has been able to come to flexible and competitive agreements regarding the European rail transport of breakbulk from the terminal. Whether we have one or ten wagons: they come to collect it under the same price conditions. For Oosterom, this is a good starting point for being able to offer customers more rail-related services. Currently, we handle a number of trains each month. 30 percent of some steel consignments are already moved by rail.

We aRe IN FoR aNY tYpe oF BReaKBULK. SteeL CoNStItUteS aN ImpoRtaNt gRoWtH maRKet IN tHat ReSpeCt

26

PORT SPECIAL RotteRdam YoUR WoRLd-CLaSS BReaKBULK poRt

27

It is a chicken and egg situation

Breakbulk and project cargo is a clear priority for the port of Rotterdam. This magazine lists numerous examples of new initiatives and capacity expansion, especially for steel. Two decades ago it was a very different story. At that time containerisation was all the rage and investment in breakbulk and project cargo plummeted to less than zero. Consequently most of this type of cargo went to other ports such as Antwerp. As such it requires missionary zeal to get Rotterdams new lan as a breakbulk port across. Its a task that Business Manager Bart-Luc Olde Hanter of the Port Authoritys Breakbulk Department has enthusiastically taken up. It is a chicken and egg situation, he explains. Shipping companies say that they will gladly come to Rotterdam, but cant find enough cargoes here. Cargo parties say that they would come to Rotterdam but cant find the right transport possibilities. My task is to bring these two groups together.

NeW LaN IN oLd poRt aRea

As part of the global Rhenus Group, Rhenus Port Logistics breakbulk terminal in Rotterdam Waalhaven is doing good business. In just nine years its handling volumes have increased by a factor of ten. What is more, the expansion currently underway will boost the terminals capacity considerably from early 2010.