Professional Documents

Culture Documents

ECB 2010 Annual Report Assets Pledged Composition

Uploaded by

lancecOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECB 2010 Annual Report Assets Pledged Composition

Uploaded by

lancecCopyright:

Available Formats

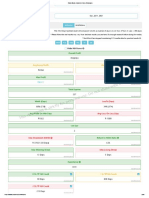

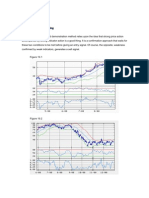

Chart 48 Breakdown of assets (including credit claims) put forward as collateral by asset type

(percentages; annual averages) central government securities regional government securities uncovered bank bonds covered bank bonds corporate bonds asset-backed securities other marketable assets non-marketable assets 100 90 80 70 60 50 40 30 20 10 0 2005 Source: ECB. 2006 2007 2008 2009 2010 100 90 80 70 60 50 40 30 20 10 0

in 2009 to 13% in 2010. The asset classes which were temporarily eligible until the end of 2010 accounted for around 1% of the total marketable collateral put forward at the end of 2010. RISK MANAGEMENT ISSUES The Eurosystem mitigates the risk of a counterparty default in a Eurosystem credit operation by requiring counterparties to submit adequate collateral. However, the Eurosystem is still exposed to a number of nancial risks if a counterparty defaults, including credit, market and liquidity risk. In addition, the Eurosystem is exposed to currency risk in the context of liquidity-providing operations in foreign currencies against euro-denominated collateral, whenever these are conducted. In order to reduce all these risks to acceptable levels, the Eurosystem maintains high credit standards for assets accepted as collateral, valuates collateral on a daily basis and applies appropriate risk control measures. The establishment of the new Risk Management Committee has further contributed to the enhancement of the Eurosystems risk management framework (see also Sections 1.5 and 1.6 of Chapter 10). As a matter of prudence, the Eurosystem has established a buffer against potential shortfalls resulting from the eventual resolution of collateral received from defaulted counterparties. The level of the buffer is reviewed annually, pending the eventual disposal of the collateral and in line with the prospect of recovery. More generally, nancial risks in credit operations are quantied and regularly reported to the ECBs decision-making bodies. In 2010 the ECB made a number of adjustments to its eligibility criteria and risk control framework. The Governing Council decided to keep the minimum credit threshold for marketable and non-marketable assets in the Eurosystem collateral framework at investmentgrade level (i.e. BBB-/Baa3) beyond the end of 2010, except in the case of asset-backed securities. As a consequence of this decision, the ECB announced on 8 April 2010 and published on 28 July 2010 a new schedule which duly

with the Eurosystem as they did in response to the nancial market turbulence (see Chart 47). The share of deposited collateral not used to cover credit from monetary policy operations therefore increased to signicantly higher levels than in the years before. This suggests that a shortage of collateral has not been a systemic constraint on the Eurosystems counterparties at the aggregate level. As regards the composition of collateral put forward (see Chart 48), the average share of asset-backed securities slightly increased from 23% in 2009 to 24% in 2010, thereby becoming the largest class of asset put forward as collateral with the Eurosystem, while the overall amount submitted remained stable. Uncovered bank bonds further decreased to 21% of the collateral put forward in 2010. Non-marketable assets gained further importance, with their share rising from 14% in 2009 to 18% in 2010. In addition, also owing to the sovereign debt crisis in some euro area countries, the average share of central government bonds further increased from 11%

98

ECB Annual Report 2010

You might also like

- Financing Independent FilmsDocument1 pageFinancing Independent FilmsYANo ratings yet

- Notes On The Art of Short SellingDocument25 pagesNotes On The Art of Short Sellingbamzoo100% (1)

- Accounting Ratios PDFDocument56 pagesAccounting Ratios PDFdavid100% (1)

- Value Investing Beat The Market in Five Minutes! PDFDocument258 pagesValue Investing Beat The Market in Five Minutes! PDFRio Bayu PratamaNo ratings yet

- Real Estate Property and Market Risk PDFDocument28 pagesReal Estate Property and Market Risk PDFadonisghlNo ratings yet

- PWC Eu Bank Recovery and Resolution Directive Triumph or TragedyDocument8 pagesPWC Eu Bank Recovery and Resolution Directive Triumph or TragedykunalwarwickNo ratings yet

- CH 12 Hull Fundamentals 8 The DDocument25 pagesCH 12 Hull Fundamentals 8 The DjlosamNo ratings yet

- Y-I Leisure Vs YuDocument3 pagesY-I Leisure Vs YuAstrid Gopo BrissonNo ratings yet

- Banking in Crisis: How strategic trends will change the banking business of the futureFrom EverandBanking in Crisis: How strategic trends will change the banking business of the futureNo ratings yet

- A European Unemployment Benefit Scheme: How to Provide for More Stability in the Euro ZoneFrom EverandA European Unemployment Benefit Scheme: How to Provide for More Stability in the Euro ZoneNo ratings yet

- CHAPTER 12 Capital Budgeting - Principles and TechniquesDocument119 pagesCHAPTER 12 Capital Budgeting - Principles and TechniquesMatessa AnneNo ratings yet

- The Wall Street Journal - 15 02 2022Document28 pagesThe Wall Street Journal - 15 02 2022Владислав ВойтенкоNo ratings yet

- PC 2014 14 PDFDocument11 pagesPC 2014 14 PDFBruegelNo ratings yet

- EFSF vs. ESM: A Comparison of Eurozone Debt Crisis ToolsDocument48 pagesEFSF vs. ESM: A Comparison of Eurozone Debt Crisis Toolsshobu_iujNo ratings yet

- Memo 14 244 - enDocument10 pagesMemo 14 244 - enopreanioan01No ratings yet

- External Debt Statistics of The Euro Area: Jorge Diz Dias Directorate General Statistics European Central BankDocument14 pagesExternal Debt Statistics of The Euro Area: Jorge Diz Dias Directorate General Statistics European Central BankCristina SanduNo ratings yet

- Greek Government DebtDocument11 pagesGreek Government DebtRaviTejaNo ratings yet

- Levente Kovacs - Bank Taxes in The European UnionDocument15 pagesLevente Kovacs - Bank Taxes in The European UnionAlex MariusNo ratings yet

- Summary Comprehensive Response enDocument5 pagesSummary Comprehensive Response endj_han85No ratings yet

- Banks Stress Tests 2011 ResultsDocument39 pagesBanks Stress Tests 2011 Resultsekapitalistis100% (1)

- European Stability Mechanism: October 2012Document28 pagesEuropean Stability Mechanism: October 2012ZerohedgeNo ratings yet

- A Three Pillar Solution To The Eurozone CrisisDocument5 pagesA Three Pillar Solution To The Eurozone CrisisDoug TengdinNo ratings yet

- Policy Brief: The Macroeconomic Effects of The Eu Recovery and Resilience FacilityDocument18 pagesPolicy Brief: The Macroeconomic Effects of The Eu Recovery and Resilience FacilityYassinefartakhNo ratings yet

- Debt Reduction Without DefaultDocument13 pagesDebt Reduction Without DefaultitargetingNo ratings yet

- Green Pepr Stability Bonds enDocument38 pagesGreen Pepr Stability Bonds enMarketsWikiNo ratings yet

- Policy BriefingDocument4 pagesPolicy BriefingNicolaiescu GheorgeNo ratings yet

- EEP Assignment Analyzes ESM Pandemic Crisis SupportDocument5 pagesEEP Assignment Analyzes ESM Pandemic Crisis SupportGiuliaNo ratings yet

- List of Acronyms Associated With The Eurozone CrisisDocument8 pagesList of Acronyms Associated With The Eurozone Crisisjosh321No ratings yet

- Annualreport2009 2010EDocument148 pagesAnnualreport2009 2010EybouriniNo ratings yet

- Banks: Stress Tests, State Aid, Regulation and Sovereign DebtDocument2 pagesBanks: Stress Tests, State Aid, Regulation and Sovereign DebtFTI Consulting EUNo ratings yet

- European Systemic Risk Board, Report On Commercial Real Estate and Financial Stability in The EU, December 2015Document77 pagesEuropean Systemic Risk Board, Report On Commercial Real Estate and Financial Stability in The EU, December 2015hulei1114No ratings yet

- Sovereign Spreads in The Euro Area. Which Prospects For A Eurobond?Document41 pagesSovereign Spreads in The Euro Area. Which Prospects For A Eurobond?italos1977No ratings yet

- Stress Testing For Bangladesh Private Commercial BanksDocument11 pagesStress Testing For Bangladesh Private Commercial Banksrubayee100% (1)

- The European Banking UnionDocument4 pagesThe European Banking UnionCarlaNo ratings yet

- Draft EFSF Guideline On Precautionary ProgrammesDocument5 pagesDraft EFSF Guideline On Precautionary Programmeslevel3assetsNo ratings yet

- Counter Terrorist Financing Policies Time For A Rethink 37877Document24 pagesCounter Terrorist Financing Policies Time For A Rethink 37877Marco MerlinoNo ratings yet

- EU Emergency MeasuresDocument6 pagesEU Emergency MeasuresA paulNo ratings yet

- SRM Q&A 10 JulyDocument13 pagesSRM Q&A 10 JulyKara BellNo ratings yet

- Capital Regulation Challenges (1) - Banking LawsDocument6 pagesCapital Regulation Challenges (1) - Banking Lawshemstone mgendyNo ratings yet

- Towards A Banking Union: Uropean OmmissionDocument6 pagesTowards A Banking Union: Uropean OmmissionMolnár LeventeNo ratings yet

- The EU Stress Test and Sovereign Debt Exposures - by Blundell-Wignall and Slovik, Aug. 2010Document13 pagesThe EU Stress Test and Sovereign Debt Exposures - by Blundell-Wignall and Slovik, Aug. 2010FloridaHossNo ratings yet

- The European Redemption Pact: An Illustrative GuideDocument23 pagesThe European Redemption Pact: An Illustrative Guidecottard2013No ratings yet

- Banking 1ST PartDocument48 pagesBanking 1ST PartAlessandra ZannellaNo ratings yet

- 3 Euro Area Financial InstitutionsDocument53 pages3 Euro Area Financial Institutionsgodfather_rNo ratings yet

- STATEMENT OF THE ECB (English) - DECLARACIÓN DEL BCE (Inglés) - EBZREN ADIERAZPENA (Ingelesez)Document12 pagesSTATEMENT OF THE ECB (English) - DECLARACIÓN DEL BCE (Inglés) - EBZREN ADIERAZPENA (Ingelesez)EKAI CenterNo ratings yet

- 2021 09 06 ZEW - Fiscal DominanceDocument22 pages2021 09 06 ZEW - Fiscal DominanceXavier StraussNo ratings yet

- ECB Monetary Policy Objectives and TargetsDocument3 pagesECB Monetary Policy Objectives and TargetsAkshat KediaNo ratings yet

- European Commission Green Paper On The Feasibility of Introducing Stability BondsDocument7 pagesEuropean Commission Green Paper On The Feasibility of Introducing Stability Bondswtc0631No ratings yet

- AcharyaSteffen Systemic Risk EUDocument37 pagesAcharyaSteffen Systemic Risk EUYustinus LiongosariNo ratings yet

- SatelliteDocument2 pagesSatelliteperig_olyaNo ratings yet

- Scholz Position Paper Banking UnionDocument8 pagesScholz Position Paper Banking UnionMario SeminerioNo ratings yet

- Systemic Risk of European Banks - Regulators and MarketsDocument26 pagesSystemic Risk of European Banks - Regulators and MarketsHoangdhNo ratings yet

- Challenges of FX Lending in SerbiaDocument4 pagesChallenges of FX Lending in SerbiaBokajgovic NenadNo ratings yet

- Eu Vision For Closer UnionDocument52 pagesEu Vision For Closer UnionEKAI CenterNo ratings yet

- Annex Main Design Elements: I. Definition of CapitalDocument7 pagesAnnex Main Design Elements: I. Definition of CapitalbionicturtleNo ratings yet

- Othp 12Document19 pagesOthp 12Muhammad FarmerNo ratings yet

- Erfra Communication enDocument10 pagesErfra Communication enRonny RonaldoNo ratings yet

- CCR Arbitrage Volatilité 150: Volatility StrategyDocument3 pagesCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiNo ratings yet

- 2020 EU banking stress test adverse scenarioDocument44 pages2020 EU banking stress test adverse scenarioHải YếnNo ratings yet

- Coverbondsintheeufinancialsystem200812en enDocument34 pagesCoverbondsintheeufinancialsystem200812en entenzin2No ratings yet

- Analysing Government Debt Sustainability in The Euro Area: ArticlesDocument15 pagesAnalysing Government Debt Sustainability in The Euro Area: ArticlesinexpugnabilNo ratings yet

- Between Austerity and Growth: The Politics of Debt in the EUDocument27 pagesBetween Austerity and Growth: The Politics of Debt in the EUAdrian SanduNo ratings yet

- ScotiaBank JUL 26 Europe Weekly OutlookDocument3 pagesScotiaBank JUL 26 Europe Weekly OutlookMiir ViirNo ratings yet

- HE Uropean Entral Bank in THE Crisis: S E L HDocument7 pagesHE Uropean Entral Bank in THE Crisis: S E L HyszowenNo ratings yet

- Croatia - Assessment of ERM II Prior Commitment No. 2 On The Macroprudential ToolkitDocument2 pagesCroatia - Assessment of ERM II Prior Commitment No. 2 On The Macroprudential ToolkitaldhibahNo ratings yet

- Synthetic Securitisation RegulationDocument24 pagesSynthetic Securitisation Regulationjohn pynchonNo ratings yet

- The Incomplete Currency: The Future of the Euro and Solutions for the EurozoneFrom EverandThe Incomplete Currency: The Future of the Euro and Solutions for the EurozoneNo ratings yet

- Systemic Risk Tomography: Signals, Measurement and Transmission ChannelsFrom EverandSystemic Risk Tomography: Signals, Measurement and Transmission ChannelsNo ratings yet

- GreeceDocument5 pagesGreecelancecNo ratings yet

- 2008-09-13 FRBNY Email Re AIG-Board CallDocument2 pages2008-09-13 FRBNY Email Re AIG-Board CalllancecNo ratings yet

- Garber Deutsche Bank Dec 2010 Intra Euro Capital Flight MechanicsDocument9 pagesGarber Deutsche Bank Dec 2010 Intra Euro Capital Flight MechanicslancecNo ratings yet

- Kanjorski TranscriptDocument420 pagesKanjorski TranscriptlancecNo ratings yet

- Alll Oct 2008Document23 pagesAlll Oct 2008lancecNo ratings yet

- 2008-07-00 FRBNY Observations On The Role of Supervision in The Current Financial CrisisDocument10 pages2008-07-00 FRBNY Observations On The Role of Supervision in The Current Financial CrisislancecNo ratings yet

- 2008-07-00 FRBNY Observations On The Role of Supervision in The Current Financial CrisisDocument10 pages2008-07-00 FRBNY Observations On The Role of Supervision in The Current Financial CrisislancecNo ratings yet

- 2008-07-00 FRBNY Observations On The Role of Supervision in The Current Financial CrisisDocument10 pages2008-07-00 FRBNY Observations On The Role of Supervision in The Current Financial CrisislancecNo ratings yet

- Functions and Equations: Back To TopDocument8 pagesFunctions and Equations: Back To ToplancecNo ratings yet

- Setting up an Architectural PracticeDocument19 pagesSetting up an Architectural PracticeAditi100% (1)

- What Is An InvestmentDocument20 pagesWhat Is An InvestmentSebin SebastianNo ratings yet

- Glackin 1Document64 pagesGlackin 1thestorydotieNo ratings yet

- Backtest Index Strategies Performance Over Monthly Periods 2017-2021Document95 pagesBacktest Index Strategies Performance Over Monthly Periods 2017-2021ThE BoNg TeChniCaLNo ratings yet

- Financial AnalysisDocument20 pagesFinancial AnalysisKylie Luigi Leynes BagonNo ratings yet

- Feasible & Efficient SetDocument2 pagesFeasible & Efficient SetAnacleto59No ratings yet

- Isb540 - HiwalahDocument16 pagesIsb540 - HiwalahMahyuddin Khalid100% (1)

- ValixDocument17 pagesValixAnne Hawkins100% (7)

- Branches and Types of Accounting ActivitiesDocument19 pagesBranches and Types of Accounting ActivitiesYzzabel Denise L. TolentinoNo ratings yet

- Sara Lee - M&a HistoryDocument4 pagesSara Lee - M&a HistoryukgrantsNo ratings yet

- Solieri, S.A Dan Hodowanitz, J. (2016)Document7 pagesSolieri, S.A Dan Hodowanitz, J. (2016)Almi HafizNo ratings yet

- Court of Appeals erred in ruling tax credit basis for senior discountsDocument1 pageCourt of Appeals erred in ruling tax credit basis for senior discountsZydalgLadyz NeadNo ratings yet

- Strategic Buyers Vs Private EquityDocument20 pagesStrategic Buyers Vs Private EquityGaboNo ratings yet

- Evaluation of Present Scenario and Estimation of Future Prospects of Portfolio ManagementDocument35 pagesEvaluation of Present Scenario and Estimation of Future Prospects of Portfolio ManagementMayura Telang100% (1)

- Manual Quick TrailingDocument2 pagesManual Quick TrailingDaniels JackNo ratings yet

- Press Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalDocument2 pagesPress Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Fixed Income Chapter3Document51 pagesFixed Income Chapter3Sourabh pathakNo ratings yet

- HDFC SL CrestDocument1 pageHDFC SL Crestk_kishan288No ratings yet

- Financial Services Overview & Top Companies in IndiaDocument11 pagesFinancial Services Overview & Top Companies in IndiaAshwin ShettyNo ratings yet

- University of Mumbai Revised Syllabus for Financial Markets ProgramDocument20 pagesUniversity of Mumbai Revised Syllabus for Financial Markets Programshoaib8682No ratings yet

- Inv. Mechanism by Islami Bank Bangladesh LTDDocument42 pagesInv. Mechanism by Islami Bank Bangladesh LTDshuvo100% (1)

- Bollinger Bands Method - LLDocument4 pagesBollinger Bands Method - LLadoniscalNo ratings yet