Professional Documents

Culture Documents

Pharmaceutical Sector Overview

Uploaded by

Kumar SouravOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pharmaceutical Sector Overview

Uploaded by

Kumar SouravCopyright:

Available Formats

PHARMACEUTICAL SECTOR OVERVIEW

The Indian pharmaceutical industry is the world's fourth-largest by volume and is likely to lead the manufacturing sector of India. The Indian pharmaceutical market is highly competitive and remains dominated by low priced, domestically-produced generics. Despite having the second largest population in the world and a growing middle class with high healthcare expectations, India accounts for less than 2% of the world pharmaceutical market in value terms.

In the financial year 2010-11, the Indian pharmaceutical industry grew more than 14 per cent, according to ORG IMS and this growth was mainly driven by the top 50 companies.

During the year, the industry also witnessed Indian pharma companies selling out to the multinationals.

As per newspaper reports, it appears that the Government of India is planning to bring under price control all the drugs which are listed in the National List of Essential Medicines. More than 350 drugs are expected to be covered. This will have an adverse impact on the Indian Pharmaceutical Industry which is already reeling under high inflationary pressures.

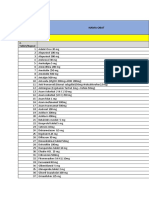

During the financial year, the following are some of the companies were acquired as subsidiaries: Cipla (Mauritius) Limited, Cipla (UK) Limited, Cipla-Oz Pty Limited, Four M Propack Private Limited, Goldencross Pharma Private Limited, Medispray Laboratories Private Limited, Meditab Holdings Limited, Meditab Pharmaceuticals South Africa (Pty) Limited, Meditab Specialities New Zealand Limited, Meditab Specialities Private Limited, Sitec Labs Private Limited and STD Chemicals Limited.

The Companies introduced many new drugs and formulations during the year. Some of them are Entavir , Febucip , Flosoft , Foracort

The Indian pharmaceutical industry is the world's fourth-largest by volume and is likely to lead the manufacturing sector of India.

The Pharmaceutical industry in India meets around 70% of the countrys demand for bulk drugs,chemical tablets, capsules, orals and injectibles.

The Indian pharmacy market is expected to reach US 55$ billion in 2020.The market has potential to reach US 70$ billion in an aggressive growth scenario.

According to the German Chemicals Association, in 2005, India's top 10 pharmaceutical companies were Ranbaxy, Cipla, Dr. Reddy's Laboratories, Lupin, Nicolas Piramal, Aurobindo Pharma, Cadila Pharmaceuticals, Sun Pharma, Wockhardt Ltd. and Aventis Pharma.5 Indian-owned firms currently account for 70 percent of the domestic market, up from less than 20 percent in 1970. In 2005, nine of the top 10 companies in India were domestically owned, compared with just four in 1994. India's potential to further boost its already-leading role in global generics production, as well as an offshore location of choice for multinational drug manufacturers seeking to curb the increasing costs of their manufacturing, R&D and other support services, presents an opportunity worth an estimated $48 billion in 2007.

Government Initiative 100 percent FDI is allowed under the automatic route in the drugs and pharmaceutical sector. The government plans to set up US 640$ million Venture Capital (VC) to give a boost to drug discovery and growth in pharma infrastructure in the country. The Department of Pharmaceuticals has prepared a Pharma vision 2020 for making India one of the leading destination for end-to-end discovery and innovation. The govt plans to open 3000 Jan Aushadhi stores which sell unbranded generic drugs at heavy discounts to branded drugs in next two years.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Intern Chap 3-4Document2 pagesIntern Chap 3-4Marc HenryNo ratings yet

- Active Pharmaceutical Ingredients: Small MoleculesDocument2 pagesActive Pharmaceutical Ingredients: Small Moleculesapi AspenbioPharmaLabsNo ratings yet

- VenusDocument8 pagesVenusEko Tjandrayani SutrisnoNo ratings yet

- Personal Data Krešimir Pavelić: Curriculum VitaeDocument16 pagesPersonal Data Krešimir Pavelić: Curriculum VitaeElena YakimovNo ratings yet

- Obat Obat ApotekDocument11 pagesObat Obat Apotekpuskesmas pagakNo ratings yet

- Mefenamic Acid Drug StudyDocument4 pagesMefenamic Acid Drug StudyJay Ann Joy PerudaNo ratings yet

- Pemakaian Obat RS Tahun 2020Document20 pagesPemakaian Obat RS Tahun 2020ENDAH SANDIAHNo ratings yet

- 2015 Atcvet GuidelinesDocument196 pages2015 Atcvet GuidelinesgokunaruNo ratings yet

- Brown 2020Document21 pagesBrown 2020dega230989No ratings yet

- Phenytoin Drug StudyDocument1 pagePhenytoin Drug StudyRoland Yuste100% (3)

- USMLE Step 1 DrugsDocument36 pagesUSMLE Step 1 DrugscougardiverNo ratings yet

- Med Cu Rulaj LentDocument5 pagesMed Cu Rulaj Lentmarkos simonaNo ratings yet

- Practices Involved in The Enteral Delivery of Drugs: Current Nutrition ReportsDocument7 pagesPractices Involved in The Enteral Delivery of Drugs: Current Nutrition ReportsRafika DitaNo ratings yet

- Anti ParkinsonDocument18 pagesAnti ParkinsonRitika DasNo ratings yet

- DiazepamDocument5 pagesDiazepamapi-3797941No ratings yet

- General PharmacologyDocument3 pagesGeneral Pharmacologywasim akhtarNo ratings yet

- Drug Study BISACODYLDocument1 pageDrug Study BISACODYLAnna Sofia ReyesNo ratings yet

- Soluvit N PIDocument11 pagesSoluvit N PIIrenne Rizki AnandaNo ratings yet

- Rate F BioDocument13 pagesRate F BiorahsreeNo ratings yet

- MEDICAMENTEDocument6 pagesMEDICAMENTEPatricia IoanaNo ratings yet

- Midwifery Drug Administration ExamDocument7 pagesMidwifery Drug Administration ExamteabagmanNo ratings yet

- Entres ToDocument17 pagesEntres ToanareadsNo ratings yet

- Marketing Antidepressants - Prozac and Paxil Case Analysis - Group HDocument7 pagesMarketing Antidepressants - Prozac and Paxil Case Analysis - Group HArpita DalviNo ratings yet

- Antimicrobial Drugs Test BankDocument15 pagesAntimicrobial Drugs Test BankGeorges Bi50% (2)

- Protocol Outline Remission Induction (6-7 Weeks)Document3 pagesProtocol Outline Remission Induction (6-7 Weeks)Mohammed HaiderNo ratings yet

- Aic 28 4 2000 363Document12 pagesAic 28 4 2000 363danielguerinNo ratings yet

- Common Prefixes and SuffixesDocument5 pagesCommon Prefixes and Suffixestriddle1969100% (1)

- Universiti Teknologi Mara (Uitm) Puncak Alam Campus Faculty of Health SciencesDocument4 pagesUniversiti Teknologi Mara (Uitm) Puncak Alam Campus Faculty of Health SciencesMOHD MU'IZZ BIN MOHD SHUKRINo ratings yet

- G) KFN KMFDF (:o'l6sn P F) L o G Nepal Pharmaceutical Association (NPA)Document6 pagesG) KFN KMFDF (:o'l6sn P F) L o G Nepal Pharmaceutical Association (NPA)isafiurNo ratings yet

- Level of Control 76 Distinguishes Prescription or POM Drugs From Over-The-Counter DrugsDocument2 pagesLevel of Control 76 Distinguishes Prescription or POM Drugs From Over-The-Counter DrugsNhu Y Nguyen TranNo ratings yet