Professional Documents

Culture Documents

Housing Data Wrap Up For 2011 - Better News Is Raising Hopes For The New Year.

Uploaded by

Christophe ChooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Housing Data Wrap Up For 2011 - Better News Is Raising Hopes For The New Year.

Uploaded by

Christophe ChooCopyright:

Available Formats

December 30, 2011

Economics Group

Special Commentary

Mark Vitner, Senior Economist

mark.vitner@wellsfargo.com (704) 383-5635

Anika R. Khan, Economist

anika.khan@wellsfargo.com (704) 715-0575

Joe Seydl, Economic Analyst

joseph.seydl@wellsfargo.com (704) 715-1488

Housing Data Wrap-Up: December 2011

Most of the economic reports dealing with housing have shown a little more strength recently. New home sales rose 1.6 percent in November and sales of existing homes climbed 4.0 percent. New home construction also improved, with housing starts rising 9.3 percent in November. Low mortgage rates, an improving job market, and some reported easing in mortgage underwriting standards has raised hopes that the momentum will carry over into 2012. Demand does appear to be firming a bit. Pending home sales jumped 7.3 percent in November, following an upwardly revised 10.4 percent rise the previous month. The National Association of Homebuilders/Wells Fargo Housing Market Index has also risen, with more builders reporting gains in buyer traffic. The news has not been universally positive. The latest S&P/Case-Shiller data shows price declines accelerating in October. The 20-city index fell 0.6 percent in October and has tumbled at a 6.4 percent pace over the past three months. Home prices are down 3.4 percent over the past year. Moreover, price declines have been fairly widespread, with 16 of the 20 markets surveyed reporting price declines in October. The sharp drop in home prices over the past three months should raise some caution flags for those expecting dramatic gains in 2012. Housing still faces a long and arduous road to recovery. That said, 2012 will be a better year. We have slightly increased our forecast for the next two years, which marks the first time we have raised our expectations for housing in any significant way in well over a year. While it is nice to see the improved numbers, we continue to stress that these reports should be treated with caution. Some of the recent improvement in the reported data is due to unseasonably mild weather, which led to slightly more sales and new construction than would normally occur in the seasonally slow fall months. The seasonal adjustment process greatly exaggerates these gains. The arrival of more typical weather in January or February would bring those figures back down fairly quickly and probably leave them close to their average levels for the past year or so. Figure 1

Existing & New Single-Family Home Sales

1.4 In Millions, Seasonally Adjusted Annual Rate 8.0 7.0 6.0 5.0 0.8 4.0 0.6 3.0 0.4 2.0 1.0 0.0 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 $100 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 $100 $150 $150 $200 $200 $250 $300

Better News Is Raising Hopes for the New Year

Figure 2

Median New & Existing Home Sale Prices

In Thousands, Single-Family Median New Sales Price: Nov @ $214,100 Median Existing Sales Price: Nov @ $164,100 $300

1.2

1.0

$250

0.2

New Home Sales: Nov @ 315 Thousand (Left Axis) Existing Home Sales: Nov @ 4.0 Million (Right Axis)

0.0

Source: U.S. Department of Commerce, National Association of Realtors and Wells Fargo Securities, LLC

This report is available on wellsfargo.com/economics and on Bloomberg WFEC

Housing Data Wrap-Up: December 2011 December 30, 2011

WELLS FARGO SECURITIES, LLC ECONOMICS GROUP

Our more upbeat view on housing is based on better reports from builders, lenders and Realtors. Builders have seen a modest uptick in buyer traffic in recent months. The NAHB/Wells Fargo Homebuilders Index has risen for three consecutive months, marking the first three-month gain since the middle of 2009. Realtors are also seeing some firming in demand and mortgage underwriting standards have loosened a little bit. Gains in sales and new home construction have been spotty, however, with builders in the South and Midwest seeing the greatest improvement. The South itself is a real mixed bag, with energy economies like Houston and Oklahoma City seeing relatively strong gains while Atlanta and much of South Florida are still languishing. Most of the regions larger markets are seeing modest gains, including Charlotte, Orlando, Nashville, Greenville and Huntsville. Activity in the Washington D.C. area, which picked up ahead of most other major areas, has cooled a bit. The Midwest is seeing modest gains across many of its midsized markets and most of the regions larger markets have bottomed. The largest gains are occurring in areas benefitting from the rebound in the automotive industry and manufacturing in general. The energy boom in the Upper Midwest is also driving gains. Energy and the high-tech sector are also the big drivers out West, with San Jose and Denver leading the way. Activity continues to be skewed toward better locations, which tend to be clustered near key employment centers with long established amenities and infrastructure. Property prices in these infill areas sky-rocketed during the boom years, sending many would-be home buyers to the outer suburbs. With lower property prices and reduced construction costs, buyers are returning to these markets, even in hard hit areas like Tampa and Phoenix. There has been much less recovery in developments in the outer suburbs. Many of these projects were started during the latter part of the housing boom and are further out from key employment centers and retail centers. This is really evident in sprawling markets like Atlanta, where prices in the distant suburbs continue to tumble and foreclosures and negative equity remain significant hurdles to recovery. Even with continued worries about competition from foreclosure sales, we expect single-family construction to rise 7 percent in 2012. Sales of new homes should rise nearly 15 percent. Strong demand for apartments should help boost multi-family starts by at least 25 percent in 2012. Overall starts should rise to 690,000 units, which would be the best year since 2008. While we have raised our forecast for home sales and new home construction slightly, the same old hurdles remain in place. There is still a significant oversupply of homes in place, even though the inventory of existing homes recently fell to 2.58-million units in November, which is the lowest they have been since May 2005. New home inventories remain at a 49-year low. We believe you can add another 2 million units of shadow inventory to this total, consisting of homes in foreclosure, bank-owned properties and some percentage of homes with mortgages that are seriously delinquent and likely to go through the foreclosure process, most of which is located in a handful of long-troubled markets. The unknown number of homes in shadow inventory will continue to weigh on the housing market by encouraging appraisers to be overly conservative and by keeping mortgage underwriting tighter than it would be otherwise.

Recent Housing Data

Release NAHB Sentiment Index Housing Starts, Thousands of Units Housing Permits Existing Home Sales, Millions of Homes Percent Change New Home Sales, Thousands of Units Percent Change S&P Case/ Shiller Composite-20 December November November November November November November October Consensus Actual Prior 20 628K 653K 4.97M 1.4% 307K 1.3% -3.59% Revised 19 627K 644K 4.25M n/ a 310K 1.3% -3.54% Next Release Jan-18 Jan-19 Jan-19 Jan-20 Jan-20 Jan-26 Jan-26 Jan-31

20 21 635K 685K 635K 681K 5.05M 4.42M 2.2% 4.0% 315K 315K 2.6% 1.6% -3.20% -3.40%

Source: S&P, NAHB, National Association of Realtors, U.S. Dept. of Commerce and Wells Fargo Securities, LLC

National Housing Outlook

2008 -0.4 -0.6 5.8 900.0 616.3 283.7 482.2 4105.8 3655.0 450.8 232.1 -4.8 197.2 -9.2 -7.4 -16.7 4.88 3.66 6.04 5.18 216.7 -6.6 172.8 -12.4 -5.2 -12.9 3.25 3.26 5.04 4.71 374.3 4335.0 3866.7 468.3 321.3 4186.7 3707.5 479.2 221.8 2.4 172.4 -0.2 -3.0 2.1 3.25 3.22 4.69 3.78 554.0 442.4 111.6 584.9 471.0 113.9 610.0 428.0 182.0 305.0 4731.0 4256.0 475.0 224.2 1.1 164.7 -4.5 -4.2 -3.6 3.25 2.64 4.39 3.00 -3.6 -4.4 9.3 3.0 -0.7 9.6 1.8 1.0 9.0

2009

2010

2011

Forecast 2012 2.1 1.0 9.0 690.0 460.0 230.0 350.0 5020.0 4580.0 500.0 224.0 -0.1 162.5 -1.3 -2.1 -3.0 3.25 2.25 4.20 3.10

2013 1.8 1.0 8.9 800.0 530.0 270.0 410.0 5150.0 4750.0 540.0 227.5 1.6 163.0 0.3 -0.2 0.1 3.25 2.63 4.50 3.20

Housing Data Wrap-Up: December 2011 December 30, 2011

Real GDP, percent change Nonfarm Employment, percent change Unemployment Rate

Home Construction Total Housing Starts, in thousands Single-Family Starts, in thousands Multi-Family Starts, in thousands

Home Sales New Home Sales, Single-Family, in thousands Total Existing Home Sales, in thousands Existing Single-Family Home Sales, in thousands Existing Condominium & Townhouse Sales, in thousands

Home Prices Median New Home, $ Thousands Percent Change Median Existing Home, $ Thousands Percent Change FHFA (OFHEO) Home Price Index (Purch Only), Pct Chg Case-Shiller C-10 Home Price Index, Percent Change

Interest Rates - Annual Averages Prime Rate Ten-Year Treasury Note Conventional 30-Year Fixed Rate, Commitment Rate One-Year ARM, Effective Rate, Commitment Rate

Forecast as of: December 30, 2011

Source: Federal Reserve Board, FHFA, MBA, NAR, S&P, U.S. Department of C ommerce, U.S. Department of Labor and Wells Fargo Securities, LLC

WELLS FARGO SECURITIES, LLC ECONOMICS GROUP

Housing Data Wrap-Up: December 2011 December 30, 2011

WELLS FARGO SECURITIES, LLC ECONOMICS GROUP

Housing Starts

Housing Starts

2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 01 02 03 04 05 06 07 08 09 10 11 Housing Starts: Nov @ 685K Seasonally Adjusted Annual Rate, In Millions 2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0

Building Permits

2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 01 02 03 04 05 06 07 08 09 10 11

Building Permits: Nov @ 681K

Seasonally Adjusted Annual Rate, In Millions

2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0

Single & Multifamily Building Permits

2,000 1,750 1,500 1,250 1,000 750 500 250 0 92 94 96 98 00 02 04 06 08 10 Single-family Building Permits: Nov @ 425K (Left Axis) Multifamily Building Permits: Nov @ 213K (Right Axis) 0 SAAR, In Thousands, 3-Month Moving Average 800 700 600 500 400 300 200 100

Single & Multifamily Housing Starts

2,200 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 87 89 91 93 95 97 99 01 03 05 07 09 11 Single-family Housing Starts: Nov @ 435K (Left Axis) Multifamily Housing Starts: Nov @ 217K (Right Axis) SAAR, In Thousands, 3-Month Moving Average 660 600 540 480 420 360 300 240 180 120 60 0

NAHB/Wells Fargo Housing Market Index

90 Diffusion Index 90 80 70 60 50 40 30 20 10 NAHB Housing Market Index: Dec @ 21.0 0 0 87 89 91 93 95 97 99 01 03 05 07 09 11

Housing Completions

2.4 Seasonally Adjusted Annual Rate, In Millions 2.4

80 70 60

2.0

2.0

50 40

1.6

1.6

30 20

1.2

1.2

10

0.8 Housing Completions: Nov @ 542K 0.4 87 89 91 93 95 97 99 01 03 05 07 09 11

0.8

0.4

Source: NAHB, U.S. Department of Commerce and Wells Fargo Securities, LLC

Housing Data Wrap-Up: December 2011 December 30, 2011

WELLS FARGO SECURITIES, LLC ECONOMICS GROUP

New Home Sales

New Home Sales

1,500 Seasonally Adjusted Annual Rate, In Thousands 1,500

Inventory of New Homes for Sale

600 Non-Seasonally Adjusted, In Thousands Inventory: Nov @ 158,000 Completed New Homes: Nov @ 59,000 600

450

450

1,300

1,300 300 300

1,100

1,100

900

900 150 150

700

700

500

500

0 89 91 93 95 97 99 01 03 05 07 09 11

300

New Home Sales: Nov @ 315,000 3-Month Moving Average: Nov @ 310,333 89 91 93 95 97 99 01 03 05 07 09 11

300

100

100

Months' Supply of New Homes

14 Seasonally Adjusted 14

Average and Median New Home Sale Price

$350 In Thousands $350

12

12

$300

$300

10

10

$250

$250

6 6

$200

$200

4 Months' Supply: Nov @ 6.0

$150 Average Sales Price: Nov @ $242,900 Median New Sales Price: Nov @ $214,100 $100 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

$150

2 90 92 94 96 98 00 02 04 06 08 10

$100

220

Inventory of New Homes for Sale

New Homes for Sale at End of Month, 2002=100 Northeast: Nov @ 70.4 Midwest: Nov @ 31.0 South: Nov @ 57.9 West: Nov @ 48.6 220 200 180 160 140 120 100 80 60 40 20 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 200

Median New Home Sales Price

20% 20%

180 160

15%

15%

140 120 100

10%

10%

5%

5%

80 60 40

0%

0%

-5%

-5%

20

-10%

Median New Sales Price: Nov @ $214,100 Year-over-Year Percent Change: Nov @ -2.5% 89 91 93 95 97 99 01 03 05 07 09 11

-10%

-15%

-15%

Source: U.S. Department of Commerce and Wells Fargo Securities, LLC

Housing Data Wrap-Up: December 2011 December 30, 2011

WELLS FARGO SECURITIES, LLC ECONOMICS GROUP

Existing Home Sales

Existing Home Resales

7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 3.5 Existing Home Sales: Nov @ 4.42 Million 3.0 1999 3.0 2001 2003 2005 2007 2009 2011 Seasonally Adjusted Annual Rate - In Millions 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 3.5

Inventory of Existing Homes for Sale

4,500 Existing Homes for Sale at End of Month - In Thousands 4,500

4,000

4,000

3,500

3,500

3,000

3,000

2,500

2,500

2,000 Total Inventory: Nov @ 2,580 1,500 1999

2,000

1,500 2001 2003 2005 2007 2009 2011

Single-Family Home vs. Condo Prices

$300 In Thousands $300

Existing Single-Family Home Resales

7.0 6.5 6.0 5.5 5.0 4.5 4.0 3.5 3.0 Existing Home Sales: Nov @ 4.0 Million 2.5 99 01 03 05 07 09 11 2.5 Seasonally Adjusted Annual Rate - In Millions 7.0 6.5 6.0 5.5 5.0 4.5

$250

$250

$200

$200

$150

$150

$100

$100 Average Single-Family Price: Nov @ $210,800 Average Condo Price: Nov @ $208,100

4.0 3.5 3.0

$50 99 00

$50 01 02 03 04 05 06 07 08 09 10 11

Pending Home Sales Index

40% Year-over-Year Percent Change 40%

Existing Condominium Resales

1,000 Seasonally Adjusted Annual Rate - In Thousands 1,000

30%

30%

20%

20%

900

900

10% 10%

800

800

0% 0%

700

700

-10%

-10%

600

600

-20% Year-over-Year Change: Nov @ 5.9% -30% 2002

-20%

500

500

-30% 2003 2004 2005 2006 2007 2008 2009 2010 2011

400 Condo Sales: Nov @ 470,000 300 99 00 01 02 03 04 05 06 07 08 09 10 11

400

300

Source: National Association of Realtors and Wells Fargo Securities, LLC

Wells Fargo Securities, LLC Economics Group

Diane Schumaker-Krieg John E. Silvia, Ph.D. Mark Vitner Jay Bryson, Ph.D. Scott Anderson, Ph.D. Eugenio Aleman, Ph.D. Sam Bullard Anika Khan Azhar Iqbal Ed Kashmarek Tim Quinlan Michael A. Brown Joe Seydl Sarah Watt Kaylyn Swankoski

Global Head of Research (704) 715-8437 & Economics (212) 214-5070 Chief Economist Senior Economist Global Economist Senior Economist Senior Economist Senior Economist Economist Econometrician Economist Economist Economist Economic Analyst Economic Analyst Economic Analyst (704) 374-7034 (704) 383-5635 (704) 383-3518 (612) 667-9281 (704) 715-0314 (704) 383-7372 (704) 715-0575 (704) 383-6805 (612) 667-0479 (704) 374-4407 (704) 715-0569 (704) 715-1488 (704) 374-7142 (704) 715-0526

diane.schumaker@wellsfargo.com john.silvia@wellsfargo.com mark.vitner@wellsfargo.com jay.bryson@wellsfargo.com scott.a.anderson@wellsfargo.com eugenio.j.aleman@wellsfargo.com sam.bullard@wellsfargo.com anika.khan@wellsfargo.com azhar.iqbal@wellsfargo.com ed.kashmarek@wellsfargo.com tim.quinlan@wellsfargo.com michael.a.brown@wellsfargo.com joseph.seydl@wellsfargo.com sarah.watt@wellsfargo.com kaylyn.swankoski@wellsfargo.com

Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S broker-dealer registered with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corp. Wells Fargo Securities, LLC, distributes these publications directly and through subsidiaries including, but not limited to, Wells Fargo & Company, Wells Fargo Bank N.A., Wells Fargo Advisors, LLC, Wells Fargo Securities International Limited, Wells Fargo Securities Asia Limited and Wells Fargo Securities (Japan) Co. Limited. The information and opinions herein are for general information use only. Wells Fargo Securities, LLC does not guarantee their accuracy or completeness, nor does Wells Fargo Securities, LLC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sales of any security or as personalized investment advice. Wells Fargo Securities, LLC is a separate legal entity and distinct from affiliated banks and is a wholly owned subsidiary of Wells Fargo & Company 2011 Wells Fargo Securities, LLC.

SECURITIES: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FEMA Earthquake ChecklistDocument18 pagesFEMA Earthquake ChecklistChristophe ChooNo ratings yet

- Statistik MBADocument41 pagesStatistik MBAFarisNo ratings yet

- KCM 04 20 PDFDocument89 pagesKCM 04 20 PDFChristophe ChooNo ratings yet

- Coldwell Banker Previews International Luxury Market Report - March 2013Document29 pagesColdwell Banker Previews International Luxury Market Report - March 2013Christophe ChooNo ratings yet

- At Home With Christophe & Gabrielle Choo in The December Issue of Beverly Hills Resident MagazineDocument5 pagesAt Home With Christophe & Gabrielle Choo in The December Issue of Beverly Hills Resident MagazineChristophe ChooNo ratings yet

- The 3 8% TaxDocument11 pagesThe 3 8% Taxsanwest60No ratings yet

- PT Daekyung IHI Cilegon BVD 22 - 08 - 2022 11 - 47Document31 pagesPT Daekyung IHI Cilegon BVD 22 - 08 - 2022 11 - 47harryxwjNo ratings yet

- Brookfield Asset Management - "Real Assets, The New Essential"Document23 pagesBrookfield Asset Management - "Real Assets, The New Essential"Equicapita Income TrustNo ratings yet

- Epa National FinalDocument294 pagesEpa National FinalAlexNo ratings yet

- Tirmizi - 2009 - An Empirical Study of Consumer Impulse Buying Behavior in Local MarketsDocument11 pagesTirmizi - 2009 - An Empirical Study of Consumer Impulse Buying Behavior in Local MarketsNelson PutraNo ratings yet

- FX MKT Insights Jun2010 Rosenberg PDFDocument27 pagesFX MKT Insights Jun2010 Rosenberg PDFsuksesNo ratings yet

- Price Indices: Cpi V/S Wpi: Presented byDocument13 pagesPrice Indices: Cpi V/S Wpi: Presented bySakshi Agarwal100% (1)

- Unit 2 Understanding Rural Environment: ObjectivesDocument20 pagesUnit 2 Understanding Rural Environment: ObjectivesbhawnabatraNo ratings yet

- Macroeconomic Goals - ECON102 Macroeconomics Theory and PracticeDocument4 pagesMacroeconomic Goals - ECON102 Macroeconomics Theory and PracticeMarilou Arcillas PanisalesNo ratings yet

- The Great Depression by Lionel RobbinsDocument252 pagesThe Great Depression by Lionel RobbinsNicholas PanayiNo ratings yet

- Consumer Price Index - Oct 14Document4 pagesConsumer Price Index - Oct 14BernewsAdminNo ratings yet

- Volatility in Indian Stock MarketDocument6 pagesVolatility in Indian Stock MarketUpender GoelNo ratings yet

- Marathon 9 - Index NumbersDocument112 pagesMarathon 9 - Index NumbersSharda SurekaNo ratings yet

- 5star EU On Euro 10 Year ReportDocument342 pages5star EU On Euro 10 Year ReportBill ZhangNo ratings yet

- October 2022 CPI ReportDocument4 pagesOctober 2022 CPI ReportBernewsAdminNo ratings yet

- Chapter 8 Measuring The Cost of Living (CPI)Document31 pagesChapter 8 Measuring The Cost of Living (CPI)Mišel VuittonNo ratings yet

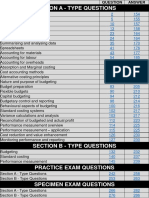

- MA Exam KitDocument304 pagesMA Exam KitAKSHAJ PRAKASHNo ratings yet

- Applying GBI Principles Retirement Problem PublicationDocument86 pagesApplying GBI Principles Retirement Problem PublicationRaghav DhootNo ratings yet

- Employment Labor Market BanDocument6 pagesEmployment Labor Market BanAhmed ShomonNo ratings yet

- The Concept of Index Number - VishnuDocument20 pagesThe Concept of Index Number - VishnuRavi Alwal100% (1)

- Kearns Article AsiaDocument1 pageKearns Article AsiaJKearns70No ratings yet

- Early Warning Signal System For Economic Crisis: A Threshold and Indicators ApproachDocument11 pagesEarly Warning Signal System For Economic Crisis: A Threshold and Indicators ApproachDeepika PadukoneNo ratings yet

- Factsheet February 2020 PDFDocument85 pagesFactsheet February 2020 PDFAshwini BhatNo ratings yet

- GK Unit 4 FinalDocument22 pagesGK Unit 4 FinalPavitra JainNo ratings yet

- EY Infrastructure Investments For Insurers PDFDocument24 pagesEY Infrastructure Investments For Insurers PDFDallas DragonNo ratings yet

- COLIpart 1Document40 pagesCOLIpart 1maniNo ratings yet

- Zbornik Konferenc Ekonomskog Fakulteta U Beogradu 2007Document234 pagesZbornik Konferenc Ekonomskog Fakulteta U Beogradu 2007biserkadvaNo ratings yet

- Metal Bulletin Iron Ore Index Methodology Specification and Usage GuideDocument24 pagesMetal Bulletin Iron Ore Index Methodology Specification and Usage GuideLeonTanNo ratings yet

- Barclays Family of IndicesDocument336 pagesBarclays Family of IndicesbretonpacomeNo ratings yet

- National IncomeDocument38 pagesNational IncomeManish SinghaniaNo ratings yet