Professional Documents

Culture Documents

Bank of Kigali Announces Q2 2011 & 1H 2011 Results

Uploaded by

Bank of KigaliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank of Kigali Announces Q2 2011 & 1H 2011 Results

Uploaded by

Bank of KigaliCopyright:

Available Formats

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

601.9 RwF/US$ Period End Exchange rate as at 30 June 2011

594.4 RwF/US$ Period End Exchange Rate as at 31 December 2010

587.8 RwF/US$ Period End Exchange Rate as at 30 June 2010

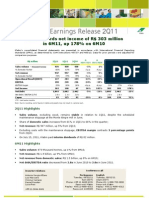

Bank of Kigali Announces Q2 2011 & 1H 2011 Audited Results

Millions, unless otherwise noted

Total Operating Income (Revenue)

Total Recurring Operating Costs

Profit Before Provisions

Net Provision Expense

Net Income (Loss)

Q2 2011

US$

11.8

5.0

6.8

(1.1)

3.3

RwF

7,113

3,039

4,075

(683)

1,975

Change

Q-o-Q

11.6%

17.4%

7.6%

47.5%

3.1%

Total Operating Income (Revenue)

Total Recurring Operating Costs

Profit Before Provisions

Net Provision Expense

Net Income (Loss)

1H 2011

US$

22.4

9.3

13.1

(1.9)

6.5

RwF

13,488

5,627

7,862

(1,145)

3,890

Change

Y-o-Y

38.4%

22.5%

52.5%

-33.4%

76.0%

Total Assets

Net Loans

Client Deposits

Total Liabilities

Shareholders' Equity

As at 30 June 2011

US$

RwF

409.5

246,466

184.9

111,299

292.1

175,826

351.7

211,707

57.7

34,759

Change

YTD

24.7%

9.8%

29.6%

27.7%

9.1%

Net Loans/Total Assets

Net Loans/Client Deposits

As at 30 June 2011

45.2%

63.3%

ROAA, annualised

ROAE, annualised

Q2 2011

3.4%

23.0%

Y-o-Y

38.0%

19.0%

56.7%

31.9%

45.1%

Y-o-Y

40.9%

24.8%

39.7%

37.3%

67.5%

As at 30 June 2010

51.0%

70.8%

Q2 2010

3.3%

26.6%

Q2 2011, Q4 2010 and Q2 2010 numbers in this press release are audited interim numbers.

About Bank of Kigali

Bank of Kigali is a leading banking institution in Rwanda, offering a wide spectrum of commercial banking services to corporate, SME and retail customers. The Bank has approximately

500 employees and serves over 90,120 retail clients. The Bank has a network of 39 branches spread across all provinces and major commercial districts in the country.

For further information, please visit www.bk.rw or contact:

Frances Ihogoza

Head of Corporate Affairs/Company Secretary

Tel: +250 252 593 100 or +250 252 593 200

Fax: +250 252 575 504 or +250 252 573 461

Email: fihogoza@bk.rw

SWIFT: BKIGRWRW

Company Code/ TIN n 10.000.3458

P.o Box 175 - KIGALI

Plot No. 6112, Avenue de la Paix Kigali (Rwanda)

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

Bank of Kigali (the Bank), the leading bank in Rwanda, announced today its non-IFRS results, reporting Net Income

of RwF 1,975 million (US$3.3 million) in Q2 2011, up 3.1% q-o-q and up 45.1% y-o-y.

Q2 2011 and 1H 2011 Financial Highlights

Total Assets grew by 16.7% q-o-q and 40.9% y-o-y (24.7% YTD 2011) to RwF 246,466 million as at 30 June 2011

Total Assets Growth

Bank of Kigali

The Rwandan Banking Sector*

1H 2011

24.7%

9.6%

2010

30.1%

26.1%

Net Loans grew by 6.1% q-o-q and 24.8% y-o-y (9.8% YTD 2011) to RwF 111,299 million as at 30 June 2011

Net Loan Book Growth

Bank of Kigali

The Rwandan Banking Sector*

1H 2011

9.8%

8.6%

2010

31.5%

13.1%

Client Deposits grew by 23.7% q-o-q and 39.7% y-o-y (29.6% YTD 2011) to RwF 175,826 million as at 30 June

2011

Client Deposits Growth

Bank of Kigali

The Rwandan Banking Sector*

1H 2011

29.6%

10.6%

2010

24.2%

27.8%

Bank of Kigali Growth vs. Rwandan Banking Sector Growth in 2010 and 1H 2011

35.0%

35.0%

31.5%

30.1%

30.0%

24.2%

25.0%

29.6%

30.0%

27.8%

26.1%

25.0%

24.7%

20.0%

20.0%

15.0%

15.0%

13.1%

10.0%

10.0%

5.0%

5.0%

9.6%

9.8%

10.6%

8.6%

0.0%

0.0%

Total Assets

Bank Of Kigali Growth In 2010

Net Loans

Total Assets

Client Deposits

Rwandan Banking Sector Growth In 2010

Bank of Kigali Growth in 1H 2011

Net Loans

Client Balances & Deposits

Rwandan Banking Sector Growth in 1H 2011

Market Share Dynamics

35.0%

31.5% 31.7%

30.9%

30.0%

26.4%

29.4%

27.4%

26.8%

25.7% 25.9%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

Total Assets

Net Loans

2009

2010

Client Deposits

1H 2011

*Preliminary estimates have been used for EcoBank in calculating the banking sector figures, whose 1H 2011 performance figures are subject to confirmation.

Any resulting changes are unlikely to be material.

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

Net Interest Income equalled RwF 4,114 million in Q2 2011, up 13.4% q-o-q and 32.3% y-o-y. Net Fee & Commission

Income amounted to RwF 987 million in Q2 2011, up 26.8% q-o-q and 100.3% y-o-y. Total Operating Income

(Revenue) reached RwF 7,113 million in Q2 2011, up 11.6% q-o-q and 38.0% y-o-y. Total Recurring Operating Costs

increased by 17.4% q-o-q and 19.0% y-o-y to RwF 3,039 in Q2 2011. Cost/Income ratio reached 49.5% in Q2 2011

slightly up from 48.2% in Q1 2011 and down from 51.8% in Q2 2010.

Annualised ROAA reached 3.4% in Q2 2011, whereas annualised ROAE reached 23.0% in Q2 2011.

Total Assets grew by 16.7% q-o-q and 40.9% y-o-y (up 24.7% YTD 2011), reaching RwF 246,466 million as at 30 June

2011. Net Loans grew by 6.1% q-o-q and 24.8% y-o-y (up 9.8% YTD 2011), reaching RwF 111,299 million as at 30 June

2011. Client Deposits amounted to RwF 176,826 million, up 23.7% q-o-q and 39.7% y-o-y (up 29.6% YTD 2011). Net

Loans/Total Assets ratio stood at 45.2% as at 30 June 2011 vs. 51.0% as at 30 June 2010. Net Loans/Client Deposits

ratio reached 63.3% as at 30 June 2011 vs. 70.8% as at 30 June 2010.

Net Interest Income equalled RwF 7,741 million in 1H 2011, up 28.9% y-o-y. Net Fee & Commission Income

amounted to RwF 1,766 million in 1H 2011, up 85.4% y-o-y. Total Operating Income (Revenue) reached RwF 13,488

million in 1H 2011, up 38.4% y-o-y. Total Recurring Operating Costs increased by 22.5% y-o-y to RwF 5,627 in 1H

2011. Cost/Income ratio decreased to 48.9% in 1H 2011 from 49.4% in 1H 2010.

I am delighted that we have managed to grow our balance sheet and further increase our market share by total

assets. We will continue growing the Bank, with a focus on profitability and increasing shareholder value,

commented James Gatera, Managing Director.

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

Q2 2011 Performance Highlights

Total Operating Income

Total Assets

RwF Millions

RwF Millions

8,000

300,000

+38%

7,113

7,000

6,000

+41%

250,000

5,153

5,000

200,000

4,000

150,000

246,466

174,901

3,000

100,000

2,000

50,000

1,000

Q2 2010

Q2 2011

Q2 2010

Recurring Operating Costs

Q2 2011

Net Loans

RwF Millions

RwF Millions

3,500

+19%

120,000

+25%

111,299

3,039

3,000

100,000

2,553

2,500

89,151

80,000

2,000

60,000

1,500

40,000

1,000

20,000

500

-

Q2 2010

Q2 2011

Q2 2010

Net Income

Client Deposits

RwF Millions

RwF Millions

2,500

200,000

+45%

1,975

2,000

+40%

180,000

175,826

160,000

140,000

1,500

Q2 2011

1,360

125,838

120,000

100,000

1,000

80,000

60,000

500

40,000

20,000

Q2 2010

Q2 2011

Q2 2010

Q2 2011

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

Q2 2011 INCOME STATEMENT

Q2 2011

Millions, unless otherwise noted

RwF/Euro Exchange Rate, e-o-p

RwF/US$ Exchange Rate, e-o-p

Interest Income

Interest Expense

Net Interest Income

Fee & Commission Income

Fee & Commission Expenses

Net Fee & Commission Income

Income From Documentary Operations

Expense On Documentary Operations

Net Income From Documentary Operations

Other Non-Interest Income

Other Non-Interest Expense

Net Other Non-interest Income

FX Trading Income

Net Non-Interest Income

Total Operating Income

Directors' Remuneration

Personnel Costs

Other Operating Expenses

Depreciation

Total Recurring Operating Costs

Profit Before Provisions

Loan Loss Provisions

Gains on recovery

Net Provisions

Profit Before Tax

Bonuses (Paid & Accrued)

Accrued Or Paid Income Tax

Net Income

RwF

867.284

601.942

Q1 2011

US$

RwF

843.505

600.052

Q2 2010

US$

Growth,

Growth,

RwF

725.112

587.801

US$

Q-o-Q

Y-o-Y

5,501

1,387

4,114

987

987

56

56

232

232

1,724

2,999

7,113

93

1,282

1,172

491

3,039

9.1

2.3

6.8

1.6

1.6

0.1

0.1

0.4

0.4

2.9

5.0

11.8

0.2

2.1

1.9

0.8

5.0

4,770

1,143

3,627

779

779

42

42

220

220

1,707

2,748

6,375

63

1,200

881

443

2,588

7.9

1.9

6.0

1.3

1.3

0.1

0.1

0.4

0.4

2.8

4.6

10.6

0.1

2.0

1.5

0.7

4.3

3,930

820

3,110

493

493

50

50

165

165

1,335

2,043

5,153

79

1,210

929

336

2,553

6.7

1.4

5.3

0.8

0.0

0.8

0.1

0.0

0.1

0.3

0.0

0.3

2.3

3.5

8.8

0.1

2.1

1.6

0.6

4.3

15.3%

21.3%

13.4%

26.8%

0.0%

26.8%

34.4%

0.0%

34.4%

5.8%

0.0%

5.8%

1.0%

9.1%

11.6%

46.5%

6.8%

33.0%

10.9%

17.4%

40.0%

69.2%

32.3%

100.3%

0.0%

100.3%

12.0%

0.0%

12.0%

40.5%

0.0%

40.5%

29.1%

46.8%

38.0%

18.2%

6.0%

26.2%

46.3%

19.0%

4,075

(1,681)

998

(683)

3,392

6.8

(2.8)

1.7

(1.1)

5.6

3,787

(1,158)

695

(463)

3,325

6.3

(1.9)

1.2

(0.8)

5.5

2,600

(1,651)

1,133

(518)

2,082

4.4

-2.8

1.9

-0.9

3.5

7.6%

45.2%

43.6%

47.5%

2.0%

56.7%

1.8%

-11.9%

31.9%

62.9%

485

933

1,975

0.8

1.5

3.3

486

924

1,915

0.8

1.5

3.2

114

608

1,360

0.2

1.0

2.3

-0.1%

0.9%

3.1%

325.4%

53.4%

45.1%

Notes: (1) Growth calculations are based on RwF values

(2) US$ values have been derived from period-end RwF/US$ exchange rates set out on page 1 of this news report

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

1H 2011 INCOME STATEMENT

1H 2011

RwF

Millions, unless otherwise noted

RwF/Euro Exchange Rate, e-o-p

RwF/US$ Exchange Rate, e-o-p

1H 2010

US$

867.284

601.942

RwF

Growth,

US$

Y-o-Y

725.112

587.801

Interest Income

Interest Expense

Net Interest Income

Fee & Commission Income

Fee & Commission Expenses

Net Fee & Commission Income

Income From Documentary Operations

Expense On Documentary Operations

Net Income From Documentary Operations

Other Non-Interest Income

Other Non-Interest Expense

Net Other Non-interest Income

FX Trading Income

Net Non-Interest Income

Total Operating Income

Directors' Remuneration

Personnel Costs

Other Operating Expenses

Depreciation

Total Recurring Operating Costs

10,271

2,530

7,741

1,766

1,766

98

98

452

452

3,431

5,747

13,488

156

2,483

2,054

934

5,627

17.1

4.2

12.9

2.9

2.9

0.2

0.2

0.8

0.8

5.7

9.5

22.4

0.3

4.1

3.4

1.6

9.3

7,871

1,866

6,005

953

953

98

98

312

312

2,380

3,743

9,748

98

2,331

1,619

543

4,592

13.4

3.2

10.2

1.6

1.6

0.2

0.2

0.5

0.5

4.0

6.4

16.6

0.2

4.0

2.8

0.9

7.8

30.5%

35.6%

28.9%

85.4%

0.0%

85.4%

-0.5%

0.0%

-0.5%

45.0%

0.0%

45.0%

44.1%

53.5%

38.4%

59.4%

6.5%

26.8%

71.9%

22.5%

Profit Before Provisions

Loan Loss Provisions

Gains on recovery

Net Provisions

Profit Before Tax

7,862

(2,838)

1,693

(1,145)

6,716

13.1

(4.7)

2.8

(1.9)

11.2

5,156

(3,189)

1,469

(1,721)

3,436

8.8

(5.4)

2.5

(2.9)

5.8

52.5%

-11.0%

15.3%

-33.4%

95.5%

970

1,856

3,890

1.6

3.1

6.5

228

998

2,210

0.4

1.7

3.8

325.5%

86.0%

76.0%

Bonuses (Paid & Accrued)

Accrued Or Paid Income Tax

Net Income

Notes: (1) Growth calculations are based on RwF values

(2) US$ values have been derived from period-end RwF/US$ exchange rates set out on page 1 of this news report

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

Q2 2011 BALANCE SHEET

Q2 2011

Q1 2011

Q4 2010

Q2 2010

Q-o-Q

Change

Millions, unless otherwise noted

Y-o-Y

Change

YTD

Growth

Cash

Balances With BNR

Cash Balances With Banks

Treasuries

Other Fixed Income Instruments

Gross Loans

Loan Loss Reserve

Net Loans To Clients

Net Investments

Net Property, Plant & Equipment

Net Intangible Assets

Net Other Assets

Total Assets

US$

15.2

9.5

69.8

72.6

11.1

192.6

(7.7)

184.9

0.4

31.5

0.3

14.1

409.5

RwF

9,165

5,710

42,044

43,672

6,682

115,913

(4,613)

111,299

268

18,958

164

8,504

246,466

US$

11.2

13.6

52.0

33.9

20.4

185.0

(10.2)

174.8

0.4

30.1

0.6

14.7

351.8

RwF

6,740

8,187

31,204

20,317

12,211

111,014

(6,113)

104,902

268

18,081

362

8,851

211,123

US$

11.6

10.7

61.4

30.6

8.8

177.5

(6.9)

170.6

0.5

30.8

0.3

7.4

332.5

RwF

6,882

6,333

36,480

18,202

5,224

105,527

(4,124)

101,403

268

18,313

181

4,391

197,677

US$

5.9

8.7

48.8

47.0

9.1

159.1

(7.4)

151.7

0.6

11.4

0.4

14.1

297.6

RwF

3,462

5,111

28,659

27,612

5,341

93,524

(4,373)

89,151

340

6,694

225

8,307

174,901

36.0%

-30.3%

34.7%

114.9%

-45.3%

4.4%

-24.5%

6.1%

0.0%

4.9%

-54.8%

-3.9%

16.7%

164.7%

11.7%

46.7%

58.2%

25.1%

23.9%

5.5%

24.8%

-21.1%

183.2%

-27.2%

2.4%

40.9%

33.2%

-9.8%

15.3%

139.9%

27.9%

9.8%

11.9%

9.8%

0.0%

3.5%

-9.3%

93.7%

24.7%

Interbank Deposits

Client Deposits

Borrowed Funds

Payable Interest & Dividends

Other Liabilities

Total Liabilities

Ordinary Shares

Retained Earnings

Revaluation Reserve

Net Income

Shareholder's Equity

Total liabilities & Shareholders' Equity

28.0

292.1

3.1

0.5

28.0

351.7

8.3

31.4

11.6

6.5

57.7

409.5

16,857

175,826

1,862

309

16,853

211,707

5,005

18,893

6,972

3,890

34,759

246,466

31.5

237.0

3.0

0.3

25.4

297.2

8.3

31.3

11.8

3.2

54.6

351.8

18,921

142,190

1,811

193

15,223

178,338

5,005

18,803

7,061

1,915

32,785

211,123

31.8

228.2

18.9

278.9

8.4

22.8

12.0

10.4

53.6

332.5

18,921

135,677

11,208

165,807

5,005

13,536

7,151

6,179

31,870

197,677

26.1

214.1

4.5

17.6

262.3

8.5

23.0

3.8

35.3

297.6

15,341

125,838

2,643

10,329

154,151

5,005

13,535

2,210

20,750

174,901

-10.9%

23.7%

2.8%

NMF

10.7%

18.7%

0.0%

0.5%

-1.3%

103.1%

6.0%

16.7%

9.9%

39.7%

NMF

-88.3%

63.2%

37.3%

0.0%

39.6%

NMF

76.0%

67.5%

40.9%

-10.9%

29.6%

NMF

0.0%

50.4%

27.7%

0.0%

39.6%

-2.5%

-37.0%

9.1%

24.7%

Notes: (1) Growth calculations are based on RwF values

(2) US$ values have been derived from period-end RwF/US$ exchange rates set out on page 1 of this news report

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

KEY RATIOS

Profitability

Return on Average Assets, Annualised, %

Return on Average Equity, Annualised, %

Net Interest Margin , Annualised, %

Loan Yield, Annualised,%

Interest Expense/Interest Income, %

Cost of Deposits, Annualised,%

Efficiency

Cost/Income Ratio

Costs/Average Assets, Annualised, %

Personnel Costs/Total Recurring Operating Costs

Personnel Costs/Average Total Assets, Annualised

Personnel Costs/Total Operating Income

Net Income/Total Operating Income

Liquidity

Net Loans/Total Assets,%

Liquid Assets / Total Deposits

Interbank Borrowings / Total Deposits

Short-term Liquidity Gap

Gross Loans / Total Deposits

Asset Quality

NPLs / Gross Loans, %

NPL Coverage Ratio

Large Exposures / Gross Loans

Cost of Risk, Annualised

Leverage (Total Liabilities/Equity), Times

Capital Adequacy

Core Capital / Risk Weighted Assets

Total Qualifying Capital / Risk Weighted Assets

Off Balance Sheet Items / Total Qualifying Capital

Large Exposures / Core Capital

NPLs less Provisions / Core Capital

Market Sensitivity

Forex Exposure / Core Capital

Forex Loans / Forex Deposits

Forex Assets / Forex Liabilities

Selected Operating Data

Full Time Employees

Assets per FTE (RwF)

Number of Active Branches

Number of ATMS

Number of POS Terminals

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

3.4%

23.0%

8.4%

16.6%

25.2%

2.8%

3.5%

23.1%

8.3%

16.4%

24.6%

2.7%

3.3%

26.6%

8.5%

14.8%

20.9%

2.3%

2.8%

21.6%

8.4%

14.5%

23.7%

3.0%

3.5%

24.5%

8.3%

14.4%

23.5%

3.2%

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

49.5%

6.0%

61.2%

3.2%

26.1%

27.8%

48.9%

5.9%

64.1%

3.2%

26.8%

28.8%

51.8%

6.5%

54.9%

3.4%

27.2%

26.4%

49.4%

6.0%

57.9%

3.3%

27.3%

22.7%

47.5%

6.1%

51.8%

3.0%

25.0%

29.2%

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

45.2%

55.7%

8.7%

28.8%

60.2%

45.2%

55.7%

8.7%

28.8%

60.2%

51.0%

49.8%

10.9%

16.1%

66.2%

51.0%

49.8%

10.9%

16.0%

66.2%

51.3%

42.9%

12.3%

11.9%

68.4%

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

7.5%

64.4%

3.6%

2.4%

6.1

7.5%

64.4%

3.6%

4.1%

6.1

9.8%

47.7%

13.1%

2.3%

7.4

9.8%

47.7%

13.1%

3.9%

7.4

8.4%

45.2%

5.8%

1.9%

5.2

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

16.1%

20.5%

468.3%

16.2%

14.5%

16.1%

20.5%

468.3%

16.2%

14.5%

16.4%

16.4%

429.0%

62.6%

22.7%

16.4%

16.4%

429.0%

62.6%

22.7%

18.7%

20.1%

402.8%

27.9%

15.3%

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

9.2%

1.5%

108.4%

9.2%

1.5%

108.4%

-2.8%

0.8%

106.3%

-2.8%

0.8%

98.4%

8.9%

1.1%

106.0%

Q2 2011

1H 2011

Q2 2010

1H 2010

2010

500

500

417

490,931 490,931 419,427

38

38

24

26

26

6

100

100

79

417

419,427

24

6

79

453

436,372

33

26

97

Note: ratios for Q2 2011, Q2 2010, 1H 2011 and 1H 2010 are annualised

Bank of Kigali Limited

Your trusted partner in wealth creation

Kigali, 2 September 2011

Ratio Definitions

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

Return On Average Total Assets (ROAA) equals Net Income of the period divided by average Total Assets for the same period;

Return On Average Total Equity (ROAE) equals Net Income of the period divided by average Total Shareholders Equity for the same period;

Average Interest Earning Assets are calculated on a quarterly basis; Interest Earning Assets include: Cash & Balances With Banks, Treasuries

and Net Loans To Clients;

Net Interest Margin equals Net Interest Income of the period divided by Average Interest Earning Assets for the same period;

Loan Yield equals Interest Income of the period divided by average Gross Loans for the same period;

Cost Of Funds equals Interest Expense of the period divided by average Total Liabilities for the same period;

Total Operating Income includes Net Interest Income and Non-Interest Income;

Costs include Total Recurring Operating Costs and Bonuses (Paid and Accrued);

Cost/Income equals Total Recurring Operating Costs plus Bonuses (Paid and Accrued) for the period divided by Total Operating Income;

Personnel Costs/Total Recurring Operating Costs equals the sum of Directors Remuneration, Personnel Costs and Bonuses (Paid and Accrued)

for the period divided by Total Recurring Operating Costs ;

Personnel Costs/Average Total Assets equals the sum of Directors Remuneration, Personnel Costs and Bonuses (Paid and Accrued) for the

period divided by average Total Assets ;

Client Deposits include Corporate and Retail deposits;

Total Deposits include Interbank Deposits and Client Deposits;

Shareholders Equity equals to Total Shareholders Equity;

NPLs are loans overdue by more than 90 days;

NPL Coverage ratio equals Loan Loss Reserve as of the period end divided by NPLs as of the same date;

Large exposures include loans that in aggregate comprise 10% of Core Capital

Cost Of Risk equals Net Provision For Loan Losses of the period, plus provisions for (less recovery of) other assets, divided by average Gross

Loans To Clients for the same period;

Total Capital Adequacy equals Total Capital as of the period end divided by Total Risk Weighted Assets as of the same date, both calculated

in accordance with the requirements of the National Bank of Rwanda.

You might also like

- 2010 10 UBS ConferenceDocument46 pages2010 10 UBS Conferenceagafonov_antonNo ratings yet

- Investor Presentation Mar31 2010Document19 pagesInvestor Presentation Mar31 2010Sahil GoyalNo ratings yet

- HDFC Bank: Performance HighlightsDocument12 pagesHDFC Bank: Performance HighlightsAnamika_Bansal_8012No ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010Document12 pagesBM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010BVMF_RINo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- BM&FBOVESPA S.A. Posts Robust Results For The Third Quarter 2011Document9 pagesBM&FBOVESPA S.A. Posts Robust Results For The Third Quarter 2011BVMF_RINo ratings yet

- United Bank Limited: Unconsolidated Condensed Interim Financial StatementsDocument20 pagesUnited Bank Limited: Unconsolidated Condensed Interim Financial StatementsYasir SheikhNo ratings yet

- BM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsDocument10 pagesBM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsBVMF_RINo ratings yet

- Yes Bank: Emergin G StarDocument5 pagesYes Bank: Emergin G StarAnkit ModaniNo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- 2011 Annual ReportDocument96 pages2011 Annual ReportOsman SalihNo ratings yet

- Q2 2011 - FinancialResultsDocument7 pagesQ2 2011 - FinancialResultspatburchall6278No ratings yet

- Bank of Kigali 1H 2010 Results UpdateDocument48 pagesBank of Kigali 1H 2010 Results UpdateBank of KigaliNo ratings yet

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- Kotak Mahindra 2011Document55 pagesKotak Mahindra 2011Pdr RaooNo ratings yet

- Q2 Year 2011: SET / Reuters / Bloomberg Tuf / Tuf - BK / Tuf TBDocument6 pagesQ2 Year 2011: SET / Reuters / Bloomberg Tuf / Tuf - BK / Tuf TBGymmy YeoNo ratings yet

- China Modern Reports 2011 Fiscal Year End EPS of $0.23: Cmci CmciDocument2 pagesChina Modern Reports 2011 Fiscal Year End EPS of $0.23: Cmci CmciJayphi Taganas BaddungonNo ratings yet

- MANDO.2Q11 Earnings PresentationDocument8 pagesMANDO.2Q11 Earnings PresentationSam_Ha_No ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Presentation - 4Q11 and 2011 ResultsDocument14 pagesPresentation - 4Q11 and 2011 ResultsLightRINo ratings yet

- BM&FBOVESPA Announces Results For The First Quarter 2011Document9 pagesBM&FBOVESPA Announces Results For The First Quarter 2011BVMF_RINo ratings yet

- HDFC Result UpdatedDocument12 pagesHDFC Result UpdatedAngel BrokingNo ratings yet

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- ICICI Group: Strategy & Performance: September 2011Document42 pagesICICI Group: Strategy & Performance: September 2011helloashokNo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010Document15 pagesBM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010BVMF_RINo ratings yet

- 2011 11 Presentation For CLSA ConferenceDocument45 pages2011 11 Presentation For CLSA Conferenceankur9usNo ratings yet

- Rezultate OTP BankDocument55 pagesRezultate OTP BankCiocoiu Vlad AndreiNo ratings yet

- Accenture Reports Strong Second-Quarter Fiscal 2011 ResultsDocument12 pagesAccenture Reports Strong Second-Quarter Fiscal 2011 ResultsPriya NairNo ratings yet

- 9m11 PPT FinalDocument29 pages9m11 PPT FinalMarcelo FrancoNo ratings yet

- Multiplan S Shopping Center EBITDA Increases 74% To R$116 Million and Reached A 74.4% Margin in 3Q11Document37 pagesMultiplan S Shopping Center EBITDA Increases 74% To R$116 Million and Reached A 74.4% Margin in 3Q11Multiplan RINo ratings yet

- 2096 Presentation Q3 2011Document16 pages2096 Presentation Q3 2011ajclintNo ratings yet

- Accenture Q3 2011Document12 pagesAccenture Q3 2011Javier BáezNo ratings yet

- 2011 5 Results eDocument58 pages2011 5 Results eDennis HoNo ratings yet

- ICICI Group: Strategy & PerformanceDocument51 pagesICICI Group: Strategy & PerformanceJason SanchezNo ratings yet

- Our Network: Our Presence, in All Corners of Pakistan, Is More Than Just Being ThereDocument4 pagesOur Network: Our Presence, in All Corners of Pakistan, Is More Than Just Being ThereRulz MakerNo ratings yet

- June 2011 Results PresentationDocument17 pagesJune 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Full Year 2011 Results Presentation 2Document16 pagesFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNo ratings yet

- AcBel PolytechDocument8 pagesAcBel PolytechPerry TannerNo ratings yet

- Q4 & Fy11 Result Update Yes Bank LTDDocument6 pagesQ4 & Fy11 Result Update Yes Bank LTDrajarun85No ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- Press Release: Milestone Achievements During FY 2011-12Document7 pagesPress Release: Milestone Achievements During FY 2011-12Mohammed JashidNo ratings yet

- 2011 Q2 Central London Offices JLLDocument16 pages2011 Q2 Central London Offices JLLpcharrisonNo ratings yet

- LG Chem.2Q ResultsDocument11 pagesLG Chem.2Q ResultsSam_Ha_No ratings yet

- United Bank of IndiaDocument51 pagesUnited Bank of IndiaSarmistha BanerjeeNo ratings yet

- Q2FY16 Investor Presentation (Company Update)Document37 pagesQ2FY16 Investor Presentation (Company Update)Shyam SunderNo ratings yet

- Stock Market Position of Icici Bank Limited: Performance Review - Quarter and Year Ended March 31, 2010Document4 pagesStock Market Position of Icici Bank Limited: Performance Review - Quarter and Year Ended March 31, 2010Nitish SinghNo ratings yet

- Welcome in The Presentation CeremonyDocument17 pagesWelcome in The Presentation CeremonyMoinul IslamNo ratings yet

- Dealogic IB Strategy Review - First Nine Months 2012 - FINALDocument10 pagesDealogic IB Strategy Review - First Nine Months 2012 - FINALasdfaNo ratings yet

- VOF VNL VNI: Capital MarketsDocument6 pagesVOF VNL VNI: Capital Marketsflocke2No ratings yet

- Bank of Kigali Investor Presentation Q1 & 3M 2012Document43 pagesBank of Kigali Investor Presentation Q1 & 3M 2012Bank of Kigali100% (1)

- Havell Q4 FY2011Document6 pagesHavell Q4 FY2011Tushar DasNo ratings yet

- Prime Bank LTD: Dse: Primebank Bloomberg: PB:BDDocument13 pagesPrime Bank LTD: Dse: Primebank Bloomberg: PB:BDSajidHuqAmitNo ratings yet

- Canara Bank: Performance HighlightsDocument11 pagesCanara Bank: Performance HighlightsAstitwa RathoreNo ratings yet

- Conomic: The Impending Signs of Global UncertaintyDocument16 pagesConomic: The Impending Signs of Global UncertaintyS GNo ratings yet

- EAC Highlights 2011 12Document5 pagesEAC Highlights 2011 12Ishaan GoelNo ratings yet

- Corporate Presentation: October 2011Document32 pagesCorporate Presentation: October 2011Ravi SagarNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Bank of Kigali Investor Presentation Q1 & 3M 2012Document43 pagesBank of Kigali Investor Presentation Q1 & 3M 2012Bank of Kigali100% (1)

- Bank of Kigali Limited: Financially Transforming LivesDocument3 pagesBank of Kigali Limited: Financially Transforming LivesBank of KigaliNo ratings yet

- Bank of Kigali Receives Best East African BankDocument1 pageBank of Kigali Receives Best East African BankBank of KigaliNo ratings yet

- 2011 Annual ReportDocument96 pages2011 Annual ReportOsman SalihNo ratings yet

- Bank of Kigali Annual Report 2010Document92 pagesBank of Kigali Annual Report 2010Bank of Kigali0% (3)

- Bank of Kigali Annual Report 2009Document80 pagesBank of Kigali Annual Report 2009Bank of KigaliNo ratings yet

- Bank of Kigali 2010 9M 2010 Results UpdateDocument59 pagesBank of Kigali 2010 9M 2010 Results UpdateBank of KigaliNo ratings yet

- Bank of Kigali 1H 2010 Results UpdateDocument48 pagesBank of Kigali 1H 2010 Results UpdateBank of KigaliNo ratings yet

- CH 10 NotesDocument13 pagesCH 10 NotesmohamedNo ratings yet

- Foreign Exchange Guidelines by Bangladesh Bank PDFDocument380 pagesForeign Exchange Guidelines by Bangladesh Bank PDFMohammad Khaled Saifullah Cdcs100% (1)

- Terminal Handling Charges: London Heathrow AirportDocument2 pagesTerminal Handling Charges: London Heathrow AirportMuhammad SiddiuqiNo ratings yet

- Kuraye Akuiyibo Plea AgreementDocument7 pagesKuraye Akuiyibo Plea AgreementEmily BabayNo ratings yet

- Catalog Fas Usa0620Document57 pagesCatalog Fas Usa0620Jorge Calcaneo MartinezNo ratings yet

- PoliciesDocument44 pagesPoliciesGabriel Joseph AdanNo ratings yet

- Dolly Khanna PortfolioDocument7 pagesDolly Khanna PortfoliomalhiNo ratings yet

- Accounting: South Pacific Form Seven CertificateDocument35 pagesAccounting: South Pacific Form Seven CertificateArun ThakurNo ratings yet

- Presentation HIRARCDocument12 pagesPresentation HIRARCahmad syouqiNo ratings yet

- Ey Fintech Exec Summary 2017Document44 pagesEy Fintech Exec Summary 2017Anonymous SNBEw8WN100% (5)

- Benefit Hub License AgreementDocument15 pagesBenefit Hub License AgreementDaniel TorsonNo ratings yet

- Mulungushi University Additional Provisional First Year Students Loan Awards - 2021/2022 Academic YearDocument4 pagesMulungushi University Additional Provisional First Year Students Loan Awards - 2021/2022 Academic YearGillian ChipoteNo ratings yet

- GSKDocument4 pagesGSKKrishna KumarNo ratings yet

- IBM SharedServices WhitepaperDocument12 pagesIBM SharedServices Whitepaperdungski0% (1)

- Capital RevenueDocument21 pagesCapital RevenueTwinkle KashyapNo ratings yet

- Boroline Brand StrategyDocument25 pagesBoroline Brand StrategyDigvijay Singh100% (2)

- SNE Libya Security Summary 05 January 2015Document15 pagesSNE Libya Security Summary 05 January 2015klatifdgNo ratings yet

- Kajian Investasi Bisnis Hotel Budget Di Medan: Lokasi Bandara KualanamuDocument10 pagesKajian Investasi Bisnis Hotel Budget Di Medan: Lokasi Bandara KualanamufitrifirdaNo ratings yet

- Whitepaper Digital ShipyardDocument8 pagesWhitepaper Digital ShipyardSuhas MayekarNo ratings yet

- Company Law QuestionsDocument9 pagesCompany Law QuestionsBadrinath ChavanNo ratings yet

- Assignment 3 - Bottom of The PyramidDocument14 pagesAssignment 3 - Bottom of The Pyramidディクソン KohNo ratings yet

- 02-Process Analysis IDocument32 pages02-Process Analysis IEllaNo ratings yet

- Strategic Sourcing PDFDocument65 pagesStrategic Sourcing PDFatolosaNo ratings yet

- Hafizuddin Razali ResumeDocument3 pagesHafizuddin Razali ResumeHafizuddin RazaliNo ratings yet

- FusionApplicationHCM Implementation PDFDocument70 pagesFusionApplicationHCM Implementation PDFacs_rectNo ratings yet

- Business License Application-1Document5 pagesBusiness License Application-1Keller Brown JnrNo ratings yet

- QUOTATION Harian Boho House 2Document1 pageQUOTATION Harian Boho House 2Timothy Integrated Farm07No ratings yet

- Embracing and Pursuing Change: WWW - Thetimes100.co - UkDocument4 pagesEmbracing and Pursuing Change: WWW - Thetimes100.co - Ukkunal bharadwajNo ratings yet

- Bloomberg Markets - November 2013 USADocument142 pagesBloomberg Markets - November 2013 USAYong Liu100% (1)

- Marketing in Hong KongDocument3 pagesMarketing in Hong KongMeenakshi ShekhawatNo ratings yet