Professional Documents

Culture Documents

Accounting Principles, Concepts & Conventions and Accounting Standards

Uploaded by

Noothan Venkatesh VarmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Principles, Concepts & Conventions and Accounting Standards

Uploaded by

Noothan Venkatesh VarmaCopyright:

Available Formats

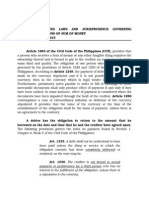

ACCOUNTING PRINCIPLES, CONCEPTS & CONVENTIONS AND ACCOUNTING STANDARDS Q. What is Accounting ? Ans. Accounting is a language of business.

Accounting is an art of indentifying, classifying, recording, summarizing, and interpreting the business transactions of financial nature. It is a means of communication between entity and outside agencies through which the affairs of an organization is reported to the interested users of the accounting information. According to R.N.Anthony, Accounting system is a means of collecting, summarising, analyzing and reporting in monetary terms the information of business. According to Derbin, Accounting may be defined as the identifying, measuring, recording and communicating financial information According to American Accounting Association, Accounting is the process of identifying, measuring and communicating economic information to permit informed judgements and decisions by the users of accounting information. **************** Q. Discuss the need of accounting . Ans. Accounting is a language of business. It is a medium of communication through which the affairs of the business can be reported to the interested users for their decision making purpose. Thus accounting is needed for :1. Determination of operating result and financial position :- Operating results of an undertaking for a particular period and its financial position at the end of a period are to be ascertained and communicated through an income statement and a position statement. 2. Ascertainment of changes in working :- Accounting shows the changes in working capital of an enterprise during a particular period. 3. Communication of significant accounting policies :- Accounting is needed in order to communicate to outside users significant accounting policies and their application through periodical financial statements. 4. Recognition and presentation of assets :- Accounting principles provide guidelines for the recognition of assets and liabilities and the preservation of those assets of a business enterprise. 5. Future reference :- Accounting generates financial information which is to be preserved for current and future users. 6. Assessment of tax liability :- Accounting is needed for the assessment of tax liabilities of a business enterprise. 7. Audit requirements :- Accounting is needed to get the financial statements audited and certified by auditors. *********************** Q. What is GAAP ? Explain its accounting implications ? Q. Give a brief account of the structure of generally accepted accounting principle (GAAP) Ans. GAAP means Generally Accepted Accounting principles. Generally accepted means the accounting principle generally approved by accounting professions. It means principles which are generally regarded as permissible or legitimate by the accounting professions. GAAP guide the accounting profession in the choice of accounting techniques and in the preparation of financial statements in a way considered to be a good accounting practice. These principles are applied in recording business transactions, preparing accounts and presenting them before the users of accounting information. GAAP are based on accounting assumptions, concepts, conventions etc. which have been evolved and used in accounting practices over the years. So an accountant should follow these assumptions, concepts, conventions, etc. honestly consistently in recording business transactions and in preparing financial statements in order to make them uniform, reliable and comparable.

Structure of GAAP The structure of GAAP refers to the forms of elements of GAAP. Traditionally these are known by various names viz. assumptions, principles, concepts, conventions etc. Based on the recent development in the theory base of accounting, the traditional structure of GAAP has been modified into the following four broad heads :(a) Assumptions (b) Principles (c) Modifying principles (d) Accounting standards. (a) Assumptions : Assumptions are the traditions and customs which have been developed over a period of time and are well accepted by the profession. Basic accounting assumptions provide a foundation for recording the transactions and preparing the financial statements therefrom. The following five assumptions are considered as basic assumptions of accounting. These are : (1) Accounting entity (2) Accrual (3) Going concern (4) Money measurement (5) Accounting period. (b) Principles : Basic accounting principles are the general decision rules which govern the development of accounting techniques. These principles do not violate or conflict with the basic accounting assumptions. Following are the basic accounting principles : (1) Dual aspect (2) Revenue recognition (3) Cost (4) Matching (5) Full disclosure (6) Objectivity Modifying principles : generally , the financial statements are prepared keeping in view the basic principles and assumptions of accounting . However difficulties are faced in the application of accounting principles in certain situations which call for the modified application of the principles and assumptions of accounting. These constraints are referred to as modifying principles which are given below :(1) Materiality (2) Conservatism (Prudence ) (3) Cost benefit (4) Timeliness (5) Consistency (6) Substance over legal form (7) Industry practice. (d) Accounting standards : Accounting standards are the established and accepted models which aim at providing excellent , adequate and unbiased treatment of accounting transaction or information and reporting the same in the financial statements to facilitate their users in forming rational and judicious decision. ************************* Q. What is accounting concept ? Ans. Accounting concepts may be defined as the postulates, basic assumptions or conditions upon which the science of accounting is based.. Accounting concepts are certain rules of general application. They are basic to the subject of accounting and provide guidelines in selecting accounting methods in certain situations. Its object is to make accounting uniform, objective and understandable. Accounting assumptions and accounting principles are traditionally termed as accounting concepts. Examples Dual aspect concept, realization concept, etc. ******************* 2

Q. Explain the main features of Accounting principles . Ans. Following are the main characteristics / features of accounting principles :1. Accounting principles are man made and have developed through the process of evolution over the years. These principles are subject to changes according to the changing economic situations. 2. Accounting principles are the process of evolution and are developing fast. It means that they are not in a finished form. 3. Accounting principles must fulfill three criteria, relevance, objectivity, and feasibility. 4. Accounting principles are not rigid and are flexible in nature. They are subject to changes from industry to industry and accountant to accountant. 5. Accounting principles are developed for common usage to ensure uniformity and understandability. ****** Q. Discuss the need / role for introducing and developing generally accepted accounting principles. Ans. Accounting should communicate those information which are useful to a group of users. Therefore , accounting information should incorporate in the financial statement in such a away that it becomes meaningful, clear, uniform and understandable to all. The role of accounting principles in incorporating those information are discussed below :1. Systemic development of accounting science : Accounting is the language of accountants. For its proper and systematic growth, it needs some principles to be followed. Accounting principles function like the rules of grammar of a language in accounting. 2. Uniformity : Accounting as a language to be understandable to all , must follow certain principle uniformly over the world. Therefore accounting principles bring about the desired uniformity in accounting practices. 3. Comparability : Accounting information must satisfy the criteria of comparability. Accounting principles , if consistently followed will make the information comparable. 4. Reliability of accounting : Accounting statements show operational performance and financial position for the users, both insiders and outsiders. This information must be uniform and reliable for any decision making purpose. Accounting principles will make the statements reliable, objective and non-biased. 5. Assessment of income and expenditure : For proper assessment of income and allocation of expenditure, certain accounting principles must be rigidly followed. 6. Recognition of assets and liabilities : Accounting principles are the guidelines for the accountants in recognition and presentation of assets and liabilities of an enterprise. 7. Presentation of financial statements : Accounting principles require to present the financial information in a way as will disclose full information of the enterprise to help the users for their decision making purpose. 8. Material information : Accounting principles guide the accountants to incorporate all those information which are material in character. ************** Q. Discuss various accounting concepts Ans. The various accounting concept or accounting principles are as follows: 1. Business Entity concept : This concept implies that a business unit is separate and distinct from the persons who supply capital to it. Irrespective of the from of organization, a business unit has got its own individually as distinguished from the persons who own or control it. Business is kept separate from the proprietor so that transactions of the business, may be recorded with him. In case this concept is followed affairs of the business will be mixed up with the private affairs of the proprietor and the true picture of the business will not be available. It should be mentioned that legally , a sole proprietor or a partner of partnership firm are not separate from their business units but from accounting point of view these are assumed to have separate entity. 3

Principles or role of this concept : (a) It facilitates the recording of transactions between the business and the proprietor e.g. capital account drawing account. (b) It enables the accountant to prepare the financial statements of an enterprise to show the performance and the financial position of the enterprise only. (c) Entity concept defines the range and boundaries of the accountants activity and limits the type of transactions that are to be recorded in the books of an enterprise. 2. Money measurement concept : According to this concept, the transactions which can be expressed in terms of money will only be recorded in accounting. It means that transactions that can be measured and expressed in terms of money are only recorded in accounting. A transaction , however important it may be to the business, will not be recorded in accounting if it cannot be expressed in terms of money. Therefore, qualitative or quantitative feature of transactions are not recorded in accounting. Under this concept one important assumption taken is that the value of money remains constant throughout the year. The effect of inflation on the value of money is completely ignored. This concept has some limitations: (a) It does not consider the changes in the purchasing power of money and qualitative or quantitative aspects of the transactions are not recorded either in the journal or in the ledger and thus ignores the effect of inflation. (b) It excludes qualitative aspect of an event. (c) It does not consider the development of human resource accounting. (d) It ignores the change in the real value of money due to a change in price level. 3. Going concern concept : According to this concept, accounting system assumes that a business entity will continue to exit indefinitely. It means that it will continue for a long period and will not be dissolved immediately. So the business entity will be considered as a going concern and its resources will be utilized to fulfill the long term objectives of the concern and therefore transactions are to be recorded from that point of view. Accounts are carried forward to the following year on the presumption that the business will be carried out in the years to come. This is called going concern assumption. However this concept does not apply in case of sick or saleable or insolvent firms. Principles or role of this concept : (a) Under this concept, business resources will be utilized to attain long tem objectives and transactions are, therefore to be recorded from that point of view. (b) It facilitates the division of expenditure between capital and revenue on the basic of duration of benefit. (c) It provides the basis of valuation of assets. Fixed assets are valued at cost price and not at market price as they are not intended for resale. (d) It provides a basis for measurement of income because it divides expenditure between asset and expenses. Limitations of this concept : (a) This concept does not hold good in sick industries where historical cost is not relevant. (b) It does not apply in case of insolvent business units where the realizable value and not the cost the is relevant. 4. Dual aspect concept :Dual aspect is another important concept applied in recording and presenting accounting information. Dual aspect concept means that for every debit, there is a corresponding credit. In every transaction , there are two aspect namely receiving aspect and giving aspect. Receiving aspect means the debit aspect and the giving aspect means the credit aspect. Receiving aspect is debited to the account which receives the benefit and giving 4

aspect is credited to the account which gives the benefit. This simultaneous recording of the two fold aspects of a transaction for the same amount is known as the Double entry system of book keeping. This concept is the vary foundation of present accounting mechanism double entry system of book keeping. Principles or role of this concept : (a) This concept has given birth to the double entry system of book keeping according to which each transaction is recorded with its two fold effect scientifically. (b) It records the events affecting the wealth of an entity. It shows the source of wealth and the form it takes. (c) It has given birth to the accounting equation e.g. A = E . 5. Accounting period concept :Accounting period refers to the period of time at the end of which books of accounts of business entity are to be closed and financial statements are to be prepared. Under this principle, to facilitate supply of accounting information, the life span of the business is divided into shorter and convenient period, which is known as accounting period. An accounting period is usually of one year. Profit and loss account is prepared for an accounting period to determine the operational results of that period and a balance sheet is drawn at the closing date of the accounting period so as to assess the financial position of the business on that date. Principles or role of this concept : (a) A business unit exits for a long period. This life of a business is divided into a number of small periods usually one year. (b) Periodical profit and loss account and balance sheet are to be prepared in order to assess profit or loss made by the firm and financial position of the business respectively. (c) On the basis of accounting period expenditure are divided between capital and revenue. (d) It is the basis of accrual accounting where outstanding items are considered. 6. Cost concept : Cost concept states that all accounting entries shall be made at cost as and when the transaction takes place. Cost means monetary price paid or to be paid for the acquisition of an asset or a service. If an asset does not require any cost for its acquisition, it is not to be recorded in accounting. It is based on historical cost and is the basis for all subsequent accounting for such an asset. Under this concept the fair market value which constantly changes is to be ignored. Principles or role of this concept : (a) This concept makes the information of the financial statement highly objective. (b) Recording of assets at cost makes the value of assets truth full and stable. (c) It provides for recording of depreciation of fixed assets for determining loss arising for their use in business. 7. Matching concept :Matching concept implies that the expenses incurred to earn a revenue are to be matched with that revenue in order to ascertain the net profit or net loss made in a period. It means relating the revenues earned with the expenses incurred to earn those revenues in a given period. Thus it is the process of measurement of performance with reference to specific accounting period. Profit of a business depends on two elements Revenue and expenses incurred to earn these revenues. Determination and comparison of these two elements give birth to net profit or net loss. This comparison between the revenue earned and expenses incurred is known as matching principle. Principles or role of this concept : (a) The matching concept measures income for a given period and relates expenses which are incurred to earn that income. Thus it helps us to determine the income for a given period. (b) This concept shows the close relationship between the incomes and expenses. (c) According to this concept, all costs incurred during the period are not taken but only the costs relating to the accounting period are taken into account though they are not directly related to revenues. 5

8. Revenue recognition concept :This concept also known as realization concept. Revenue recognition principle is important when the income statement is prepared. This principle deals with the determination of the point of time when a revenue is to be recognized. A revenue is deemed to be earned or realized when goods have been transferred or services have been rendered to the customers legally and cash has been realized or the customers have accepted a legal obligation to pay. In simple words, revenue recognition principle tells us the procedure of determining the income and expenses for incorporation in profit and loss account. Under this concept , anticipated profits are not considered though anticipated adverse effects are recorded. Principles or role of this concept : (a) This concepts helps the accountants to determine the point of time at which the revenue is to be recognized or considered. So it plays an important role in preparing a correct income statement. (b) This concepts enables us to prepare the income statement in a prudent way taking future loss into account while ignoring future profits. (c) This concept gives birth to accrual principle according to which the outstanding incomes and expenses are included in the income statement. 9. Full disclosure concept :Accounting information are required for decision making purpose by various users. Therefore to be useful as the basis of decision making process, there should be full disclosure in the financial statements of all significant information. Under this principle, all accounting statements should be honestly prepared and all information of material interest to proprietors, creditors, investors etc. should be disclosed in the accounting statements. Moreover books of accounts should be prepared in such a way that they become reliable , informative and transparent. Principles or role of this concept : (a) Full disclosure principle ensures that financial statements contain full and fair information of the enterprise for decision making purpose of the different classes of users. (b) According to this principle, it is obligatory for the accountant to report full facts in the financial statements. So it eliminates his personal choice in the matter of reporting. (c) As all assets and liabilities and incomes and expenditure are shown under proper heads with explanatory notes, it becomes easier for the users to understand the significant of the financial statements. (d) As assets and liabilities are to be shown under proper heads , any deliberate omission of an item is not possible. 10. Objectivity concept :The objectivity principle states that accounting should be definite, verifiable, reliable and free from manipulation and personal bias of the persons engaged in the process of recording and presenting accounting data. For this reason , accounting must be carried out on an objective and factual basis. Every entry in the books of account must be based on documentary evidence i.e. sources documents, viz.vouchers and receipt. Where no vouchers or receipt are available as in the case of provision for doubtful debt, certificate from the competent authority of the business firm must be obtained. Verifiability and objectivity means accounting information is supported by proper documentary evidence e.g. cash memos etc. Principles or role of this concept : (a) This concept has given rise to audit practices. (b) This principle make financial statements free from personal bias. **********************

Q. What is accounting information ? Or Q. Write notes on Accounting information Ans. Accounting information means the data provided in the financial statements. Financial statements include: (a) trading account, (b) profit and loss account (c) balance sheet, (d) cash flow statement and (e) fund flow statement. The first three are the basic financial statements and the later two are prepared on the basis of the former three statements. Trading account and profit & loss account are together called revenue statement or income statement and the balance sheet is known as position statement. Both income statement and position statement contains five elements, these are (a) assets, (b) liabilities, (c) equities (capital) , (d) incomes and gains, and (e) expenses and losses. Information regarding these elements of financial statements is called accounting information. Accounting information gives benefit to its users. The benefit of accounting information are the same as to the advantages of financial statements. Basically , the accounting information is used for decision making purpose by users. The users of accounting information have their own interests in the financial statements and accordingly they expect information from their point of view. ******************** Q. Name the different parties interested in accounting information and explain why they want it. Ans. There are various parties interested in accounting information to make use of the same for their respective purposes. These parties are :1. Owners : Owners provide capital fund to the business and bear all the risk of the business. Therefore , they are interested to know the operating profit earned or loss sustained and financial position of an entity. Accounting information helps the owners to achieve their information for the purpose they need. 2. Managers : Accounting information is useful to managers for the purpose of planning, decision making, controlling, motivating, directing and monitoring the working of a business entity. 3. Creditors: Creditors and suppliers of materials use accounting information to ascertain the short term liquidity , long term liquidity or solvency position, the ability of the entity to repay the amount in scheduled time and the earning capacity. 4. Bankers and lenders : Bankers and lenders who advance money to a business entity are interested in financial statements to ascertain short term and long term debt repaying and debt servicing capacity of the business entity. 5. Employees : Employees are interested in financial accounting in order to assess the stability of their employment, to lodge their claim for hike in wage, share in profit, bonus etc. 6. Consumers :- Consumers use accounting information to safeguard their interest in regard to quality of products, price level maintained , price charged and to uphold the consumer movement. 7. Prospective Investors : Prospective investors are interested in accounting information to determine safety of their investment in the business. They are also interested to know earning capacity and dividend policy of the business. 8. Government and regulatory agency : Government and other regulating authority are interested in financial statements in order to assess, levy and collect sales tax, excise duty, custom duty , income tax, wealth tax etc. They also require accounting information in order to regulate the activity of the enterprise where necessary and to determine economic policies. 9. Trade association and chambers of commerce : This group of users make use of accounting information to frame various types of industry demands to be placed before the concerned authority, and also to formulate business policy. 10. Researchers : Research scholars make use of financial statements for making analysis and interpretation of data to derive new findings. Financial data are also used for creating information database about industry performance. ***************** 7

Q. Explain the purpose of accounting/ financial information ? What purpose in your opinion is the most important and why ? [ GU 1994 ] Ans. Purposes / objectives of accounting / financial information : Accounting information provided in the financial statements serves the following objectives :1. Decision making : Accounting provided information regarding profit or loss of the business. It also shows the causes of profits or losses. Therefore, management of the business can take decisions regarding appropriate remedial measures on the basis of those information. 2. Owners decision : Owners provide capital to the business and bear all the risk of the business. They want to know whether their funds have been properly utilized or not. Therefore, financial statements provides informations to the owner to ensure whether their investment is safe or not. 3. Performance of the business :- Accounting information shows the performance of the enterprise during a given period. The investors of the business can assess the efficiency or otherwise of the management. 4. Financial position : Accounting information provides information about the financial position of the business. These financial position is useful for predicting , comparing and evaluating enterprises earning power. 5. Government policy : Accounting information helps the government in determining economic policy and planning. 6. Economic activity : Financial statements should contain such information as will serve primarily those users who have limited authority or ability to obtain information . 7. Information for forecasting : Financial statements provide actual and interpretive information about transactions and other events for predicting, comparing and evaluation enterprises earning power. 8. Supply of strategic information : Among all the purposes mentioned above , the most important purpose served by accounting information is to provide adequate information to outside users in their decision making process , because accounting in the only link between the business and the outsiders. ************************* Q. Explain modifying accounting principles. Q. Explain any three modifying accounting principles. [ GU 2004 ] Q. briefly explain the accounting conventions which guide the accountant at the recording stage. Ans. In the application of accounting principles and assumptions in certain situations some have been modified for preparation of financial statement. These constraints are referred to as modifying principles. The modifying principles are considered as accounting conventions. These modifying principles are as follows :1. Cost benefit :- Modifying cost benefit principle states that the cost of generating an information should not exceed the benefit to be derived from it. This principle weeds out non significant information from financial statements. It is to be noted that this principle is primarily used where the information to be generated is a supplementary one. However, the cost is not a factor to be considered where such information is a significant one.. 2. Materiality :- The term materiality refers to the relative importance of an item. This modifying principle states that only material information should be incorporated in the financial statement and non material information should not be stated in those statements. An item of information should be judged as material, if the knowledge of that item has an influence on its users in their decision making process. For example instead of writing pen, pencils, rubber, register etc. we may write stationery a/c. 3. Consistency :- The principle of consistency implies that a method decided once to treat a given event should be consistently followed from one period to another. It means that the same accounting procedure should be followed for similar items over the periods. For example if written down value method of depreciation is followed in a particular year the same method should be followed in subsequent years. 8

4. Conservation ( prudence ) :- This principles states that all unfavourable events should be recognized at the earliest and favourable events should be recorded only when they actually takes place. In other words, accountants should preferably report the highest values of liabilities and expenses, and the lowest values of assets and revenues. This principle is called modifying principle since it may not be applied in all cases. 5. Timeliness : An information is useful for a decision maker if it is relevant and reliable. Information becomes useful, relevant and reliable if it is made available in time. The principle of timeliness states that information should be disclosed timely. The Companies Act 1956 requires that the annual reports must be submitted to the Registrar of companies and made available to the users within a specified period of time after the closure of accounting year. 6. Substance over legal form : The modifying principle of substance over legal form implies that the accountant should record and present in financial statements, transactions and events in such a way that the substance of the transactions and not their legality is communicated to the users. Thus in certain cases, transactions may be presented in the financial statements without observing the legal position where it becomes necessary. 7. Industry practice :- Industries have to work under various situations. Some situation may be unique to only one industry. Therefore , sometimes practice prevailing in a particular industry is given precedence over generally accepted accounting principles. For example generally in case of all business, the result of operation i.e. profit/loss is ascertained annually whereas in case of life insurance business it is done once in every two years after actuarial valuation. This is because of unique industry practice. ******************* Q. Distinguish between Accounting concept and Accounting conventions. Ans. Distinction between Accounting concepts and accounting conventions are as follows : Points Accounting concept Accounting conventions Accounting concepts are Accounting conventions are some 1.Meaning certain rules of general reporting standards applied for application. They provide fair presentation of financial guidelines in selecting statement. These are based on accounting methods in certain local needs and traditions. situations. Accounting concepts are Accounting conventions have no 2.Nature generally agreed principle general applicability. These are flexible, optional and provides followed by accountant. several alternative practice. Accounting concepts are Accounting conventions are the 3.Source products of the deliberation of product of economical, social and legal forces. the accounting professionals. These are primarily used in These are primarily used to 4.Use recording, classifying, preparing financial statements. analyzing and communicating financial information of a business. Accounting concepts refers to Convention does not constitute a 5. Rules of the propositions upon which stipulated rule. application accounting work. It means certain rules of application. Accounting concepts are made Conventions are not mandatory 6.Mandatory by regulating agency mandatory in a specific to be enforced by any regulating accounting standard enforced agency. by a regulating agency. 9

Q. What is accounting standard ? Ans. The term accounting standards may be defined as written statements issued from time to time by the institutions of accounting profession. It refers to a set of rules concerning concepts , conventions and principles issued by institutions of accounting professions for application in accounting process. According to T.P.Ghose, Accounting standards are the policy document issued by the recognized expert accountancy body relating to various aspects of measurement , treatment and disclosure of accounting transactions and events. Accounting standard provides a standardized practice of accounting which aims to reduce the several alternative practices and also provides guidelines for honest and fair presentation of financial statements. It prescribe definite rules for treating specific events and disclosing the same in financial statements to make them uniform, neutral, reliable and comparable. Accounting standards aims at bringing about uniformity, objectivity and reliability in accounting practices. So its central idea is to harmonise the diverse accounting policies and practices followed by business enterprises. ************ Q. Explain the need / objectives/ utility of accounting standard. [ GU 1999 ] Ans. Following are the needs/ objectives of accounting standards :1. Uniformity in financial reporting : Accounting standards are aimed at bringing uniformity in financial reporting by prescribing standardized practices. Moreover , standards ensure consistency and comparability of data contained in the financial statements. 2. Reduction of uncertainties : Accounting standards are aimed at reduction of uncertainties prevailing in accounting practices such as life of an asset, depreciation, valuation of assets, recovery of book debts etc. Reduction of uncertainties enables the preparation of financial statements reliable and usable for their users. 3. Harmonizing accounting policies and practices : Financial statements are based on accounting policies which vary from enterprise to enterprise both within a single country and among the countries. Accounting standards harmonises accounting practices followed by different enterprises, both nationally and internationally. 4. Facilitating correct interpretation : Accounting standards enforce the disclosure of significant accounting policies on which financial statements are based because such disclosure of financial policies is an integral part of financial statements. This disclosure of financial policies is helpful to the users in understanding and interpreting financial information. 5. Tool to improve corporate governance : Accounting standards are formulated to ensure fairness, probity, consistency and transparency in business operations and accounting practice by removing accounting diversity and alternative accounting practices as are prevailing in traditional GAAPs. 6. Facilitates to arrive at judicious decisions by users : Introduction of accounting standards have made the financial statements neutral, consistent and factual. Hence, it helps the users to take judicious decisions on the matters relating to the organization. 7. Measurement of financial position : Accounting standards provide a definite guideline for measurement of incomes and valuation of assets of various nature in different situations. Thus, operational results of the organization can be properly evalued and financial position can be fairly ascertained. 8. Measurement managerial accountability : Accounting standards facilitate in determining specific corporate accountability and regulation of the company. They measure managerial skill and improve the profitability of a company. They reduce manipulation of accounts. ****************

10

Q. Discuss the limitations of Accounting Standards . Ans. Following are the limitations of Accounting standards : 1. Non applicability to non members : Accounting standards are the guidelines of accounting treatment. They are to be followed by the members of the institute but non-members have no obligation to follow them. Thus the desired uniformity in the preparation of financial statements may not be achieved. 2. Disregard to Minority views : Standards are the majority views of the members and the minority views, though ideal, will not be incorporated in the standards. Thus the desired results may not be achieved. 3. Unsuitable in changing economic situations : Accounting standards are event specific and time specific and they may become obsolete in changing economic situations. 4. Discourage innovations: Standards stifle innovative ideas of accountants and make accountants regimented. 5. Non-responsive to peculiar units: Standards cannot obviate altogether the scope of subjective views in the preparation and presentation of financial statements because of peculiar situations prevailing in different industrical units. *********************** Q. Distinguish between Accounting Principles and Accounting Standard. Ans. Distinction between Accounting Principles and Accounting Standard are as follows : Points Accounting Principles Accounting standard standards are Accounting principles are Accounting 1.Nature fundamental or basic rule professional opinion and guidelines governing the accounting formulated and recommended by institute of chartered system. These are broad the guidelines established through accountant. discussion. Accounting principles termed 2. Legal standards bear as generally accepted Accounting binding accounting principles are not professional stamp or authority of the ICAI established under the act binding upon the accountant. Accounting principles provide of parliament namely ICAI Act 3.Alternative a large number of alternative 1949. treatment treatment to a given accounting Accounting standard try to reduce item like revenues, costs, assets the alternatives and reduce the flexibility of opinion. and liabilities. 4.Problem in Accounting principles are Accounting standards can be easily implementation generally difficult to be enforced by the professional institute. implemented into practice. Accounting principles are Accounting standards are based on 5.Formation opinion of different based on certain basic the process assumptions and do not require professional bodies and public in general any public opinion. Accounting principles are not Accounting standards are always 6.Precedence preceded by any other concept preceded by a concept statement or conceptual framework. statement.

11

Q. Write notes on Accounting standard in India. GU 2004 ] Or Q. What progress has been made in India regarding standardization of accounting practices. Ans. Recognising the need to harmonise the diverse accounting policies and practices in India and keeping in view the international development in the field of accounting, the institute of chartered accountants of India constituted the Accounting Standard Board (ASB) in April,1977. The accounting standard board gives adequate representation to the related and interested groups of bodies in the line of business, industry, finance , audit , taxation etc. The accounting standards formulated by the ASB are thus finally established by the council of the ICAI. The ASB is entrusted with the following functions :1. To formulate accounting standards, while formulating standards, the ASB is required to take into consideration the applicable laws, customs and usages and business environment. 2. To propagate the accounting standards and persuade the concerned parties to adopt them in the preparation and presentation of financial statements. 3. To issue guidance notes on the accounting standards and give clarifications on issues arising there from. 4. To review the accounting standards at periodical intervals. Till April,2004 , the ASB have issued 29 Accounting standards covering different aspects of Accounting. The Accounting Standards are as follows : 1. AS 1 = Disclosure of accounting policies 2. AS 2 = Valuation of inventories 3. AS 3 = Cash flow statements 4. AS 4 = Contingencies and events occurring after the balance sheet date 5. AS 5 = Net profit or loss for the period, prior period and extraordinary items and changes in accounting policies. 6. AS 6 = Depreciation accounting 7. AS 7 = Accounting for construction contracts. 8. AS 8 = Accounting for research and development 9. AS 9 = Revenue recognition. 10. AS 10 = Accounting for fixed assets. 11. AS 11 = The effects of changes in foreign exchange rate 12. AS 12 = Accounting for government grants. 13. AS 13 = Accounting for investments 14. AS 14 = Accounting for amalgamations. 15. AS 15 = Accounting for retirement benefits in the financial statement of employers. 16. AS 16 = Borrowing costs. 17. AS 17 = Segment reporting. 18. AS 18 = Related party disclosures. 19. AS 19 = Leases 20. AS 20 = Earnings per share. 21. AS 21 = Consolidated financial statements. 22. AS 22 = Accounting for taxes on income 23. AS 23 = Accounting for investments in associates in consolidated financial statements. 24. AS 24 = Discontinuing operations. 25. AS 25 = Interim financial reporting 26. AS 26 = Intangible assets. 27. AS 27 = Financial reporting of interests in joint ventures. 28. AS 28 = Impairment of assets. 29. AS 29 = Provisions, contingent liabilities and contingent assets. ************************** 12

Q. Give a brief account of the accounting standard setting procedure in India. [ GU 2005 ] Ans. The institute of chartered accountants of India (ICAI) is an associate member of the international accounting standard committee (IASC). Accounting standard setting procedure, its issue and implementation are performed by this institute of chartered accountants of India (ICAI). In order to recognise the need to harmonise the diverse accounting policies and practices in India and keeping in view the international development in the field of accounting, the institute of chartered accountants of India constituted the Accounting Standard Board (ASB) in April 1977. The accounting standard board gives adequate representation to the related and interested groups of bodies in the line of business, industry, finance, audit, taxation etc. Thus it gives representation to the representatives of industry and commerce, company law, central board of direct taxes, comptroller and auditor general of India, Banks, Public enterprises and practicing auditors. The accounting standards board prepares a draft of the standard on a subject which is published in the journal of the institute, viz. The Chartered Accountant for the views and comments of the accounting professionals, practicing chartered accountants, industry people, academics and other persons, bodies and associations. Such draft standard exposed to the public is called Exposure Draft . Through such exposure draft, people are requested to send their comments and suggestions for consideration to the Accounting Standard Board. A definite timeframe is given for sending comments and suggestions. Accounting standard board then examines all the issues related to the proposed standard in the light of the comments and suggestions received from various quarters. Finally the standard on the concerned subject is formulated and placed before the council of the institute for its consideration. After adoption by the council, the standard is finally established for its implementation. The accounting standards formulated by the ASB are thus finally established by the council of the ICAI. While formulating accounting standard, ASB should be given due consideration to international accounting standard (IAS) issued by International accounting standard committee (IASC) and try to integrate them, to the extent possible , in the light of conditions and practices prevailing in India. **********************

SECTIONAL AND SELF BALANCING LEDGER Q. What is meant by Sectional Balancing System ? Ans. Sectional ledger balancing system is a system under which only one section of the ledgers is self balanced with the help of two control accounts. It means that out of the three ledgers viz. debtors ledger , creditors ledger and general ledger, only the general ledger is self balanced by opening two separate accounts called total debtors account and total creditors account. Under this system the debtors ledger and the creditors ledger are not self balanced because of the fact that the double entry of a transaction is not completed in either of the ledgers. Sectional balancing system is a technique to check the accuracy of any ledger with the help of control accounts. In order to make the general ledger self balanced, two control accounts viz. total debtors account and total creditors account are opened in the general ledger. The total debtors account is used to complete the double aspects relating to debtors ledger and total creditors account, to complete the double aspects relating to creditors ledger. Thus this two control accounts enable the preparation of trial balance from the general ledger.

****************** 13

Q. What are the features of sectional balancing system ? Ans. The following are the special features of sectional ledger balancing system :1. Sub-division of ledger :- Under this system, ledger is divided into three sections : (a) Debtors ledger (b) Creditors ledger (c) General ledger or Nominal ledger 2. Self balancing of one ledger :- Under this system only one ledger i.e.General ledger is made self balancing. 3. Preparation of control accounts :- Under this system two control accounts, viz. total debtors account and total creditors account are required to be opened in the general ledger . 4. Preparation of trial balance :- Under this system , trial balance of the business as a whole can be prepared at periodical intervals from the balances of the accounts in the general ledger including the control accounts. **************** Q. What are the advantages of sectional ledger balancing system ? Ans. Following are the advantages of sectional ledger balance system :1. Division of work :- Since the ledgers are sub-divided, under this system more than one ledger keeper can be employed, which facilitates the division of work among the bookkeepers. 2. Internal check :- The work on each ledger is independently checked and controlled by the work of another ledger by means of control accounts opened in the general ledger. So, it is a technique of good internal check. 3. Ascertainment of debtors and creditors balances :- The balances of sundry debtors and sundry creditors at the end of a period can be easily determined from the Total debtors account and the Total creditors account. 4. Location of errors :- Under this system , errors can be located without much effort and time. 5. Reduction in auditors work :- As the debtors and creditors ledgers are automatically checked, it reduces the volume of work of an auditor. 6. Preparation of interim accounts:- Interim accounts can be prepared without waiting for rectification of errors, if any in debtors ledger and in creditors ledger. **************** Q. Explain the defects / disadvantages of sectional balancing system . Ans. Following are defects / disadvantages of sectional balancing system :1. Self balancing of one ledger only :- Under this system only one ledger i.e. general ledger is self balanced. Debtors ledger and creditors ledger are not self balanced. Hence, errors cannot be located in these two ledgers. 2. Arithmetical accuracy :- As debtors ledger and creditors ledger are not self balanced, the arithmetical errors of these ledgers cannot be tested. 3. Limited application of internal check:- Sectional balancing has a limited application of interim check because it is limited to exercising internal check for general ledgers only. 4. Non-adherence to double entry :- Sectional balancing system does not adhere to double entry system of accounting as no journal entry is required to be passed. 5. Lack of effective supervision :- Since the control accounts for the general ledger are maintained by different ledger clerks, effective supervision is not possible. *************************

14

Q. What is self balancing ledger system . Ans. Self balancing ledger system is a system of maintaining ledgers in such a way that an independent trial balance can be prepared from each ledger without the help of any other ledger. According to Roger N.Carter, A self balancing ledger is one whose balances , when extracted , from a complete trial balance Under this system an account called adjustment account is opened in the back side of each ledger for the purpose of completing double entry of each of the transactions relating to each ledger within the ledger itself. The principle involved in this case in that to each adjustment account the posting of the summary of all transactions of the relevant accounts are made only in the reverse manner so that the total of debit balance of all accounts would exactly be equal to the total of the summarized credit entries and vice versa. It helps the preparation of the trial balance and the ledger is thus made self balancing. The following adjustment accounts are required to be opened in the ledgers :Name of the ledger Name of the Adjustment Account (a) General Ledger (i) Debtors ledger adjustment account (ii) Creditors ledger adjustment account (b) Debtors Ledger Creditors Ledger (i) General ledger adjustment account.

(i) General ledger adjustment account. ***************************** Q. Explain the features of self balancing ledger system . Ans. Following are the special features of self balancing ledger system :1. Self balancing of each ledger :- Under this system each ledger is made self balanced which means that an independent trial balance can be prepared for each ledger out of the balances in the accounts appearing in that ledger. 2. Periodical posting :- Self balancing entries are passed and posted at the time of periodical testing of arithmetical accuracy of ledgers. 3. Contra entries :- Journal entries for maintaining the ledgers under self balancing system are required to be passed between two adjustment accounts maintained in two different ledgers. Contra entries for transactions relating to trade debtors will be passed between the general adjustment account in debtors ledger and debtors ledger adjustment account in general ledger. 4. Specially designed subsidiary books :- Subsidiary books are made in such a manner that they readily show the total of transactions to be posted in adjustment accounts. 5. Adjustment accounts :- Each ledger contains an adjustment account in order to complete the double entry of the transactions. Adjustment accounts are Debtors ledger adjustment account, Creditors ledger adjustment account and the General ledger adjustment account. ************************** Q. State the objectives of self balancing ledger system. Ans. Following are the objectives of self balancing ledger. 1. Location of errors :- The primary objective of self balancing system is the location of book keeping and arithmetical errors if any, to a particular ledger. If a ledger is not made self balanced, the mistake is likely to be committed in that ledger itself. 2. Internal check :- It enforces an internal check on all the ledgers. The work on one ledger is independently checked by the work on the other ledger. 3. Fixation of responsibility :- Each ledger is usually entrusted with a particular ledger keeper and the location of an error in that particular ledger becomes the responsibility of that particular ledger keeper. 4. Effective supervision :- The object of effective supervision over the accounts keeping staff can be exercised by the person in charge of accounts department through control accounts in the general ledger. 15

5. Preparation of interim accounts :- Interim accounts can be prepared for managerial purpose because the accounts are kept up-to-date under this system. 6. Early preparation of trial balance :- A trial balance can be prepared from the control accounts without waiting for rectification of any error in any ledger. 7. Early preparation of final accounts :- Draft annual or periodical accounts can be prepared without waiting for the schedules of sundry debtors and sundry creditors. 8. Proof of arithmetical accuracy :- It provides a proof of the total arithmetical accuracy of the book-keeping entries in any ledger. ******************************** Q. State the advantages of self balancing ledger system . Ans. The following are the advantages of self balancing ledger system :1. Arithmetical accuracy of ledgers : It provides a proof of the total arithmetical accuracy of the book-keeping entries in any ledger. 2. Early detection of errors : As the adjustments accounts are prepared at periodical intervals, errors can be quickly localized and detected. 3. Internal check : It provides a good method of internal check. It means that the works of one ledger keeper is automatically checked by other ledger keeper. 4. Division of labour : As multiple ledgers are kept under this system, the whole work can be divided among many personal of the accounts department. 5. Early preparation of final accounts : As the accounts are kept always up-to-date , thus it facilitates early preparation of final accounts. 6. Reduction of audit work : It reduces the work of the auditor because this system acts as an automatic control over the ledger. 7. Effective supervision : This system exercises effective supervision of the work of the ledger clerks. 8. Reduction of burden of the main ledger : It reduces the burden of the main ledger by taking out personal ledgers from it. 9. Fixation of responsibility : The responsibility for the commission of errors may be fixed by the localization of errors. 10. Acts as control accounts : It acts as control accounts on the individual debtors and creditors. *************************** Q. Distinguish between sectional ledger balancing system and self balancing ledger system Ans. Following are the difference between sectional ledger balancing system and self balancing ledger system :Sectional ledger balancing system Points Self balancing system It involves balancing of a section It involves balancing of each 1.Nature of work ledger. of a group of ledgers Its object is location of error for a Its object is location of error for 2.Object each ledger. section of group of ledger. Only one trial balance for the A trial balance can be prepared 3.Trial Balance for each ledger i.e. for the general ledger can be drawn. debtors ledger, creditors ledger and general ledger. It makes a part of the ledgers self It can make each ledger self 4.Scope of work balanced. balanced Applied mainly in sales and Applied in sales and purchase 5. Application transactions along with other purchase transactions. transactions. 6.Application of double Double entry system can be Double entry is completed in completed only in respect of general ledger and other ledgers entry system. by preparing Adjustments a/c. general ledger. 7.Transfer from one Transfers are shown through total Transfer from one ledger to 16

ledger to another ledger 8.Adjustment Account

The errors and omissions are self detected by the clerks entrusted with a particular ledger. Control can be enforced only in It enforces total internal check 10.Internal check respect of sales ledger and on the net work of the accounts because all the purchase ledger but not on the system transactions are subject to general ledger. scrutiny of more than one person. ********************************** Q. Distinguish between a total debtors account and a debtors ledger adjustment account opened in the general ledger. Ans. Following are the difference existing between a total debtors account and a debtors ledger adjustment account :Points Total debtors account Debtors ledger adjustment a/c It is used in sectional ledger It is used in self balancing 1.Application ledger system. balancing system Items are directly recorded in Items are posted to this account 2.Entries total in this account from the after passing journal entries. relevant subsidiary books. No journal entries are required to be passed. It does not require completion of Process of double entry is 3.Double entry completed here. double entry. Its object is to make the general Its objects is to make both the 4.Object debtors ledger and the general ledger self balanced. ledger self balanced. It exercises on internal check on It exercises internal check along 5.Internal check with general ledger adjustment the debtors ledger only. account. Subsidiary books and other It is related to the general ledger 6.Sources of relevant records are the source of adjustment account in the information debtors ledger. information. 9.Detection of errors

Debtors account and total creditors account only. Total debtors account and total creditors account are opened in the general ledger but no adjustment account is opened in the sales ledger or in the purchase ledger. Errors in debtors ledger and creditors ledger cannot be self detected.

another is shown through Adjustment Account Each ledger contains an adjustment account.

17

Q. Distinguish between a total creditors account and a creditors ledger adjustment account opened in the general ledger. Ans. Following are the difference existing between a total debtors account and a debtors ledger adjustment account :Points Total creditors account Creditors ledger adjustment a/c It is used in sectional ledger It is used in self balancing ledger 1.Application system. balancing system Items are directly recorded in Items are posted to this account 2.Entries total in this account from the after passing journal entries. relevant subsidiary books. No journal entries are required to be passed. It does not require completion of Process of double entry is 3.Double entry completed here. double entry. Its object is to make the general Its objects is to make both the 4.Object creditors ledger and the general ledger self balanced. ledger self balanced. It exercises on internal check on It exercises internal check along 5.Internal check with general ledger adjustment the creditors ledger only. account. Subsidiary books and other It is related to the general ledger 6.Sources of relevant records are the source of adjustment account in the information creditors ledger. information. HIRE PURCHASE AND INSTALMENT PURCHASE SYSTEM Q. What do you mean by Hire Purchase System ? Ans. Hire purchase system means a transaction where the buyer acquires the immediate possession of the goods entering into an agreement and agrees to pay the total hire purchase price by an agreed number of periodical instalments. Each instalment is treated as a hire charge until the last instalment is paid out when the ownership of the goods passes from the seller to the buyer. In the words of J.Stephenson, The hire purchase is a form of trade in which credit is granted to the buyer on the security of a lien on the goods. In a hire purchase transaction, there are two parties the seller, known as hire vendor and the buyer, known as hire purchaser or hirer. Features : 1. Agreement : It is an agreement to sell goods but not a contract of sale. Sale takes place in future. 2. Possession of goods : The hire purchase agreement gives the buyer the right to get immediate possession of the goods. 3. Ownership : The ownership of the goods sold under the hire purchase system remains with the seller till the payment of last instalment. The buyer can become owner only on the payment of last instalment. 4. Down payment : On agreement and delivery of the goods, generally some payment is made by the buyer to the seller , which is called cash down. It does not include any interest. 5. Mode of payment : The payment is made by instalments viz half yearly, yearly etc. and each instalment includes interest at a certain rate on the balance due. 6. Hire charge : Instalments paid by the hire purchaser are treated as hire charge till the payment of the last instalment. 7. Right of repossession : The hire vendor has the right to reposses the goods if the hire purchaser makes default in the payment of any instalment. 8. Right to return goods : The buyer has an option to return the goods before the payment of last instalment. 18

Q. Discuss the advantages and disadvantages of hire purchase system. Ans. Advantages :The advantages of hire purchase system are as follows : 1. As the hire buyer gets the immediate possession of the goods he can enjoy the goods before the full payment is made. 2. The buyer enjoys the option to return the goods before payment of last instalment. 3. The seller is entitled to receive interest on unpaid amount at an agreed rate and so the seller gets compensation for fund blocked for long time. 4. This system proves helpful to the sellers as it provides opportunity to increase their volume of turnover and consequently to increase profit. 5. The seller has a right of lien on the goods i.e. he may take back the goods if the buyer fails to pay any instalment. Disadvantages : The disadvantages of hire purchase system are as follows : 1. The goods purchased under hire purchase system are generally charged at a higher price because it includes interest. 2. As the buyer does not enjoy the right of ownership , he cannot sell nor can he take loan against the mortgage of the asset until the last instalment is paid. 3. Hire purchase trading is a credit business hence it requires a huge amount of capital. So for small traders it is not possible to undertake hire purchase trading. 4. The hire vendor runs the risk of bad debt if the hire purchaser makes default in payment of instalments. 5. It is a difficult task on behalf of the seller to select the right buyers. ************************************ Q. What is instalment purchase system ? Ans. Instalment system or instalment purchase system indicates a system of sale under which the price for the goods and the interest on the price are paid by the buyer by periodical instalments. Under this system, the buyer acquires the tittle of the goods and the possession thereof as soon as the transaction is completed. Under this system, in the event of default by the buyer in payment of of any instalment , the seller cannot take back the goods, he can only take steps for the recovery of the unpaid instalments. This system hardly differs from a contract for sale except that payment of the price of the goods is spread over a number of instalments and that each instalment includes interest. However, it differs from hire purchase in the same way as credit sale differs from hire purchase. Both the systems i.e hire purchase and instalment, have one point common viz payment of price by instalment. Features : 1. Ownership : The ownership of the goods passes to the buyer as soon as the transaction is completed and delivery is effected. 2. Nature of sale : Instalment payment system is a type of credit sale where price of the goods is paid in periodical instalments 3. Interest : Every instalment is paid along with interest calculated on outstanding balance. 4. Repossession : The seller under instalment system does not have the right of repossession of goods, if the buyer defaults in payment of instalments. 5. Buyers right : The buyer has the right to deal with the goods as he likes viz: sale mortgage etc of the goods. 6. Return of goods : The buyer has no option to return the goods once they are purchased. *************************

19

Q. Discuss the rights of hire purchaser or hirer. Ans. The following are the rights of hirer or hire purchaser under the Hire Purchase Act 1972 :1. Right to get possession of the Goods = Under hire purchase, the hire purchaser has the right to get possession of the goods on the date of signing the agreement after making down payment , if any. 2. Right to return the goods = A hire purchaser has the right to return the goods before he pays the last instalment. 3. Right to get notice of termination = A hirer has the right to receive from the hire vendor a written notice of termination of the hire purchase agreement when he does not pay an instalment. 4. Right to receive statement of account =A hirer has the right to receive from the vendor , a statement showing the amount paid by or to be paid together with interest and dates of payment etc. 5. Right to seek courts sanction from vendor = In certain cases the hire purchaser can seek from the vendor the courts sanction. 6. Right to get back excess payment on repossession = A hirer has the right to get back any excess payment to vendor on time of repossession. 7. Right of assignment and transmission = The hirer may assign his right, title and interest under the hire purchase agreement with the consent of the owner. However he can do so without the consent of the owner if the owner withholds his consent unreasonably. 8. Right to Appropriate payments :- A hirer has the right to appropriate payments in respect of two or more agreements. ******************************* Q. Discuss the rights of hire vendor Ans. The following rights are enjoyed by a hire vendor under the hire purchase act. 1. Right to get payment = A hire vendor has the right to get the full agreed amount from the hire buyer by instalment on due dates. 2. Right to charge interest = A hire vendor has the right to charge interest on the outstanding amount. 3. Right to repossess = A hire vendor has the right to repossess the goods if the buyer fails to pay any installment. 4. Right to forfeit the initial deposit = On the termination of the hire purchase agreement, the hire vendor has the right to forfeit initial deposit made by the hire purchaser. 5. Right to charge fee for statement of account = The hire vendor has a right to charge a fee Rs.1 from the hire purchaser for expenses for a statement of account. 6. Right to terminate the hire purchase agreement = The hire vendor has a right to terminate the hire purchase agreement for default in payment of hire or unauthorized act by the hirer. 7. Right to claim damage for non delivery of the goods = The hire vendor has the right to claim damage for non delivery of the goods from the date on which termination of hire purchase agreement is effective. 8. Right to seize the goods = On termination of hire purchase agreement, the hire vendor has the right to enter the premises of the hire purchaser and seize the goods sold on hire purchase. ************************* Q. Bring out the distinctions existing between Hire Purchase and Installment System. Ans. The difference between Hire Purchase and Installment System are as follows : Points 1.Nature of Contract 2.Ownership Hire Purchase It is an agreement of hiring Installment purchase It is an agreement to sell

The buyer becomes the owner of The buyer becomes the owner the goods only after clearing the of the goods immediately after 20

final instalment. 3.Return of goods

The buyer can return the goods at any time before the payment of final instalment. The buyer cannot sell, destroy, 4.Rights of disposal transfer, damage etc. the goods before paying the final instalment. The seller can repossess the goods The seller can sue in the court 5.Rights of seller if the buyer makes default in the of law for price if the buyer makes default in payment of payment of any instalment. any instalment. It is controlled by law of It is controlled by H.P.Act 1972 6.Controlling Act contract The payments made by the buyer The payments made by the 7.Nature of payment are regarded as hire charges for the buyer are regarded as part goods till the final installment is payment of the goods paid 8.Right of lien on goods The seller has a lien on the goods The seller has no lien on the goods as it is a contract of sale. until he receives full payment The seller gains if there is default The seller does not gain in case 9.Effect of default in of default in payment by the in payment by the hirer. payment hirer. It is the responsibility of the seller The buyer must arrange for 10.After sale services to provide after sale service till the such services at his own cost. last installment is made. 11.Position of the buyer The position of the buyer is like a The position of a buyer is that of an owner. bailee. Q. Distinguish between installment sale and credit sale. Ans. The difference between installment purchase system and credit sale are as follows : Points Instalment Purchase System Credit Sale Instalment payment system is an Credit sale is a contract of sale 1.Nature of contract agreement to sell. It is controlled by the sale of It is controlled by law of contract 2.Controlling act. goods Act 1930. The payment is made by a fixed Payment may not be made in 3.Mode of payment periodical instalment. Generally number of periodical instalment. it is paid at a time or at the convenience of the buyer. Interest is paid on the unpaid Generally no interest is charged 4.Interest balance and is included in on the outstanding balances. instalment. Instalment purchase system is a Credit sales are generally short 5.Period of credit period credit contract. long period credit contract. Cash discount is not allowed in Discount is allowed if the 6.Cash discount payment is made within the case of instalment system stipulated period. In case of default of payment , the In case of default of payment, 7.Suit for outstanding seller can sue the buyer for the the seller can sue the buyer for amount. outstanding balance including the outstanding balance of the principal only. interest. Usually adequate securities or Usually credit sales are made to 8.Security 21

the agreement to sell is complete The buyer cannot return the goods unless there is any defect in the goods. The buyer can do all these things

guarantees are necessary in case of known customers on personal instalment purchase system security only Q. Mention points of differences between Hire purchase and credit sale. Ans. The difference between Hire purchase and credit sale are as follows : Points Hire Purchase Credit sale Hire purchase is in the nature of Credit sale is a contract of sale 1.Nature of contract of goods. agreement to sale It is controlled by the Hire It is controlled by the sale of 2.Controlling act. goods Act 1930. Purchase Act of 1972 The ownership of the goods passes The ownership of the goods 3.Ownership of goods from the seller to the buyer after passes from the seller to the buyer when the contract to sell the last instalment is paid is completed. The outstanding balance after The price agreed upon does not 4.Interest down payment is subject to include any interest charges. interest charged by the hire vendor No discount is allowed by the hire Discount is allowed on bulk 5.Discount vendor on timely payment of the purchase as well as on timely payment of the price. instalment The buyer can return the goods at Generally, the buyer cannot 6.Return of goods any time before the last instalment return the goods unless there is an agreement to the contrary is paid The buyer has no right to dispose The buyer can dispose off the 7.Disposal of goods off until he pays the last instalment goods even before the final payment is made The buyer holds the position of the The buyer holds the position of 8.Position of the buyer the owner bailee in respect of the goods. The seller provides after sale The buyer bears the cost of 9.After sale services after sale services services The payments are treated as hire The payments are treated as a 10.Treatment of charge until the last instalment is part of the price of the goods. payments paid Short Note : Interest Suspense Account : Interest suspense account is usually opened in the book of both the buyer and the seller when the goods are purchased or sold under instalment purchase system with the total amount of interest. It is a deferred interest to be paid by the buyer to the seller. It consists of total interest payable by the buyer along with different instalments during the period of contract. It is a future liability to the buyer and future income to the seller. It is treated as deferred expenses by the buyer. In the books of the buyer Interest suspense account is debited and vendor account is credited on the day of contract. When the periodical instalment becomes due interest due on the date of instalment on the unpaid balance is transferred from interest suspense account to interest account and thus it is gradually written off to interest account over the contractual period. Any balance remaining in this account on the closing day is shown in the balance sheet as a deduction from Vendors A/c on the liabilities side. In the books of the vendor, interest suspense account is credited and the purchaser account is debited on the day of contract. It is a future income and is gradually adjusted when instalments become due. It is shown as a deduction from the buyer account in the balance sheet on the assets side. 22

Q. Explain the meaning of Repossession. Discuss the various forms of repossession. Ans. The ownership of the goods sold under hire purchase system passes to the hire purchaser only after the payment of the last instalment . If the hire purchaser makes default in the payment of any of the instalment as agreed at the time of entering into the hire-purchase agreement, the hire vendor has the right to take back the goods sold under such system. In case of default by the hire purchaser to pay the instalment as per the agreement, the hire vendor has the right to take back the goods sold under hire purchase system. When the hire vendor takes back the possession of such goods from the hire purchaser, it is termed as repossession. When the goods are repossessed by the hire vendor, he is not required to compensate the hire purchaser. The amount already paid by the hire purchaser as down payment and instalments , if any are forfeited. Forms of Repossession : When the hire vendor sells different goods or more than one item of the same goods to the same party under hire purchase agreement, the hire vendor may , at his option, either repossess all the goods or a part thereof in case of default in payment of instalments by the hire purchase depending on the terms of agreement. Thus, the repossession may take of the following forms : (a) Complete repossession (b) Partial repossession (a) Complete repossession : Complete repossession means taking over the possession of all the goods sold under hire purchase system from the hire purchaser (b) Partial repossession : in case of default in making payment of instalments by the hire purchaser, if the hire vendor repossess a part of the goods sold, it is a case of partial repossession. In partial repossession, the value of goods so repossessed is determined through mutual agreement.

************************************** BRANCH ACCOUNTING Q. What is Branch Accounting? Discuss its features. Ans. A branch may be defined as a section of an enterprise geographically separated from the rest of the business, controlled by a head office and generally carrying on the same activities as of the enterprise. In order to increase the volume of profit, is it the primary objective the firms open their shops in different parts of the locality / country to increase their volume of sales. It is a method to sell goods direct to customers spread over a large territory without any intermediary. The main establishment is called the head office and its off shoots are called branches. The method of accounting which is used by the head office to record the branch activities in order to ascertain profit or loss made by branch is called branch accounting. According to William Pickles, Branch as, where a section of a business is segregated physically from the main section, it is a branch, in other words, if the location of activities is separated from the main place of operation, there may be said to be a head office and a branch. Features : The following are the some important features of branch accounting :1. Branches are physically and geographically separated from each other as well as from the head office. 2. A branch is not a separate legal entity. 3. A branch acting under the direction and control of the head office. 4. A branch depends on its head office for its supply of goods except in case of an independent branch. 5. A branch acting under the direction and control of the head office.

23