Professional Documents

Culture Documents

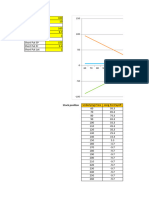

Check Figures Cost

Uploaded by

emie08Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Check Figures Cost

Uploaded by

emie08Copyright:

Available Formats

CHECK FIGURES FOR SELECTED EXERCISES, PROBLEMS AND CASES COST ACCOUNTING, 14th Edition, by Carter

EXERCISE, PROBLEM, or CASE

CHECK FIGURE

(4) Total cost incurred, $828,000 Operating loss, $(500,850) Factory overhead cost per blade, $300 Factory overhead cost per machine, $1,500 (4) Total variable cost, $20; (5) Total cost, $53,900 Direct labor cost, $3,000 (1) Percentage profit margin, 82.50%; (2) Percentage profit margin, 60% (3) Total cost, $2,800; (5) Total cost, $4,500 Fixed cost, $260 Variable cost, $.6936 per direct labor hour b = $60 a = $356 r = .92 r2 = .882 (2) b = $.384 (2) r2 = .7753 s'= $114.018 s' = $62 (1)(a) r2 = .8957 (3) b = $.29141 (3) a = $836.20 (3) r2 = .91489 (1) b = $.1015 (2) r2 = .916 (3) s' = $324 (2) b = $.979213 Cost of goods sold, $130 Cost of goods sold, $310 (1) Cost of goods manufactured. $386,000 (1) Total overhead, $78,390; (2) Cost of goods manufactured, $282,060; (3) Finished goods ending balance, $47,662 Cost of goods manufactured, $1,050 Cost of goods sold, $795,800 (1) Cost of goods sold, $60 (1) Cost of goods sold, $140 (1) Cost of goods manufactured, $348,000 (8) Payment of payroll, $259,000 (3) Cash, $36,412

E2-2 E2-3 E2-6 E2-8 E2-11 E2-12 C2-1 C2-2 E3-1 E3-2 E3-3 E3-4 E3-5 E3-6 E3-7 E3-8 E3-9 E3-10 P3-1 P3-2 P3-3 P3-4 P3-5 P3-6 P3-7 P3-8 E4-1 E4-2 E4-3 E4-4 E4-7 E4-8 P4-1 P4-2 P4-3 P4-5 P4-7

E5-3 E5-4 P5-1 P5-2 P5-3 P5-4 P5-5 P5-6 P5-8 E6-1 E6-2 E6-3 E6-4 E6-5 E6-6 E6-7 E6-8 E6-9 E6-10 E6-11 E6-12 P6-1 P6-2 P6-3 P6-4 P6-5 P6-6 P6-7 P6-8 E7-1 E7-2 E7-3 E7-4 E7-5 E7-6 E7-7 E7-8 E7-9 E7-10 E7-11 E7-12 P7-1 P7-2 P7-3 P7-4 P7-5 P7-6 P7-7

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter (1) Direct labor in finished goods, $14,000 (3) Cost of goods manufactured, $184,800 (1) Total cost put into process, $217,200; (3) Cost of goods sold, $219,600 (3) Cost of goods manufactured, $28,630; (5) April gross profit, $10,375 (7) Overapplied factory overhead, $(3,000) (1) Cost of goods sold, $76,030; (2) Income before income tax, $22,730 (2) Cost of goods soldadjusted, $40,000 (3) Total, $51,306 (4) Cash, $171,320; Work in Process, $46,075 (1) Equivalent units for overhead, 23,000 Cost transferred from Dept. X to Dept. Y, $300,000 Work in process, ending inventory, $12,672 Total average cost per equivalent unit, $8.00 Cost transferred to Painting Dept., $155,000 Equivalent units for labor and overhead, 2,300 Work in process, ending inventory, $6,200 Cost transferred to Bottling Dept., $15,600 Equivalent units for overhead, 29,600 Cost transferred to Assembly Dept., $84,935 Work in process, ending inventory, $32,800 Cost transferred to Finished Goods, $26,280 Cost transferred from Cutting Dept. to Assembly Dept., $45,500 Total average cost per equivalent unit, $4.10 Assembly Dept. work in process, ending inventory, $85,656 Equivalent units for overhead in the Blending Dept., 6,550 Cost transferred from Blending Dept. to Finished Goods, $24,840 Cost transferred from Cutting Dept to Assembly Dept., $128,350 Fabrication Dept. work in process, ending inventory, $59,400 Equivalent units for labor in the Mashing Dept., 2,940 (1) Credit to scrap sales, $1,650 Debit to Factory Overhead Control, $112 Debit to Factory Overhead Control, $1,700 Debit to Spoiled Goods Inventory, $10,000 Debit to Factory Overhead Control, $700 Cost of Goods Sold, $73,500 Charge to Factory Overhead Control for spoilage, $3,725 Cost transferred to Finished Goods, $102,600 Total average cost per unit, $.50 Charge to Factory Overhead Control for spoilage, $8,250 (1) Work in process, ending inventory, $25,800 Cost transferred to Bottling Dept., $18,300 (1) Charge to Factory Overhead Control, $1,450 (2) Sales revenue, $121,800 (1) Charge to Factory Overhead Control, $2,000 Charge to Factory Overhead Control for spoilage of Assembling Dept., $12,000 Cost transferred from Mixing and Brewing Dept. to Canning Dept., $6,440 Charge to Factory Overhead Control for spoilage of Fabricating Dept., $810 Distillation Dept. work in process, ending inventory, $2,760

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

P8-1 P8-2 P8-3 P8-4 P8-5 P8-6 (2) Cost of goods sold, B, $808,200 (1) May gross profit, T, $45,000 (2) Gross profit for Alpha, $73,792 (3) Gross profit for Jana, $50,000 (2) Finished goods inventory, SPL-3, $178,160 (1) Total cost accounted for, Process 3, $137,500; (3) Total unit cost, Process 2, $4.10 Quantity to order for November delivery, 4,400 units (1) Quantity to order for March delivery, 5,800 units (2) Ordering and carrying costs, $1,510 (4) Absolute maximum inventory, 6,000 units (3) Normal maximum inventory, 3,960 units (1) Jan. 27 inventory, $842 (2) Normal maximum inventory, 4,300 units (1) March 31 inventory, $12,400 (2) (b) Dec. 5 inventory, $3,900 (1)(a) April 30 inventory, $7,805.60; (b) April 30 inventory, $7,700; (c) April 30 inventory, $6,800 (1)(b) Optimum production run of desks, 2,000 Expected annual savings, $40,500 Expected annual savings, $2,200,000 (1)(c) Per unit, $66.726 (4) Difference, rounded to the nearest tenth of one percent, 0.9% (3) Difference, rounded to the nearest tenth of one percent, 0.1% (1) Expected annual savings, $720,000 (1) Average lead time, 42 days (2) Cost of Goods Sold balance at June 30, $1,810,700 (2) Cost of Goods Sold balance at May 31, $1,306,200 (1) Estimated before-tax dollar savings, $37,500 (1) Per-unit conversion cost for 40 units, $4.40 (2) Incentive plan unit conversion cost, $13.55 (1) Monday's unit labor cost, $.514 (2) Conversion cost per unit, $.3685 Underpayment, Emerson Efficiency System: Suggs, $35.60; Ward, $39.76 (2) Group's total earnings for week, $1,380 (1) Factory workers' share of bonus, $9,375 (1) Direct labor hours per unit for the next order, 2.4192 (2) Factory overhead charge for Employee #1071, $333.20 (3) Accrued Payroll, $2,640

E9-2 E9-3 E9-6 E9-8 E9-9 E9-11 P9-3 P9-5 P9-6 P9-7 C9-1 E10-1 E10-3 E10-4 E10-10 E10-11 P10-1 P10-2 P10-3 P10-4 P10-5 P11-1 P11-2 P11-3 P11-4 P11-5 P11-6 P11-7 P11-8 P11-9 P11-10

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E12-1 E12-5 E12-7 E12-8 E12-9 E12-11 P12-1 P12-3 P12-4 P12-5 P12-6 E13-3 E13-4 E13-6 E13-7 E13-8 E13-13 E13-14 P13-1 P13-2 P13-3 P13-4 P13-6 P13-7 P13-8 E14-3 E14-4 E14-7 E14-9 P14-1 P14-2 P14-3 P14-4 P14-5 P14-6 C14-1 C14-2 (1) Fixed overhead, $1,750,000 (2)(a) Factory overhead rate, $16.69 (2) Underapplied factory overhead, $10,600 Overapplied overhead, $(1,086) (2) Underapplied overhead, $461 (3) Overapplied factory overhead, $(9,000) (2) Predetermined rate at practical capacity, $316.67 per machine hour (MH) (1) Total cost of Job 50, $156,750 (3) Amount included in cost of goods sold for Job 1376, $91,700; (4) Cost assigned to work in process account at end of year 20, $205,800 (1) Factory overhead rate, $.95; (5) Underapplied overhead, $2,450 (2) Total actual factory overhead, $117,000 (1) Job 437 Overhead, $30.18 (1) Plantwide rate per direct labor hour, $.83 Mixing Dept. rate, $3.00; Finishing Dept rate, $4.00 (2) Plantwide rate per direct labor hour, $36.317 (2) Job No. 3752 total, $331 (2) Job No. 345 total, $2,425 (2) Job No. 103 total, $47,500 (2) Overhead rates: Grinding Dept., $82.25 per machine hour; Smoothing Dept., $11.73 per direct labor hour; (3) Overhead rates: Grinding Dept., $84.05 per machine hour; Smoothing Dept., $11.49 per direct labor hour (2) Cutting Dept., $2.30 per machine hour; Assembly Dept., $4.50 per direct labor hour; Finishing Dept., $1.50 per direct labor hour Dept. 10 overhead rate per machine hour, $100.00 Overhead rates per direct labor hour: (1) Molding Dept., $10.60; Assembly Dept., $2.46; (2) Molding Dept., $9.80; Assembly Dept., $2.66 (1) Powerhouse = $30,000; Personnel = $40,000; Gen. Factory = $50,000 (2) Factory overhead applied to Dept. 10, $8,928 (2) Job No. 564 total, $3,350; (4)(b) Job No. 564 total, $4,175 $2,000 overstatement $4,800 overstatement (1) Overhead cost allocated, $126; (2) Overhead cost allocated, $554 (1) Overhead cost allocated, $140; (2) Overhead cost allocated, $740 (3) Overhead rate, $57 per setup (3) Overhead rate, $1,020 per setup (1) Custom cost per unit, $1,900; (2) Standard cost per unit, $106.98 (1) Fancy cost per unit $1,000; (2) Plain cost per unit, $87.34 (1) Super cost per unit, $400; (2) Normal cost per unit, $34 Large cost per unit: (1) $172; (2) $156.80 #321 cost per unit: (1) $135; (2) $84.83 #33 cost per unit: (1) $557.40; (2) $525.30; (4) $816.35

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E15-1 E15-2 E15-3 E15-4 E15-5 E15-6 E15-7 E15-8 E15-9 P15-1 P15-2 P15-3 P15-4 P15-5 P15-6 P15-7 P15-8 P15-9 Total budgeted sales revenue, $1,136,040 Budgeted Production for Flop, 21,500 units Budgeted Production for Moon Glow, 251,200 equivalent units (1) Budgeted Production for Low Band, 190 units (4) Materials purchase budget for Material A, $10,900 (3) Total variable manufacturing cost for Tribolite, $89,100 Budgeted purchases, $2,600,000 Income before income tax, $190,000 Operating income before taxes and interest, $1,617,000 (4) Total budgeted labor, $2,147,000 (1) January total DLH, 20,000 (2) Total cost of budgeted purchases of Material 101, $255,840 (1) 6-month total budgeted sales, 1,327,500 units (1) First quarter budgeted net income, $56,000 (2) Budgeted billing rate for Vickers, $52.00 Model 100, planned production, 12,100 units Predetermined overhead rate for Testing Dept., $11.00 per machine hour (1) Ending balance in retained earnings, $99,300

E16-1 E16-2 E16-3 E16-4 E16-5 E16-6 E16-7 E16-8 P16-1 P16-2 P16-3 P16-4 P16-5 P16-6 P16-7 P16-8 P16-9

January ending cash balance, $20,500 May cash disbursements for materials purchases, $619,360 July cash disbursements for purchases of Tee, $509,600 Ending cash balance, $1,550 (2) Critical path 1-2-5-6-7, 11 weeks Expected time for activity 1-2, 2.00 days (2) Slack time at event 3, 1 day (4) Slack time at event 2, 2 days (1) Budgeted cash disbursements for June, $323,279 Cash to be borrowed in April, $122,000 Cash balance at the end of 20B, $75,000 Current financing required, $84,162 (1) Total cash revenue, $709, 100 (1) Total cash receipts during July, $4,580,000 (2) Cost of operating on the first day, $1,600 (3) Total normal cost, $17,100 (1) Critical path A-B-E-H-K-L, 11 weeks

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E17-1 E17-2 E17-3 E17-4 E17-5 E17-6 E17-7 E17-8 E17-9 E17-10 P17-1 P17-2 P17-3 P17-4 P17-5 P17-6 E18-1 E18-2 E18-3 E18-4 E18-5 E18-6 E18-7 E18-8 E18-9 E18-10 E18-11 E18-12 E18-13 E18-14 E18-15 P18-1 P18-2 P18-3 P18-4 P18-5 P18-6 P18-7 P18-8 P18-9 P18-10 (2) Maintenance Dept. spending variance, $5,500 unfav. (3) Carpenter Shop idle capacity variance, $2,450 unfav. (2) Payroll Dept. spending variance, $(455) fav. (1) Total cost billed to Dept. A, $2,800 (1) First quarter total billing to Cutting Dept., $5,400 Total actual cost per mile, $.0059 under budget Total budgeted cost at 90% capacity, $34,090 Total budgeted cost at 110% capacity, $27,500.00 Total spending variance, $220 unfav. Idle capacity variance, $12,280 unfav. (2) Dept. A overhead, $2,191 underapplied (2) Planers overhead rate, $3.825 per DLH (2) Machining Dept. spending variance, $328 unfav. Total variable cost at 90% capacity, $102,645 (2) Total spending variance, $689.00 unfav. (2) Idle capacity variance, $600.00 unfav. Materials quantity variance, $2,700 unfav. Materials purchase price variance, $(2,500) fav. (2) Materials price usage variance, $1,278 unfav. Labor efficiency variance, $500 unfav. (2) Labor rate variance, $93 unfav. Controllable variance, $20,500 unfav. Volume variance, $4,800 unfav. Variable efficiency variance, $2,320 unfav. Spending variance, $650 unfav. (2) Spending variance, $(5,000) fav. Materials mix variance, $(4,500) fav. (2) Materials yield variance, $540 unfav. Total controllable variance, $282 unfav. Idle capacity variance, $(800) fav. Fixed efficiency variance, $(500) fav. (2) Volume variance, $1,000 unfav. (1) Standard quantity allowed for Material A, 14,700 units (2) Labor efficiency variance, $2,300 unfav. (2) Materials quantity variance, $8,000 unfav. (2) Variable efficiency variance, $200 unfav. (3)(b) Labor efficiency variance for Lot 22, $(98) fav. Volume variance, $1,005 unfav. Total spending quantity variance, $690 unfav. Factory overhead efficiency variance, $3,150 unfav. Fixed efficiency variance, $20,000 unfav.

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E19-1 E19-2 E19-3 E19-4 E19-5 E19-6 E19-7 E19-8 E19-9 E19-10 E19-11 E19-12 P19-1 P19-2 P19-3 P19-4 P19-5 P19-6 P19-7 P19-8 P19-9 P19-10 E20-1 E20-2 E20-3 E20-4 E20-5 E20-6 E20-7 E20-8 E20-9 E20-10 E20-11 E20-12 E20-13 P20-1 P20-2 P20-3 P20-4 P20-5 P20-6 P20-7 P20-8 P20-9 P20-10 Materials quantity variance, $42 debit (3) Materials price usage variance (fifo inventory), $760 debit Labor efficiency variance, $1,140 debit Labor efficiency variance, $900 credit (3) Controllable variance, $8,700 credit (4) Controllable variance, $2,900 debit (3) Variable efficiency variance, $1,600 debit (3) Volume variance, $3,000 debit Adjusted end-of-year balance in Finished Goods Inventory, $181,400 Total net variances charged to Work in Process, $237.50 debit Idle capacity variance, $2,040 debit Spending variance, $7,200 credit Labor efficiency variance, $400 debit Materials quantity variance, $3,000 debit Volume variance, $2,250 credit Net manufacturing variances, $90 fav. Net income, $1,741,700 (1) Volume variance, $12,000 debit (1) Labor efficiency variance, $1,400 credit (3) Work in Process adjusted to actual cost, $15,150 Overhead efficiency variance, $500 debit Spending variance, $520 credit Operating income, $412,000 (1) Cost of goods sold at standard under absorption costing, $6,500,000 (2) Operating income under direct costing, $96,000 Break-even point, $10,000 (1) Break-even point, 13,000 units Margin of safety, $500,000 (1) Break-even point, $15,000 (1) Break-even point, $50,000 Fixed cost, $1,190,000 Break-even point, $1,500,000 (2) Required sales, $1,275,000 (1) Sales price to break-even, $6.50 Break-even point, $140,000 and 7,000 units Operating income, $100,000 (2) Operating income under direct costing, $296,000 (1) Operating income under absorption costing, $191,000 (2) First quarter operating income under direct costing, $22,600 (1) Break-even point with capital-intensive manufacturing, 210,000 units (2) Units to be sold at $40 each to produce required profit, 4,500 Sales to produce required profit, 12,324 units of B2 plus 18,486 units of B4 (1) sales to break-even, 40,000 tape recorders plus 80,000 calculators (1) (a) Sales to break-even, 500 units (2) Break-even point, $1,000,000

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E21-1 E21-2 E21-3 E21-4 E21-5 E21-6 E21-7 E21-8 E21-9 E21-10 E21-11 E21-12 E21-13 E21-14 E21-15 P21-1 P21-2 P21-3 P21-4 P21-5 P21-6 P21-7 P21-8 P21-9 P21-10 E22-1 E22-2 E22-3 E22-4 E22-5 E22-6 E22-7 P22-1 P22-2 P22-3 P22-4 P22-5 P22-6 P22-7 Differential profit from accepting new business, $1,595 (1) Differential cost, $250,000 Differential profit from sale, $45,000 Savings from manufacturing part, $5,000 Savings from purchasing pistons, $6,000 (1) Gross contribution margin from Tift, $14,000 Net contribution margin, $.70 per unit (1) Minimum bid price, $.008 per dose Average daily franchise fee collections, $52,500 Annual savings with new AZ-17 process, $125,333 Marking board contribution margin when using automated assembly, $19.90 Maximum contribution margin, $900 Maximum contribution margin, $2,600 Minimum cost, $17 Minimum cost, $8,200 (1) Increment to pretax profit, $432,000 (1) Increase in net income by accepting bid, $27,900 (1) (c) Differential cost if level production is used, $88,785 Group I total production costs, $32,050 (1) Differential cost of special order, $34,750 Total operating income with additional capacity, $65,855 (1) Sales required to recover fixed overhead and regional promotion costs, 160,000 units Annual cost savings with discount quantity plan, $41,850 (1) Net revenue with plain paper and bulk mail, $1,083,600 (1) Net local market contribution, $310,000 Excess cash inflows over outflows, $200,000 Excess cash inflows over outflows, $116,000 Total price-level adjusted pretax cash inflows, $128,795 Excess of pretax cash inflows over outflows, $524,070 Excess of net after-tax cash inflows over outflows, $360,000 Excess of net after-tax cash inflows over outflows, $114,000 Excess of net after-tax cash inflows over outflows, $60,000 Excess of inflation-adjusted net after-tax cash inflows over outflows, $47,278 Excess of net after-tax cash inflows over outflows, $7,560 (1) Total after-tax cash inflows from making product, $3,868,000 Excess of inflation-adjusted net after-tax cash inflows over outflows, $347,940 (2) Excess of inflation-adjusted net after-tax cash inflows over outflows, $23,984 Excess of inflation-adjusted net after-tax cash inflows over outflows, $151,952 (1) Excess cost of CIM system over after-tax savings, $359,652

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E23-1 E23-2 E23-3 E23-4 E23-5 E23-6 E23-7 E23-8 E23-9 E23-10 P23-1 P23-2 P23-3 P23-4 P23-5 P23-6 P23-7 P23-8 P23-9 P23-10 24-1 E24-2 E24-3 E24-4 E24-5 E24-6 E24-7 E24-8 E24-9 E24-10 E24-11 E24-12 E24-13 E24-14 E24-15 P24-1 P24-2 P24-3 P24-4 P24-5 P24-6 P24-7 P24-8 P24-9 P24-10 P24-11 P24-12 P24-13 Weighted average cost of capital, 11.90% Weighted average cost of capital before bond retirement and sale-leaseback, 8.3% (1) Payback period, 3.636 years (2) Net present value of investment, $4,840 (2) Present value index, 8.1% Present value of tax savings, $2,439 (2) Net present value of investment, $5,998 Net present value of investment, $31,731 Internal rate of return, 12.76% (2) Project A internal rate of return, 19.87% (2) Weighted average cost of capital, 9.33% Estimated land value, $552,791 (2) Project 1 internal rate of return, 15.67% (2) Accounting rate of return on original investment, 13.9% (5) Machine 1, internal rate of return, 18.6% (2) Accounting rate of return on average investment, 20.58% (4) Net present value index, .249 (3) Net present value of investment, $175,163 Net present value of purchase alternative, $727,129 Net present value of lease alternative, $14,000 (2) Standard deviation, $24,000 (2) Coefficient of variation, .114 Expected value of unit cost, $13.40 Expected value of purchasing 180,000 units, $32,500 (2) Expected value of perfect information, $1,800 Posterior probability of 40,000 unit demand, .25 Expected value of moving, $40,000 Expected value of making sub-assembly, $26,000 Expected value of bidding on Parcel A, $120,000 (1) Standard deviation, 7,496 units Expected net present value, $1,775 Variance of net present value, $822,539 Standard deviation of net present value, $3,791 Variance of the total net present value of the investment, $49,994,656 (2) Probability that the NPV will be positive, .88493 (2) Expected annual pretax advantage, $2,743,250 Plan 3 estimated total cost, $347,160 Maximum amount to pay for quality control program, $440,000 (1) Expected value of ordering 400 shirts, $1,480 (1) Posterior probability of demand for 2,000 sq. ft. houses, .3125 (2) Decrease in costs from accepting printer's offer, $3,331 Expected value of not testing, $900 Expected value of selecting a $5.25 sales price, $387,000 Expected value of Strategy 2, $1,000,000 (2) Expected net present value, $16,895 (3) Standard deviation of expected NPV, $107,308 (2) Standard deviation of total NPV, $2,554 Weighted score for new technology, 90.0

CHECK FIGURES, COST ACCOUNTING, 14th Ed., by Carter

E25-1 E25-2 E25-4 E25-5 P25-1 P25-2 P25-3 P25-4 P25-5 (3) Rate of return on capital employed, .20 (3) Recreational products rate of return on capital employed, .300 (1) Increased income from outside sales, $600,000 Savings if Blade Division manufactures blades, $2,500 (1) Rate of return on capital employed for Springy, 20% (3) Cost savings by using units from Compressor Division, $312,500 (1) $10 advantage to Clarkson (1) Opportunity cost of shifting production to Economy model, $540 (1) Difference for Cole Division in favor of Wales Company contract, $25,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sahara ScamDocument14 pagesSahara Scamsagar srivastava100% (1)

- Commerce Guru: AccountancyDocument1 pageCommerce Guru: AccountancyHEMMU SAHU INSTITUTENo ratings yet

- Novus OverlapDocument8 pagesNovus OverlaptabbforumNo ratings yet

- Reading 23 Questions - FRA - Financial Reporting MechanicsDocument7 pagesReading 23 Questions - FRA - Financial Reporting MechanicsAlabson Erhuvwu AnneNo ratings yet

- Alternative Monthly Report FidelityDocument5 pagesAlternative Monthly Report FidelityForkLogNo ratings yet

- Efficient Capital MarketsDocument25 pagesEfficient Capital MarketsAshik Ahmed NahidNo ratings yet

- USSIF ImpactofSRI FINALDocument64 pagesUSSIF ImpactofSRI FINALmansavi bihaniNo ratings yet

- Multipurpose MallDocument90 pagesMultipurpose MallkidanemariamNo ratings yet

- Bear Spread Payoff Strategy CalculationDocument3 pagesBear Spread Payoff Strategy CalculationMukund KumarNo ratings yet

- Transfer To Shariah Baby Bond Child Trust FundDocument14 pagesTransfer To Shariah Baby Bond Child Trust FundOumelfadhl OumahmedNo ratings yet

- MS-04 Accounting and Finance for Managers Assignment 1-5Document3 pagesMS-04 Accounting and Finance for Managers Assignment 1-5Sanjay SanariyaNo ratings yet

- SIMPLE INTEREST COMPLETE CHAPTERDocument81 pagesSIMPLE INTEREST COMPLETE CHAPTERarobindatictNo ratings yet

- Sharpe, Treynor and Jensen ratios explainedDocument3 pagesSharpe, Treynor and Jensen ratios explainednegm8850% (2)

- FIN546Document8 pagesFIN546Florarytha RebaNo ratings yet

- Conceptual QuestionsDocument5 pagesConceptual QuestionsSarwanti PurwandariNo ratings yet

- Integrated Management System) : (Prime Constructions LTDDocument17 pagesIntegrated Management System) : (Prime Constructions LTDsniparagNo ratings yet

- Questions Number One P LTD and Its Subsidiary Consolidated Income Statement For The Year Ended 31 December 2003Document29 pagesQuestions Number One P LTD and Its Subsidiary Consolidated Income Statement For The Year Ended 31 December 2003JOHN KAMANDANo ratings yet

- Business Plan For Dredging BusinessDocument6 pagesBusiness Plan For Dredging Businessokoro matthew100% (4)

- Profile On The Production of Synthetic Marble EthiopiaDocument29 pagesProfile On The Production of Synthetic Marble EthiopiaNasra HusseinNo ratings yet

- McDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaDocument12 pagesMcDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaWaleed TariqNo ratings yet

- 24 Securities OperationsDocument61 pages24 Securities OperationsPaula Ella BatasNo ratings yet

- Illiquidity and Stock Returns - Cross-Section and Time-Series Effects - Yakov AmihudDocument50 pagesIlliquidity and Stock Returns - Cross-Section and Time-Series Effects - Yakov AmihudKim PhượngNo ratings yet

- Revenue StreamDocument11 pagesRevenue Stream1B053Faura Finda FantasticNo ratings yet

- NBL NewDocument110 pagesNBL NewDeepak JhaNo ratings yet

- Cash Management and Working Capital ProblemsDocument2 pagesCash Management and Working Capital ProblemsRachel RiveraNo ratings yet

- GayanDocument23 pagesGayanijayathungaNo ratings yet

- NSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedDocument24 pagesNSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedSamaan RishadNo ratings yet

- Introduction to Financial Management Chapter 1Document30 pagesIntroduction to Financial Management Chapter 1Mark DavidNo ratings yet

- Financial Stability ActivityDocument3 pagesFinancial Stability Activity[AP-Student] Lhena Jessica GeleraNo ratings yet

- Kekra-01 220119Document8 pagesKekra-01 220119rastamanrmNo ratings yet