Professional Documents

Culture Documents

SEB Report: U.S. Economic Growth Forecast Revised Up

Uploaded by

SEB GroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SEB Report: U.S. Economic Growth Forecast Revised Up

Uploaded by

SEB GroupCopyright:

Available Formats

US Economy: muddling through

We estimate that real GDP grew at a 3.5% annualized rate in the fourth quarter; a tad higher than our view in the latest Nordic Outlook. Moreover, the economy clearly has momentum and the fiscal headwind is actually less severe than previously forecasted, at least in the very short term. But while the U.S. economy gives off the allure of a country that has decoupled, we are concerned about the tightening in financial conditions as well as the lagged effects from the recession in Europe. That being said, our forecast is that the U.S. economy is winning the beauty price in the ugly contest. We forecast 2.3 per cent and 2.2 per cent GDP growth in 2012 and 2013, respectively. Core inflation is peaking and should start to decline this year. The last couple of readings have been muted and according to our forecast core inflation will fall to 1.2 per cent by the end of 2012. The December labor market report was strong, and the unemployment rate managed again to drift lower, to 8.5 per cent from 8.7 per cent in November. A year ago, the unemployment rate was sitting at 9.4 per cent. The rapidly declining jobless rate has surprised us; the drop is much bigger than suggested by the Okun relationship. A flyin-the-ointment is that decline in the labor force has helped pull the unemployment rate lower. Since GDP is growing at around the potential rate in 2012-13, we expect the unemployment rate to hold steady at its current level. The Fed will start publishing forecasts for the fed funds rate after the January 24-25 FOMC meeting. Not only that, but there will be a text as well describing the key factors underlying those assessments as well as qualitative information regarding participants expectations for the Federal reserves balance sheet. We expect the text to reveal that several FOMC participants look for the balance sheet to increase in 2012, thus affecting market expectations. Our forecast is for another round of asset purchases (QE3) this summer. Mattias Brur, +46 8 763 85 06

TUESDAY 10 JANUARY 2012 Growth

Inflation

Labour-market

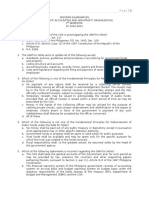

Key data Percentage change

2010 2011 2012 2013 GDP* Unemployment** Inflation* Government deficit*** Fiscal tightening**** 3.0 9.6 1.7 -10.3 -0.3 1.8 9.0 3.2 -9.2 0.6 2.3 8.4 1.7 -8.4 1.2 2.2 8.4 1.3 -7.5 1.3

* Percentage change, ** Per cent of labour force, *** Per cent of GDP **** Change in structural balance as a percentage of GDP Source: SEB

Economic Insight

GDP AND ACTIVITY INDICATORS

U.S. economic data has surprised to the upside, and we have bumped up our Q4 real GDP forecast to 3.5 per cent. Inventories provided a sizable boost in Q4; underlying growth (final sales) was around 2 per cent. But there is a strong near-term momentum, and the H1 GDP forecast was too pessimistic in the November Nordic Outlook. We expect real GDP growth slightly above 2 per cent both this year and the next. The recession in Europe is preventing a classic bungee-jump recovery. Our Financial Conditions Index is on a rising trend, although the tightening today is nowhere near that after Lehman. Our Credit Constraint Index is rising too, but current index levels are still consistent with ongoing, albeit low, growth. In the eleventh hour Congress extended the payroll tax cut and the unemployment insurance, but only for a couple of months. Our forecast assumes that legislators ultimately extend the stimulus measures for the entire year, but it is likely going to be a messy process. Fiscal austerity still is a headwind both this year and the next. Meanwhile the Fed is taking actions to support the recovery and we look for another round of large-scale asset purchases later this year. We have collected a variety of macro indicators in the two charts on the bottom of the page. The first chart takes off in June 2011, whereas the second chart takes off in September. Compared to six months ago, the housingrelated indicators have risen firmly. It is noteworthy, however, that consumer expectations are lower today than six months ago. Compared to three months ago the consumer has emerged from the dead, presumably reflecting both the better jobs market and lower gasoline prices. But the improvement is broad-based; only industrial production and ISM services have basically flat-lined since September.

Economic Insight

CONSUMER SPENDING AND THE LABOR MARKET

The trend in real consumer spending is pointing slightly downwards, and our indicator model suggests no pick up in the near term. Real disposable income actually is deflating, which means that a major pick up in consumer spending looks unlikely. In year-on-year terms, real average earnings (both on an hourly and a weekly basis) are deep into negative territory. Arguably the key is the labor market; our hunch is that the current unemployment level will limit wage growth. From July to November, the U.S. economy managed to generate 653k new jobs on net, and yet real personal disposable income fell in four of those five months and at a 1 percent annual rate. However the large drop in initial claims indicates that the labor market improvement will continue, unless, of course Europes problems get in the way. Households are still focused on reducing their debt levels rather than increase borrowing. But the fact that the household debt service ratio has dropped to its lowest level in 15 years is telling us that ongoing deleveraging will not be the last straw that breaks the camels back. The 60 cent drop in gasoline prices since last summer supported consumption, as did the drop in the savings rate from 5 per cent to 3.5 per cent while household net worth, if anything, is suggesting that savings should rise.

Economic Insight

INFLATION INDICATORS

Reflecting the drumbeat of positive U.S. economic news, the dollar index has risen to its highest level in 16 months. The stronger dollar may eventually put pressure on the trade and current account deficits. The current account deficit has been moving sideways over the last two years. Meanwhile the growing economy in combination with a touch of fiscal austerity has pushed the budget deficit in right direction. Core CPI inflation was 2.2 percent in November in year-on-year terms. Several factors, such as higher demand for rental housing units and the supply-chain constraints in the auto industry may have contributed to the rise. Core CPI inflation is close to its peak, and our forecast is that it will fall back to 1.2 per cent by the end of 2012. The market expects lower inflation too; breakeven inflation rates are muted. The output gap is shrinking, but it is still huge in a historical perspective.

Breakeven inflation

(Constant Maturity Inflation Indexed bonds)

3 2 1 0 -1 -2 -3 03 04 05 06 07 08 09 10 11 12 3 2 1 0 -1 -2 -3

10Y

5Y

Source: Reuters EcoWin, SEB

A proxy of the food/energy shock

Headline less core inflation

4 3 2 1 0 -1 -2 -3 -4 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 4 3 2 1 0 -1 -2 -3 -4

US

Euro zone

Source: Reuters EcoWin, SEB

percentage change

You might also like

- Investment Outlook 1412: Slowly, But in The Right DirectionDocument38 pagesInvestment Outlook 1412: Slowly, But in The Right DirectionSEB GroupNo ratings yet

- Nordic Outlook 1502: Central Banks and Oil Help Sustain GrowthDocument52 pagesNordic Outlook 1502: Central Banks and Oil Help Sustain GrowthSEB GroupNo ratings yet

- Eastern European Outlook 1503: Baltics and Central Europe Showing ResilienceDocument23 pagesEastern European Outlook 1503: Baltics and Central Europe Showing ResilienceSEB GroupNo ratings yet

- Insights From 2014 of Significance For 2015Document5 pagesInsights From 2014 of Significance For 2015SEB GroupNo ratings yet

- CFO Survey 1409: More Cautious View On Business ClimateDocument16 pagesCFO Survey 1409: More Cautious View On Business ClimateSEB GroupNo ratings yet

- Investment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksDocument39 pagesInvestment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksSEB GroupNo ratings yet

- Nordic Outlook 1411: Increased Stress Squeezing Global GrowthDocument40 pagesNordic Outlook 1411: Increased Stress Squeezing Global GrowthSEB GroupNo ratings yet

- Nordic Outlook 1405: Recovery and Monetary Policy DivergenceDocument48 pagesNordic Outlook 1405: Recovery and Monetary Policy DivergenceSEB GroupNo ratings yet

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayDocument4 pagesEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupNo ratings yet

- Economic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthDocument3 pagesEconomic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthSEB GroupNo ratings yet

- Investment Outlook 1405: The Road To Reasonable ExpectationsDocument37 pagesInvestment Outlook 1405: The Road To Reasonable ExpectationsSEB GroupNo ratings yet

- SEB Report: Brazil - Back To Grey Economic Reality After The World CupDocument2 pagesSEB Report: Brazil - Back To Grey Economic Reality After The World CupSEB GroupNo ratings yet

- Nordic Outlook 1408: Continued Recovery - Greater Downside RisksDocument53 pagesNordic Outlook 1408: Continued Recovery - Greater Downside RisksSEB GroupNo ratings yet

- SEB Report: Change of Government in India Creates Reform HopesDocument2 pagesSEB Report: Change of Government in India Creates Reform HopesSEB GroupNo ratings yet

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleDocument3 pagesEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupNo ratings yet

- Asia Strategy Focus:Is The Indonesia Rally Over?Document17 pagesAsia Strategy Focus:Is The Indonesia Rally Over?SEB GroupNo ratings yet

- Deloitte/SEB CFO Survey Finland 1405: Closing The GapDocument12 pagesDeloitte/SEB CFO Survey Finland 1405: Closing The GapSEB GroupNo ratings yet

- Eastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilDocument24 pagesEastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilSEB GroupNo ratings yet

- Swedish Housing Price Indicator Signals Rising PricesDocument1 pageSwedish Housing Price Indicator Signals Rising PricesSEB GroupNo ratings yet

- CFO Survey 1403: Improving Swedish Business Climate and HiringDocument12 pagesCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupNo ratings yet

- Economic Insights: Global Economy Resilient To Geopolitical UncertaintyDocument31 pagesEconomic Insights: Global Economy Resilient To Geopolitical UncertaintySEB GroupNo ratings yet

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialDocument5 pagesEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupNo ratings yet

- China Financial Index 1403: Better Business Climate AheadDocument6 pagesChina Financial Index 1403: Better Business Climate AheadSEB GroupNo ratings yet

- SEB's China Tracker: Top 7 FAQ On China's SlowdownDocument11 pagesSEB's China Tracker: Top 7 FAQ On China's SlowdownSEB GroupNo ratings yet

- Asia Strategy Comment: Tokyo Election May Affect YenDocument3 pagesAsia Strategy Comment: Tokyo Election May Affect YenSEB GroupNo ratings yet

- Nordic Outlook 1402: Recovery With Shift in Global Growth EnginesDocument49 pagesNordic Outlook 1402: Recovery With Shift in Global Growth EnginesSEB GroupNo ratings yet

- Investment Outlook 1403: Markets Waiting For Earnings ConfirmationDocument39 pagesInvestment Outlook 1403: Markets Waiting For Earnings ConfirmationSEB GroupNo ratings yet

- Optimism On Swedish Home Prices Fading A LittleDocument1 pageOptimism On Swedish Home Prices Fading A LittleSEB GroupNo ratings yet

- SEB Report: More Emergency Actions Needed in UkraineDocument2 pagesSEB Report: More Emergency Actions Needed in UkraineSEB GroupNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Data Base Management DataflowDocument49 pagesData Base Management DataflowGhanShyam ParmarNo ratings yet

- The Anatomy of Translation Problems: The Application of Minimal Deviation and The Proportionality Principle in The Translation of Economic EditorialsDocument99 pagesThe Anatomy of Translation Problems: The Application of Minimal Deviation and The Proportionality Principle in The Translation of Economic EditorialsChartridge Books OxfordNo ratings yet

- Main 181004134008Document22 pagesMain 181004134008MohammadAlAmeenNo ratings yet

- Chap 011Document18 pagesChap 011Xeniya Morozova Kurmayeva100% (9)

- Not For Profit Organisations: AccountancyDocument79 pagesNot For Profit Organisations: AccountancySoumendra RoyNo ratings yet

- Z Belay ZewudeDocument102 pagesZ Belay ZewudeamanualNo ratings yet

- Monetary and Fiscal Policy (Final)Document27 pagesMonetary and Fiscal Policy (Final)nohel01100% (1)

- ACLEDA AnnRept2005Document84 pagesACLEDA AnnRept2005henglayNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) February 2023Document101 pagesBeepedia Monthly Current Affairs (Beepedia) February 2023Rishabh MalhotraNo ratings yet

- The Effects of State and Local Public Policies OnDocument13 pagesThe Effects of State and Local Public Policies OnGeda wakoNo ratings yet

- Fundamentals of Money and BankingDocument104 pagesFundamentals of Money and BankingSiraajNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial Statementsmaria isabella100% (1)

- Jamila Mufazzal - Chapter002.pptx (BF)Document49 pagesJamila Mufazzal - Chapter002.pptx (BF)jamila mufazzalNo ratings yet

- Assessment and EvaluationDocument9 pagesAssessment and EvaluationDhruv MalhotraNo ratings yet

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocument12 pagesMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsNate Dela Cruz100% (1)

- Bahir Dar Textile Share CompanyDocument5 pagesBahir Dar Textile Share CompanyBedilu Liul100% (1)

- Budget Statement 2020Document154 pagesBudget Statement 2020JackieWilsonNo ratings yet

- DR Bawumia Presentation at Kumasi Townhall MeetingDocument77 pagesDR Bawumia Presentation at Kumasi Townhall Meetingmyjoyonline.comNo ratings yet

- Volume - 1 Enforcement OfficerDocument402 pagesVolume - 1 Enforcement Officere44175No ratings yet

- Pastor Fred Mwesigye ManifestoDocument24 pagesPastor Fred Mwesigye ManifestoAfrican Centre for Media ExcellenceNo ratings yet

- MacroeconomicsDocument18 pagesMacroeconomicsHarshaNo ratings yet

- What Are The Basic Benefits and Purposes of DeveloDocument7 pagesWhat Are The Basic Benefits and Purposes of DeveloHenry L BanaagNo ratings yet

- Internship Report of Im Studies PeshawarDocument36 pagesInternship Report of Im Studies PeshawarGham e UlfaatNo ratings yet

- Breaking Bad (The Rules) : Argentina Defaults, Inflates (And Grows), 1997-2015Document3 pagesBreaking Bad (The Rules) : Argentina Defaults, Inflates (And Grows), 1997-2015KiranJumanNo ratings yet

- Ambrian Gold Book - 2011Document56 pagesAmbrian Gold Book - 2011gpperkNo ratings yet

- AP DSC Secondary Grade Teacher (SGT) Syllabus 2015Document14 pagesAP DSC Secondary Grade Teacher (SGT) Syllabus 2015MruthyunjayNo ratings yet

- Egypt Balance of PaymentDocument7 pagesEgypt Balance of PaymentBram DirgantaraNo ratings yet

- Balance Budget Sim Lesson PlanDocument5 pagesBalance Budget Sim Lesson Planapi-245012288No ratings yet

- CFA三级密卷 答案Document42 pagesCFA三级密卷 答案vxm9pctmrrNo ratings yet

- Informe MoodysDocument9 pagesInforme MoodysMontevideo PortalNo ratings yet