Professional Documents

Culture Documents

Cambodia Oil Gas Newsletter 8

Uploaded by

Murad MuradovOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambodia Oil Gas Newsletter 8

Uploaded by

Murad MuradovCopyright:

Available Formats

No.

Petroleum Sector Briefing Note

November 2007

Contracts for Petroleum Development - Part 2

Petroleum contracts are long and complex. Production sharing agreements, the type of contracts being signed in Cambodia, are no exception. However, they are important to the countrys future economic and development options and hence it would be helpful if the public had a basic understanding of how these contracts work and, in particular, how government revenues are determined. This briefing note, part 2 of a three-part series, describes the terms used in defining payments made by petroleum companies and the order in which they are paid.

any developing countries around the world use production sharing agreements (PSAs) to govern the relationship between the state and petroleum companies. PSAs in the oil sector were first developed in Indonesia; the Asian governments that have used production sharing include China, India, Malaysia, Pakistan, the Philippines, Timor Leste, and Vietnam. Beginning in 2002, the government of Cambodia has signed a series of PSAs. Briefing Note No. 7 gave an overview of the legal framework governing the petroleum sector and two types of contractual systems, concessionary and production sharing [1]. This note discusses in more detail different aspects of fiscal terms in production sharing. There is a fundamental conflict between petroleum companies, referred to as contractors in production sharing, and the government: both want to maximize their respective revenues and minimize risks. The government can potentially increase its revenue by setting tax, royalty, and other rates at high levels, but doing so could deter investment, especially in marginal fields, and reduce, rather than enhance, the governments overall revenue. Judging what would be a reasonable burden on petroleum companies is one of the challenges in setting up an effective fiscal system.

flowing to the government increases with increasing incomethat is, government income rises at a faster rate than the net-of-cost project incomethe fiscal parameter is progressive. Progressive parameters tend to be based on some measure of profitability. To reflect profit elements, two approaches are often used.

Responding to Market Incentives

Briefing Note No. 7 explained that some fiscal terms are regressive and others are progressive. Briefly, if the percentage of the net-of-cost income

An R-factor is the ratio of cumulative receipts from the sale of petroleum to cumulative expenditures. This ratio is initially zeroduring exploration there is no sale of petroleum while there may be considerable expensesand gradually grows in time. An R-factor less than 1 would mean that costs have not been fully recovered yet: total expenditures exceed total receipts. The larger the R-factor, the more profitable the operation. The royalty rate or the governments share of production may increase with increasing R-factor. In the rate-of-return contracts (also referred to as resource rent royalties, resource rent taxes, or trigger taxes), the government receives additional income from the contractors cash flows in excess of specified thresholds for the internal rate of return. The rate (for royalty, tax, production share) due to the government increases with increasing rate of returnthe more profitable the operation, the higher the rate. Fiscal parameters based on either of these are among the most progressive.

Petroleum Sector Briefing Note

November 2007

Revenue Streams

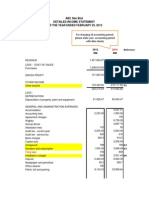

Typical revenue streams in a PSA are shown in Figure 1. Oil (or gas) produced is split into cost oil, profit oil, and the royalty.

Royalty

Royalties are based on the volume or value of petroleum extracted. Royalties may be paid in cash or in kind; if the latter, specified amounts of oil, gas, or both are delivered to the government. Royalties are paid as soon as commercial production commences, thereby providing early revenue to the government. They also ensure that contractors make a minimal payment. Simple royaltiesfor example, 10 percent of the value of the oil extractedare easy to administer, but do not take into account the profitability of the project and hence are regressive. As such, royalties deter investment. One way of redressing this is to make the royalty rate depend on the level of production, increasing it with increasing production. The rationale is that larger production levels lead to greater profitability because of economies of scale (this is not always the case, because many factors other than the scale of production affect a projects profitability). In that case, royalties are said to be on a sliding scale. Some countries have designed the royalty rate to depend on the R-factor.

tor to recover the costs of exploration, development, and production. Most PSAs limit the amount of cost oil that can be retained in a given accounting period. Costs that are not recovered are carried forward and recovered later; most PSAs allow virtually unlimited carry forward. The cost oil limit is the only substantive distinction between concessionary systems and production sharing. It is another avenue available to the government to ensure early revenue. Certain expenses may not be eligible for cost recovery. Examples include bonuses (see below), royalties; interest or other financing related payments and overheads beyond specified limits; and costs outside the budget, unless approved by the government.

Profit oil

Profit oil is the share of production remaining after the royalty is paid and cost oil has been retained by the contractor. Profit oil can be paid in cash or in kind. In its simplest formulation, the agreement may stipulate that the profit oil be split, for example, 40/ 60the contractors share being 40 percent and the governments share 60 percentirrespective of the world oil price or production level. Production sharing can also be on a sliding scale: the percent share of the government can increase with increasing production level, cumulative production, R-factor, or rate of return.

Cost oil

Cost oil refers to the oil retained by the contrac-

Income tax

In Figure 1, the contractor is subject to income

November 2007

Petroleum Sector Briefing Note

tax based on taxable income. Income tax is paid after production is shared in this figure; it is also possible to write a PSA in which income tax is paid before production sharing (see Briefing Note No. 9). A PSA does not have to provide for the actual payment of taxes, and instead can include the tax equivalent portion in the governments share. Known as a pay-on-behalf scheme, it assures stability with respect to income tax. The tax equivalent portion is subtracted before production sharing.

velopment (such as building roads) on a voluntary basis. Training of local employees is another example. Training of government officials is normally a contractual obligation.

Accounting Rules

Accounting rules also affect how much and when the government will receive revenues from contractors. It is not the intention of this note to explain these rules, but they are mentioned to give a sense of what contractors look for. They include ring-fencing by contract (or sometimes by field), depreciation rates, allowance for accelerated depreciation, loss carry forward, treatment of pre-production expenses, uplifting of costs, rules against thin capitalization, and treatment of abandonment costs.

Bonuse

Bonuses are the most regressive fiscal parameters and give early revenue to the government. Signature bonuses are paid when the contract becomes effective, and can be considerable in highly prospective areas. For example, the first financial report for the Nigeria Extractive Industries Transparency Initiative showed that Shell Nigeria Ultra Deep Limited in 2003 paid US$210 million as a signature bonus [2]. In 2006, a new record was set when Sonangol-Sinopec International, a joint venture between two national oil companies from Angola and China, bid a total of US$2.4 billion for the relinquished parts of two blocks in Angola [3]. Production bonuses are paid at the start of commercial production and when production reaches specified levels. Bonuses are generally not recognized as cost-recoverable expenses.

Foreign Tax Credit Considerations

Foreign petroleum companies must pay income tax to their home governments. Foreign companies are allowed to credit taxes paid to the host government (the government of the country in which petroleum operations are being conducted) against tax liabilities in their home countries, provided that the tax in question is an income/profit tax and a tax certificate is issued by the host government.1 In pay-on-behalf schemes, to enable foreign tax credits, the host country taxes are still calculated and the host government issues a tax certificate. Everything else being equal, it does not make sense to set the income tax rate markedly lower than those prevailing in the countries where contractors are headquartered, because that would likely mean that the difference would be paid to foreign tax authorities the host government would be sacrificing tax revenue to foreign governments when doing so offers no additional incentives for investment.

Surface rental and other fees

Contractors pay annually for acreage covered by a PSA. Surface rental fees are often given in monetary units per square kilometer, so that the overall flow to the government declines with each relinquishment. There are other fees, such as fees paid by bidders in licensing rounds or contributions to the training of government personnel which, if not spent, are payable in cash.

Other taxes

Other taxes include withholding tax, foreign national and sub-contractor income tax, value added tax, and customs duties.

How Payments Are Made

Signature bonuses, as explained above, are paid before any work starts. Surface rental fees and a few other fees and taxes are paid prior to production, but they are relatively small. Once commercial production starts, Figure 1 gives an illustration of what happens to receipts from petroleum sale. The royalty is paid first. The contractor is next allowed to recover costs, often up to a specified limit, in the form of cost

Payments in kind

Contractors may undertake social programs (such as building schools and clinics) and infrastructure de1

To avoid double taxation, there are often, but not always, formal agreements between governments to coordinate taxation provisions so that the net income is not taxed twice. Cambodia has no bilateral tax treaties. However, income tax paid in Cambodia can be credited if it meets the criteria of income tax in the home country. In the United States, for example, foreign income tax is creditable against U.S. income tax liabilities if it is a tax on net income.

Petroleum Sector Briefing Note

November 2007

oil. Revenues remaining after royalty and cost recovery constitute profit oil (or gas), and are shared between the government and the contractor. In Figure 1, the contractor is further required to pay income tax on its share of profit oil. While bonuses and royalties start flowing early on, corporate taxes and the governments share of production usually do not start flowing in significant amounts until costs are substantially recovered. Because upfront investment costs in oil and gas may be very large, it could take several years from the start of production before the government receives any sizable revenue.

Illustration

A very simplified case is given in Figure 2 to illustrate how the system in Figure 1 may work. For simplicity, only the royalty, production share, and income tax are considered; bonuses, depreciation and loss carry forward rules, surface rental and other fees, and other taxes and payments due are not considered.

for these two barrels, and the contractor can take as cost oil the full cash expenditures incurred because US$25 is less than the maximum allowable limit of US$60. This leaves profit oil of US$65. The production split in the PSA is 40 percent for the contractor and 60 percent for the government. The government takes 60 percent of US$65, or US$39, and the remaining US$26 goes to the contractor. The contractor has to pay income tax out of its share of profit oil. For paying income tax, there are no limits on deductible expenses in the way there are limits on cost oil. (In this example, however, costs recovered in this accounting period happens to be the same for both cost oil and for income tax purposes.) The taxable income is US$26 (100102539), giving an income tax of US$7.8. The end result is that the contractor retains US$43 and the government takes $57. In practice, calculations of revenue streams are more complex because of depreciation, loss carry forward, and the determination of deductible costs (for tax purposes) which normally differ from recoverable costs (for computing cost oil). The next briefing note will illustrate how different fiscal terms can affect revenue flows to the government over the life of a contract.

References

[1] World Bank. 2007. Contracts for Petroleum Development Part 1. Petroleum Sector Briefing Note No. 7, October. [2] Hart Group. 2006. Nigeria Extractive Industry Transparency Initiative Financial Audit. Financial Flows 19992004. www.neiti.org/files-pdf/ FARFinFlowsUpload.pdf. [3] Global Insight Daily Analysis. 2006. Angola set for new licensing round, Gimboa field developments. August 31.

For more information contact: Mr. Bun Veasna Infrastructure Officer Email: vbun@worldbank.org or Masami Kojima Lead Energy Specialist Email: mkojima@worldbank.org

Figure 2 considers the proceeds from the sale of two barrels of oil at US$50 each, giving a total of $100 in gross revenue to be shared between the contractor and the government. In accordance with Figure 1, the royalty is paid first. At 10 percent, this amounts to $10 going to the government. Out of the remaining $90, the contractor recovers costs to the limit permitted, in this case 60 percent of the gross revenue or US$60. The total expenses incurred (including pre-production expenses) amount to US$25

You might also like

- Fiscal Regimes: Scientific ReportDocument11 pagesFiscal Regimes: Scientific ReportHomam MohammadNo ratings yet

- Fiscal Regimes TopicDocument17 pagesFiscal Regimes TopicAaron Gbogbo MorthyNo ratings yet

- Designing and Implementing Production Sharing Contracts For The Mining SectorDocument16 pagesDesigning and Implementing Production Sharing Contracts For The Mining SectorMariano LamotheNo ratings yet

- June 2019 Module 3.04Document14 pagesJune 2019 Module 3.04Faisal MehmoodNo ratings yet

- Investment Tax Incentives ExplainedDocument12 pagesInvestment Tax Incentives ExplainedSeid KassawNo ratings yet

- Fiscal Costs: Scientific ReportDocument11 pagesFiscal Costs: Scientific ReportHomam MohammadNo ratings yet

- AIIT CH 12 Oil and Gas CoDocument17 pagesAIIT CH 12 Oil and Gas CoOdvut SwapnoNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- Mapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingDocument22 pagesMapping Risks To Future Government Petroleum Revenues in Kenya: A Framework For Prioritizing Advocacy, Research and Capacity BuildingOxfamNo ratings yet

- The Impact of New Nigerian Petroleum Industry Bill PIB 2021 On Government andDocument39 pagesThe Impact of New Nigerian Petroleum Industry Bill PIB 2021 On Government andIbrahim SalahudinNo ratings yet

- Nigeria August Tax News Fiscal Regime Under The New Petroleum Industry BillDocument3 pagesNigeria August Tax News Fiscal Regime Under The New Petroleum Industry BillMark allenNo ratings yet

- File Comp Mining Tax RegimeDocument12 pagesFile Comp Mining Tax Regimeatcher01No ratings yet

- Precept 4.: Fiscal Regimes and Contract TermsDocument45 pagesPrecept 4.: Fiscal Regimes and Contract TermsAaron Gbogbo MorthyNo ratings yet

- OTC-29568-MS Impacts of Fiscal Systems On Oil Projects ValuationDocument6 pagesOTC-29568-MS Impacts of Fiscal Systems On Oil Projects ValuationIbrahim SalahudinNo ratings yet

- Chapter 1 Taxation 2 Onsite Bba3 June To August 2021Document20 pagesChapter 1 Taxation 2 Onsite Bba3 June To August 2021hamidNo ratings yet

- 4 - June 2016 Paper 3.04 (Suggested Solutions)Document11 pages4 - June 2016 Paper 3.04 (Suggested Solutions)Faisal MehmoodNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Investment and Decision Analysis For Petroleum ExplorationDocument24 pagesInvestment and Decision Analysis For Petroleum Explorationsandro0112No ratings yet

- Taxation and Investment Issues in Mining: Paul MitchellDocument5 pagesTaxation and Investment Issues in Mining: Paul MitchellbenaskotNo ratings yet

- MBATaxDocument24 pagesMBATaxFilsufGorontaloNo ratings yet

- Financial Sector Tax ReformDocument104 pagesFinancial Sector Tax ReformLianne Carmeli B. Fronteras100% (1)

- 55 1605231035 jsKDFvK1 PDFDocument12 pages55 1605231035 jsKDFvK1 PDFanita syaputriNo ratings yet

- Assignment Fiscal RegimesDocument6 pagesAssignment Fiscal RegimesRAMJI TRIPATHYNo ratings yet

- Buckwold 21e - CH 1 & 2 Selected SolutionDocument15 pagesBuckwold 21e - CH 1 & 2 Selected SolutionLucyNo ratings yet

- Gulf Cooperation CouncilDocument21 pagesGulf Cooperation Councilabid murtazaiNo ratings yet

- Which WACC WhenDocument6 pagesWhich WACC Whenkalyan_mallaNo ratings yet

- Joint Ventures and Tax Considerations - Uganda - Global Law Firm - Norton Rose FulbrightDocument4 pagesJoint Ventures and Tax Considerations - Uganda - Global Law Firm - Norton Rose FulbrightGRAFERNo ratings yet

- SPE-193470-MS Analysis of Government and Contractor Take Statistics in The Proposed Petroleum Industry Fiscal BillDocument14 pagesSPE-193470-MS Analysis of Government and Contractor Take Statistics in The Proposed Petroleum Industry Fiscal Billipali4christ_5308248No ratings yet

- GPJ v4 Art1Document30 pagesGPJ v4 Art1Aries SatriaNo ratings yet

- Lecture 2 - Income TaxDocument13 pagesLecture 2 - Income TaxMasitala PhiriNo ratings yet

- Ifrs 8 CPD ArticleDocument5 pagesIfrs 8 CPD ArticleMurad MuradovNo ratings yet

- p3 Acca Workbook Q & A PDFDocument163 pagesp3 Acca Workbook Q & A PDFMurad MuradovNo ratings yet

- Acca P3Document111 pagesAcca P3Eileen LimNo ratings yet

- ACCA P7 Pass KeyDocument2 pagesACCA P7 Pass KeyMurad MuradovNo ratings yet

- Holt On IAS 12 NewDocument4 pagesHolt On IAS 12 NewMurad MuradovNo ratings yet

- Examiner's Report: P1 Governance, Risk and Ethics June 2011Document4 pagesExaminer's Report: P1 Governance, Risk and Ethics June 2011Murad MuradovNo ratings yet

- ACCA P1 NotesDocument96 pagesACCA P1 NotesWaqas AbrarNo ratings yet

- ACCA P1 NotesDocument96 pagesACCA P1 NotesWaqas AbrarNo ratings yet

- ACCA P1 RevisionDocument18 pagesACCA P1 RevisionMike Bree100% (1)

- Cambodia Oil Gas Newsletter 8Document4 pagesCambodia Oil Gas Newsletter 8Murad MuradovNo ratings yet

- Test 1 QP Sir FRK CAME PREDocument3 pagesTest 1 QP Sir FRK CAME PREUmair GOLDNo ratings yet

- Types of BudgetDocument6 pagesTypes of BudgetadityatnnlsNo ratings yet

- Module 6 TAXATION OF CORPORATIONS PDFDocument60 pagesModule 6 TAXATION OF CORPORATIONS PDFGuinevereNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuNo ratings yet

- An Overview of Business Finance-1Document24 pagesAn Overview of Business Finance-1HamzaNo ratings yet

- Ise 307Document56 pagesIse 307Hussain Ali Al-HarthiNo ratings yet

- Ratio AnalysisDocument56 pagesRatio Analysisvishi takhar80% (10)

- To AuditorsDocument6 pagesTo AuditorsJson LooiNo ratings yet

- 1.1.revenue SD RevrecDocument91 pages1.1.revenue SD Revrecanurag vermaNo ratings yet

- Advanced Accounting: Accounting For Not-for-Profit OrganizationsDocument37 pagesAdvanced Accounting: Accounting For Not-for-Profit Organizationsmuath alzahraniNo ratings yet

- Assignment 4 SolutionDocument2 pagesAssignment 4 SolutionSanjeev TripathiNo ratings yet

- Income Tax Study Material 2019-20Document16 pagesIncome Tax Study Material 2019-20Ayush MittalNo ratings yet

- Conference Call Results January - September 2014: WelcomeDocument21 pagesConference Call Results January - September 2014: WelcomeToni HercegNo ratings yet

- Ch08TB PDFDocument15 pagesCh08TB PDFMico Duñas CruzNo ratings yet

- Chapter 6 - FS Analysis (Worksheet)Document6 pagesChapter 6 - FS Analysis (Worksheet)angelapearlrNo ratings yet

- Home Based Professional Services Business PlanDocument18 pagesHome Based Professional Services Business PlanIsrael Jackson100% (4)

- Tax Banggawan2019 Ch15BDocument17 pagesTax Banggawan2019 Ch15BNoreen Ledda100% (1)

- CfasDocument3 pagesCfaskathie alegarmeNo ratings yet

- Chapter-1 State of Finances: 1.1 Summary of Current Year's Fiscal TransactionsDocument26 pagesChapter-1 State of Finances: 1.1 Summary of Current Year's Fiscal TransactionsANURAJM44No ratings yet

- CV - Assignment - Group 8 - Teuer - Case BDocument6 pagesCV - Assignment - Group 8 - Teuer - Case BKhushbooNo ratings yet

- What is Financial ManagementDocument10 pagesWhat is Financial ManagementCamille CornelioNo ratings yet

- Project On HDFC Car LoanDocument12 pagesProject On HDFC Car Loansoniparmar80% (5)

- Best SAP BW Interview Questions OriginalDocument34 pagesBest SAP BW Interview Questions Originalsumeet100% (1)

- An Introduction To Closed Loop MarketingDocument40 pagesAn Introduction To Closed Loop MarketingGeorgiana VasilescuNo ratings yet

- Midterm Exam ReviewDocument12 pagesMidterm Exam ReviewAllison0% (1)

- VarianceDocument5 pagesVarianceMuhammad Hussnain100% (1)

- Quiz3 HolyeDocument35 pagesQuiz3 HolyegoamankNo ratings yet

- Receivables and Investments ChapterDocument33 pagesReceivables and Investments ChapterFiras HamadNo ratings yet

- Rules of Determining Debit & Credit PDFDocument26 pagesRules of Determining Debit & Credit PDFasadurrahman40100% (1)

- Balance Sheet of CompanyDocument3 pagesBalance Sheet of Companyshubham jagtapNo ratings yet