Professional Documents

Culture Documents

The Corcoran Report: 4 QUARTER 2011

Uploaded by

robertnycityOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Corcoran Report: 4 QUARTER 2011

Uploaded by

robertnycityCopyright:

Available Formats

the corcoran report

4th QUARTER 2011

A comprehensive analysis of the residential real estate market in Manhattan.

the corcoran report

4th QUARTER 2011

Welcome to the Corcoran Report, our quarterly examination of Manhattans residential real estate market. This report uses market-wide data based on transactions that closed in the Fourth Quarter 2011 (October 1 through December 31) and compares it to closings that took place last quarter and during the same quarter one year ago. Closings typically occur eight to twelve weeks after a contract is signed; for that reason, the sales activity charted here trails actual market conditions. After strong demand over the past two quarters, market wide transaction activity pulled back during Fourth Quarter 2011 to approximately 2,600 sales, the lowest level of activity since Second Quarter 2009. The number of quarterly sales was 12% lower than Fourth Quarter 2010 and 20% lower than Third Quarter 2011. The compression in sales this quarter can be attributed to seasonal activity trending downward at the end of each year and low new development inventory. The condo and co-op market statistics were divergent this quarter, and fundamentals should be viewed separately. Condo inventory decreased 11% from a year ago due to limited new development openings but in contrast, co-op availability remained even. The net effect to market-wide listed inventory, at 8,440 listings, fell 6% from last quarter and 4% from Fourth Quarter 2010. Limited availability in the condo market has led to a surge in pricing. Condo median price and average price per square foot in Fourth Quarter 2011 were at their highest levels since the downturn. Condo median price is at its highest level since Fourth Quarter 2008 and average price per square foot is at its highest level since First Quarter 2009. Co-op median price declined this quarter while average price per square foot held relatively firm from one year ago and declined only marginally from Third Quarter 2011. In the new development sector, supply cannot keep pace with demand and several markets are already undersupplied; when properties enter the market they are highly anticipated and get absorbed rapidly, usually with price increases. The last few years have brought enormous change to our industry. We are excited to see the evolution of the Manhattan residential market in 2012. Whatever your real estate needs may be in the coming year, Corcoran is the market-leader and we hope you take full advantage of every resource our company and our agents can offer you. For the most comprehensive analysis of the Manhattan, Brooklyn, East End and South Florida residential markets, visit the Reports page of our website at www.corcoran.com/thecorcoranreport.

Sincerely,

Pamela Liebman Chief Executive Officer

The following members of the The Corcoran Group made significant contributions to this report: Bill Begert I William Goldstein I Douglas LaMere I Ryan Schleis I Kirsten Spanjer

The following members of the PropertyShark team made significant contributions to this report: Ioana Falcusan I Paula Flonta I Tudor Manole I Calin Onet I Mihai Palermo

the corcoran report

Market Trends

Condo pricing showed solid positive growth and increased 4% from one year ago while co-op pricing remained stable. Marketwide sales volume was lower from both last quarter and one year ago. Page 4

View all our current market reports for the most comprehensive analysis of Manhattan, Brooklyn, Hamptons and South Florida at www.corcoran.com/thecorcoranreport

4th QUARTER 2011

Uptown

New development median price increased 15% while average price per square foot increased 23% from last quarter. Compared to a year ago, new development median price increased 5% while average price per square foot increased 21% to $700. Page 14

West Side

The West Side is an undersupplied market. Compared to a year ago, co-op pricing was lower from a year ago but increased from last quarter. Resale condo pricing decreased from one year ago. Page 11

East Side

Co-ops on the East Side increased 4% in median price but remained even in average price per square foot compared to one year ago. Overall condo pricing fell from a year ago with average price per square foot declining 4% to $1,165 while median price held firm. Page 9

Midtown West

Resale co-op pricing declined. Resale condos increased 20% in median price and 2% in average price per square foot from one year ago. New development pricing was significantly higher than both last year and last quarter. Page 12

Midtown East Downtown

Resale condos increased 11% in median price and 3% in average price per square foot compared to Fourth Quarter 2010. New developments Downtown increased 2% in median price and 7% in average price per square foot from last quarter. Page 13

Average unit sales per square foot (SF):

Resale co-op pricing decreased from both last quarter and one year ago. Resale condos increased slightly from one year ago as median price increased 2% while average price per square foot increased slightly by 1%. Page 10

PropertyShark.coms map of Manhattan plots sales in the Fourth Quarter according to their numbers and their prices per square foot.

Number of unit sales per building:

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available

SF SF SF SF SF SF SF SF

Interactive map online at

propertyshark.com/maps

The Manhattan Sales Report is based on data collected by The Corcoran Group from internal and external resources including the public records of the City of New York. All material herein is intended for information purposes only and has been compiled from sources deemed reliable. Through information is believed to be correct, it is presented subject to errors, omissions, changes or withdrawal without notice. This is not intended to solicit property already listed. Equal Housing Opportunity. The Corcoran Group is a licensed real estate broker. Owned and operated by NRT LLC.

the corcoran report

4th QUARTER 2011

Manhattan Market Trends - Market-Wide

During Fourth Quarter 2011 there were 2,600 market-wide sales, a 12% decrease from Fourth Quarter 2010 and a 20% decrease from Third Quarter 2011. Limited availability is holding sales activity down, leaving buyers with fewer choices and pushing prices higher. The decline from last quarter can be attributed to typical seasonal trends as transaction activity usually wanes towards the end of the year.

Five Year Trend of Sales Activity (Number of Sales)

5,500 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Q4 06 Q1 07 Q2 07 Q3 07 Q4 07 Q1 08 Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 AVERAGE

5875 5750 5625

5375 5250 5125

4875 4750 4625

4375 4250 4125

3875 3750 3625 3375 3250 3125

2875 2750 2625

2375 2250 2125

Market-wide pricing was slightly lower than both Fourth Quarter 2010 and Third Quarter 2011. At $795,000, median price decreased 5% from last year and 6% from last quarter. Average price per square foot was relatively even over both time periods, down only 1% to $1,044.

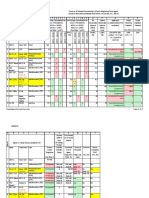

Market-Wide - All Apartments

Average Sale Price Q4 2011 1.388M -1% 1.407M 1.388M -4% 1.447M Median Price 795K -6% 849K 795K -5% 841K Avg Price per sf 1,044 -1% 1,054 1,044 -1% 1,056 Median Price

Studio 1 BR 2 BR 3+ BR

365K -5% 383K 365K -10% 405K

640K -1% 649K 640K +1% 635K

1.238M +4% 1.195M 1.238M 0% 1.237M

2.575M -5% 2.700M 2.575M -9% 2.825M

All Sales

Change Q3 2011 Q4 2011 Change Q4 2010

Market-Wide - Resale

Average Sale Price Median Price 741K -9% 810K 741K -6% 790K Avg Price per sf 994 -3% 1,024 994 -3% 1,027 Median Price

Studio 1 BR 2 BR 3+ BR

All Resales

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

1.287M -5% 1.350M 1.287M -6% 1.376M

350K -6% 370K 350K -10% 390K

625K 0% 623K 625K +1% 616K

1.225M +4% 1.180M 1.225M +0% 1.225M

2.331M -5% 2.450M 2.331M -8% 2.535M

the corcoran report

4th QUARTER 2011

Manhattan Market Trends - Co-ops and Condos

Pricing in the co-op market dipped in the Fourth Quarter. Median price fell 5% from Fourth Quarter 2010 and 8% from Third Quarter 2011. Average price per square foot has trended between $801 and $882 since its low in Third Quarter 2009 and remains even with one year ago. In the condo market, median price increased 10% from Fourth Quarter 2010 and 11% from Third Quarter 2011. Condo median price is at its highest level since Fourth Quarter 2008. Condo average price per square foot increased 4% from last quarter and 3% from last year to reach its highest level since First Quarter 2009.

Market-Wide Co-op Historical Sales Prices (Resale & New)

$800,000

Median Sale Price

Average PPSF $1,100

$750,000

$1,000

$700,000

$900

$650,000

$800

$600,000

$700

$550,000

4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11

$600

Market-Wide Condo Historical Sales Prices (Resale & New)

Median Sale Price $1,500,000 Average PPSF $1,400

$1,300,000

$1,300

$1,100,000

$1,200

$900,000

$1,100

$700,000

4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11

$1,000

Market-Wide Resale & New

Median Avg Price Price per sf Q4 2011 629K -8% 680K 629K -5% 665K 843 -2% 858 843 -2% 856 Median Price

Studio 1 BR 2 BR 3+ BR

Median Avg Price Price per sf Q4 2011 1.197M +11% 1.079M 1.197M +10% 1242 +3% 1209 1242 +4% 1195

Median Price

Studio 1 BR 2 BR 3+ BR

330K -3% 340K 330K -8% 360K

560K 2% 551K 560K 2% 548K

995K 0% 995K 995K -5% 1.052M

2.135M

507K +2% 495K 507K +7% 475K

800K +2% 787K 800K 0% 802K

1.516M +5% 1.450M 1.516M +6% 1.425M

3.160M +1% 3.131M 3.160M -1% 3.200M

Change Q3 2011 Q4 2011 Change Q4 2010

Condos

Co-ops

4% 2.050M 2.135M -6% 2.263M

Change Q3 2011 Q4 2011 Change

Q4 2010 1.089M

the corcoran report

4th QUARTER 2011

Manhattan Absorption vs. New & Total Listings

At the end of Fourth Quarter 2011, there were 8,440 units listed market-wide, a 6% decline from Third Quarter 2011 and a 4% decrease from Fourth Quarter 2010. The decrease in total inventory from last year is a net byproduct of condo inventory having decreased 11% while co-op availability remained even. New listings added during the quarter were 27% lower than Fourth Quarter 2010 and 16% lower than Third Quarter 2011. Since reaching its peak in First Quarter 2009, listed inventory has dropped 32%.

14,000

12,000

10,000 Number of Listings

8,000

6,000

4,000

5%

2,000

7%

Neighborhood Sales Comparison

9% 5% 34%

1Q11 9,181 6,406 60% 2Q11 9,171 5,957 3,637 52% 3Q11 8,989 5,316 2,579 70% 4Q11 8,440 3,864 2,144 65%

10%

4Q06 10,264 4,948 3,449 21% 1Q07 8,521 6,616 6,513 22% 2Q07 8,212 6,886 6,193 11% 3Q07 8,444 5,224 4,023 25% 4Q07 8,496 5,563 4,214 24% 1Q08 9,572 6,648 4,052 24% 2Q08 9,968 6,135 3,820 65% 3Q08 10,761 5,769 2,548 69% 4Q08 11,231 5,172 1,588 62% 1Q09 12,336 7,229 1,929 54% 2Q09 11,216 5,821 3,263 46% 3Q09 9,718 4Q09 7,942 4,369 3,450 52%

5% 6% 32%

1Q10 6,005 3,096 50% 2Q10 9,406 6,156 3,991 55% 3Q10 9,243 5,501 2,724 66% 9,068 12%

10%

4Q10 8,829 2,942 65%

0

Total Listings New Listings Absorbed Listings Percent New Listing

22%4,904

3,489 59%

36% 4,603

21% 3,450

24% 21%

22%

20%

Neighborhood Sales Comparison

Q4 2010 Q4 2011

Downtown

Bedroom Type Sales Comparison

Q4 2010

West Side East Side Midtown East

Q4 2011

Midtown West

Uptown

Bedroom Type Sales Comparison

5% 10%

7%

Neighborhood Sales Comparison

9%

15%

5%

6% 12% 36% 5%

13%

18% 12%

18%

15%

32% 22% 24%

21% 20%

10%

34%

32%

21% 22%

39% 31%

30% 39%

38%

Downtown

West Side

East Side

Midtown East

Midtown West

Uptown

Studio

One Bedroom

Two Bedroom

Three+ Bedroom

Downtown sales increased to 34% market share this quarter up from 32% a year ago. The East and West Sides declined slightly in market share while Uptown increased to 9% of sales, up from 12% 13% 18% 7% last 15% at this time. year

Bedroom Type Sales Comparison

18%

15%

Market share of studios increased to 15% while one- and twobedrooms contracted slightly in their share of the market. Three-plus bedroom sales increased to 18% of the market compared to a year ago.

* Percentages may not total 100 due to rounding.

31%

39%

32%

39%

30%

38%

the corcoran report

Luxury Market

4th QUARTER 2011

Manhattans luxury market is defined as the top 10% of all co-op and condo transactions. With median price at $4.1 million and average price per square foot at $1,979, luxury pricing increased slightly by 1% from Third Quarter 2011. Compared to a year ago, the luxury segment decreased 2% in median price and 3% in average price per square foot, attributable in part to steadily declining availability of high-end new development product. The top four closed sales this quarter were all on Park Avenue, the highest at $27 million.

Average Sale Price Median Price 4.110M +1% 4.060M 4.110M -2% 4.200M Avg Price per sf Average Sale Price Median Price 3.900M 0% 3.900M 3.900M -3% 4.000M Avg Price per sf 1,769 +3% 1,725 1,769 +3% 1,719

Q4 2011

Resale Co-ops

5.551M +2% 5.427M 5.551M -7% 5.973M

1,979 +1% 1,965 1,979 -3% 2,041

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

5.940M +10% 5.392M 5.940M +8% 5.523M

All Sales

Change Q3 2011 Q4 2011 Change Q4 2010

Average Sale Price

Median Price 5.750M +14%

Avg Price per sf

Average Sale Price

Median Price 3.445M -12%

Avg Price per sf 1,919 -7%

New Developments

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

Resale Condos

6.541M +19% 5.483M 6.541M

2,151 +10%

Q4 2011 Change Q3 2011

4.341M -18% 5.309M 4.341M -28% 6.044M

1Q11

5.058M 5.750M

24%

1,958 2,151

37%

22%

3.915M

7%

2,068 1,919

6% 4%

Q4 2011 Change

3.445M

+3% 6.327M

Quarter

4Q10

+9% 5.259M

23%

+7% 2,001

36%

24%

-13%

7%

-13%

5% 4%

Q4 2010

3.950M

2,210

1Q10

23%

37%

23%

8%

5% 4%

Sales under $500,000 increased to one-quarter of the market, up from both last quarter and one year ago, pushing market share of sales under $1 million to just over 60%. Sales between $1 and $2 million contracted slightly but market share over $2 million 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% remained on par with a year ago. Percent of Sales

Sales by Price Category

$0-$500K

$500K-$1MM

$1MM-$2MM

$2MM-$3MM

$3MM-$5MM

$5MM+

4Q11 Quarter

25%

36%

22%

8%

5% 4%

3Q11

22%

38%

23%

8%

6% 3%

4Q10 0%

23% 10% 20% 30%

36% 40% 50% 60%

24% 70% 80%

8%

5% 4% 100%

90%

Percent of Sales

* Percentages may not total 100 due to rounding.

the corcoran report

Townhouses

4th QUARTER 2011

Average townhouse pricing can be skewed each quarter due to the low number of transactions. East Side townhouse median price declined 13% from a year ago and 16% from last quarter due to a larger number of two- to four-family transactions this quarter. West Side townhouses decreased 45% in median price from last quarter due to a limited number of sales between $2 million and $3 million, all of them two- to four-family homes whereas last quarter, most sales traded between $4 million and $5 million with two sales over $12 million. Downtown and Uptown median price increased over both time periods.

East Side

Average Price Median

West Side

Average Price Median

Downtown

Average Price Median

Uptown

Average Price Median

Q4 2011

6.258M -49% 12.168M 6.258M -27% 8.540M

5.500M -16% 6.580M 5.500M -13% 6.354M

3.345M -44% 5.969M 3.345M -23% 4.324M

2.783M -45% 5.100M 2.783M -26% 3.775M

5.331M +7% 4.968M 5.331M -9% 5.828M

4.800M +4% 4.600M 4.800M +4% 4.613M

1.200M -13% 1.380M 1.200M +24% 966K

1.125M +22% 925K 1.125M +18% 957K

All Sales

Change Q3 2011 Q4 2011 Change Q4 2010

Lofts

Pricing was higher over both time periods. Versus a year ago, median price increased 20% to $1.79 million while average price per square foot increased 7% to $1,187. Such increases are due to a drop off in smaller loft sales between 1,000-1,500 square feet coupled with larger lofts trading at 17% and 28% higher in median price in the 2,000-2,500 and 2,500-plus square foot ranges, respectively.

Average Sale Price Median Price Avg Price per sf

1,000 1,500 sf

Average Price Median Price

1,500 2,000 sf

Average Price Median Price

2,000 2,500 sf

Average Price Median Price

2,500+ sf

Average Price Median Price

Q4 2011

2.429M +7% 2.274M 2.429M +17% 2.080M

1.792M +8% 1.665M 1.792M +20% 1.490M

1,187 +1% 1,177 1,187 +7% 1,112

1.129M -17% 1.355M 1.129M -12% 1.285M

1.055M -19% 1.308M 1.055M -13% 1.211M

2.007M -1% 2.036M 2.007M +2% 1.977M

1.900M 0% 1.900M 1.900M +3% 1.840M

2.669M -2% 2.719M 2.669M -1% 2.697M

2.600M +2% 2.550M 2.600M +17% 2.220M

4.811M 0% 4.820M 4.811M +24% 3.872M

4.300M +2% 4.200M 4.300M +28% 3.350M

All Sales

Change Q3 2011 Q4 2011 Change Q4 2010

N E W D E V E LO P M E N T S

The new development landscape has changed substantially over the past few years and fundamentals vary greatly by submarket. Compared to a year ago, median price declined 9% to $1 million while average price per square foot increased 5% to $1,210. This decline in median price is due to a drop in two- and three-plus bedroom market share coupled with Upper Manhattan garnering increased market share. These trends are a result of the limited amount of new product available, particularly in prime locations. Compared to a year ago, average price per square foot increased in every submarket except for the East Side.

Average Sale Price Median Price 1.000M 0% 998K 1.000M -9% 1.103M Avg Price per sf 1,210 +6% 1,146 1,210 +5% 1,153 Median Price

Studio 1 BR 2 BR 3+ BR

Market-wide

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

1.812M +12% 1.621M 1.812M +3% 1.764M

504K -9% 555K 504K -7% 545K

785K -1% 796K 785K -4% 817K

1.325M +1% 1.315M 1.325M +6% 1.255M

3.395M +7% 3.174M 3.395M +1% 3.375M

corcoransunshine.com

the corcoran report

Resale

4th QUARTER 2011

East Side

Co-ops on the East Side increased 4% in median price but remained even in average price per square foot compared to one year ago. This is a result of a slight increase in the percentage of three-plus bedroom sales as each bedroom category declined in median pricing. In the condo market, there was a significant fall-off in the number of three-bedroom transactions and while the three-bedroom category saw median price increases of 19% from last year and 22% from last quarter, overall condo pricing fell. Compared to a year ago, average price per square foot fell 4% to $1,165 while median price held firm.

Median Avg Price Price per sf Q4 2011 840K -1% 850K 840K +4% 810K 878 -3% 909 878 0% 878 Median Price

Studio 1 BR 2 BR 3+ BR

EAST 96TH STREET 2.702M +13% Central Park East River

303K -4% 315K 303K -17% 366K

510K -4% 530K 510K -6% 543K

1.100M +1%

Co-ops

Change Q3 2011 Q4 2011 Change Q4 2010

1.089M 2.400M 1.100M -6% 1.170M 2.702M -14% 3.131M

Change Q3 2011 Q4 2011 Change Q4 2010

-14% 1.095M 940K 0% 938K

-6% 1,238 1,165 -4% 1,214

-17% 415K 345K -17% 415K

+8% 660K 710K +11% 638K

+18% 1.345M 1.593M +1% 1.575M

+22% 2.875M 3.500M +19% 2.938M

Average unit sales per square foot (SF):

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available SF SF SF SF SF SF SF SF

Number of unit sales per building:

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

Interactive map online at PropertyShark.com/maps

EAST 57TH STREET

N E W D E V E LO P M E N T S

EAST SIDE

New developments increased 7% in median price but declined 6% in average price per square foot from Fourth Quarter 2010. Versus Third Quarter 2011, median price declined 5% with a 7% decline in average price per square foot. Three-plus bedroom median price was much lower this quarter, down 26% from last quarter and 37% from a year ago due to a number of $6-plus million sales at The Lucida, The Laurel, Georgica and Manhattan House in Fourth Quarter 2010 and Third Quarter 2011. The highest sale this quarter was $5.2 million. Median Price Avg Price per sf 1,281 -7% 1,376 1,281 -6% 1,356 Median Price

Studio 1 BR 2 BR 3+ BR

East Side

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

1.818M -5% 1.913M 1.818M +7% 1.706M

N/A N/A N/A N/A N/A 527K

685K -35% 1.046M 685K -20% 861K

2.261M +53% 1.477M 2.261M +43% 1.581M

2.515M -26% 3.376M 2.515M -37% 3.986M

corcoransunshine.com

Roosevelt Isla

Q4 2011

940K

1,165

345K

710K

1.593M

3.500M

Condos

FDR DRIVE

nd

Studio

1 BR

2 BR

3+ BR

5TH AVENUE

Median Avg Price Price per sf

Median Price

the corcoran report

Resale

10

4th QUARTER 2011

Midtown East

Resale co-op pricing in Midtown East decreased from both last quarter and one year ago. Median price decreased 15% while average price per square foot decreased 10% from one year ago as market share for studios and one-bedrooms surged this quarter. Versus last quarter, co-op median price declined 8% while average price per square foot declined 5%. In contrast, resale condos increased slightly from one year ago as median price increased 2% to $815,000 while average price per square foot increased slightly 1% to $1,129. Condo median price dropped 8% from last quarter due to a drop off in two-bedroom market share.

Median Avg Price Price per sf Q4 2011 487K -8% 529K 487K -15% 570K 671 -5% 707 671 -10% 745 Median Price

Studio 1 BR 2 BR 3+ BR

EAST 57TH STREET 1.700M -3% 1.750M 1.700M -21% 2.139M

310K +4% 299K 310K -3% 319K

527K +1% 520K 527K -4% 550K

758K -22% 973K 758K -16% 900K

Co-ops

Change Q3 2011 Q4 2011 Change Q4 2010

Q4 2011

815K -8% 887K 815K +2% 796K

1,129 +3% 1,093 1,129 +1% 1,118

507K +18% 428K 507K +19% 425K

700K -3% 720K 700K 0% 703K

1.270M +2% 1.250M 1.270M -2%

2.565M 0% 2.560M 2.565M -36%

Condos

Change Q3 2011 Q4 2011 Change Q4 2010

1.300M 4.000M East River

Average unit sales per square foot (SF):

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available SF SF SF SF SF SF SF SF

Number of unit sales per building:

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

Interactive map online at PropertyShark.com/maps

EAST 34TH STREET

N E W D E V E LO P M E N T S

MIDTOWN EAST

Of the few new development transactions that closed in Midtown East this quarter, median price increased 20% while average price per square foot increased 5% versus Fourth Quarter 2010. Such increases can be attributed to a 22% increase in one-bedroom median price as the few transactions were all over $740,000 whereas a year ago there were a number of trades in the same properties under $700,000. Median Price Avg Price per sf 1,156 +2% 1,132 1,156 +5% 1,100 Median Price

Studio 1 BR 2 BR 3+ BR

Midtown East

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

1.006M +1% 998K 1.006M +20% 839K

N/A N/A N/A N/A N/A 642K

983K +16% 849K 983K +22% 804K

1.228M -6% 1.312M 1.228M -17% 1.476M

N/A N/A N/A N/A N/A N/A

corcoransunshine.com

FDR DRIVE

Studio

1 BR

2 BR

3+ BR

5TH AVENUE

Median Avg Price Price per sf

Median Price

the corcoran report

Resale

11

4th QUARTER 2011

West Side

Co-op sales on the West Side exhibited lower pricing than a year ago but were higher versus Third Quarter 2011. Median price was 4% higher while average price per square foot was 2% higher than last quarter, due to a 5% and 12% increase in one- and two-bedroom median price, respectively. Resale condo pricing decreased over both time periods due to two-bedroom median price declines of 12% from last quarter and 17% from a year ago, largely due to few sales over $1 million this quarter.

WEST 110TH STREET Central Park Q4 2011 Median Avg Price Price per sf 825K +4% 797K 825K -1% 836K 930 +2% 916 930 -4% 967 Median Price

Studio 1 BR 2 BR 3+ BR

320K -8% 350K 320K -9% 350K

584K +5% 554K 584K +1% 579K

1.200M +12% 1.068M 1.200M +10% 1.095M

2.275M +3% 2.218M 2.275M +6% 2.138M

Co-ops

CENTRAL PARK WEST

Change Q3 2011 Q4 2011 Change Q4 2010

Hudson River

WEST SIDE HWY

Median Avg Price Price per sf Q4 2011 1.100M -4% 1.140M 1.100M -5% 1.163M 1,344 -4% 1,394 1,344 -6% 1,425

Median Price

Studio 1 BR 2 BR 3+ BR

583K +8% 540K 583K +10% 530K

805K +1% 800K 805K -4% 835K

1.349M -12% 1.540M 1.349M -17% 1.618M

3.010M +5% 2.875M 3.010M -5% 3.175M

Condos

Change Q3 2011 Q4 2011 Change Q4 2010

Average unit sales per square foot (SF):

5TH AVE

CENTRAL PARK SOUTH WEST 57TH STREET

Number of unit sales per building:

Interactive map online at PropertyShark.com/maps

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available

SF SF SF SF SF SF SF SF

N E W D E V E LO P M E N T S

WEST SIDE

West Side new development pricing exhibited stellar growth this quarter due to the extremely limited product available. Compared to a year ago, median price doubled to $2.9 million while average price per square foot increased 33% to $1,624. Compared to last quarter, median price increased 20% while average price per square foot increased 10%. This boom is primarily due to high-priced closings at The Aldyn and The Laureate. Median Price Avg Price per sf 1,624 +10% 1,480 1,624 +33% 1,222 Median Price

Studio 1 BR 2 BR 3+ BR

West Side

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

2.871M +20% 2.389M 2.871M +100% 1.435M

628K -10% 694K 628K -15% 739K

777K -12% 884K 777K -13% 891K

2.090M +15% 1.810M 2.090M +66% 1.260M

4.071M +14% 3.575M 4.071M +20% 3.391M

corcoransunshine.com

the corcoran report

Resale

12

4th QUARTER 2011

Midtown West

Co-ops in Midtown West saw prices decline from last year and last quarter. Median price dropped 16% from last year and 20% from last quarter while average price per square foot dropped 8% from last year and 12% from last quarter. Resale condos, however, increased 20% in median price and 2% in average price per square foot versus Fourth Quarter 2010. This appreciation is due to a 17% and 21% increase in one- and two-bedroom median price, respectively.

Median Avg Price Price per sf Q4 2011 394K -20% 495K 394K -16% 469K 635 -12% 722 635 -8% 687 Median Price

Studio 1 BR 2 BR 3+ BR

Central Park

288K +2% 281K 288K -3% 298K

438K -10% 487K 438K -3% 449K

N/A N/A 950K N/A N/A 705K

N/A N/A N/A N/A N/A N/A

Co-ops

WEST 57TH STREET

Change Q3 2011 Q4 2011 Change Q4 2010

WEST SIDE HWY

5TH AVENUE

Median Avg Price Price per sf Q4 2011 925K -6% 980K 925K +20% 770K 1,153 0% 1,155 1,153 +2% 1,129

Median Price

Studio 1 BR 2 BR 3+ BR

530K +5% 505K 530K -2% 540K

898K +7% 840K 898K +17% 770K

1.543M +17% 1.314M 1.543M +21% 1.280M

N/A N/A N/A N/A N/A 4.675M

Condos

Change Q3 2011 Q4 2011 Change Q4 2010

WEST 34TH STREET

Number of unit sales per building:

Average unit sales per square foot (SF):

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available SF SF SF SF SF SF SF SF

Interactive map online at PropertyShark.com/maps

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

N E W D E V E LO P M E N T S

MIDTOWN WEST

Midtown West new development pricing was significantly higher than both last year and last quarter. Median price increased 34% to $1.25 million while average price per square foot increased 19% to $1,403, compared to last quarter. Versus Fourth Quarter 2010, median price increased 26% while average price per square foot increased 6%. These increases can be attributable to a 48% and 51% increase in one-bedroom median price from last quarter and last year, respectively. One-bedroom median price surged due to a concentration of sales at The Setai Fifth Avenue. Median Price Avg Price per sf 1,403 +19% 1,178 1,403 +6% 1,319 Median Price

Studio 1 BR 2 BR 3+ BR

Midtown West

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

1.247M +34% 931K 1.247M +26% 991K

N/A N/A N/A N/A N/A 789K

1.222M +48% 825K 1.222M +51% 808K

1.460M -8% 1.585M 1.460M -12% 1.658M

N/A N/A 2.169M N/A N/A N/A

corcoransunshine.com

the corcoran report

Resale

13

4th QUARTER 2011

Downtown

34TH STREET

Downtown co-ops decreased 5% in median price but increased slightly by 1% in average price per square foot compared to one year ago. This decrease in median price is due to a higher percentage of Studio market share and a lower percentage of two-bedroom market share. Three-plus bedroom co-ops increased 27% in median price compared to a year ago, reaching just over $2 million. Resale condos increased 11% in median price and 3% in average price per square foot compared to Fourth Quarter 2010.

Median Avg Price Price per sf Q4 2011 605K -12% 685K 605K -5% 635K 902 -5% 951 902 +1% 890 Median Price

Studio 1 BR 2 BR 3+ BR

FDR

390K -1% 395K 390K -4% 407K

625K -2% 637K 625K +2% 610K

1.070M -14% 1.250M 1.070M -6% 1.140M

2.070M +4% 1.995M 2.070M +27% 1.625M

S ST WE

DRI

Co-ops

VE

Change Q3 2011 Q4 2011 Change Q4 2010

SOU TH

IDE Y HW

Median Avg Price Price per sf Q4 2011 1.496M +11% 1.353M 1.496M +11% 1,217 0% 1,221 1,217 +3% 1,178

Median Price

Studio 1 BR 2 BR 3+ BR

488K +6% 459K 488K -1% 493K

813K +5% 775K 813K -3% 835K

1.725M -3% 1.788M 1.725M +6% 1.635M

2.500M -23% 3.250M 2.500M -15% 2.927M Hudson River East River

Condos

Change Q3 2011 Q4 2011 Change

Q4 2010 1.350M

Average unit sales per square foot (SF):

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available SF SF SF SF SF SF SF SF

Number of unit sales per building:

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

Interactive map online at PropertyShark.com/maps

N E W D E V E LO P M E N T S

DOWNTOWN

New developments Downtown increased 2% in median price and 7% in average price per square foot from last quarter, with three-plus bedroom median price up 47% to $4.5 million. Similarly, average price per square foot was up 7% from one year ago as three-plus bedroom median price was up 31%. These increases can be attributed to a number of high-end transactions in boutique properties with a number of sales over $5 million at 41 Bond and penthouse sales at HL23, 15 Union Square West and Devonshire House. Median Price Avg Price per sf 1,359 +7% 1,265 1,359 +7% 1,271 Median Price

Studio 1 BR 2 BR 3+ BR

Dowtown

Q4 2011 Change Q3 2011 Q4 2011 Change Q4 2010

1.178M +2% 1.150M 1.178M -6% 1.247M

560K -11% 630K 560K +2% 549K

850K -1% 860K 850K -2% 865K

1.465M -5% 1.547M 1.465M -3% 1.510M

4.500M +47% 3.066M 4.500M +31% 3.429M

corcoransunshine.com

the corcoran report

14

4th QUARTER 2011

Resale

Uptown

Uptown co-op pricing decreased noticeably from last quarter as median price declined 14% and average price per square foot fell 21%, somewhat attributable to a big decline in two-bedroom market share and a 48% decline in three-plus bedroom median price. Resale condo pricing is skewed due to the low number of sales.

Harlem River Median Avg Price Price per sf Q4 2011 335K -14% 389K 335K +2% 330K 376 -21% 473 376 -16% 446 Median Price

Studio 1 BR 2 BR 3+ BR

215K +31% 164K 215K +23% 175K

261K -10% 290K 261K -9% 288K

396K -12% 450K 396K -17% 475K

349K -48% 677K 349K -38% 563K

Co-ops

HENRY HUDSON PKWY

HA RL

Change Q3 2011 Q4 2011 Change Q4 2010

Median Avg Price Price per sf Q4 2011 449K -10% 557K 449K +13% 440K 451 -18% 547 451 -9% 493

Median Price

Studio 1 BR 2 BR 3+ BR

Condos

WEST 110TH STREET Central Park EAST 96TH STREET

N E W D E V E LO P M E N T S

New developments Uptown exhibited strong price metrics this quarter. Median price increased 15% while average price per square foot increased 23% from last quarter. Compared to a year ago, median price increased 5% while average price per square foot increased 21% to $700. A wave of closings at 88 Morningside played a role in pushing pricing higher this quarter. Median Price Q4 2011 559K +15% 488K 559K +5% 530K Avg Price per sf 700 +23% 567 700 +21% 578 Median Price

Studio 1 BR 2 BR 3+ BR

Uptown

EM RI VE

N/A N/A N/A N/A N/A 260K

431K +9% 395K 431K +45% 298K

N/A N/A 574K N/A N/A 575K

730K -8% 793K 730K +14% 642K

Q4 2010 corcoransunshine.com

Change Q3 2011 Q4 2011 Change Q4 2010

Change Q3 2011 Q4 2011 Change

DR IV E

Average unit sales per square foot (SF): Number of unit sales per building:

Above $2,500 $2,000 - $2,500 $1,500 - $2,000 $1,250 - $1,500 $1,000 - $1,250 $750 - $1,000 $500 - $750 Below $500 No SF Available SF SF SF SF SF SF SF SF

Interactive map online at PropertyShark.com/maps

Above 20 Units 10 to 20 Units 3 to 9 Units 1 to 2 Units

UPTOWN

400K +36% 295K 400K +13% 354K

430K +5% 409K 430K -7% 463K

646K +8% 600K 646K -2% 662K

955K -9% 1.050M 955K +15% 830K

You might also like

- Manhattan Q42014Document16 pagesManhattan Q42014Joseph DimaNo ratings yet

- Manhattan Q32013Document16 pagesManhattan Q32013Joseph DimaNo ratings yet

- Market Report: Manhattan Q1 2010Document1 pageMarket Report: Manhattan Q1 2010api-25961397No ratings yet

- Manhattan Sales Volume Q2 2012Document4 pagesManhattan Sales Volume Q2 2012Anonymous Feglbx5No ratings yet

- RlepageDocument2 pagesRlepageSteve LadurantayeNo ratings yet

- Manhattan Sales Volume Q2 2011Document4 pagesManhattan Sales Volume Q2 2011Anonymous Feglbx5No ratings yet

- May 2011 Portland Metro Real Estate Statistics Data Home Price Sale Values Courtesy of Listed Sold Team Prudential NW PropertiesDocument7 pagesMay 2011 Portland Metro Real Estate Statistics Data Home Price Sale Values Courtesy of Listed Sold Team Prudential NW PropertiesAndrewBeachNo ratings yet

- Mid Month 1015Document1 pageMid Month 1015api-125614979No ratings yet

- Housing Prices in First Quarter Rise in Active Local Market: News ReleaseDocument2 pagesHousing Prices in First Quarter Rise in Active Local Market: News ReleaseTed BauerNo ratings yet

- 2011 Full ReportDocument6 pages2011 Full ReportAdriane DeFeoNo ratings yet

- Compass PDFDocument17 pagesCompass PDFAnonymous Feglbx5No ratings yet

- August 2011 REBGV Statistics PackageDocument7 pagesAugust 2011 REBGV Statistics PackageMike StewartNo ratings yet

- Nest Report: Charlottesville Area Real Estate Market Report Q3 2012Document9 pagesNest Report: Charlottesville Area Real Estate Market Report Q3 2012Jonathan KauffmannNo ratings yet

- Summary of The Central Virginia Area Housing Market Analysis 1st Quarter 2011Document4 pagesSummary of The Central Virginia Area Housing Market Analysis 1st Quarter 2011askbarbaraNo ratings yet

- New Rochelle October 2011 Single FamilyDocument3 pagesNew Rochelle October 2011 Single FamilyEgen WarnerNo ratings yet

- 2011 Q2 Stat Report SummaryDocument2 pages2011 Q2 Stat Report SummaryaskbarbaraNo ratings yet

- S C AS D C M: Urging Lass Ector Riving Harlotte ArketDocument4 pagesS C AS D C M: Urging Lass Ector Riving Harlotte ArketAnonymous Feglbx5No ratings yet

- Quarterly Review NOV11Document22 pagesQuarterly Review NOV11ftforee2No ratings yet

- Mount Vernon October 2011 Single FamilyDocument3 pagesMount Vernon October 2011 Single FamilyEgen WarnerNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For June 2011Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiNo ratings yet

- Sotheby's International Realty Canada Top-Tier 2019 Year-End ReportDocument44 pagesSotheby's International Realty Canada Top-Tier 2019 Year-End ReportCTV CalgaryNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For June 2011Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales November 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales November 2011Nicole TruszkowskiNo ratings yet

- Move Smartly Report - Aug 2023Document24 pagesMove Smartly Report - Aug 2023subzerohNo ratings yet

- Zillow Q3 Real Estate ReportDocument4 pagesZillow Q3 Real Estate ReportLani RosalesNo ratings yet

- Fairfield Market Report 10.11Document3 pagesFairfield Market Report 10.11Tracie RigioneNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales July 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales July 2011Nicole TruszkowskiNo ratings yet

- Carmel Highlands Homes Market Action Report Real Estate Sales For May 2011Document3 pagesCarmel Highlands Homes Market Action Report Real Estate Sales For May 2011Nicole TruszkowskiNo ratings yet

- ANZ Greater China Weekly Insight 2 April 2013Document13 pagesANZ Greater China Weekly Insight 2 April 2013leithvanonselenNo ratings yet

- MLS Statistics 3rd QuarterDocument6 pagesMLS Statistics 3rd QuarterAaron HolnessNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales August 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales August 2011Rebekah SchroederNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For October 2011Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For October 2011Nicole TruszkowskiNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales September 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales September 2011Rebekah SchroederNo ratings yet

- Singapore Property Weekly Issue 202Document12 pagesSingapore Property Weekly Issue 202Propwise.sgNo ratings yet

- Tallinn Real Estate Market Review September 2010Document11 pagesTallinn Real Estate Market Review September 2010TallinnPropertyNo ratings yet

- Real Estate ReportDocument9 pagesReal Estate Reportgkuntzman6255No ratings yet

- VancovDocument7 pagesVancovSteve LadurantayeNo ratings yet

- Darien CT Real Estate Trends 10.11Document3 pagesDarien CT Real Estate Trends 10.11Tracie RigioneNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales June 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For April 2012Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For April 2012Nicole TruszkowskiNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For July 2011Document3 pagesMonterey Homes Market Action Report Real Estate Sales For July 2011Nicole TruszkowskiNo ratings yet

- Edmonton Home Values, July 2015Document2 pagesEdmonton Home Values, July 2015Edmonton SunNo ratings yet

- BuzzDocument4 pagesBuzzapi-125614979No ratings yet

- Carmel Ca Homes Market Action Report For Real Estate Sales June 2011Document3 pagesCarmel Ca Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For December 2011Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For December 2011nicole3159No ratings yet

- TRNDGX PressRelease Aug2011Document2 pagesTRNDGX PressRelease Aug2011deedrileyNo ratings yet

- Wright Report Q2 2010Document33 pagesWright Report Q2 2010Wright Real EstateNo ratings yet

- Farmingnton Valley June 2011Document3 pagesFarmingnton Valley June 2011Matt LloydNo ratings yet

- Q2 2012 Charlottesville Nest ReportDocument9 pagesQ2 2012 Charlottesville Nest ReportJim DuncanNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales October 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales October 2011Nicole TruszkowskiNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For July 2011Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For July 2011Nicole TruszkowskiNo ratings yet

- Beverly-Hanks & Associates: Second Quarter Market Report 2011Document20 pagesBeverly-Hanks & Associates: Second Quarter Market Report 2011ashevillerealestateNo ratings yet

- CBRE Cap Rate Survey August 2011Document30 pagesCBRE Cap Rate Survey August 2011CRE ConsoleNo ratings yet

- Carmel Homes Market Action Report Real Estate Sales For May 2011Document3 pagesCarmel Homes Market Action Report Real Estate Sales For May 2011Nicole TruszkowskiNo ratings yet

- Global Capital Flows 2011: Executive SummaryDocument8 pagesGlobal Capital Flows 2011: Executive SummaryChaitanya KattaNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For June 2011Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiNo ratings yet

- WTW - Sept 2011Document9 pagesWTW - Sept 2011Don SheaNo ratings yet

- The New York Times Magazine - 22 03 2020Document56 pagesThe New York Times Magazine - 22 03 2020robertnycityNo ratings yet

- Ask Time Warner CableDocument2 pagesAsk Time Warner CablerobertnycityNo ratings yet

- Israel21c Org Travel Meet Israels Tech Stars On Israel21cs JDocument10 pagesIsrael21c Org Travel Meet Israels Tech Stars On Israel21cs JrobertnycityNo ratings yet

- Friday - Kiddush-Pm PDFDocument1 pageFriday - Kiddush-Pm PDFrobertnycityNo ratings yet

- Passover-Primer - 8 Ways To HAve A Great Seder PDFDocument23 pagesPassover-Primer - 8 Ways To HAve A Great Seder PDFrobertnycityNo ratings yet

- Supply List - 2016-2017 Grade 1 English & Hebrew Grade 2 English & Hebrew Grade 3 English & Hebrew Grade 4 English & HebrewDocument1 pageSupply List - 2016-2017 Grade 1 English & Hebrew Grade 2 English & Hebrew Grade 3 English & Hebrew Grade 4 English & HebrewrobertnycityNo ratings yet

- Map PDFDocument1 pageMap PDFrobertnycityNo ratings yet

- Hunter FanDocument15 pagesHunter FanrobertnycityNo ratings yet

- Passover-Primer - 8 Ways To HAve A Great Seder PDFDocument23 pagesPassover-Primer - 8 Ways To HAve A Great Seder PDFrobertnycityNo ratings yet

- A Faith of OneDocument3 pagesA Faith of OnerobertnycityNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- The Muslim Riots in AntwerpDocument4 pagesThe Muslim Riots in AntwerprobertnycityNo ratings yet

- 27 MARCH 2020: Assignment 5 Question PaperDocument4 pages27 MARCH 2020: Assignment 5 Question PaperShadreck SandweNo ratings yet

- Trading Course DetailsDocument9 pagesTrading Course DetailsAnonymous O6q0dCOW6No ratings yet

- AE-Electrical LMRC PDFDocument26 pagesAE-Electrical LMRC PDFDeepak GautamNo ratings yet

- Paradigm Shift Essay 2Document17 pagesParadigm Shift Essay 2api-607732716No ratings yet

- Wacker Neuson RTDocument120 pagesWacker Neuson RTJANUSZ2017100% (4)

- Clean Agent ComparisonDocument9 pagesClean Agent ComparisonJohn ANo ratings yet

- Tender34 MSSDSDocument76 pagesTender34 MSSDSAjay SinghNo ratings yet

- Expressive Matter Vendor FaqDocument14 pagesExpressive Matter Vendor FaqRobert LedermanNo ratings yet

- Amar Sonar BanglaDocument4 pagesAmar Sonar BanglaAliNo ratings yet

- Lecture 4Document25 pagesLecture 4ptnyagortey91No ratings yet

- Key ssl101 Academic Skills For University Success ssl101cDocument196 pagesKey ssl101 Academic Skills For University Success ssl101cHùng NguyễnNo ratings yet

- 'K Is Mentally Ill' The Anatomy of A Factual AccountDocument32 pages'K Is Mentally Ill' The Anatomy of A Factual AccountDiego TorresNo ratings yet

- Unit 1 Writing. Exercise 1Document316 pagesUnit 1 Writing. Exercise 1Hoài Thương NguyễnNo ratings yet

- Calibration Motion Control System-Part2 PDFDocument6 pagesCalibration Motion Control System-Part2 PDFnurhazwaniNo ratings yet

- Course Tutorial ASP - Net TrainingDocument67 pagesCourse Tutorial ASP - Net Traininglanka.rkNo ratings yet

- 5 Important Methods Used For Studying Comparative EducationDocument35 pages5 Important Methods Used For Studying Comparative EducationPatrick Joseph63% (8)

- The Sound Collector - The Prepared Piano of John CageDocument12 pagesThe Sound Collector - The Prepared Piano of John CageLuigie VazquezNo ratings yet

- (Bio) Chemistry of Bacterial Leaching-Direct vs. Indirect BioleachingDocument17 pages(Bio) Chemistry of Bacterial Leaching-Direct vs. Indirect BioleachingKatherine Natalia Pino Arredondo100% (1)

- sl2018 667 PDFDocument8 pagessl2018 667 PDFGaurav MaithilNo ratings yet

- PWC Global Project Management Report SmallDocument40 pagesPWC Global Project Management Report SmallDaniel MoraNo ratings yet

- FBCA Biomarkers and ConditionsDocument8 pagesFBCA Biomarkers and Conditionsmet50% (2)

- Chicago Electric Inverter Plasma Cutter - 35A Model 45949Document12 pagesChicago Electric Inverter Plasma Cutter - 35A Model 45949trollforgeNo ratings yet

- PharmacologyAnesthesiology RevalidaDocument166 pagesPharmacologyAnesthesiology RevalidaKENT DANIEL SEGUBIENSE100% (1)

- (Variable Length Subnet MasksDocument49 pages(Variable Length Subnet MasksAnonymous GvIT4n41GNo ratings yet

- Florence Walking Tour MapDocument14 pagesFlorence Walking Tour MapNguyễn Tấn QuangNo ratings yet

- General Separator 1636422026Document55 pagesGeneral Separator 1636422026mohamed abdelazizNo ratings yet

- NGPDU For BS SelectDocument14 pagesNGPDU For BS SelectMario RamosNo ratings yet

- Key formulas for introductory statisticsDocument8 pagesKey formulas for introductory statisticsimam awaluddinNo ratings yet

- The Singular Mind of Terry Tao - The New York TimesDocument13 pagesThe Singular Mind of Terry Tao - The New York TimesX FlaneurNo ratings yet

- Miami Police File The O'Nell Case - Clemen Gina D. BDocument30 pagesMiami Police File The O'Nell Case - Clemen Gina D. Barda15biceNo ratings yet