Professional Documents

Culture Documents

Exchange Examiner

Uploaded by

firnass2000Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exchange Examiner

Uploaded by

firnass2000Copyright:

Available Formats

FIG/Diversified Financials Services 26 October 2011

Exchange Examiner

Three big issues: FTT, OTC and valuation

The European Commissions proposed financial transaction tax (FTT) could reduce volumes by up to 50%, and we adjust our valuations for Deutsche Brse, NYSE Euronext, Helex and LSE. Exchange-traded derivatives comprise just 11% of global volumes, but regulation will reshape these markets in Europe and US and we expect a further shift to central counterparty clearing, if not trading. This could be positive for exchange-owned clearing houses. Stocks have de-rated in recent weeks while consensus forecasts have been upgraded, and we think the sector now looks very attractive on valuation. We have cut our target prices for Deutsche Brse, Hellenic Exchanges, LSE and NYSE Euronext, but remain Overweight. We also maintain our Overweight ratings on BM&F Bovespa, Cetip, HKEx, Singapore Exchange and Tullett. We are Neutral on ICAP and DFM (on a lower target price). Our conviction Overweight ideas are LSE for developed markets and HKEx for emerging markets.

By Johannes Thormann, Nitin Arora, Dimitris Haralabopoulos, Shirin Panicker, York Pun and Paulo Ribeiro

Disclosures and Disclaimer This report must be read with the disclosures and analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it

FIG Diversified Financial Services 26 October 2011

abc

Summary

There are three big issues driving exchange shares: FTT, OTC and valuation. Regarding the first of these, we estimate the European Commissions proposal to introduce a financial transaction tax in 2014 could reduce volume by up to 50%. The second uncertainty is how regulation will reshape OTC derivatives trading; we expect a further shift to central clearing, if not trading. Finally, on valuation we think the sector looks very attractive, trading at close to historical lows. Our conviction ideas are LSE for developed markets and HKEx for emerging markets. Among European names, LSE is least exposed to Eurozone woes and FTT risk. Looking at emerging markets exchanges, we think that HKEx offers good growth opportunities while its shares have been de-rated in recent months.

Issue 1: Financial transaction tax (FTT)

The European Commission is proposing the introduction of a financial transaction tax starting from 2014. This would generate massive tax revenues of an estimated EUR23bn from cash instruments and EUR59bn from derivatives in Europe based on 2010 volumes. However, the introduction of the tax would result in a decline in trading volumes. We assume a two-thirds probability of a Eurozone FTT. We also see a possibility that governments in the rest of Europe will also go down this route since Eurozone politicians have firmly committed themselves because of the potential billions of additional tax revenues. The decline in trading volumes resulting from FTT would depend on several factors, but we believe it could be up to 50% for both cash instruments and derivatives. The European Commission expects to raise tax revenues of EUR57bn per year, which implies that it expects a 30% volume decline (assuming EUR82bn tax revenues based on the 2010 volumes). This decline would be partly driven by institutional clients reducing their trading activity, but would mainly be due to the crowding out of high frequency trading because of higher costs per trade. All exchanges would be affected, in particular those with lower operational gearing. Another problem is the proposal that the European counterparty will have to pay both sides of the tax, thereby increasing counterparty risk in the market. We have introduced a valuation discount for the European exchanges we cover based on the potential decline in trading volumes due to the FTT; 25% for Deutsche Brse and NYSE Euronext, 10% for Helex and LSE.

FIG Diversified Financial Services 26 October 2011

abc

Issue 2: OTC derivatives trading

The second big issue is what will happen to trading activity in the 2011e USD790trn global derivatives market. The derivatives market is still dominated by OTC transactions, which comprise about 89% of the global market, but will soon be subject to major regulatory change. The market share of listed derivatives is expected to continue growing as increased regulatory burdens reduce the growth in the OTC market and lead to a shift of activity towards exchange-traded products. Tackling stability and transparency issues, regulators around the globe are drafting major laws that will move considerable amounts of OTC trading to clearing houses, and transactions will be subject to daily reporting through so-called trade repositories. The move of bilateral OTC clearing to central counterparty (CCP) clearing will lead to a higher level of collateralisation of derivatives transactions, and aims to increase investor protection and market stability due to reduced counterparty risk and the mutualisation of losses. Mandatory CCP clearing of standardised OTC derivatives will additionally benefit investors as a higher percentage of margins will be subject to netting effects which effectively reduces the amount of deposited collateral. However, as no common global regulatory framework is in sight, the speed of the lawmaking process is slow and final rules are not expected before the end of 2012. The fear of over-regulation in Europe and the US is slowing the process even further, as less regulated markets in Asia might attract significant amounts of business from the West which would eliminate the transparency benefits achieved in Europe and the US.

Issue 3: Valuation

The third big issue is valuation. We believe that sector valuation looks very attractive. While sector multiples have fallen recently, we have seen upgrades to consensus forecasts for European and US exchanges since June. One exception is in Asia, where, although HKExs earnings look quite secure for 2011e, it seems consensus is worrying about its prospects; consensus has slashed numbers for 2012-13 recently to reflect a potential bear market. Emerging markets names still show valuation premiums to the exchanges focused on mature European markets, but these premiums have fallen sharply in recent months. We estimate that the exchanges sector is trading at close to historical lows at a one-year forward PE of 15.4x (versus 19.1x a year ago). Further, the peer group is inflated by the DFM valuation; adjusted for this, forward PE is 12.3x. We use two valuation methodologies for the stocks under coverage. We believe that an equity-valuebased valuation remains more appropriate for the mature European names we cover because they have enough equity to be able to pay out high dividends. Furthermore, the stocks are less influenced by longterm growth prospects which would normally drive DCF models. For emerging markets stocks, an equity value model cannot factor the long-term growth opportunities into the valuation whereas we believe that a DCF or residual income (economic value added) model offers a better way to factor those long-term trends into the valuation.

FIG Diversified Financial Services 26 October 2011

abc

Companies

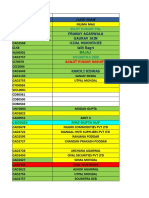

Overview of HSBC Global exchanges and related stocks coverage (priced at close on 21 October 2011) Bloomberg Currency BM&F Bovespa Cetip Deutsche Brse DFM* Hellenic Exchanges Hong Kong Exch & Clearing ICAP LSE NYSE Euronext Singapore Exchange Tullett Prebon

*As at close 20 October Source: Company data, HSBC estimates

Rating OW OW OW N OW(V) OW N OW OW(V) OW OW(V)

Price 9.87 23.50 41.08 0.99 3.35 114.4 4.29 8.82 26.78 6.21 3.80

Target price 11.6 31.0 55.0 1.15 4.00 190.0 4.70 10.8 35.0 8.20 4.50

Old Potential target return 18% 32% 34% 16% 19% 74% 10% 22% 31% 37% 18%

Yield PE 2011e PE 2012e 2010a 5.2% 5.5% 5.1% 0.0% 4.5% 3.7% 4.6% 3.0% 4.5% 4.3% 4.1% 17.3 29.7 9.3 283.5 9.6 22.4 14.3 10.7 10.9 19.8 8.6 14.5 18.4 7.7 60.6 10.0 17.4 12.5 9.8 8.3 16.5 8.0

BVMF3 BZ CTIP3 BZ DB1 GY DFM UH EXAE GA 388 HK IAP LN LSE LN NYX N SGX SP TLPR LN

BRL BRL EUR AED EUR HKD GBP GBP USD SGD GBP

73.0 1.40 6.70

12.0 47.0

BM&F Bovespa

The Q3 2011 operating figures indicate stronger traded volumes q-o-q for both the cash equities and derivatives segments. However, the risk from macro prudential measures is still meaningful, but lower interest rates could boost volumes. We rate BM&F Bovespa Overweight with a BRL11.6 target price, helped by attractive valuation relative to peers.

Cetip

Cetips Q3 2011 operating data highlights strong volumes in fixed income and derivatives but softness in vehicles financing which is as expected. The OTC derivatives regulations in Brazil are generally more stringent than in other countries. We rate Cetip Overweight with a BRL31.0 target price. We prefer Cetip to BM&F Bovespa as a way to play the growth in financial markets in Brazil.

Deutsche Brse

Despite being the most diversified exchange group globally and having potential synergies of EUR11.77 per share from the proposed merger with NYSE Euronext, the shares have not performed. The macroeconomic environment and fears about the possible introduction of a FTT in Europe have massively weighed on shares. While we cut our target price from EUR73 to EUR54 to factor in a 25% discount due to introduction of FTT, we still see 34% upside and stay Overweight.

Dubai Financial Markets (DFM)

The near-term revenue outlook remains challenging as the continued market sell-off impacts DFMs trading-based fee income. We thus see little room for cost efficiency gains, and this would further constrain its short-term profitability. We maintain our Neutral rating but cut our target price to AED1.15 from AED1.40 due to changes in our fee income estimates.

Hellenic Exchanges (HELEX)

Declining trading activity is having an adverse effect on profitability; we forecast a 29% annual drop in volumes for 2012e (at EUR60m). Nevertheless, a low valuation (5.0x 2012e ex-cash trough EPS, deep discount to peers) and cash-rich balance sheet (EUR1.8 per share or c54% of market cap) are the key merits; the current price discounts 40% WACC and 2012e daily turnover of EUR45m. We reiterate our Overweight

FIG Diversified Financial Services 26 October 2011

abc

(V) rating, but we cut our target price to EUR4.0 from EUR6.70 on our lower volume forecasts (down by c55% for 2012e-13e), higher WACC estimate and 10% discount for the potential FTT.

Hong Kong Exchange (HKEx)

The concern about a sharp fall in cash turnover might be misplaced, in view of the quick market recovery we are forecasting .While RMB deposits gathering has slowed, the growth story is intact and RMB stock trading remains a credible theme. We stay Overweight with HKD190 target price unchanged. The current market weakness provides a good chance to accumulate the stock in our view.

ICAP

Increased volatility in financial markets should benefit volumes at ICAP. Whilst e-broking is doing well, Brazil remains a concern. We maintain our Neutral rating with target price of 470p.

London Stock Exchange (LSE)

LSE has turned from simple UK cash trading profit maximiser into a diversified European exchange running a with customers model. By bidding for LCH.Clearnet, LSE has turned from potential prey into predator once more, and if the deal goes ahead it could result in promising synergies. However, we cut our target price from 1,200p to 1,080p to reflect the risk of FTT nevertheless we reiterate our Overweight rating.

NYSE Euronext (NYX)

NYSE Euronext will benefit strongly from the planned merger with Deutsche Brse as its dependency on trading business will be reduced. Fears about macroeconomic conditions have hit the share price, and the potential introduction of a FTT does not help either. We cut our target price from USD47 to USD35 but stay Overweight, albeit adding a volatility flag. NYSE Euronext seems to us the better stock for playing the proposed merger.

Singapore Exchange (SGX)

Given the flexibility available to SGX, it is premature to assume a potential deal with LME will be value destructive, in our view. Growth in stock turnover is likely to resume with a prospective market recovery, and technology costs are likely to peak soon. Fundamentals are still on the mend, and the market has overreacted to the M&A news. Reiterate Overweight with a SGD8.2 target price.

Tullett Prebon

We expect increased volatility in financial markets to result in higher trading volumes at Tullett. The launch of tpSWAPDEAL will strengthen its e-Broking revenue. We maintain our Overweight rating with a target price of 450p.

FIG Diversified Financial Services 26 October 2011

abc

Contents

Impact of FTT What will happen to derivatives trading? Current valuation Company profiles

BM&F Bovespa Cetip SA Deutsche Brse Dubai Financial Market Hellenic Exchanges HKEx ICAP London Stock Exchange NYSE Euronext Singapore Exchange Tullett Prebon

6 12 26 31

32 38 47 57 63 72 78 83 90 97 103

Disclosure appendix Disclaimer

109 112

FIG Diversified Financial Services 26 October 2011

abc

Impact of FTT

European Commission is proposing a financial transaction tax

starting in 2014

It could generate EUR23bn from cash instruments and EUR59bn

from derivatives in Europe according to our forecasts based on 2010 volumes; the European Commission expects EUR57bn, implying a 30% volume decline

The potential trading volume decline depends on several factors,

but we estimate it could be up to 50% for both cash instruments and derivatives

EU wants to introduce a transaction tax by 2014

The Brsen-Zeitung reported on 21 September that in a draft document the European Commission is proposing a financial transaction tax (FTT) for exchange traded and OTC business, starting in 2014 instead of 2018 as previously indicated. The proposal does not cover all financial transactions. First, all primary markets activity as well as central bank business will be excluded from this tax. Second, cash forex trading business will be excluded. Finally, all transactions of the EFSF and other financial assistance funds will be excluded. The first reaction of many market participants is to conclude that this tax would be easy to circumvent. A FTT could lead to trading activity being moved to locations outside the taxation area, such as Asia or the US. However, the European Commission is trying to take countermeasures to prevent this. The Commission

suggests that the taxation will be based on a country of residence principle to avoid moving trading activity outside Europe. So, for example, a bank in Germany will even be taxed for trades done by its subsidiary in Asia. Conversely, this also means that any market participant from outside the taxation zone, such as those of Swiss or US origin, would be exempt from the tax. The Brsen-Zeitung reported that one article of the proposed tax law has caused irritation. The terms of this article suggest that if only one counterparty to a trade is located in Europe or the Eurozone, it will have to pay the taxes for both sides of the transaction, while the non-Eurozone counterparty is exempt. In practice this could mean that a Eurozone asset manager would only give orders to a broker located in the Eurozone to ensure that it would not have to pay the full tax bill. The legislation would therefore deter brokers from closing down Eurozone operations and moving to a location not subject to FTT as they would lose their Eurozone customer business.

Johannes Thormann* Analyst HSBC Trinkaus & Burkhardt AG, Germany +49 211 910 3017 johannes.thormann@hsbc.de *Employed by a non-US affiliate of HSBC Securities (USA) Inc, and is not registered/ qualified pursuant to FINRA regulations.

FIG Diversified Financial Services 26 October 2011

abc

One other possible but draconian and unlikely way of stopping the circumvention of the FTT would be a reversion of the liberalisation of markets under MiFID in 2007 by reintroducing the old French/Spanish model of the concentration rule, resulting in forced trading on a domestic exchange on a central order book. By introducing this measure, all trades would have to be executed on one platform. Of course some OTC trades could be done by investors outside Europe without paying the tax, but as soon as the trade was settled at one of the European ICSDs, either Clearstream or Euroclear, the tax authorities could see it. And looking at the recent success of the German finance ministry of introducing a general withholding tax for previously untaxed deposits in Switzerland held by German citizens, it could be that the officials in the European Commission and the individual European finance ministries have learned from the mistakes of the Swedes in the 1980s, and measures for circumventing the tax might be made more difficult. This could be positive for all incumbent exchanges, but of course would put all Multilateral Trading Facilities (MTFs) out of business, and this could be seen as unlawful.

FTT revenues from exchange-traded cash instruments implied by 2010 volumes and assuming 0.1% rate (EURbn) Equities volumes Bonds volumes Total volumes Potential tax revenues

Source: Company data, HSBC estimates

could lead to EUR23bn of taxes for European cash instruments. But only a third of bonds are traded on-exchange while two-thirds are traded OTC. If all trading is moved on-exchange, which could be the case looking at current regulatory initiatives, this could triple bond trading volumes, leading to even higher tax revenue of EUR49bn for Europe or approximately EUR30bn for the Eurozone. However, this does not factor in any decline in volumes due to the introduction of the tax.

FTT revenues from exchange-traded derivatives implied by 2010 volumes and assuming 0.01% rate (EURbn) Notional turnover Potential tax revenues

Source: BIS data, HSBC estimates

Europe 591,573.6 59.2

Based on 2010 volumes and a 0.01% rate, we estimate that up to EUR59bn could be raised by a tax for exchange traded derivatives based on notional turnover. However, as approximately only a tenth of all derivatives are traded onexchange, the tax revenues could be much higher. We think that part of the OTC derivatives trading will move onto exchange platforms, part could vanish and only some will stay OTC. So in total we estimate up to EUR82bn could be raised, which is even higher than the EUR57bn estimated by European Commission per year. It may be that European Commission is already factoring some volume decline into its calculations. Based on our forecasts, this could imply that the European Commission expects a 30% volume decline overall.

Mitigating solutions

Europe 10,094 13,094 23,187 23.2

Eurozone only 4,868 8,679 13,547 13.5

The European Commission is targeting the introduction of the tax in January 2014, but tax rates are still unclear. Rates of 0.1% for trading of cash underlying, such as equities and bonds, and 0.01% for derivatives on notional amount outstanding are being discussed. The FTT would be charged on both sides of the trade. This could lead to the generation of substantial tax revenues. Based on 2010 exchange-traded volumes, this

One possibility would be a tax rate of just 5bps on cash instruments and 0.5bp for derivatives. Another mitigating effect could be that the FTT is just charged on one side, also halving the original planned tax amounts. Furthermore, the taxation of derivatives could also be based on gross market

FIG Diversified Financial Services 26 October 2011

abc

values instead of the notional amount outstanding which would cut revenues by a factor of 25-30x, thus lowering the tax burden to EUR2.0-2.4bn.

Europe versus Eurozone

country or region. Finally, we divided the adjusted turnover by market cap to arrive at the velocity.

10% volume decline for institutional volumes

Although the introduction of a financial transaction tax in all of Europe is relatively unlikely considering the opposition of the Swedish and UK governments, a Eurozone FTT looks more realistic as the governments of Austria, Belgium, France, Germany, Italy and Spain support the tax. It seems that only the Dutch government is opposed within the Eurozone. The UK government has indicated that it would not oppose such a measure, if it is just agreed for the Eurozone.

Estimating the FTT impact

Impact on cash trading

In our November 2010 edition of Exchange Examiner, we tried to estimate the potential impact of a FTT on the trading volumes and exchanges revenues as well as profits. We repeat this exercise here. First, we had to estimate the correct velocity levels for each market. We took the domestic trading volumes from FESE for the exchanges and adjusted them for market shares, to get to estimated total domestic trading volumes. We also took the FESE market cap levels for each

To gauge the potential impact of a transaction tax, we compared the velocity of Euronext-listed stocks and those of UK-listed stocks for 2009 and 2010 because the two markets have a comparable mix of listed stocks and retail investors have limited importance. Nevertheless, the UKs velocity is five percentage points lower across the two years, which could be explained by the impact of UK stamp duty. In this context, the position of the UK government in the European discussions seems to be in contrast to its tax regime. HM Government is clearly arguing against a transaction tax although UK equities are already burdened by a 50bps stamp duty for buyers (thus effectively two and a half times the level now targeted by European Commission) which is just charged at settlement point. The stamp duty has been vigorously opposed by LSE and other market participants for many years. The 2010 UK tax revenues from stamp duty are GBP3bn, or about EUR3.4bn. So looking at the velocity differential, we estimate that the introduction of an EU-wide transaction tax could lead to a 5% to 10% reduction in cash trading

Development of velocity for equity trading at selected European markets

250% 200%

219%

149% 150% 100% 50% 0% UK Italy Euronex t 84% 91% 87% 97%

145% 135% 94%

124% 79% 72%

109%

97%

Germany 2009a 2010a

Spain

Sw iss

Nordics

Source: Company data, FESE data, HSBC estimates, WFE data

FIG Diversified Financial Services 26 October 2011

abc

Scenarios for potential profit decline __________________mild case __________________ Decline in volumes Decline in revenues Operating margin Potential profit decline

Source: HSBC estimates

_________________ bear case___________________ 50% 45% 30% -150% 50% 45% 40% -113% 50% 45% 50% -90% 50% 45% 60% -75%

10% 9% 30% -30%

10% 9% 40% -23%

10% 9% 50% -18%

10% 9% 50% -15%

volumes for institutional investors which make up one of the largest customer groups. This would hurt but not kill the markets.

Impact on HFT much bigger

we combine these important customer groups, it seems fair to argue that 10% of all cash trading volumes could fall away in a optimistic scenario and up to 50% in a pessimistic scenario. To estimate the general P+L impact, we can say that a 10% decline in volumes should normally lead to a 10% decline in revenues although volume rebates may mitigate this to some extent. So we would estimate a 9% revenue decline. A 50% volume decline should lead to 45% decline in revenues. Nevertheless, as most exchanges have an operating margin of 30% to 60% in the trading business, this could still imply a profit decline of 15% to 30% in the optimistic scenario and an even more severe 75% to 150% decline in the pessimistic scenario. If we assume a worst case scenario, the exchange would be loss making no matter how good the operating margin was before. But this does not factor in any countermeasures by respective management teams to preserve profits by cutting costs. In essence, all companies will suffer but the higher the operational gearing, the better protected the company.

Impact on derivatives

However, the impact of the tax on high frequency trading activities, which nowadays are the biggest group of market participants, should be far bigger. High frequency traders are mainly the proprietary desks of banks and brokers, but also include independent trading firms. The impact of a reduction in high-frequency trading is difficult to gauge because it will depend on the point of the transaction to which taxation is applied. If taxation is triggered by execution of trade, major parts of high frequency trading will fall away as we estimate that those traders in average generate 30% to 40% of all European trading volumes. We see two possibilities. If the FTT is charged at point of settlement, as in the UK, most of the activities might continue because normally those market participants end the day with flat positions. But we consider this favourable treatment as very unlikely as one draft explicitly mentions HFT as the reason for introducing the tax. Thus the second option of no exception seems more likely. And the FT reported on 12 October that regulators have concerns that high-frequency traders tend to withdraw from markets amid signs of stress anyway, which would favour a crack down on such market participants. Nevertheless, this analysis again faces difficulties as some high-frequency trading firms have become general quant traders and so might not completely withdraw from markets even if they are taxed. So if

The impact on derivatives trading by 2014 is even harder to estimate. A European Commission official said in a speech on 4 October 2011 that high frequency trading activity could drop by 90%, which is in line with our assumptions. As high frequency traders make up around 40-50% of trading activity on Eurex, according to our forecasts, and slightly less on NYSE Liffe, this implies that 35% to 40% of trading activity could fall away. Adding some percentage points for other market participants, it once again seems fair to argue that up to 50% of all derivatives trading

FIG Diversified Financial Services 26 October 2011

abc

volumes could fall away. Thus the same logic on potential profit declines applies to derivatives as well as cash trading.

Settlement business

The impact of FTT on the settlement business of CSDs (central securities depositories) should be minimal as the tax is scheduled to start in 2014 at the same time as the ECBs TARGET2-Securities platform.

No winners, just losers

revenues. What might speak in favour of the tax is that cash equities trading for UK institutional investors like pension funds and retail investors would become even cheaper. The government could argue it wants to promote long-term savings but create disincentives for speculation.

Even the US may be moving

In the end, all market participants are likely to be losers and even the broad population will not be a winner in our view. This is because promised tax revenues will be much smaller than estimated due to the negative effect on trading volumes. Furthermore, the tax will not prevent another financial crisis because crises tend to occur as a result of massive economic imbalances. Of course, European or Eurozone exchanges will be major losers of this new tax, but a further burden will be borne by European banks because they have additional costs and will lose major parts of their business volumes and revenues in the corporate and investment banking (CIB) area.

What is the likelihood of FTT happening?

US politicians also have to find a way to cut the massive US budget deficit, although US Treasury Secretary Timothy Geithner has recently reiterated his opposition to such plans as have many Republican politicians and industry groups. Nevertheless, we see two proposals coming up and give them a 10% likelihood of being the means of introducing a financial transaction tax in the US. Senator Levin (D-Mich) with the support of Warren Buffett wants to cut a tax benefit for derivatives trading, called the 60/40 tax treatment or the 1256 contracts code. Since 1981, some types of derivatives trades have been taxed at a blended rate of maximum 23% (40% based on short-term tax of maximum 35% and 60% long term tax rate of 15%) according to Bloomberg on 20 September. This tax benefit would be cut and normal taxation rules of maximum 35% introduced. In addition, two Democratic Congress members, Senator Tom Harkin of Iowa and Representative Peter DeFazio of Oregon, want to reintroduce a transaction tax proposal, a sequel to their 2009 bill before the November G-20 meeting, according to Politico.com from 4 October 2011.

We assume a two-thirds probability of a Eurozone FTT. We also see the possibility that other European governments go down this route, since Eurozone politicians have firmly committed themselves, in the light of potential billions in tax revenues to be raised. In the end, it is the simple urge of mainstream politics to make markets pay for what they have done which will mainly drive politicians in France and Germany, and probably even the UK. Although we consider the introduction of a FTT in the UK as unlikely (less than 25%), we would like to play the devils advocate briefly. The UK government could decide to replace stamp duty with a more general FTT which would boost tax

Impact on our valuation models

As 50% of Deutsche Brse revenues come from Europe trading activities and European trading volumes could decline by 50%, we introduce a 25% valuation discount for Deutsche Brse. However, none of the potential benefits of the

10

FIG Diversified Financial Services 26 October 2011

abc

merger with NYSE Euronext are priced into shares in our view. Although all of Helex revenues are related to European trading activities, we estimate that Greek trading volumes would decline by just 10% because Greek volumes are already extremely low and there is no HFT in this market. We thus introduce a 10% valuation discount for Helex.

As roughly 20% of London Stock Exchange revenues come from Eurozone trading activities, which could decline by 50%, we introduce a 10% valuation discount for LSE. As roughly 50% of NYSE Euronext revenues come from Europe and European trading volumes could decline by 50%, we introduce a 25% valuation discount for NYSE Euronext. However, none of potential benefits of merger with Deutsche Brse are priced into shares in our view.

11

FIG Diversified Financial Services 26 October 2011

abc

What will happen to derivatives trading?

Exchange traded derivatives just 11% of global market OTC derivatives are dominated by G14 and still show big leverage

and cluster risks

Regulation will reshape derivatives markets in Europe and US but

implementation is slow

The global derivatives market

Despite talks about changes in regulation, the OTC market still makes up close to 90% of the derivative market and thereby is roughly eight times the size of the exchange traded market.

Global derivatives market in terms of notional amounts outstanding (USDtrn)

900 800 700 600 500 400 300 200 100 0 2008a OTC 2009 a 2010a Exchange-traded 2011 e 2012e 2013e Exchange-traded (rhs) 13.5% 13.0% 12.5% 12.0% 11.5% 11.0% 10.5% 10.0% 9.5% 9.0%

2012e in OTC trading, while exchange traded volumes should reach USD84.3trn and USD81.0trn in 2011e and 2012e respectively.

Notional amounts outstanding and world GDP (USDtrn) 2008 2009 2010 2011e 2012e

Global GDP OTC Adjusted OTC volume* in terms of GDP On-exchange in terms of GDP

61.26 598.1 472.3 771% 57.7 94%

58.11 603.9 447 769% 73.1 126%

63.05 601.0 418.9 664% 67.9 108%

64.20 705.3 480.3 748% 85.3 133%

66.50 719.4 454.4 683% 90.9 137%

Note: *adjusted for FX products and double accounting of cleared swaps Source: BIS, ISDA

Source: BIS, HSBC estimates

To put it into context, 2010 global GDP, as published by the World Bank in July 2011, stood at USD63trn compared to USD601trn of notional amounts outstanding in the OTC derivatives market and USD68trn in the exchange-traded derivatives markets. Notional amounts outstanding are forecast to reach USD705trn in 2011e and USD719trn in

However, we have to caution that notional amounts are not a good representation of the market risk, as they also represent past contracts, some over 20 years old, rather than just reflecting market values of the derivatives. This measure reflects the value of derivatives if they were sold and cleared at that moment. Gross market value of derivatives outstanding was worth USD21.1trn in December 2010. Thats USD14.1trn lower than the comparable 2008 level and only a third of global GDP, down from 57% in 2008. All exchange-traded derivatives are cleared by clearing houses, while OTC-traded derivatives may be conducted bilaterally, with no central

12

FIG Diversified Financial Services 26 October 2011

abc

Exchange-traded derivatives market share by region (analysis by trading volume in billions of contracts traded)

2012e

2010a

2008a

2006a 0% 10% 20% Asia Pacific

Source: FIA, BIS, HSBC estimates

30%

40%

50% Europe

60%

70% Latin America

80%

90% Other

100%

North America

counterparty (CCP) involved, or via CCPs. With CCP clearing picking up pace, market transparency should increase in the near future. With increased usage of CCP, the level of collateralisation is expected to reach 71% in 2011e versus 66% in 2008. In the past four years the proportion of collateralised OTC traded derivatives has been around 65% to 70%. A possible tax on derivatives transactions would adversely affect OTC and exchange-traded derivative volumes in years after 2013e by 10% to 50%. However, how big the shift from OTC onto exchange trading will be is still unclear, as there has not yet been agreement about the level of taxation or how it will be imposed.

Exchange traded derivatives

The exchange-traded derivatives market is dominated by a few large exchange groups in Asia, Europe and America. When comparing global derivative exchanges, it is important to keep in mind that the contract sizes of Asian derivatives are often much smaller than their European or US counterparts. This artificially inflates trading volumes, as indicated by the FIAs statement in its 2010 annual volume survey that the ZCE sugar contract is one-fifth of the size of the comparative ICE contract. Nevertheless, Asia has been picking up pace and catching up on its Western peers as shown in the

Exchange-traded derivatives market share by region (segregated by notional amounts outstanding)

2013e 2012e 2011e

Turnover of exchange-traded derivatives (USDtrn)

1,200bn 1,000bn 815.4 800bn 600bn 707.9 990.7 784.8

2010a

400bn

2009a

200bn

2008a

115.9 20.9 2009 North America

175.0 36.6 2010 Other Markets

bn

0% 10% 20% North America 30% 40% Europe 50% 60% 70% Asia & Pacific 80% 90% 100% Other Markets

Europe

Asia & Pacific

Source: BIS, HSBC estimates

Source: BIS

13

FIG Diversified Financial Services 26 October 2011

abc

chart above. It assumed the lead position for the first time in terms of contracts traded in 2010. Notable is a constant decline in the European share beginning in 2008. FIA numbers show that from 2008 until 2010, Europes market share declined from 24% to 20%. We expect Europes market share to be just below 18% in 2012e. While Asia & Pacific saw contract volumes increase continuously since 2006, Europe and the US lost volumes in 2009. Latin America saw a short decline in 2008, yet has recovered quickly and we expect it to have doubled its 2006 volume in 2011e. Volumes traded on all exchanges exceeded 22bn contracts in 2010. This represents a 26% increase versus 2009 and an 88% increase versus 2006. For 2011e we expect contract volumes to reach 26bn contracts and we forecast 29bn contracts for 2012e. This is driven by increased product offerings by exchanges and regulatory reforms which will boost exchange traded volumes. Comparing regional trading volumes in terms of notional amounts outstanding, it is notable that North America and Europe have significantly higher market shares than Asia & Pacific, which in turn is market leader by volume traded. This supports our analysis that contract sizes in Asia & Pacific are much smaller than their Western counterparts. Notional amounts outstanding on Western

exchanges are about 15x to 20x higher than their Asian & Pacific peers. Taking the Kospi 200 Index Options of the Korean Exchange as a measure, volume traded was 3.5bn contracts in 2010. Despite a shrinking market share in terms of contracts traded, North America will hold firm its market share in terms of notional amounts outstanding in 2011e before it is likely to decline slightly in 2012e.

Top five derivatives exchanges globally

The top five derivative exchange groups in terms of contracts traded saw one change in November 2010, according to FIA magazine, as we forecast. The National Stock Exchange of India took over the fifth place from CBOE Group, which is now ranked number seven. The other four heavyweights changed places amongst themselves. As expected, CME Group took over the second place from Eurex Group including ISE (Eurex Group), while Korean Stock Exchange remained the unchallenged leader. The development is depicted in the chart below. While volumes have been rather flat for Eurex Group, Korea Exchange, CME Group and NYSE Euronext (including Liffe) each increased their volumes by more than 19%. National Stock Exchange of India has even increased its volume by 76%. The top 15 exchanges had one new entrant, namely the Osaka Securities Exchange, gaining

Market share of selected exchanges in derivatives trading by contracts traded

201 3e 201 2e 201 1e 201 0a 200 9a 0% 10% BM&F 20 % C ME 30% C BOE 4 0% E UR EX KEX 50% NYX 6 0% ND AQ 70% NS E Oth ers 8 0% 90% 100 %

Source: World Exchanges Federation, FIA, HSBC estimates

14

FIG Diversified Financial Services 26 October 2011

abc

Five largest derivative exchange groups by volume traded in 2009 and 2010 and y-o-y growth (both in number of contracts traded in m)

4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 -30% 0% 30% 2010

Source: World Exchanges Federation, HSBC estimates

Korea Exchange CME Grou p Eu rex NYSE Liffe Eurex CME Group Korea Exchange National Stock Exchange of India

NYSE Liffe National Stock Exch ange of Ind ia 60% 90%

20 09

one spot from JSE South Africa, now ranked sixteenth. The highest volume gain was achieved by the relatively new MCX-Exchange in India. It is now the ninth largest derivatives exchange by volume, up from twelfth place. The Zhengzhou Commodity Exchange gained 118% and was the second biggest gainer within the top 15 exchanges, now ranking twelfth. The dispersion among the exchanges may be best described by the relative volume traded as compared to the Korean Exchange. The second ranked exchange, CME Group, has 85% of the volume traded on Korea Exchange. The same statistics translates into 70% for the third (Eurex Group), 43% for the fifth and only 17% for the tenth largest exchange. Korea Exchange alone has almost 17% of globally traded derivative contracts on its exchange. The top three exchanges account for 43% of all contracts traded globally, while the top 10 make up 60%. This shows the domination of the market by a few exchanges. We still believe that intellectual property (IP) rights for index options and futures are unlikely to be broken by regulators, but some changes could happen if the EU Commission asks for remedies in this area to approve the Deutsche Brse/NYSE Euronext merger. This could increase competition and

could lead to lower costs for investors. However, this does not guarantee that small exchanges will benefit and gain volumes as the champions still have the liquidity advantage. Finally, there is no indication as to when or if the matter could become law. Our forecast for 2011e sees two changes within the top 10 as we expect Nasdaq OMX Group to take over the seventh place from CBOE Group. We also forecast that the Russian Trading Facility should reach the same volume as CBOE Group ranked eighth in 2011e. But again, we highlight the difference in the ranking if we rank exchanges by notional amounts outstanding or turnover, as Asian exchanges have smaller contract multipliers. However, due to a lack of transparency and comparable data, a ranking by turnover is not really feasible.

Taking a look by product

The global exchange traded derivatives market is dominated by interest rate products, which made up more than 91% of the market in 2010, while equity derivatives only had a share of 8% in terms of notional amounts outstanding. This is the same as in the OTC derivatives market.

15

FIG Diversified Financial Services 26 October 2011

abc

Exchange traded derivatives in number of contracts (m) by asset class 2010

Ex otic Commodities Currency IR ETF Stock Index Single Stock 0 Americas

Source: WFE, HSBC

Exchange traded derivatives in number of contracts (m) by type of contract in 2010

7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Futures

2,000 Asia Pac ific 4,000 6,000 8,000

Options Equity Index

IR

Currenc y

Europe, Africa, Middle East

Source: BIS, HSBC

However, when comparing the number of contracts traded in 2010, the charts show that equity derivatives have more than double the volume of interest rate derivatives traded. The high volume in equity derivatives is mainly influenced by 3.5bn equity index option contracts traded on the Korea Exchange, which as said before have a fairly low notional value compared to contracts of their Western peers. Data from BIS and the world federation of exchanges (WFE) further suggests that more than 87% of the 4.8bn equity contracts traded in Asia & Pacific were options. We therefore highlight the concentration of Asian volume on the Korean Exchange,

especially in Kospi 200 index options, while most other exchanges in Asia have more futures than option contracts traded according to WFE data. We think that the parallels between the OTC and the exchange traded derivatives market show that at least CCPs are ready to take on clearing volume from OTC trades. During dividend season in Germany, Eurex Clearing has taken big parts of OTC equity options trading on exchange via reduced fees for block trades. In a second step, the trading could even migrate from OTC on-exchange. If clearing for such an asymmetric and difficult derivative products like CDS with its jump-todefault risk could be developed, we think nearly

Exchange traded contracts (m) by asset class and overall contract growth in %

35, 000 30, 000 25, 000 20, 000 15, 000 10, 000 5, 000 0 2008a Single s toc k

Source: WFE, HSBC estimates

35% 30% 25% 20% 15% 10% 5% 0% 2009a Equity index IR 2010a FX 2011e Commodity 2012e ET F Ex otic 2013e Grow th (RH)

16

FIG Diversified Financial Services 26 October 2011

abc

every instrument can be cleared centrally. We can see no reason for any interest rate or equity product to remain traded OTC except to keep the level of transparency low.

BRICS alliance

the participating exchanges expect to develop a BRICS index (and related derivatives products and ETFs) to track the BRICS exchanges and discuss joint development of other products.

OTC derivatives

The global derivatives market stood at USD601trn end of 2010 according to BIS data. The major part of the volumes outstanding are interest rate (IR) products, which make up USD465trn of the total market in 2010. In H1 2011, notional amounts outstanding of IR even increased to USD543.2trn. The second-largest category is FX products, with USD58trn in notional amounts outstanding. FX derivatives are different from other derivatives mainly due to their life span, which is much shorter than that of most other derivatives. FX derivatives were therefore excluded from all regulation imposed by Dodd-Frank Act (DFA) in the US. The third category is credit default swaps (CDS) which have USD30trn notional amounts outstanding in 2010. We forecast USD35trn at the end of 2011e because of increased trading activity driven by current markets, such as increased hedging of sovereign risk. In 2010, 15% of all notional amounts outstanding of CDS were held with CCPs, 25% with

In combination with five other BRICS exchanges, BM&F Bovespa and HKEx announced on 13 October a cross-listing joint initiative between exchanges of the BRICS countries (Brazil, Russia, India, China, and South Africa). The first phase of the initiative involves the exchanges cross-listing each others benchmark equity index derivatives, traded in the local currency of the exchange (for instance, a Brazilian investor can buy and sell a Hang Seng Index futures contract in reals on the BM&F Bovespa) and is expected to be in place by June 2012. Revenues will be shared between the issuing exchange and the exchange where the contract is traded on an undisclosed basis. While we view the agreement positively, we anticipate a limited impact on earnings through 2013, growing only gradually from then, so we have not changed our estimates or valuation. As an example, equity index derivatives now represent about 2% of BVMFs total gross revenues. In the next phases,

Global OTC derivatives market, classified by amounts outstanding per category

H2 12e H1 12e H2 11e H1 11e H2 10a H1 10a H2 09a H1 09a H2 08a H1 08a H2 07a H1 07a 0% 10% 20% 30% IR 40% FX 50% CDS 60% Equity 70% Other 80% 90% 100%

Source: BIS, HSBC estimates

17

FIG Diversified Financial Services 26 October 2011

abc

OTC traded IRS volumes (USDtrn)

400 350 300 250 200 150 100 50 0 2007a 2008a 2009a 2010a 2011 H1e IRS volumes

Source: BIS, TriOptima, HSBC estimates

OTC derivatives notional amounts outstanding (USDtrn)

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% IRS volumes cleared (rhs)

800 700 600 500 400 300 200 100 0 2007a 2008a 2009a 2010a 2011e 2012e 2013e Total contracts Adjusted volume s

Source: BIS, ISDA, HSBC estimates

banks and securities firms, 50% with reporting dealers and the rest with other institutions. Fourth in line are equity derivatives with notional amounts outstanding of USD5.6trn. They are roughly in line with exchange traded amounts outstanding and are the only category in which OTC trading is not significantly greater than exchange traded notional amounts outstanding. In 2011e we expect notional amounts outstanding to increase to USD6.8trn because of increased equity trading volumes and due to a fall in share prices, which increased the value of hedging positions in derivatives. Commodity contracts made up the smallest reported part of the OTC derivatives market. Of these USD2.9trn, gold contracts made up 13.6%. According to ISDA data, 82% of total notional amounts outstanding are held by the G-14, the 14 largest derivative dealers. They have a market share of 90% in CDS, 82% in IR and 86% in equity derivatives. The five largest US dealers account for 37% of total notional amounts outstanding according to ISDA. Considering the massive volumes outstanding and the lack of central clearing, this remains a big cluster risk.

cooperation with the ISDA, show the amount of OTC interest rate products has increased to USD543trn, up 16.8% from USD465trn in H2 2010. Notional amounts outstanding of all derivatives are expected to be even higher as the new estimate for the global OTC market is now at USD705trn in 2011e. This value is 11x forecast global GDP for 2011e, above the actual 9.5x in 2010. While derivatives traded on organised exchanges gained ground compared to OTC derivatives (for example USD82.6trn at end of June 2011 compared to USD67.9trn end of 2010), notional amounts outstanding fell to USD82.6trn end of H1 2011. We expect a rebound in H2 and estimate total notional amounts outstanding for 2011e at USD85.3trn, and in 2012e we expect this value to reach USD90.9trn. However the outlook for 2012e is largely dependent on CFTC rulings on OTC clearing, the availability of good and qualifying collateral and other effects of DFA, as regulators in Europe and Asia are looking at decisions made by the CFTC and SEC and are expected to follow suit. The decision about a potential financial transaction tax in Europe that covers derivatives trading will also have significant effects on future volumes and the development of the market. The general BIS statistic does include double accounting in cleared derivatives contracts. Each time a derivative contract is cleared via any CCP, the dealer of each

2011e and further developments

The latest numbers from the interest rate trade repository report (IRTRR) from 12 August 2011, submitted to regulators by TriOptima in

18

FIG Diversified Financial Services 26 October 2011

abc

side enters into new contracts with the clearing house, thus doubling the notional amounts outstanding, as both transactions are included in the comprehensive semi-annual BIS statistics. In contrast, ISDA publishes adjusted volumes which can be used to analyse the effects of double accounting. As only LCH.Clearnet has a significant market share in OTC interest rate swap (IRS) clearing, ISDA adjusts OTC contracts traded by LCH.Clearnets IRS volume. The adjustment for the novation process via CCPs leads to different market shares when comparing exchange traded and OTC traded derivatives. In terms of notional amounts outstanding, the market share of exchange traded derivatives as compared to OTC traded derivatives was fairly stable around 10% and 12% between 2008 and 2010. When comparing exchange traded derivatives with adjusted OTC traded derivatives, the market share increased from 12% in 2008 to 18% in 2010. This is because of an increasing number of cleared IRS, which increase the unadjusted OTC volume significantly due to double accounting and thereby inflates the OTC market share. As a result of increasing clearing volumes, we expect the spread between the two market share measures to increase even further in the future. Regulatory actions will lead to increasing clearing volumes. In 2012e and 2013e the exchange traded market share will reach 12.6% and 13.2% of the total OTC amount outstanding, respectively, compared to 20% and 22.7% of adjusted OTC volumes outstanding.

of OTC contracts. This might lead to institutions or individuals shifting trades from more regulated markets to the other Asian countries. Still, financial regulators in both HK and Singapore have pledged to follow global regulations (mainly under G-20) and are setting up their own CCPs. However, as yet, there is no legislation to require OTC trade to migrate to exchanges in both markets. Below, we explain the US regulation in brief from the point of view of how it might impact European regulation.

US regulation

The Commodity Futures and Trading Commission (CFTC), established in 1974 under the Commodities Futures and Trading Act is the top level regulator in the options and futures business. Over the years the CFTC has received special jurisdiction. All exchanges and futures commission merchants have to report to the CFTC on a daily basis. A futures commission merchant (FCM) is an individual or institution which is registered with the National Futures Association (NFA), defined below, and is licensed to accept orders for futures and options on futures contracts and accepts margin payments for these products. All institutional investors, brokers and banks not investing solely on their own behalf, must submit trades via FCMs or be registered as an FCM themselves. FCMs are also useful indicators for derivative market volumes and trend recognition, as the CFTC publishes monthly data on the money held in FCM accounts for customers, which therefore gives an indication of the publics interest in derivatives. With potential changes for derivatives taxation discussions in mind, the FCM statistics might be quite important in the future. Recent statistics show accelerating account readings of money deposited with FCMs, which are in line with current volume increases at all derivative exchanges.

Update on global regulation

There is no global or truly supranational regulator for derivatives. However, regulators in Europe are observing steps taken in the US and are expected to follow suit. In Asia, only some countries appear to be replicating the new regulatory framework that the US and Europe are trying to set up in order to ease and enable oversight and regulation

19

FIG Diversified Financial Services 26 October 2011

abc

The National Futures Association was created in 1981 as a self-regulatory organisation. According to the Code of Federal Regulations part 17, which outlines the Commodity Exchange Act (CEA), each FCM is obliged to be member of a designated self-regulatory organisation (DSRO) unless the organisation is not solely trading on its own behalf or if it has solely non US customers and is trading through an FCM.

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (DFA)

The variety of products offered as well as the increase of OTC trading has made the market fairly difficult to evaluate over time. Together with the government, the CFTC and the NFA have come up with rules and regulations to guide the market and aiming at more transparency, especially for OTC trading. Last in line are drafts outlining regulation required by DFA, which aims at the elimination of loopholes for OTC derivative trades and asks for a more aggressive prosecution of fraud and market manipulation. DFA is intended to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end too big to fail, [] to protect consumers from abusive financial services practices, and for other purposes. It has major effects on OTC derivative transactions, especially Swaps and Credit derivatives. Furthermore it declares some exchanges and clearing houses to be systemically important financial institutions (SIFIs). There are many drafts and research notes from regulators, DSROs and associations available about as to when a clearing house should be classified and treated as a SIFI, but no final decisions have been made, yet. The Federal Reserve Bank of Cleveland proposed in August 2009 to treat a clearing house as a SIFI if it conducts more than 25% of trades in an important asset class or if it is handling more than 30% of an important credit activity.

DFA will also impose obligatory clearing of all standardised derivatives traded over-the-counter, with the exemption of FX-derivatives. The requirement for central clearing rather than bilateral clearing has many implications. First, it will make the market more transparent. This would also ease the probable implementation of taxes on derivative transactions. It will also help regulators monitor the market. Secondly, it might drive investors out of the market as central clearing could be too cost-intensive for some trading strategies. Higher amounts of margin requirements might make their trades unprofitable under these new regulations. DFA will also have effects on Swap dealers and swap transactions in general as Swap dealers would now have to be separate entities so-called Swap Execution Facilities (SEFs) and are required to report all transaction data to the CFTC. In fact, registration with the CFTC will be required for all SEFs. According to an article in Forbes on 13 October, many market participants outside the US like Ronald Arculli, chairman of the World Federation of Exchanges as well as HKEx, worry about the US habit of extending their laws beyond their shores.

EMIR and MiFID impact

Other than in the US, there are two distinct large scale regulatory frameworks under discussion in Europe that will have impact on derivatives regulation. The proposal to create European Markets Infrastructure Regulation (EMIR) followed the G-20 summit meeting in Pittsburgh in 2009. A final decision on the regulation is expected for November 2011. The current proposal includes a central clearing of standardised OTC transactions, obligatory reporting of all OTC transactions to repositories and an exemption of corporate end-users of the underlying under a not yet specified threshold. The European Securities and Markets Authority (ESMA) should be responsible for the compliance

20

FIG Diversified Financial Services 26 October 2011

abc

Overview of European regulators estimated to cost EUR37m in FY2011e and EUR68m in 2014e

European Systemic Risk Board

European Supervisory Authorities (ESAs)

European Insurance and Occupational Pensions Authority (EOPIA) European Commission (one member)

European Securities and Markets Authority (ESMA)

Advisory Technical Committee (ATC)

European Banking Authority (EBA)

ECB Council (President, Vice President and Governors of member states 'CB's)

no voting rights

President of the Economic and Financial Committee (EFC)

Source: ESRB, EU Commission, ESMA, FSA, HSBC

one rep. per member state of a national supervisory authority

of the regulation and will most likely set up final rules in 2012e. ESMA has been created in January 2011 and is now responsible for the oversight and safeguarding of the European securities markets as stated by ESMA. It should eventually impose equal rules on all 27 EU member states and would therefore harmonise regulation within the European Union, though there has been no agreement to a final draft, yet. ESMA is part of the newly created European System of Financial Supervision (ESFS), a European supranational framework which also includes the European banking Authority (EBA) and the European Insurance Occupational Pensions Authority (EIOPA). Together, they will be responsible for the safeguarding and supervision of the European financial market and its members. The oversight of ESMA is part of the regulation which is discussed in EMIR. ESMA is solely responsible to the European Parliament. With regard to OTC Swap trading, the Markets in Financial Instruments Directive (MiFID) proposal calls for the implementation of so called Organised Trading Facilities (OTFs) which will be responsible for OTC Swap transactions.

According to the FT on 31 May 2011, it seems that the regulation of OTFs in Europe would be more elastic than the US regulation with its SEFs. As laid out above, European regulations under EMIR and MiFID call for similar actions to those required by the DFA. They call for the clearing of standardised derivative contracts, the enforcement of reporting of all OTC and cleared transactions and the exemption of end-users from the regulation. The end-user rule applies to all investors who are hedging risks, buying or selling goods via derivatives. A key difference between Europe and the US remains the swap trading regulation. The framework being discussed in Europe is similar to, but will not be as closely defined as the US alternative. In Risk.net, Gary Gensler, chairman of the US CFTC stated that European regulators would make a mistake if they regulate only OTC derivatives as they should regulate all derivatives, including those trading on exchanges. But this appears to be the approach the EU parliament is taking, which seems, to us, to be more pragmatic as exchange traded derivatives offer higher transparency and risk mitigation.

21

FIG Diversified Financial Services 26 October 2011

abc

Clearing house ownership structure

An important point in current discussion remains ownership of clearing houses; whether a clearing house owned by shareholders or users would serve markets better. The matter, which we discussed in the last Exchange Examiner in June 2011, has not been resolved yet.

Risk management practices of CCPs

Clearing houses are serving as central counterparties, guaranteeing all trades and thereby taking on all risks associated with the trades of their clearing members. Counterparty risk is reduced because default risk is shared among clearing members and the clearing house. CCPs therefore need a sustainable risk management system to cope with possible defaults of clearing members, consisting of many different measures.

Clearing house procedures in case of a members default

Position netting Collateral liquidation Clearing fund of defaulting member Reserves of clearing house Clearing fund contribution of other members Liable equity of clearing house Parental guarantee

Source: Deutsche Brse, HSBC

respective position. Additionally clearing houses collect variation margin or intra-day margin that is adjusted real-time for many clearing houses such as Eurex Clearing. This risk monitoring procedure balances losses between investors. As soon as aggregated margin accounts of clearing members are running below certain limits, margin calls will be triggered immediately at real-time monitoring clearing houses to shore up the margin account. These measures secure the exterior funding of the risk management system of clearing houses. Clearing houses also have interior measures that are part of the risk management structure in case exterior funding is wiped out completely due to the default of a clearing member. These are reserves of the clearing house, liable equity of the clearing house and potential guarantees from parental organisations. When a clearing member defaults, the clearing house would immediately hedge or close all positions of that member or transfer them to other members if possible. The losses that occur will be accounted for in the following order. First, the clearing house would use all collateral of the defaulting member. Second, it would use the capital paid into the clearing fund by the defaulting clearing member. Third, the clearing house would use its reserves before the rest of the clearing fund is touched. The last measures are liable equity and potential parental guarantees that would pay for losses exceeding those paid for the all the other measures. The clearing house would default if all measures fail to cover the total losses associated with the members default. When Lehman defaulted, all Lehman trades were hedged and all losses contained within 40% of Lehmans initial margin according to an article in the just published November 2011 Futures Industry. Mark-to-market measures should reduce counterparty risk and to some extent also the risk of the clearing house incurring losses due to a

First of all, clearing members are required to contribute to a default fund of the clearing house. This fund is used in case of default of a clearing member. Secondly, initial margins are collected based on the level of risk associated with each trade. Margins may be deposited in cash or in securities, including physical gold, selected sovereign debt and selected money market funds. The margins cover potential losses between the time of default of a clearing member and the time a clearing house could close or hedge the

22

FIG Diversified Financial Services 26 October 2011

abc

counterparty default. The earlier a clearing house can hedge the positions of a defaulting member, the smaller the impact of losses on the default fund and other risk provisions. There remain some major differences between clearing houses and their mark-to-market procedures. While marking-tomarket is done twice a day by clearing houses such as CME Clearing, other clearing houses, like Eurex Clearing, offer real-time marking-to-market, which reduces counterparty risk more than CME Groups system. Marking-to-market only twice a day may be dangerous for investors as prices might fluctuate significantly in the meantime. As central clearing is expected to become mandatory for standardised derivatives, real-time mark-to-market clearing houses should become mandatory as well. On 29 November 2010, the FT ran an article that highlights the importance of real-time risk management. As high-frequency trading (HFT) is becoming more popular and volumes are increasing, the clearing industry sees the need for a change in the way risk management is to be handled. CFTC Commissioner Bart Chilton in his 5 October 2011 speech said that about 50% of all trading in Europe and around 30% of all trading in the US is done by high-frequency traders. HFT should lead the drive towards real-time clearing.

Trade repositories

The need for central trade repositories, which will collect data on OTC trades, is omnipresent. Europe and the US have worked out their own proposals, but Europe is far behind the US in the law making process. Regulators have not agreed whether there should be one global repository per asset class as the US wishes or whether each country or region should have its own repository with access to regulators worldwide (FT, 10 October 2011). While the DFA draft in the US makes foreign regulators liable in case submitted data is leaked, the EU proposal has no such clause in its current form. Another matter of discussion is the level of information mined by trade repositories. The FT quotes insiders who say that the current proposal does not include collateralisation levels of outstanding bilateral OTC trades, which would be important to know. The data would enable regulators to assess the market risk in a better way than today.

Collateralisation

Collateralisation is the process when collateral is posted as recourse, for example margin payments, for doing a trade as a protection against a counterparty default. As an increasing number of contracts are being cleared centrally, the need for

Graphic representation of trade repository transaction reporting

ID 600 Name A Name B XYZ Corp 1,000,000 EUR 600 ID 200 Name A Name B XYZ Corp 1,000,000 EUR 200

Buyer: Seller: Referent: Notional: Currency: Side ID:

Buyer: Seller: Referent: Notional: Currency: Side ID: ID 600 and ID 200 sides are paired Transaction ID 100 assigned to paired sides CDS ID 100 Buyer: Seller: Referent: Notional: Currency: Side ID:

Buyer: Seller: Referent: Notional: Currency: Side ID:

Source: OTC Derivatives Regulators Forum, HSBC

Name A Name B XYZ Corp 1,000,000 EUR 600

Name A Name B XYZ Corp 1,000,000 EUR 200

23

FIG Diversified Financial Services 26 October 2011

abc

Reported and estimated levels of total collateral (USDbn), not adjusted for double accounting

4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 2002a 2003a 2004a 2005a 2006a 2007a 2008a 2009a 2010a 2011e 2012e 2013e 71% 70% 69% 68% 67% 66% 65%

R eported (LH)

Source: ISDA, HSBC estimates

Es tim ated (LH)

R eported v s es tim ates (R H)

collateral to be used for margin payments increases. Investors clearing derivative trades via CCP clearing houses, have to post collateral as initial and variation margin. This collateral needs to meet certain criteria which can differ from one clearing house to another. The wish for the clearance of all standardised contracts via CCPs, as explained and proposed by regulators, could lead to a shortage of qualifying collateral which could be used for the clearing of those trades, according to an FT article on 11 July, 2011. The June 2011 BIS Quarterly Review suggests that some derivative dealers might not have enough cash for variation margin requirements. Collateral transformation could be needed in order to create the necessary margin collateral for all the new OTC clearing as said by the FT. Collateral transformation describes the creation of collateral which is accepted by clearing houses out of collateral which does not qualify as such. A repo agreement in which some low rated corporate bonds are exchanged for cash so that the cash could be used as collateral would be a possibility, according to the article. However, the proposed merger of Deutsche Brse and NYSE Euronext could help in this respect as it promises to free up to EUR3bn of margin calls. Looking at industry data of BIS, ICE and

TriOptima, we estimate that already more than 50% of IRS and approximately 30% of CDS are centrally cleared. But a higher level would of course be welcomed by regulators. Another sign of cost pressure could be the fact that ICE Clear Credit and CME Group want to merge their margin accounts for CDS clients, as reported by Dow Jones Newswires on 7 October. For 2010, ISDA data show that 81% of all posted collateral was cash, followed by 10% in government securities and the remaining 9% in other assets. Clearing members are quoted in the mentioned FT article as highlighting that pension funds and mutual funds do not have unlimited cash and government securities to use as collateral for their trades. However, according to ISDA data, they are already showing a collateralisation rate of 70% for their OTC trades and thus the extra burdens might not be too heavy when the mandatory clearing regulation is enforced. It depends on the level of collateral CCPs will require and what kind of collateral is currently used by pension funds and insurance companies in their bilateral agreements. Banks and other bilateral OTC partners might accept collateral which would not qualify as such with CCPs. However, Bloomberg Businessweek ran story on 14 October that LCH.Clearnet is looking at the

24

FIG Diversified Financial Services 26 October 2011

abc

Development of counterparty credit exposure in OTC derivatives trading (USDbn)

5, 005

6,000

3,859

3, 744

2, 075

2, 032

1,969

1,897

1,511

1,750

2,000 1,000 0

1, 317

H1 2003a

1, 478

H1 2005a

1,900

3,000

2, 036

2, 672

4,000

3,256

H1 2008a

3,521

H1 2010a

3,578

3,650

3, 785

3, 995

5,000

4,053

4,129

Counterparty credit ex posure

Source: ISDA, HSBC estimates

possibility of accepting investment-grade corporate bonds as collateral. Others like CME Groups clearinghouse are already doing so. The level of collateral used in OTC transactions may be seen as a benchmark for the assessment counter-party risk in the market. The higher the collateral posted, the lower the risk of losses associated with the bankruptcy of any counterparty investor. However, as cross margining and other measures of margin reduction are becoming increasingly used to reduce the amount of margin needed to be posted, the level of collateralisation will also face downward pressure. This is especially the case as more trades are conducted via CCPs. As a result, a decline or increase in reported collateral does not automatically indicate rising or falling counterparty risk, respectively. For 2011e and 2012e we expect slightly growing collateral levels. This is because an increasing volume of trades will be handled by CCPs which have been conducted as bilateral and uncollateralised deals in the past. This trend is affected by Dodd Frank Act (DFA) in the US and the planned EMIR regulation in Europe. Clearing houses and the G14 will net large quantities of initial and variation margins payable, but the expected increase in volume traded via CCPs will

inevitably lead to an increase in collateral used in OTC transactions in the future. We therefore estimate a growth rate of total collateral posted of 4% in 2011e, 11% in 2012e and 9% in 2013e.

Netting

Another measure of risk, not for the assessment of counter party risk, but rather for market risk, is the netting effect, or netting factor for gross market values. In the near future we estimate gross market values to remain in the range of 3% to 4% of notional amounts outstanding. Gross market values are netted by a factor of 5.8x in 2010 to arrive at the gross credit exposure of USD3.7trn of all counterparties according to ISDA and BIS data. This netting factor should increase to 6.2x in 2011e, because of a higher percentage of contracts cleared. The netting factor shows the degree of efficient risk reduction by CCPs. As they net positions, CCPs efficiently reduce the amount of collateral needed to be posted as margin. The November 2010 edition of the Exchange Examiner had a close look at the pros and cons of netting and the theoretical ideal number of CCPs needed.

H1 2013e

H1 2012e

H1 2002a

H1 2004a

H1 2006a

H1 2007a

H1 2009a

H1 2011e

4,200

4, 300

25

FIG Diversified Financial Services 26 October 2011

abc

Current valuation

Stocks have de-rated, valuation looks very promising We saw upgrades of consensus forecasts Exchange sector trading at historical lows

Relative valuation

The third big issue is sector valuation. This looks very attractive to us. In addition we have seen upgrades of consensus forecasts for European and US exchanges since June. In Asia, the earnings of HKEx seems quite secure for 2011e, but it looks like consensus is worrying about the companys prospects and is slashing the numbers for 2012-13 to reflect a potential bear market. We expect that in the Asian markets a similar trend to the volume recovery in 2009 will be seen as the market seems oversold now and a rebound is around the corner. In other words, we expect that the

traditional bear market wisdom might not work well this time. This point is also true for European names The emerging markets names are still on valuation premiums to the exchanges focused on mature European markets. However, HKEx and SGX are trading at around 20x 2011e earnings, which is below the average forward PE of the last five years and well below peak valuations. BM&F Bovespas share price has continued to de-rate, however, and is now just around 17x 2011e earnings. This is more in line with the US names, which does not seem justified to us. The Emirates exchange DFM is still on a high PE, but the share price has continued to fall as well.

2011e and 2012e PE of global exchanges (as on 21 October 2011)

30 283.5 60.6 25 20 13.8 12.7 11.2 11. 3 9.3 10 5 0 Deut sche Brs e Hong Kong Ex ch I ntercontinent al DFM NYSE Euronex t Exchanges Nas daq OMX* CME Group* Singapore BME* BM &F Bovespa & Clearing Exc hange* Exchange Hellenic TMX* ASX* LSE 7.7 9.1 8. 4 22.4 18.8 16.8 14.1 15. 2 13.4 17.4 16.6 10. 9 9.8 10.0 9.0 8.3 19. 8 16.5 11. 3

15

10.7

10.6

company 2011

Source: Factset consensus, HSBC estimates

company 2012

adj. s ector av erage 2011

adj. s ector av erage 2012

26

FIG Diversified Financial Services 26 October 2011

abc

12-month rolling PE of European and US exchanges (as of 21 October 2011)

70 60 50 40 30 20 10 0 Jan-04 J an-05 J an-06 Jan-07 DB1

Source: Company data, HSBC estimates

Jan-08 LSE NYX

J an-09 Helex

Jan-10

Jan-11

Looking at our European and US coverage, the previous boost from returning M&A activity has completely vanished from share price performance in the last months as fears regarding the macroeconomic environment and the possible introduction of the FTT in Europe have taken their toll. Consequently, we believe that sector valuation now looks attractive. We estimate that the exchanges sector is trading close to historical lows as valuations have become much cheaper versus last year. Global exchanges currently trade on a one-year forward PE of 15.5x versus 19.1x a year ago. Further, the peer group is inflated by the DFM valuation; adjusted for this, forward PE is 12.3x.

We think that the current sector valuation has factored in expectations for trading volumes and earnings (and consequently share prices), and a macro-economic slowdown not only in Europe and US, but also in Asia, especially in China. Some risk of a FTT is likely to be included in the valuation of the European names. Our conviction ideas are LSE for developed and HKEx for emerging markets. Among European names, LSE is least exposed to Eurozone woes and risk of FTT introduction. Looking at emerging markets exchanges, we think that HKEx promises good growth opportunities while the shares have been de-rated in the last few months.

12-month rolling PE of emerging market exchanges (as on 21 October 2011)

70 60 50 40 30 20 10 0 Jan-04 Jan-05 J an-06 Jan-07 HKEx

Source: Company data, HSBC estimates

Jan-08 SGX DFM

J an-09 BM&F

J an-10

J an-11

27

FIG Diversified Financial Services 26 October 2011

abc

Global exchanges peer group data (as of 21 October 2011) Rating Currency Market cap in local curr Market cap Closing Target price (USD) price Potential return PE 2011e PE 2012e Yield 2010a Yield 2011e

ASX* BME* BM&F Bovespa CBOE Holdings* CME Group* Deutsche Brse DFM Hellenic Exchanges Hong Kong Exch & Clearing Intercontinental Exchange* LSE Nasdaq OMX* NYSE Euronext Singapore Exchange TMX* Global sector average Adj. global sector average European average

NR NR OW NR NR OW N OW (V) OW NR OW NR OW OW NR

AUD EUR BRL USD USD EUR AED EUR HKD USD GBP USD USD SGD CAD

5,235 1,706 19,602 2,303 17,694 7,643 7,920 235 123,438 9,294 2,366 4,520 6,990 6,651 2,996

5,349 2,286 10,205 2,303 17,694 10,241 2,156 315 15,828 9,294 3,644 4,520 6,990 5,101 2,976

30.16 20.40 9.87 25.57 264.49 41.08 0.99 3.35 114.40 126.51 8.820 25.11 26.78 6.21 41.70

----11.6 ----55 1.15 4.00 190 --10.8 --35.0 8.2 ---

----18% ----34% 16% 19% 70% --22% --31% 37% ---

13.8 11.2 17.3 16.6 15.2 9.3 283.5 9.6 22.4 18.8 10.7 10.0 10.9 19.8 11.3 32.0 14.1 10.2

12.7 11.3 14.5 14.6 13.4 7.7 60.6 10.0 17.4 16.6 9.8 9.0 8.3 16.5 10.6 15.5 12.3 9.2

5.7% 7.7% 5.2% 0.8% 1.7% 5.1% 0.0% 4.5% 3.7% 0.0% 3.0% 0.0% 4.5% 4.3% 3.7% 3.3% 3.6% 5.1%

6.0% 7.8% 4.4% 1.6% 2.0% 5.1% 0.0% 4.5% 4.0% 0.0% 3.2% 0.0% 4.5% 4.5% 3.8% 3.4% 3.7% 5.1%

Note: * not covered by HSBC but median of Factset consensus. Adjusted global sector average excludes DFM. FY for LSE ends March, for ASX and SGX ends June. For all other companies FY ends December Source: Company data, Factset consensus, HSBC estimates

Valuation models