Professional Documents

Culture Documents

Is This A Marketing Plan Worthy of A Passing Grade

Uploaded by

72ChasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is This A Marketing Plan Worthy of A Passing Grade

Uploaded by

72ChasCopyright:

Available Formats

1

EXECUTIVE SUMMARY

Peter MacDougall the president of Nintendo was responsible to launch the colour version of Nintendo s Game Boy to November 23, 1998, scheduling to release simultaneously in North America and Europe. It is the most important launches in Nintendo s history, after declined steadily since 1992 to 1996. Although Nintendo had recovered somehow in 1997 due to marketing efforts, the efforts, however this effort was unlikely to sustain as no new products can be marketed. As a result, the third party developers begun to lose their support towards Nintendo, resulted the limitation of the game offerings. They viewed their rival s, Sony Playstation as an easier platform and more profitable in developing games. Faced with huge competition from Sony Playstation in the teens and tweens market segment, indicated that Nintendo needs to reinforce itself as the primary offering to its target market. With the new product of Nintendo Game Boy color to be launched, Nintendo will have the opportunity to continue to expand its largest market share in the handheld games market. The launch of the strategy Game Boy Color plan is surely hope to achieve 200,000 units within the 1999 fiscal year and altogether achieved the highest possible level of profitability for Nintendo.

ISSUES STATEMENT

Peter MacDougall challenge was to be responsible for ensuring the Canadian launch successful. Despite of the competitive position in Canada, the Canadian launch strategy needs to be different and profitable in significant ways. Therefore, Peter MacDougall needs to increase Nintendo s market share and boost sales by making decisions in these areas: a) Target Market; b) Product Positioning; c) Marketing Communication Mix; i. Product ii. Price iii. Promotions d) Marketing Mix Strategies.

3

3.1

DATA ANALYSIS

Channel of Distribution

The distribution of Game Boy in Canada had become increasingly concentrated in about 20 large direct accounts like Wal-Mart, Future Shop as well as Toys R Us. 80% of Nintendo sales had accounted from these 1,000 retail outlets. Smaller retail accounts such as specialty electronics store like Beamscope and Fidelity also contributed to Nintendo Sales. However, in the late 1990s, a number of specialty stores had delisted Game Boy due to no achieving competitive return on their sales of Game Boy both hardware and software. Another major symptom of the decreasing sales of Nintendo is the difficulties getting the large retailers to commit their open to buy dollars to Game Boy. As the retailers have constraints in their budget, Nintendo had to compete against other competitors before the retailers placing an order to support the hot products. As Nintendo had no new product since 1997, Nintendo failed to get very much initial support from the large direct accounts.

3.2

Promotion-Marketing Communications

The marketing communication budget for Nintendo in Canada was only a small fraction of Nintendo United States. With the budget limitation, leaving no choice for Nintendo Canada but to select its ads from the pool developed by the Nintendo United States. Compare to United States, Nintendo Canada has historically done much more grassroots marketing by demonstrating centres in Toronto, Montreal and Vancouver. This had given the masses the real experience trying out the latest Nintendo Hardware and games. Nintendo also worked closely with partners like McDonalds and Famous Players Theatres to promote its products. 3.3 Competition

An early competitor for Game Boy was Atari Lynx, which was the world s first color handheld video game system. It was launched in 1989 and had a backlit screen. However, Atari experienced siginificant difficulties during the 1990s and had essentially gone out of business in 1998. The TurboExpress was a handheld 16-bit graphics active matrix color liquid crystal display (LCD) screen. In comparison to Atari Lynx and Sega s game Gear that only had 8-bit graphics chip, the Turbo Express had one major weaknesses, which is the short span of battery life of only 3 hours. The strongest competitor was Sega s Game Gear which had 32-color backlit LCD screen. Sharing the same limitation with the TurboExpress, Game Gear too drained batteries very quickly. Sega s other product, Nomad which was introduced in 1995, too faced the short duration of batteries life. Therefore, despite all of the competitive competitors in the handheld games, Game Boy still has the prospect of regaining its largest market share. 3.4 Customer

The disposable income was substantially lower, especially among kids/ tweens and teens in Canada, compare to the United States. This resulted a lower sales achievement for Nintendo in Canada. As Game Boy was typically purchased by their parents as a holiday gift or great report card present, the purchases are more seasonal rather than all year round. The kids too, have the potential in becoming Nintendo Game Boy Color s target market by positioning the product as a gotta have product for the younger set. The size of population among the kids segment shows the potential to associate the product as being the cool and must have product. However, similar to the tweens, the purchasing power would still be on their parents and therefore remains the seasonal purchases. The teens that comprises more male than female, have the prospect of purchasing power throughout the year. However, many had already owned a Game Boy leading this segment to view the product as old technology . The teens instead, appeared to move past the handheld machines to console due to greater spend and game complexity. Moreover, there is a possibility of other competitors are targeting teens as their market segment, leaving Nintendo to gain smaller market share. Table 1: Population of Canada By Sex And Age 3.5 Behavior/Decision Making

Considerations in terms of price, may become one of the main determinants in the decision making phase. Nintendo in Canada charged slightly higher in Canada compare to its neighbour United States. This resulted greater sales in the United States partly to this pricing decision. In order to address the behaviour of its target market, Nintendo has to design the handheld Game Boy Color to be consistently affordable and resilient in compare to its competitors as well as its neighbouring countries.

KEY DECISION CRITERIA

From the analysis mentioned above, it showed that the marketing communication in Canada appeared to be an opportunity for Peter MacDougall as grassroots marketing had been emphasized in Canada for the unique gaming experiences. Permanent Nintendo demonstration centres in Toronto, Montreal and Vancouver, the biggest cities in Canada giving Nintendo the prospect to strengthen the brand awareness among the people. Nintendo has been a leader throughout worldwide in the retail video game industry making its reputable brand among the people. This strength can also be seen through Nintendo s first part software that has accounted for about 50 percent of the Game Boy software sold. Therefore, this gives Nintendo Canada the control of the games that ran on its game machines, keeping its thirdparty software providers under tight control. One major threat is from the Sony Playstation where third party developers began focusing more in developing their games. They viewed them as an easier platform to develop games, resulting limited games for Nintendo. The major weakness for Nintendo is lack of its new product development. As resulted in 1997 that marked a recovery sales due to marketing efforts, but without significant new products the recovery was unlikely to sustain for a longer period.

5

5.1

ALTERNATIVES ANALYSIS

Target Market

Target Market is defined as consumer segment that present the greatest opportunity in developing products. Essentially, Nintendo should continue to target five to nineteen year old segment of gamers and primary focus should be emphasized to the 10 to 14 years of age. This is due to the fact that on average, girls spend 70% less time than boys gaming, and therefore, with the primary target market on the tweens group that comprises 7.0 male out of the population, create a valuable opportunity to make this segment as a primary target group. The second target market should be the kids group. In comparison to the teens group was also targeted by other competitors like Sony Playstation, the kids group could view Nintendo Game Boy Color as the cool product , and then would become a gotta have for the younger children. The size of demographic segment of the 5 to 9 years showed that the domination of boys against girls gives the prospect in solidifying its image as being the product that continues in dominating the handheld gaming market for kids. As historically has proven, it was the younger segments that kept Nintendo at the top. The teens should also not to be forgotten as the teens have the ability to purchase the product all year round. However, despite of competitor that targeted mainly on teens market segment, it therefore overlaps. As many teens appeared to move past the handheld machines

to consoles that offered greater speed and game complexity, Nintendo Game Boy color would less likely catch their attention. 5.2 Choosing The Right Market Approach

The budget planned for advertising are Cdn$3 million on corporate advertising for Game Boy Color in the first year where the advertising area would be through the television ads and also print ads. While for the point of sale materials MacDougall planned to spend Cdn$400,000 for the budget. In addition, there is an allocation of Cdn$1,100,000 during the launch year for contests and cross promotions with manufacturers. Ron Bertram, Nintendo Canada s director of communications and consumer support knew that a crucial factor contributing to Game Boy Color s success would be the consumer sampling program. Three major sampling approaches were being considered. 5.2.1 Low-cost interactive display

It will generate brand/product awareness when teens/kids/tweens visit the stores. Estimated in store interactive displays would be used approximately 20 % of store hours for an average of 3 minutes/use. No sales staff required to monitoring the displays which is mean this handheld is easy to operate.1000 potential outlets and Nintendo could achieve an 80% placement rate. Each Game Boy Color would cost Cdn$250 per unit. Using the low cost interactive display may also bring negative point such as no one is there to explain the new product or the benefits of the product if kids/tweens/teens have questions. Most sales clerks knew little about Game Boy Color hardware or software. 5.2.2 Mall Tours

Nintendo representatives, who were highly knowledgeable gamers, and would show game insights and tricks to the kiosk visitor could use to improve their scores on popular games. Incentives encourage trial among teens/tweens/kids, where mall tour visitors can enter contests for Nintendo products and would receive a temporary Nintendo tattoo when they left. They will spend 6-8 minutes on the product which is more than store displays which lasts only 3 minutes. This sampling approaches suitable because teens/kids/tweens tends to spend a lot of time in the mall. Choosing this approach is quite expensive, that may cost $10,000 per Mall. Nintendo can only managed to made a visit only 25 mall tours per year. 5.2.3 Cross-Canada tour

This campaign will create high awareness due to scale of the events. This way will give more freedom to promote in a bold manner. Its offer bigger kiosks and more staff to promote the new product. It may reach high volume of people due to the size of audiences attending each event which is may achieve 80%. This approach may cost around $150,000 per year for major regional or national events such as CNE, Klondike Days, and the Calgary Stampede. These events only take place in summer months Bertram s also plan to use Public Relations by having Nintendo marketing representatives obtain the new hadware and software to leading gaming magazines and Web publications such as Eletronics

Gaming Monthly, Next Generation and Computer Gaming World. This strategy aimed for greater and favorable coverage. The combined monthly circulation of the top seven magazines was 110,000 Canadian readers and also 60,000 readers (monthly from Nintendo Power magazine). 5.3 How to price game boy color in Canada

As product s price must be set before it was introduced in order to position itself from the aspect of quality and target market. The original price of Game Boy in 1989 had been priced slightly higher than Canada compare to the United States. As the target market now focuses on the kids as well as the tweens segments, the price issue needs to be addresses accurately. Moreover, the disposable income that was substantially lower in Canada especially among kids/tweens market should be taken into account in order to achieve high target sales. Based on the factor mentioned above and using the Current strategy using maximum market share to provide higher sale volume to lower unit cost and higher long run profit, it is well recommended for Nintendo Game Boy Color in Canada to price the product just as similar as the price in United States at Cdn$120.00. The price is charged similarly to the United States was purposely to cater customer s price sensitivity as well as a push strategy for the retailers to sell, promote as well carry the product to the end-user. If Nintendo decide to price Game Boy Color at a lower cost of less than Cdn100, this would be the lowest Game Boy Color price in the world. Nintendo Canada would only receive a gross margin of 5% instead of the past 6%. With a lower margin received from each Game Boy sold, retailers might chose to spend their money on carrying and aggressively marketing other game systems. 5.4 New product

The new Game Boy Color units were similar in size to the existing black and white units, but the color version contained new technology that would display sharp and vivid color graphics. In contrast to the technology used by the Sega, Atari and TurboExpress color game handhelds, Game Boy Color s screen was not backlit and required an external light source (the brighter the ambient light, the better the color). However, by using an external light source, two AA batteries would last about 12 hours. A new reflective screen allowed the units to be used either indoors or outdoors. Game Boy Color would be able to display up to 56 colors with a very low power drain resulting in the long battery life. Game Boy Color would be backwards compatible allowing users to run any of the 1,000 games written for Game Boy since its launch in 1989. These games would show colors in a range of hues from a 10-palette selection, chosen by the user. Six new games, specifically developed to take advantage of the 56-color palette on Game Boy Color, were expected to be available at the launch date.

RECOMMENDATIONS

Nintendo Canada needs to make a strong marketing strategy to make sure the new Game Boy Color launch successful. All aspects from target market, marketing communication, product and price will give impact during and after the launched. The detailed implementation and plan for the launching of the product is further explained on the section below.

ACTION AND IMPLEMENTATION PLAN

The action and implementation plan involved Target Market, Promotion, Price and Product for Nintendo Canada launch their Game Boy Color. 7.1 Target Market and Positioning CRITERIA Size Purchasing Power Sales Potential Marketing Accessibility Company Objective Weighted Points TEENS 1 2 1 1 1 6 NEW KID/ TWEENS 2 1 2 1 1 7

Table 2: Weightage of each criteria of choosing target market Refe to Referring to Table 2, we have divided the criteria on selecting the target market based on weighted points which had been given on size, purchasing power, sales potential, marketing accessibility and company objective. Examining based on the size criteria, new kids and tweens segment is likely to have more weight than teens segment as per shown in Table 3 below: Table 3: Population of Canada By Sex And Age Analyzing through the purchasing power criteria, teens are more likely to have more weight because they tend to buy the products with their own money, and not depend only for the holiday season. They make the purchase throughout the year while for new kids and tweens, the products are purchased usually by their parents as a gift. The third criteria, which is the sales potential for the new Game Boy Colour is likely to be favourable to the new kids and tweens segments as they might perceived the products as a gotta have products for younger. Contradictory for the teens segment, mostly they might have already the old version of black and white Game Boy and causing them to view the products as "old technology". Forth, both for teens and new kids and tweens users are equally weighted on the marketing accessibility criteria. The last criterion which is the company objective, focusing on both on teens or new kids and tweens users, likely conforms to the company objective which is to provide products of the highest quality, but to treat every customer with attention, consideration and respect. Therefore, it is by far recommended for Nintendo Game Boy Color to target its product for the kids and the tweens segment for the unique gaming experience. As these segments had already were target markets for Nintendo, brand awareness to these segments can be done by strengthen its recognition of Nintendo Game Boy Color being the new product as well as reinforce strong preferences for the purchase intentions. 7.2 Promotion

For launching strategy, Nintendo Canada may adopt the best marketing communications mixes which are : 7.2.1 Advertising

* presentation and promotion of ideas, goods, or service by an identified sponsor * it may used television ads and points of sales materials 7.2.2 Sales promotion

* Short-term incentives to encourage trial or purchase of a product or service * It can done trough contest, low cost interactive displays and mall tours * We recommend the mall tours as the best way to promote this new Game Boy Color 7.2.3 Events and experience

* Company-sponsored activities and programs designed to create daily or special brand-related interactions such as the Cross-Canada tour 7.2.4 Public relations and publicity

* A programmes designed to promote or protect a company s image or its individual products * Nintendo may use the magazine and web publications to increase awareness and interest from consumers about their new product We suggested the best marketing communications mix for launching this new Game Boy Color are through advertising, mall tours for sales promotion and public relations. From this perspective its help presentation and promotion of ideas, goods, or service by an identified sponsor. The designed program to promote a its new products and short-term incentives to encourage trial or purchase of a product or service will increased awareness of this new Game Boy Color. The other sales promotion and experiences can be carried after the launch of Game Boy Color. 7.3 Price

We suggested pricing Game Boy Color at Cdn$120 to best satisfy factors such as profitability, consumer price sensibility and sufficient motivation for retailers to carry the product. This will remain consistent with pricing in the US. Nintendo Canada wouldn t experience proportionately lower sales than the US similar to when the original version had been launched in 1989. Prevent black market trafficking and sales from the US to Canada because of the cheaper price and produce a retail margin of 20% on Game Boy consoles. Nintendo believe that a higher sales volume will lead to lower unit costs and higher long run profit. They set the lowest price, assuming the market is price sensitive.

If the price of Game Boy Color at a lower cost of Cdn $98, this could lead to black market exporting of product to other markets and Nintendo Canada would only receive a gross margin of 5% instead of the past 6%. With a lower margin received from each Game Boy sold, retailers might chose to spend their money on carrying and aggressively marketing other game systems. 7.4 Product

A company s positioning and differentiation strategy must change as the product, market and competitors change over the Product Life Cycle (PLC). Product has a life cycle is to assert four things i. ii. iii. iv. Product have a limited life Product sales pass through distinct stages, each posing different challenges, opportunities, and problems to the seller Profits rise and fall at the different stages of the PLC Product requires different marketing, financial, manufacturing purchasing and human resources strategies in each life-cycle stage.

As the black and white version Game Boy had reached the maturity product life cycle, Nintendo should stop offering the black and white version Game Boy and this to avoid losing money producing the black and white version and avoid cannibalizing sales of Game Boy color. It will create Incentive to purchase. Nintendo also should bundle a game cartridge with Game Boy Color as teens/tweens/kids can see the difference between color and black and white games and if they think color is superior, they would keep purchasing the color games instead of just keep using their old owned black and white games. History could repeat itself with Game Boy having the same success it experienced when packaging Tetris with the original Game Boy. As the Game Boy Color is at the introduction phase, by stopping/decreased the production of black and white version may encourage users to adapt to the new product faster.

Conclusion

Nintendo has been dominating the handheld gaming for the past years which has given it brand recognition, loyalty and opportunities to identity its own target market especially in Canada. Although competitors have been stiff, Nintendo still maintains its overall advantages especially with the younger demographics. By producing more new product, Nintendo can grow its share by continuing attract younger gamers, broaden its scope of entertainment while at the same time, maintaining a kid-friendly image. With detailed launch strategy, Nintendo would be able to generate the highest possible level of profitability for Nintendo, not just with Game Boy Color, but also with more innovative products to come.

You might also like

- Nintendo Case Analysis - Dang Vinh GiangDocument25 pagesNintendo Case Analysis - Dang Vinh GiangVĩnh Giang86% (7)

- Marketing NintendoDocument9 pagesMarketing NintendoMakinde Oyedemi100% (1)

- Sony StrategyDocument15 pagesSony Strategyhkn1984No ratings yet

- Careers in Focus: Computer and Video Game Design, Third EditionFrom EverandCareers in Focus: Computer and Video Game Design, Third EditionNo ratings yet

- Echeverria Motion For Proof of AuthorityDocument13 pagesEcheverria Motion For Proof of AuthorityIsabel SantamariaNo ratings yet

- NIntendo Business StrategyDocument16 pagesNIntendo Business StrategyIrwin Prawira100% (1)

- Business PlanDocument11 pagesBusiness PlanBabyZrNo ratings yet

- Game-Based Marketing: Inspire Customer Loyalty Through Rewards, Challenges, and ContestsFrom EverandGame-Based Marketing: Inspire Customer Loyalty Through Rewards, Challenges, and ContestsRating: 3.5 out of 5 stars3.5/5 (5)

- Europe Landmarks Reading Comprehension Activity - Ver - 1Document12 pagesEurope Landmarks Reading Comprehension Activity - Ver - 1Plamenna Pavlova100% (1)

- Marketing Strategy of Nintendo Nintendo Marketing StrategyDocument6 pagesMarketing Strategy of Nintendo Nintendo Marketing StrategyHaoyang WeiNo ratings yet

- Nintendo - Game Boy ColorDocument21 pagesNintendo - Game Boy ColorJohn Raj PeresathNo ratings yet

- Crowdgaming: The Role of Crowdsourcing in the Video Games IndustryFrom EverandCrowdgaming: The Role of Crowdsourcing in the Video Games IndustryNo ratings yet

- Case Study FinalDocument22 pagesCase Study FinalRashad KhattakNo ratings yet

- How to Host a Game Night: What to Serve, Who to Invite, How to Play—Strategies for the Perfect Game NightFrom EverandHow to Host a Game Night: What to Serve, Who to Invite, How to Play—Strategies for the Perfect Game NightNo ratings yet

- Nintendo Strategy in 2009 by Dwitya AribawaDocument3 pagesNintendo Strategy in 2009 by Dwitya AribawaDwitya Aribawa100% (1)

- Strategy Management Team 5 - Nintendo Switch Case StudyDocument6 pagesStrategy Management Team 5 - Nintendo Switch Case StudyBuudha ChakrabortyNo ratings yet

- Innovation Management and New Product Development (Nintendo Wii)Document21 pagesInnovation Management and New Product Development (Nintendo Wii)Arjun Pratap Singh100% (1)

- Get in the Game: How to Level Up Your Business with Gaming, Esports, and Emerging TechnologiesFrom EverandGet in the Game: How to Level Up Your Business with Gaming, Esports, and Emerging TechnologiesNo ratings yet

- Nintendo Wii Blue Ocean StrategyDocument15 pagesNintendo Wii Blue Ocean Strategykaykscribd80% (5)

- Nintendo Wii Marketing PlanDocument13 pagesNintendo Wii Marketing PlanAzlan PspNo ratings yet

- NintendoDocument20 pagesNintendoMichael WainainaNo ratings yet

- Midterm Case GlobalDocument8 pagesMidterm Case GlobalSofia ArosteguiNo ratings yet

- Nintendo's Vision: Strong Commitment Towards Production and Marketing of Best Products and ServicesDocument28 pagesNintendo's Vision: Strong Commitment Towards Production and Marketing of Best Products and ServicesCarlo MedenillaNo ratings yet

- CASE Study Responding To The WiiDocument10 pagesCASE Study Responding To The WiiSaladSlayerNo ratings yet

- Nintendo Research PaperDocument8 pagesNintendo Research Paperhubegynowig3100% (1)

- Nintendo - Maintaining Competitive AdvantageDocument9 pagesNintendo - Maintaining Competitive Advantagealexcrowe915No ratings yet

- SMMC - G2 - (TP0) - TP Company 范睿翔 Jonathan 張博崴 Wei 陳頎翰 Hank 張明聖 Michael 楊子皜 EricDocument7 pagesSMMC - G2 - (TP0) - TP Company 范睿翔 Jonathan 張博崴 Wei 陳頎翰 Hank 張明聖 Michael 楊子皜 Ericcaroline 1307No ratings yet

- Corporative Strategy - Renewal Nintendo and LegoDocument3 pagesCorporative Strategy - Renewal Nintendo and LegoDilrabo VahobovaNo ratings yet

- Project XDocument12 pagesProject XPurnansh GuptaNo ratings yet

- WDWFDocument3 pagesWDWFDan NgugiNo ratings yet

- Nintendo Strategy CaseDocument7 pagesNintendo Strategy CaseRohit Oberoi50% (2)

- Nintendo Wii Supply Chain PaperDocument12 pagesNintendo Wii Supply Chain PaperTamer Aladin Sergany100% (2)

- HRM 370 2013 Spring Case C3 1 GametronicsDocument12 pagesHRM 370 2013 Spring Case C3 1 GametronicsEhsan KarimNo ratings yet

- Strategy Formulation and ImplementationDocument7 pagesStrategy Formulation and ImplementationHarsha VardhanNo ratings yet

- Vodc Minicase - Nintendo: The Wii Success: 1.1. CrisisDocument3 pagesVodc Minicase - Nintendo: The Wii Success: 1.1. CrisisYerson Luis CoaquiraNo ratings yet

- Strategic Management A1Document5 pagesStrategic Management A1203370245No ratings yet

- Running Head: Business Strategy Project 1 Nintendo Company StrategyDocument11 pagesRunning Head: Business Strategy Project 1 Nintendo Company StrategyAnonymous eGU01arDvNo ratings yet

- I. Analysis 1. Familiarize The CompanyDocument5 pagesI. Analysis 1. Familiarize The Companykenn benNo ratings yet

- NintendoDocument16 pagesNintendoLiew Ee Hoong100% (2)

- Strategic Analysis of Nintendo PDFDocument21 pagesStrategic Analysis of Nintendo PDFaudreen loricoNo ratings yet

- Strategic Analysis of Nintendo: MMM001 - International Strategic ManagementDocument21 pagesStrategic Analysis of Nintendo: MMM001 - International Strategic Managementaudreen loricoNo ratings yet

- Bsa2-4 - Nintendo Case Study - Om&tqm - Mendiola, Roz RainielDocument16 pagesBsa2-4 - Nintendo Case Study - Om&tqm - Mendiola, Roz RainielYes Channel100% (1)

- Mid Term Exam - CB - 19P052Document6 pagesMid Term Exam - CB - 19P052shreyanshagrawalNo ratings yet

- Wii - Creating A Blue OceanDocument12 pagesWii - Creating A Blue OceanbmobileleeNo ratings yet

- Essay 4 Final DraftDocument4 pagesEssay 4 Final Draftapi-459237053No ratings yet

- TestDocument5 pagesTestAph AmberNo ratings yet

- Nintendo's Case Study AnalysisDocument5 pagesNintendo's Case Study AnalysisRosanaNo ratings yet

- Assignment - 1 - WiiDocument17 pagesAssignment - 1 - WiiPat ChuaNo ratings yet

- (Revised) Gaming Industry-JvazquezDocument6 pages(Revised) Gaming Industry-Jvazquezjony06No ratings yet

- Nintendo's Revolution (CIA)Document14 pagesNintendo's Revolution (CIA)SAYANEE MITRA 21214098No ratings yet

- Console WarsDocument17 pagesConsole WarsAlvian Surya ChandraNo ratings yet

- 2016 Gaming Industry ReportDocument11 pages2016 Gaming Industry ReportNan Ilie-IonutNo ratings yet

- Section 1: Internal PerformanceDocument7 pagesSection 1: Internal PerformanceHieuNo ratings yet

- Nintendo Case StudyDocument3 pagesNintendo Case StudyAnne-Laure La Mongis100% (2)

- 2.1.1 Political: Safety Measures - The Political Aspect That Affects The Industry Is Mainly The Safety Measures. SafetyDocument6 pages2.1.1 Political: Safety Measures - The Political Aspect That Affects The Industry Is Mainly The Safety Measures. SafetyAngelos AntoniouNo ratings yet

- Pros and Cons of Mobile Game Development: The Upside and Downside of Developing Games For The Mobile Phone MarketDocument3 pagesPros and Cons of Mobile Game Development: The Upside and Downside of Developing Games For The Mobile Phone MarketJenica BunyiNo ratings yet

- Ninetendo Vs PlaystationDocument49 pagesNinetendo Vs PlaystationHarmanNo ratings yet

- Changing the Game (Review and Analysis of Edery and Mollick's Book)From EverandChanging the Game (Review and Analysis of Edery and Mollick's Book)No ratings yet

- Curriculum Vitae Mukhammad Fitrah Malik FINAL 2Document1 pageCurriculum Vitae Mukhammad Fitrah Malik FINAL 2Bill Divend SihombingNo ratings yet

- Entrep Bazaar Rating SheetDocument7 pagesEntrep Bazaar Rating SheetJupiter WhitesideNo ratings yet

- Weill Cornell Medicine International Tax QuestionaireDocument2 pagesWeill Cornell Medicine International Tax QuestionaireboxeritoNo ratings yet

- RSA ChangeMakers - Identifying The Key People Driving Positive Change in Local AreasDocument29 pagesRSA ChangeMakers - Identifying The Key People Driving Positive Change in Local AreasThe RSANo ratings yet

- RESO NO. 4 - LANYARD FinalDocument1 pageRESO NO. 4 - LANYARD FinalsharonleefulloNo ratings yet

- Nandurbar District S.E. (CGPA) Nov 2013Document336 pagesNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaNo ratings yet

- EMI - Module 1 Downloadable Packet - Fall 2021Document34 pagesEMI - Module 1 Downloadable Packet - Fall 2021Eucarlos MartinsNo ratings yet

- Church A Rchitecture Abbey: Throne" Ecclesia Cathedralis (In Latin)Document18 pagesChurch A Rchitecture Abbey: Throne" Ecclesia Cathedralis (In Latin)Pat GeronzNo ratings yet

- Pre T&C Checklist (3 Language) - Updated - 2022 DavidDocument1 pagePre T&C Checklist (3 Language) - Updated - 2022 Davidmuhammad farisNo ratings yet

- Gastric Emptying PresentationDocument8 pagesGastric Emptying Presentationrahul2kNo ratings yet

- People Vs Felipe Santiago - FCDocument2 pagesPeople Vs Felipe Santiago - FCBryle DrioNo ratings yet

- Contoh RPH Ts 25 Engish (Ppki)Document1 pageContoh RPH Ts 25 Engish (Ppki)muhariz78No ratings yet

- MSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKDocument19 pagesMSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKLSBRNo ratings yet

- Narrative ReportDocument6 pagesNarrative ReportAlyssa Marie AsuncionNo ratings yet

- Curriculum Vitae: Personal InformationDocument3 pagesCurriculum Vitae: Personal InformationMira ChenNo ratings yet

- What Is SCOPIC Clause - A Simple Overview - SailorinsightDocument8 pagesWhat Is SCOPIC Clause - A Simple Overview - SailorinsightJivan Jyoti RoutNo ratings yet

- Network Function Virtualization (NFV) : Presented By: Laith AbbasDocument30 pagesNetwork Function Virtualization (NFV) : Presented By: Laith AbbasBaraa EsamNo ratings yet

- Charles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsDocument20 pagesCharles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsRizki AuliaNo ratings yet

- Chain of CommandDocument6 pagesChain of CommandDale NaughtonNo ratings yet

- DLL LayoutDocument4 pagesDLL LayoutMarife GuadalupeNo ratings yet

- LM213 First Exam Notes PDFDocument7 pagesLM213 First Exam Notes PDFNikki KatesNo ratings yet

- Economies of Scale in European Manufacturing Revisited: July 2001Document31 pagesEconomies of Scale in European Manufacturing Revisited: July 2001vladut_stan_5No ratings yet

- L 1 One On A Page PDFDocument128 pagesL 1 One On A Page PDFNana Kwame Osei AsareNo ratings yet

- Test AmeeshDocument7 pagesTest AmeeshUdit DravidNo ratings yet

- KalamDocument8 pagesKalamRohitKumarSahuNo ratings yet

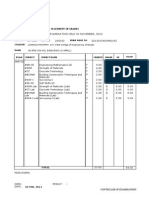

- Account Statement From 1 Jan 2017 To 30 Jun 2017Document2 pagesAccount Statement From 1 Jan 2017 To 30 Jun 2017Ujjain mpNo ratings yet

- CGP Module 1 FinalDocument19 pagesCGP Module 1 Finaljohn lexter emberadorNo ratings yet

- SULTANS OF SWING - Dire Straits (Impresión)Document1 pageSULTANS OF SWING - Dire Straits (Impresión)fabio.mattos.tkd100% (1)