Professional Documents

Culture Documents

VP Finance & Controller

Uploaded by

api-122240965Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VP Finance & Controller

Uploaded by

api-122240965Copyright:

Available Formats

PABLO F. SANCHEZ, CPA 22-62 78th Street Astoria, NY 11370 (917) 562-3675 ps1e485e6@westpost.

net FINANCE EXECUTIVE/CONTROLLER Trusted, hands-on CPA, Finance & Accounting executive with Big 4 Accounting back ground, and extensive public, private and international company experience in th e financial services, media and online segments. Expertise spans all facets of Finance & Accounting with emphasis on month/quarte r/year-end financial reporting. Performed GAAP reconciliations for banks in the US, Mexico, Spain, and Italy and for corporate IPOs. Record of building scalable financial infrastructure (people, policies, processe s and systems) to support average annual revenue growth up to 17% over 11 years -- from zero to $23M net revenue at Gannaway Web Holdings. Sophisticated audit experience with diverse Fortune 500 companies, foreign banks and broker dealers. Able to develop and retain top talent. Fluent English and Spanish and extensive multicultural experience. CORE COMPETENCIES * Strategic Planning * Accounting Operations * Financial Reporting * Key Performance Metrics * Capital Management * Budgets & Forecasts * Revenue Recognition * Asset Impairment * Discontinued Operations * Capitalized Software * Policy Development * Process Improvement * Systems Implementations * SEC & GAAP Compliance

PROFESSIONAL HISTORY GANNAWAY WEB HOLDINGS New York, NY 2000-Present VP, of Finance & Controller Key member of management team FOR $17M Internet broadcast/media solutions servic e provider (d/b/a WorldNow). Built company from start up through high growth, restructuring due to dot-com co llapse, and financial turnaround. Direct all financial systems, processes, polic ies, and 12 staff. Scope spans accounting operations (G/L, A/R, A/P, reconciliat ions, and more); design and execution of financial reporting, key metrics and ma nagement discussion analysis; budgets and forecasts; GAAP compliance and interna l controls. Emphasis on ensuring proper revenue recognition for 50+ software lic ensing contracts. ** Built financial infrastructure (systems, processes, policies, and people) to support extreme growth phase (to $23M peak revenue). ** Led enterprise restructuring in 2001, including downsizing from 155 employees to 65 employees (58% drop) driving out $2M in expenses. Restructure was critica l to company`s longevity and current success. ** Converted $14M debt to equity, saving $1.3M interest expense annually. Opened

new avenues of debt financing with $4M in computer leases. ** Achieved clean audit opinions for 11 consecutive years. ** Created numerous financial models projecting revenue for license fees, banner ads, streaming video, desktop applications, and sponsorship programs. Created a valuation tool (using the Black Scholes model) to calculate the fair value for options and warrants. SANCHEZ PROFESSIONAL SERVICES LLC New York, NY 1999-2000 Principal/Project Manager Execute consulting engagements for diverse dot.com and nonprofit companies. Scop e includes management of finance and accounting operations, auditing and special accounting projects. ** Served as Controller for 5 KPMG LLP Web-based clients: Espernet.com, Innernet .com, Netplus.com, ISOC.com, and Internet Nebraska.com. ** Converted books and records from cash basis accounting to accrual basis accou nting for IPO purposes for 5 Internet companies. ** Audited and/or assisted 6 non-profit organizations in the planning and execut ion of accounting projects. Clients included Part of the Solution, The Education Alliance, The Point Development Corporation, The Puerto Rican BAR Association, True Worship Church, and West Side Campaign Against Hunger. KPMG LLP New York, NY 1998-1999 Senior Audit Manager Recruited to audit multibillion-dollar foreign banks and broker dealers for glob al Big 4 public accounting firm. Trained 5 staff and led team in concurrent audits for clients such as ING Baring s Furman Selz, NatWest Markets, Republic Securities, Ryan Beck, Banco Bilbao Viz caya, Banco Nacional de Mexico, and Banco do Brasil ** Evaluated client internal controls. Created account risk analysis and schedul ed audits based on risk assessment. ** Cross sold $200k worth of internal audit services to Excel Bank. MERRILL LYNCH & CO. New York, NY 1996-1998 AVP & Capital Markets Auditor Audited diverse divisions for world leader in financial management and investmen t advisory services, including Listed Block Trading (equities, option, bonds); P rofessional Clearing Corporation (PCC); International Bank (foreign exchange); a nd Government Securities Inc. Puerto Rico (Repurchase and Reverse Repurchase boo k). ** Audited Professional Clearing Corp. amidst SEC clearing house sweep. Audit wo rk papers were adopted as industry standard and PCC was one of only a few remain ing clearing houses after SEC review. PREVIOUS FINANCE & AUDITING EXPERIENCE: SANIZ TELECOM INC. VP & Interim Chief Financial Officer 1995-1996 BANCO INTERNACIONAL S.A. (Mexico) Audit Manager 1994-1995 ARTHUR ANDERSEN & CO. Experienced Audit Senior

1990-1994 EDUCATION & CREDENTIALS Bachelor of Business Administration, Accounting, Baruch College, City University of New York Certified Public Accountant (CPA) -- State of New York PROFESSIONAL AFFILIATIONS American Institute of Certified Public Accountants (AICPA) American College of Forensic Examiners International, Inc. New York State Society of Certified Public Accountants FENG (Financial Executives Networking Group) State of New York Appointed Court Guardian/Evaluator MILITARY EXPERIENCE US Marine Corps, 1980-1984

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Final Exam SampleDocument11 pagesFinal Exam SampleFelixEternityStabilityNo ratings yet

- Whether Court Can Rely On Documents Which Are Not Exhibited?Document22 pagesWhether Court Can Rely On Documents Which Are Not Exhibited?lawwebinNo ratings yet

- Working Capital Management in Sirpur PaperDocument82 pagesWorking Capital Management in Sirpur Paper2562923No ratings yet

- Report Format Baru Sept SafetyDocument12 pagesReport Format Baru Sept SafetyDylanNo ratings yet

- Football'S Back With A Dramatic Turnaround: United Stun City RivalsDocument28 pagesFootball'S Back With A Dramatic Turnaround: United Stun City RivalsCity A.M.No ratings yet

- Axxerion WorkflowDocument13 pagesAxxerion WorkflowKonrad SzakalNo ratings yet

- 1 MW BrochureDocument4 pages1 MW BrochureJose VicenteNo ratings yet

- Nit 1Document7 pagesNit 1AnilKChoudharyNo ratings yet

- WSMDocument4 pagesWSMWaseem MughalNo ratings yet

- ASME History, Overview and Membership BenefitsDocument33 pagesASME History, Overview and Membership BenefitsRaees SwatiNo ratings yet

- Evidence of Market Manipulation in The Financial CrisisDocument21 pagesEvidence of Market Manipulation in The Financial Crisiscapatul14No ratings yet

- Beginner Tutorials: Salesforce Coding Lessons For The 99%Document85 pagesBeginner Tutorials: Salesforce Coding Lessons For The 99%Ram KumarNo ratings yet

- KSIs KSFsDocument61 pagesKSIs KSFsDavid HermanNo ratings yet

- Import SampleDocument17 pagesImport SampleZED AAR LOGISTICSNo ratings yet

- Finance Project Presentation Dollar Vs RupeeDocument14 pagesFinance Project Presentation Dollar Vs RupeeDhruv ShahNo ratings yet

- Facts of The Case:: (G.R. No. 32329. March 23, 1929.) in Re Luis B. Tagorda Duran & Lim For RespondentDocument2 pagesFacts of The Case:: (G.R. No. 32329. March 23, 1929.) in Re Luis B. Tagorda Duran & Lim For RespondentCherry BepitelNo ratings yet

- Ak - Keu (Problem)Document51 pagesAk - Keu (Problem)RAMA100% (9)

- 32 San Jose VS NLRCDocument14 pages32 San Jose VS NLRCJan Niño JugadoraNo ratings yet

- Commercial Dispatch Eedition 1-27-19Document28 pagesCommercial Dispatch Eedition 1-27-19The DispatchNo ratings yet

- Appendix 2.1 First Screen Part 1: Strength of Business IdeaDocument4 pagesAppendix 2.1 First Screen Part 1: Strength of Business IdeaMohammad ArslaanNo ratings yet

- IT Consulting RevisionDocument98 pagesIT Consulting RevisionChintan BhankhariaNo ratings yet

- Australian/New Zealand Standard: Wet Area MembranesDocument7 pagesAustralian/New Zealand Standard: Wet Area MembranesGopi KrishnanNo ratings yet

- Cost Leadership and Differentiation An Investigation of The Fundamental Trade-OffDocument38 pagesCost Leadership and Differentiation An Investigation of The Fundamental Trade-Offjulie100% (3)

- Comparative Vs Competitive AdvantageDocument19 pagesComparative Vs Competitive AdvantageSuntari CakSoenNo ratings yet

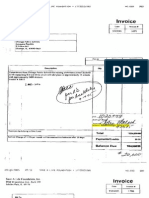

- $24.5K Paid From Office of Chicago Public School CEO Arne Duncan To Save-A-Life Foundation, 9/6+28/05Document2 pages$24.5K Paid From Office of Chicago Public School CEO Arne Duncan To Save-A-Life Foundation, 9/6+28/05deanNo ratings yet

- Quiz 102 Part 2Document3 pagesQuiz 102 Part 2Madie sanNo ratings yet

- B203B-Week 4 - (Accounting-1)Document11 pagesB203B-Week 4 - (Accounting-1)ahmed helmyNo ratings yet

- The Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Document23 pagesThe Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Sanjay ParekhNo ratings yet

- Corporate IdentityDocument64 pagesCorporate IdentityGeetanshi Agarwal100% (1)

- Ad Copy That SellsDocument58 pagesAd Copy That SellsMonica Istrate100% (21)