Professional Documents

Culture Documents

FM11 CH 04 Mini Case

Uploaded by

Amjad IqbalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM11 CH 04 Mini Case

Uploaded by

Amjad IqbalCopyright:

Available Formats

4/27/2003

CHAPTER 4 MINI CASE

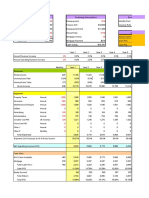

SITUATION Assume that you recently graduated with a major in finance, and you just landed a job as a financial planner with Barney Smith Inc., a large financial services corporation. Your first assignment is to invest $100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1 year holding period. Further, your boss has restricted you to the following investment alternatives, shown with their probabilities and associtated outcomes.

Barney Smith's economic forecasting staff has developed estimates for the state of the economy and its security analyst have developed a sophisticated computer program which was used to estimate the rate of return on each state of the economy. Alta Industries, Inc. is an electronics firm; Repo Men Inc. collects past due debts; and American Foam manufactures mattresses and various other foam products. Merril Finch also maintains an "index fund" which owns a market-weighted fraction of all publicly traded stocks; you can invest in that fund, and thus obtain average stock market results. Given the situation as described, answer the following questions.

State of Economy Recession Below Average Average Above Average Boom

Probability 0.1 0.2 0.4 0.2 0.1

T-Bills 8.00% 8.00% 8.00% 8.00% 8.00%

Alta Inds. -22.00% -2.00% 20.00% 35.00% 50.00%

American Repo Men Foam 28.00% 10.00% 14.70% -10.00% 0.00% 7.00% -10.00% 45.00% -20.00% 30.00%

Market Port. -13.00% 1.00% 15.00% 29.00% 43.00%

2-Stock Portfolio 3.00% 10.00% 15.00%

Return on Investment a. What is the return on an investment that costs $1,000 and is sold a year later for $1,100? Inputs Amount Invested Amount Received

$1,000 $1,100

Dollar Return = Dollar Return =

$Received $1,100 $100

$Invested $1,000

Percentage Return = Percentage Return =

$Return $100 10.00%

/ /

$Invested $1,000

Probability Distribution

Stock X

Riskier Stock

Stock Y Rate of -20 0 50

Returns on Alternative Investments Estimated Rate of Return

b. (1.) Why is the T-bill's return independent of the state of the economy? Do T-bills promise a completely risk-free return? Answer: See Ch 04 Mini Case Show. (2.) Why are Alta Inds' returns expected to move with the economy whereas Repo Men's are expected to move counter to the economy? Answer: See Ch 04 Mini Case Show. c. Calculate the expected rate of return on each alternative. American Repo Men Foam 1.74% 13.80%

T-Bills 8%

Alta Inds. 17.40%

Market Port. 18.50%

d. You should recognize that basing a decision solely on expected returns is only appropriate for risk-neutral individuals. Since your client, like virtually everyone, is risk averse, the riskiness of each alternative is an important aspect of the decision. One possible measure of risk is the standard deviation of returns Harcourt, Inc. items and derived items copyright 2002 by Harcourt, Inc.

Since your client, like virtually everyone, is risk averse, the riskiness of each alternative is an important aspect of the decision. One possible measure of risk is the standard deviation of returns (1.) Calculate the standard deviation for each alternative. American Repo Men Foam 13.4% 18.8%

Standard Deviat

T-Bills 0%

Alta Inds. 20.0%

Market Port. 15.7%

(2.) What type of risk is measured by the standard deviation? Answer: See Ch 04 Mini Case Show

(3.) Draw a graph which shows roughly the shape of the probability distributions for Alta Inds., American Foam, and Tbills. Prob. T-Bill

Am. Foam Alta Inds

17.4

Rate of Return %

e. Suppose you suddenly remembered that the coefficient of variation (CV) is generally regarded as being a better measure of stand-alone risk than the standard deviation when the alternatives being considered have widely differing expected 1 returns. Calculate the missing CVs and fill in the blanks on the row for CV in the table above. Does the CV produce the same risk rankings as the standard deviation? Expected Return vs. Risk Risk Expected (Standard Return Deviation) Security HT Market USR T-bills Repo Men 17.40% 18.50% 13.80% 8.00% 1.74% 20.0% 15.7% 18.8% 0% 13.4% American Repo Men Foam 7.68 1.36

CV

T-Bills 0.00

Alta Inds. 1.15

Market Port. 0.85

f. Suppose you created a 2-stock portfolio by investing $50,000 in Alta Inds. and $50,000 in Repo Men. (1.) Calculate the expected return, the standard deviation, and the coefficient of variation (CVp) for this portfolio and fill in the appropriate blanks in the table above. (2.) How does the risk of this 2-stock portfolio compare with the risk of the individual stocks if they were held in isolation? Answer: See Ch 04 Mini Case Show PORTFOLIO RETURNS The expected return on a portfolio is simply a weighted average of the expected returns of the individual assets in the portfolio. Consider the following portfolio. Portfolio weight 0.5 0.5 9.6% 3.3% Expected Return 17.4% 1.7%

Stock Alta Inds. Repo Men rp Standard Dev.

Estimate Portfolio Return Recession 3.00% Below Avg. 6.35% Average 10.00% Above Average 12.50% Boom 15.00%

g. Suppose an investor starts with a portfolio consisting of one randomly selected stock. What would happen (1) to the risk and (2) to the expected return of the portfolio as more and more randomly selected stocks were added to the portfolio? What is the implication for investors? Draw a graph of the two portfolios to illustrate your answer. PORTFOLIO RISK Perfect Negative Correlation The standard deviation of a portfolio is generally not a weighted average of individual standard deviations--usually, it is much lower than the weighted average. The portfolio's SD is a weighted average only if all the securities in it are perfectly positively correlated, which is almost never the case. In the equally rare case where the stocks in a portfolio are perfectly negatively correlated, we can create a portfolio with absolutely no risk. Such is the case for the next example of Portfolio WM, a portfolio composed equally of Stocks W and M. Portfolio WM

Harcourt, Inc. items and derived items copyright 2002 by Harcourt, Inc.

Year Stock W returns M returnsEqually weighted avg.) Stock ( 1997 40% -10% 15% 1998 -10% 40% 15% 1999 35% -5% 15% 2000 -5% 35% 15% 2001 15% 15% 15% Average return 15% 15% 15% Standard deviati 22.64% 22.64% 0.00% -1.00 Correlation Coefficient

These two stocks are perfectly negatively correlated--when one goes up, the other goes down by the same amount. We could use Excel's correlation function to find the correlation, but when exact positive or negative correlation occurs, an error message is given. We demonstrate correlation in a later section.

Perfect Positive Correlation. Now suppose the stocks were perfectly positively correlated, as in the following example: Year Stock M returns M' returns Stock Portfolio MM' 1997 -10% -10% -10% 1998 40% 40% 40% 1999 -5% -5% -5% 2000 35% 35% 35% 2001 15% 15% 15% Average return 15% 15% 15% Standard deviati 22.64% 22.64% 22.64% Correlation Coefficient 1.00 With perfect positive correlation, the portfolio is exactly as risky as the individual stocks. Partial Correlation. Now suppose the stocks are positively but not perfectly so, with the following returns. What is the portfolio's expected return, standard deviation, and correlation coefficient? Year Stock W returns Stock Y returns ortfolio WY P 1997 40% 28% 34% 1998 -10% 20% 5% 1999 35% 41% 38% 2000 -5% -17% -11% 2001 15% 3% 9% Average return 15% 15% 15% Standard deviati 22.64% 22.57% 20.63% Correlation coefficient 0.67 Here the portfolio is less risky than the individual stocks contained in it.

We found the correlation coefficient by using Excel's "CORREL" function. Click the wizard, then Statistical, then CORREL, and then use the mouse to select the ranges for stocks W and Y's returns. The correlation here is about what we would expect for two randomly selected stocks. Stocks in the same industry would tend to be more highly correlated than stocks in different industries. Adding more stocks to a portfolio The standard deviation of the portfolio would decrease because the stocks being added are not perfectly correlated. The expected return of the portfolio would remain relatively constant.

PROB.

Large

Two

One

0 15 Stand. Dev 1=

RETURN Stand. Dev. Lg. =

Stand .

Company Specific Stand Alone Risk

Harcourt, Inc. items and derived items copyright 2002 by Harcourt, Inc.

Market Risk

10

20

30

40 # Stocks in Port.

2000+

h. (1.) Should portfolio effects impact the way investors think about the risk of individual stocks? Answer: See Ch 04 Mini Case Show (2.) If you decided to hold a 1-stock portfolio, and consequently were exposed to more risk than diversified investors, could you expect to be compensated for all of your risk; that is, could you earn a risk premium on that part of your risk that you could have eliminated by diversifying? Answer: See Ch 02 Mini Case Show Market Risk The part of a security's stand alone risk that cannot be diversified away. Stand-Alone Risk = Market Risk + Diversifiable Risk Diversifiable Risk The part of a security's stand alone risk that can be diversified away. i. How is risk measured for individual securities? How are beta coefficients calculated? THE CONCEPT OF BETA The beta coefficient reflects the tendency of a stock to move up and down with the market. An average-risk stock moves equally up and down with the market and has a beta of 1.0. Beta is found by regressing the stock's returns against returns on some market index. It is also useful to show graphs with individual stocks' returns on the vertical axis and market returns on the horizontal axis. The slopes of the lines represent the stocks betas.

j. Suppose you have the following historical returns for the stock market and for another company,P.Q. Unlimited. Explain how to calculate beta, and use the historical stock returns to calculate the beta for PQU. Interpret your results. Year 1 2 3 4 5 6 7 8 9 10 Market 26% 8% -11% 15% 33% 14% 40% 10% -11% -13% PQU 40% -15% -15% 35% 10% 30% 42% -10% -25% 25%

Run a regression with returns on the stock in question plotted on the Y axis and returns on the market portfolio plotted on the X axis. The slope of the regression line, which measures relative volatility, is defined as the stocks beta coefficient, or b.

The regression line, and hence beta, can be found using a calculator with a regression function or a spreadsheet program. In this example, b = 0.83.

Calculating Beta for PQU

50% 40% 30% KWE Return 20%

Beta

y = 0.8308x + 0.0256 R = 0.3546

10%

Linear (Beta)

To show the regression equation on the chart, follow these instructions: (1) select the chart with your cursor; (2) click on Chart on the menu bar (the menu will only show Chart if your cursor has already selected the embedded chart); (3) Choose the item Add Trendline...; (4) select the tab Options; (5) check the boxes for Display Equation and Display R-squared. An even easier way to calculate beta, as shown below, is to use the function wizard to select the SLOPE function: Beta (using the SLOPE function)=

0% -20% -10% -20% -30% Market Return 0% 20% 40% 60%

0.8308

k. The expected rates of return and the beta coefficients of the alternatives as supplied by Barney Smith's computer program are as follows: Expected Return vs. Required Return Expected Return 17.40% Required Return 17.0%

Security Alta

Harcourt, Inc. items and derived items copyright 2002 by Harcourt, Inc.

Market Am Foam T-bills Repo Men

15.00% 13.80% 8.00% 1.70%

15.0% 12.8% 8.0% 2.0%

(1.) Do the expected returns appear to be related to each alternative's market risk? Answer: See Ch 04 Mini Case Show (2.) Is it possible to choose among the alternatives on the basis of the information developed thus far? Answer: See Ch 04 Mini Case Show

l. (1.) Write out the Security Market Line (SML) equation, use it to calculate the required rate of return on each alternative, and then graph the relationship between the expected and required rates of return. THE SECURITY MARKET LINE The Security Market Line shows the relationship between a stock's beta and its expected return. Risk-free rate (Varies over tim Market return (Also varies ove Risk Premium Expected Return 17.4% 15.0% 13.8% 8.0% 1.7% 8% 15% 7%

Security Alta Market Am Foam T-bills Repo Men

Risk 1.29 1.00 0.68 0.00 (0.86)

Beta 1.29 1.00 0.68 0.00 -0.86

Required Return 17.0% 15.0% 12.8% 8.0% 2.0%

Required Rates of Return SML equation = ri = Alta Market Am. Foam T-bills Repo Men 17.0% 15.0% 12.8% 8.0% 2.0%

rrf

(RPM)* b

Security Market Line

18.0% 16.0% 14.0% Required Return 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -1.00 -0.50 0.00 Beta 0.50 1.00 1.50

SML Linear (SML)

(2.) How do the expected rates of return compare with the required rates of return? (3.) Does the fact that Repo Men has an expected return which is less than the T-bill rate make any sense? (4.) What would be the market risk and the required return of a 50-50 portfolio of Alta Inds. and Repo Men? Answer: See Ch 02 Mini Case Show Security Alta Market Am. Foam T-bills Repo Men Expected Return 17.4% 15.0% 13.8% 8.0% 1.7% Required Return 17.0% 15.0% 12.8% 8.0% 2.0%

Undervalued Fairly Valued Undervalued Fairly Valued Overvalued

m. (1.) Suppose investors raised their inflation expectations by 3 percentage points over current estimates as reflected in the 8 percent T-bill rate. What effect would higher inflation have on the SML and on the returns required on high- and lowrisk securities? (2.) Suppose instead that investors' risk aversion increased enough to cause the market risk premium to increase by 3 percentage points. (Inflation remains constant.) What effect would this have on the SML and on returns of high- and lowrisk securities?

The Security Market Line shows the projected changes in expected return, due to changes in the beta coefficient. However, we can also look at the potential changes in the required return due to variation of other factors, namely the market return and risk-free rate. In other words, we can see how required returns can be influenced by changing inflation and risk aversion. The level of investor risk aversion is measured by the market risk premium (rm-rrf), which is also the slope of the

Harcourt, Inc. items and derived items copyright 2002 by Harcourt, Inc.

SML. Hence, an increase in the market return results in an increase in the maturity risk premium, other things held constant. We will look at two potential conditions as shown in the following columns: Scenario 1. Inflation Increases: Old Risk-free Rate Change in inflation New Risk-free Rate Old Market Risk Premium Increase in MRP New Market Risk Premium Beta Required Return Scenario 2. Investors become more risk averse: Old Risk-free Rate 8% Change in inflation 0% New Risk-free Rate 8% Old Market Risk Premium 7% Increase in MRP 3.0% New Market Risk Premium 10.0% Beta 1.00 Required Return 18.0%

8% 3% 11% 7% 0.0% 7.0% 1.00 18.0%

Now, we can see how these two factors can affect a Security Market Line, by creating a table for the required return with different beta coefficients. Required Return Original Increased Increased Situation Inflation MRP Beta 0.00 0.50 1.00 1.50 2.00 8.00% 11.50% 15.00% 18.50% 22.00% 11.00% 14.50% 18.00% 21.50% 25.00% 8.00% 13.00% 18.00% 23.00% 28.00%

The SML Under Different Conditions

30.00%

Original

25.00% Required Return 20.00% 15.00% 10.00% 5.00% 0.00% 0.00

Increased Inflation Increase risk aversion Linear (Original) Linear (Increased Inflation)

1.00 Beta

2.00

3.00

Linear (Increase risk aversion)

The graph shows that as risk as measured by beta increases, so does the required rate of return on securities. However, the required return for any given beta varies depending on the position and slope of the SML.

Harcourt, Inc. items and derived items copyright 2002 by Harcourt, Inc.

You might also like

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Mini Case On Risk Return 1-SolutionDocument27 pagesMini Case On Risk Return 1-Solutionjagrutic_09No ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisSharmila DeviNo ratings yet

- Performing Monte Carlo Simulations in Crystal BallDocument16 pagesPerforming Monte Carlo Simulations in Crystal BallVishwanath VerenkarNo ratings yet

- FM11 CH 07 Mini CaseDocument12 pagesFM11 CH 07 Mini CaseMariam Sharif100% (2)

- Ch07 Tool KitDocument21 pagesCh07 Tool KitQazi Mohammed AhmedNo ratings yet

- Example of Monte Carlo Simulation - Vose Software: #Addin?Document33 pagesExample of Monte Carlo Simulation - Vose Software: #Addin?Anass CherrafiNo ratings yet

- Helius Medical Technologies Mackie Initiation June 2016Document49 pagesHelius Medical Technologies Mackie Initiation June 2016Martin TsankovNo ratings yet

- DuPoint AnalysisDocument10 pagesDuPoint AnalysisNishanth M S HebbarNo ratings yet

- BOND PRICING DURATIONDocument19 pagesBOND PRICING DURATIONShruti SankarNo ratings yet

- Corporate Finance: Risk Analysis ReportDocument3 pagesCorporate Finance: Risk Analysis ReportJasdeep Singh KalraNo ratings yet

- 001 7-Steps-Template-of-Financial-Statements-and-Modeling-and-ValuationDocument113 pages001 7-Steps-Template-of-Financial-Statements-and-Modeling-and-ValuationAbhinav VermaNo ratings yet

- Vcel PDFDocument30 pagesVcel PDFAnonymous XGz2JENo ratings yet

- LBO Model Historical FinancialsDocument4 pagesLBO Model Historical Financialsharshalp1212No ratings yet

- ACE-9 - VSWR Meter Scrapping BSS Sub Div KLMDocument3 pagesACE-9 - VSWR Meter Scrapping BSS Sub Div KLMSDE BSS KollamNo ratings yet

- Reverse Discounted Cash FlowDocument11 pagesReverse Discounted Cash FlowSiddharthaNo ratings yet

- MonteCarlito v1 10-2Document9 pagesMonteCarlito v1 10-2MarkNo ratings yet

- Scoring and Predicting Risk PreferencesDocument22 pagesScoring and Predicting Risk PreferencesertekgNo ratings yet

- Myriad Genetics Coverage ReportDocument8 pagesMyriad Genetics Coverage ReportChazz262No ratings yet

- Detailed Tables Are Provided in The Appendix at The EndDocument9 pagesDetailed Tables Are Provided in The Appendix at The Endanil1820No ratings yet

- Financial Modeling of TCS LockDocument43 pagesFinancial Modeling of TCS LockSiddhesh GurjarNo ratings yet

- Analysis of Sumsung Annual ReportDocument11 pagesAnalysis of Sumsung Annual ReportEr YogendraNo ratings yet

- German Dataset TasksDocument6 pagesGerman Dataset TasksPrateek SinghNo ratings yet

- Assignment Due September 8Document9 pagesAssignment Due September 8Alexander UrvinaNo ratings yet

- JPM - 021914 - 123336 Bloomberg Report (Luxottica Group)Document6 pagesJPM - 021914 - 123336 Bloomberg Report (Luxottica Group)reginetalucodNo ratings yet

- Test 3 Project Finance Case Question Yogesh GandhiDocument14 pagesTest 3 Project Finance Case Question Yogesh GandhiYogi GandhiNo ratings yet

- Gary Brode of Silver Arrow Investment Management: Long NCRDocument0 pagesGary Brode of Silver Arrow Investment Management: Long NCRcurrygoatNo ratings yet

- Discounted Cash Flow ValuationDocument16 pagesDiscounted Cash Flow ValuationvarunjajooNo ratings yet

- Valuation-Dividend Discount ModelDocument23 pagesValuation-Dividend Discount Modelswaroop shettyNo ratings yet

- FINA, CIVE, ENMG Courses in Business, Civil Engineering & ManagementDocument5 pagesFINA, CIVE, ENMG Courses in Business, Civil Engineering & Managementnassif75No ratings yet

- Actuaries 4Document69 pagesActuaries 4MuradNo ratings yet

- Shareholder structure and financial modeling insightsDocument20 pagesShareholder structure and financial modeling insightsabdul5721No ratings yet

- Venture Capital: Now and After The Dotcom CrashDocument41 pagesVenture Capital: Now and After The Dotcom CrashNestaNo ratings yet

- Total Amount To Invest:: Moderate Risk ToleranceDocument3 pagesTotal Amount To Invest:: Moderate Risk ToleranceElaineNo ratings yet

- Climate Fintech App Pitch Deck by SlidesgoDocument41 pagesClimate Fintech App Pitch Deck by SlidesgoAfif Dwijayanto, S.Si.No ratings yet

- 09 JAZZ Equity Research ReportDocument9 pages09 JAZZ Equity Research ReportAfiq KhidhirNo ratings yet

- Equity Research ReportDocument7 pagesEquity Research Reportjyoti_prakash_11No ratings yet

- Investor Guide BookDocument169 pagesInvestor Guide BooktonyvinayakNo ratings yet

- MioPocket ChangelogDocument59 pagesMioPocket ChangelogMaría José AntúnezNo ratings yet

- MioPocket ReadmeDocument27 pagesMioPocket ReadmeMon CeleronNo ratings yet

- Days-Sales-Outstanding-TemplateDocument3 pagesDays-Sales-Outstanding-TemplateKaren Anne Pineda IngenteNo ratings yet

- Report On Performance AnalysisDocument62 pagesReport On Performance Analysisjaved_90319279No ratings yet

- India Pharma Sector - Sector UpdateDocument142 pagesIndia Pharma Sector - Sector Updatekushal-sinha-680No ratings yet

- Maximizing Client Yield Within Risk ConstraintsDocument20 pagesMaximizing Client Yield Within Risk ConstraintschristinekehyengNo ratings yet

- Ganje M FINC600 Week 5 Due Feb 9Document6 pagesGanje M FINC600 Week 5 Due Feb 9Nafis HasanNo ratings yet

- RC Equity Research Report Essentials CFA InstituteDocument3 pagesRC Equity Research Report Essentials CFA InstitutetheakjNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- CHM271 - Chapter 7 - Colloid - Surface ChemistryDocument45 pagesCHM271 - Chapter 7 - Colloid - Surface Chemistryhidayahtul adhaNo ratings yet

- Medtronic Investor Meeting - Omar IshrakDocument19 pagesMedtronic Investor Meeting - Omar IshrakmedtechyNo ratings yet

- ProcessDocument61 pagesProcesskodiraRakshithNo ratings yet

- Statement of Cash Flows Indirect MethodDocument3 pagesStatement of Cash Flows Indirect MethodheykmmyNo ratings yet

- A Detailed Comparison Between AtRisk ModelRisk and Crystal Ball PDFDocument11 pagesA Detailed Comparison Between AtRisk ModelRisk and Crystal Ball PDFkamaraNo ratings yet

- Creditrisk Credit SuisseDocument92 pagesCreditrisk Credit SuisseAdarsh Kumar50% (6)

- Eileen Segall of Tildenrow Partners: Long On ReachLocalDocument0 pagesEileen Segall of Tildenrow Partners: Long On ReachLocalcurrygoatNo ratings yet

- What Do High-Growth Firms in The United States and Europe Teach Policymakers?Document8 pagesWhat Do High-Growth Firms in The United States and Europe Teach Policymakers?German Marshall Fund of the United StatesNo ratings yet

- Monthly Portfolio Oct 22Document583 pagesMonthly Portfolio Oct 22ribhu singhNo ratings yet

- Safal Niveshak Stock Analysis Excel GuideDocument37 pagesSafal Niveshak Stock Analysis Excel GuideBandaru NarendrababuNo ratings yet

- FM11 CH 04 Mini-Case Old6Document19 pagesFM11 CH 04 Mini-Case Old6AGNo ratings yet

- Merrill Finch IncDocument7 pagesMerrill Finch IncAnaRoqueniNo ratings yet

- 2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing ModelDocument51 pages2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing Model'Osvaldo' RioNo ratings yet

- Rural Marketing Presention - WIPDocument31 pagesRural Marketing Presention - WIPRuee TambatNo ratings yet

- ULI Europe Reshaping Retail - Final PDFDocument30 pagesULI Europe Reshaping Retail - Final PDFFong KhNo ratings yet

- 8 Edsa Shangri-La Hotel Vs BF CorpDocument21 pages8 Edsa Shangri-La Hotel Vs BF CorpKyla Ellen CalelaoNo ratings yet

- Century 21 Broker Properti Jual Beli Sewa Rumah IndonesiaDocument2 pagesCentury 21 Broker Properti Jual Beli Sewa Rumah IndonesiaAyunk SyahNo ratings yet

- Computer Shopee - Final Project SummaryDocument3 pagesComputer Shopee - Final Project Summarykvds_2012No ratings yet

- NDRRMF GuidebookDocument126 pagesNDRRMF GuidebookS B100% (1)

- Silicon Valley Competitiveness AND Innovation Project - 2017 ReportDocument1 pageSilicon Valley Competitiveness AND Innovation Project - 2017 ReportFJ ERNo ratings yet

- The Girl of Fire and Thorns Discussion GuideDocument1 pageThe Girl of Fire and Thorns Discussion GuidePitchDark100% (1)

- Logistics AssignmentDocument15 pagesLogistics AssignmentYashasvi ParsaiNo ratings yet

- Benito Mussolini - English (Auto-Generated)Document35 pagesBenito Mussolini - English (Auto-Generated)FJ MacaleNo ratings yet

- Apg-Deck-2022-50 - Nautical Charts & PublicationsDocument1 pageApg-Deck-2022-50 - Nautical Charts & PublicationsruchirrathoreNo ratings yet

- Mutual Fund: Advnatages and Disadvantages To InvestorsDocument11 pagesMutual Fund: Advnatages and Disadvantages To InvestorsSnehi GuptaNo ratings yet

- XTRO Royal FantasyDocument80 pagesXTRO Royal Fantasydsherratt74100% (2)

- JPM The Audacity of BitcoinDocument8 pagesJPM The Audacity of BitcoinZerohedge100% (3)

- 2Nd Regional Conference of Amarc Asia PacificDocument9 pages2Nd Regional Conference of Amarc Asia PacificAMARC - Association mondiale des radiodiffuseurs communautairesNo ratings yet

- Writ of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Document2 pagesWrit of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Judicial_FraudNo ratings yet

- Lec 2 IS - LMDocument42 pagesLec 2 IS - LMDương ThùyNo ratings yet

- Project ReportDocument55 pagesProject Reportshrestha mobile repringNo ratings yet

- United Nations Industrial Development Organization (Unido)Document11 pagesUnited Nations Industrial Development Organization (Unido)Ayesha RaoNo ratings yet

- Heiter Skelter: L.A. Art in The 9o'sDocument2 pagesHeiter Skelter: L.A. Art in The 9o'sluis_rhNo ratings yet

- In Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Under Case No 10-13800)Document3 pagesIn Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Under Case No 10-13800)Chapter 11 DocketsNo ratings yet

- Boundary computation detailsDocument6 pagesBoundary computation detailsJomar FrogosoNo ratings yet

- O&M Manager Seeks New Career OpportunityDocument7 pagesO&M Manager Seeks New Career Opportunitybruno devinckNo ratings yet

- Marcos v. Robredo Reaction PaperDocument1 pageMarcos v. Robredo Reaction PaperDaveKarlRamada-MaraonNo ratings yet

- Innovation Simulation: Breaking News: HBP Product No. 8678Document9 pagesInnovation Simulation: Breaking News: HBP Product No. 8678Karan ShahNo ratings yet

- Weekly Mass Toolbox Talk - 23rd Feb' 20Document3 pagesWeekly Mass Toolbox Talk - 23rd Feb' 20AnwarulNo ratings yet

- Indian Leadership Philosophy Focused on Integrity and ServiceDocument13 pagesIndian Leadership Philosophy Focused on Integrity and ServicesapkotamonishNo ratings yet

- Recent Course CompactDocument2 pagesRecent Course Compactprecious omokhaiyeNo ratings yet

- Main MenuDocument9 pagesMain MenueatlocalmenusNo ratings yet

- Why The Irish Became Domestics and Italians and Jews Did NotDocument9 pagesWhy The Irish Became Domestics and Italians and Jews Did NotMeshel AlkorbiNo ratings yet