Professional Documents

Culture Documents

T.Y. B.B.A.

Uploaded by

Yasar KalvaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T.Y. B.B.A.

Uploaded by

Yasar KalvaCopyright:

Available Formats

BHAVNAGAR UNIVERSITY BHAVNAGAR THIRD YEAR B.B.A.

Detailed syllabus

Compulsory Paper Paper C1 BUSINESS ENVIRONMENT. (Term end exam 70 marks + Internal Assessment 30 marks)

Section I Trends and Structure of the Indian Economy: A developing economy. National Income, Agriculture, Industry, External Trade, Socio-Economic problems: Population, Unemployment, Poverty and inequality, Inflation and Public Distribution. Liberalization and Indian Economy: The international Economic Environment, Regional Trading B locks. The Uruguay round, Domestic Economic Environment. Reforms in the external sector. Reforms in the Domestic economy. Planning, Policies and Programmes: Three roles of the Govt. Market failure, Planning, State failure. The promotion of 'Industrialization: Section II The State's role in promoting industrialization. Development of backward areas. Industrial sickness, Infrastructure. Control and Regulations: Industrial Licensing. Policy, Curbing Monopolies and Restrictive Trade Practices, Regulating Foreign Exchange flows, foreign technology. Monetary and Fiscal System: The Banking and Credit Structure: Commercial Banks, the Reserve Bank of India. Financial Institutions: Sources of Finance, Development of Finance Institutions. The Fiscal System; Government Expenditure and Receipts, The Budget, The Public debt, Taxes and other revenues. Reference Books: Dibek Oebroy The Economic and Social Environment Global Business Press AIMA - CMF. K. Aswathappa Essentials of Business Environment HPH. Anant K. Sundaram & J. Stewart Black International Business Environment: Text & Cases By, PHI. Paper C2: ENTREPRENEURSHIP & MANAGEMENT OF SMALL BUSINESS (Term end exam 70 marks + Internal Assessment 30 marks)

Section I Conceptual Framework: Entrepreneurship, Conceptual Model of Development of Entrepreneurship A Training Model for Entrepreneurship CED, EDIT, Entrepreneurial Motivation: Motivation Training, Personal Efficiency, Cultural Values, Action Planning, Motivation Development Strategies, Promoting a Small Scale Unit: The concept of Small Scale Industry Registration Procedure and associated privileges Facilities to Technocrats, Special Assistance to SC I S1, Identification of Project Opportunities and Project I Product Feasibility Report : Sources of Project Idea Preliminary Screening An Introduction to the general format and the information to be covered in the report. (Ready made project reports obtained from sources like

GIIC, FSFC etc. "may be provided to the students for the understanding of the format and the details to be provided) Section II Market and Technical Appraisal:(a) Information required for market analysis Sources of market information, Demand Forecasting (b) Technical Analysis: Location and site, material, Product Technology, Site preparation, Project Engineering Manpower Projections, Financial Projections: Preparation of the Projected Financial Statements, Projected Cash Flow and Fund Flow statements, Debt Services Coverage ratio, Financing the Projects : Study of the types of financial assistance available from financial Institutions, Procedure for procurement of project loan. Submission of loan application, project appraisal, sanctions the loan and acceptance, execution of agreement, Disbursement of loan etc. Project Monitoring and Control: Warning Signals and remedies required Rehabilitation of sick projects: Causes of sickness, package of rehabilitation measures offered by financial Institutions. Reference Books: Vasant Desai Entrepreneurial Development by Himalaya Publishing House Dr. N. Gangadhara Rao Entrepreneurship and Growth of Enterprise in Industrial Estates, Deep & Deep Publications Prasanna Chandra PROJECTS: Planning, Analysis, Selection, Implementation & Review Tata McGraw Hill Paper C3: MANAGEMENT & COST ACCOUNTING (Term end exam 70 marks + Internal Assessment 30 marks)

SECTION I: Cost accounting Fundamentals: Nature, Methods, Technique, Contemporary Cost Accounting, Cost Terms: cost Unit, Cost Driver, Classification of Cost, Cost Management, Elements of Cost, Cost Volume Profit Relationship: Mechanics, Relevance, Conceptual Framework, Graphical Representation, Uncertainty, Costing Systems: Types, Designing and Implementation of Cot Accounting Systems, Relevance, Activity-Based Costing: Nature, Application in Manufacturing Sector, Comparison with Traditional Systems, Tools for Planning and Control: Master Budget and Responsibility Accounting, Flexible Budget: Nature, Utility, Application, Preparation Process SECTIONII: Cost Information for Decisions: Cost Behaviour, Relevant Revenues, Cost and Decision Process, Pricing Decisions and Cost Management, Cost Allocation and Revenues, Cost Allocation: Purpose, Interdepartmental Cost Allocation, Allocation of Common Cost, Cost Assignment and Cost Hierarchies, Variance Analysis and Standard Costing, Process Costing, Transfer Pricing Suggested Readings: 1. Horngran C. T. Cost Accounting: A Managerial Emphasis (9 th edition) PHI New Delhi 2. Robert Kaplan, Management Accountancy

OPTIONAL GROUP MARKETING: Paper O1 (M): MARKETING RESEARCH (Term end exam 70 marks + Internal Assessment 30 marks)

Section I Introduction: Concept of research, market research and marketing research Nature and scope of marketing research, Marketing research and decision making, Types of research, Research Process and Design: Major research designs, Problem definition and hypothesis development, Types of hypotheses JI Research Planning, Data Collection and Sampling: Sources of data, Data Collection Methods Section II Sampling methods and selecting a sample, Limitations of Sampling, Data Analysis: Data presentation and tabulation, Use of statistical methods for analysis of data, Testing of hypotheses and interpretations, Computer application in analysis, Presentation: Drawing inferences, Presentation of research findings Principle guidelines for report writing, Personal presentation of research findings. Compensating the channel members Reference Books: Tull and Hawkins, Marketing Research G.C. Beri, Marketing Research Luck and Rubin, Statistics for Management Paper O2 (M): PRODUCT PLANNING & MANAGEMENT' (Term end exam 70 marks + Internal Assessment 30 marks)

Section I Introduction: Definition of Product, Types and Classification of Product, Concept of Product line and Product mix, Product line and Product mix decisions, Product portfolio analysis, Brand, packaging, labeling and other image building decisions, Product life cycle: Concept and application, PLC strategies, The concept of market evolution, Strategies for leaders, challengers and niches, New Product Development: Importance of product innovation, The new product development process Section II New product failure, Alternative to new products viz. Licensing, Franchising, acquisitions etc. Adoption and diffusion of new product, Product differentiation and positioning, Concepts of product differentiation and product positioning Product, service, personal and image differentiation of market offers Positioning strategies, Communicating the positioning, Product entry into new markets; adoption vs. adaptation, Managing services as a Product : Characteristics of services, Major service classifications, Adding tangibility to service or marking service tangibles, Service marketing strategies Reference Books: Philip Kotler, Marketing - Analysis, Planning Implementation and Control Marketing Product management in India Brand Positioning - Strategies for: competitive advantage

Paper O3 (M):

SALES AND Distribution MANAGEMENT (Term end exam 70 marks + Internal Assessment 30 marks)

Section I Introduction: Meaning and evolution of sales management concept Sales Management, Personal selling and Salesmanship Relation of Sales Department with other Departments Theories of Selling, Sales Promotion: Concept of Sales Promotion, Deciding Sales Promotion budget, Methods of Sales Promotion, Regulating sales promotion activities, Sales Promotion as a part of overall promotion strategy, Sales Force Management:, Recruitment and Selection of Sales Force, Compensating the Sales Force, Strategic Sales Force Management Controlling the Sales efforts - Quotas and Sales territories Assessing Sales Force Efficiency, Sales Personnel Training Section II Managing Distribution Channels: Meaning and nature of marketing channels Designing distribution channels selecting a type of channel Wholesaling and retailing Functions of distribution channels Management of Physical Distribution: Meaning andimportance-Ofphysical4isbibutiotr Total-system concept Major tasks in physical distribution Strategic use of physical distribution compensating the channel members Reference Books : Cundiff, Still and Govani Stanton, Sales Management OPTIONAL GROUP FINANCE: Paper O1 (F): FINANCIALMARKETS (Term end exam 70 marks + Internal Assessment 30 marks) Section I Financial System: Overview, Components of Financial System - Functions of Financial System Money Market: Concept, Classification, Role of Money Markets, Characteristics of Money' Market, Organised and unorganised Money Markets - Role of RBI, Call Money Market, Concept, Evolution, Importance, DFHI-Evolution, Role, Functions. Limitations - Present Status of Call Money Market, Bills Market: ConceptCharacteristics, Importance - Salient features of old and new scheme of bill discounted. Capital Market: Concept, Characteristics, Types (primary and secondary), Structure, Role, Constituents of Capital Market, Instruments, New Issue Markets Section II Foreign Exchange Markets: Concepts, Instruments, Components, Functions, Role of RBI - Introduction to Asian Clearing Unit and Asian Currency Unit - Operations in Foreign Exchange Markets -Euro bonds- Foreign Currency Financing for projects Exchange Rate Determination, Stock Exchanges : Introduction -Classification Recognition - Functions - Advantages- Dealing in Stock Exchanges - Introduction to NSE, OTCE, National Depository, Stock Invest Scheme, Securities and Exchange Board of India: Evolution, Functions, Objectives, Evaluation of performance of SEBI Reference Books: Vasant Desai, Indian Financial System Bhole L. M.,Indian Financial System

Paper O2 (F):

BUSINESS FINANCE (Term end exam 70 marks + Internal Assessment 30 marks)

Section I Valuation of Securities : Basic Valuation Model- Valuation of Bonds , Valuation of Equities :Dividend Capitalization Approach, Earnings Capitalization Approach Realized Yield Approach CAPM Approach, Capital Budgeting: Risk Analysis in Capital Budgeting - Application of the technique of Probability Analysis - Decision Tree Analysis - Sensitivity Analysis Cost of Capital: Concept, Rationale, Assumptions - Cost of debt capital, preference capital and equity capital - Cost of external equity and retained earnings - Weighted Average (Over all) Cost of Capital Marginal Cost of Capital, Capital Structure: Concept, Assumptions - Approaches , Net Income Approach, Net Operating Approach Traditional Approach, Modigliani Miller Approach, Planning the Capital Structure: EBIT-EPS Analysis, Factors determining ideal capital structure. Dividend Decision: Models, Traditional Position, Walter Model, Gordon Model, MM Model, Radical Position, Dividend Practice Section II Marketing of Securities, 'Public Issue, Private Placement, Study of procedure and relevant rules of Companies Act and SEBI Guidelines Listening Securities, Financial Institutions, Forms of Assistance of national level financial institution and state level financial institution. Introductory idea of project financing, Leasing and Hire Purchase: Mechanics of Leasing, Types of Lease agreements, Financial Evaluation from Lessee's point of view Determination of Lease Rate by the Leassor Considerations in Leasing, Hire Purchase agreements, Choice between Leasing and Hire Purchase Merger and Acquisitions: Concept, Merger , Reasons, Mechanics, Cost, Benefits, Evaluation of a Merger as Capital Budgeting Proposal, Terms of a Merger-Determination of Exchange Rate, Takeovers - Pitfalls of Acquisitions, Managing acquisition program Introduction to-sell-offs, going public, privatization, Leveraged Buyouts, Buy Back of Shares, Joint Ventures Reference Books: Prasanna Chandra, Financial Management: Theory &Practice: :TMH I.M.Pandey, Financial Management VIkas Khan & Jain, Financial Management TMH

Paper O3 (F):

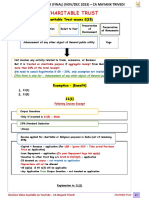

TAX PLANNING (DIRECT TAXES) (Term end exam 70 marks + Internal Assessment 30 marks)

Section II Introduction: Tax System in India - its components, Tax Planning, Tax Management Tax Avoidance, Tax Evasion, Definitions of Terms. Residential Status: Types, Incidence of Tax, Conditions, Income from salaries: Concepts, Calculation of total Income, HRA, Provident Fund, Gratuity, Perquisites, Deductions from salaries, Tax Rebates U/s 88.Income from House Property :Chargeability, Exemption, Annual Value, Deductions allowed. Profit & Gains from Business and Professions: Computation of profits, Admissible Deductions, Expressly allowed Deductions, Expressly dissolved expenses, Deemed profits. Deemed income, Valuation of Stock, Methods of Accounting. Section II Computation of Taxable Profits. Depreciation: Requisites, Computation, Actual Cost, Unabsorbed Depreciation, Concept, Types, Computation of Capital Gains, Exemptions, Treatment of losses. Computation of tax. Income from other sources : Chargeability, Deemed Profits, Deductions allowed, Amount not Deductible. VIII Deductions available from Gross Total Income: Tax Planning for different types of Assesses. Provisions relating to: Tax Deducted at source, Advance payment of Tax, Refund of Tax. Reference Books: Y.K. Singhania, Direct Taxes: Theory & Practice' Bhagwati Prasad, Direct Taxes: Theory & Practice N.V.Mehta, Income Tax Ready Reckner , Tax man OPTIONAL GROUP HRM: Organizational Behavior (External 70 + Internal 30) Section I Introduction and Individual behavior, Concepts in organization behavior, Contribution, research methods and approaches in OB, Attitudes, Perception, Motivation: Theories and applications, Leadership: Theories and applications, Leadership theories, Personality theories, Self management and management of stress, Creativity and innovation Section II Group behavior and organizational system, Interpersonal and group behavior, Formal and Informal organization, Inter group relations, Organizational culture, Organizational change, Organizational development, Power and politics in Organization, Case studies and readings Suggested readings Robbins, Stephen P., Organizational Behaviour: Concepts, Controversies & Applications, New Delhi, Prentice Hall Of India Pvt. Ltd., 1994.

HUMAN RESOURCE PLANNING & DEVELOPMENT (External 70 + Internal 30)

Section I Macro Level manpower Planning and Labor Market Analysis; Organizational Human Resource Planning; Stock Taking; Work Force Flow Mapping; Age and Grade Distribution Mapping; Models and Techniques of Manpower Demand and Supply Forecasting; Behavioral Factors in Human Resource Planning Wastage Analysis; Retention; Section II Redeployment and Exit Strategies: Career Management and Career Planning. Performance Planning; Potential Appraisal and Career Development; HRD Climate; Culture; OWL and Management of Change; TOM and HRD Strategies; HRD in Strategic Organizations; Human Resource Information System; Human Resource valuation and Accounting. Reference Books 1. Arthur, M. Career Theory Handbook. Englewood cliff, Prentice Hall Inc., 1991. 2. Belkaoul, A R and Belkaoui, J M. Human Resource Valuation: A Guide to Strategies and Techniques. Geenwood, Quorum Books, 1995. 3. Dale, B. Total Quality and Human Resources; an Executive Guide, Oxford, Blackwell, 1992. 4. Greenhaus, J. H. Career Management, New York, Dryden, 1987. HUMAN RESOURCE LEGISLATION (External 70 + Internal 30) Section I The Employment Exchange Act 1959, The Apprentices Act 1961, The Contract Labour Act 1970, ESI Act 1948, The Payment of Wages Act 1936, Workmen Compensation Act Section II Minimum Wages Act 1948, Payment of Bonus Act 1965, Payment of Gratuity Act 1972, The Employees Provident Fund and Miscellaneous Provisions Act 1952, The Trade Union Act 1926, Factories Act 1948 (Specified Portions) Reference Books: Sharmma A. M. Industrial Jurisprudence and Labour legislation Deepak Bhatnagar Labour welfare and social securities legislation in India N.D.Kapoor Handbook of Industrial Law Different Bare Acts published by the Government of India

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- 3420F Personal Financial Management (MCI)Document498 pages3420F Personal Financial Management (MCI)jonhac1554% (13)

- Tax 1 DigestsDocument165 pagesTax 1 DigestsJm Palisoc100% (5)

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax NotesMaruSalvatierra100% (1)

- Additional Income Tax QuizzerDocument2 pagesAdditional Income Tax QuizzerJohn Brian D. Soriano100% (1)

- ICARE First Preboard TAXDocument12 pagesICARE First Preboard TAXLuna VNo ratings yet

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- Payslip 1Document1 pagePayslip 1bktsuna0201100% (2)

- CHARITABLE TRUST DT CONCEPT BOOK (FINAL) Nov 2023Document11 pagesCHARITABLE TRUST DT CONCEPT BOOK (FINAL) Nov 2023Apurva MehtaNo ratings yet

- Final ReviewDocument44 pagesFinal Reviewnidal charaf eddine50% (2)

- Acclaw QuizDocument4 pagesAcclaw QuizJasmine PeraltaNo ratings yet

- CIR v. LednickyDocument19 pagesCIR v. LednickyAran Khristian MendozaNo ratings yet

- Pls Print - 1998 RMO 53-98 - Checklist of Documents To Be Submitted by Taxpayer Upon AuditDocument25 pagesPls Print - 1998 RMO 53-98 - Checklist of Documents To Be Submitted by Taxpayer Upon AuditJoyce CabatanNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- 2013 Afr Goccs Volume II-ADocument456 pages2013 Afr Goccs Volume II-AjunmiguelNo ratings yet

- Income Tax Handbook 2021-22Document66 pagesIncome Tax Handbook 2021-22Shahabuddin LimonNo ratings yet

- TDS CertificateDocument3 pagesTDS Certificatejfcgfh8fc6No ratings yet

- Taxation Lecture by DR LimDocument3 pagesTaxation Lecture by DR LimPatricia Blanca Ramos0% (1)

- Only Statement 1Document45 pagesOnly Statement 1Helen AlvaradoNo ratings yet

- CodyCommission 07112023Document4 pagesCodyCommission 07112023amirulsyafiq1994No ratings yet

- App III Summer Final ExamDocument7 pagesApp III Summer Final ExamPamela SantosNo ratings yet

- Payroll Statement InsentifDocument3 pagesPayroll Statement Insentifdhika agustyaNo ratings yet

- 721 Decision CanorecoDocument45 pages721 Decision CanorecoHjktdmhmNo ratings yet

- A Permanent Difference Between Taxable Income and Accounting Profits Results When A RevenueDocument4 pagesA Permanent Difference Between Taxable Income and Accounting Profits Results When A Revenuerohanfyaz00No ratings yet

- NOLCODocument8 pagesNOLCOChristopher SantosNo ratings yet

- Business Modeling Lab Room Activities Lab03 - Model Design Activity 1 - Management FeeDocument4 pagesBusiness Modeling Lab Room Activities Lab03 - Model Design Activity 1 - Management FeeViem AnhNo ratings yet

- Solved Carlos Opens A Dry Cleaning Store During The Year He PDFDocument1 pageSolved Carlos Opens A Dry Cleaning Store During The Year He PDFAnbu jaromiaNo ratings yet

- SEZ-Special Economic ZoneDocument81 pagesSEZ-Special Economic ZoneCA Ratan MoondraNo ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Blueprint For ReformDocument152 pagesBlueprint For ReformFedSmith Inc.100% (1)