Professional Documents

Culture Documents

Mountain Man Brewing Co

Uploaded by

Maite GorostiagaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mountain Man Brewing Co

Uploaded by

Maite GorostiagaCopyright:

Available Formats

Problem Statement While mountain Man Brewing Co.

generates over $ 50 Million in sales, it is experiencing a decrease in revenue by 2% per year and traditional premium beer overall sales is declining by 4% annually. Situation Analysis 1) Customer y y y The beer industry in the United States generates $ 75 Billion in annual sales. Customers base their choice on taste, price, occasion, perceived quality, brand image, tradition, local and authenticity. Comment [??1]: Whether it s a local beer? The Eastern Central region of the United States represents $13 billion in annual sales out of the $ 75 billion of the Total Comment [??2]: Meaning 17.3 % addressable market (TAM). Mountain Man lager has a specific target market: blue-collar male workers. While their target customer brings them the focus Comment [??3]: Maybe add a footnote on what this is. and loyalty needed to build brand awareness and equity, Mountain Man lager is not taking into consideration other market segments such as the white-collar class and other potential niches. Comment [??4]: Are you sure it is 64% of Mountain Man drinkers are 45+ years old while the TAM for that age category represents 49% of the domestic premium awareness? beer market in the Eastern Central. It is worth mentioning that drinkers within the age bracket of 21-27 years old represent 27% of total beer consumers, and spend twice per person on alcoholic beverages than consumers over 35 years old. From a gender perspective, Mountain Man counts with 81% male drinkers, thus neglecting the Female market segment which represents 32% of the TAM of domestic premium beer.

2) Competition The main competitors for Mountain Man are Anheuser Bush, Miller brewing Co. and Adolf Coors possessing 74% market share Comment [??5]: What is Mountain Man s market of the overall brewing market. It is worth mentioning that those 3 companies have 84% market share in the light beer market. share? These companies rely heavily on broadcasting market as well product diversification to create barriers of entry for other Comment [??6]: What is this? brands. 3) Company With Revenues of over $ 50 Million, Mountain Man Brewing Company was founded in 1925 by Guntar Prangel who established itself as a premium domestic quality beer, known for its flavor and bitter taste. With time Mountain Man Lager became the beer of pride in the Eastern Central region of the United States. Oscar Pragnel retired president and owner and the business stayed focused on maintaining the quality and serving a specific market niche building brand equity among blue-collar, middle-income and below workers. 4) Collaborators Off-premise locations, such as liquor stores and super markets, is Mountain Man s main sales channel as it sells 70% of its Comment [??7]: Is that what they are production at these locations. The main reason for this result is that 60% of blue-collar workers buy their beer through the off called? premise locations. Another channel are local distributors; however, one big disadvantage is that distributors favor brands that provide more product variety which eventually helps them ensure a higher sale turnover for the brands they are distributing. It is worth mentioning that Mountain Man did not have any significant presence in restaurants and bars. 5) Context The beer industry has witnessed an increase in federal excise tax, campaigns and movements encouraging moderation and careful consumption of alcohol. In certain states such as West Virginia laws were passed to limit the promotion of beer sales in retail stores. The whole industry has been facing per capita decrease in consumption due to fierce competition from Wine and other spirit products.

Alternatives

First alternative is to continue without any changes in the business model: continue manufacturing only premium beer. The pro s of this choice would be (1) maintain brand image and equity and (2) incur no additional costs. However, the cons would be: (1) continuous decrease in revenues (2) dismiss the opportunity to tap into new niches and capture potential customers such as female drinkers or the population aged in the 21 to 27 year-old bracket. Another major con would be losing ground with the distributors due to the lack of product variety. Second alternative would be to sell the company to one of the major players in the market. The pro s of this alternative is eliminating the possible risks of bad investments and playing it safe. The con of this alternative is dissolving a legacy business that has survived for a very long time based on strong brand equity and customer focus.

Recommendation

My recommendation would be to produce light beer in the Eastern Central region of the U.S in the coming 6 months. The first advantage of this decision is tapping into a potential market of almost $38 Billion of sales annually. Second advantage is meeting the growing demands of the younger generation representing almost 28% of the beer drinking market. Third advantage is meeting the needs of the distributors who seek product variety to ensure shelf space with their customers and tapping into the restaurant and pub business where Mountain Man had no significant presence before. The first disadvantage of this decision is the potential brand image damage resulting from a change in brand perception that has been linked for a very long period of time to the average blue-collar male worker with middle to low income thus risking a repercussion on current sales. Another disadvantage would be the potential risk in investments due to the rise in expenses such as marketing $750,000 and other SG&A expenses estimated at $900,000 which could drain the company financially. Last disadvantage to consider is the nature of the beer market which is characterized by an intense marketing spending and where the competition has much more capabilities to spend compared to Mountain Man s capabilities.

Implementation Plan

Price

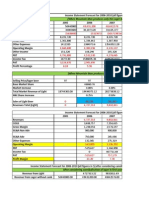

Based on the Projected estimate for 2006 ( Exhibit 1) Mountain Man will gain a 3% market share of light beer in the first year which is estimated to be 562000 barrels while maintaining the 7% market share in the Premium beer at 520000 barrels. The selling price per barrel will remain the same at $ 97. According to the breakeven analysis (Exhibit 2) Mountain Man will need to sell 456531 barrels, that is, $44,283,547 worth, in order to break even. This will result in a net profit of $11,318,913 for the year 2006.

Product

Mountain Man will introduce a new product called Mountain Light. While maintaining the high quality characteristic of Mountain Man premium lager, the company will introduce a similar quality product to the market. The product will target the younger generation, male and female as well as white-collar workers who seek light beer.

Promotion

Mountain Man will spend an additional $750000 on marketing & advertising in the form of TV campaigns and in popular youth magazines such as GQ and Cosmopolitan. Sponsoring events such as the Super Bowl and major artistic concerts and events. The branding will focus on the younger generation within the age bracket of 21-35 years old. Additional sales incentives will be provided to the distributors in order for them to buy the Mountain Man light beer based on challenging sales targets.

Place

Mountain Man will capitalize on its existing sales force to promote the brand within the distributors. The sales force will penetrate the restaurant and bar channels of the Eastern Central region building on the existing reputation of Mountain Man beer company. MMBC will also increase its product shelf space at the existing off premises locations such as the supermarkets and major liquor stores while providing them with sales incentives based on challenging targets.

Exhibit 1

Exhibit 2

You might also like

- Mountain Man Beer CompanyDocument4 pagesMountain Man Beer CompanyAshwin Golapkar100% (1)

- MMBC Light Beer Launch Cannibalize Core BrandDocument2 pagesMMBC Light Beer Launch Cannibalize Core BrandKundan K100% (1)

- MMBC Light Beer Launch FeasibleDocument5 pagesMMBC Light Beer Launch FeasibleSabyasachi Sahu100% (1)

- Mountain Man Brewery Case Report UploadDocument6 pagesMountain Man Brewery Case Report Uploadherediamario100% (1)

- MMBC Marketing Plan Targets Light Beer GrowthDocument12 pagesMMBC Marketing Plan Targets Light Beer GrowthCuriosity KillerNo ratings yet

- Mountain Man Brewing CompanyDocument6 pagesMountain Man Brewing CompanyChida_m100% (3)

- Mountain Man BrewingDocument3 pagesMountain Man BrewingAlfred EstacaNo ratings yet

- Individual Write Up MMBCDocument5 pagesIndividual Write Up MMBCchetankabra85No ratings yet

- Mountain ManDocument5 pagesMountain ManShrey PandeyNo ratings yet

- Mountain Man Brewing CompanyDocument2 pagesMountain Man Brewing CompanySharon Goh67% (3)

- Mountain Man Brewing Company Writing Case AnalysisDocument6 pagesMountain Man Brewing Company Writing Case AnalysisAleksandra100% (1)

- Mountain Man Brewing Company Analysis UpdatedDocument8 pagesMountain Man Brewing Company Analysis UpdatedSandhya Rajan50% (2)

- Mountain Man Brewing Company - CompliedDocument21 pagesMountain Man Brewing Company - CompliedSukriti Vijay100% (3)

- Mountain Man Case StudyDocument4 pagesMountain Man Case StudyZhijian Huang100% (2)

- Mountain Man Brewing CompanyDocument13 pagesMountain Man Brewing CompanySuneetSinghBadla100% (1)

- Mountain Man Brewing Company Case Study AnalysisDocument21 pagesMountain Man Brewing Company Case Study AnalysisRDH100% (9)

- Mountain Man Brewing Company - Group8Document3 pagesMountain Man Brewing Company - Group8Akriti Sehgal100% (2)

- MM CaseDocument22 pagesMM Casemusadhiq_yavar100% (1)

- Mountain Man BeerDocument29 pagesMountain Man BeerShivam TrivediNo ratings yet

- Mountain Man Brewing Company Case StudyDocument3 pagesMountain Man Brewing Company Case StudyPreetam Joga75% (4)

- Mountain Man Brewing Company Explores Brand ExtensionDocument32 pagesMountain Man Brewing Company Explores Brand ExtensionRahul Goyal100% (1)

- Tanya: Product Life CycleDocument8 pagesTanya: Product Life CycleJoey G CirilloNo ratings yet

- Mountain Man Brewing CompanyDocument2 pagesMountain Man Brewing CompanyHamza AnyNo ratings yet

- Mountain Man Brewing Bringing Brand To Light Marketing EssayDocument7 pagesMountain Man Brewing Bringing Brand To Light Marketing EssayRaghavendra NaduvinamaniNo ratings yet

- Mountain Man Brewery Company Case AnalysisDocument4 pagesMountain Man Brewery Company Case AnalysisAmit PathakNo ratings yet

- Mountain Man Brewing CompanyDocument3 pagesMountain Man Brewing CompanySajal Gupta100% (1)

- Mountain Man Brewing Company - BE - TemplateDocument2 pagesMountain Man Brewing Company - BE - TemplateswapniljsoniNo ratings yet

- Mountain Man Brewing CompanyDocument32 pagesMountain Man Brewing CompanyFez Research Laboratory83% (12)

- MMBC - Case AnalysisDocument28 pagesMMBC - Case AnalysisPhong Phan Thanh100% (1)

- Case Project - Mountain ManDocument2 pagesCase Project - Mountain ManSubhrodeep Das100% (1)

- PBM - Mountain Man BrewingDocument17 pagesPBM - Mountain Man Brewingpreeti jainNo ratings yet

- MMBCDocument12 pagesMMBCCaro Gomez de CaroNo ratings yet

- Mountain Man Brewing Company ProjectDocument41 pagesMountain Man Brewing Company Projectmon309250% (2)

- Mountain Man Brewing Scenario AnalyzerDocument4 pagesMountain Man Brewing Scenario AnalyzerAnjulHans100% (1)

- MM Case Analysis Group12 Mountain ManDocument14 pagesMM Case Analysis Group12 Mountain ManVineet Khandelwal100% (1)

- Individual Write Up - MMBCDocument5 pagesIndividual Write Up - MMBCmradulraj50% (2)

- Case Analysis: Mountain Man Brewing Company: Marketing Management IDocument10 pagesCase Analysis: Mountain Man Brewing Company: Marketing Management Iarushi_78198No ratings yet

- Mountain Man Case Analysis by Group 2Document2 pagesMountain Man Case Analysis by Group 2Curiosity Killer100% (2)

- MMBC Breakeven AnalysisDocument11 pagesMMBC Breakeven Analysismrr2012No ratings yet

- Mountain Man Brewing CompanyDocument1 pageMountain Man Brewing CompanyDiptanu DasNo ratings yet

- Mountain Man Brewing CompanyDocument1 pageMountain Man Brewing Companynarender sNo ratings yet

- Income Statement Forecast NPVDocument12 pagesIncome Statement Forecast NPVTatsat Pandey100% (2)

- Mountain Men Brewing CompanyDocument12 pagesMountain Men Brewing CompanyStephanie Lawrence Knop25% (4)

- Mountain Man Brewing Case StudyDocument4 pagesMountain Man Brewing Case StudyrcrsanowNo ratings yet

- MMBC Case StudyDocument41 pagesMMBC Case StudyKanika Verma100% (1)

- MMBCDocument16 pagesMMBCapi-314437085100% (1)

- Case - Laura Ashley and Federal Express Strategic AllianceDocument6 pagesCase - Laura Ashley and Federal Express Strategic Alliancerobin709290% (1)

- Mountain Man Brewing Company - Bringing The Brand To Light PDFDocument3 pagesMountain Man Brewing Company - Bringing The Brand To Light PDFUdita BasuNo ratings yet

- Mountain ManDocument9 pagesMountain Manvish_b_soni100% (1)

- Pillsbury Cookie Challenge - IIM-KDocument5 pagesPillsbury Cookie Challenge - IIM-KDeepu SNo ratings yet

- Department of Management Studies Marketing Management: Case Study ReportDocument16 pagesDepartment of Management Studies Marketing Management: Case Study ReportAakanksha Panwar100% (1)

- Crescent Pure Group 9Document4 pagesCrescent Pure Group 9Sreelakshmi MohanNo ratings yet

- IssuesDocument4 pagesIssuesSiavash ChavoshiNo ratings yet

- Eco7 AnalysisDocument11 pagesEco7 AnalysisDewang PalavNo ratings yet

- Light Beer Segment's Core Customer Base Has Different CharacteristicDocument6 pagesLight Beer Segment's Core Customer Base Has Different Characteristicasli_balci100% (1)

- Ratio Calculations of Reject ShopDocument3 pagesRatio Calculations of Reject ShopSurya ChandraNo ratings yet

- MMBCDocument4 pagesMMBCsandeepshinde1991No ratings yet

- The Bar Marketing-Plan Final-PaperDocument15 pagesThe Bar Marketing-Plan Final-Paperapi-291981727100% (1)

- Part 2Document5 pagesPart 2vi viNo ratings yet

- MK-2 Session 3 Group 2: 1. What Are The Critical Success Factors For MMBC? What Are Its Competitive Advantages?Document3 pagesMK-2 Session 3 Group 2: 1. What Are The Critical Success Factors For MMBC? What Are Its Competitive Advantages?Pankaj KolteNo ratings yet

- Unitary Small Air-Conditioners and Air-Source Heat Pumps (Includes Mixed-Match Coils) (RATED BELOW 65,000 BTU/H) Certification ProgramDocument65 pagesUnitary Small Air-Conditioners and Air-Source Heat Pumps (Includes Mixed-Match Coils) (RATED BELOW 65,000 BTU/H) Certification ProgramAmer GaladNo ratings yet

- BE 510 Business Economics 1 Problem Set 5 SolutionsDocument5 pagesBE 510 Business Economics 1 Problem Set 5 SolutionsCreative Work21stNo ratings yet

- Questions - TrasportationDocument13 pagesQuestions - TrasportationAbhijeet GholapNo ratings yet

- Sales Account Manager (Building Construction Segment) - Hilti UAEDocument2 pagesSales Account Manager (Building Construction Segment) - Hilti UAESomar KarimNo ratings yet

- C++ Programmierung (Benjamin Buch, Wikibooks - Org)Document257 pagesC++ Programmierung (Benjamin Buch, Wikibooks - Org)stefano rossiNo ratings yet

- SSNDocument1,377 pagesSSNBrymo Suarez100% (9)

- Efficient Power Supply for Inductive LoadsDocument7 pagesEfficient Power Supply for Inductive LoadsMary AndersonNo ratings yet

- APTARE IT Analytics: Presenter NameDocument16 pagesAPTARE IT Analytics: Presenter NameCCIE DetectNo ratings yet

- 7 Equity Futures and Delta OneDocument65 pages7 Equity Futures and Delta OneBarry HeNo ratings yet

- p2 - Guerrero Ch13Document40 pagesp2 - Guerrero Ch13JerichoPedragosa88% (17)

- Research of William Wells at HarvardDocument10 pagesResearch of William Wells at HarvardARGHA MANNANo ratings yet

- Excel Bill of Materials Bom TemplateDocument8 pagesExcel Bill of Materials Bom TemplateRavi ChhawdiNo ratings yet

- Service: Audi A6 1998Document256 pagesService: Audi A6 1998Kovács EndreNo ratings yet

- Ericsson 3G Chapter 5 (Service Integrity) - WCDMA RAN OptDocument61 pagesEricsson 3G Chapter 5 (Service Integrity) - WCDMA RAN OptMehmet Can KahramanNo ratings yet

- Online Music Courses With NifaDocument5 pagesOnline Music Courses With NifagksamuraiNo ratings yet

- Imp RssDocument8 pagesImp RssPriya SharmaNo ratings yet

- Differentiation: Vehicle Network SolutionsDocument1 pageDifferentiation: Vehicle Network SolutionsДрагиша Небитни ТрифуновићNo ratings yet

- COP2251 Syllabus - Ellis 0525Document9 pagesCOP2251 Syllabus - Ellis 0525Satish PrajapatiNo ratings yet

- Activity2 Mba 302Document2 pagesActivity2 Mba 302Juan PasyalanNo ratings yet

- Case Study, g6Document62 pagesCase Study, g6julie pearl peliyoNo ratings yet

- TSGE - TLGE - TTGE - Reduce Moment High Performance CouplingDocument6 pagesTSGE - TLGE - TTGE - Reduce Moment High Performance CouplingazayfathirNo ratings yet

- Design of Steel Structures Handout 2012-2013Document3 pagesDesign of Steel Structures Handout 2012-2013Tushar Gupta100% (1)

- Rivalry and Central PlanningDocument109 pagesRivalry and Central PlanningElias GarciaNo ratings yet

- Classification of Methods of MeasurementsDocument60 pagesClassification of Methods of MeasurementsVenkat Krishna100% (2)

- Monitoring Tool in ScienceDocument10 pagesMonitoring Tool in ScienceCatherine RenanteNo ratings yet

- DMDPrework QuizDocument5 pagesDMDPrework Quizjunpe- yuutoNo ratings yet

- An Improved Ant Colony Algorithm and Its ApplicatiDocument10 pagesAn Improved Ant Colony Algorithm and Its ApplicatiI n T e R e Y eNo ratings yet

- Lks Bahasa Inggris Kelas Vii Semester 1 Dan 2Document6 pagesLks Bahasa Inggris Kelas Vii Semester 1 Dan 2ꓰꓡꓡꓰꓠ.ꓓꓰꓖꓰꓠꓰꓣꓰꓢꓢ.No ratings yet

- 6.standard CostingDocument11 pages6.standard CostingInnocent escoNo ratings yet

- An RNA Vaccine Drives Expansion and Efficacy of claudin-CAR-T Cells Against Solid TumorsDocument9 pagesAn RNA Vaccine Drives Expansion and Efficacy of claudin-CAR-T Cells Against Solid TumorsYusuf DemirNo ratings yet

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- An Ugly Truth: Inside Facebook's Battle for DominationFrom EverandAn Ugly Truth: Inside Facebook's Battle for DominationRating: 4 out of 5 stars4/5 (33)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerFrom EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerRating: 4 out of 5 stars4/5 (52)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Betrayal: The Life and Lies of Bernie MadoffFrom EverandBetrayal: The Life and Lies of Bernie MadoffRating: 3.5 out of 5 stars3.5/5 (10)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (19)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (794)

- Crushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooFrom EverandCrushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooRating: 5 out of 5 stars5/5 (887)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)