Professional Documents

Culture Documents

Doing Business in UK - June 2009

Uploaded by

nehampplOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Doing Business in UK - June 2009

Uploaded by

nehampplCopyright:

Available Formats

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Information on the investment environment and legal, accounting and taxation framework are essential to keep you on the right track.

Doing Business in the United Kingdom 2009

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Foreword

The United Kingdom is one of the worlds major trading markets. It welcomes foreign investment and is a relatively easy country in which to do business. But even in the United Kingdom you will be faced with many regulatory, legal and cultural differences which could ruin business ventures. We at Grant Thornton can assist you. Grant Thornton UK LLP is a leading business and financial adviser with offices in 30 locations nationwide. Led by over 250 partners and employing more than 4,000 of the professions brightest minds, we provide assurance, tax and advisory services to over 40,000 individuals, privately-held businesses and public interest entities. Our market-facing business units are supported by relevant sector specialists who share their expertise and insight across our firm, resulting in an agile and innovative environment. Were flexible to

respond to our clients increasingly discerning requirements and meet the challenges posed by our rapidly changing marketplace. Taking everything into account, Grant Thornton UK LLP strives to speak out on issues that matter to business and are in the wider public interest. We focus on being a bold and positive leader in our chosen markets and within the accounting profession. We are a member firm within Grant Thornton International Limited, one of the worlds leading organisations of independently owned and managed accounting and consulting firms. Clients of member and correspondent firms can access the knowledge and experience of more than 2,600 partners in over 100 countries and consistently receive a distinctive, high quality and personalised service wherever they choose to do business. If you require any further information, please do not hesitate

to contact our International Business Centre in the United Kingdom at the following address:

London Grant Thornton UK LLP Grant Thornton House Melton Street Euston Square LONDON NW1 2EP UK IBC Director: Jatin Radia T +44 (0)20 7728 2320 E jatin.m.radia@gtuk.com

This guide has been prepared for the assistance of those interested in doing business in the United Kingdom. It does not cover the subject exhaustively but is intended to answer some of the important, broad questions that may arise. When specific problems occur in practice, it will often be necessary to refer to the laws and regulations of the United Kingdom and to obtain appropriate accounting and legal advice. This booklet includes legislation in force at June 2009.

Pictured on front cover, left to right: Jatin Radia, David White, Craig Burton, Paula Simpson, Amrish Shah, David Maxwell and Stephen Weatherseed

2 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Country profile

Summary

stable government and economy dependence on international trade large consumer market educated workforce

Geography and population

The United Kingdom is situated on the continental shelf off the northwest coast of Europe and covers an area of 243,000 square kilometres with a population of approximately 61 million and a workforce of 30 million. The United Kingdom consists of Great Britain and Northern Ireland. Great Britain includes England, Wales and Scotland. The UK does not include the Channel Islands and the Isle of Man, which have their own laws and tax systems.

Political and legal system

Parliament is the supreme political power. It consists of two houses, the House of Commons and the House of Lords. The House of Commons is elected. The House of Lords is presently being reformed and will

consist of appointed and elected members. The party which commands a majority of votes forms the Government, led by the Prime Minister. The effect of the system is that there are few effective checks on the Governments power to bring new laws into effect, except for public opinion. The main political parties are Labour (present Government), Conservative and Liberal Democrats. There are additional local parties in Scotland (Scottish National Party), Wales (Plaid Cymru) and Northern Ireland (including Democratic Unionist Party, Sinn Fein, Social Democratic and Labour Party, Ulster Unionist Party). Scotland, Wales and Northern Ireland have their own elected political institutions and there are three separate legal systems in the UK, one for England and Wales, one for Scotland and one for Northern Ireland. Parliament passes laws for

the whole of the UK, but the Scottish Parliament, Northern Ireland Parliament and Welsh Assembly also have some legislative powers. Tax laws apply to the whole of the UK but additionally the Scottish Parliament has limited tax-raising powers. There are separate, but similar, corporate laws for Great Britain and Northern Ireland. The UK is a member state of the European Union. In some areas, European Union (EU) law overrides UK law. The UK joined the EU in 1973 (then the European Economic Community). The completion of the Single Market in 1993 largely removed the remaining physical, fiscal and technical barriers to trade within the EU. In 1993 the UK ratified the Maastricht Treaty, which resulted in the development of common policies for international relations, and security and initiated moves

towards economic and monetary union. The single European currency (the Euro) was established in 1999 and fully implemented in 2002, but the UK (together with Sweden and Denmark) is not currently a member of the Eurozone. Britains external commercial policy is now conducted primarily through the EU.

Language

The population is diverse, particularly in urban areas. English is universally spoken and understood, although many minority languages are also spoken. The UK also has a very large supply of fluent foreign language speakers, with London being cited as Europes best city in terms of languages spoken. British English has some differences from American English, but American English is usually understood.

3 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Dates are written DDMMYY, and the MMDDYY form causes confusion. A full stop (period) is used for the decimal point, and long numbers are written with a comma (99,999,999.99).

Business hours/time zone

Economy

Normal business hours are 9.00am to 5.30pm from Monday to Friday. Banks are generally open from 9.30am to 5.00pm from Monday to Friday. Some retail banks are open on Saturday mornings. The whole of the UK observes Greenwich Mean Time, which is one hour behind most of Western Europe. Daylight Saving Time (British Summer Time) is observed from late March to late October.

Public holidays

The UK economy is built on the free enterprise system. Historically, the basis of the strength of the UK economy was manufacturing industries but this balance has shifted towards the provision of services. The economy is characterised by its dependence overwhelmingly on international trade, being the worlds largest exporter of services (and 3rd largest importer) and 8th largest exporter of goods (5th largest importer). Although the UK has less than 1% of the worlds population, according to the World Bank, it is the fifth largest economy in the world (second largest in the European Union).

Economic growth

the majority of the current decade, the economy has experienced sustainable growth in the region of 2-3.5%. However, this level of growth has significantly decreased, as a result of anti-inflationary measures and the global recession.

Cost of living

Culture and customs

The following link provides an insight as to how others perceive the British culture.

www.communicaid.com/ british-business-culture.asp

The average cost of living in the UK is relatively high by Western European standards, although rents and prices tend to be higher in London and the South East than the rest of the country. Purchased housing is generally available in all parts of the country, although suitable accommodation may be difficult to find in major cities, particularly in central London, which ranked in 2008 as the third most expensive city in the world.

In England and Wales there are eight public holidays, usually known as bank holidays. Scotland and Northern Ireland have their own public holidays.

Although the country has had low inflation for several years, the level of inflation as at May 2009 was 3%. The economy has also experienced continuous economic growth since the early 1990s. Additionally, for

4 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Regulatory environment

Summary

UK Government promotes investment from overseas few restrictions imposed upon foreign investment and ownership tax incentives and grants available for foreign investors

Restrictions on foreign ownership

There are very few restrictions on foreign ownership of businesses or property.

Government approvals and registration

No government approval is needed for most businesses. An exception is the field of financial services, where strict controls exist to protect the investor. A foreign corporation is required to register a UK branch or place of business. Registration is also required for tax purposes.

Competition rules/consumer protection

situations which could operate against the public interest. A monopoly position may exist where 25% of any given type of products or services is under the same control. The Competition Commission conducts in-depth inquiries into mergers, markets and the regulation of the major regulated industries. Every inquiry is undertaken in response to a reference made to it by another authority: usually by the Office of Fair Trading (OFT) but in certain circumstances the Secretary of State, or by the regulators under sector-specific legislative provisions relating to regulated industries. The Commission has no power to conduct inquiries on its own initiative.

Financial Services and Markets Act 2000

2000, with responsibility for regulating financial services in the UK. The FSAs aim is to promote efficient, orderly and fair financial markets and help retail financial service consumers get a fair deal. The UK government is responsible for the overall scope of the FSAs regulatory activities and for its powers. The FSA regulates and authorises most types of financial services firms, such as banks, building societies, credit unions, insurance companies, financial advisers, stockbrokers, mortgage and insurance sellers. It sets the standards that they must meet and can take action against firms if they fail to meet the required standards.

Import and export controls

Mergers may be examined to prevent unacceptable monopoly

The Financial Services Authority (FSA) is an independent statutory organisation set up under the Financial services and Markets Act

The importation of all and any goods is potentially subject to prohibition and control. Generally the importation of firearms, ammunition, endangered species, live animals, meat, plants, vegetables

and drugs is prohibited without authorisation and is subject to strict controls. Export restrictions are placed on certain types of strategic goods and materials, weapons of war, atomic energy materials, diamonds, live animals, endangered species, antiques, works of art and EU Common Agricultural Policy products. Provisions exist under which the exportation of goods and services, or their transportation within the UK, without a licence, can be prohibited depending in certain circumstances on their destination. HM Revenue & Customs is the main Government Department charged with controlling imports and exports to and from the UK, for customs purposes and on behalf of other Government Departments. All goods imported into the UK must be declared to Customs on arrival in one form or another. Their involvement with exported

5 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

goods starts at the time the goods are declared for export. This could be at business premises or the Port or Airport when they leave the country. The export cannot proceed until clearance is given by Customs.

Price controls

Government investment incentives

There is no general control over prices. Some utilities are subject to pricing controls. The Office of Fair Trading can investigate prices and price increases of major public concerns if competition appears to be threatened.

Use of land

The use of land is closely regulated. It is generally necessary to obtain planning permission from local government for real estate development and for some changes of use of existing property.

Exchange control

There are no exchange controls and no reporting requirements for transfer of funds into or out of the UK.

The UK government actively encourages investment from overseas; foreign-owned businesses are eligible for the same benefits as local ones. Investment incentives compare favourably with those available elsewhere in Europe and the EU. Regional Selective Assistance (RSA) is a discretionary scheme available in certain parts of Great Britain designated as Assisted Areas. The scheme takes the form of discretionary grants to encourage firms to locate or expand in these areas. Projects must either create new employment or safeguard jobs. In England RSA is available for projects involving capital expenditure of at least 500k. In Northern Ireland similar funding towards the stimulation of new enterprises and expansion of existing companies is available from the Industrial Development Board or LEDU.

Some grants are available for research and development and there are also tax incentives. The Government provides technical assistance for exports and the Export Credit Guarantees Department provides guarantees, insurance and reinsurance against loss. Grants are also available for agriculture, horticulture and forestry and for tourism and leisure projects. UK Trade & Investment is the Government organisation that supports companies both in the UK trading internationally and those overseas businesses seeking to set up or expand in the UK.

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Finance

Summary

London is one of the worlds key financial markets various financial markets allow organisations to raise finance clearing banks supply a full range of financial services other financial institutions supply a full range of specialist services the UK has a large and developed venture capital industry no significant restrictions on foreign investors accessing UK financing

Note

The comments below pre-date the impact of the current global financial crisis which has seen a significant reduction in the availability of loan finance from financial institutions.

Banking system

The Bank of England is the central bank of the United Kingdom and has two core purposes monetary stability and financial stability. The Bank is perhaps most visible to the general public through its banknotes and, more recently, its

interest rate decisions. The Bank has had a monopoly on the issue of banknotes in England and Wales since the early 20th century. But it is only since 1997 that the Bank has had statutory responsibility for setting the UKs official interest rate. The banking system in England and Wales is dominated by the four clearing banks: Barclays, HSBC (formerly Midland Bank), Lloyds TSB (which owns Halifax Bank of Scotland) and The Royal Bank of Scotland Group (which owns National Westminster Bank). Almost all banks offer current account (cheque account) services. Most business payments are made by cheque, but direct deposits to the payees bank account (known as credit transfers or bank giro payments) are also common. Wages are usually paid by direct deposit. The larger banks also offer internet banking. Cross border payments are usually made by wire transfer.

The larger banks also provide accounts in US dollars, euros and other foreign currencies. Money laundering rules are strictly enforced and banks require evidence of identity to open an account. No tax identification number is needed. The clearing banks are also major providers of finance. Such lending usually takes one of two forms either overdraft or term loan. An overdraft is an extremely flexible method of finance as the amount borrowed can be varied on a day-to-day basis. However, this level of flexibility usually results in a significantly higher rate of interest than would be applied on a term loan. Details of term loans are agreed when the business negotiates the loan agreement with the bank. As a result the term loan is more rigidly structured than an overdraft and can be changed only in exceptional circumstances, normally resulting in additional cost.

Over the years the divisions between the various types of bank in the UK have been largely eroded. Clearing banks now offer a full range of financial services. Most major overseas banks are represented in the UK through branches, subsidiaries or representative offices.

Capital markets

There are two securities markets available for overseas companies, both operated by the London Stock Exchange. These are the Official List and the Alternative Investment Market (AIM). The Official List (otherwise known as the main market) is the London Stock Exchanges principal market for listed companies and is the traditional market for larger mature companies with a wellestablished trading record.

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Approximately 1,500 UK companies and 400 overseas companies are currently on the Official List. Companies applying for a listing must: demonstrate a three year trading history have a market capitalisation of at least 700,000 maintain at least 25% of the share capital in public hands. Traditionally, within the Official List investors have looked at stocks from two perspectives size and sector. But increasingly they are looking at a third dimension picking companies that possess specific attributes, irrespective of their size, industrial classification or location. To address this issue the London Stock Exchange has introduced the techMARK, bringing together listed technology companies of all sizes from FTSE 100 to FTSE Fledgling enhancing every companys visibility and media profile and allowing the

long-term tracking of the companys performance. Launched in 1995, AIM was specifically developed to meet the needs of smaller, growing companies that might not meet the full criteria for a listing on the main market or for whom a more flexible regulatory environment is more appropriate. AIM is suitable for a wide range of companies - from young and venture capital backed businesses to long-established family concerns. Companies on AIM are active in all sectors of commercial activity, ranging from leading-edge technology to distribution, restaurants and leisure. Approximately 1,600 companies (including 350 overseas companies) are listed on AIM. Unlike the main market, there is no requirement for a minimum % of shares to be in public hands. AIM has recently tightened its rules. Issuers must now display core information of board members,

announcements and financial results on a website. Nominated advisers (Nomads) that companies are obliged to retain while listed on AIM, will have greater responsibility for assessing the suitability of companies and the quality of their business plans and management. PLUS (formerly known as Ofex) is a cost-effective market to enable shareholders to deal in stocks that might otherwise prove to be illiquid. It is a market for dealing in unquoted and unlisted securities. Trading is undertaken between member firms via a competing market maker system. Companies on PLUS tend to be smaller than those that apply for membership to AIM, typically seeking to raise capital in the region of 250,000 to 1,000,000. It also suits those companies not seeking to raise capital but who want to create a dealing facility for their shareholders without having the

burden and expense of meeting the regulations of AIM or the Main Market. It is viewed as a source of retail venture capital for young companies and as a stepping-stone to a Recognised Investment Exchange for others. The requirements of joining PLUS are less onerous than those of applying to the Main Market or AIM.

Other sources of finance Venture capital

The UK has the largest and most developed venture capital industry in Europe, accounting for 57% of total private equity investment and is second to the USA in world importance. Venture capital is the term used for unsecured funding provided by specialist firms in return for a proportion of the companys shares. Whilst bank loans will have a legal right to interest and require repayment regardless of success or failure, venture capitalists (VCs)

8 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

will be looking for a high return largely generated by growth in the capital value of a business. There are no standard regulations defining the venture capital industry and terms of any investment are dependant on the circumstances surrounding the investment. VCs do not normally consider an investment under 250,000, while through syndication there is almost no upper limit. A return on the investment is usually sought within three to five years. VCs will look for entrepreneurial businesses with aspirations and the potential for growth. They will look at the track record of the business and the proven ability of the management team in making their investment decisions. In return, they will provide input from experienced executives who may join the companys board, although they will not normally look to day-to-day

control. An exit may be sought through a sale of shares back to management, sale to another investor, trade sale or a stock market listing.

Finance houses

Finance houses, usually subsidiaries or affiliates of UK banks, provide various forms of instalment credit, ranging from hire purchase to leasing. The lending is often asset based.

Factoring companies

stage companies. Unlike Venture Capitalists, they will seek smaller equity stakes, the level of investment varying but generally between 10,000 to 250,000 per company (although larger amounts may be invested as part of a syndicate).

Factoring companies provide finance to commercial organisations by buying trade receivables at a discount.

Business Angels

The concept of Business Angels was developed in the USA to provide solutions to funding gaps. Business Angels are individual investors with substantial private funds who invest directly in early

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Imports

Summary

importation restrictions maybe applied in specific circumstances common customs tariff on goods coming into EU from outside no customs duties between EU member states Value Added Tax (VAT) charged on goods coming in from outside EU

Import restrictions

Most categories of goods can be imported without restriction under Open General Import Licences. Individual import licences may be required when importing a limited number of goods such as textiles, iron and steel. Licences for these are issued by the Department of Trade and Industry (DTI) through the Import Licensing Branch and fall into the following classes:

open unlimited importation of particular goods from specified areas for a stated period specific limits quantity or value and limits the period of the licence (quota restrictions) surveillance provides surveillance into the trade in sensitive commodities on the basis of which action can be taken to manage the trade in the commodity embargo no imports allowed as a result of international obligations The Rural Payments Agency is another Government department and issues import licences for agricultural and horticultural products as well as certain items of food and drink. Further assistance is available through the following links:

www.dti.gov.uk www.hmrc.gov.uk

Customs duties

Customs duty is assessed on the fair market value of imported goods at the time they are landed in the UK. The UK is a member of the EU, which has a common customs system. No customs duty or Value Added Tax (VAT) is payable when goods are imported from other EU member states. In addition to customs duty, VAT is payable on most goods imported from outside the EU. Most UK businesses are able to reclaim the VAT which they pay on goods which they import. They cannot reclaim customs duty. Arrangements can be made for the payment of customs duty and VAT on imported goods to be deferred until the goods are used, sold or re-exported.

10

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Business entities

Summary

foreign investors may operate in the UK through whatever entity they choose the most common entities used by foreign investors in practice are subsidiaries or branches

Corporations

The usual form of business entity is the private limited company. The name of a private limited company must end in Limited or Ltd (or the Welsh equivalent). A limited company need only have one shareholder and it is therefore a suitable entity for a wholly owned subsidiary.

Formation

There are a few restrictions on names. The name of a company can be similar to (but not identical to) the name of an existing company, but an existing company can object that the name of a new company is too similar to its own name. Total costs for the formation of a company are typically less than 1,000.

Minimum capital/capital maintenance

Accountants and lawyers can assist with the formation of a company. The process usually takes one to two weeks but if a company is required immediately a ready-made company can be bought from a company formation agent. The name of the ready-made company can easily be changed.

There is no minimum capital requirement and companies are commonly formed with a share capital of only 1 or 2. Share capital is often divided into shares of 1 each, but shares of any denomination can be used. Shares are usually denominated in sterling but need not be. Zero value shares are not permitted. A company can issue shares up to its nominal or authorised share capital. The nominal capital can be easily increased by shareholder resolution.

Capital can be contributed above the nominal value of the shares issued. The additional paid in capital is known as share premium. It is not normal practice to contribute capital without an issue of shares, although it is possible. A limited company can only pay dividends if it has sufficient accumulated profits. It can only repay share capital and share premium if it follows statutory procedures designed to protect the interests of the creditors. A subsidiary company cannot hold shares in its parent.

Management and officers

The minimum number of directors is one, but if there is only one director the same person cannot also be company secretary. Companies can be directors and secretaries of other companies.

Filing requirements

A company is managed by its directors who are elected by the shareholders. A director can normally bind the company without reference to other directors. Apart from the directors the only officer required by corporate law is the company secretary, who is responsible for various administrative matters.

Every company registered in the UK must maintain a public file at Companies House. This includes copies of the latest set of signed financial statements, information on directors, the company secretary and shareholders. Failure to maintain the file properly may result in fines, penalties or in severe circumstances prosecution against the directors. Limited companies must file their financial statements within ten months of their period end (different rules will apply for the first accounting period). This time limit is reduced to seven months for Public Limited Companies.

Note that the filing deadlines are due to be reduced to nine months and six months for private and public companies respectively, for accounting periods commencing after 6 April 2008.

11

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Dissolution

Public Limited Company

Branch

A solvent company is dissolved by a process known as members voluntary liquidation. This requires the shareholders to appoint a liquidator, generally a suitably qualified accountant, who takes control of the company, discharges its liabilities and distributes the surplus to shareholders. A fast-track process, which avoids the appointment of a liquidator, is also possible but this process gives less protection to the companys directors. The directors of an insolvent company should seek advice from an insolvency practitioner or a lawyer on their options. These include: administration administrative receivership creditors voluntary arrangement creditors voluntary liquidation compulsory liquidation. All these processes require the active involvement of an insolvency practitioner (generally an accountant).

A PLC (or Public Limited Company) is a limited company which is permitted by its constitution to offer its shares to the public. Its name must end in PLC. The main differences from a private limited company are: before a PLC can start to trade it must have at least 50,000 worth of shares issued and at least 25% of the value must have been paid. A private limited company can have just one 1 share issued. a PLC must have at least two directors and a company secretary. A private limited company may have one director and a formally qualified company secretary a PLC may be listed on the Stock Exchange but does not have to be. A private limited company cannot be listed. there is no exemption from an annual audit irrespective of size of the company (see page 25).

A foreign company that carries on business in the UK through a branch must register at Companies House. It must file details of its constitution, its directors, share capital and other matters. Each year, it must file financial statements (of the whole company, not the branch). These financial statements can be denominated in any currency. If these documents are not in English, they must be accompanied by a certified translation. All of these documents are on the public record.

Limited Liability Partnership

Unlike members of ordinary partnerships, the LLP itself is responsible for any debts that it runs up, not the individual partners. LLPs were introduced in 2001 and although not common in the UK, they are expected to be increasingly used for joint ventures.

Other entities

An LLP (or Limited Liability Partnership) is a corporate body with at least two members, each of whom have limited liability. It is subject to the same registration and disclosure requirements as a limited company, but is generally treated as a partnership for tax purposes with the tax liability falling on the individual members, not the LLP.

Other entities are not commonly used by foreign businesses operating in the UK. They include: unlimited company: a corporate body whose members have unlimited liability company limited by guarantee: a company without a share capital partnership: partners may be companies or individuals and have unlimited liability limited partnership, which must include at least one partner with unlimited liability.

Useful websites

www.companieshouse.gov.uk

12

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Labour

Summary

the UK has a skilled workforce traditionally in construction and production but there has been a long-standing shift towards employment in the services sector state operated social security system provides benefits during sickness, unemployment and invalidity all persons in employment, including resident foreigners, contribute to and benefit from social security system the UK enforces minimum wage and working time legislation.

Average earnings

Europe and from April 2008 are 12.8% of earnings (including taxable fringe benefits) with no upper limit. The rate is slightly lower for those who are contracted out of the state pension scheme and with earnings below 770 per week (nil rate for low earners).

Pension costs

In April 2008, average fulltime gross weekly earnings were 479, with levels being highest in London at 613, 500 in the South East and lowest in Northern Ireland at 418.

Social security costs

Employers social security costs (known as National Insurance Contributions) in the UK are much lower than much of Continental

Many employers pay pension contributions for their employees. The employers costs are generally in the range of 4% to 15 % of the payroll. Employer and employee contributions are usually paid into a pension fund whose assets are kept separate from the assets of the employer. Pension plans may be either defined benefit or defined contribution plans, but defined contribution plans are now favoured. Pension contributions to qualified plans are tax deductible. The pension fund pays no tax on its income. Benefits are not generally payable until retirement age

which is generally 65 years of age. A limited lump sum can be paid tax free, but other benefits are taxable. Employers with five or more employees are obliged by law to offer access to a pension plan unless the employee is under 18 or earns less than the lower national insurance earnings limit (currently 105 a week). Employers who are not exempt must provide information to employees on pension plans and access to a plan. The employer is not required to contribute to a plan, but must collect contributions from employees and remit these to the plan within 19 days of the end of the month in which they are deducted.

Healthcare and usual fringe benefits

which is normally provided free to UK residents by General Practitioners under the National Health Service (NHS). Entitlement to healthcare under the NHS does not depend on insurance.

Paid holidays

There are eight statutory public holidays a year, usually known as bank holidays. Some holidays are observed only in England and Wales, Scotland or Northern Ireland. Under the Working Time Regulations employees are entitled to 4 weeks paid holiday. Provided prior notice is given, an employer may specify when this holiday can be taken.

Many large employers provide employees with private health care, company cars, subsidised meals and other fringe benefits. Most private healthcare insurance does not cover primary healthcare,

13 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Minimum wage

The statutory minimum wage is 5.73 (from October 2008) per hour for employees aged 22 or over; 4.77 (from October 2008) per hour for employees aged 18 to 21 and 3.53 (from October 2008) for those between school leaving age and 16-17. The UK enforces working time regulations which provide for a maximum 48 hour working week. However, a number of exceptions to the rules exist and employees may give their written consent to work more hours. Recent surveys indicate that UK employees work more hours than their EC counterparts.

Employment protection legislation

entitlement to lump sum redundancy payments protection against unfair dismissal the provision of written terms and conditions of employment and establishment of appropriate grievance procedures the minimum period of notice required for the termination of contracts. There is also legislation to protect employees from discrimination on the grounds of sex, race, age and disability. Under the Health & Safety at Work Act 1974 employers are responsible for providing suitable health and safety arrangements. Maternity leave for babies born after 1 April 2007, employees have the right to leave of a year in total. Employers may have their own maternity pay schemes but all qualifying employees will at least be entitled to Statutory Maternity Pay of 90% of earnings for six weeks and up to 117.18 per week for a further 33 weeks.

Paternity leave some employers may have their own arrangements, but providing certain conditions are met, qualifying employees may take leave of one or two weeks with a maximum statutory pay of 117.18 per week.

Unemployment levels

Individual employee rights are governed by the Employment Rights Act 1996. The main issues covered include: the minimum period of notice required for the termination of contracts

The number of people in employment for the three months to May 2009 was just under 29 million. Following the recession in the early 1990s unemployment hit three million in January 1993. The economic recovery gradually reduced this level although in May 2009 the level of unemployment stood at 2.38 million. The Claimant count as at June 2009 was 1.56 million people, the highest level since June 1997.

Unions

a trade dispute. To protect these immunities a union must conduct an official secret ballot of its members, inform the employer of the ballot and the result and give the employer seven days notice of its intentions. Companies cannot discriminate between employees on the grounds of union membership.

Work permits

Union power has been steadily eroded since 1979. However, unions still have special protection against civil law proceedings raised against actions taken for the furtherance of

Nationals from the EU do not require permits to work in the UK. Other foreign nationals generally require work permits issued by the UK Border Agency. A new points based tier system has been introduced and specialist advice should be sought by individuals for route of entry into the UK. Generally, foreign employees contribute to and are eligible for social security and health care. However, in certain circumstances they may be eligible for a limitedperiod exemption from social security contributions.

14

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Financial reporting and audit

Summary

company financial accounts are prepared in accordance with UK GAAP company accounts must follow format prescribed by the Companies Act company accounts must be submitted with Registrar of Companies company with subsidiaries must generally prepare group accounts

Domestic corporations Filing/publication requirements

means that they should comply with UK generally accepted accounting practices.

Accounting standards

All companies incorporated in the UK, including Limited Liability Partnerships but excluding unlimited companies, must file annual financial statements at Companies House, where they are open to inspection by the public. The law prescribes the format of the financial statements. The law does not prescribe the accounting policies to be followed, but requires that the financial statements show a true and fair view. This effectively

UK GAAP differs from US GAAP and international accounting standards in a number of areas. For example: UK GAAP permits standards to be overridden where it is essential to provide a true and fair view. US GAAP does not permit standards to be overridden UK GAAP permits the revaluation of assets and requires investment properties to be held at market value without depreciation. US GAAP does not generally allow revaluations development costs may be capitalised under UK GAAP providing strict criteria are met, those not meeting the criteria must be expensed. US GAAP requires most development costs to be expensed UK GAAP requires goodwill to be

amortised over its estimated useful life (up to 20 years). US GAAP does not require amortisation, but requires an annual impairment review under UK GAAP changes in accounting policies are dealt with as adjustments to opening reserves whilst under US GAAP a change in accounting policy is recognised by a cumulative change to current year income companies with subsidiaries are generally required to file consolidated financial statements. This does not apply to small and medium sized groups, (medium sized exemption ceases for accounting periods commencing on or after 6 April 2008) and to parent companies which are themselves subsidiaries of companies incorporated in the EU. Small and medium sized companies are permitted to file financial statements showing more limited information.

International Financial Reporting Standards (IFRS)

Under EU regulation on IFRS, only consolidated financial statements of companies incorporated in a Member State and which have securities listed on a regulated market at their balance sheet date, are required to be prepared under EU adopted IFRS. Other financial statements issued by UK companies may continue to be prepared under UK GAAP although a company may elect to move to IFRS for its individual or consolidated accounts. IFRS applies to accounting periods commencing on or after 1 January 2005 for fully listed companies and on or after 1 January 2007 for AIM.

15

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Audit requirements Requirement for statutory audit

Companies may qualify for entitlement to exemption from audit if they are considered to be small. Reference to legislation is important to ensure all conditions have been met, but the following provides an overview: if a company is a public listed company (a plc), or engaged in insurance or various financial services activities it is excluded from the exemption for the year in which exemption is sought, its turnover (revenues) must not exceed 6.5million and its gross (total) assets must not exceed 3.26million. Further, if the company is a member of a group, the group must qualify as a small group, the activities of which should exclude those in the previous paragraph, and the entire groups turnover for the year must not exceed 7.8million gross

(or 6.5million net) and the groups gross assets must not exceed 3.9million (or 3.26million net). Not withstanding the above paragraph, a company that has been dormant (ie non-trading and no transactions) throughout the period, may still qualify for audit exemption. The Institute for Chartered Accountants in England & Wales (ICAEW) has issued guidance on the preparation of financial statements which are exempt from audit. The guidance, which is not mandatory refers to the issue of a Compilation Report by the accountants. This would involve the consideration of whether the financial statements are consistent with their understanding of the business and if they are misleading. In so doing, the accountants make such enquiries of management and undertake such procedures as they judge appropriate.

Branches of foreign companies Filing/publication requirements

A foreign company with a UK branch must file financial statements of the whole company (not the branch and not a group of companies of which the company may be a part). The filing requirement depends on whether the company is required to publish its audited financial statements under its home law. If it is, it must file those financial statements in the UK. If it is not, it must file financial statements in a form provided by UK law.

16

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Tax

Summary

The UK offers internationally competitive rates of tax and tax incentives. It is party to an extensive international treaty network and provides a favourable environment in which to set up and carry on business. The main disadvantage is the complexity of the tax legislation. Appropriate professional advice should be sought prior to doing business in the UK to ensure that the most tax efficient structure compatible with the commercial requirements is achieved. The Appendix at the end of this section sets out more detail on tax rates and compliance requirements.

Companies What creates a taxable presence in the UK?

UK resident companies are subject to corporation tax currently at rates of up to 28% on their worldwide profits, with a credit for overseas taxes.

A company is resident in the UK if it is incorporated in the UK or if its central management and control is in the UK. If the company is dual resident, the relevant tax treaty may in some cases determine ultimate residence. Partnerships are transparent for tax purposes, that is, partners are taxed on their share of partnership profits. Limited Liability Partnerships, though corporate entities, are generally treated as transparent for tax purposes, ie you would look through the partnership and the members of the partnership would be taxed based on their status. Non-resident companies are typically subject to corporation tax (at rates up to 28%) on the income and capital gains of a UK permanent establishment (broadly, branch or agency). They may also be required to withhold income tax (at 20%) on rental income, interest and royalty income.

The UK has an extensive tax treaty network, which can eliminate or reduce the level of UK tax in some circumstances.

What is the preferred corporate structure?

Planning

Overseas companies may trade in the UK through private limited companies or branches. Partnerships are sometimes used, particularly in joint venture situations or with professional partnerships. Operating through a UK subsidiary company may result in the profits being subject only to UK corporation tax, whereas trading through a branch may mean that these profits are taxable in the territory of residence as well as in the UK. Where tax is charged on the UK branch profits in the overseas companys home territory, relief from double taxation may be available under the terms of the relevant tax treaty.

The choice between UK subsidiary and UK branch will often depend on commercial issues, as well as tax considerations in the territory of residence of the overseas company and the UK. Operating via a subsidiary is more common they are often easier to administer, as well as offering better litigation protection and commercial advantages. However branches can sometimes offer tax advantages, particularly if the operation is expected to be loss-making in the start-up period.

17

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Overview of the tax system and major tax reliefs General

Corporation tax is assessed at rates up to 28% on trading and investment income and gains. All categories of income are taxable. Trading income is reduced by revenue expenses wholly and exclusively incurred for the purposes of the trade. Certain types of expenditure are specifically excluded from being deductible.

Tax depreciation

created by the company or acquired from an unrelated third party on or after 1 April 2002, but equally gains on such intangibles will be subject to tax on disposal.

Dividend income

1 July 2009 (subject to transitional rules) owing to the introduction of the dividends exemption.

Research and development relief

Accounting depreciation is not deductible from profits. Tax relief is provided on investment in qualifying plant and machinery through capital allowances. The previous system of Industrial and Agricultural Building Allowances is being phased out over a transitional period. From the tax year 2011-12, no allowances will be available on buildings. Relief is given for the amortisation of goodwill and intangible assets

From 1 July 2009, all dividends will be taxable, subject to a range of exemptions. Previously dividends from UK companies were exempt and dividends from foreign companies were taxable, subject to credit for foreign tax. There is one set of exemptions for small companies and a different range of exemptions that apply to medium and large companies.

Controlled foreign companies

The aim of the legislation is to prevent the avoidance of UK corporation tax on the profits of low taxed foreign resident, but UK controlled, companies, by attributing those profits to the UK parent company. There are a range of exemptions although some of these will cease to apply from

Enhanced relief is provided in respect of qualifying research and development expenditure. Relief is provided on qualifying expenditure (consumables, software, staff costs, externally-provided workers and subcontract costs) incurred on research and development activities within the scope set out by the Department for Business, Enterprise & Regulatory Reform and HM Revenue and Customs (HMRC). Different rules and rates of relief apply for large, and small and medium-sized enterprises (SMEs), with more generous relief available under the SME scheme. 175% relief is available on qualifying revenue expenditure incurred by SMEs, for expenditure incurred on or after 1 August 2008 and 130% relief for expenditure incurred on or after 1 April 2008 on qualifying revenue expenditure

incurred by large companies. Loss-making SMEs can elect to surrender their R&D-related tax loss in return for a repayable tax credit.

Capital gains

Corporate capital gains are chargeable to corporation tax at the same rates as income. Gains are computed by deducting the cost (or market value at March 1982, if the asset was held by the company at that date) plus indexation allowance from sales proceeds. A range of reliefs and exemptions may apply. Capital gains on qualifying assets of the trade may be deferred against the tax base cost of qualifying replacement assets acquired within a four year period commencing one year before and ending three years after the sale of the original asset. Gains on the disposal of a substantial shareholding (broadly, greater than 10%) in a trading company will qualify for exemption if certain conditions are met.

18

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Groups

Companies within a group are separate taxable entities, responsible for their own returns and payments. Group relief provides for the set-off of certain current year profits and losses within a UK group but does not amount to a full consolidation of profits and losses within the group. For these purposes, a UK group broadly consists of two or more UK resident companies under common worldwide 75% control. A UK branch of an overseas company may be included in the UK group. Capital assets can be transferred within a UK group without incurring a taxable gain, subject to a tax charge if the transferee company leaves the group within six years of the transfer. The definition of a group for capital gains purposes is slightly looser than for trading losses.

Losses

Trading losses may be set off against

total profits (including interest, rental income and capital gains) in the same accounting period or carried back to the previous year or carried forward for relief against future profits of the same trade without time limit. For accounting periods ending between 24 November 2008 and 23 November 2010, companies will benefit from an extended carry back period for trading losses. Losses can be carried back for three years (ie 36 months, not three accounting periods), and set first against profits of more recent years, before carry back to earlier years. The total extended carry back may not exceed 50,000, disregarding the unlimited one-year carry back normally available. Subject to certain limitations, similar rules broadly apply for non-trading losses, although they can typically only be carried back or forward against non-trading profits. Capital losses can be offset against capital gains of the same or later periods.

Planning

The loss utilisation rules are complex. Managing the utilisation of tax losses to maximise cash-tax savings is critical, particularly in the start-up period of a company.

Supply chain planning and transfer pricing

from the transfer pricing rules, though medium-sized enterprises may have to comply if they are issued with a notice to apply transfer pricing, or if they have transactions with certain overseas territories.

Planning

Companies are responsible for applying arms length prices to transactions with related parties, including UK affiliates. Subject to certain exemptions below, they are required to self-assess their transfer pricing position, and should have adequate documentation in place in case of enquiry. Where a UK tax advantage arises as a result of non-arms length prices, transfer pricing legislation requires the substitution of arms length prices for tax purposes. Small and medium-sized enterprises are generally exempt

Determining the correct supply chain model is fundamental when setting up in a new territory. Not only does this ensure the operating structure is aligned with commercial objectives, it can be a very useful tool to manage the global tax rate of the Group.

Tax costs of financing and capital extraction

Particular care is needed when considering optimal methods to finance the UK, and to return funds to the parent from the UK.

19 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

The tax effects of various capital extraction methods are set out as follows: Interest Withholding tax at 20% applies to payments, though this may be reduced or eliminated under the terms of the relevant tax treaty. Clearance from the UK taxation authorities is required before treaty relief can be claimed. A corporation tax deduction should in principle be available for the UK interest-paying company, though this is subject to complex anti-avoidance rules, especially in the following areas: deferral of relief for late paid interest between connected parties (although this has been relaxed in many cases from 1 April 2009) permanent denial of relief under thin capitalisation rules where debt finance is provided on a non-arms length basis between related parties denial of relief for interest on loans for unallowable purposes from 1 January 2010, the tax deduction for intra-group interest

costs in the UK for large enterprises will generally be restricted to the groups net external interest.

Dividends No withholding tax is applied to dividends from UK companies and no tax deduction is available to the dividend-paying company. Management charges No withholding tax applies. Commercially justifiable, arms length management charges should provide a tax deduction for the paying company, provided the relevant transfer pricing rules have been considered as previously mentioned. Royalties Withholding tax at 20% applies, which may be reduced or eliminated under the relevant tax treaty. A corporation tax deduction should be available for justifiable arms length charges, subject to rules relating to the deferral of relief for late paid royalties.

Planning

A key question is to determine the optimal financing route for a subsidiary. This will depend on a number of factors, including the rates of tax in overseas territories. There are no minimum capital requirements in the UK, and companies will often seek to use debt finance to fund the subsidiary, due to the flexibility this offers. Anti-avoidance will however require careful consideration, and this route may not always maximise tax efficiency.

Broadly, VAT is levied on the value added at each stage of the production and distribution supply chain. Registered businesses act as collection points for HM Revenue & Customs, paying over the VAT levied on their customers after deducting a credit for the VAT they pay to suppliers. Complications arise because not all transactions are subject to the tax, and those that are may be subject to different rates. In addition, not all of the VAT incurred by a business can be reclaimed.

Making taxable supplies

Indirect taxes and duties Value Added Tax

VAT is a transaction tax. The majority of transactions involving the supply of goods, the provision of services, and importations will be subject to the tax.

A business will have a liability to register and account for VAT if the value of its taxable supplies exceeds the prevailing registration limit. For these purposes a business can be an individual, a partnership (including a limited liability partnership), a trust, an incorporated business, or a branch of an overseas corporate entity. The establishment of either a place of business or an operation that has

20 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

the technical and human resources necessary for making and receiving supplies in the UK will, generally, indicate a potential liability to register. However, a complex set of place of supply rules mean that even without such an establishment, transactions can still be liable to VAT in the UK. These rules differ depending upon whether the supply is one of goods or services. It is therefore possible that an overseas company, which does not have an establishment or any other presence in the UK for corporation tax purposes, may nevertheless have a liability to account for UK VAT by virtue of the transactions undertaken in the UK or with UK customers.

Planning

Simplification measures exist which are intended to minimise the VAT burden on overseas businesses. However, these measures often relate to specific circumstances and so may not have general application. An early review of the nature of the intended supply can potentially avoid a VAT cost, or a liability to register for VAT in the UK.

It is possible to deregister for VAT where the value of taxable supplies fall below a deregistration threshold. The threshold is currently 66,000.

Planning

VAT Registration

Where a new business operation or branch has yet to reach the registration threshold, there may be situations where it will be beneficial to consider registering for VAT voluntarily. This would assist with cash flow as it would enable VAT incurred on set-up costs to be recovered.

European Union (EU) countries. Such reporting is required in all EU Member States. It is anticipated that similar reporting will be required from 2010 throughout the EU for certain services. Special anti-avoidance reporting is also required if certain electronic goods are supplied in the UK.

Planning

Registration is compulsory for any businesses whose taxable supplies have exceeded the registration limit in the last 12 months (or less if the taxable supplies have been made for a period of less than 12 months), or at any time if the business has reasonable grounds for believing that the limit will be exceeded in the next 30 days. The current registration limit is 68,000.

Administration

Monthly accounting for VAT is of particular relevance if the net position will be a repayment of VAT. In order to speed the repayment process up, you do not have to wait for the due submission date.

VAT returns are generally filed on a quarterly basis, although it is possible to do so each month. The VAT returns, together with any tax due, must be submitted within one month of the relevant period end. Additional declarations may have to be made if goods are acquired from or despatched to other

Applicable rates

With effect from 1 December 2008 the standard rate of VAT has been temporarily reduced from 17.5% to 15%. The current intention is that it will remain at 15% until 1 January 2010, at which point it will revert back to 17.5%.

21 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

A reduced rate of 5% exists for certain supplies which are generally regarded as having a social benefit. The zero-rate is applicable to certain goods and services, such as food (not catering), books, the construction and sale of private housing, public transport, childrens clothing and certain charitable activities. However, this list is not exhaustive. Some supplies are exempt from VAT. These are typically financial and insurance transactions, as well as certain supplies of land. Also included are most supplies of education, health, and welfare. As with the zero-rate, no VAT is levied on these transactions. However, unlike the supply of zero-rated goods and services, exempt transactions preclude the recovery of VAT on related purchases (subject to a de minimis limit). As such, exempt transactions can lead to a restriction of VAT recovery and result in an absolute cost for businesses.

Importation

Goods which are imported from outside the EU are subject to VAT at the rate which would be applicable if they were sold in the UK. Relief from import VAT may be available where goods are temporarily imported, with the intention of being removed from the UK within a specific time. The payment of import VAT is due at the time and place of entry into the UK. However, payment can be delayed until the 15th day of the following month if a duty deferment account is used. In addition to deferring the payment of VAT (and Customs Duty), the deferment account helps to ensure that goods awaiting clearance are not delayed pending the payment of taxes. In order to obtain such an account, a financial guarantee will have to be provided to HM Revenue & Customs. The required level of guarantee is related to the expected level of imports.

A credit for VAT paid at importation can be claimed by the business on its VAT return, subject to the normal rules.

Planning

Member State into which they are imported. Once Customs Duty has been paid, the goods are in free circulation within the EU, and no further duty is payable on any subsequent movements within the EU.

Valuation

A simplified import VAT accounting scheme (SIVA) can be used to reduce the level of financial guarantee. The scheme is available to businesses with a good compliance history.

Customs Duty

The value on which duty is based should be the open market export price of the goods from the supplier (as if between unrelated businesses), plus insurance and freight charges to the EU border. This is commonly known as the CIF value.

Along with import VAT, Customs Duty is levied on goods brought in to the UK from outside the EU. The level of duty is determined by the Customs tariff classification and will vary subject to what is being imported and the origin of the goods. This is a common tariff across the EU, and as such goods falling within the same tariff classification will be taxed at the same rate regardless of the EU

22 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Planning

Customs duty is generally an absolute cost to the importer and as such it is imperative to consider the tariff classification and, in particular, the value of the goods to which the tariff will be applied prior to importation and, preferably, prior to the creation of the supply chain. Whilst the classification is subject to very rigid rules, the legislation relating to valuation allows for certain costs to be removed or added, so planning is important if unnecessary duty costs are to be avoided.

Excise Duty

suspension arrangement, affording the business a potentially significant cash flow or absolute benefit. In contrast to the EU governed Customs Duty, Excise Duty is a national tax. It is due on imports from outside the EU and on the intra-EU movement of goods into the UK, unless they are deposited in an approved excise warehouse or a specific relief is available.

Stamp Taxes

Individuals

UK resident individuals are subject to UK tax on their worldwide income and capital gains, with some important exceptions. There are separate taxes on income and capital gains. The tax year for individuals is the year ending on 5 April.

When is an individual liable to UK tax?

per year, measured over four years) and habitual. Days of arrival and departure are counted for the purpose of these tests if the individual was present in the UK at midnight on that day. Ordinary residence is mainly relevant to individuals coming to the UK for employment. Individuals will be regarded as ordinarily resident in the UK if they come to the UK to take up employment expected to last three years or more, or with the intention of taking up permanent residence. Domicile is relevant to individuals with foreign income or gains. Establishing the domicile of an individual is not a simple matter, however broadly speaking individuals are domiciled in the country in which they regard as their permanent home, for example, the country to which they eventually intend to return, even if in the distant future.

Certain items such as tobacco, alcohol, and oils are liable to Excise Duty. Generally, the duty liability is due prior to the goods being released for retail sale. Businesses that trade in excisable goods can apply for an excise duty and VAT

Stamp Duty is charged on transfers of shares at a rate of 0.5%. Stamp Duty Reserve Tax (SDRT) is charged on agreements to transfer shares and is cancelled by the payment of Stamp Duty on completion of the transfer. Stamp Duty Land Tax (SDLT) is charged on documents transferring real estate at rates between 1% and 4%, depending upon the consideration and status (commercial or residential) of the property, and is charged at a rate of 1% on the net present value of rentals payable under a lease.

An individuals exposure to UK tax is dependent on whether the individual is resident, ordinarily resident and/or domiciled in the UK. Tax treaties can affect the residence position of impatriates, and the UK tax liability of non-residents. Individuals not previously resident in the UK will generally be treated as resident where: they are physically present in the UK for 183 days or more in any tax year (ending 5 April) their visits to the UK have become substantial (an average of 91 days

23

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

What are the administrative requirements on arriving in or departing from the UK?

HM Revenue & Customs (HMRC) must be notified by individuals arriving and leaving the UK. Failure to file the appropriate forms in the correct format and manner may lead to penalties being charged.

How is the foreign income of impatriates taxed?

Some foreign income of impatriates is not taxed in the UK unless it is remitted to the UK, even if the individual is resident. Non UK resident individuals are subject to income tax on income arising from sources in the UK. For example, employment income in respect of work performed in the UK is potentially subject to UK income tax. Relief may be available under a double tax treaty in some circumstances. From 6 April 2008, UK resident but non-domiciled or not ordinarily resident individuals are taxed for any given tax year on their

worldwide income and capital gains unless they meet certain exemptions, or they make a claim to be taxed on the remittance basis (paying an annual charge of 30,000 if they are long-term resident). The remittance basis is extremely complex with uncertainty over how the legislation is applied in certain circumstances. Therefore advice should be sought on claiming the remittance basis. Overseas earnings of remittance basis users will not be subject to UK taxation provided certain criteria are met and the earnings are not remitted to the UK.

Planning

What are the employers responsibilities in relation to UK tax?

The tax status of the individuals should be carefully reviewed, in particular non-domiciled individuals, as this may give opportunities to manage their liability to income tax. Full advantage should be taken of concessions under double tax treaties.

Wage withholding tax (Pay As You Earn or PAYE) applies to all wages and salaries paid in the UK and also to wages and salaries paid outside the UK if the individual is employed by a UK company. Employed by is not the same as working for. The test is whether the UK company bears the risks and rewards of the individuals labour. It is the employers responsibility to account for all necessary withholding taxes and to make all relevant returns of the same to HMRC. There are set forms and procedures which must be adhered to, and penalties may apply if this is not done. In certain circumstances it is possible to enter into modified payroll arrangements with HMRC for companies using foreign employees in the UK. These arrangements can lessen the administrative burden on the company. A separate option available in limited circumstances is

voluntary PAYE. This process allows the individuals to account for withholding taxes themselves (rather than their employer). In both modified and voluntary arrangements, this is a complex area and we suggest that appropriate advice is sought. In addition to withholding taxes on cash remuneration given to employees in the UK, withholding taxes also apply to expenses and non-cash benefits provided to employees. There are also specific complex reporting requirements which must be met. Please refer to the Appendix for rates of withholding tax. There is a national minimum wage which applies to legally employed individuals in the UK, and this is policed by HMRC. Furthermore there are complex rules regarding other pay, benefits and legal entitlements, and it is recommended that legal advice is sought concerning any of these matters.

24 Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

Work arrangements may be structured to enable certain expense payments to be provided to employees without tax charges arising, for example, for certain accommodation and subsistence payments.

Planning

The structuring of employee benefits should be carefully considered to ensure that they are provided on the most tax-efficient basis, for example, through the use of share incentive schemes or pension payments.

Individuals, including employees, with more complicated affairs are generally required to file a tax return. Tax returns can either be filed on paper or electronically. Tax returns filed by paper are due by 31 October following the end of the tax year, and tax returns filed electronically are due by 31 January following the end of the tax year.

Social security taxes

NICs for the first 52 weeks that the employee is in the UK. An individual who is liable to make National Insurance Contributions (NICs) must register for a National Insurance number. They can obtain this by contacting a Jobcentre Plus. Please refer to the Appendix for contact details.

Planning

Tax returns

Most employees whose income is mainly wages subject to PAYE should not have a balance due at the end of the tax year and are not required to file a tax return. This is unlikely to apply to foreign personnel working in the UK.

Employees are liable to social security taxes (National Insurance Contributions) on their earnings. Please refer to the Appendix for rates. Employees sent to work in the UK for limited periods from other countries in the EU or from countries with which the UK has Social Security Agreements may continue to pay social security taxes in their home countries, and not UK social security taxes. In certain circumstances, foreign employers sending employees to the UK may not be required to pay

Assignments of individuals should be reviewed to determine whether they can be engaged on a self-employed basis to achieving Social Security savings.

25

Doing business in the United Kingdom

Home

Foreword

Country profile

Regulatory environment

Finance

Imports

Business entities

Labour

Financial reporting and audit

Tax

Contacts

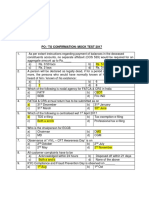

Detailed facts on the UK tax system

A Companies Tax rates (2009-10)

The large company rate of corporation tax is 28% A reduced rate of corporation tax of 21% applies to smaller companies. This will increase to 22% from 1 April 2010 The large company rate applies to stand-alone companies with taxable profits of 1.5m. The small companies rate applies to standalone companies whose taxable profits are below 300,000. Profits between 300,000 and 1.5m are effectively taxed at a marginal rate of 29.75% The profit limits are divided by the number of active worldwide associated companies and are pro-rated for accounting periods of less than 12 months.

Payment and tax return dates

companies rate must pay corporation tax by quarterly instalments on the 14th day of the seventh, tenth, thirteenth and sixteenth months from the start of the accounting period. Other companies must pay corporation tax nine months and one day after the end of the accounting period.

Capital allowance rates (2009-10)

new electric cars and low carbon dioxide emission cars 100% The special rate is applicable to long-life assets, specified integral features within buildings, and expenditure on cars with CO2 emissions over 160g/km. Writing down allowances are available on a reducing balance basis.

Research and development enhanced relief (2009-10)

Large enterprises 130% Small and medium-sized enterprises 175%

Companies are required to file returns 12 months from the end of the accounting period. Companies paying tax at the large

Allowances are available on qualifying plant and machinery at the following rates: annual writing down allowance (standard rate) 20% annual writing down allowance (special rate) 10% annual investment allowance (AIA) (on first 50,000 of qualifying expenditure) 100% first year allowance on balance after AIA (qualifying plant & machinery) 40% energy saving or environmentally beneficial plant and machinery 100%

Small and medium-sized enterprise size limits for R&D relief

The limits are: From 1 August 2008 Employees full-time equivalent Turnover Balance sheet gross assets 500 100 million 86 million

For a company to qualify as an SME, the employee condition must be met together with either the turnover or balance sheet condition.

Small and medium-sized enterprise size limits for transfer pricing

The limits are: Employees full-time equivalent Turnover Balance sheet gross assets 250 50 million 43 million

26 Doing business in the United Kingdom