Professional Documents

Culture Documents

MPSERS 2011 Financial Assumptions Pg36

Uploaded by

Rob LawrenceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MPSERS 2011 Financial Assumptions Pg36

Uploaded by

Rob LawrenceCopyright:

Available Formats

FINANCIAL SECTION

Notes to Basic Financial Statements (continued)

The information presented in the required supplementary schedules was determined as part of the actuarial valuations at the dates indicated. Additional information as of the latest actuarial valuation follows:

Summary of Actuarial Assumptions

Valuation Date Actuarial Cost Method Amortization Method - Pension Amortization Method - OPEB Remaining Amortization Period - Pension Remaining Amortization Period - OPEB Asset Valuation Method - Pension Asset Valuation Method - OPEB Actuarial Assumptions: Wage Inflation Rate Investment Rate of Return - Pension - MIP and Basic Plans - Pension Plus Plan Investment Rate of Return - OPEB Projected Salary Increases Cost-of-Living Pension Adjustments Healthcare Cost Trend Rate Other Assumptions OPEB only: Opt Out Assumption 9/30/2010 Entry Age, Normal Level Percent of Payroll, Closed Level Percent of Payroll, Closed 26 years* 26 years 5-Year Smoothed Market Market 3.5% 8.0% 7.0% 4.0% 3.5 - 15.9% 3% Annual Non-Compounded for MIP Members 8.5% Year 1 graded to 3.5% Year 11 21% of eligible participants hired before 7/1/2008 and 30% of those hired after 6/30/2008 are assumed to opt out of the retiree health plan 80% of male retirees and 67% of female retirees are assumed to have coverage continuing after the retiree's death 75% of male and 60% of female future retirees are assumed to elect coverage for 1 or more dependents

Survivor Coverage

Coverage Election at Retirement

*Based on the provisions of GASB Statement Nos. 25, 43 and 45 when the actuarial accrued liability for a defined benefit pension plan is underfunded or overfunded, the difference should be amortized over a period not to exceed thirty years for the fiscal periods beginning on or after June 15, 2006.

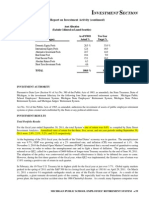

NOTE 4 - INVESTMENTS

Investment Authority Under Public Act 380 of 1965, as amended, the authority for the purchase and the sale of investments resides with the State Treasurer. Investments are made subject to the Public Employee Retirement System Investment Act, Public Act 314 of 1965, as amended. The Public Employee Retirement System Investment Act authorizes, with certain restrictions, the investment of pension fund assets in stocks, corporate and government bonds and notes, mortgages, real estate, and certain short-term and alternative investments. Investments must be made for the exclusive purposes of providing benefits to active members, retired members and beneficiaries, and for defraying the expenses of investing the assets. Under Public Act 314 of 1965, as amended, the State Treasurer may invest up to 5% of the Systems assets in small businesses having more than one-half of assets or employees in Michigan as described in section 20(a) of the Act and up to 20% of the Systems assets in investments not otherwise qualified under the Act as described in section 20(d).

36 MICHIGAN PUBLIC SCHOOL EMPLOYEES RETIREMENT SYSTEM

You might also like

- Summary PASDocument7 pagesSummary PASRemie Rose BarcebalNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- BIR-How To Compute Fringe Benefit Tax, REL PARTYDocument69 pagesBIR-How To Compute Fringe Benefit Tax, REL PARTYLeandrix Billena Remorin Jr75% (4)

- Retirement Benefit PlansDocument1 pageRetirement Benefit Plansm2mlckNo ratings yet

- Social Security: MemorandumDocument29 pagesSocial Security: MemorandumjosephragoNo ratings yet

- Unit 3 - Interim Reporting - 1484598619Document14 pagesUnit 3 - Interim Reporting - 1484598619Charmaine CañeteNo ratings yet

- Mr. Basit HassanDocument4 pagesMr. Basit HassanBasit Hassan QureshiNo ratings yet

- Guidelines PFRS For SMEsDocument4 pagesGuidelines PFRS For SMEsRachel GarciaNo ratings yet

- Comparative Study On Igaap, Usgaap &Document11 pagesComparative Study On Igaap, Usgaap &Narayanan GopalacharyNo ratings yet

- NBC 557Document18 pagesNBC 557Elizabeth VasquezNo ratings yet

- Group Gratuity Schemes: BY: Manjusha Arora Ankur GargDocument15 pagesGroup Gratuity Schemes: BY: Manjusha Arora Ankur GargManjusha AroraNo ratings yet

- BIR How To Compute Fringe Benefit Tax REL PARTYDocument69 pagesBIR How To Compute Fringe Benefit Tax REL PARTYRyoNo ratings yet

- Corporate Recovery and Tax Incentives For EnterprisesDocument5 pagesCorporate Recovery and Tax Incentives For EnterprisesIvy BoseNo ratings yet

- The Payment of Bonus Act, 1965Document6 pagesThe Payment of Bonus Act, 1965Ravi GuptaNo ratings yet

- Statewide Accounting Policy & Procedure: Accounting Manual Reference: Effective Date: Revision DateDocument4 pagesStatewide Accounting Policy & Procedure: Accounting Manual Reference: Effective Date: Revision DatekimNo ratings yet

- 2019 Riverside County Pension Advisory Review Committee ReportDocument20 pages2019 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- AsianPaintsLimited DividendDistributionPolicyDocument3 pagesAsianPaintsLimited DividendDistributionPolicyCurious FacTreeNo ratings yet

- Corporate Disclosure and Investor ProtectionDocument26 pagesCorporate Disclosure and Investor ProtectionMatharu Knowlittle100% (1)

- Budget PLUS 2011Document108 pagesBudget PLUS 2011Meenu Mittal SinghalNo ratings yet

- RemunerationDocument18 pagesRemunerationNoamanNo ratings yet

- TIIN 8127 Venture Capital Trusts Return of CapitalDocument2 pagesTIIN 8127 Venture Capital Trusts Return of CapitalErn_DabsNo ratings yet

- Retirement and Retirement Benefits - Pension Scheme For The Public SectorDocument26 pagesRetirement and Retirement Benefits - Pension Scheme For The Public Sectorrachna357No ratings yet

- PAS 19 Practice GuideDocument4 pagesPAS 19 Practice GuideEllaine Montojo MirandaNo ratings yet

- AFC2240 Equities and Investment Analysis Tutorial 1 Solution Guide - Semester 2, 2008Document9 pagesAFC2240 Equities and Investment Analysis Tutorial 1 Solution Guide - Semester 2, 2008B BoysNo ratings yet

- KPMG Budget HighlightsDocument24 pagesKPMG Budget Highlightsapi-3732007No ratings yet

- 1FU491 Employee BenefitsDocument14 pages1FU491 Employee BenefitsEmil DavtyanNo ratings yet

- Lab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application AssignmentDocument4 pagesLab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application Assignmentsandeepraina0% (1)

- Indian Accounting Standards: Manish B TardejaDocument45 pagesIndian Accounting Standards: Manish B TardejaManish TardejaNo ratings yet

- Taxation Notes 4.1.23 MidtermDocument11 pagesTaxation Notes 4.1.23 MidtermRaissa Anjela Carman-JardenicoNo ratings yet

- Tax Planning IndiaDocument20 pagesTax Planning IndiaRohanTheGreatNo ratings yet

- Analysis of Dividend PolicyDocument6 pagesAnalysis of Dividend PolicyShubhangi GargNo ratings yet

- Chapter 3 Fringe & de Minimis BenefitsDocument6 pagesChapter 3 Fringe & de Minimis BenefitsNovelyn Hiso-anNo ratings yet

- Auditor Opinion Re IPSDocument3 pagesAuditor Opinion Re IPSJuan Esteban Garcia MahechaNo ratings yet

- Withholding Tax SystemDocument73 pagesWithholding Tax SystemrickmortyNo ratings yet

- Income-Taxation 3Document44 pagesIncome-Taxation 3Maria Maganda MalditaNo ratings yet

- The Payment of Bonus Act, 1965Document36 pagesThe Payment of Bonus Act, 1965NiveditaSharmaNo ratings yet

- SRC Rule 68 As AmendedDocument158 pagesSRC Rule 68 As Amendedjimmy rodolfo LazanNo ratings yet

- Lakshya Plus v1Document10 pagesLakshya Plus v1Mahadevan VenkatesanNo ratings yet

- Mahesh Prepared Income Tax HighlightsDocument39 pagesMahesh Prepared Income Tax HighlightsMaheshkumar PerlaNo ratings yet

- The Income Tax ActDocument15 pagesThe Income Tax ActfbuameNo ratings yet

- PFRF MildsDocument31 pagesPFRF Mildsgerald lloyd sudarioNo ratings yet

- DT AmendmentsDocument39 pagesDT AmendmentsMurali GopalakrishnaNo ratings yet

- Revenue Regulations No. 7 - 2006: Quezon City May 18, 2006Document2 pagesRevenue Regulations No. 7 - 2006: Quezon City May 18, 2006Sy HimNo ratings yet

- Finance Bill 2023 HighlightsDocument34 pagesFinance Bill 2023 HighlightsVijay Shankar PandeyNo ratings yet

- Comparative Matrix of Social Legislation in The PhilippinesDocument14 pagesComparative Matrix of Social Legislation in The PhilippinesHowie Malik100% (2)

- Assam Financial Corporation (1) Accounting PoliciesDocument27 pagesAssam Financial Corporation (1) Accounting PoliciesChinmoy DasNo ratings yet

- Ias 26Document4 pagesIas 26muhammadazmatullahNo ratings yet

- Direct Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnDocument5 pagesDirect Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnPriya KudnekarNo ratings yet

- Instructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnDocument4 pagesInstructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnjoshisanjeevNo ratings yet

- Intermediate Accounting IIIDocument12 pagesIntermediate Accounting IIIAlma FigueroaNo ratings yet

- Direct Taxes Code Bill, 2009: at A GlanceDocument181 pagesDirect Taxes Code Bill, 2009: at A GlanceSanni KumarNo ratings yet

- Sales Brochure - LIC S NGSCA - CleanDocument6 pagesSales Brochure - LIC S NGSCA - CleanPrakash kumarTripathiNo ratings yet

- FINANCIAL STATEMENTS: Preparation and PresentationDocument39 pagesFINANCIAL STATEMENTS: Preparation and PresentationPaul BanuaNo ratings yet

- Compensation and IncentivesDocument2 pagesCompensation and IncentivesLuis WashingtonNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingBea ChristineNo ratings yet

- Tax Saving and Investment AvenuesDocument39 pagesTax Saving and Investment AvenuesHimanshu SharmaNo ratings yet

- Comparative MEA Salaries 2018 To 2019Document3 pagesComparative MEA Salaries 2018 To 2019Rob LawrenceNo ratings yet

- Top Ten MEA Earners 2017Document1 pageTop Ten MEA Earners 2017Rob LawrenceNo ratings yet

- MEA Top 10 Pay 2020Document1 pageMEA Top 10 Pay 2020Rob LawrenceNo ratings yet

- Comparative MEA Salareis 2019 To 2020Document3 pagesComparative MEA Salareis 2019 To 2020Rob LawrenceNo ratings yet

- Comparative Salaries of MEA 2015 To 2016Document4 pagesComparative Salaries of MEA 2015 To 2016Rob LawrenceNo ratings yet

- MPSERS 2011 Investment Return pg59Document1 pageMPSERS 2011 Investment Return pg59Rob LawrenceNo ratings yet

- MPSERS - Michigan Teachers Pension Fund Deceptive On Its Financial PerformanceDocument1 pageMPSERS - Michigan Teachers Pension Fund Deceptive On Its Financial PerformanceRob LawrenceNo ratings yet

- MEA Top Ten Salaries 2010Document1 pageMEA Top Ten Salaries 2010Rob LawrenceNo ratings yet

- MPSERS 2011 Assets Pg23Document1 pageMPSERS 2011 Assets Pg23Rob LawrenceNo ratings yet

- MPSERS 2011 Investment Section pg68Document1 pageMPSERS 2011 Investment Section pg68Rob LawrenceNo ratings yet

- MEA Top Ten Salaries 2011Document1 pageMEA Top Ten Salaries 2011Rob LawrenceNo ratings yet

- MEA Salaries 10-11Document5 pagesMEA Salaries 10-11Rob LawrenceNo ratings yet

- Increae Base (+$100k) From '06 Increae Total (+$100k) From '06Document6 pagesIncreae Base (+$100k) From '06 Increae Total (+$100k) From '06Rob LawrenceNo ratings yet

- MEA Salaries 08-09Document5 pagesMEA Salaries 08-09Rob LawrenceNo ratings yet

- Ruth Beier Tesimony HB 5963Document6 pagesRuth Beier Tesimony HB 5963Rob LawrenceNo ratings yet

- Audit and Actuary Letters MPSERSDocument4 pagesAudit and Actuary Letters MPSERSRob LawrenceNo ratings yet

- Ruth Beier Tesimony HB 5963Document6 pagesRuth Beier Tesimony HB 5963Rob LawrenceNo ratings yet

- Mpsers 2009 Audit 109Document1 pageMpsers 2009 Audit 109Rob LawrenceNo ratings yet

- Mpsers 2009 Audit Page 36Document1 pageMpsers 2009 Audit Page 36Rob LawrenceNo ratings yet

- MPSERS - Michigan Teachers' Pension Fund Lost $9.2 Billion in 2008Document1 pageMPSERS - Michigan Teachers' Pension Fund Lost $9.2 Billion in 2008Rob LawrenceNo ratings yet

- State Aid 20j Impact 2009-10 UpdatedDocument1 pageState Aid 20j Impact 2009-10 UpdatedRob LawrenceNo ratings yet

- Mpsers 2009 Audit Page 34Document1 pageMpsers 2009 Audit Page 34Rob LawrenceNo ratings yet

- MCA Proposal For OutsourcingDocument2 pagesMCA Proposal For OutsourcingLazaros KarapouNo ratings yet

- 9MFY18 MylanDocument94 pages9MFY18 MylanRahul GautamNo ratings yet

- ITMC (International Transmission Maintenance Center)Document8 pagesITMC (International Transmission Maintenance Center)akilaamaNo ratings yet

- CSFP's Annual Executive Budget 2014Document169 pagesCSFP's Annual Executive Budget 2014rizzelmangilitNo ratings yet

- C++ & Object Oriented Programming: Dr. Alekha Kumar MishraDocument23 pagesC++ & Object Oriented Programming: Dr. Alekha Kumar MishraPriyanshu Kumar KeshriNo ratings yet

- Rule 63Document43 pagesRule 63Lady Paul SyNo ratings yet

- Wind Flow ProfileDocument5 pagesWind Flow ProfileAhamed HussanNo ratings yet

- About FW TaylorDocument9 pagesAbout FW TaylorGayaz SkNo ratings yet

- Inteligen NT BB - NTC BB Datasheet PDFDocument4 pagesInteligen NT BB - NTC BB Datasheet PDFfrancis erl ligsayNo ratings yet

- Borang Pengesahan PembetulanDocument7 pagesBorang Pengesahan PembetulanARMIZAWANI BINTI MOHAMED BUANG (KMPH)No ratings yet

- Khrone 5 Beam Flow Meter DatasheetDocument16 pagesKhrone 5 Beam Flow Meter DatasheetAnoop ChulliyanNo ratings yet

- ISA 265 Standalone 2009 HandbookDocument16 pagesISA 265 Standalone 2009 HandbookAbraham ChinNo ratings yet

- AMM Company ProfileDocument12 pagesAMM Company ProfileValery PrihartonoNo ratings yet

- Gears, Splines, and Serrations: Unit 24Document8 pagesGears, Splines, and Serrations: Unit 24Satish Dhandole100% (1)

- Natures CandyDocument19 pagesNatures CandyFanejegNo ratings yet

- Outline - Essay and Argumentative EssayDocument2 pagesOutline - Essay and Argumentative EssayGabbo GómezNo ratings yet

- APCJ Directory 2019Document34 pagesAPCJ Directory 2019Anonymous Pu3OF7100% (3)

- Define Constitution. What Is The Importance of Constitution in A State?Document2 pagesDefine Constitution. What Is The Importance of Constitution in A State?Carmela AlfonsoNo ratings yet

- Link Belt Rec Parts LastDocument15 pagesLink Belt Rec Parts LastBishoo ShenoudaNo ratings yet

- 173089Document22 pages173089aiabbasi9615100% (1)

- Manual de Partes Dm45-50-lDocument690 pagesManual de Partes Dm45-50-lklausNo ratings yet

- TDS - Total - Carter 68 - Wyh - 202201 - en - IdnDocument1 pageTDS - Total - Carter 68 - Wyh - 202201 - en - IdnAnya J PamungkasNo ratings yet

- Microsoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeDocument2 pagesMicrosoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeOmar PiñaNo ratings yet

- SC Circular Re BP 22 Docket FeeDocument2 pagesSC Circular Re BP 22 Docket FeeBenjamin HaysNo ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Document21 pagesAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Donnie HavierNo ratings yet

- Raport de Incercare TL 82 Engleza 2015 MasticDocument3 pagesRaport de Incercare TL 82 Engleza 2015 MasticRoxana IoanaNo ratings yet

- Feed Water Heater ValvesDocument4 pagesFeed Water Heater ValvesMukesh AggarwalNo ratings yet

- Oracle Absence Management SetupDocument9 pagesOracle Absence Management SetupRavish Kumar SinghNo ratings yet

- Standard Wiring Colors - Automation & Control Engineering ForumDocument1 pageStandard Wiring Colors - Automation & Control Engineering ForumHBNBILNo ratings yet