Professional Documents

Culture Documents

David

Uploaded by

Dave MathewOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

David

Uploaded by

Dave MathewCopyright:

Available Formats

C. SURESH KUMAR, M.Com.

C L I A & Chairman's Club Member

Contact No.

Address :

Mobile: 98401 62796

New No. 34, Munusamy Street, Ayanavaram, CHENNAI - 600 023. Email: suresh0509_1964@yahoo.co.in

THIS PLAN PRESENTATION RECOMMENDED TO :MR.DAVID MATHEW Age : 24 Policy Maturity age : 40 Prem. Paying Term : 16 Sum Assured : 9,00,000

Term : 16

Plan Description : New Bima Gold (179) Date : 20/08/2011 INCOME TAX BENEFITS

PREMIUM Yearly Prem. 44,204.00

I.T. rebate u/Sec.80 (C) INCOME TAX SAVED EVERY YEAR Rs. Total I.T. saved during the entire term Rs. I.T. exemption u/Sec.10(10D) Maturity Benefits from this policy are exempted from Income Tax under the above provisions of IT Act.

RISK COVER Normal Risk cover

(upto end of the term)

Tax Free Survival Benefits & Maturity Benefit 9,00,000 4,50,000 18,00,000 9,00,000 Investment Per Day 4th Year (15%) 1,35,000 At 16th Year

Total Premium paid Add: Loyalty Addns. 12th Year(15%) 1,35,000 Less : AB Premium

8th Year (15%) 1,35,000

years

7,07,264 1,26,000 ** 14,400 4,05,000 4,13,864 8,18,864

Extended Term Cover

(continues upto 8 even after maturity)

Less : SB paid Total Total income out of this plan

Accident Cover Disability Benefit

121.00

**(Loyalty Additions will vary depending on the experience of the Corporation)

Accidental Risk & Disability Cover available upto age 70 only. Extent of cover subject to other conditions.

Highlights in a nutshell

1. A unique golden jubilee year money back policy from LIC with a very special feature of extended term cover which ensures continued protection even after maturity to the extent of 50% of sum assured for half the term selected. 2. An inbuilt benefit viz. Auto cover feature is available in this plan. By this,after 2 years' premium are paid and if further premia could not be paid, risk cover to the extent of full sum assured continues for 2 years from then. 3. In case of unfortunate death during the term of the policy, full Sum Assured is paid without deducting the Survival Benefits already paid provided the policy is in full force. 4. Accident Benefit is optional and if availed, one more additional feature viz., Disability benefit will also be available. 5. At the end of the term, maturity benefit equal to total premium paid less survival benefits paid, rider premium, and extras if any is paid. Loyalty additions, if any declared in future will also be paid. 6. Liquidity options like Guaranteed Surrender Value/Paid up Value available. 7. After 3 full years' premium are paid, loan can also be raised under the plan at a very low interest rate. (For detailed highlights of this plan pl. refer

C.Suresh Kumar

Benefits & Highlights report)

The above maturity benefit is based on assumed future bonus rates and is subject to change depending on the policies of LIC/GOVT. For any specific reference with regard to the highlights, the policy bond issued by LIC of India will only hold good.

PDF created with pdfFactory trial version www.pdffactory.com

C. SURESH KUMAR, M.Com.

C L I A & Chairman's Club Member

Contact No.

Address :

Mobile: 98401 62796

New No. 34, Munusamy Street, Ayanavaram, CHENNAI - 600 023. Email: suresh0509_1964@yahoo.co.in

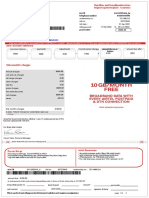

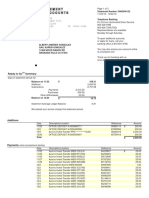

MOST ATTRACTIVE PLAN RECOMMENDED TO MR/MRS/MS.MR.DAVID MATHEW Age : 24 Policy Maturity age : 40.00 / 16 Sum Assured : 9,00,000

Term & Premium Paying Term : 16 Date : 20/08/2011 SNo Age Year

NEW BIMA GOLD (179) Returns after Risk Cover reinvestment of MB payments (normal risk)

9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000 9,00,000

Yly. Prem. after IT rebate

44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204 44,204

Cumulative Outgo

44,204 88,408 1,32,612 1,76,816 2,21,020 2,65,224 3,09,428 3,53,632 3,97,836 4,42,040 4,86,244 5,30,448 5,74,652 6,18,856 6,63,060 7,07,264

Money back payments

Age

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

1,35,000

1,35,000

1,35,000

7,06,364

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40

7,07,264 * **

Returns without reinvestment of money back payments Arrived to show how money back payments can be multiplied if reinvested @ % p.a.

**

IMPORTANT

**Guaranteed Additions 70 (12 years term) & 65 (9 years term) **Assumed Loyalty Additions per 1000 SA @

20/08/2011

C.Suresh Kumar

The above figures are based on certain assumptions which may change based on the policies of lic/govt.

PDF created with pdfFactory trial version www.pdffactory.com

You might also like

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDocument7 pagesBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Term Plan Sales BrochureDocument8 pagesTerm Plan Sales BrochurePreethi GopalanNo ratings yet

- Life Gain Premier BrochureDocument12 pagesLife Gain Premier BrochureNeeralNo ratings yet

- Money Back PlusDocument4 pagesMoney Back Plusvek80No ratings yet

- Mr. Piyush Verma: Insurance Proposal ForDocument6 pagesMr. Piyush Verma: Insurance Proposal ForDilip BaghelNo ratings yet

- ICICI Savings Suraksha BrochureDocument8 pagesICICI Savings Suraksha BrochureJetesh DevgunNo ratings yet

- 836 JeevanLabh 304V01 SLDocument9 pages836 JeevanLabh 304V01 SLPriya PahujaNo ratings yet

- 836 JeevanLabh 304V01 SLDocument9 pages836 JeevanLabh 304V01 SLPriya PahujaNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term PlanRKNo ratings yet

- Smart Platina Plus Brochure - BRDocument13 pagesSmart Platina Plus Brochure - BRSUNEET KUMARNo ratings yet

- Table No 93Document1 pageTable No 93ssfinservNo ratings yet

- Table No 91Document2 pagesTable No 91ssfinserv100% (1)

- Eligibility Conditions and Other Restriction:: Date of Commencement of Risk Under The PlanDocument5 pagesEligibility Conditions and Other Restriction:: Date of Commencement of Risk Under The PlansyedNo ratings yet

- GSIP BrochureDocument2 pagesGSIP Brochureabdul.nm4064No ratings yet

- Aam Admi Bima Yojana Lic PolicyDocument13 pagesAam Admi Bima Yojana Lic PolicyNarendra KumarNo ratings yet

- MMIP 7payDocument6 pagesMMIP 7paykarthikrajan123No ratings yet

- Sales Brochure LIC-s E-Term Rev PDFDocument3 pagesSales Brochure LIC-s E-Term Rev PDFRamesh ThumburuNo ratings yet

- Mr. Tarun: Insurance Proposal ForDocument4 pagesMr. Tarun: Insurance Proposal ForKumar KbrlNo ratings yet

- Test PDFDocument1 pageTest PDFsatyabhimeNo ratings yet

- Kotak Assured Income PlanDocument9 pagesKotak Assured Income Plandinesh2u85No ratings yet

- Ko Tak Assured in Come PlanDocument12 pagesKo Tak Assured in Come Planbvvrao787669No ratings yet

- Policy PitchDocument4 pagesPolicy PitchMahalaxmi SoojiNo ratings yet

- 825 E-Term 288V01 SLDocument5 pages825 E-Term 288V01 SLIncredible MediaNo ratings yet

- Cash Advantage BrochureDocument8 pagesCash Advantage Brochurevikrambakshi67No ratings yet

- Global Business School, Hubli - 580025:: 2nd: Sunway: Insurance and Risk ManagementDocument5 pagesGlobal Business School, Hubli - 580025:: 2nd: Sunway: Insurance and Risk ManagementMahalaxmi SoojiNo ratings yet

- Max Life Future Genius Education Plan ProspectusDocument16 pagesMax Life Future Genius Education Plan ProspectusmanishaNo ratings yet

- Secure Savings FAB: Features Advantages BenefitsDocument1 pageSecure Savings FAB: Features Advantages Benefitsvisa_kpNo ratings yet

- Sub Center ListDocument12 pagesSub Center ListVinaykumar HgNo ratings yet

- Saurabh Kumar Singh House No 505, Post Officebasantpur, Near Hanuman Mandir, Basantpur, Ballia, UTTAR PRADESH-277301 MOBILE NUMBER: 8354953469Document33 pagesSaurabh Kumar Singh House No 505, Post Officebasantpur, Near Hanuman Mandir, Basantpur, Ballia, UTTAR PRADESH-277301 MOBILE NUMBER: 8354953469Saurabh Kumar SinghNo ratings yet

- Super Endowment BrochureDocument13 pagesSuper Endowment BrochuremiteshtakeNo ratings yet

- LifeXL PDFDocument6 pagesLifeXL PDFJoydeep Kar0% (1)

- Great Cash Wonder (Launch) Write-UpDocument8 pagesGreat Cash Wonder (Launch) Write-UpAlex GeorgeNo ratings yet

- Life Insurance Policy For UDocument3 pagesLife Insurance Policy For USujaPriyanNo ratings yet

- LIC's CHILD FUTURE (Table No. 185) Benefit IllustrationDocument7 pagesLIC's CHILD FUTURE (Table No. 185) Benefit Illustrationpavan kumarNo ratings yet

- Edelweiss Tokio Life - Cashflow ProtectionDocument10 pagesEdelweiss Tokio Life - Cashflow ProtectionRohan R TamhaneNo ratings yet

- Jiban Bima CorporationDocument29 pagesJiban Bima CorporationBijoy Salahuddin100% (1)

- HDFC Life Super Income Plan SHAREDocument6 pagesHDFC Life Super Income Plan SHARESandeep MookerjeeNo ratings yet

- Table No 179Document2 pagesTable No 179ssfinservNo ratings yet

- Jeevan Anurag: Assured BenefitDocument10 pagesJeevan Anurag: Assured BenefitMandheer ChitnavisNo ratings yet

- Insurance 1685500628960Document2 pagesInsurance 1685500628960subhaniNo ratings yet

- Preferred Term Plan: Faidey Ka InsuranceDocument7 pagesPreferred Term Plan: Faidey Ka InsurancePratik JainNo ratings yet

- Birla Sun Life Vision PlanDocument3 pagesBirla Sun Life Vision Planshahtejas12No ratings yet

- Kotak Endowment PlanDocument2 pagesKotak Endowment PlanMichael GreenNo ratings yet

- Eprotect BrochureDocument13 pagesEprotect BrochureAbhishek RamNo ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- Igain Iii - Investment Plan: FeaturesDocument8 pagesIgain Iii - Investment Plan: FeaturesShankar VasuNo ratings yet

- Fulfil The Smaller Joys in Life, Through Regular IncomeDocument8 pagesFulfil The Smaller Joys in Life, Through Regular IncomeSajeed ShaikhNo ratings yet

- SSGML Products As On 7th Nov 2011Document9 pagesSSGML Products As On 7th Nov 2011synergygroupNo ratings yet

- LIC Jeevan Anurag PDFDocument6 pagesLIC Jeevan Anurag PDFshyam_inkNo ratings yet

- GIP Sales BrochureDocument15 pagesGIP Sales BrochureSiva NandNo ratings yet

- Life Insurance Corporation Pension PlusDocument9 pagesLife Insurance Corporation Pension PlusAmitabh AnandNo ratings yet

- 821 MoneyBack25 278V01 SLDocument8 pages821 MoneyBack25 278V01 SLdvk.dummymailNo ratings yet

- Sales Enablers CashRich Insurance PlanDocument2 pagesSales Enablers CashRich Insurance PlanhdfcblgoaNo ratings yet

- LICJeevan AnuragDocument10 pagesLICJeevan Anuragnadhiya2007No ratings yet

- Seving Surakha Plan: Summary InfoDocument2 pagesSeving Surakha Plan: Summary InfoPankaj ChauhanNo ratings yet

- Mr. Anil Kumar: An Innovative Retirement Solution ForDocument6 pagesMr. Anil Kumar: An Innovative Retirement Solution ForBhanu ANinnocentNo ratings yet

- JeevanBeema9 4 2023Document2 pagesJeevanBeema9 4 2023Mr. PerfectNo ratings yet

- JeevanBeema12 21 2022Document2 pagesJeevanBeema12 21 2022Preetam TomarNo ratings yet

- kw-3Document36 pageskw-3sunilkumar1988No ratings yet

- Christ Jyoti School Singrauli: Fee Structure-2022-23Document1 pageChrist Jyoti School Singrauli: Fee Structure-2022-23rachit websitesNo ratings yet

- Purchase OrderDocument1 pagePurchase Orderksb sales teamNo ratings yet

- Materi Publik 1 Taxation Sesi 12 2021 - 13882 - 0Document33 pagesMateri Publik 1 Taxation Sesi 12 2021 - 13882 - 0Dzochra Miltaz YaoumielNo ratings yet

- General Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshDocument47 pagesGeneral Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshMoyan HossainNo ratings yet

- TAX-201 (Donor's Tax)Document6 pagesTAX-201 (Donor's Tax)Princess ManaloNo ratings yet

- Haroon Sharif S/O M. Sharif Bhatti 152-Pak Block A I Town: Web Generated BillDocument1 pageHaroon Sharif S/O M. Sharif Bhatti 152-Pak Block A I Town: Web Generated BillHamza KhanNo ratings yet

- GST101Document1 pageGST101ANKIT KUMAR IPM 2018 BatchNo ratings yet

- Arthakranti BTT Budget Proposal - Advertorial PDFDocument1 pageArthakranti BTT Budget Proposal - Advertorial PDFAryann GuptaNo ratings yet

- Taxation: DFA 2104YDocument16 pagesTaxation: DFA 2104YFhawez KodoruthNo ratings yet

- Merchandising Business PDFDocument5 pagesMerchandising Business PDFJenny Valerie SualNo ratings yet

- InvoiceDocument1 pageInvoiceadlzilliNo ratings yet

- Lalaine Mae L. Balmes September 26, 2021 201812779 BGMT 28A: "Likas Na". ButDocument3 pagesLalaine Mae L. Balmes September 26, 2021 201812779 BGMT 28A: "Likas Na". ButLalaine BalmesNo ratings yet

- RRB Recruitment 130000-Posts (WWW - Majhinaukri.in)Document2 pagesRRB Recruitment 130000-Posts (WWW - Majhinaukri.in)Ashish SalviNo ratings yet

- 2014 December Statement PDFDocument1 page2014 December Statement PDFMishaal ShaukatNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- Collector of Internal Revenue V Manila Lodge 761 Keyword: Social Club - Topic: Ordinary SenseDocument2 pagesCollector of Internal Revenue V Manila Lodge 761 Keyword: Social Club - Topic: Ordinary SenseJOHN CARLO PACALANo ratings yet

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- Airtel Broadband Bill Apr To Jun 22Document2 pagesAirtel Broadband Bill Apr To Jun 22Megha ChughNo ratings yet

- Chapter 16 Problem SolutionsDocument6 pagesChapter 16 Problem SolutionsAnila ANo ratings yet

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- Booking Confirmation: N425907720 14/04/2023 +++ (Valid Until:) +++Document2 pagesBooking Confirmation: N425907720 14/04/2023 +++ (Valid Until:) +++Fitri SukendarNo ratings yet

- RAB, PaymentsDocument7 pagesRAB, Paymentsagrawalbs0% (1)

- rr7 2003Document6 pagesrr7 2003James Estrada CastroNo ratings yet

- Sold By: Tech-Connect Retail Private Limited, Invoice NumberDocument2 pagesSold By: Tech-Connect Retail Private Limited, Invoice NumberanvithaNo ratings yet

- Bal BBL 712 - Taxation Law IDocument22 pagesBal BBL 712 - Taxation Law ISumit GuptaNo ratings yet

- Avanzado BRDocument2 pagesAvanzado BRCristian Diaz KooNo ratings yet

- Flowchart Account Payable & Cash DisbursementsDocument4 pagesFlowchart Account Payable & Cash DisbursementsAlif Nur IrvanNo ratings yet

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino Rivas100% (1)