Professional Documents

Culture Documents

S&P Sbux

Uploaded by

Bill MountsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S&P Sbux

Uploaded by

Bill MountsCopyright:

Available Formats

Stock Report | April 2, 2011 | NNM Symbol: SBUX | SBUX is in the S&P 500

Starbucks Corp

S&P Recommendation HOLD

55555

Price $37.25 (as of Apr 1, 2011)

12-Mo. Target Price $41.00

Investment Style Large-Cap Growth

UPDATE: PLEASE SEE THE ANALYST'S LATEST RESEARCH NOTE IN THE COMPANY NEWS SECTION

GICS Sector Consumer Discretionary Sub-Industry Restaurants

Summary Starbucks is the world's leading coffee roaster and retailer of high-quality coffee products, which it sells through its approximately 16,850 retail stores globally, as well as increasingly through multiple retail channels.

Key Stock Statistics (Source S&P, Vickers, company reports) 52-Wk Range $38.21 22.50 Trailing 12-Month EPS $1.37 Trailing 12-Month P/E 27.2 $10K Invested 5 Yrs Ago $10,075 Price Performance

30-Week Mov. Avg. 12-Mo. Target Price

40 25 20 15 10

S&P Oper. EPS 2011E S&P Oper. EPS 2012E P/E on S&P Oper. EPS 2011E Common Shares Outstg. (M)

1.45 1.79 25.7 746.0

Market Capitalization(B) Yield (%) Dividend Rate/Share Institutional Ownership (%)

$27.789 1.40 $0.52 75

Beta S&P 3-Yr. Proj. EPS CAGR(%) S&P Credit Rating

1.25 13 BBB+

Qualitative Risk Assessment

10-Week Mov. Avg. Relative Strength GAAP Earnings vs. Previous Year Up Down No Change Volume Above Avg. Below Avg. STARS

LOW

MEDIUM

HIGH

Our risk assessment reflects uncertainties of ongoing steps to reinvigorate the Starbucks brand. We also see a threat from specialty coffee offerings by competitors. Offsetting these concerns, we think the company has significant financial strength, affording it the potential to return to moderate growth. Recent cost cutting has further bolstered the company's finances. Quantitative Evaluations S&P Quality Ranking

5

Vol. Mil. 90 60 30 0 5 1 N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J

B+ B B+ AA A+ STRONG 86

HIGHEST = 99

D

4 2 3

B-

Relative Strength Rank

LOWEST = 1

2008

2009

2010

2011

Options: ASE, CBOE, P, Ph

Analysis prepared by Erik Kolb on March 11, 2011, when the stock traded at $ 36.56. Highlights

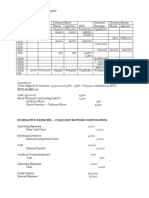

Revenue/Earnings Data Revenue (Million $) 1Q 2Q 2011 2,951 -2010 2,723 2,535 2009 2,615 2,333 2008 2,768 2,526 2007 2,356 2,256 2006 1,934 1,886 Earnings Per Share ($) 2011 0.45 E0.37 2010 0.32 0.28 2009 0.09 0.03 2008 0.28 0.15 2007 0.26 0.19 2006 0.22 0.16

Investment Rationale/Risk

We expect positive momentum to continue following FY 10's (Sep.) new product, service and store initiatives to revitalize the brand, after the company essentially completed a restructuring plan in FY 09 that is expected to save about $590 million annually. Prominently, it introduced VIA instant coffee, which is being rolled out through multiple channels. After a 9.5% increase in FY 10, we see 7.5% higher net revenues of FY 11, on further rollout of VIA and the opening of 500 new stores, including 100 domestic locations. We see underlying samestore comparisons rising by a mid-single digit percentage. For FY 12, we see 4.9% revenue growth. Based on restructuring and other cost savings efforts, we estimate that operating margins will widen to 14.1% in FY 11, after increasing to 13.8% in FY 10 from 9.2% in FY 09. Our estimates assume that arabica coffee prices will remain elevated and will reduce FY 11 EPS by about $0.09. We expect EPS of $1.45 in FY 11 and $1.79 in FY 12, up from $1.28 in FY 10. All figures are nonGAAP, as they exclude restructuring charges.

We think the company's revitalization agenda is on the right track, and that the restructuring and cost cutting of FY 09 and FY 10 have resulted in a material improvement in fundamentals, with positive trends seen continuing through FY 11. Plans to offer Keurig K-Cup products by fall 2011 are also encouraging to us. Additionally, we think international opportunities should help drive further top-line growth, while POS upgrades and better labor management should lead to further operating margin improvements. Risks to our recommendation and target price include a weaker than anticipated impact from the company's revitalization initiatives on customer traffic, lower cost savings from restructuring initiatives, and higher than expected pricing for commodity items such as coffee. Our 12-month target price of $41 is based on our relative P/E analysis. We use a slightly above peer average multiple of 23X applied to a blend of our FY 11 and FY 12 EPS estimates, reflecting our view of SBUX's improved near-term prospects.

3Q -2,612 2,404 2,574 2,359 1,964

4Q -2,838 2,422 2,515 2,441 2,003

Year -10,707 9,775 10,383 9,411 7,787

E0.32 0.27 0.20 -0.01 0.21 0.18

E0.31 0.37 0.20 0.01 0.21 0.17

E1.45 1.24 0.52 0.43 0.87 0.73

Fiscal year ended Sep. 30. Next earnings report expected: Late April. EPS Estimates based on S&P Operating Earnings; historical GAAP earnings are as reported.

Dividend Data (Dates: mm/dd Payment Date: mm/dd/yy)

Amount ($) Date Decl. Ex-Div. Date Stk. of Record Payment Date

0.100 0.130 0.130 0.130

03/24 07/21 11/04 01/26

04/05 08/02 11/16 02/07

04/07 08/04 11/18 02/09

04/23/10 08/20/10 12/03/10 02/25/11

Dividends have been paid since 2010. Source: Company reports.

Please read the Required Disclosures and Analyst Certification on the last page of this report.

Redistribution or reproduction is prohibited without written permission. Copyright 2011 The McGraw-Hill Companies, Inc.

Stock Report | April 2, 2011 | NNM Symbol: SBUX

Starbucks Corp

Business Summary March 11, 2011 CORPORATE OVERVIEW. The Starbucks brand is nearly synonymous with specialty coffee. However, a slowing economy and over-expansion under prior management led the company, beginning in FY 08 (Sep.) under returning CEO H. Schultz, to dramatically reduce expansion and begin to evolve the brand. After a decrease of 45 in the number of Starbucks retail stores in the FY 09, the number of stores increased by 223 to 16,858 in FY 10. Company-operated retail stores accounted for 83% to 84% of net sales in FY 10, FY 09 and FY 08. Stores are typically clustered in high-traffic, high-visibility locations in each market. In FY 08 (latest available), the retail store sales mix by product type was 76% beverages, 17% food items, 3% whole bean coffees, and 4% coffee-related hardware items. At September 30, 2010, SBUX owned and operated 6,707 (6,764 as of September 30, 2009) of its stores in the U.S., and 2,126 (2,141) stores in international markets. It closed a net 42 company stores in FY 10, compared to a net total of 385 company-owned stores closed in FY 09. There were also 4,424 (4,364) licensed retail stores in the U.S. and 3,601 (3,366) in international markets at September 30, 2010. A net 295 licensed store opened in FY 10, compared to 340 opened in FY 09. Revenue from retail licensees was approximately 13% of total revenues in FY 10 (13% in FY 09). The Global Consumer Products Group and a number of foodservice accounts contributed 3.8% of total revenues in FY 10 (3.8% in FY 09). IMPACT OF MAJOR DEVELOPMENTS. At the time of the January 2008 reappointment of Howard Schultz as CEO, the company outlined a five-point agenda: 1) improve the U.S. business by focusing on the customer experience and other factors affecting store operations; 2) slow the pace of U.S. expansion and close underperforming U.S. locations; 3) re-energize the Starbucks brand and create an emotional connection to the brand with customers and employees; 4) realign and streamline management and back-end functions to better support customer-focused initiatives; and 5) accelerate expansion outside the U.S. and drive profit margins higher at international operations. CORPORATE STRATEGY. SBUX closed a significant number of units due to underperformance totaling about 800 locations in the U.S., 61 in Australia, and another 100 in various international markets. The closures resulted in the elimination of 19,000 to 19,500 positions, and the company also eliminated about 1,700 corporate positions. In addition, SBUX slowed expansion markedly in FY 09, to 273 new company-owned units and 676 licensed units. FY 09 capital expenditures were cut to $446 million, from $985 million in FY 08. In FY 10, the company opened 223 net new stores, most of which were licensed. Capital expenditures were $441 million, with one-fourth allocated to new stores, one-half to renovations and store upgrades and the remainder to system upgrades. For FY 11, SBUX anticipates opening 500 new stores (100 U.S., 400 international), with capital expenditures of $550 million to $600 million. Aggregate write-offs, expenses and severance associated with the closures on a pretax basis amounted to $599 million. The closings, personnel reductions and other cost initiatives resulted in $590 million in cost savings in FY 09, exceeding the $500 million initial target. A nominal amount of additional restructuring charges were incurred in the first quarter of FY 10. The company expects cost savings of about $880 million annually compared to FY 07 levels. FINANCIAL TRENDS. Largely as a result of its restructuring and revitalization efforts, in FY 09 the company achieved a more conservative capital structure compared to past years. SBUX reduced commercial paper and other short-term borrowings to zero as of September 30, 2010, while long-term debt remained stable at year-earlier levels of $549 million, and cash and equivalents grew to $1,164 million from $600 million. In the first quarter of FY 11, SBUX reported that comparable-store sales rose 7%, driven by a 5% increase in traffic and a 2% advance in average ticket. The comp increase was 8% in the U.S. and 5% in international markets. Corporate Information Office 2401 Utah Avenue South, Seattle, WA 98134. Telephone 206-447-1575. Fax 206-682-7570. Email investorrelations@starbucks.com Website http://www.starbucks.com

Officers Chrmn, Pres & CEO H.D. Schultz EVP, Secy & General Counsel P.E. Boggs EVP & CIO S. Gillett CFO & Chief Admin Officer T. Alstead

Board Members W. W. Bradley M. Hobson K. R. Johnson O. C. Lee S. Sandberg H. D. Schultz J. G. Shennan, Jr. J. G. Teruel M. E. Ullman, III C. E. Weatherup

Domicile Washington Founded 1985 Employees 137,000 Stockholders 21,700

Redistribution or reproduction is prohibited without written permission. Copyright 2011 The McGraw-Hill Companies, Inc.

Stock Report | April 2, 2011 | NNM Symbol: SBUX

Starbucks Corp

Quantitative Evaluations S&P Fair Value Rank

2 1

LOWEST

Expanded Ratio Analysis

2 3 4 5

HIGHEST

Based on S&P's proprietary quantitative model, stocks are ranked from most overvalued (1) to most undervalued (5).

Fair Value Calculation Investability Quotient Percentile Volatility Technical Evaluation Insider Activity

$32.10 Analysis of the stock's current worth, based on S&P's proprietary

quantitative model suggests that SBUX is overvalued by $5.15 or 13.8%.

Price/Sales Price/EBITDA Price/Pretax Income P/E Ratio Avg. Diluted Shares Outstg (M)

Figures based on calendar year-end price

2010 2.29 13.16 17.09 25.97 764.2

2009 1.76 12.92 30.76 44.01 745.9

2008 0.68 5.49 15.27 22.24 741.7

2007 1.68 10.97 14.92 23.44 770.1

97

LOWEST = 1 HIGHEST = 100

Key Growth Rates and Averages Past Growth Rate (%) Sales Net Income Ratio Analysis (Annual Avg.) Net Margin (%) % LT Debt to Capitalization Return on Equity (%)

1 Year 3 Years 5 Years 9 Years

SBUX scored higher than 97% of all companies for which an S&P Report is available.

9.54 NM

3.32 13.15

10.13 3.76

17.63 14.02

LOW BULLISH

AVERAGE

HIGH

Since March, 2011, the technical indicators for SBUX have been BULLISH.

8.83 12.98 28.14

5.29 15.41 18.49

6.10 13.15 22.44

6.53 7.39 19.89

UNFAVORABLE

NEUTRAL

FAVORABLE

Company Financials Fiscal Year Ended Sep. 30 Per Share Data ($) Tangible Book Value Cash Flow Earnings S&P Core Earnings Dividends Payout Ratio Prices:High Prices:Low P/E Ratio:High P/E Ratio:Low Income Statement Analysis (Million $) Revenue Operating Income Depreciation Interest Expense Pretax Income Effective Tax Rate Net Income S&P Core Earnings 2010 4.50 1.95 1.24 1.24 0.23 19% 33.15 21.26 27 17 2009 3.66 1.24 0.52 0.53 Nil Nil 23.95 8.12 46 16 2008 2.93 1.17 0.43 0.44 Nil Nil 21.01 7.06 49 16 2007 2.74 1.51 0.87 0.86 Nil Nil 36.61 19.89 42 23 2006 2.68 1.25 0.73 0.73 Nil Nil 40.01 28.72 55 39 2005 2.56 1.06 0.61 0.53 Nil Nil 32.46 22.29 53 37 2004 3.00 0.85 0.48 0.42 Nil Nil 32.13 16.45 68 35 2003 2.52 0.66 0.34 0.29 Nil Nil 16.72 9.81 50 29 2002 2.20 0.55 0.27 0.23 Nil Nil 12.85 9.22 48 34 2001 1.78 0.45 0.23 0.18 Nil Nil 12.83 6.73 56 29

10,707 1,865 541 32.7 1,437 NA 946 943

9,775 1,331 535 42.0 559 30.1% 391 399

10,383 1,279 549 60.6 460 31.3% 316 325

9,411 1,437 491 Nil 1,056 36.3% 673 668

7,787 1,213 413 Nil 906 35.8% 581 579

6,369 1,071 367 Nil 796 37.9% 494 437

5,294 854 305 Nil 624 37.2% 392 346

4,076 646 259 Nil 436 38.5% 268 231

3,289 504 221 Nil 341 37.0% 215 181

2,649 430 177 Nil 289 37.3% 181 143

Balance Sheet & Other Financial Data (Million $) Cash 1,450 Current Assets 2,756 Total Assets 6,386 Current Liabilities 1,779 Long Term Debt 549 Common Equity 3,675 Total Capital 4,232 Capital Expenditures 441 Cash Flow 1,486 Current Ratio 1.6 % Long Term Debt of Capitalization 13.0 % Net Income of Revenue 8.8 % Return on Assets 15.8 % Return on Equity 28.1

666 2,036 5,577 1,581 549 3,046 3,595 446 926 1.3 15.3 4.0 7.0 14.1

322 1,748 5,673 2,190 550 2,491 3,059 984 865 0.8 18.0 3.0 5.7 13.2

281 1,696 5,344 2,156 550 2,284 2,834 1,080 1,164 0.8 19.4 7.1 13.8 29.8

313 1,530 4,429 1,936 1.96 2,229 2,230 771 994 0.8 0.1 7.5 14.6 26.9

174 1,209 3,514 1,227 2.87 2,091 2,094 644 862 1.0 0.1 7.8 14.3 21.7

299 1,368 3,328 783 3.62 2,487 2,537 386 697 1.7 0.1 7.4 12.9 17.1

201 924 2,730 609 4.35 2,082 2,120 357 528 1.5 0.2 6.6 10.9 14.1

175 848 2,293 537 5.08 1,727 1,754 375 436 1.6 0.3 6.5 10.4 13.9

113 594 1,851 445 5.79 1,376 1,406 384 358 1.3 0.4 6.8 10.8 14.4

Data as orig reptd.; bef. results of disc opers/spec. items. Per share data adj. for stk. divs.; EPS diluted. E-Estimated. NA-Not Available. NM-Not Meaningful. NR-Not Ranked. UR-Under Review. Redistribution or reproduction is prohibited without written permission. Copyright 2011 The McGraw-Hill Companies, Inc.

Stock Report | April 2, 2011 | NNM Symbol: SBUX

Starbucks Corp

Sub-Industry Outlook

Our fundamental outlook for the restaurants sub-industry is neutral, as we expect meaningful top-line growth to remain difficult in the face of high joblessness and an ongoing troubled housing market, offset by our outlook for GDP growth through 2011. We see generally stabilizing fundamentals among companies in the full-service dining segment, including most casual dining and fine dining establishments. Specifically, we believe global economic growth has the potential to offset more lackluster domestic prospects. For the full-service restaurant segment, we believe the group will continue to be affected by the after-effects of the recession. That said, we think consumers are demonstrating a willingness to resume spending, albeit at a lower level. We note that operators with a large proportion of their locations in states where housing prices are likely to remain weak, or where unemployment is above the national average, are likely to experience weaker results. We estimate revenues for full-service dining restaurants were roughly flat for 2010, and we expect a modest low single digit uptick in 2011, as the sub-group will likely stabilize following the muted economic rebound that started in late 2009. After economic factors including high unemployment likely contributed to approximately 4% lower segment traffic in 2010, we think traffic trends will be about flat in 2011 as customers return to restaurants, but preferences will likely favor less expensive menu choices. Quick-service restaurants did not suffer as greatly in 2009, with sales rising 1.5%, as we believe consumers traded down from eating out at full-service outfits. We believe segment traffic fell about 1% to 2% in 2010, and we see a small increase for 2011; however, we see a lack of ability to materially raise prices across the sector, which has increasingly relied on promotional pricing to drive traffic. In total, we estimate low single digit sales increases for both 2010 and 2011. When considering all types of venues for eating outside the home, 2009 marked the first time total industry guest traffic fell two years in a row, and the first year in the history of the modern restaurant industry that sales fell. Despite lower sales, margins were aided by cost cutting and sharply reduced food costs. Given the depth of these cuts, we think it is unlikely that meaningful improvement will continue in 2011. Year to date through March 18, the S&P Restaurants Index was up 0.4% versus a 1.9% increase for the S&P 1500. In 2010, the index outperformed the 1500, with a gain of 31.9% versus a 14.2% rise. --Erik B. Kolb

Stock Performance

GICS Sector: Consumer Discretionary Sub-Industry: Restaurants Based on S&P 1500 Indexes Month-end Price Performance as of 03/31/11

180 160 140 120 100 80 60 40 20 0

2007

Sub-Industry Sector

2008

2009

2010

2011

S&P 1500

NOTE: All Sector & Sub-Industry information is based on the Global Industry Classification Standard (GICS)

Sub-Industry : Restaurants Peer Group*: Fast-food - Larger

Peer Group Starbucks Corp Biglari Holdings Domino's Pizza Jack in the Box McDonald's Corp Papa John's Intl Yum Brands Stock Symbol SBUX BH DPZ JACK MCD PZZA YUM Stk.Mkt. Cap. (Mil. $) 27,789 586 1,108 1,146 79,280 814 24,027 Recent Stock Price($) 37.25 408.81 18.47 22.58 75.99 31.71 51.40 52 Week High/Low($) 38.21/22.50 464.77/254.01 18.74/10.66 26.37/18.42 80.94/65.31 32.19/22.51 53.19/37.54 Beta 1.25 1.49 1.17 0.82 0.51 0.61 0.99 Yield (%) 1.4 Nil Nil Nil 3.2 Nil 1.9 P/E Ratio 27 18 13 16 17 16 22 Fair Value Calc.($) 30.90 NA 9.10 24.70 61.90 30.60 30.10 S&P Return on Quality IQ Revenue Ranking %ile (%) B+ BNR B+ A B A 97 89 20 97 100 94 99 8.8 4.2 5.6 3.1 20.6 4.9 10.4 LTD to Cap (%) 13.0 5.4 601.0 39.8 44.0 32.3 62.3

NA-Not Available NM-Not Meaningful NR-Not Rated. *For Peer Groups with more than 15 companies or stocks, selection of issues is based on market capitalization.

Source: S&P. Redistribution or reproduction is prohibited without written permission. Copyright 2011 The McGraw-Hill Companies,Inc.

Stock Report | April 2, 2011 | NNM Symbol: SBUX

Starbucks Corp

S&P Analyst Research Notes and other Company News

March 29, 2011 12:34 pm ET ... S&P REITERATES HOLD OPINION ON SHARES OF KRAFT FOODS (KFT 31.19***): We expect KFT to face increased year-to-year commodity cost pressure this year, which we think will make KFT more reliant on price increases to bolster margins. Before special items, we look for KFT to report Q1 EPS of $0.50 (lowered from $0.51) vs. $0.49. We are keeping our full-year '11 EPS forecast of $2.25, and are initiating '12's EPS of $2.45. Also, we see the prospect that the outcome of a dispute with Starbucks (SBUX 37, Hold) could be a relatively modest negative for KFT. We keep our 12-month target price of $31. Indicated dividend yield is 3.7%. /T.Graves-CFA March 25, 2011 02:50 pm ET ... STARBUCKS CORPORATION (SBUX 36.52) UP 1.57, DEUTSCHE BANK RESUMES COVERAGE OF STARBUCKS (SBUX) WITH BUY... Analyst Jason West tells salesforce while SBUX has seen a dramatic recovery in profitability over past two years, he still sees room for further upside. Six reasons why he believes SBUX story still has legs: 1) op. momentum remains robust, 2) U.S. comps may stay above-trend longer than expected, 3) intl margins still have room for recovery, 4) unit growth is on verge of reacceleration, 5) CPG (consumer products group) should see a "step function" in growth in coming quarters, and 6) strong FCF bolsters shareholder returns and limits downside. Has $41 target. S.Trombino March 23, 2011 UP 1.74 to 36.69... Deutsche Bank resumes coverage of SBUX with buy, $41 target. Co. unavailable. ... March 23, 2011 02:50 pm ET ... STARBUCKS CORPORATION (SBUX 36.52) UP 1.57, DEUTSCHE BANK RESUMES COVERAGE OF STARBUCKS (SBUX) WITH BUY... Analyst Jason West tells salesforce while SBUX has seen a dramatic recovery in profitability over past two years, he still sees room for further upside. Six reasons why he believes SBUX story still has legs: 1) op. momentum remains robust, 2) U.S. comps may stay above-trend longer than expected, 3) intl margins still have room for recovery, 4) unit growth is on verge of reacceleration, 5) CPG (consumer products group) should see a "step function" in growth in coming quarters, and 6) strong FCF bolsters shareholder returns and limits downside. Has $41 target. S.Trombino March 10, 2011 SBUX, GREEN MOUNTAIN COFFEE ROASTERS announce strategic relationship for the manufacturing, marketing, distribution and sale of Starbucks and Tazo tea branded K-Cup portion packs for use in GMCR's Keurig Single-Cup brewing system. March 10, 2011 02:19 pm ET ... STARBUCKS CORPORATION (SBUX 37.78) UP 3.24, STARBUCKS (SBUX) IN DEAL W/ GREEN MTN COFFEE (GMCR). OPPENHEIMER UPS EST, TARGET... Analyst Matthew DiFrisco says SBUX announced a partnership with GREEN MOUNTAIN COFFEE to provide Starbucks ground coffees and Tazo tea for use in the Keurig Single-Cup brewing system. Notes though the deal was a surprise, he views the partnership with GMCR as incrementally positive as it is an immediate low risk and low investment solution to address the fast-growing at-home single-serve market, in turn furthering the growth of SBUX's higher margin Consumer Products division. Raises $1.73 FY 12 (Sep) EPS estimate to $1.85, $35 target to $46. Keeps outperform. B.Brodie March 10, 2011 10:12 am ET ... S&P MAINTAINS HOLD OPINION ON SHARES OF STARBUCKS CORP (SBUX 37.14***): SBUX is partnering with Green Mountain Coffee Roasters (GMCR 56, NR) to offer Starbucks K-Cup packs for use in GMCR's Keurig single-cup system (K-Cup). We favorably view the alliance, and think this will significantly raise SBUX's presence in the growing single-cup segment, as well as further SBUX's efforts to enter new consumer markets. We are also encouraged to hear SBUX K-Cups will likely be available at a large variety of retailers in fall '11. We raise our '12 EPS estimate to $1.79 from $1.71, and our target price to $41 from $38 on our updated peer P/E analysis. /EKolb March 7, 2011 01:44 pm ET ... S&P MAINTAINS HOLD OPINION ON SHARES OF STARBUCKS CORP (SBUX 33.41***): We are increasing our FY 12 (Sep) estimates, on SBUX's further efforts to enter the at-home market, as well as continued geographic expansion. We expect retail sales to be driven by both higher traffic and average ticket in the near term, and for positive sales momentum to generally offset rising commodity costs. We see continued U.S. and international sales growth, along with better fixed cost leverage. We keep our $1.45 FY 11 EPS forecast and raise our FY 12 estimate to $1.71 from $1.45. We lift our target price to $38 from $35 on our updated peer P/E analysis. /EKolb February 11, 2011 10:13 am ET ... S&P REITERATES HOLD OPINION ON SHARES OF KRAFT FOODS (KFT 30.47***): Before some special items, Q4 EPS from continuing operations of $0.46, vs. $0.47 (restated), is $0.02 below our estimate. We expect increased commodity cost pressure this year, which we think will make KFT more reliant on price increases to bolster margins. We are reducing our '11 EPS forecast to $2.25, from $2.30. With a lowered EPS projection and the prospect that the outcome of a dispute with Starbucks (SBUX 33, Hold) could be a relatively modest negative for KFT, we are reducing our 12-month target price to $31 from $32. The stock has an indicated dividend yield of 3.8%. /TGraves-CFA January 27, 2011 SBUX posts $0.45 vs. $0.32 Q1 EPS on 7% higher same-store sales, 8% higher total net revenues. Street was looking for $0.39 EPS. Sees FY 11 EPS $1.43-$1.47, below Street's $1.49; says commodity costs are now expected to have unfavorable impact on EPS of about $0.20, primarily to higher coffee costs. January 27, 2011 10:23 am ET ... S&P MAINTAINS HOLD OPINION ON SHARES OF STARBUCKS CORP (SBUX 33.42***): Dec-Q EPS of $0.45, vs. $0.32, is above our $0.38 estimate, on a 7% comp sales increase, driven by both higher traffic and average ticket. FY 11 (Sep) guidance gives us greater confidence in the long-term viability of SBUX's turnaround efforts, especially given elevated coffee costs. We see continued U.S. and international sales momentum, along with better fixed cost leverage, leading to continued EPS growth. Some 500 new store openings, including 400 abroad, support our estimates. We keep our $1.45 FY 11 EPS estimate and our $35 12-month target price. /EKolb January 19, 2011 09:36 am ET ... S&P REITERATES HOLD OPINION ON SHARES OF KRAFT FOODS (KFT 31.02***): We do not expect resolution of a dispute with Starbucks (SBUX 33, Hold) to have a major financial impact on KFT. We think giving up distribution of Starbucks coffee would have no more than modest negative EPS impact on KFT. Given the size of the two companies and strategic implications, we see issues related to distribution of Starbucks branded coffee more important for SBUX than for KFT. But we think KFT's strategy in coffee markets could change, including greater emphasis on building its own premium brands or possibly moving away from coffee with divestiture of Maxwell House. /TGraves-CFA

Source: S&P. Redistribution or reproduction is prohibited without written permission. Copyright 2011 The McGraw-Hill Companies,Inc.

Stock Report | April 2, 2011 | NNM Symbol: SBUX

Starbucks Corp

Analysts' Recommendations

Monthly Average Trend Buy

B

Wall Steet Consensus Opinion

Buy/Hold

BH

Hold

H

Weak Hold

WH

Sell S

No Opinion

SBUX Trend

BUY/HOLD Companies Offering Coverage Argus Research Company BMO Capital Markets-us Barclays Capital Bofa Merrill Lynch Buckingham Research Citi Cleveland Research Company Cowen AND Company Credit Suisse - North America D. A. Davidson & Co. Deutsche Bank North America Goldman Sachs & Co. Janney Montgomery Scott LLC Jpmorgan Mcadams Wright Ragen Morgan Stanley Morningstar, Inc. Oppenheimer & Co. Piper Jaffray RBC Capital Markets Robert W. Baird & Co., Inc. Sanford C. Bernstein & Co., LLC UBS (us) Wall Street Strategies William Blair & Company, L.l.c. Williams Capital Group, L.p.

Wall Street Average

B BH H WH S

Number of Analysts Following Stock 24 22 20

Stock Price ($) 40

30

20

10

2009

2010

2011

Of the total 26 companies following SBUX, 25 analysts currently publish recommendations. No. of Ratings 6 7 9 1 0 2 25 % of Total 24 28 36 4 0 8 100 1 Mo. Prior 3 Mos. Prior 6 7 7 6 9 10 1 0 0 0 2 1 25 24

Buy Buy/Hold Hold Weak Hold Sell No Opinion Total Wall Street Consensus Estimates

Estimates 2.5 2 1.5 1

D J F M A M J

Wall Street Consensus vs. Performance

2011 2012 2010 Actual $1.24

2010

For fiscal year 2011, analysts estimate that SBUX will earn $1.50. For the 1st quarter of fiscal year 2011, SBUX announced earnings per share of $0.45, representing 30% of the total annual estimate. For fiscal year 2012, analysts estimate that SBUX's earnings per share will grow by 21% to $1.81.

2010

2011

Fiscal Years 2012 2011 2012 vs. 2011 Q2'12 Q2'11 Q2'12 vs. Q2'11

Avg Est. 1.81 1.50 21% 0.42 0.34 24%

High Est. 1.95 1.56 25% 0.45 0.36 25%

Low Est. 1.62 1.45 12% 0.36 0.31 16%

# of Est. 24 25 -4% 6 22 -73%

Est. P/E 20.6 24.8 -17% 88.7 NM NM

A company's earnings outlook plays a major part in any investment decision. Standard & Poor's organizes the earnings estimates of over 2,300 Wall Street analysts, and provides their consensus of earnings over the next two years. This graph shows the trend in analyst estimates over the past 15 months.

Source: S&P,I/B/E/S International, Inc. Redistribution or reproduction is prohibited without written permission. Copyright 2011 The McGraw-Hill Companies,Inc.

Stock Report | April 3, 2011 | NNM Symbol: SBUX

Starbucks Corp

Glossary

S&P STARS Since January 1, 1987, Standard & Poors Equity Research Services has ranked a universe of U.S. common stocks, ADRs (American Depositary Receipts), and ADSs (American Depositary Shares) based on a given equitys potential for future performance. Similarly, Standard & Poors Equity Research Services has used STARS methodology to rank Asian and European equities since June 30, 2002. Under proprietary STARS (STock Appreciation Ranking System), S&P equity analysts rank equities according to their individual forecast of an equitys future total return potential versus the expected total return of a relevant benchmark (e.g., a regional index (S&P Asia 50 Index, S&P Europe 350 Index or S&P 500 Index)), based on a 12-month time horizon. STARS was designed to meet the needs of investors looking to put their investment decisions in perspective. S&P Quality Ranking (also known as S&P Earnings & Dividend Rankings)Growth and stability of earnings and dividends are deemed key elements in establishing S&Ps earnings and dividend rankings for common stocks, which are designed to capsulize the nature of this record in a single symbol. It should be noted, however, that the process also takes into consideration certain adjustments and modifications deemed desirable in establishing such rankings. The final score for each stock is measured against a scoring matrix determined by analysis of the scores of a large and representative sample of stocks. The range of scores in the array of this sample has been aligned with the following ladder of rankings: A+ A AB+ NR Highest High Above Average Average Not Ranked B BC D Below Average Lower Lowest In Reorganization S&P Equity Research Services Standard & Poors Equity Research Services U.S. includes Standard & Poors Investment Advisory Services LLC; Standard & Poors Equity Research Services Europe includes Standard &Poors LLCLondon; Standard & Poors Equity Research Services Asia includes Standard & Poors LLCs offices in Singapore, Standard & Poors Investment Advisory Services (HK) Limited in Hong Kong, Standard & Poors Malaysia Sdn Bhd, and Standard & Poors Information Services (Australia) Pty Ltd. Abbreviations Used in S&P Equity Research Reports CAGR- Compound Annual Growth Rate; CAPEX- Capital Expenditures; CY- Calendar Year; DCF- Discounted Cash Flow; EBIT- Earnings Before Interest and Taxes; EBITDAEarnings Before Interest, Taxes, Depreciation and Amortization; EPS- Earnings Per Share; EV- Enterprise Value; FCF- Free Cash Flow; FFO- Funds From Operations; FY- Fiscal Year; P/E- Price/Earnings ; PEG RatioP/E-to-Growth Ratio; PV- Present Value; R&D- Research & Development; ROE- Return on Equity; ROI- Return on Investment; ROIC- Return on Invested Capital; ROAReturn on Assets; SG&A- Selling, General & Administrative Expenses; WACC- Weighted Average Cost of Capital Dividends on American Depository Receipts (ADRs) and American Depository Shares (ADSs) are net of taxes (paid in the country of origin). absolute basis.

55555 3-STARS (Hold): Total return is expected to

closely approximate the total return of a relevant benchmark over the coming 12 months, with shares generally rising in price on an absolute basis.

55555 2-STARS (Sell): Total return is expected to

underperform the total return of a relevant benchmark over the coming 12 months, and the share price not anticipated to show a gain.

555551-STARS (Strong Sell): Total return is

expected to underperform the total return of a relevant benchmark by a wide margin over the coming 12 months, with shares falling in price on an absolute basis. Relevant benchmarks: In North America the relevant benchmark is the S&P 500 Index, in Europe and in Asia, the relevant benchmarks are generally the S&P Europe 350 Index and the S&P Asia 50 Index. For All Regions: All of the views expressed in this research report accurately reflect the research analyst's personal views regarding any and all of the subject securities or issuers. No part of analyst compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this research report. S&P Global Quantitative Recommendations Distribution In Europe: As of December 31, 2010, Standard & Poor's Quantitative Services Europe recommended 47.0% of issuers with buy recommendations, 21.0% with hold recommendations and 31.0% with sell recommendations. In Asia: As of December 31, 2010, Standard & Poor's Quantitative Services Asia recommended 39.4% of issuers with buy recommendations, 18.0% with hold recommendations and 32.0% with sell recommendations. Globally: As of December 31, 2010, Standard & Poor's Quantitative Services globally recommended 45.0% of issuers with buy recommendations, 19.0% with hold recommendations and 34.0% with sell recommendations. Additional information is available upon request.

Required Disclosures

In contrast to the qualitative STARS recommendations covered in this report, which are determined and assigned by S&P equity analysts, S&Ps quantitative evaluations are derived from S&Ps proprietary Fair Value quantitative model. In particular, the Fair Value Ranking methodology is a relative ranking methodology, whereas the STARS methodology is not. Because the Fair Value model and the STARS methodology reflect different criteria, assumptions and analytical methods, quantitative evaluations may at times differ from (or even contradict) an equity analysts STARS recommendations. As a quantitative model, Fair Value relies on history and consensus estimates and does not introduce an element of subjectivity as can be the case with equity analysts in assigning STARS recommendations. S&P Global STARS Distribution In North America: As of December 31, 2010, research analysts at Standard & Poor's Equity Research Services North America recommended 35.0% of issuers with buy recommendations, 56.4% with hold recommendations and 8.6% with sell recommendations. In Europe: As of December 31, 2010, research analysts at Standard & Poor's Equity Research Services Europe recommended 33.6% of issuers with buy recommendations, 45.6% with hold recommendations and 20.8% with sell recommendations. In Asia: As of December 31, 2010, research analysts at Standard & Poor's Equity Research Services Asia recommended 39.4% of issuers with buy recommendations, 51.8% with hold recommendations and 8.8% with sell recommendations. Globally: As of December 31, 2010, research analysts at Standard & Poor's Equity Research Services globally recommended 35.2% of issuers with buy recommendations, 54.0% with hold recommendations and 10.8% with sell recommendations.

S&P Issuer Credit Rating A Standard & Poors Issuer Credit Rating is a current opinion of an obligors overall financial capacity (its creditworthiness) to pay its financial obligations. This opinion focuses on the obligors capacity and willingness to meet its financial commitments as they come due. It does not apply to any specific financial obligation, as it does not take into account the nature of and provisions of the obligation, its standing in bankruptcy or liquidation, statutory preferences, or the legality and enforceability of the obligation. In addition, it does not take into account the creditworthiness of the guarantors, insurers, or other forms of credit enhancement on the obligation. S&P Core Earnings Standard & Poor's Core Earnings is a uniform methodology for adjusting operating earnings by focusing on a company's after-tax earnings generated from its principal businesses. Included in the Standard & Poor's definition are employee stock option grant expenses, pension costs, restructuring charges from ongoing operations, write-downs of depreciable or amortizable operating assets, purchased research and development, M&A related expenses and unrealized gains/losses from hedging activities. Excluded from the definition are pension gains, impairment of goodwill charges, gains or losses from asset sales, reversal of prior-year charges and provision from litigation or insurance settlements. S&P 12-Month Target Price The S&P equity analysts projection of the market price a given security will command 12 months hence, based on a combination of intrinsic, relative, and private market valuation metrics.

Other Disclosures

This report has been prepared and issued by Standard & Poor's and/or one of its affiliates. In the United States, research reports are prepared by Standard & Poor's Investment Advisory Services LLC ("SPIAS"). In the United States, research reports are issued by Standard & Poor's ("S&P"), in the United Kingdom by Standard & Poor's LLC ("S&P LLC"), which is authorized and regulated by the Financial Services Authority; in Hong Kong by Standard & Poor's LLC which is regulated by the Hong Kong Securities Futures Commission, in Singapore by Standard & Poor's LLC, which is regulated by the Monetary Authority of Singapore; in by Standard & Poor's Malaysia Sdn Bhd ("S&PM") which is regulated by the Securities Commission; in Australia by Standard & Poor's Information Services (Australia) Pty Ltd ("SPIS") which is regulated by the Australian Securities & Investments Commission; and in Korea by SPIAS, which is also registered in Korea as a cross-border investment advisory company. The research and analytical services performed by SPIAS, S&P LLC, S&PM, and SPIS are each conducted separately from any other analytical activity of Standard & Poor's. Standard & Poor's or an affiliate may license certain intellectual property or provide pricing or other services to, or otherwise have a financial interest in, certain issuers of securities, including exchange-traded investments whose investment objective is to substantially replicate the returns of a proprietary

55555 5-STARS (Strong Buy): Total return is

expected to outperform the total return of a relevant benchmark, by a wide margin over the coming 12 months, with shares rising in price on an absolute basis.

55555 4-STARS (Buy): Total return is expected to

outperform the total return of a relevant benchmark over the coming 12 months, with shares rising in price on an

Redistribution or reproduction is prohibited without written permission. Copyright 2011 Standard & Poor's Financial Services LLC. STANDARD & POORS, S&P, S&P 500, S&P Europe 350 and STARS are registered trademarks of Standard & Poors Financial Services LLC.

Stock Report | April 3, 2011 | NNM Symbol: SBUX

Starbucks Corp

Standard & Poor's index, such as the S&P 500. In cases where Standard & Poor's or an affiliate is paid fees that are tied to the amount of assets that are invested in the fund or the volume of trading activity in the fund, investment in the fund will generally result in Standard & Poor's or an affiliate earning compensation in addition to the subscription fees or other compensation for services rendered by Standard & Poor's. A reference to a particular investment or security by Standard & Poor's and one of its affiliates is not a recommendation to buy, sell, or hold such investment or security, nor is it considered to be investment advice. Indexes are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. Standard & Poor's and its affiliates provide a wide range of services to, or relating to, many organizations, including issuers of securities, investment advisers, broker-dealers, investment banks, other financial institutions and financial intermediaries, and accordingly may receive fees or other economic benefits from those organizations, including organizations whose securities or services they may recommend, rate, include in model portfolios, evaluate or otherwise address. S&P and/or one of its affiliates has performed services for and received compensation from this company during the past twelve months. (Financial Promotion) Order 2005, respectively. Poors rating opinions do not address the suitability of any security. Standard & Poors does not act as a fiduciary. While Standard & Poors has obtained information from sources it believes to be reliable, Standard & Poors does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. For residents of Singapore - Anything herein that may be construed as a recommendation is intended for general circulation and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Advice should be sought from a financial adviser regarding the suitability of an investment, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the recommendation, before the person makes a commitment to purchase the investment product. For residents of Malaysia - All queries in relation to this report should be referred to Ching Wah Tam. For residents of Indonesia - This research report does not constitute an offering document and it should not be construed as an offer of securities in Indonesia, and that any such securities will only be offered or sold through a financial institution. For residents of the Philippines - The securities being offered or sold have not been registered with the Securities and Exchange Commission under the Securities Regulation Code of the Philippines. Any future offer or sale thereof is subject to registration requirements under the Code unless such offer or sale qualifies as an exempt transaction. U.S. STARS Cumulative Model Performance Hypothetical Growth Due to Price Appreciation of $100 For the Period 12/31/1986 through 03/31/2011

Standard & Poors keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of Standard & Poors may have information that is not available to other Standard & Poors business units. Standard & Poors has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

Disclaimers

With respect to reports issued to clients in Japan and in the case of inconsistencies between the English and Japanese version of a report, the English version prevails. With respect to reports issued to clients in German and in the case of inconsistencies between the English and German version of a report, the English version prevails. Neither S&P nor its affiliates guarantee the accuracy of the translation. Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not necessarily indicative of future results.

Standard & Poors Ratings Services did not participate in the development of this report. Standard & Poors may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from obligors. Standard & Poors reserves the right to disseminate its opinions and analyses. Standard & Poors public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed through other means, including via Standard & Poors publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

S&P 500 2,400

5 STARS

4 STARS

3 STARS

2 STARS

1 STARS

Standard & Poors, its affiliates, and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness or adequacy of this material, and S&P Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of the information provided by the S&P Parties. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investors currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor. The information contained in this report does not constitute advice on the tax consequences of making any particular investment decision. This material is not intended for any specific investor and does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation of particular securities, financial instruments or strategies to you. Before acting on any recommendation in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

1,600

800

0 '92 '94 '96 '98 '0 '02 '04 '06 '08 '10

Ratings from Standard & Poors Ratings Services are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. Standard & Poors assumes no obligation to update its opinions following publication in any form or format. Standard & Poors ratings should not be relied on and are not substitutes for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. Standard &

This document does not constitute an offer of services in jurisdictions where Standard & Poors or its affiliates do not have the necessary licenses. For residents of the U.K. - This report is only directed at and should only be relied on by persons outside of the United Kingdom or persons who are inside the United Kingdom and who have professional experience in matters relating to investments or who are high net worth persons, as defined in Article 19(5) or Article 49(2) (a) to (d) of the Financial Services and Markets Act 2000

The performance above represents only the results of Standard & Poors model portfolios. Model performance has inherent limitations. Standard & Poors maintains the models and calculates the model performance shown, but does not manage actual assets. The U.S. STARS model performance chart is only an illustration of Standard & Poors (S&P) research; it shows how U.S. common stocks, ADRs (American Depositary Receipts) and ADSs (American Depositary Shares), collectively equities, that received particular STARS rankings performed. STARS categories are models only; they are not collective investment funds. The STARS performance does not show how any actual portfolio has performed. STARS model performance does not represent the results of actual trading of investor assets. Thus, the model performance shown does not reflect the impact that material economic and market factors might have had on decision-making if actual investor money had been managed. Performance is calculated using a time-weighted rate of return. While model performance for some or all STARS categories performed better than the S&P 500 for the period shown, the performance during any shorter period may not have, and there is no assurance that they will perform better than the S&P 500 in the future. STARS does not take into account any particular investment objective, financial situation or need and is not intended as an investment recommendation or strategy. Investments based on the STARS methodology may lose money. High returns are not necessarily the norm and there is no assurance that

Redistribution or reproduction is prohibited without written permission. Copyright 2011 Standard & Poor's Financial Services LLC. STANDARD & POORS, S&P, S&P 500, S&P Europe 350 and STARS are registered trademarks of Standard & Poors Financial Services LLC.

Stock Report | April 3, 2011 | NNM Symbol: SBUX

Starbucks Corp

they can be sustained. Past model performance of STARS is no guarantee of future performance. For model performance calculation purposes, the equities within each STARS category at December 31, 1986 were equally weighted. Thereafter, additions to the composition of the equities in each STARS category are made at the average value of the STARS category at the preceding month end with no rebalancing. Deletions are made at the closing price of the day that the deletion is made. Performance was calculated from inception through March 31, 2003 on a monthly basis. Thereafter, performance is calculated daily. Equities in each STARS category will change over time, and some or all of the equities that received STARS rankings during the time period shown may not have maintained their STARS ranking during the entire period. The model performance does not consider taxes and brokerage commissions, nor does it reflect the deduction of any advisory or other fees charged by advisors or other parties that investors will incur when their accounts are managed in accordance with the models. The imposition of these fees and charges would cause actual performance to be lower than the performance shown. For example, if a model returned 10 percent on a $100,000 investment for a 12-month period (or $10,000) and an annual asset-based fee of 1.5 percent were imposed at the end of the period (or $1,650), the net return would be 8.35 percent (or $8,350) for the year. Over 3 years, an annual 1.5% fee taken at year end with an assumed 10% return per year would result in a cumulative gross return of 33.1%, a total fee of $5,375 and a cumulative net return of 27.2% (or $27,200). Fees deducted on a frequency other than annual would result in a different cumulative net return in the preceding example. The Standard & Poors 500 index is the benchmark for U.S. STARS. The S&P 500 index is calculated in U.S. dollars and does not take into account the reinvestment of dividends. Indexes are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. The S&P 500 index includes a different number of constituents and has different risk characteristics than the STARS equities. Some of the STARS equities may have been included in the S&P 500 index for some (but not necessarily all) of the period covered in the chart, and some such equities may not have been included at all. The S&P 500 excludes ADRs and ADSs. The methodology for calculating the return of the S&P 500 index differs from the methodology of calculating the return for STARS. Past performance of the S&P 500 index is no guarantee of future performance. An investment based upon the models should only be made after consulting with a financial advisor and with an understanding of the risks associated with any investment in securities, including, but not limited to, market risk, currency risk, political and credit risks, the risk of economic recession and the risk that issuers of securities or general stock market conditions may worsen, over time. Foreign investing involves certain risks, including currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity and the potential for market volatility and political instability. As with any investment, investment returns and principal value will fluctuate, so that when redeemed, an investors shares may be worth more or less than their original cost.

Redistribution or reproduction is prohibited without written permission. Copyright 2011 Standard & Poor's Financial Services LLC. STANDARD & POORS, S&P, S&P 500, S&P Europe 350 and STARS are registered trademarks of Standard & Poors Financial Services LLC.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Investment Banking KnowledgeDocument7 pagesInvestment Banking Knowledge1raju1234100% (1)

- Albert Kaufman v. Walter M. Jeffords, Jr., and P. B. Garrett, Richard E. Krafve, H. Dewayne Kreager, Walter S. Ivancevic, Darien International Corporation and Met Verwaltungs-Aktiengesellschaft, 368 F.2d 539, 2d Cir. (1966)Document2 pagesAlbert Kaufman v. Walter M. Jeffords, Jr., and P. B. Garrett, Richard E. Krafve, H. Dewayne Kreager, Walter S. Ivancevic, Darien International Corporation and Met Verwaltungs-Aktiengesellschaft, 368 F.2d 539, 2d Cir. (1966)Scribd Government DocsNo ratings yet

- Chart PatternsDocument3 pagesChart PatternsCma Saurabh AroraNo ratings yet

- DHFL CrisisDocument2 pagesDHFL CrisisCritiNo ratings yet

- Malaysia Low ResDocument9 pagesMalaysia Low ResMujahidahFaqihahNo ratings yet

- Levered and Unlevered BetaDocument27 pagesLevered and Unlevered BetaJatin NandaNo ratings yet

- ADMS 2500 Practice Final Exam SolutionsDocument20 pagesADMS 2500 Practice Final Exam SolutionsAyat TaNo ratings yet

- Bhag Milkha Bhag 5 Financial Planning Lessons To Be Learnt - InvestmentYogiDocument8 pagesBhag Milkha Bhag 5 Financial Planning Lessons To Be Learnt - InvestmentYogirmehta26No ratings yet

- Lecture 18 Relative Strength Index RSI PDFDocument1 pageLecture 18 Relative Strength Index RSI PDFbraetto_1x1No ratings yet

- Julius Csurgo Creative Capital VenturesDocument38 pagesJulius Csurgo Creative Capital VenturesmergerlawassociatesNo ratings yet

- Nism Exam For Mutual FundDocument210 pagesNism Exam For Mutual FundarmailgmNo ratings yet

- Butler Lumber Case AnalysisDocument2 pagesButler Lumber Case AnalysisDucNo ratings yet

- Executive SummaryDocument2 pagesExecutive Summarycsaswin2010No ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- CEO Private Equity 6-06Document16 pagesCEO Private Equity 6-06dysertNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Impact of FII and FDI On Indian Stock Market: A Project ReportDocument75 pagesImpact of FII and FDI On Indian Stock Market: A Project ReportJake AlwinNo ratings yet

- Jesse Livermore MethodsDocument64 pagesJesse Livermore MethodsIrene Lye100% (3)

- LBS Bina GroupDocument13 pagesLBS Bina GroupNorazmi Abdul RahmanNo ratings yet

- Financial Accounting and Accounting StandardDocument18 pagesFinancial Accounting and Accounting StandardZahidnsuNo ratings yet

- AFAR First Preboard - 2nd Semester 2018-2019Document11 pagesAFAR First Preboard - 2nd Semester 2018-2019Kris Dela Cruz50% (4)

- NK SurabayaDocument84 pagesNK SurabayaZamroni BonangNo ratings yet

- CapStr 1 NTDocument40 pagesCapStr 1 NTWong Yong Sheng WongNo ratings yet

- Technical Analysis and Fundamental Analysis of Stock Market PDFDocument32 pagesTechnical Analysis and Fundamental Analysis of Stock Market PDFLaxmi Dhakal100% (1)

- BluestarDocument11 pagesBluestaramol1928No ratings yet

- Global Themes 2019 (What To Watch For) 20181213 PDFDocument68 pagesGlobal Themes 2019 (What To Watch For) 20181213 PDFrohanNo ratings yet

- ZapatoesDocument12 pagesZapatoesCheeze cake100% (6)

- 20 A Long-Run and Short-Run Component Model of Stock Return VolatilityDocument23 pages20 A Long-Run and Short-Run Component Model of Stock Return Volatilityrob-engleNo ratings yet

- Northern Forest ProductsDocument15 pagesNorthern Forest ProductsHương Lan TrịnhNo ratings yet