Professional Documents

Culture Documents

Amendments To IAS 20 Accounting For Government Grants and Disclosure

Uploaded by

therese flosaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amendments To IAS 20 Accounting For Government Grants and Disclosure

Uploaded by

therese flosaCopyright:

Available Formats

Amendments to IAS 20 Accounting for Government Grants and Disclosure of Government Assistance July 2010

International Accounting Standards Board (IASB) 30 Cannon Street, London EC4M 6XH | UK Tel: +44 (0)20 7246 6410, Fax: +44 (0)20 7246 6411 Email: info@ifrs.org Website: www.ifrs.org

The IASB is the independent standard-setting body of the IFRS Foundation.

Latest revision: July 2010

Amendments to IAS 20 Accounting for Government Grants and Disclosure of Government Assistance

Project Updates are provided for the information and convenience of constituents who wish to follow the IASB's deliberations. All conclusions reported are tentative and may be changed as the project develops.

Introduction

This project report is structured as follows: Objective Next steps Background Project history: tentative decisions to date Contact information

Objective

1. The objective of the project is to amend IAS 20 Accounting for Government Grants and Disclosure of Government Assistance to improve the information provided to users of financial statements by: a. eliminating inconsistencies with the Framework, in particular the recognition of a deferred credit when the entity has no liability; and b. eliminating options that can reduce the comparability of financial statements and understate the assets controlled by an entity.

Copyright 2010 IFRS Foundation. All rights reserved. May be distributed freely with appropriate attribution.

Amendments to IAS 20 Accounting for Government Grants and Disclosure of Government Assistance July 2010

Next steps

2. The project has been deferred since February 2006 (see below for project history). The Board will continue to monitor progress in other related projects to determine the appropriate timing for activating work on the project.

Background

3. IAS 20 provides guidance on recognising, measuring and disclosing government grants and disclosing other forms of government assistance. Government grants are assistance by government in the form of transfers of resources to an entity in return for past or future compliance with certain conditions relating to the operating activities of the entity. They exclude those forms of government assistance which cannot reasonably have a value placed upon them and transactions with government which cannot be distinguished from the normal trading transactions of the entity.

Reasons for amending IAS 20 4. The Board has many reservations about the requirements of IAS 20, in particular: The recognition requirements of IAS 20 often result in accounting that is inconsistent with the Framework. For example, the requirement in paragraph 12 to recognise grants as income over the periods necessary to match them with the related costs which they are intended to compensate can result in an entity recognising an amount in the statement of financial position as a deferred credit when the entity has no liability. As well as being inconsistent with the Framework, the recognition requirements of IAS 20 are also inconsistent with more recent pronouncements of standard-setting bodies relating to either non-reciprocal transfers in general or, more specifically, government grants. For example, FASB Statement No. 116 Accounting for Contributions Received and Contributions Made (SFAS 116), whilst exempting government grants to business entities from its scope, provides an accounting model that can be applied to government grants and that is consistent with the Framework. In Australia, UIG Abstract 11 Accounting for contributions of, or contributions for the acquisition of, non-current assets, whilst specifying a different treatment for contributions subject to conditions than SFAS 116, is also consistent with the Framework. International Public Sector Accounting Standard 23 Revenue from Non-Exchange Transactions (Taxes and Transfers) is also based on principles that are consistent with the Framework. IAS 20 contains numerous options. For example, an entity that receives a grant to finance the acquisition of an item of property, plant or equipment is entitled to deduct the grant from the carrying amount of that item, and an entity that receives a non-monetary grant is permitted to measure the asset and the grant at a nominal amount rather than fair value. In addition to reducing the comparability of financial statements, these particular options in IAS 20 result in understatement of the assets controlled by the entity and do not provide the most relevant information to users of financial statements.

Initial project scope 5. The Board initially concluded that it should undertake a limited scope project to improve IAS 20. The Board noted that it would be best placed to undertake a fundamental reconsideration of the accounting for government grants (and other nonreciprocal transfers) once it had made progress with its Revenue Recognition project. However, the Board was concerned that leaving IAS 20 in its present form in the

Copyright 2010 IFRS Foundation. All rights reserved. May be distributed freely with appropriate attribution.

Amendments to IAS 20 Accounting for Government Grants and Disclosure of Government Assistance July 2010

short term would have an unfortunate affect on countries adopting IFRSs that either (a) have already issued standards for government grants that are consistent with the IASB Framework or (b) have no specific requirements and require entities to follow conceptual frameworks similar to the IASBs. It would result in entities in these countries, after first adopting IFRSs, applying accounting that would be less consistent with the Framework than the accounting that they previously used. 6. The Board also understood that some of its partner standard-setters in countries that were adopting IFRSs were particularly concerned about the effect of applying the requirements of IAS 20 to the financial statements of public sector benefit entities (otherwise known as not-for-profit entities in the public sector). The Board understood that if it left IAS 20 in its present form, these standard-setters would be likely to specify different accounting requirements to those in IAS 20 (that would be more consistent with the Framework) for public sector benefit entities. The Board noted that this would result in an unfortunate and avoidable difference between reporting requirements by public sector benefit entities and profit oriented entities.

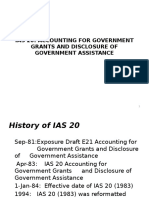

Project history: tentative decisions to date

7. In February 2004, the Board tentatively decided to amend IAS 20 by applying the accounting model for government grants contained in IAS 41 to all government grants. At present, the model in IAS 41 applies only to biological assets measured at fair value less estimated point-of-sale costs and grants that require entities not to engage in specified agricultural activity. In contrast to IAS 20, recognition of a government grant as income in accordance with IAS 41 depends on whether the grant is conditional and, if so, when the conditions are satisfied. Hence, the objective in IAS 41 is to recognise the obligations the entity has until conditions are satisfied, rather than to match the grant with the expenses it is intended to compensate or the acquisition costs of assets that it is used to finance. In July 2004, the Board discussed some issues that arose from incorporating into IAS 20 the IAS 41 model. Distinguishing between unconditional and conditional grants 9. IAS 41 distinguishes between unconditional and conditional grants. An unconditional grant is recognised as income when the grant becomes receivable; a conditional grant when the condition is satisfied. IAS 41, however, contains little guidance about what is meant by unconditional or conditional in this context. Therefore the Board decided to define a condition for the purposes of revised IAS 20 as a stipulation that entitles government to the return of the granted resources if a specified event either occurs or does not occur. The Board also noted that any such stipulation should have commercial substance to be regarded as a condition. Recognition of grant as an asset or as a reduction in a liability 10. IAS 41 specifies when a government grant is recognised as income. It does not specify when the transfer of resources from government is recognised. Therefore, the Board decided to specify that an entity should recognise a government grant as an asset at the earlier of (i) having an unconditional right to receive the government grant (regardless of whether there are conditions attached to retaining the grant) and (ii) receiving the government grant. The Board decided that if the grant involves government waiving repayment of all or part of a liability, the reduction in liability should be recognised when the liability is discharged or cancelled. Definition of a government grant 11. A government grant is defined in IAS 20 as a transfer of resources in return for past or future compliance with certain conditions relating to the operating activities of the entity. The Board observed that in an accounting model that distinguishes between

8.

Copyright 2010 IFRS Foundation. All rights reserved. May be distributed freely with appropriate attribution.

Amendments to IAS 20 Accounting for Government Grants and Disclosure of Government Assistance July 2010

conditional and unconditional grants, the use of the word conditions in this definition could be confusing. Therefore, the Board decided to delete the phrase in return for past or future compliance with certain conditions relating to the operating activities of the entity from the definition of a government grant. The Board also decided to provide additional guidance in the amended Standard to clarify which transactions with government meet the definition of a grant. Conflict with IAS 39 12. IAS 20 explains that loans at nil or low interest rates are forms of government assistance, but the benefit of the reduced loan is not treated as a government grant. Similarly, a government may guarantee an entitys borrowing, but IAS 20 does not treat the benefit of the guarantee as a government grant. The Board noted that these requirements of IAS 20 conflict with IAS 39 Financial Instruments: Recognition and Measurement because IAS 39 requires financial liabilities to be measured initially at fair value. Therefore, the Board decided to delete the references to loans at nil or low interest rates and guarantees from paragraphs 35 and 37 of IAS 20. Impairment 13. The Board decided that entities that receive a government grant in connection with the acquisition of an asset should be required to test that asset for impairment in accordance with IAS 36 Impairment of Assets on its initial recognition. The Board also decided to clarify that any recognised liability arising from conditions attaching to the grant should be included in the same cash-generating unit as the acquired asset. Transition requirements for the amendments to IAS 20 14. The Board decided to propose retrospective application in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. However, it decided to ask constituents to provide details of circumstances in which this requirement would cause difficulties. In February 2006 the Board reviewed the status of the project and decided to defer work on the project until further progress is made in related projects (in particular, the project to amend IAS 37 Provisions, Contingent Liabilities and Contingent Assets). The Board affirmed its view that IAS 20 is inconsistent with the Framework and that there is a need to update the Standard. However, the Board also noted some concerns about the conceptual basis of the government grant model in IAS 41, particularly in its treatment of conditional grants. The Board noted that its work in other projects, in particular its project to amend IAS 37, might yield insights into the appropriate treatment of obligations arising in conditional grants and, hence, enable it to develop a more robust model for accounting for government grants. In December 2007 the Board discussed the accounting for government grants in the context of a proposal to activate work on its Emissions Trading Schemes project. The Board decided to activate the emissions project, but decided to limit the scope of the project to the issues that arise in accounting for emissions trading schemes, rather than addressing broadly the accounting for all government grants (which would have involved activating the IAS 20 project). The Board will continue to monitor progress in related projects to determine the appropriate timing for activating work on the IAS 20 project.

15.

16.

17.

18.

Contact information

19. Staff contacts

Allison McManus (Technical Manager): amcmanus@ifrs.org

Copyright 2010 IFRS Foundation. All rights reserved. May be distributed freely with appropriate attribution.

You might also like

- Red BV2014 - IAS20 GovgrantDocument10 pagesRed BV2014 - IAS20 GovgrantEricaNo ratings yet

- Accounting For Government Grants and Disclosure of Government AssistanceDocument10 pagesAccounting For Government Grants and Disclosure of Government AssistanceJorreyGarciaOplasNo ratings yet

- 2 Gov GrantsDocument10 pages2 Gov GrantsChelsea Anne VidalloNo ratings yet

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument12 pagesIAS 20 Accounting For Government Grants and Disclosure of Government AssistanceCHAZNAY MENORCA QUIROSNo ratings yet

- Accounting For Government Grants and Disclosure of Government Assistance: IAS 20Document24 pagesAccounting For Government Grants and Disclosure of Government Assistance: IAS 20cris lu salem100% (1)

- International Accounting Standard 20Document10 pagesInternational Accounting Standard 20PlatonicNo ratings yet

- Summary of Significant Accounting PoliciesDocument6 pagesSummary of Significant Accounting PoliciesCaptain ObviousNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Ias 20 - Gov't GrantDocument19 pagesIas 20 - Gov't GrantGail Bermudez100% (1)

- SB-FRS 20: Statutory Board Financial Reporting StandardDocument10 pagesSB-FRS 20: Statutory Board Financial Reporting StandardCindyNo ratings yet

- Amendments To PAS 19, Plan Amendment, Curtailment or SettlementDocument4 pagesAmendments To PAS 19, Plan Amendment, Curtailment or SettlementRizza Mae AbanielNo ratings yet

- Ias 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument10 pagesIas 20 Accounting For Government Grants and Disclosure of Government AssistancegoodluckboasNo ratings yet

- IAS 20 Accounting For Government Grants0Document44 pagesIAS 20 Accounting For Government Grants0ontykerls100% (1)

- Ias 20Document6 pagesIas 20Azz GuzNo ratings yet

- LKAS 20-Accounting For Government Grants and Disclosure of Government AssistanceDocument11 pagesLKAS 20-Accounting For Government Grants and Disclosure of Government AssistanceThunder BoltNo ratings yet

- International Accounting Standard 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument7 pagesInternational Accounting Standard 20 Accounting For Government Grants and Disclosure of Government AssistanceParisNo ratings yet

- Business CombinationsDocument16 pagesBusiness Combinationscindycanlas_07No ratings yet

- Icai Differences Between Ifrss and Ind AsDocument21 pagesIcai Differences Between Ifrss and Ind AsdhuvadpratikNo ratings yet

- Comparison of Ind As With IFRSDocument30 pagesComparison of Ind As With IFRSRakeshkargwalNo ratings yet

- Chapter 13 IAS 20 Govt GrantDocument11 pagesChapter 13 IAS 20 Govt GrantKelvin Chu JYNo ratings yet

- Revised Schedule ViDocument20 pagesRevised Schedule VialkaNo ratings yet

- REVIEWER UFRS (Finals)Document5 pagesREVIEWER UFRS (Finals)cynthia karylle natividadNo ratings yet

- LEC03D BSA 2102 012021-Government GrantsDocument2 pagesLEC03D BSA 2102 012021-Government GrantsKatarame LermanNo ratings yet

- Advanced Accounting 13th Edition Beams Solutions Manual DownloadDocument44 pagesAdvanced Accounting 13th Edition Beams Solutions Manual DownloadMay Madrigal100% (21)

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- International Public Sector Accounting Standard 23 Revenue From Non-Exchange Transactions (Taxes and Transfers) IPSASB Basis For ConclusionsDocument5 pagesInternational Public Sector Accounting Standard 23 Revenue From Non-Exchange Transactions (Taxes and Transfers) IPSASB Basis For Conclusionsgenenegetachew64No ratings yet

- ACCT540 Week 1 HomeworkDocument8 pagesACCT540 Week 1 HomeworkDaniel WelschmeyerNo ratings yet

- Updates On PFRSDocument50 pagesUpdates On PFRSPrincess ElaineNo ratings yet

- Transportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectDocument6 pagesTransportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectSo LokNo ratings yet

- IPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019Document8 pagesIPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019EmekaNo ratings yet

- Accounting For Government Grants and Disclosure of Government AssistanceDocument18 pagesAccounting For Government Grants and Disclosure of Government AssistanceMaria DevinaNo ratings yet

- Sun and Earth Corporation: Notes To The Financial Statements-AmendedDocument57 pagesSun and Earth Corporation: Notes To The Financial Statements-AmendedBeatrice ReynanciaNo ratings yet

- 2020 HB30 ReconvenedExecAmendHalfsheets 04112020Document159 pages2020 HB30 ReconvenedExecAmendHalfsheets 04112020Lowell FeldNo ratings yet

- PWC Straight Away OffsettingDocument2 pagesPWC Straight Away Offsettingtwiener1No ratings yet

- Coa Circular No. 2024 - 007 - 0001Document21 pagesCoa Circular No. 2024 - 007 - 0001nieves.averheaNo ratings yet

- Indasitfg 42666Document21 pagesIndasitfg 42666sneh bansalNo ratings yet

- Legal Developments 2015Document13 pagesLegal Developments 2015hasnansuaimiNo ratings yet

- Financial Audit and Accounting Subcommittee (Faas) : Optimised Just NowDocument3 pagesFinancial Audit and Accounting Subcommittee (Faas) : Optimised Just Nowarsen lupinNo ratings yet

- Financial Reporting Standard: This Standard Is Applicable For Annual Reporting Period Beginning On 1 January 2021Document9 pagesFinancial Reporting Standard: This Standard Is Applicable For Annual Reporting Period Beginning On 1 January 2021MuhammadAlwiNo ratings yet

- Sunil Sir Paper FinalDocument38 pagesSunil Sir Paper FinalOkkishoreNo ratings yet

- CombinepdfDocument20 pagesCombinepdfKen ZafraNo ratings yet

- CombinepdfDocument14 pagesCombinepdfKen ZafraNo ratings yet

- In Focus: FASB Concepts Statement No. 8, Conceptual Framework For Elements of Financial StatementsDocument2 pagesIn Focus: FASB Concepts Statement No. 8, Conceptual Framework For Elements of Financial StatementsThiago AlvesNo ratings yet

- REVIEWER UFRS (Midterm)Document10 pagesREVIEWER UFRS (Midterm)cynthia karylle natividadNo ratings yet

- COVID-19 Challenges On Financial Reporting and Auditing: Sabbir Ahmed, FCADocument25 pagesCOVID-19 Challenges On Financial Reporting and Auditing: Sabbir Ahmed, FCAMd Joinal AbedinNo ratings yet

- IASB Update September 2009Document9 pagesIASB Update September 2009Gon FreecsNo ratings yet

- General Features:: Fair Presentation and Compliance With IfrssDocument4 pagesGeneral Features:: Fair Presentation and Compliance With Ifrssbeer beerNo ratings yet

- IAS20Document2 pagesIAS20khanjansherNo ratings yet

- 03 Ias 20Document3 pages03 Ias 20Irtiza AbbasNo ratings yet

- ACMA Unit 2Document47 pagesACMA Unit 2Subhodeep Roy ChowdhuryNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- NZ Ias 20Document18 pagesNZ Ias 20Heroe TriawanNo ratings yet

- IFRS 9 - Financial InstrumentsDocument63 pagesIFRS 9 - Financial InstrumentsMonirul Islam MoniirrNo ratings yet

- Accounting StandardsDocument33 pagesAccounting StandardsMilind Ramesh DudheNo ratings yet

- Fixed Licence Fee To Revenue Sharing FeeDocument7 pagesFixed Licence Fee To Revenue Sharing FeemuskanNo ratings yet

- Decoding Indian Union BudgetDocument6 pagesDecoding Indian Union BudgetkumarNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Qualtrics CX 5competenciesDocument38 pagesQualtrics CX 5competenciesSamarthya Gupta100% (1)

- CSR On Yes BankDocument21 pagesCSR On Yes BankSaurabhNo ratings yet

- TNPSC Maths Only QuestionsDocument22 pagesTNPSC Maths Only QuestionsSri RamNo ratings yet

- Retail Strategic Planning and Operations ManagementDocument33 pagesRetail Strategic Planning and Operations ManagementYash JashNo ratings yet

- Supply and Demand Power Gap - Case Study of GujaratDocument55 pagesSupply and Demand Power Gap - Case Study of GujaratSparshy SaxenaNo ratings yet

- Study of Consumer Behaviour Towards Nestle and Cadbury Choclates2Document26 pagesStudy of Consumer Behaviour Towards Nestle and Cadbury Choclates2GarryLopesNo ratings yet

- Introduction To Business Case Study Report About SainsburysDocument13 pagesIntroduction To Business Case Study Report About Sainsburysahsan_ch786100% (1)

- A Review of Beyond WinningDocument18 pagesA Review of Beyond WinningAndre Fernandes0% (1)

- Flow Element Orifice SpecDocument14 pagesFlow Element Orifice Specvishal.nithamNo ratings yet

- Book ReviewDocument5 pagesBook ReviewsivainamduguNo ratings yet

- Kashif NoorDocument4 pagesKashif NoorHaseebPirachaNo ratings yet

- Case Study - PescanovaDocument17 pagesCase Study - PescanovaAngus SadpetNo ratings yet

- Wilson - Lowi - Policy Types - FinalDocument40 pagesWilson - Lowi - Policy Types - FinalHiroaki OmuraNo ratings yet

- KFX Medical v. ArthrexDocument53 pagesKFX Medical v. ArthrexPriorSmartNo ratings yet

- VARMORADocument69 pagesVARMORAMayur JatNo ratings yet

- ch17 New PptsDocument22 pagesch17 New Pptsapi-216265989No ratings yet

- Professional MDocument24 pagesProfessional Mmusa219No ratings yet

- T1 PERKI - Alexander Veraro Tarigan - 175010100111024Document4 pagesT1 PERKI - Alexander Veraro Tarigan - 175010100111024AlexanderTariganNo ratings yet

- KPMG - IfRS9 AdditionsDocument23 pagesKPMG - IfRS9 AdditionsDalila SartorNo ratings yet

- D. Abstract & Executive Summary - Docx FormattedDocument12 pagesD. Abstract & Executive Summary - Docx FormattedJeston TamayoNo ratings yet

- Shikher - Mscu9891530Document1 pageShikher - Mscu9891530Ravi kantNo ratings yet

- DaburDocument6 pagesDabursneh pimpalkarNo ratings yet

- Dabur StrategiesDocument4 pagesDabur StrategiesNeha GillNo ratings yet

- MoaDocument5 pagesMoaRaghvirNo ratings yet

- Order Management: Microsoft Great Plains Solomon IV 5.0Document506 pagesOrder Management: Microsoft Great Plains Solomon IV 5.0vanloi88No ratings yet

- Individual Assignment 26june 2017Document6 pagesIndividual Assignment 26june 2017Eileen OngNo ratings yet

- 1preface For EDDocument15 pages1preface For EDrajendrakumarNo ratings yet

- MGT657 Jan2013 PDFDocument5 pagesMGT657 Jan2013 PDFAthirah Hassan0% (1)

- Caiib Information TechnologyDocument474 pagesCaiib Information TechnologyBiswajit GhoshNo ratings yet

- Mallari - BolinaoDocument5 pagesMallari - BolinaoJustine M.No ratings yet