Professional Documents

Culture Documents

Is Inflation Desirable

Uploaded by

TTCTAOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is Inflation Desirable

Uploaded by

TTCTACopyright:

Available Formats

Is Inflation desirable? Depends on: 1) Degree of inflation: Mild or Severe? 2) Time period under consideration: SR or LR? 3) Anticipated or Unanticipated?

Introduction Step 1: Define Inflation Inflation refers to the sustained increase in general price level. Step 2: State the determinants of the desirability of inflation Whether inflation will results in positive or negative effects depends on the degree of inflation, that is, whether it is just mild inflation or severe inflation; the time period under consideration: are we looking at the short-run effect or long-run effect; as well as whether the inflation is anticipated or unanticipated. Development Step 3: Explain effects of anticipated inflation Generally, inflation that is anticipated is more manageable than unanticipated inflation as indexation that increases a nominal costs can be used to prevent inflation from eroding purchasing power. Nevertheless, economists still identify 2 main adverse effects of anticipated inflation. They are menu costs and shoe-leather costs. The former refers to the cost to firms and restaurants for constantly having to revise price lists, labels and catalogues due to the continuous increase in general price level. Shoe-leather costs are costs firms incur in moving money in and out of financial institutions in search of the highest returns. As inflation rate continues to surge, firms want to ensure that their investment generates a high returns to counter the fall in money value. Step 4: Explain effects of unanticipated inflation Define unanticipated inflation Unanticipated inflation occurs when economic agents make errors in their inflation forecasts where actual inflation may end up higher or lower than expected. This impose extra costs on individuals where their real incomes and savings may fall as well as businesses who misjudge the real return on capital investment projects and who find it difficult to predict what is likely to happen to their costs. Thesis: Desirable (Positive effect): Internal effect on Production, Investment & Employment (SR) A mild demand-pull inflation can be beneficial to an economy in the short-run. It stimulates production and output due to the prospect of earning higher profits. In the short-run, when increase 1

in production costs lags behind increase in product prices (due to imperfect information and contract obligations), business activities will be stimulated as profit margins widen. In addition, with expectation of higher profit margins than before, businesses are more willing to invest. Thus, in the short-run, investment is likely to increase in the period of rising prices. With increased production and investment, this result in an increase in AD, assuming other components of AD remains unchanged. Assuming the economy is operating with spare resources, this rise in AD results in an increase in NY as well as rise in employment rate. Anti-Thesis: Undesirable (Adverse) Internal effect on Production, Investment & Employment (LR) However, in the long-run, production, national income and employment rate will fall when the cost of production also rises, narrowing the profit margins which lead to businesses reducing their AS. In the long-run, as firms begin to demand more of these raw materials to produce more goods to meet the increasing demand, prices of such raw materials also rise. In addition, in the long-run when contracts expires, new contracts drawn will be based on new current prices that reflects the rising prices. Also, due to the higher cost of living, workers will bargain for higher nominal wages in order to keep real wages unchanged. Assuming employers oblige, this rise in labour costs further increases the cost of production. Firms that cannot pass on the higher costs to consumers in the form of higher prices will have to absorb the higher factor costs. All the above lowers the profit margins of firms. Firms react to this by reducing their AS. This shifts the SRAS curve to the left, causing a fall in production, employment and national income. In addition, when inflation continues to climb, uncertainty arises, making it difficult for firms to predict future streams of costs and revenues. Producers will also lose confident with the high and uncertain inflation rate and therefore be less willing to produce or invest. Firms will cut back expenditure on capital goods such as machinery and plants. This results in a fall in Investment leading to a fall in AD which in turn has adverse repercussions on the employment and income level. (Adverse) Internal effect on Savings With rising prices, the value of money falls. Savings in real terms decline hence people will be discouraged from savings. This leads to a fall in savings. With a fall in savings, less fund will be available to loan out for investment. Wealth in other less liquid forms such as buying real estates would be preferred since prices of it will most likely rise and hence wealth will also rise. (Adverse) Internal effect on Redistribution of Income & Wealth Inflation worsens income distribution as it creates inequity among the different groups of people in the economy. Inflation redistributes income away from creditors to debtors. Debtors gain while creditors lose because debts are expressed in terms of fixed monetary units. As prices rise, value of money falls. This results in a fall in the real value of debt during inflation. Thus, the purchasing power of the money repaid by the debtor is less than the purchasing power of the initial amount borrowed.

Inflation also redistributes income away from those on fixed incomes to employers of such workers. Fixed income earners have less purchasing power during inflation as the same amount of salary now can get them less goods. On the other hand, employers of such workers now pay less in terms of real value of the salary. In the short-run, entrepreneurs and shareholders benefit as their incomes respond quickly and in the same direction as the changes in prices. Initially, as product prices go up, producer s profits and income raises because product prices rise faster than production costs in the short-run during mild demand-pull inflation, hence raising their profits and redistribute income from consumers to producers. However, in the long-run, the redistribution may not be so apparent when production costs catch up with the rise in product prices. Producer s income may fall unless they pass the rise in COP to consumers. (Adverse) Internal effects on Social Discontentment Due to the unequal income distribution, internal social discontentment may result. Escalating costs of living is also a cause for social discontentment. The standard of living might fall since wages tend to increase slower than the rise in prices because wages have been fixed on a contract basis and take some time to be revised. If inflation is serious and persists too long, poverty might result. (Adverse) External effects of BOP During inflation, balance of trade worsens and may also adversely affect balance of trade payment, assuming the capital account remains unchanged. During inflation, the price of the country s exports would be higher relative to the exports of other countries, hence causing quantity demanded of exports to fall. Assuming demand for exports to be price elastic, this would lead to a more than proportionate fall in quantity demanded, hence resulting in a fall in export revenue as the country s exports become less price competitive. In addition, demand for imports rises as prices of imports become relatively cheaper compared with locally-produced substitutes. Assuming that imports and locally produced products are close substitutes, the rise in price of products leads to a more than proportionate increase in the quantity demanded of imports. Import expenditure rises. With the fall in export revenue and rise in import expenditure, the country s BOT worsens. In the case of high degree of inflation, the economy will be unattractive to foreign investors since costs are escalating, causing production to be uncompetitive. Firms will not be willing to invest and existing firms may choose to relocate their production to other low cost countries. This outflow of foreign direct investment will lead to a long-term capital outflow, worsening capital account. Hence, the worsening of both current account (BOT) and capital account will have adverse effect of the country s balance of payments. (Adverse) Loss of Confidence in Future Value of Currency (External effect of ER)

When balance of payment worsens due to high degree of inflation, external value of the country s currency will also fall, ceteris paribus. As mentioned earlier, price of the country s exports rises, leading to a more than proportionate fall in quantity demanded of its exports, demand for the country s currency fall as a result. In addition, as price of imports is now relatively cheaper, quantity demanded of imports rise more than proportionate, resulting in an increase in the supply of the country s currency as they sell it to buy foreign currency to pay for imports. The fall in demand with a concurrent rise in supply of currency results in a fall in its exchange rate. This may in turn cause an outflow of hot money and puts further pressure on the BOP and exchange rate as investors lose confidence in the future value of the currency. Conclusion Therefore, inflation is desirable in the short-run provided that degree of inflation is mild as it leads to economic growth. However, it is important to note that if it persists or worsens, inflation is undesirable as it creates conflicts to the other macro goals of the country.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SAP MH02 HCM Payroll Business Blue Print VDocument25 pagesSAP MH02 HCM Payroll Business Blue Print VJyothiM100% (1)

- Sample of Field Research AssignmentDocument15 pagesSample of Field Research AssignmentKamarulazwa Muhammad100% (2)

- 2020 07 23 - Brand Ambassador Agreement LeahDocument2 pages2020 07 23 - Brand Ambassador Agreement LeahFara Dinaa SusiloNo ratings yet

- Case Study Consumer Behavior and Gucci Brand AwarenessDocument8 pagesCase Study Consumer Behavior and Gucci Brand AwarenessSao Nguyễn ToànNo ratings yet

- AE GE and More SL Work Schedule Summer 2014Document20 pagesAE GE and More SL Work Schedule Summer 2014TTCTANo ratings yet

- Holiday Homework Notice 24 Nov 2010Document4 pagesHoliday Homework Notice 24 Nov 2010chourongjieNo ratings yet

- AE GE and More SL Work Schedule Summer 2014Document20 pagesAE GE and More SL Work Schedule Summer 2014TTCTANo ratings yet

- DiscussionDocument2 pagesDiscussionTTCTANo ratings yet

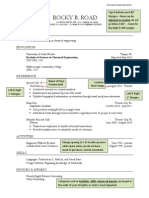

- Transfer Student Sample ADocument1 pageTransfer Student Sample ATTCTANo ratings yet

- Competitor AnalysisDocument39 pagesCompetitor AnalysisMalik MohamedNo ratings yet

- AASB 3 Is Relevant When Accounting For A Business Combination ThatDocument6 pagesAASB 3 Is Relevant When Accounting For A Business Combination ThatBiruk GultaNo ratings yet

- NP EX19 8a JinruiDong 2Document14 pagesNP EX19 8a JinruiDong 2Ike DongNo ratings yet

- Intro PM Chapter 1 6e: Test Your Understanding of Kathy Schwalbe's An Introduction To Project Management, Sixth EditionDocument57 pagesIntro PM Chapter 1 6e: Test Your Understanding of Kathy Schwalbe's An Introduction To Project Management, Sixth EditionAmanda JamesNo ratings yet

- Proposal For InternDocument4 pagesProposal For InternshuvofinduNo ratings yet

- Educational Process: Dieter G. Berstecher Ananda W.P GurugeDocument5 pagesEducational Process: Dieter G. Berstecher Ananda W.P GurugeAliejah CasanNo ratings yet

- SCORE Annual Marketing Budget TemplateDocument1 pageSCORE Annual Marketing Budget TemplateFadiNo ratings yet

- CABINAS - Partnership Formation & OperationDocument16 pagesCABINAS - Partnership Formation & OperationJoshua CabinasNo ratings yet

- Chapter 8 - GlobalizationDocument16 pagesChapter 8 - GlobalizationAnuj ChandaNo ratings yet

- KingfisherDocument28 pagesKingfisherJeevan DassNo ratings yet

- IAS 35 Discontinuing Operations: International Accounting StandardsDocument19 pagesIAS 35 Discontinuing Operations: International Accounting Standardsrio1603No ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- Implementing Total Quality Management at WiproDocument4 pagesImplementing Total Quality Management at WiproDullStar MOTONo ratings yet

- BR Sustainability Report 2021 ENDocument155 pagesBR Sustainability Report 2021 ENyuri roseroNo ratings yet

- DBG Group ProfileDocument26 pagesDBG Group Profiledinar aimcNo ratings yet

- Trainee Evaluation FormDocument6 pagesTrainee Evaluation FormIndranilGhoshNo ratings yet

- LifebuoyDocument10 pagesLifebuoyJyoti JangidNo ratings yet

- Creating and Leading Entrepreneurial VenturesDocument37 pagesCreating and Leading Entrepreneurial Venturessakibsultan_308100% (1)

- Tally - ERP 9: Major Features of - Power of SimplicityDocument8 pagesTally - ERP 9: Major Features of - Power of SimplicityfawwazNo ratings yet

- Case Analysis: Mcdonalds in IndiaDocument12 pagesCase Analysis: Mcdonalds in IndiaNazifa AfrozeNo ratings yet

- Security Analysis IntroductionDocument18 pagesSecurity Analysis IntroductionAshish KumarNo ratings yet

- Company Sales Plan TemplateDocument3 pagesCompany Sales Plan TemplateAbdelfatah Zyan50% (2)

- A Study On Service Quality at HERO Motocorp Service Centre at Shubham Motors, KamrejDocument7 pagesA Study On Service Quality at HERO Motocorp Service Centre at Shubham Motors, KamrejJANANI.K 19BBA BPMNo ratings yet

- 1 Binswanger-MkhizeDocument17 pages1 Binswanger-MkhizeSauby LongangNo ratings yet

- Acctg 3b-3cDocument4 pagesAcctg 3b-3cRizelle Louisse Cantalejo33% (3)

- Chapter 9 (English)Document25 pagesChapter 9 (English)Idem MedNo ratings yet