Professional Documents

Culture Documents

Enough Liquidity in M'Sia To Meet Needs

Uploaded by

meor3705Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enough Liquidity in M'Sia To Meet Needs

Uploaded by

meor3705Copyright:

Available Formats

Enough liquidity in M'sia to meet needs

http://biz.thestar.com.my/news/story.asp?file=/2012/2/27/business/108...

SEARCH

News

News

Business

Sports

Multimedia

Lifestyle

Entertainment

Tech

Education

MyStar

Classifieds

Motoring

Property

Jobs

Business

Home > Business > News

Property

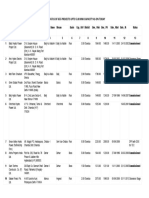

News Market Watch Bursa Malaysia My Portfolio Exchange Rates Unit Trusts Market Intelligence IPO Watch Company Ratings Bonus & Dividends Financial Results Share Buybacks Changes in Shareholdings Currency Converter Investor Relations Maritime

Search for Property

Monday February 27, 2012

Enough liquidity in M'sia to meet needs

By DALJIT DHESI daljit@thestar.com.my

Firefly Holiday Packages

Setia Haruman - Gardenview Residence

Ad Type : Sales Property Type : Others Facilities : Security, Barbeque Area, Gymnasium Posted Date : 14/9/2011

From SGD289*

Tee-Off At Ipoh From SGD289*

Share

PETALING JAYA: The Malaysian banking system and bond market have ample liquidity to meet borrowers' funding needs unlike in some Asian countries where companies are scrambling to issue local currency bonds due to difficulty in getting foreign currency loans. Everyday Low Fare 2 Spore Celebrate With Massive Discounts Book Now Before Seats Are Gone!

www.airasia.com/lgksin

Nation

Business

World

Sports

These Asian companies are even offering higher yields for the bonds which are seeing less take-up from European banks as they pull back funding to the region. There is no doubt that some European banks have tightened their US dollar lending to companies in Asia due to the sovereign debt crisis coupled with the deleveraging effect and stringent capital requirements of the Basel III accord,'' said Bond Pricing Agency Malaysia Sdn Bhd (BPAM) CEO Meor Amri Meor Ayob. But local banks are in better shape compared with their foreign counterparts due to their limited exposure to the eurozone debt crisis. Contrary to what is being reported and observed in other emerging markets in Asia, the yield spread has actually narrowed in the ringgit bond market (indicating that companies are not really in a rush to issue bonds by offering high yields),'' Meor Amri told StarBiz. In fact, the corporate yield curve, especially those with AAA credit rating, has been flattening since beginning of the year rather than steepening. The yields from mid to long-end of the yield curve has actually decreased quite substantially,'' he said. Reuters recently reported that corporates were rushing in to issue bonds in some Asian countries as they were not able to get banks to lend them US dollars or euros. This had resulted in the widening of bond spreads and soaring yields. Issuers in Hong Kong had paid a mark-up of as much as four percentage points above the US debt yields to secure five-year funds, about 10 times more than they did in 2007 before the US subprime crisis. It also reported that eight top-tier Hong Kong-based companies had hit debt markets with a record US$8bil worth of dollar bonds in January and the risk, according to bankers, was now of a long-term jump in funding costs in the region as US and European banks stayed away. Industry observers said as European banks shrank their balance sheets

FBM KLCI ends morning trading lower Celcom surpasses RM2bil net profit mark Indonesia and M'sia to begin power trade in 2014 Mah Sing records RM238.628mil profit Emkay aims to own seven buildings

Most Viewed

Most E-mailed

Today's Safe Stock Picks How You Could Profit... Even During A Looming Global Financial Crisis.

www.insideinvestingdai

Mining making big comeback in Malaysia Domestic demand to sustain growth CIMB sets new record posting net profit of RM4bil Opposing Felda Global Ventures listing is a waste IOI gets tenants for mall Felda settlers to get shares in SPV FBM KLCI ends morning trading lower Silver Birds suspension raises questions IGB planning hotel REIT Higher earnings for HLB

Agoda - Hotels worldwide Special rates on hotels worldwide. Search hotels!

Agoda.com/Hotels

Jobs at MIDF

Latest Jobs

Internship

<

>

Assistant Manager, Legal & Compliance Departm... Manager, Corporate Finance Department Manager, Debt Capital Market Department HEAD, Market Risk Unit HEAD, Credit Risk Management Unit

Forex Malaysia Get paid to trade with FxPro. Direct rebates into your account!

www.fxpro.com/Malaysia

Landslide danger in Seri Kembangan Challenging property market in China Road closure at Genting IOI gets tenants for mall Motorists spooked by lack of streetlights on highways More time to give views on gardens' SAP

1 of 3

2/28/2012 4:14 PM

Enough liquidity in M'sia to meet needs

http://biz.thestar.com.my/news/story.asp?file=/2012/2/27/business/108...

and reduced lending to Asian companies, the local currency bank loan and bond markets would have to absorb some of the US dollar loans that were not rolled over or renewed as European banks retreated from the funding market. But they agree that this was more applicable in the region than in Malaysia which had almost negligible foreign currency debt or loans and the country's ringgit bond market and banking system were more than able to meet the funding needs of corporations and the public sector. Bank Negara's international reserves stood at a healthy level of RM423.4bil in 2011, and had risen by RM94.8bil from a year earlier. Meor Amri said there was enough liquidity, demand and confidence in the ringgit bond market, both from foreign and local investors and issuers. This, he said, could be observed in the healthy growth of the local bond market over the years, especially in the Islamic sukuk segment. He noted that the real interest rate had also turned positive as inflation rate moderated to 2.7% in January, which was below the current Bank Negara overnight policy rate of 3%. This would encourage more savings and as well as attract both local and foreign investors into the Malaysian bond market on the backdrop of a strengthening ringgit, he said. He added that this would provide a good platform for local/foreign companies to take advantage of the cheaper funding costs in the local bond market. Meanwhile, Islamic finance consultancy Amanie Advisors Sdn Bhd director Baiza Bain said there were institutions from the eurozone and the Gulf Cooperation Council (GCC) that were currently exploring a ringgit-based sukuk issuance. At the moment, Malaysia has ample liquidity to absorb the combination of the foreign and local sukuk issuers. Towards the middle and by year-end, it may be a different story as more issuances hit the market, investors may ask for tighter credit rating and a higher yield spread as they would be spoilt for choices amongst the many issuers that have entered the market by then,'' he noted. The central bank, Meor Amri said, had also taken pro-active steps to contain the rising household debts as evident from the tighter approvals for home mortgages, car loans and credit cards over the past year, noting that this would provide ample cushion for the local banking sector, moving forward.

IGB planning hotel REIT Strauss-Kahns owe back taxes on unsold US house

2 of 3

2/28/2012 4:14 PM

Enough liquidity in M'sia to meet needs

http://biz.thestar.com.my/news/story.asp?file=/2012/2/27/business/108...

In This Article Follow or your session has expired You haven't logged in List

You are currently not logged in Login to continue

Asian FX Stockbroker www.valburycapital.com Based London, regulated by the FSA Asian market focus Buy Gold Now www.nubex.com.my Malaysian's No.1 Trusted & Reliable Online Bullion Dealer "Heart Attack Warning" www.YourTicker.com/Angioprim Clean Arteries Before Surgery. Painless, Fast, Safe & Easy ANA KUL-Japan Flights www.ana.co.jp Flights to Japan Everyday. You Can Book Until The Day Before.

Recommend More News

Be the first of your friends to recommend this.

Site Map

FAQ

Privacy Statement

Terms Of Use W rite To Us

Advertise With Us

Investor Relations

Careers

RSS

Copyright 1995-2012 Star Publications (M) Bhd (Co No 10894-D)

3 of 3

2/28/2012 4:14 PM

You might also like

- 4R34 NSY4R341-A2203: English ...............................................Document15 pages4R34 NSY4R341-A2203: English ...............................................meor3705No ratings yet

- 6R31 / 6R35 JSY6R3C1-A2103: English ...............................................Document13 pages6R31 / 6R35 JSY6R3C1-A2103: English ...............................................meor3705No ratings yet

- OptimDocument1 pageOptimmeor3705No ratings yet

- Hamilton PSR ManualDocument8 pagesHamilton PSR Manualmeor3705No ratings yet

- Seiko 3M62 5M62 5M63Document15 pagesSeiko 3M62 5M62 5M63Hendra YudistiraNo ratings yet

- Seiko Watch Catalogue 2020Document78 pagesSeiko Watch Catalogue 2020meor3705No ratings yet

- Seiko Watch Catalogue 2019Document90 pagesSeiko Watch Catalogue 2019meor3705100% (1)

- Instruction ManualDocument33 pagesInstruction Manualmeor3705No ratings yet

- On Demandware - Static - Sites-Timex-Master-Catalog Default Dw1c459b26 Productdocs 02N-095000Document21 pagesOn Demandware - Static - Sites-Timex-Master-Catalog Default Dw1c459b26 Productdocs 02N-095000meor3705No ratings yet

- Operation Guide 3475: Using Mobile Link With A Mobile Phone Using The Training FunctionDocument58 pagesOperation Guide 3475: Using Mobile Link With A Mobile Phone Using The Training FunctionWAnNaaZrieyNo ratings yet

- Ball Watch Catalogue 2016/2017Document108 pagesBall Watch Catalogue 2016/2017meor3705No ratings yet

- Seiko Manual 6R15Document12 pagesSeiko Manual 6R15meor3705No ratings yet

- Swiss Army PDFDocument80 pagesSwiss Army PDFSter RncNo ratings yet

- MIDO Watch Catalogue 2018-2019Document106 pagesMIDO Watch Catalogue 2018-2019meor3705No ratings yet

- Rado Watch Catalog 2018Document172 pagesRado Watch Catalog 2018meor3705No ratings yet

- M-18 Manual For 6R35 Powered Seiko Dive WatchDocument12 pagesM-18 Manual For 6R35 Powered Seiko Dive Watchmeor3705No ratings yet

- Promaster Tough Setting GuideDocument14 pagesPromaster Tough Setting Guidemeor3705No ratings yet

- Jsy6r351 en 20190528 PDFDocument12 pagesJsy6r351 en 20190528 PDFmeor_ayobNo ratings yet

- Casio Operating Manual For Caliber 3461Document22 pagesCasio Operating Manual For Caliber 3461meor3705No ratings yet

- Basic I Europe - ENDocument23 pagesBasic I Europe - ENmurjianto_ekoNo ratings yet

- Technologies On SuperTitaniumDocument5 pagesTechnologies On SuperTitaniummeor3705No ratings yet

- BALL Watch Catalogue 2014 - 2015Document214 pagesBALL Watch Catalogue 2014 - 2015Simon LászlóNo ratings yet

- Victorinox Swiss Army I.N.O.X. Quick GuideDocument12 pagesVictorinox Swiss Army I.N.O.X. Quick Guidemeor3705No ratings yet

- Solarzilla ManualDocument45 pagesSolarzilla Manualmeor3705No ratings yet

- Seiko Astron. The World's First GPS Solar WatchDocument4 pagesSeiko Astron. The World's First GPS Solar Watchmeor3705No ratings yet

- TheEdgeFinancialDaily090312 2Document1 pageTheEdgeFinancialDaily090312 2meor3705No ratings yet

- Wider Credit Yield SpreadDocument3 pagesWider Credit Yield Spreadmeor3705No ratings yet

- The Star 130312Document1 pageThe Star 130312meor3705No ratings yet

- bsl2012 rls1203-02Document2 pagesbsl2012 rls1203-02meor3705No ratings yet

- The New Sportura. Proving The Value of ExperienceDocument4 pagesThe New Sportura. Proving The Value of Experiencemeor3705No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The RF Line: Semiconductor Technical DataDocument4 pagesThe RF Line: Semiconductor Technical DataJuan David Manrique GuerraNo ratings yet

- Feminism in Lucia SartoriDocument41 pagesFeminism in Lucia SartoriRaraNo ratings yet

- McKesson Point of Use Supply - FINALDocument9 pagesMcKesson Point of Use Supply - FINALAbduRahman MuhammedNo ratings yet

- Absolute Advantage and Comparative AdvantageDocument11 pagesAbsolute Advantage and Comparative AdvantageLouie ManaoNo ratings yet

- Fatwa Backbiting An Aalim Fatwa Razwiya PDFDocument3 pagesFatwa Backbiting An Aalim Fatwa Razwiya PDFzubairmbbsNo ratings yet

- (Click Here) : Watch All Paid Porn Sites For FreeDocument16 pages(Click Here) : Watch All Paid Porn Sites For Freexboxlivecode2011No ratings yet

- Financial Management Module - 3Document2 pagesFinancial Management Module - 3Roel AsduloNo ratings yet

- Erp Software Internship Report of Union GroupDocument66 pagesErp Software Internship Report of Union GroupMOHAMMAD MOHSINNo ratings yet

- El Rol Del Fonoaudiólogo Como Agente de Cambio Social (Segundo Borrador)Document11 pagesEl Rol Del Fonoaudiólogo Como Agente de Cambio Social (Segundo Borrador)Jorge Nicolás Silva Flores100% (1)

- DepEd K to 12 Awards PolicyDocument29 pagesDepEd K to 12 Awards PolicyAstraea Knight100% (1)

- Statement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FDocument2 pagesStatement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FPavan BasundeNo ratings yet

- Sky Education: Organisation of Commerce and ManagementDocument12 pagesSky Education: Organisation of Commerce and ManagementKiyaara RathoreNo ratings yet

- Archives of Gerontology and Geriatrics: Naile Bilgili, Fatma ArpacıDocument7 pagesArchives of Gerontology and Geriatrics: Naile Bilgili, Fatma ArpacıIsyfaun NisaNo ratings yet

- AL E C Usda S W P: OOK AT THE Ngineering Hallenges OF THE Mall Atershed RogramDocument6 pagesAL E C Usda S W P: OOK AT THE Ngineering Hallenges OF THE Mall Atershed RogramFranciscoNo ratings yet

- M8 UTS A. Sexual SelfDocument10 pagesM8 UTS A. Sexual SelfAnon UnoNo ratings yet

- Test Bank For Understanding Pathophysiology 4th Edition Sue e HuetherDocument36 pagesTest Bank For Understanding Pathophysiology 4th Edition Sue e Huethercarotin.shallowupearp100% (41)

- The Greco-Turkish War of 1920-1922: Greece Seeks Territory in Asia MinorDocument14 pagesThe Greco-Turkish War of 1920-1922: Greece Seeks Territory in Asia MinorFauzan Rasip100% (1)

- 25 Virtues Explained with Real Life SituationsDocument5 pages25 Virtues Explained with Real Life Situationsleslie vine deloso100% (2)

- 6.variable V Variable F Control - Braking, Closed Loop ControlDocument25 pages6.variable V Variable F Control - Braking, Closed Loop ControlJanani RangarajanNo ratings yet

- Amadora V CA Case DigestDocument3 pagesAmadora V CA Case DigestLatjing SolimanNo ratings yet

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- Under the Angels Restaurant Transports Guests to Old CracowDocument2 pagesUnder the Angels Restaurant Transports Guests to Old CracowBence KlusóczkiNo ratings yet

- PORT DEVELOPMENT in MALAYSIADocument25 pagesPORT DEVELOPMENT in MALAYSIAShhkyn MnNo ratings yet

- FORM 20-F: United States Securities and Exchange CommissionDocument219 pagesFORM 20-F: United States Securities and Exchange Commissionaggmeghantarwal9No ratings yet

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDocument45 pagesList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21No ratings yet

- Schematic Electric System Cat D8T Vol1Document33 pagesSchematic Electric System Cat D8T Vol1Andaru Gunawan100% (1)

- Booklet - CopyxDocument20 pagesBooklet - CopyxHåkon HallenbergNo ratings yet

- Alsa Alsatom MB, MC - Service ManualDocument26 pagesAlsa Alsatom MB, MC - Service ManualJoão Francisco MontanhaniNo ratings yet

- Drill Works Release NotesDocument29 pagesDrill Works Release NotesMichelle DuncanNo ratings yet

- Httpswww.ceec.Edu.twfilesfile Pool10j07580923432342090202 97指考英文試卷 PDFDocument8 pagesHttpswww.ceec.Edu.twfilesfile Pool10j07580923432342090202 97指考英文試卷 PDFAurora ZengNo ratings yet