Professional Documents

Culture Documents

Income Tax Rules

Uploaded by

venkatanagachandraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Rules

Uploaded by

venkatanagachandraCopyright:

Available Formats

HRA tax exemption under section 10 (13A)

Majority of the salaried people get an allowance for taking care of the rent that they pay for their home. This is called House Rent Allowance, or HRA. The Indian Income Tax Laws considers housing as a basic necessity, and hence gives sympathetic treatment to the HRA Allowance received by the employees, by way of giving some tax benefits under section 10 (13A) of Income Tax Act, Government of India. The tax benefit available to the employee on the HRA received is treated as follows for computation of Income tax. The minimum of the following is available as exemption from employees earning. The actual HRA received from your employer OR The actual rent paid by you for the house, minus 10% of your salary (this includes basic + dearness allowance, if any) OR 50% of your basic salary (if you live in a metro) or 40% of your basic salary (if you live in a non-metro) Let us consider a hypothetical case or evaluate with an example. Consider the Salary Components as follows: Basic: Rs. 15,000, Dear Allowance(DA) or other allowances Rs. 5,000 and HRA: Rs. 9,000 So a total salary of Rs 29,000 Let actual rent rent paid be: Rs. 10,000 You live in Mumbai (It is a Metro in Income Tax Computation. it is a Metro otherwise too!). Now let us understand how the rule works. 1. The actual HRA received from employer = This Amount is Rs. 9,000 2. The actual rent paid for the house minus 10% of the salary (Excluding HRA Component) This would be Rs. 10,000 10% of (Rs. 15,000 + Rs. 5,000) = Rs. 10,000 Rs. 2,000 = Rs. 8,000 3. Fifty percent 50% of your basic salary Since you live in a metro, this would be 50% of Rs. 15,000 = Rs. 7,500 The minimum amount out of 1, 2 and 3 is Rs. 7,500. Therefore, the amount of HRA exempt from tax is Rs. 7,500 per month. The remaining HRA amount of Rs. 1,500 (Actual HRA received Rs. 9,000 Minus exempt HRA Rs. 7,500 = Rs. 1,500) would be added to your taxable income.

Income Tax Exemption on Housing Loan

Tax rebate on home loans means that you can benefit and save significant part of your tax liability if you have taken a home loan. It works in following manner. Interest paid on the home loan

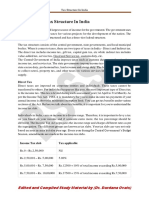

As per Sec 24(b) of the Income Tax Act, 1961 in India a deduction up to Rs. 150,000 can be claimed as tax exemption on housing loan. This deduction is claimed towards the total interest that we pay on the home loan towards purchase or construction of house property while computing the income from house property. The interest payable before you acquire home or start the construction work would be deductible in five equal annual installments commencing from the year in which the house has been acquired or constructed. In case of self- occupied property, housing loan tax benefit is allowed only for one such self occupied property. The interest towards home loan taken for purchase, construction, repairs, renewal or reconstruction of house property is eligible for deduction under section 24(b). Principal repayment of the home loan As per the newly introduced Sections 80C read with section 80CCE of the Income Tax Act, 1961 the principal repayment up to Rs. 100,000 on your home loan will be allowed as a deduction from the gross total income subject to fulfillment of prescribed conditions. Let us consider a hypothetical example. Your taxable Income: Rs 5,50,000 Principal repayment for the same year: Rs 1,10,000 and Interest payable for the year: Rs 1,60,000 Total Deductions allowed: Rs 2,50,000 (Rs 1,50,000 towards interest payable & Rs 1,00,000 for principal repayment of the loan) Thus, your taxable income will reduce to Rs 3,00,000 (Rs 5,50,000 Rs 2,50,000)

Income Tax Deductions section 80C

Each year most of the people eagerly wait for the budget proposals to be announced for various reasons. One of the significant reasons is to know what all instruments of investments and deductions / exemptions have been included in the Section 80C of Indian Income Tax for employees, so that they can plan their tax savings according to the same, and maximize the benefits. As income tax is major component of the salary, the changes / additions in 80C Section has major impact on the savings and expenses of salaried employees as they have a fixed source of income. The 80C Section deductions are introduced to boost savings of employees on one side and save tax on the other side. Actually, Section 80C replaced the earlier Section 88 which was available till 1st April 2006. The Deductions permitted in the 80 C Section of Indian Income Tax is more or less the same investment mixes that were available in Section 88. Even the section 80CCC on pension scheme contributions was merged with the above 80C. However, this new section has allowed a major change in the method of providing the tax benefit. Section 80C of the Income Tax Act allows certain investments and expenditure to be tax-exempt. One must plan investments well and spread it out across the various instruments specified under this section to avail maximum tax benefit. Unlike Section 88, there are no sub-limits and is irrespective of how much you earn and under which tax bracket you fall. The most important aspect that needs to be kept in mind is that the total exemption limit under section 80c is Rs 1,00,000/- only. This benefit is available to everyone, irrespective of his or her income levels. Thus, if you are in the highest tax bracket of 30%, and you invest the full Rs. 1,00,000/-, you save tax of Rs. 30,000. We will now see in detail those deductions that are permissible under section 80C in this section. The following is section 80c deductions / exemption list. Provident Fund (PF) deduction under section 80C Any contributions to Provident Fund, Voluntary provident Fund (VPF) or savings made in Public Provident Fund (PPF Account) are eligible for income tax deduction under section 80C of Indian Income Tax Act. Life Insurance Premiums

Any Life Insurance premiums (for one or more insurance policies) paid by you for yourself, your spouse or your children is eligible under income tax deduction under section 80C of Indian Income Tax Act. ELSS Equity Linked Saving Schemes Any investment made in certain Mutual Funds called equity linked saving schemes qualifies for section 80C deduction. Please note that not all mutual fund investments are eligible for this deduction. Some examples of ELSS funds are SBI Magnum Tax Gain, HDFC Tax Saver, HDFC Long term advantage, etc. ULIP Unit Linked Insurance Plan Investments made in certain ULIPs of Unit Trust of India and LIC of India are eligible for 80C deduction. Bank Fixed deposits or Term deposits of term greater than 5 years According to a relatively new provision amount saved in fixed deposits of term at least five years is eligible for income tax deduction under section 80C of Indian Income Tax Act. Principal part of EMI on Housing Loan deduction under section 80C If you are paying EMI on a housing loan, you would be aware that the EMI (equated monthly installments) consists of two parts principal part and interest part. The principal part of the EMI on your housing loan is eligible for income tax deduction under section 80C. The interest part is also eligible for tax deduction, however not under section 80C but section 24. Tuition Fees deduction under section 80C Amount paid as tuition fee for the education of two children of the employee / Tax Payer is eligible for deduction under section 80C of Indian Income Tax Act. Other 80C deductions Amount saved in National Saving Certificate (NSC), Infrastructure Bonds or Infra Bonds, amount paid as stamp duty and registration charges while buying a new home are eligible for income tax deductions under section 80C of Indian Income Tax Act. These are the eight avenues, which qualify for deductions under Section 80 C of Indian Income Tax What is Assessment Year and Financial Year Most of us face a barrage of financial terms throughout the year during the course of our work, and more so while it comes to filing of Income Tax returns. During this time we most prominently encounter terms like Assessment Year and Financial Year. We are providing simple understanding for Assessment Year and Financial Year for the benefit of Employees as well as people from all section of life, who have the obligation to file Income Tax returns. What is Financial Year or FY (As it is termed by Income Tax Department of India) Financial year is the Year in which a person has earned his income. In simple terms, if you have been employed from 01st of April 2009 to 31st of March 2010, then this period is termed as your Financial Year. However it is not restricted only to an employee or an individual. In the Income Tax Of Indias list of Jargon or terms of usage, Financial year is applicable to all entities, whether it is employee, small and medium enterprise, large corporates etc. In fact it is applicable to every entity which generates revenue / or manages revenue (Like Trusts) in a given Financial Year. It must be understood that in India always the Financial Year starts on 01st of April of every Year, and ends on 31st of March next year. So, if you have generated income in Financial Year (FY) 2009 2010, then it means that you have generated that income between 01st of April 2009 to 31st of March 2010. What is Assessment Year or AY (As it is called by Income Tax Department of India)

Assessment year is the year in which you file your returns for the Income earned for the financial year, which had just ended. For example if you are filing income tax returns in July 2010, then you would be filing returns for Financial Year 2009 2010 & this is what is called Assessment Year. Why so? Please note that you have earned your income in Financial Year 2009 2010 (whose definition has been already explained) and you are now approaching Income Tax Department of India for Assessment of Your Income earned in last financial year, in the current financial year which is 2010 2011 (As July 2010 falls in the financial year 2010 2011, since Financial year 2010 starts on 01st April 2010 and ends on 31st March 2011), that is precisely the reason the Income Tax Department Terms your Assessment of Income as Assessment Year. In other words, the running financial year (which is 2010 2011) is also Assessment Year 2010 2011 for the purpose of Income Tax returns submission.

You might also like

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Indian Income Tax DeductionsDocument4 pagesIndian Income Tax DeductionsDivyanshu ShekharNo ratings yet

- The Payments That You Make To Your PF Are Counted Towards Sec 80CDocument4 pagesThe Payments That You Make To Your PF Are Counted Towards Sec 80CManu VermaNo ratings yet

- Income Tax Deductions From SalaryDocument34 pagesIncome Tax Deductions From SalaryPaymaster Services100% (2)

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Interest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very SoonDocument3 pagesInterest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very Soonanshushah_144850168No ratings yet

- Saving Income Tax - Understanding Section 80C DeductionsDocument4 pagesSaving Income Tax - Understanding Section 80C DeductionsArun SinghNo ratings yet

- Saving Income Tax - Understanding Section 80C DeductionsDocument6 pagesSaving Income Tax - Understanding Section 80C DeductionsAbhishek JainNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Deductions U/s 80C To 80 U From Gross Total Income: For The AY-2018-19 FY-2017-18Document19 pagesDeductions U/s 80C To 80 U From Gross Total Income: For The AY-2018-19 FY-2017-18Shamrao GhodakeNo ratings yet

- Income Tax KnowledgeDocument5 pagesIncome Tax KnowledgeAbhishekNo ratings yet

- TdsDocument4 pagesTdsAdityaNo ratings yet

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210No ratings yet

- Income From Other SourcesDocument6 pagesIncome From Other Sourcesanusaya1988No ratings yet

- Analysis of Tax05Document19 pagesAnalysis of Tax05kharemixNo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- Basics of Personal FinanceDocument15 pagesBasics of Personal FinanceAnjali TejaniNo ratings yet

- Tax Planning IndiaDocument20 pagesTax Planning IndiaRohanTheGreatNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Budget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaDocument79 pagesBudget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaLukkana VaraprasadNo ratings yet

- Aviva I LifeDocument13 pagesAviva I LifeSatyendra KumarNo ratings yet

- Section 80C: List of Eligible Investments Are As FollowsDocument7 pagesSection 80C: List of Eligible Investments Are As FollowsKachua SinghNo ratings yet

- Exemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Document5 pagesExemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Ramakoteswar NampalliNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- 8 SMART Ways To Lower Your Tax LiabilityDocument6 pages8 SMART Ways To Lower Your Tax LiabilityansplanetNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- Incom TaxDocument54 pagesIncom TaxRamesh AlathurNo ratings yet

- The New Direct Tax Code (DTC)Document18 pagesThe New Direct Tax Code (DTC)aggarwalajay2No ratings yet

- Assignment 5: Legal Aspects of Business MS5210Document6 pagesAssignment 5: Legal Aspects of Business MS5210karanNo ratings yet

- Deduction Under Section 80Document8 pagesDeduction Under Section 80gaureshbandalNo ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- 80C Deduction - Tax Deduction Under Section 80C and Tax PlanningDocument121 pages80C Deduction - Tax Deduction Under Section 80C and Tax PlanningRaamakrishnan Narayanan SankaranarayananNo ratings yet

- 5 Tax-Planning Tips For Salaried People: Share ThisDocument3 pages5 Tax-Planning Tips For Salaried People: Share ThisPriya DubeyNo ratings yet

- What Is Section 10 of The Income Tax ActDocument15 pagesWhat Is Section 10 of The Income Tax Actdevam05006No ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- TAX ON INTEREST INCOME: Interest On Saving Bank Account: Tax, 80TTA, ITRDocument4 pagesTAX ON INTEREST INCOME: Interest On Saving Bank Account: Tax, 80TTA, ITRcmlcbhtidNo ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- How To Pay Zero Tax For Income Up To Rs 12 Lakhs From Salary For Financial Year 2016-17 Budget 2016 by CA Chirag ChauhanDocument18 pagesHow To Pay Zero Tax For Income Up To Rs 12 Lakhs From Salary For Financial Year 2016-17 Budget 2016 by CA Chirag Chauhanaghosh704No ratings yet

- Income Tax Deductions Under Section 80cDocument1 pageIncome Tax Deductions Under Section 80cPaymaster ServicesNo ratings yet

- Tax PlaningDocument9 pagesTax PlaningGaurav Singh JadaunNo ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- DGM Annexure B Know Your Pay ComponentsDocument3 pagesDGM Annexure B Know Your Pay ComponentsaakritishellNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- The Financial Kaleidoscope - Feb 2021 (Eng)Document9 pagesThe Financial Kaleidoscope - Feb 2021 (Eng)MdNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- Making The Best of Tax Saving OptionsDocument12 pagesMaking The Best of Tax Saving Optionssumit_shindeNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Are Your Savings Flying Away?Document20 pagesAre Your Savings Flying Away?livin2dieNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Project Topic: Income Tax Systems in Pakistan, India & UKDocument53 pagesProject Topic: Income Tax Systems in Pakistan, India & UKAfzal RocksxNo ratings yet

- DT NotesDocument41 pagesDT NotesHariprasad bhatNo ratings yet

- Income From Salary: Explain Fully On What Basis Income Is Taxed Under The Head SalaryDocument4 pagesIncome From Salary: Explain Fully On What Basis Income Is Taxed Under The Head SalaryDeepika BhopaleNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- SHAKE2000Document2 pagesSHAKE2000venkatanagachandraNo ratings yet

- Essent 1.1 PDFDocument90 pagesEssent 1.1 PDFvenkatanagachandraNo ratings yet

- Astrology GlossaryDocument9 pagesAstrology GlossaryvenkatanagachandraNo ratings yet

- PAN Card ApplicationDocument4 pagesPAN Card ApplicationRanjan KumarNo ratings yet

- Katha PDFDocument12 pagesKatha PDFvenkatanagachandraNo ratings yet

- Geology Research India Golden Jubille Volume of Geol Soc of India PDFDocument107 pagesGeology Research India Golden Jubille Volume of Geol Soc of India PDFvenkatanagachandraNo ratings yet

- 12142012123603Document59 pages12142012123603venkatanagachandraNo ratings yet

- Bihar NepalDocument3 pagesBihar NepalvenkatanagachandraNo ratings yet

- Specification - Grad - 03 - 500L Gradiometer: Magnetic Field SensorsDocument1 pageSpecification - Grad - 03 - 500L Gradiometer: Magnetic Field SensorsvenkatanagachandraNo ratings yet

- SS 1 PDFDocument1 pageSS 1 PDFvenkatanagachandraNo ratings yet

- Seisnotes PDFDocument70 pagesSeisnotes PDFvenkatanagachandraNo ratings yet

- The Da For January 2011 Is 6%. With This The Total Da Is 51%Document1 pageThe Da For January 2011 Is 6%. With This The Total Da Is 51%venkatanagachandraNo ratings yet

- Cook County Executive Budget Recommendation FY 2018Document432 pagesCook County Executive Budget Recommendation FY 2018CrainsChicagoBusiness100% (1)

- Pas 34 Interim Financial Reporting Group 15Document56 pagesPas 34 Interim Financial Reporting Group 15Faker MejiaNo ratings yet

- BPI vs. CIRDocument5 pagesBPI vs. CIRmatinikki100% (1)

- Deloitte Kenya Budget Highlights 2022-23Document34 pagesDeloitte Kenya Budget Highlights 2022-23Nasim AzarNo ratings yet

- PEs Review 2018 Eng For Web - 20180801103644Document368 pagesPEs Review 2018 Eng For Web - 20180801103644Bibek JoshiNo ratings yet

- Enterprise Structure:: Basic SettingsDocument62 pagesEnterprise Structure:: Basic SettingspawanhegdeNo ratings yet

- NEPAL Tax Reform Strategic PlanDocument44 pagesNEPAL Tax Reform Strategic PlanPaxton Walung LamaNo ratings yet

- Sl. No. Particular Provision Form Due Date (Companies Act) Relaxed Due Date (COVID-19) 1Document3 pagesSl. No. Particular Provision Form Due Date (Companies Act) Relaxed Due Date (COVID-19) 1Munish SharmaNo ratings yet

- Ramsey County, Minnsota 2012-2013 Biennial BudgetDocument638 pagesRamsey County, Minnsota 2012-2013 Biennial BudgetMetalAnonNo ratings yet

- 6 Budget in Brief English 2021 22Document55 pages6 Budget in Brief English 2021 22Dawndotcom100% (2)

- Income VIVIDocument19 pagesIncome VIVISim BelsondraNo ratings yet

- State of Hawaii Basic Business Application: Form Bb-1 (Rev. 2022)Document6 pagesState of Hawaii Basic Business Application: Form Bb-1 (Rev. 2022)Tham DangNo ratings yet

- Pakistan's Economy AnalysisDocument2 pagesPakistan's Economy AnalysisAbidiNo ratings yet

- Sage300 GeneralLedger UsersGuideDocument280 pagesSage300 GeneralLedger UsersGuideAmani100% (1)

- Hegar LetterDocument3 pagesHegar LetterThe TexanNo ratings yet

- Sioux City 2013 Operating BudgetDocument378 pagesSioux City 2013 Operating BudgetSioux City JournalNo ratings yet

- GPPB Resolution No. 05-2021 Issuance of Position Paper On DFA E-Passport ProjectDocument7 pagesGPPB Resolution No. 05-2021 Issuance of Position Paper On DFA E-Passport ProjectJoAnneGallowayNo ratings yet

- PEFA Regional Government of SomaliDocument172 pagesPEFA Regional Government of SomaliGirmaye HaileNo ratings yet

- RR 9 98 PDFDocument7 pagesRR 9 98 PDFJoey Villas MaputiNo ratings yet

- Introduction To Business Taxation Nature of Business TaxDocument24 pagesIntroduction To Business Taxation Nature of Business Taxmy miNo ratings yet

- 2017-2018 Kuamri Bank Annual ReportDocument144 pages2017-2018 Kuamri Bank Annual Reportdevi ghimireNo ratings yet

- Emkay BudgetDocument32 pagesEmkay BudgetaparmarinNo ratings yet

- 2 - Bir Ruling No. 517-11Document5 pages2 - Bir Ruling No. 517-11Gino Alejandro SisonNo ratings yet

- Walgreens Brings LPGA Legends To SCW: Too Hot To Handle Join The Celebration As SCW Marks AZ CentennialDocument27 pagesWalgreens Brings LPGA Legends To SCW: Too Hot To Handle Join The Celebration As SCW Marks AZ CentennialDel Webb Sun Cities MuseumNo ratings yet

- Tax Reviewer General Principles by Rene CallantaDocument8 pagesTax Reviewer General Principles by Rene CallantarehnegibbNo ratings yet

- ZEEL Balance Sheet 2013-14Document176 pagesZEEL Balance Sheet 2013-14Rohit PandeyNo ratings yet

- Bangladesh and Development Related Data For Focus WritingDocument8 pagesBangladesh and Development Related Data For Focus WritingKAMRUN NAHERNo ratings yet

- D100 EnglezaDocument7 pagesD100 EnglezaZsuzsa ANo ratings yet

- Budget Manual Klein IsdDocument12 pagesBudget Manual Klein Isdapi-237940284No ratings yet

- Pardons and Paroles Statistical ReportDocument13 pagesPardons and Paroles Statistical ReportMike CasonNo ratings yet