Professional Documents

Culture Documents

Sesa Sterlite Result Updated

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sesa Sterlite Result Updated

Uploaded by

Angel BrokingCopyright:

Available Formats

Company Update | Metals

February 27, 2012 Bhavesh Chauhan

Tel: 022- 39357800 Ext: 6821 bhaveshu.chauhan@angelbroking.com

Sesa Sterlite

Promoter gains, Minorities to lose

Vedanta Resources, the promoter of Sesa Goa and Sterlite Industries, has approved to merge the two companies in order to simplify the groups holding structure and to lower its debt. The merger will create a new entity Sesa Sterlite, wherein existing shareholders of Sterlite Industries will receive three shares of Sesa Goa for every five existing shares of Sterlite Industries. The merged entity will takeover the remaining 70.5% (Sterlite Industries holds 29.5%) stake of Vedanta Aluminium (VAL) from Vedanta Resources by issuing 72.3mn (2.4% of the merged entity) existing shares of Sesa Goa, valuing VALs equity at `2,332cr and the enterprises value at `30,000cr. The merged entity will also assume VALs net debt of `19,695cr. Madras Aluminium Company (MALCO) will also be merged with Sesa Sterlite through the issue of 78.7mn (2.7% of the merged entity) existing shares of Sesa Goa, valuing MALCOs equity at `1,790cr. Vedanta Resources will also transfer its 38.8% stake in Cairn India at a nominal consideration of US$1 along with the associated acquisition debt of US$5.9bn. The debt of Vedanta Resources will decrease by 61% to US$3.8bn post the deal. Vedanta Resources will hold 58.3% in Sesa Sterlite (currently, Vedanta Resources holding in Sesa Goa is 55.1% and that in Sterlite Industries is 53.3%). As per Vedanta Resources, the combined entity is expected to generate synergies of `1,000cr per year. The deal is subject to approval by at least 75% of the shareholders by value and 50% by number of voters. We believe the merger will take at least 6-8 months, until then the stocks of Sesa Goa and Sterlite Industries will continue to trade independently. Sesa Sterlites debt to rise significantly: Currently, Sesa Goa has net debt of `4,272cr and Sterlite Industries has net cash of `9,183cr. However, Sesa Sterlites debt is expected to increase on account of takeover of US$5.9bn of debt related to Cairn India and US$4.0bn debt related to VAL. VAL continues to make losses; No turnaround seen in the near future: While Cairn Indias takeover in the merged entity is value-neutral in our view, loss-making VALs debt of `19,695cr will increase leverage for Sesa Sterlite without any corresponding increase in profits in the near future. VAL continues to make losses (loss of `2,346cr during CY2011), given its high cost of production and lower utilization levels (currently 30%). We expect VAL to continue to make losses in FY2013 on account of lack of captive bauxite/coal mines and high interest costs. Vedanta Resources emerges a winner: Vedanta Resources will clearly emerge as a beneficiary with the transfer of loss-making VAL to Sesa Sterlite along with the associated debt. The deal implies an enterprise value of `32,695cr for VAL, which is significantly higher than our estimates. On account of VALs takeover, Sesa Sterlites debt (hence enterprise value) increases without any corresponding increase in earnings in the near future (implying higher forward EV/EBITDA). Hence, in our view, the deal is negative for Sesa Goas and Sterlite Industries minority shareholders. We value Sesa Goa and Sterlite Industries on an SOTP basis with target prices of `202 and `121, respectively, and recommend Neutral on both the stocks.

Please refer to important disclosures at the end of this report

Sesa Sterlite | Company Update

Components of the deal

(a) The merger will create a new entity Sesa Sterlite, wherein existing shareholders of Sterlite Industries will receive three shares of Sesa Goa for every five existing shares of Sterlite Industries. (b) Currently, Sterlite Industries owns 29.5% stake in VAL. The merged entity will takeover the remaining 70.5% stake of VAL from Vedanta Resources by issuing 72.3mn (2.4% of the merged entity) existing shares of Sesa Goa, valuing VALs equity at `2,332cr and the enterprises value at `30,000cr. The merged entity will also assume VALs net debt of `19,695cr. (c) MALCO will also be merged with Sesa Sterlite through the issue of 78.7mn (2.7% of the merged entity) existing shares of Sesa Goa, valuing MALCOs equity at `1,790cr. (d) Vedanta will also transfer its 38.8% stake in Cairn India at a nominal consideration of US$1 along with the associated acquisition debt of US$5.9bn. The debt of Vedanta Resources will reduce by 61% to US$3.8bn post the deal. Vedanta Resources will hold 58.3% in Sesa Sterlite (currently, Vedanta Resources holding in Sesa Goa is 55.1% and that in Sterlite Industries is 53.3%). As per Vedanta Resources, the combined entity is expected to generate synergies of `1,000cr per year. The deal requires over 13 approvals from various Indian and U.K. regulatory authorities and is expected to be completed in CY2012. The deal is subject to approval by at least 75% of the shareholders by value and 50% by number of voters. We believe the merger will take at least 6-8 months, until then the stocks of Sesa Goa and Sterlite Industries will continue to trade independently.

February 27, 2012

Sesa Sterlite | Company Update

Exhibit 1: Shares outstanding (Current and post the deal) Company Sesa Goa Sterlite Industries VAL MALCO Cancellation of Sterlite shares by MALCO Total shares post Source: Company, Angel Research Current 87 336

(cr)

Post deal 87 202 7 8 (7) 296

Exhibit 2: Estimated transaction timeline

Event BSE and NSE approval Competition Commission approval High Court of India an Supreme Court of Mauritius approval Vedanta EGM Sesa / Sterlite / MALCO EGM Other required approvals Transaction completion

Source: Company

Expected date April 2012 April 2012 September 2012 May 2012 June 2012 CY2012 CY2012

Sesa Sterlites debt to rise significantly: Currently, Sesa Goa has net debt of `4,272cr and Sterlite Industries has net cash of `9,183cr. However, Sesa Sterlites debt is expected to increase on account of takeover of US$5.9bn of debt related to Cairn India and US$4.0bn debt related to VAL. Exhibit 3: Vedanta Resources debt to decline...

12.0 10.0 8.0 9.7

Exhibit 4: ...while Sesa Sterlites debt to increase

10.0 8.0 6.0 7.5

(US$ bn)

6.0 4.0 2.0 0.0 Pre -merger Vedanta's debt Post merger 3.8

(US$ bn)

4.0 2.0 0.0 0.9 Sesa Sterlite (1.9) Net debt Sesa Sterlite

(2.0) (4.0)

Source: Company, Angel Research

Source: Company, Angel Research, Note: Sesa Sterlite net debt post merger

February 27, 2012

Sesa Sterlite | Company Update

VAL continues to make losses; No turnaround seen in the near future: While Cairn Indias takeover in the merged entity is value-neutral in our view, loss-making VALs debt of `19,695cr will increase leverage for Sesa Sterlite without any corresponding increase in profits in the near future. VAL continues to make losses (loss of `2,346cr during CY2011), given its high cost of production and lower utilization levels (currently 30%). We expect VAL to continue to make losses in the near future on account of lack of captive bauxite/coal mines and high interest costs. Exhibit 5: VALs losses continue to mount

0 (100) (200) (300) (400)

(` cr)

(500) (600) (700) (800) (900)

(1,000) 3QFY2011 4QFY2011 1QFY2012 2QFY2012 3QFY2012

Source: Company, Angel Research

Vedanta Resources emerges a winner: Vedanta Resources will clearly emerge as a beneficiary with the transfer of loss-making VAL to Sesa Sterlite along with the associated debt. The deal implies an enterprise value of `32,695cr for VAL, which is significantly higher than our estimates. On account of VALs takeover, Sesa Sterlites debt (hence enterprise value) increases without corresponding (meaningful) increase in earnings in the near future (implying higher forward EV/EBITDA). Hence, in our view, the deal is negative for Sesa Goas and Sterlite Industries minority shareholders. We value Sesa Goa and Sterlite Industries on an SOTP basis with target prices of `202 and `121, respectively, and recommend Neutral on both the stocks.

February 27, 2012

Sesa Sterlite | Company Update

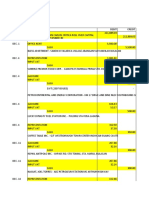

Exhibit 6: SOTP valuation of Sesa Sterlite

Subsidiary Sterlite Industries Balco Vedanta Aluminium Hindustan Zinc (20% holding company discount) Sterlite Energy Tasmania Copper mines International Zinc MALCO Sesa Goa Cairn India (20% holding company discount) less : Cairn debt Net equity value Fair value for Sesa Sterlite (`) Fair value for Sterlite (`)

Source: Angel Research

(` cr)

Valuation technique EV/EBITDA EV/EBITDA EV/EBITDA EV/EBITDA FCFE P/BV EV/EBITDA BV EV/EBITDA DCF Target multiple (x) Equity value % Stake Sterlite Industries value 3.0 3.0 4.0 5.0 1.0 1.0 3.0 3.5 11,135 2,268 (8,103) 67,677 1,475 1,009 1,422 10,392 70,907 100% 51% 100% 65% 100% 100% 100% 100% 100% 59% 11,135 1,157 (8,103) 35,138 1,475 1,009 1,422 1,712 10,392 33,355 (28,797) 59,894 202 121

Exhibit 7: Recommendation summary

Companies CMP Target Reco. Mcap Upside (` cr) P/E (x) P/BV (x) EV/EBITDA (x) RoE (%) RoCE (%) (`) price (`) (%) FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E

Nalco Sesa Goa Sterlite Industries Hindalco HZL

60 204 116 140 136

53 Reduce 15,335 - Neutral 17,694 - Neutral 38,872 152 Accum. 26,774 - Neutral 57,253

(11) 9 -

21.7 5.7 7.3 8.5 10.4

18.4 4.6 6.4 8.9 8.9

1.3 1.1 0.8 0.8 2.1

1.3 0.9 0.8 0.8 1.7

11.0

2.0

8.4

1.5

6.2

22.3

7.0

22.5

3.8

21.2

5.3

13.3

2.5 5.4 6.7

2.0 5.7 4.9

12.1 10.3 22.0

12.4 9.1 21.3

11.3 7.4 20.9

11.2 6.8 20.4

Source: Company, Angel Research

February 27, 2012

Sesa Sterlite | Company Update

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Analyst ownership of the stock Sesa Goa Sterlite Industries No No Angel and its Group companies ownership of the stock No No Angel and its Group companies' Directors ownership of the stock No No Broking relationship with company covered No No

Note: We have not considered any Exposure below `1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

February 27, 2012

Sesa Sterlite | Company Update

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 39357800 Research Team

Fundamental: Sarabjit Kour Nangra Vaibhav Agrawal Shailesh Kanani Bhavesh Chauhan Sharan Lillaney V Srinivasan Yaresh Kothari Hemang Thaker Nitin Arora Ankita Somani Varun Varma Sourabh Taparia Technicals: Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Derivatives: Siddarth Bhamre Institutional Sales Team: Mayuresh Joshi Hiten Sampat Meenakshi Chavan Gaurang Tisani Akshay Shah Production Team: Simran Kaur Dilip Patel Research Editor Production simran.kaur@angelbroking.com dilipm.patel@angelbroking.com VP - Institutional Sales Sr. A.V.P- Institution sales Dealer Dealer Sr. Executive mayuresh.joshi@angelbroking.com Hiten.Sampat@angelbroking.com meenakshis.chavan@angelbroking.com gaurangp.tisani@angelbroking.com akshayr.shah@angelbroking.com Head - Derivatives siddarth.bhamre@angelbroking.com Sr. Technical Analyst Technical Analyst Technical Analyst shardul.kulkarni@angelbroking.com sameet.chavan@angelbroking.com sacchitanand.uttekar@angelbroking.com VP-Research, Pharmaceutical VP-Research, Banking Infrastructure Metals, Mining Mid-cap Research Associate (Cement, Power) Research Associate (Automobile) Research Associate (Capital Goods) Research Associate (Infra, Real Estate) Research Associate (IT, Telecom) Research Associate (Banking) Research Associate (Cement, Power) sarabjit@angelbroking.com vaibhav.agrawal@angelbroking.com shailesh.kanani@angelbroking.com bhaveshu.chauhan@angelbroking.com sharanb.lillaney@angelbroking.com v.srinivasan@angelbroking.com yareshb.kothari@angelbroking.com hemang.thaker@angelbroking.com nitin.arora@angelbroking.com ankita.somani@angelbroking.com varun.varma@angelbroking.com sourabh.taparia@angelbroking.com

CSO & Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.Tel.: (022) 3083 7700. Angel Broking Ltd: BSE Sebi Regn No: INB010996539 / PMS Regd Code: PM/INP000001546 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / NSE Sebi Regn Nos: Cash: INB231279838 / NSE F&O: INF231279838 / Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500 / Angel Commodities Broking Pvt. Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

February 27, 2012

You might also like

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Wasting Asset AnswerDocument3 pagesWasting Asset AnswerJessalyn DaneNo ratings yet

- Advanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (29-35)Document1 pageAdvanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (29-35)John Carlos Doringo100% (1)

- TAX - Individual TaxationDocument40 pagesTAX - Individual TaxationErika Mae LegaspiNo ratings yet

- Pakistan Stock ExchangeDocument41 pagesPakistan Stock ExchangeAdanNo ratings yet

- BBP New Sap FicoDocument96 pagesBBP New Sap FicoHima BinduNo ratings yet

- IAS 40 Investment PropertyDocument12 pagesIAS 40 Investment PropertyIrfan AhmedNo ratings yet

- 7-Eleven FS 2016 pg.94Document171 pages7-Eleven FS 2016 pg.94Myles Ninon LazoNo ratings yet

- Analyst Meet Presentation - 15022010Document26 pagesAnalyst Meet Presentation - 15022010damani.manojNo ratings yet

- TIAA-CREF Lifecycle FundsDocument135 pagesTIAA-CREF Lifecycle FundsDiarmadhim MoresbyNo ratings yet

- Finance E2-E3-Financial ManagementDocument39 pagesFinance E2-E3-Financial Managementpintu_dyNo ratings yet

- Adhi - LK - 30 September 2023Document241 pagesAdhi - LK - 30 September 2023Timothy GracianovNo ratings yet

- Accounting Principles: 11 Edition - US GAAPDocument73 pagesAccounting Principles: 11 Edition - US GAAPPutu Deny WijayaNo ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- Abbl3144 Tutorial 3 AnswerDocument9 pagesAbbl3144 Tutorial 3 AnswerSooXueJiaNo ratings yet

- JAIBB - AFS Solutions (Collected) PDFDocument78 pagesJAIBB - AFS Solutions (Collected) PDFZinia Zerin92% (13)

- MCQ's On Financial ManagementDocument22 pagesMCQ's On Financial ManagementsvparoNo ratings yet

- Financial Management Ebook Capital Budgeting Only.Document41 pagesFinancial Management Ebook Capital Budgeting Only.Edet Nsikak BasseyNo ratings yet

- AFAR 2305 Not-for-Profit OrganizationsDocument14 pagesAFAR 2305 Not-for-Profit OrganizationsDzulija TalipanNo ratings yet

- 12linsteel Book of Account DecemberDocument54 pages12linsteel Book of Account DecemberCarlos_CriticaNo ratings yet

- Topic 3 & 4 - EXERCISES3 - Working Capital Management - TheoriesDocument36 pagesTopic 3 & 4 - EXERCISES3 - Working Capital Management - TheoriesHazel Jane EsclamadaNo ratings yet

- Module 4 - Going Concern Asset Based Valuation - Comparable Company AnalysisDocument3 pagesModule 4 - Going Concern Asset Based Valuation - Comparable Company AnalysisLiaNo ratings yet

- Sid - Sbi Multi Asset Allocation Fund PDFDocument95 pagesSid - Sbi Multi Asset Allocation Fund PDFANo ratings yet

- TAX Ch05Document12 pagesTAX Ch05GabriellaNo ratings yet

- MergerDocument16 pagesMergeralysonmicheaalaNo ratings yet

- PalamonDocument6 pagesPalamonRyan Teichmann75% (8)

- FA2 Syllabus and Study Guide - Sept 22-Aug 23Document14 pagesFA2 Syllabus and Study Guide - Sept 22-Aug 23Ahmed RazaNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- 11 Ashok Leyland HosurDocument67 pages11 Ashok Leyland HosurJ N PradeepNo ratings yet

- Fast's Stock Market BluffDocument16 pagesFast's Stock Market Blufferickschonfeld100% (4)