Professional Documents

Culture Documents

Repurchase Agreement Presentation of Kds

Uploaded by

pandubhagyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Repurchase Agreement Presentation of Kds

Uploaded by

pandubhagyaCopyright:

Available Formats

Repurchase agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is the sale of securities together with an agreement for the seller to buy back the securities at a later date. The repurchase price should be greater than the original sale price, the difference effectively representing interest, sometimes called the repo rate. The party that originally buys the securities effectively acts as a lender. The original seller is effectively acting as a borrower, using their security as collateral for a secured cash loan at a fixed rate of interest.

Structure and terminology

A repo is economically similar to a secured loan, with the buyer (effectively the lender or investor) receiving securities as collateral to protect him against default by the seller. The party who initially sells the securities is effectively the borrower. Almost any security may be employed in a repo, though highly liquid securities are preferred as they are more easily disposed of in the event of a default and, more importantly, they can be easily obtained in the open market where the buyer has created a short position in the repo security by a reverse repo and market sale; by the same token, non liquid securities are discouraged. Treasury or Government bills, corporate and Treasury/Government bonds, and stocks may all be used as "collateral" in a repo transaction. Unlike a secured loan, however, legal title to the securities passes from the seller to the buyer. Coupons (interest payable to the owner of the securities) falling due while the repo buyer owns the securities are, in fact, usually passed directly onto the repo seller. This might seem counterintuitive, as the legal ownership of the collateral rests with the buyer during the repo agreement. The agreement might instead provide that the buyer receives the coupon, with the cash payable on repurchase being adjusted to compensate, though this is more typical of sell/buybacks. Although the transaction is similar to a loan, and its economic effect is similar to a loan, the terminology differs from that applying to loans: the seller legally repurchases the securities from the buyer at the end of the loan term. However a key aspect of repos is that they are legally recognised as a single transaction (important in the event of counterparty insolvency) and not as a disposal and a repurchase for tax purposes. The following table summarizes the terminology:

Repo

Reverse repo

Borrower Participant Seller Cash receiver

Lender Buyer Cash provider

Near leg

Sells securities Buys securities

Far leg

Buys securities Sells securities

Types of repo and related products

There are three types of repo maturities: overnight, term, and open repo. Overnight refers to a one-day maturity transaction. Term refers to a repo with a specified end date. Open simply has no end date. Although repos are typically short-term, it is not unusual to see repos with a maturity as long as two years. Repo transactions occur in three forms: specified delivery, tri-party, and held in custody. The third form is quite rare in developing markets primarily due to risks. The first form requires the delivery of a prespecified bond at the onset, and at maturity of the contractual period. Tri-party essentially is a basket form of transaction, and allows for a wider range of instruments in the basket or pool. Tri-party utilizes a tri-party clearing agent or bank and is a more efficient form of repo transaction.

Due bill/hold in-custody repo

In a due bill repo, the collateral pledged by the (cash) borrower is not actually delivered to the cash lender. Rather, it is placed in an internal account ("held in custody") by the borrower, for the lender, throughout the duration of the trade. This has become less common as the repo market has grown, particularly owing to the creation of centralized counterparties. Due to the high risk to the cash lender, these are generally only transacted with large, financially stable institutions.

Tri-party repo

The distinguishing feature of a tri-party repo is that a custodian bank or international clearing organization, the tri-party agent, acts as an intermediary between the two parties to the repo. The tri-party agent is responsible for the administration of the transaction including collateral allocation, marking to market, and substitution of collateral. In the US, the two principal tri-party agents are The Bank of New York Mellon and JP Morgan Chase. The size of the US tri-party repo market peaked in 2008 before the worst effects of the crisis at approximately $2.8 trillion and by mid 2010 was about $1.6 trillion. [1] As triparty agents administer hundreds of billions of US$ of collateral, they have the scale to subscribe to multiple data feeds to maximise the universe of coverage. As part of a tri-party agreement the three parties to the agreement, the tri-party agent, the repo buyer and the repo seller agree to a collateral management service agreement which includes an "eligible collateral profile". It is this "eligible collateral profile" that enables the repo buyer to define their risk appetite in respect of the collateral that they are prepared to hold against their cash. For example a more risk averse repo buyer may wish to only hold "on-the-run" government bonds as collateral. In the event of a liquidation event of the repo seller the collateral is highly liquid thus enabling the repo buyer to sell the collateral quickly. A less risk averse repo buyer may be prepared to take non investment grade bonds or equities as collateral, these may be less liquid and may suffer a higher price volatility in the event of a repo seller default, making it more difficult for the repo buyer to sell the collateral and recover their cash. The tri-party agents are able to offer sophisticated collateral eligibility filters which allow the repo buyer to create these "eligible collateral profiles" which can systemically generate collateral pools which reflect the buyer's risk appetite. Collateral eligibility criteria could include asset type, issuer, currency, domicile, credit rating, maturity, index, issue size, average daily traded volume, etc. Both the lender (repo buyer) and borrower (repo seller) of cash enter into these transactions to avoid the administrative burden of bi-lateral repos. In addition, because the collateral is being held by an agent, counterparty risk is reduced. A triparty repo may be seen as the outgrowth of the due bill repo, in which the collateral is held by a neutral third party.

Whole loan repo

A whole loan repo is a form of repo where the transaction is collateralized by a loan or other form of obligation (e.g. mortgage receivables) rather than a security.

Equity repo

The underlying security for many repo transactions is in the form of government or corporate bonds. Equity repos are simply repos on equity securities such as common (or ordinary) shares. Some complications can arise because of greater complexity in the tax rules for dividends as opposed to coupons.

Sell/buy backs and buy/sell backs

A sell/buy back is the spot sale and a forward repurchase of a security. It is two distinct outright cash market trades, one for forward settlement. The forward price is set relative to the spot price to yield a market rate of return. The basic motivation of sell/buy backs is generally the same as for a classic repo, i.e. attempting to benefit from the lower financing rates generally available for collateralized as opposed to non-secured borrowing. The economics of the transaction are also similar with the interest on the cash borrowed through the sell/buy back being implicit in the difference between the sale price and the purchase price. There are a number of differences between the two structures. A repo is technically a single transaction whereas a sell/buy back is a pair of transactions (a sell and a buy). A sell/buy back does not require any special legal documentation while a repo generally requires a master agreement to be in place between the buyer and seller (typically the SIFMA/ICMA commissioned Global Master Repo Agreement (GMRA)). For this reason there is an associated increase in risk compared to repo. Should the counterparty default, the lack of agreement may lessen legal standing in retrieving collateral. Any coupon payment on the underlying security during the life of the sell/buy back will generally be passed back to the seller of the security by adjusting the cash paid at the termination of the sell/buy back. In a repo, the coupon will be passed on immediately to the seller of the security. A buy/sell back is the equivalent of a "reverse repo".

Securities lending

In securities lending, the purpose is to temporarily obtain the security for other purposes, such as covering short positions or for use in complex financial structures. Securities are generally lent out for a fee and securities lending trades are governed by different types of legal agreements than repos. Repos have traditionally been used as a form of collateralized loan and have been treated as such for tax purposes. Modern Repo agreements, however, often allow the cash lender to sell the security provided as collateral and substitute an equivalent security at repurchase.[3] In this way the cash lender acts as a security borrower and the Repo agreement can be used to take a short position in the security very much like a security loan might be used.

Reverse Repo

A reverse repo is simply the same repurchase agreement from the buyer's viewpoint, not the seller's. Hence, the seller executing the transaction would describe it as a "repo", while the buyer in the same transaction would describe it a "reverse repo". So "repo" and "reverse repo" are exactly the same kind of transaction, just described from opposite viewpoints. The term "reverse repo and sale" is commonly used to describe the creation of a short position in a debt instrument where the

buyer in the repo transaction immediately sells the security provided by the seller on the open market. On the settlement date of the repo, the buyer acquires the relevant security on the open market and delivers it to the seller. In such a short transaction the seller is wagering that the relevant security will decline in value between the date of the repo and the settlement date.

Uses

For the buyer, a repo is an opportunity to invest cash for a customized period of time (other investments typically limit tenures). It is short-term and safer as a secured investment since the investor receives collateral. Market liquidity for repos is good, and rates are competitive for investors. Money Funds are large buyers of Repurchase Agreements. For traders in trading firms, repos are used to finance long positions, obtain access to cheaper funding costs of other speculative investments, and cover short positions in securities. In addition to using repo as a funding vehicle, repo traders "make markets". These traders have been traditionally known as "matched-book repo traders". The concept of a matched-book trade follows closely to that of a broker who takes both sides of an active trade, essentially having no market risk, only credit risk. Elementary matched-book traders engage in both the repo and a reverse repo within a short period of time, capturing the profits from the bid/ask spread between the reverse repo and repo rates. Presently, matched-book repo traders employ other profit strategies, such as non-matched maturities, collateral swaps, and liquidity management.

United States Federal Reserve use of repos

Repurchase agreements when transacted by the Federal Open Market Committee of the Federal Reserve in open market operations adds reserves to the banking system and then after a specified period of time withdraws them; reverse repos initially drain reserves and later add them back. This tool can also be used to stabilize interest rates, and the Federal Reserve has used it to adjust theFederal funds rate to match the target rate.[5] Under a repurchase agreement ("RP" or "repo"), the Federal Reserve (Fed) buys U.S. Treasury securities, U.S. agency securities, or mortgage-backed securities from a primary dealer who agrees to buy them back, typically within one to seven days; a reverse repo is the opposite. Thus the Fed describes these transactions from the counterparty's viewpoint rather than from their own viewpoint. If the Federal Reserve is one of the transacting parties, the RP is called a "system repo", but if they are trading on behalf of a customer (e.g. a foreign central bank) it is called a "customer repo". Until 2003 the Fed did not use the term "reverse repo" which it believed implied that it was borrowing money (counter to its charter)but used the term "matched sale" instead.

Risks

While classic repos are generally credit-risk mitigated instruments, there are residual credit risks. Though it is essentially a collateralized transaction, the seller may fail to repurchase the securities sold at the maturity date. In other words, the repo seller defaults on his obligation. Consequently, the buyer may keep the security, and liquidate the security in order to recover the cash lent. The security, however, may have lost value since the outset of the transaction as the security is subject to market movements. To mitigate this risk, repos often are over-collateralized as well as being subject to daily mark-to-market margining. Conversely, if the value of the security rises there is a credit risk for the borrower in that the creditor may not sell

them back. If this is expected to happen then the borrower may negotiate a repo which is under-collateralized. [6] Credit risk associated with repo is subject to many factors: term of repo, liquidity of security, the strength of the counterparties involved, etc. Repo transactions came into focus within the financial press due to the technicalities of settlements following the collapse of Refco. Occasionally, a party involved in a repo transaction may not have a specific bond at the end of the repo contract. This may cause a string of failures from one party to the next, for as long as different parties have transacted for the same underlying instrument. The focus of the media attention centers on attempts to mitigate these failures.

History

In the US, Repos have been used from as early as 1917 when war time taxes made older forms of lending less attractive. At first Repos were used just by the Federal reserve to lend to other banks, but the practice soon spread to other market participants. The use of Repos expanded in the 1920s, fell away through the Great depression and WWII , then expanded once again in the 1950s, enjoying rapid growth in the 1970s and 1980s in part due to computer technology. [6] In July 2011, concerns arose among bankers and the financial press that if the 2011 U.S. debt ceiling crisis leads to a default it could cause considerable disruption to the repo market. This is because treasuries are the most commonly used collateral within the US repo market, and as a default would downgrade the value of treasuries it could result in repo borrowers having to post far more collateral.[7]

Market size

The US Federal Reserve and the European Repo Council (a body of the International Capital Market Association) both try to estimate the size of their respective repo markets. At the end of 2004, the U.S. repo market reached US$5 trillion. The European repo market has experienced consistent growth over the past five years, from 1.9 billion in 2001 to 6.4 trillion by the end of 2006, and is expected to continue significant growth due toBasel II, according to a 2007 Celent report entitled The European Repo Market.[8] Especially in the US and to a lesser degree in Europe, the repo market contracted in 2008 as a result of the financial crisis. But by mid 2010 the market had largely recovered and at least in Europe had grown to exceed its pre-crisis peak. [1] Other countries including Chile, India, Japan, Mexico, Hungary, Russia, China, and Taiwan, have their own repo markets, though activity varies by country, and no global survey or report has been compiled.

RBI IN REPO

Whenever the banks have any shortage of funds they can borrow it from RBI. Repo rate is the rate at which our banks borrow rupees from RBI. A reduction in the repo rate will help banks to get money at a cheaper rate. When the repo rate increases borrowing from RBI becomes more expensive. The rate charged by RBI for its Repo operations is 5.75% and Reverse Repo rate is 3.25%. When RBI lends money to bankers against approved securities for meeting their day to day requirements or to fill short term gap.It takes approved securities as securityand lends money.These types of operations are generally for overnight operations.

Definition of a Repo The term Repo is from Sale and Repurchase Agreement Repo is a money market instrument. There are two usually two parties to a repo transaction. g One party sells bonds to the other while simultaneously agreeing to repurchase them or receive them back at a specified future date One party requires either the cash or the bonds and provides collateral to the other as well as compensation for the temporary use of the desired asset Although legal title to the collateral is transferred, the seller/lender retains both the economic benefits and the market risk of owning them If cash is involved the party receiving the cash will pay interest on this cash at the agreed repo rate(c) 2000 The Securities Institute (Services) Ltd 7 Repo Definition (cont.) Repo is therefore a secured loan Legally: a sale and repurchase of bonds Economically: a secured loan of cash The cash investor receives the repo rate Advantages for the cash investor: -- secured investment -- Repo rate competitive with bank deposits -- Diversification away from bank risk

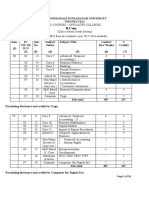

Policy rates, Reserve ratios, lending, and deposit rates as of 14 September, 2011

Bank Rate

6.0%

Repo Rate

8.25%

Reverse Repo Rate

7.25%

Cash Reserve Ratio (CRR)

6.0%

Statutory Liquidity Ratio (SLR)

24.0%

Base Rate

9.50%10.75%

Reserve Bank Rate

4%

Deposit Rate

8.50%9.50%

Monetary function One of the functions of RBI is monetary policy structuring and implementation. The core focus of monetary policy is to increase or reduce the money supply in the market. The only way to do it is to increase or reduce the repo and reverse repo rate. Repo rate is the rate at which banks borrow money from RBI and reverse repo is the rate at which RBI borrows money from the bank. Now what does RBI intend to achieve by changi ng these rates. Lets look at how increasing and reducing the repo and reverse repo rates affect the market. If the policy rates are higher, the cost of money for banks is high. This means that the banks will charge higher interest rate for loans. The banks will also provide high rates to depositors. If the depositors get good rates, this will encourage people to deposit money in banks. People will prefer saving because of the good returns that banks promise. This will reduce money in the market thus impacting consumption. Similarly, when the banks start charging high rates for lending, this will discourage people from borrowing. People will postpone their purchases of home, vehicles, and other items because of high lending rates on their home loans, personal loans and car loans. This will again reduce money supply thus impacting consumption.

RBIs objective vis--vis policy rate RBI intends to do the same thing by increasing the repo and reverse repo rates. The money supply will be reduced and hence consumption will go down. If the consumption goes down, producers will reduce the price of goods to attract buyers to increase consumption. This will reduce the overall prices of commodities and other goods. Since India is facing high inflation for last couple of years, RBIs chief objective is to reduce the inflation by reducing money supply in the market. This explains why RBI increased the policy rates 11 times since early days of 2010. Price stability has become the main objective for RBI.

Last Cash and liquidity management Creating liquidity in the underlying instrument Financing and leveraging the investment Credit enhancement and greater volume Role in other structured products (derivatives, swaps etc) Repo oils the wheel of the bond market

RBI slashes CRR and SLR by 100 bps each and Repo rate by 50 bps CRR revised to 5.5%, Repo rates to 7.5% while SLR stands reduced to 24% RBI has cut CRR by 100 basis points to 5.5%, SLR by100 basis points to 24% and repo rate by 50 basis points to 7.5%, in a surprise move on 1st November 2008. Though the market was expecting a cut, the market is surprised by strong dose of cut in all the three rates in one go.

The cut in CRR will be implemented in two phases of 50 basis points each. CRR will come down to 6.0% effective from the fortnight beginning 25th October 2008 and further down to 5.5% effective from the fortnight beginning 8th November 2008. Incidentally, this is in addition to 250 basis points cut in CRR effective from the fortnight beginning 11th October 2008. Thus, in October 2008 alone, we are seeing 300 bps cut and another 50 bps cut in November 2008. The latest 100 basis point cut in CRR will bring in Rs 40000 crore into the banking system. Together, the 350 basis points cut across October and November 2008 will bring in Rs 140000 crore into the banking system

Since 16 September RBI has been offering an additional liquidity support for banks to the extent of 1% of NDTL under the Liquidity Adjustment Facility (LAF) along with waiver of penal interest. Now, RBI making this reduction permanent has reduced the Statutory Liquidity Ratio (SLR) by 100 bps to 24% of NDTL effective from the fortnight beginning 8th November 2008.

You might also like

- Repurchase AgreementDocument11 pagesRepurchase AgreementSanjay MitalNo ratings yet

- Repos: SecuritiesDocument5 pagesRepos: SecuritiesSURYANo ratings yet

- A Repurchase AgreementDocument10 pagesA Repurchase AgreementIndu GadeNo ratings yet

- Repurchase AgreementDocument7 pagesRepurchase AgreementAAM26No ratings yet

- Repurchase Agreements (Repo and Strips)Document5 pagesRepurchase Agreements (Repo and Strips)swissmoney1No ratings yet

- Repo Vs Reverse RepoDocument9 pagesRepo Vs Reverse RepoRajesh GuptaNo ratings yet

- Repo Vs Reverse RepoDocument16 pagesRepo Vs Reverse Repogupta_rajesh_621791No ratings yet

- Repurchase AgreementDocument11 pagesRepurchase Agreementtimothy454No ratings yet

- Repurchase Agreement: 1 Ambiguity in The Usage of The Term RepoDocument6 pagesRepurchase Agreement: 1 Ambiguity in The Usage of The Term RepoafjkjchhghgfbfNo ratings yet

- Repurchase AgreementDocument2 pagesRepurchase AgreementMy Nguyễn Thị DiễmNo ratings yet

- 0205 ReposedDocument45 pages0205 ReposedLameuneNo ratings yet

- 26 Structured RepoDocument4 pages26 Structured RepoJasvinder JosenNo ratings yet

- Descriptions of Repurchase Agreement (Repo)Document1 pageDescriptions of Repurchase Agreement (Repo)Sandia EspejoNo ratings yet

- Ca - Final - SFM TheoryDocument13 pagesCa - Final - SFM TheoryPravinn_MahajanNo ratings yet

- Chapter 1 INVESTMENT A P MGMTDocument18 pagesChapter 1 INVESTMENT A P MGMTRahel asfawNo ratings yet

- RepoDocument37 pagesRepoMuhammad Munir100% (1)

- Futures ContractDocument15 pagesFutures Contractitika jainNo ratings yet

- Repurchase Agreements (Repos) : Concept, Mechanics and UsesDocument5 pagesRepurchase Agreements (Repos) : Concept, Mechanics and UsesManish KumarNo ratings yet

- Investement CHAPTER ONEDocument13 pagesInvestement CHAPTER ONEBeamlakNo ratings yet

- Tayyab RIAZ Mcom 3 Weekend: Non Current Liabilities Explain The Following Terminologies:-1.face ValueDocument2 pagesTayyab RIAZ Mcom 3 Weekend: Non Current Liabilities Explain The Following Terminologies:-1.face ValueIsmaeel rajaNo ratings yet

- Financial Derivatives Study MaterialDocument6 pagesFinancial Derivatives Study MaterialVishal DhekaleNo ratings yet

- Financial Instrument Asset Index Underlying Futures ContractDocument9 pagesFinancial Instrument Asset Index Underlying Futures Contractkristel-marie-pitogo-4419No ratings yet

- T4 - Interest Rates and Bond ValuationDocument2 pagesT4 - Interest Rates and Bond ValuationJERRIE MAY JAMBANGANNo ratings yet

- 3.6 Trillion: Understanding Repo: A Cash Building BlockDocument4 pages3.6 Trillion: Understanding Repo: A Cash Building BlocksdfasdfahgadsNo ratings yet

- Repurchase Agreements: Ritesh Garg (64) Sunil Kumar MauryaDocument24 pagesRepurchase Agreements: Ritesh Garg (64) Sunil Kumar MauryaArjun KalraNo ratings yet

- Chapter One Introduction To InvestmentDocument15 pagesChapter One Introduction To InvestmentHaileNo ratings yet

- Chapter One Introduction To InvestmentDocument13 pagesChapter One Introduction To InvestmentAdugna KeneaNo ratings yet

- Bond (Finance) : IssuanceDocument66 pagesBond (Finance) : IssuanceAnonymous 83chWz2voNo ratings yet

- DerivativesDocument18 pagesDerivativesJay Lord FlorescaNo ratings yet

- What Exactly Is Stock?Document7 pagesWhat Exactly Is Stock?Selvinder KaurNo ratings yet

- Derivates NotesDocument7 pagesDerivates NotesSachin MethreeNo ratings yet

- Credit Risk Management M.Numan Naeem BBA (Hons) 8 (Evening, B Section)Document6 pagesCredit Risk Management M.Numan Naeem BBA (Hons) 8 (Evening, B Section)Numan NaeemNo ratings yet

- Asset Encumbrance Apr14Document2 pagesAsset Encumbrance Apr14biomed12No ratings yet

- Repurchase Agreement: PurposeDocument1 pageRepurchase Agreement: PurposeSaba BaigNo ratings yet

- A Derivative Is A Financial Instrument That Derives or Gets It Value From Some Real Good or StockDocument19 pagesA Derivative Is A Financial Instrument That Derives or Gets It Value From Some Real Good or Stockdipak_pandey_007No ratings yet

- Basic Financial Derivatives Forwards: in Finance, A Forward Contract or Simply A Forward Is A Derivative ContractDocument3 pagesBasic Financial Derivatives Forwards: in Finance, A Forward Contract or Simply A Forward Is A Derivative Contractsid1982No ratings yet

- Finance TermsDocument14 pagesFinance TermsJoann SacolNo ratings yet

- Info On Nature Risks of InvestmentsDocument0 pagesInfo On Nature Risks of InvestmentsIndra PramanaNo ratings yet

- Financial DerivativesDocument108 pagesFinancial Derivativesramesh158No ratings yet

- Financial Derivatives: Robert M. Hayes 2002Document108 pagesFinancial Derivatives: Robert M. Hayes 2002Suryanarayanan VenkataramananNo ratings yet

- Chapter 5 FIMDocument13 pagesChapter 5 FIMMintayto TebekaNo ratings yet

- Financial MarketDocument8 pagesFinancial Marketshahid3454No ratings yet

- W ElcomeDocument18 pagesW ElcomeRamesha SNo ratings yet

- Derivatives and OptionsDocument23 pagesDerivatives and OptionsSathya Keerthy KNo ratings yet

- FD Bcom Module 1Document75 pagesFD Bcom Module 1Mandy RandiNo ratings yet

- Please Read: A Personal Appeal From Wikipedia Founder Jimmy WalesDocument14 pagesPlease Read: A Personal Appeal From Wikipedia Founder Jimmy WalesJay BhattNo ratings yet

- Are Repos Really LoansDocument8 pagesAre Repos Really LoansMarius AngaraNo ratings yet

- Debt InstrumentDocument5 pagesDebt InstrumentDhaval JoshiNo ratings yet

- Bond MarketDocument5 pagesBond MarketJonahNo ratings yet

- Risk Management in Future ContractsDocument4 pagesRisk Management in Future Contractsareesakhtar100% (1)

- Financial DerivativesDocument6 pagesFinancial DerivativesAlfred osafo100% (4)

- MortgageDocument4 pagesMortgageNuman NaeemNo ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementFrom EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementRating: 5 out of 5 stars5/5 (1)

- SWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)From EverandSWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)No ratings yet

- Ibe Union BudgetDocument11 pagesIbe Union BudgetpandubhagyaNo ratings yet

- Motivation Theories and Lerning TheoriesDocument29 pagesMotivation Theories and Lerning TheoriespandubhagyaNo ratings yet

- Receivables Management and FactoringDocument11 pagesReceivables Management and FactoringpandubhagyaNo ratings yet

- Module 4Document48 pagesModule 4pandubhagyaNo ratings yet

- 115 MRS V JPMC 3rd Amended Complaint-SDNYDocument190 pages115 MRS V JPMC 3rd Amended Complaint-SDNYlarry-612445No ratings yet

- Muhammad Waqas Internship Report - OutputDocument49 pagesMuhammad Waqas Internship Report - OutputIjaz Ul HassanNo ratings yet

- HR The Fulcrum of Business Process OutsourcingDocument11 pagesHR The Fulcrum of Business Process OutsourcingPooja HarshalNo ratings yet

- Bañas vs. Asia Pacific Corp., 343 SCRA 527 October 18, 2000 TEODORO BAÑASDocument39 pagesBañas vs. Asia Pacific Corp., 343 SCRA 527 October 18, 2000 TEODORO BAÑASRizza Mae EudNo ratings yet

- Campos V BPI (Civil Procedure)Document2 pagesCampos V BPI (Civil Procedure)AngeliNo ratings yet

- Case Digest - General Banking ActDocument15 pagesCase Digest - General Banking ActAiko DalaganNo ratings yet

- Case #28 MANUEL R. DULAY ENTERPRISES, INC. VS. COURT OF APPEALSDocument2 pagesCase #28 MANUEL R. DULAY ENTERPRISES, INC. VS. COURT OF APPEALSBill Mar100% (1)

- PPI Provisional BST 2018-19Document6 pagesPPI Provisional BST 2018-19accounts ppintNo ratings yet

- Philippine National Bank vs. Court of Appeals: - Third DivisionDocument12 pagesPhilippine National Bank vs. Court of Appeals: - Third DivisionKar EnNo ratings yet

- Final Roadmap Reit IpoDocument110 pagesFinal Roadmap Reit IposhumbaNo ratings yet

- Shemberg Vs CitibankDocument4 pagesShemberg Vs CitibankIheart DxcNo ratings yet

- Creditors Allege Argentine Soy Giant SiphonedDocument3 pagesCreditors Allege Argentine Soy Giant SiphonedMarianela De EmilioNo ratings yet

- Rosales Vs YboaDocument3 pagesRosales Vs Yboalalisa lalisaNo ratings yet

- PaytmDocument22 pagesPaytmSukanya SonaNo ratings yet

- The Career As Alife Insurance AgentDocument8 pagesThe Career As Alife Insurance AgentTarun Kumar SinghNo ratings yet

- Real Estate Option To Buy AgreementDocument3 pagesReal Estate Option To Buy Agreementevangareth100% (2)

- 25 RESA vs. MO 39Document37 pages25 RESA vs. MO 39George Poligratis Rico100% (2)

- Cent VidyarthiDocument3 pagesCent Vidyarthigcadvisers100% (1)

- Vda de Jayme, Et Al Vs CA, Cebu Asiancars Et AlDocument4 pagesVda de Jayme, Et Al Vs CA, Cebu Asiancars Et AlGlenn FloresNo ratings yet

- (G.R. No. 102998. July 5, 1996) Ba Finance Corporation, ReyesDocument12 pages(G.R. No. 102998. July 5, 1996) Ba Finance Corporation, ReyesAnthea Louise RosinoNo ratings yet

- Q and ADocument9 pagesQ and AVal ReyesNo ratings yet

- Ug Courses - Affiliated Colleges (Choice Based Credit System) (With Effect From The Academic Year 2017-2018 Onwards)Document35 pagesUg Courses - Affiliated Colleges (Choice Based Credit System) (With Effect From The Academic Year 2017-2018 Onwards)Vinayaga MoorthyNo ratings yet

- Case Digest Credit-GuarantyDocument16 pagesCase Digest Credit-GuarantyCarmela SalazarNo ratings yet

- Compendium For LandDocument341 pagesCompendium For Landkailasasundaram87% (15)

- Deeds Registries Act 47 of 1937Document51 pagesDeeds Registries Act 47 of 1937André Le RouxNo ratings yet

- 1631 Lise42 Sbsbprdsa10 02 01Document2 pages1631 Lise42 Sbsbprdsa10 02 01wd216No ratings yet

- Mortgage Bond: Mortgage Is A Security Furnished by A Person For The Repayment of A LoanDocument2 pagesMortgage Bond: Mortgage Is A Security Furnished by A Person For The Repayment of A LoanUsmanFarisNo ratings yet

- Gregory - Gifts To Men and Gifts To GodDocument28 pagesGregory - Gifts To Men and Gifts To GodГригорий ЮдинNo ratings yet

- BuildersHandbook EnglishDocument35 pagesBuildersHandbook EnglishJP VersterNo ratings yet

- Summary of Doctrines Civil LawDocument23 pagesSummary of Doctrines Civil LawChristian Carl GarciaNo ratings yet