Professional Documents

Culture Documents

FX1

Uploaded by

Daniel Archer-CoxOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FX1

Uploaded by

Daniel Archer-CoxCopyright:

Available Formats

GLOBALFXSTRATEGY

DailyForeignExchangeUpdate

Wednesday,February29,2012 530bnINLTROSUPPORTSRISKASSETS

USDisonweakerfootingasrisktradeissupported.Bernankeisrisk. CADbreaksoutofitsrecentrangeandhitsanew5monthhigh.Cor relationsareshiftingsuggestingchangeisafoot. EUR 530bnin LTRO by 800 banks leaves EUR almost flat but the risktradesupportedastailriskcontinuestodwindle. GBPgainsdrivenbypositivemarketsentimentandBoEcomments. CHFSNBtonesuggestspotentialforincreasetoflooronMarch15. SEKslowinggrowthdrivenbyexportshighlightsneedforeasing. JPYflatdespitebetterindustrialproductiondata;PMIfallsto50.5. CNYChinatakingmeasurestoliberalizeyuanFXtransactions. MonthendflowssupportiveofCAD&AUD;weighingonJPYtoday. FX Market Update The highly anticipated ECB LTRO did not disap pointmarkets,as800banksbidforatotalof530bnin3yearloans. The number of banks suggest that participation was more widely dis persed across the banking sector and that the funds will be used for both funding requirements and carry trades, accordingly it is positive forriskassets.Aswemoveintotheopen,oilpricesremainelevated, withWTIat$106.80,equitiesareflat,Europeanbondyieldshavefallen and the USD is generally weak. Commodity and risk sensitive curren cies(NZD,AUD,CADandMXN)areoutperforming,upbetween0.5and 0.8%;whilemostoftheothersarefairlyclosetoyesterdaysNAclose. TodaysfocuswillbeChairBernankessemiannualtestimony.C.S.

CamillaSutton,CFA,CMTEricTheoret ChiefCurrencyStrategistCurrencyStrategist (416)8665470 (416)8637030

Camilla.Sutton@scotiabank.comEric.Theoret@scotiabank.com

RECENTRALLYINEURNOTSUPPORTEDBYYIELDS

ECBRATECUTSUNLIKELYWITHINFLATIONABOVE2%

Chair Bernanke delivers his semiannual testimony to the House at 10am EST. We do not expect a major shift in his recent dovish tone. Economicdatahasimproved,howeverwewouldexpectthatwewould needtoseeamuchbroaderandmoresustainedimprovementbefore the Fed would shift to a more neutral stance. Accordingly, we expect histestimonytocontinuetosupporttherisktrade.C.S.

Monthendflowscanleadtoawkwardchartpatternsaspassiveequity managers rebalance their equity holdings. In February, Canadian and Australian equities have underperformed, which could lead to some CADandAUDpositiveflowsaspositionsarebroughtbackuptobench mark; while Japanese equities have significantly outperformed, which couldweighonJPYasthesearesoldoff.Therewereonlyminordiffer encesbetweenequityperformanceintheUS,EuropeandtheUK.C.S.

GERMANYBENEFITSFROMAWEAKENEDEURO

Americas USDCAD(0.9900)CADreachedanewfourmonthhighinlateEuro peantrading,intandemwithAUDsnewsevenmonthhigh.TheEuro peanLTROisthoughttoincreaseriskappetiteandputdownwardpres sureontheUSD.TodaysriskisChairBernankestestimonyfollowedby thereleaseofChinasPMI(cons.50.9).SupportforUSDCADfromhere lies at the psychological 0.9850 followed by 0.9700; while resistance comesinattodaysopenof0.9953.C.S.

Correlationsareshifting,whichistypicallyanearlywarningsignalthat marketdynamicsarealsochanging.Therolling30daycorrelationbe tween CAD and equities has dropped from 0.92 in early February to

~ Please consider voting for Scotiabank in Euromoney's FX 2012 Poll between January 26th and March 2nd ~

To vote please go to: www.euromoney.com/fx2012

GlobalFXResearch

Wednesday,February29,2012

GBPUSD(1.5946)GBPisup0.2%vsthe USD,allowingforabreakofresistanceat the 200 day MA (1.5902), following a positive reaction to the ECBs LTRO and commentary from the BoEs Governor Kingthatmutedexpectationsforfurther QE. GBP had been consolidating for most of February, with support at 1.5650andresistancejustabove1.5900. BoE Governor King was quoted, com menting to parliamentary officials, that hedidnotthinkthattherewasanyhard andfastexpectationoffurtherQE,and thatcurrentactionwasappropriate.E.T.

0.77,whiletherelationshipwithinterestratespreadshascollapsedto0.1,suggestingthetwo assets are not moving in tandem, even the correlation with EUR has fallen from its mid February level of 0.9 down to 0.7. However the correlation between AUD and CAD has re mainedstrong,currentlyat0.95;whilethecorrelationwithoilisrisingoffitsrecentlows.C.S.

Europe EURUSD(1.3435)EURisjust0.2%weakerfromwhereitclosedyesterday,withtheminimal downsideallgeneratedafterthereleaseoftheLTROandlikelyhavingtodowithclosingout longpositions.SpanishandItalian2yearyieldshavedroppedtonew16monthlows.Support forEURcomesinat1.3301,bothcongestionandthe100dayMA;resistanceliesat1.35.C.S.

TodaysLTROcameinclosetoconsensusat530bn,with800bankssubmittingbids;thiscom paresto489bnand523banksintheDecembertreeyearLTRO.Theuseofthefundsismulti fold,withevidencethattheyhavebeenusedtoeasefundingrequirementsforthebanks,but alsoaspartofsovereigncarrytrade.AsreportedbytheFT,datasuggeststhattherewasasig nificantincreaseinsovereignexposureafterthefirstLTROinDecember,bytheendofJanuary Italianbankshadincreasedtheirexposureby13%(280bn)andSpanishbankshadboughtan additional29%(230bn).Thequestionthistimeiswhatthe800bankswhoreceivedfundswill dowithit.Wewouldexpectmoreofthesameandthatthisinturnwillsupportriskandmini mizetailrisksintheEuropeanbankingsector.C.S.

InotherEuropean newsIrelandistoholdareferendumonthefiscalcompact,withthebig gestimpactofanovotemeaningthatIrelandcouldnotaccessfundingprovidedbytheESM. Eurozoneinflationcameinbelowexpectationswithcorefallingto1.5%andheadlinefallingto 2.6%;thisprovidesabitmoreroomfortheECBtocutinterestratesevenasoilpricesrise.The Germanunemploymentrateroseto6.8%;butinthecontextofEurope,itremainsarelatively low rate. Finally, ISDA will rule later today as to whether they will proceed with the request they have had for Greece. With a net CDS exposure of just $3.2bn now, it is widely believed thattheriskismanageable.C.S.

KeyPricing&Levels

USDCAD EURUSD GBPUSD USDCHF USDJPY AUDUSD USDMXN DXY(USDindex) CRBCommodity Gold WTCrude(Nymex) NatGas(Nymex) BoCNoonRate 30Day HistVol 5.0 7.7 6.2 7.3 8.8 8.5 9.5 6.0 Spot 0.9881 1.3446 1.5944 0.8963 80.43 1.0836 12.78 78.17 323.12 1,786.57 107.07 2.52 0.9956 largest 1Day% 1Week 100Day 200Day Pivot1st Chg %Chg MA MA Support 0.73 1.18 1.0142 0.9991 0.9840 0.09 1.49 1.3302 1.3722 1.3395 0.26 1.75 1.5709 1.5902 1.5843 0.09 1.53 0.9180 0.8773 0.8932 0.04 0.17 77.57 77.97 80.04 0.64 1.85 1.0345 1.0409 1.0758 0.48 0.48 13.42 12.86 12.73 0.10 1.32 78.85 77.12 77.97 0.61 0.21 312.85 323.32 N/A 0.13 0.58 1,693.07 1,674.57 1,771.45 0.47 0.72 97.44 94.60 105.92 0.04 4.65 3.13 3.65 2.48 CAD(closefromBloombergnotBoC): loss gain Pivot1st Resistance 0.9957 1.3492 1.6002 0.8998 80.81 1.0885 12.87 78.48 N/A 1,796.22 108.51 2.59 0.9953

2/29/2012

EURCHF (1.2051) CHF remains flat vs EUR despite an escalation in currency relatedrhetoricfromtheSNBthatcame ahead of todays CPI release, in which deflationary pressures continue to be seen;inadditiontothestillnegativeKoF leading indicator, suggesting that the Swisseconomyremainschallenged.CPI hasfallento0.9%onay/ybasisandhas remained negative since October 2011 as continued CHF strength allows for fallingimportprices.E.T.

PricingSource:Bloomberg

Today'sReleases&Speakers Time Country Release Period Cons Last Significance (EST) 08:30 US GDPQoQ(Annualized) 4QS 2.8% 2.8% Medium 09:45 US ChicagoPurchasingManager FEB 61.0 60.2 Medium 10:00 US FedChairBernanke(dove)DeliversSemiAnnualMonetaryPolicyReport High 10:00 US NAPMMilwaukee FEB 58.8 58.4 Medium 10:25 US Fed'sFisher(nonvotinghawk)SpeaksonfiscalreformsinMexicoCity;Q&A Medium 13:00 US Fed'sPlosser(nonvotinghawk)SpeaksonEconomyinNewYork;Q&A Medium 14:00 US FedReleasesBeigeBookEconomicSurvey Medium 20:00 CH PMIManufacturing FEB 50.9 50.5 High 03:55 PMIManufacturing:Germany,EU,UK;EZUnemployment High

Asia/Oceania USDCNY(6.2938)CNYisflatvstheUSD ahead of the NA session as it continues to trade within a limited range in 2012. Since February 1st, movement in USDCNY has been bound between 6.2892 and 6.3144 as the previous downwardtrendhaspaused.Thestabil ityintheexchangerateislikelyareflec tion of policymakers concerns over the recent shift in capital flows, in addition to worries about demand growth in Europe. The official manufacturing PMI is set to be released following todays NA close, with expectations of a slight increasefrom50.5to50.9.Chinascen tralbank,thePBOC,hasannouncedad ditionalmeasurestointernationalizethe yuan, and is now allowing banks in the city of Shenzhen to provide individuals with the ability to engage in cross border yuan transactions. The measure followsonetakenin2009inwhichbusi nesses were allowed to settle trade in yuan, an endeavor that was expanded acrossallofChinain2011.E.T.

SuggestedReading BewareSovereignStressifECBBackdoorBetBackfires,J.Plender,FT(February29,2012) LowRatesAidCongressionalCanKickers,S.Jakab,WSJ(February29,2012) ChinaTakesNewSteponYuanLiberalization,L.Wei,WSJ(February29,2012) ChinaisRighttoOpenUpSlowly,M.Wolf,FT(February29,2012)

GlobalFXResearch

Wednesday,February29,2012

PleasejoinusinourFXStrategyConferencecall,availableforthenext30days Dial:9056949451 Passcode:505774261# The20minutecallishostedbyCamillaSutton,ChiefCurrencyStrategist,anddiscusses: WhathaschangedsinceDecembertospurtheriskrallyandwillitlast? Theimpacttheoutlookforgrowth,centralbankpolicy,volatilityandtheEuropeanbondmarkethavehadoncurrencies. EURisundergoingaretracementofpreviouslosses;butweexpectittotrendlowerintoyearend2012. TheoutlookforCADintoyearend2012isrelativelystrong. AnoverviewofourotherFXforecast Thepresentationcanbefoundat: http://www.scotiafx.com/conference/index.htm

CONTACTSGLOBALFXSTRATEGY THEMAJORS&PRIMARYCURRENCIES CamillaSutton ChiefCurrencyStrategist 4168665470 Camilla.Sutton@scotiabank.com EricTheoret CurrencyStrategist 4168637030 Eric.Theoret@scotiabank.com LATAM EduardoSuarez SeniorCurrencyStrategist 4169454538 Eduardo.Suarez@scotiabank.com ASIA SachaTihanyi SeniorCurrencyStrategist 85261176070 Sacha.Tihanyi@scotiabank.com Shouldyouwishtobeaddedtoanyoneofourthreedistributionlists,pleasereachouttooneoftheaboveauthors.

ThisreportispreparedbyTheBankofNovaScotia(Scotiabank)asaresourceforclientsofScotiabank.Opinions,estimatesandprojectionscontainedhereinareourownasofthedate hereofandaresubjecttochangewithoutnotice.Theinformationandopinionscontainedhereinhavebeencompiledorarrivedatfromsourcesbelievedreliablebutnorepresentationor warranty,expressorimplied,ismadeastotheiraccuracyorcompletenessandneithertheinformationnortheforecastshallbetakenasarepresentationforwhichTheBankoritsaffili atesoranyoftheiremployeesincuranyresponsibility.NeitherScotiabankoritsaffiliatesacceptanyliabilitywhatsoeverforanylossarisingfromanyuseofthisreportoritscontents.This reportisnot,andisnotconstructedas,anoffertosellorsolicitationofanyoffertobuyanyofthecurrenciesreferredtointhisreport.Scotiabank,itsaffiliatesand/ortheirrespective officers,directorsoremployeesmayfromtimetotimetakepositionsinthecurrenciesmentionedhereinasprincipaloragent.Directors,officersoremployeesofScotiabankanditsaffili atesmayserveasdirectorsofcorporationsreferredtoherein.Scotiabankand/oritsaffiliatesmayhaveactedasfinancialadvisorand/orunderwriterforcertainofthecorporationsmen tionedhereinandmayhavereceivedandmayreceiveremunerationforsame.Thisreportmayincludeforwardlookingstatementsabouttheobjectivesandstrategiesofmembersofthe ScotiabankGroup.SuchforwardlookingstatementsareinherentlysubjecttouncertaintiesbeyondthecontrolofthemembersoftheScotiabankGroupincludingbutnotlimitedtoeco nomicandfinancialconditionsglobally,regulatorydevelopmentinCanadaandelsewhere,technologicaldevelopmentsandcompetition.Thereaderiscautionedthatthemember'sactual performancecoulddiffermateriallyfromsuchforwardlookingstatements.Youshouldnotethatthemannerinwhichyouimplementanyofstrategiessetoutinthisreportmayexpose youtosignificantriskandyoushouldcarefullyconsideryourabilitytobearsuchrisksthroughconsultationwithyourlegal,accountingandotheradvisors.Informationinthisreportregard ingservicesandproductsofScotiabankisapplicableonlyinjurisdictionswheresuchservicesandproductsmaylawfullybeofferedforsaleandisvoidwhereprohibitedbylaw.Ifyou accessthisreportfromoutsideofCanada,youareresponsibleforcompliancewithlocal,nationalandinternationallaws.NotallproductsandservicesareavailableacrossCanadaorinall countries.AllScotiabankproductsandservicesaresubjecttothetermsofapplicableagreements.Thisresearchandallinformation,opinionsandconclusionscontainedinitareprotected bycopyright.Thisreportmaynotbereproducedinwholeorinpart,orreferredtoinanymannerwhatsoevernormaytheinformation,opinionsandconclusionscontainedinitbere ferredtowithoutineachcasethepriorexpressconsentofScotiabank.ScotiabankisaCanadiancharteredbank.TMTrademarkofTheBankofNovaScotia.Usedunderlicense,where applicable.Scotiabank,togetherwithGlobalBankingandMarkets,isamarketingnamefortheglobalcorporateandinvestmentbankingandcapitalmarketsbusinessesofTheBankof NovaScotiaandcertainofitsaffiliatesinthecountrieswheretheyoperate,including,ScotiaCapitalInc.andScotiaCapital(USA)Inc.allmembersoftheScotiabankGroup.

You might also like

- Danske DailyDocument5 pagesDanske DailyDaniel Archer-CoxNo ratings yet

- X-Factor 012612 - Pollyanna Meets The EconomyDocument16 pagesX-Factor 012612 - Pollyanna Meets The EconomyDaniel Archer-CoxNo ratings yet

- Kauffman Economic Outlook: A Quarterly Survey of Leading Economics Bloggers - First Quarter 2012Document19 pagesKauffman Economic Outlook: A Quarterly Survey of Leading Economics Bloggers - First Quarter 2012The Ewing Marion Kauffman FoundationNo ratings yet

- UK Research: How Long Can The UK Maintain Its AAA Rating?Document15 pagesUK Research: How Long Can The UK Maintain Its AAA Rating?Daniel Archer-CoxNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

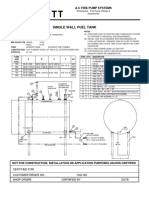

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDocument1 pageSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNo ratings yet

- Ebook The Managers Guide To Effective Feedback by ImpraiseDocument30 pagesEbook The Managers Guide To Effective Feedback by ImpraiseDebarkaChakrabortyNo ratings yet

- Photoshop Tools and Toolbar OverviewDocument11 pagesPhotoshop Tools and Toolbar OverviewMcheaven NojramNo ratings yet

- Compilation of CasesDocument121 pagesCompilation of CasesMabelle ArellanoNo ratings yet

- People vs. Ulip, G.R. No. L-3455Document1 pagePeople vs. Ulip, G.R. No. L-3455Grace GomezNo ratings yet

- 3838 Chandra Dev Gurung BSBADM502 Assessment 2 ProjectDocument13 pages3838 Chandra Dev Gurung BSBADM502 Assessment 2 Projectxadow sahNo ratings yet

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating EmplDocument37 pagesTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating Emplpolkadots939100% (1)

- QSK45 60 oil change intervalDocument35 pagesQSK45 60 oil change intervalHingga Setiawan Bin SuhadiNo ratings yet

- Berry B Brey Part IDocument49 pagesBerry B Brey Part Ikalpesh_chandakNo ratings yet

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDocument1 pageQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiNo ratings yet

- Debentures Issued Are SecuritiesDocument8 pagesDebentures Issued Are Securitiesarthimalla priyankaNo ratings yet

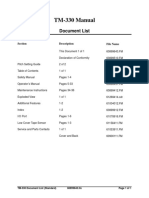

- PS300-TM-330 Owners Manual PDFDocument55 pagesPS300-TM-330 Owners Manual PDFLester LouisNo ratings yet

- Oop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Document14 pagesOop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Hashir KhanNo ratings yet

- EFM2e, CH 03, SlidesDocument36 pagesEFM2e, CH 03, SlidesEricLiangtoNo ratings yet

- Safety QualificationDocument2 pagesSafety QualificationB&R HSE BALCO SEP SiteNo ratings yet

- Battery Impedance Test Equipment: Biddle Bite 2PDocument4 pagesBattery Impedance Test Equipment: Biddle Bite 2PJorge PinzonNo ratings yet

- Chapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationDocument16 pagesChapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationSarmila MahendranNo ratings yet

- An Overview of Tensorflow + Deep learning 沒一村Document31 pagesAn Overview of Tensorflow + Deep learning 沒一村Syed AdeelNo ratings yet

- Server LogDocument5 pagesServer LogVlad CiubotariuNo ratings yet

- Haul Cables and Care For InfrastructureDocument11 pagesHaul Cables and Care For InfrastructureSathiyaseelan VelayuthamNo ratings yet

- Metamorphic Rocks ImagesDocument7 pagesMetamorphic Rocks Imagesapi-289985616100% (1)

- Quezon City Department of The Building OfficialDocument2 pagesQuezon City Department of The Building OfficialBrightNotes86% (7)

- iec-60896-112002-8582Document3 pagesiec-60896-112002-8582tamjid.kabir89No ratings yet

- 01 Automatic English To Braille TranslatorDocument8 pages01 Automatic English To Braille TranslatorShreejith NairNo ratings yet

- Entrepreneurship WholeDocument20 pagesEntrepreneurship WholeKrizztian SiuaganNo ratings yet

- Computers As Components 2nd Edi - Wayne WolfDocument815 pagesComputers As Components 2nd Edi - Wayne WolfShubham RajNo ratings yet

- ContactsDocument10 pagesContactsSana Pewekar0% (1)

- Ten Golden Rules of LobbyingDocument1 pageTen Golden Rules of LobbyingChaibde DeNo ratings yet

- 50TS Operators Manual 1551000 Rev CDocument184 pages50TS Operators Manual 1551000 Rev CraymondNo ratings yet

- Abb Drives: User'S Manual Flashdrop Mfdt-01Document62 pagesAbb Drives: User'S Manual Flashdrop Mfdt-01Сергей СалтыковNo ratings yet