Professional Documents

Culture Documents

Guarantee & Indemnity Agreement

Uploaded by

jingwen23Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guarantee & Indemnity Agreement

Uploaded by

jingwen23Copyright:

Available Formats

This document has been prepared by the Law Institute of Victoria.

This document may require to be added to or amended to ensure its suitability for a particular transaction. For that reason you should consult a solicitor. Published by the Law Institute of Victoria. 2003

Law Institute of Victoria

Guarantee & Indemnity Agreement

Overview Details of this agreement Signatures of parties Your acknowledgment and representations 1. Your acknowledgments before signing this agreement 2. Your representations The guarantee 3. What do you guarantee? 4. What is the guaranteed money? The indemnity 5. What is the indemnity? Your obligations 6. Your obligations are separate and continuing 7. If you are a trustee 8. Even if not everyone signs 9. You waive your rights as guarantor Paying money under the guarantee and indemnity 10. When and what amounts you must pay 11. How you must pay 12. How we may use your money 13. We may credit money to a suspense account 14. Our certificate

Discharging this agreement 15. You my request a discharge 16. No right to make claims Our rights 17. Giving of our consent or approval 18. Waivers must be in writing 19. We may assign our rights etc 20. We may enforce at any time Giving a valid notice 21. How to give a notice and when it is given Miscellaneous provisions 22. Effect of law on our rights 23. Effect of this agreement and other agreements 24. This is the entire agreement 25. If a condition is prohibited or unenforceable 26. Variations must be in writing 27. Credit legislation is not excluded 28. Governing law is Victorian Defining and interpreting this agreement 29. Defined words 30. Interpreting this agreement Attachments 1 Certificate of independent legal advice 2 Information Statement Things you should know about guarantees

LawSoft

elawpublishing.com.au

Copyright Law Institute of Victoria

Ref

Law Institute of Victoria

Guarantee & Indemnity Agreement

Law Institute of Victoria

Guarantee & Indemnity Agreement

Overview

Summary of this agreement

This is a guarantee and indemnity agreement between you and us. You have asked us to provide credit to the borrower under a credit contract. We have agreed to provide this credit if you give us the guarantee and indemnity set out in this agreement. You have agreed to do this. We may be asked to provide credit to the borrower in the future under a future credit contract. If we agree to provide this credit, and you accept in writing the conditions of the future credit contract, then this guarantee and indemnity also covers that future credit contract. In this agreement, you guarantee that the borrower will pay all money owing under the credit contract or a future credit contract. You also indemnify us in certain circumstances against our loss if the guaranteed money owing is not paid or cannot be recovered. We may call on you to pay us the guaranteed money: - if the borrower does not pay on time or at all; and - even if we have not asked the borrower to pay. We may also call on you to pay our reasonable expenses of enforcing the guarantee or the indemnity. Please note: If the borrower is under 18 years of age at the time the borrower incurs a liability guaranteed by you, you may not be able to claim or enforce an indemnity against the borrower. we, us and our means each person named as lender (see page 3). you means each person named as guarantor (see page 3). A reference to you includes all or any of you. If there is more than one person, each person is jointly and severally liable under this agreement. This means we may require one, all, or any combination of you to pay any unpaid amount in full. Some words and expressions used in this agreement have special meanings. They are explained in clauses 29 and 30.

Words used in this agreement

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Guarantee & Indemnity Agreement

Details of this agreement

Date of agreement Lender

Name Address

Guarantor 1

Name Address

Guarantor 2

Name Address

Borrower 1

Name Address

Borrower 2

Name Address

Limit on guaranteed money?

Yes

The guaranteed money is limited to the amount of

$ No The guaranteed money is not limited to a specific dollar amount, but is limited by clause 4.3.

................. ................. (Initials of each guarantor)

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Guarantee & Indemnity Agreement

IMPORTANT BEFORE YOU SIGN

READ THIS GUARANTEE DOCUMENT AND THE CREDIT CONTRACT DOCUMENT

THINGS YOU MUST KNOW

Understand that, by signing this guarantee, you may become personally responsible instead of, or as wells as, the debtor to pay the amounts which the debtor owes and the reasonable expenses of the credit provider in enforcing the guarantee. If the debtor does not pay you must pay. This could mean you lose everything you own including your home. You may be able to withdraw from this guarantee or limit your liability. Ask your legal adviser about this before you sign this guarantee.

You should also read the information statement: THINGS YOU SHOULD KNOW ABOUT GUARANTEES You should obtain independent legal advice.

You should also consider obtaining independent financial advice. You should make your own inquiries about the credit worthiness, financial position and honesty of the debtor. You are not bound by a change to the credit contract, or by a new credit contract, that increases your liabilities under the guarantee unless you have agreed in writing and have been given written particulars of the change or a copy of the new credit contract document.

Signature of parties

Signed by guarantor 1 in the presence of:

....................................................................... Signature of guarantor 1 ....................................................................... Name of guarantor 1 (please print)

...................................................................... Signature of witness ...................................................................... Name of witness (please print)

Signed by guarantor 2

in the presence of:

....................................................................... Signature of guarantor 2 ....................................................................... Name of guarantor 2 (please print)

...................................................................... Signature of witness ...................................................................... Name of witness (please print)

Signed by lender

in the presence of:

....................................................................... Signature of lender ....................................................................... Name of lender (please print)

...................................................................... Signature of witness ...................................................................... Name of witness (please print)

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Guarantee & Indemnity Agreement

Your acknowledgments and representations

1. Your acknowledgments before signing this agreement

1.1 Before signing this agreement you acknowledge that you did the following: (a) (b) asked us to provide credit to the borrower under a credit contract; were given a copy of, and have read, both the credit contract that we and the borrower propose to enter into, and the attached information statement called Things you should know about guarantees; have read this agreement; were advised by us to, and had the opportunity to, get advice from an independent lawyer and an independent financial adviser about this agreement including its obligations, effect, legal consequences and financial consequences; consulted and received advice about the meaning, consequences of, and obligations created by this agreement from a lawyer who is independent of us and the borrower, and obtained a certificate from that lawyer in the form set out in attachment 1; read and understood this agreement including its obligations, effect, legal consequences and financial consequences; and agreed that it is your responsibility to fully investigate the financial position, credit worthiness and honesty of each of the borrower and any other guarantor.

(c) (d)

(e)

(f)

(g)

2.

Your representations

2.1

You represent to us that all information provided to us by you or on your behalf is true and correct and not misleading. You have not withheld from us any document or information that may substantially affect our decision to extend credit to the borrower. You represent to us that you have not taken any security from the borrower concerning this agreement or the guaranteed money.

2.2

The guarantee

3. 4. What do you guarantee? What is the guaranteed money?

3.1 You guarantee unconditionally that the guaranteed money will be paid to us when it is due and payable. The guaranteed money is all the money that the borrower owes us now or in the future under a credit contract. The guaranteed money also includes all the money that the borrower is liable for under a future credit contract if:

4.1

4.2

LawSoft

elawpublishing.com.au

Law Institute of Victoria a) (b) 4.3

Guarantee & Indemnity Agreement we first give you a copy of the proposed future credit contract; and you then agree in writing that this guarantee and indemnity also covers that future credit contract.

Your maximum liability under this agreement is the lesser amount of: (a) the borrowers liabilities under each credit contract plus our reasonable enforcement expenses reasonably incurred in enforcing the agreement; and the amount (if any) set out next to the Yes box in the section headed Limit on guaranteed money on page 3.

(b)

5.

What is the indemnity

5.1

You must pay us as an indemnity all amounts we cannot recover from the borrower if a credit contract is not enforceable solely because of: (a) (b) (c) the borrowers death, insolvency or incapacity; the borrowers act or omission; or other circumstances affecting the borrower.

Your obligations

6. Your obligations are separate and continuing

6.1 The guarantee is a continuing guarantee and the indemnity is a continuing indemnity. This means that your obligations and promises continue until this agreement is discharged or ends. Your obligations under the guarantee are separate and independent from your obligations under the indemnity. You agree that we may enforce our rights under the indemnity against you as a principal debtor even if we cannot recover the guaranteed money under the guarantee. This clause applies if you give the guarantee and indemnity as a trustee of a trust (whether or not we know about the trust). You enter into and are liable under the guarantee and indemnity both as trustee of the trust to the extent of the trust assets and personally. We may: (a) (b) directly access the trust assets for the purpose of paying the guaranteed money; and require you to, and you then must, exercise all rights you have against the trust assets and the trust beneficiaries for the purpose of paying the guaranteed money.

6.2 6.3

7.

If you are a trustee

7.1

7.2

7.3

7.4

You represent to us that all the following are true and correct and not misleading: (a) you have the right to be indemnified out of the trust assets (and before any trust beneficiary) for all liabilities you incur under the guarantee and indemnity and the trust property is sufficient to satisfy this right of indemnity;

LawSoft

elawpublishing.com.au

Law Institute of Victoria (b)

Guarantee & Indemnity Agreement you have the power under the trust to enter into the guarantee and indemnity and perform your obligations under the guarantee and indemnity. You are not in breach of the trust by entering into the guarantee and indemnity; you have entered into the guarantee and indemnity for a proper purpose of the trust; your performance of your obligations under the guarantee and indemnity is for the trusts commercial benefit and interests, and is for the benefit of the trust beneficiaries; you are not in default under or in breach of the trust; you are the only trustee of the trust, and no step has been taken to remove you or to appoint another trustee; the trust is a valid trust and no action has been taken to terminate the trust; and you have given us all the terms of the trust, including a complete, up-to-date copy of any trust deed.

(c) (d)

(e) (f)

(g) (h)

7.5

At any time after you have signed the guarantee and indemnity you must tell us if, on the facts at that time, you become aware that a representation is no longer true or correct or is misleading. If another person is appointed to replace you as trustee of the trust, you must make sure that the person signs all documents and does all other things we required so that the guarantee and indemnity is binding on that person. When you sign this agreement you are bound by it, even if: (a) another person named or described as a guarantor does not sign it, is not bound by it or has no power to sign it; or another person who intended to give a security for part or all of the guaranteed money: does not sign, is not bound by, or has no power to sign the security; or is no longer liable under, or is discharged from liability under, the security.

7.6

8.

Even if not everyone signs

8.1

(b)

9.

You waive your rights as guarantor

9.1

As far as permitted by law you waive all rights that you may have as a guarantor under the law (including surety law) and that may: (a) entitle you to be partly or fully released or discharged from your obligations under this agreement; or restrict or prevent us from enforcing our rights and remedies under this agreement.

(b)

LawSoft

elawpublishing.com.au

Law Institute of Victoria 9.2

Guarantee & Indemnity Agreement For example, you waive a right that may arise in one or more of these circumstances: (a) if the guaranteed money cannot be recovered from the borrower, another guarantor or a security provider; if an agreement or security given to us concerning the guaranteed money is defective, unenforceable, or ranks after another agreement, security or obligation; if, without first getting your consent, we do anything concerning the guaranteed money, a credit contract, or a security or indemnity for the guaranteed money. For example, if we grant time or other indulgence to, or waive an obligation of, the borrower, another guarantor or a security provider; compromise, compound or make an arrangement concerning an obligation owed to us by the borrower, another guarantor or a security provider; release the borrower, another guarantor or a security provider from an obligation under a credit contract, the guarantee and indemnity or a security; or obtain a court judgment against the borrower, another guarantor or a security provider.

(b)

(c)

(d)

if, without first telling you or getting your consent, we vary or allow a variation to a credit contract. But we must tell you and get your prior written consent if a variation increases or allows for an increase in liabilities under that credit contract; or if the borrower, another guarantor or another person dies, becomes mentally incapable or becomes insolvent.

(e)

Paying money under the guarantee or indemnity

10. When and what amounts you must pay

10.1 You must immediately pay us the guaranteed money (see clause 4) if the guaranteed money is not paid when it is due and payable. 10.2 You must immediately pay us all money you are liable to pay under the indemnity (see clause 5) when we give you a written demand for payment under the indemnity. 10.3 You must also immediately pay us all reasonable expenses we reasonably incur in enforcing this agreement if we give you a written demand for payment setting out those enforcement expenses.

11. How you must pay

11.1 You must pay in cash or by bank cheque to the account nominated by us. We may change the method of payment or the nominated account by giving you written notice. 11.2 You must pay all amounts in full and must not make a set-off, a counterclaim, a deduction, or attach any condition to the payment unless required or permitted by legislation.

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Guarantee & Indemnity Agreement 12.1 At any time we may use any money that is now or in the future credited to your account with us to reduce or satisfy amounts you owe us under this agreement. 12.2 We may also set off any other debt or monetary liability that we owe you against amounts which are due and payable by you under this agreement.

12. How we may use your money

13. We may credit money to a suspense account

13.1 We may credit any money that we receive from you or on your behalf to a suspense account. We may apply the money in the suspense account to reduce your liability under this agreement when we reasonably determine. 14.1 A certificate signed by us or our authorised agent or employee concerning any thing (for example; the amount of the guaranteed money, or the date when a demand or notice was sent) is sufficient evidence of the accuracy of the thing at the date of the certificate. This is so unless the certificate is proved incorrect.

14. Our certificate

Discharging this agreement

15. You may request a discharge

15.1 At your written request, we must discharge this agreement if: (a) the guaranteed money (which includes any future or contingent part of the guaranteed money) has been paid in full; and all obligations under this agreement and each security or other agreement concerning the guaranteed money have been performed.

(b)

15.2 But we are not obliged to discharge this agreement if, at the time when its requirements are satisfied, we believe that: (a) (b) you owe further money (contingently or otherwise) to us under this agreement; or you will owe further money to us under this agreement within a reasonable time from the date of your request to discharge this agreement.

15.3 If a transaction in our favour (for example: a payment to us) concerning the guaranteed money is wholly or partly avoided, set aside, refunded or repaid, then, even if this agreement has been discharged or ended, you agree to all the following: (a) your liabilities and our rights under this agreement are the same as if the transaction had not been avoided, set aside, refunded or repaid; and

16. No right to make claims

we may exercise all our rights under this agreement as if the agreement had never been discharged. 16.1 Until this agreement is discharged, you may not: (a) claim the benefit of, or require us to transfer to you, the security or rights that we have concerning the guaranteed money; or claim an amount from another guarantor or in the insolvency of another guarantor concerning an amount paid or payable by you under this agreement.

(b)

(b)

LawSoft

Law Institute of Victoria

Guarantee & Indemnity Agreement

Our rights

17. Giving of our consent or approval 18. Waivers must be in writing

17.1 When you are required to obtain our consent or approval, we may withhold or give it as we think fit, and with or without conditions. You must comply with all conditions or our consent or approval. 18.1 If we omit to or do not exercise a right under this agreement, then we have not waived or given up the right. We may exercise it at any later time. 18.2 We only waive or give up our right if the waiver or consent in writing and signed by us or our authorised agent or employee. The waiver or consent is only effective for the circumstance and purpose set out in writing.

19. We may assign our rights etc

19.1 We may transfer or assign or otherwise deal with any of our rights, benefits or obligations under the guarantee and indemnity. We do not need your consent to do this. We may also disclose any information or documents concerning this agreement or you to any person to whom we assign or may assign our rights under this agreement. 19.2 If the guarantee and indemnity has been assigned or transferred to a person, a reference to we, us or our includes that person. That person may exercise our rights under the guarantee and indemnity.

20. We may enforce at any time

20.1 Before or after we enforce this agreement we are not required (except if required by legislation): (a) to enforce any of our rights against the borrower or another person, including under a security that you, the borrower or another person has given us; or to appropriate or recover any money or asset for you to another person that we hold or are entitled to receive at any time (for example; money in an account a person has with us).

(b)

Giving a valid notice

21. How to give a notice and when it is given

21.1 Our notice to you is valid if signed by us or on our behalf by our agent or solicitor. 21.2 We may give a demand or notice to you in any way the law allows, including the following ways: (a) (b) (c) (d) giving it personally to you; leaving it at your last known address; posting it by ordinary mail in a prepaid envelope to your last known address; or transmitting it by facsimile to your last known facsimile number.

21.3 You must give us notice by: (a) giving it personally to us or one of our employees; (b) posting it by ordinary mail in a prepaid envelope to our office at our address (see page 3); or (c) any other means permitted by law.

LawSoft elawpublishing.com.au

10

Law Institute of Victoria

Guarantee & Indemnity Agreement 21.4 A notice is taken to be given (a) if given personally, when it is received; (b) (c) if left at our address, when left; if posted, when it would be delivered in the ordinary course of post but no later than 5 business days after it is posted; or if transmitted by facsimile, when the machine sending the facsimile reports (for example; by a confirmation of transmission printout) that the notice was sent to the addressees facsimile number.

(d)

Miscellaneous provisions

22. Effect of law on our rights

22.1 If a law or lawful requirement of a government body makes illegal, void or unenforceable: (a) (b) a right given to us in this agreement; or a provision of the agreement;

then the right of provision must be interpreted as limited or omitted to the extent that it has the effect. This does not invalidate any other right or provision.

23. Effect of this agreement and other agreements

23.1 This agreement does not merge with, extinguish, postpone, or lessen: (a) (b) another security in our favour; an indemnity in our favour in any security or another agreement concerning the guaranteed money; or a right we may have against you or other person.

(c)

23.2 Any other security we hold does not limit or lessen any of our rights under this agreement.

24. This is the entire agreement 25. If a condition is prohibited or unenforceable

24.1 This agreement sets out all of the terms between you and us. This agreement supersedes any other representation, promise or statement made by us or by any of our employees or agents. 25.1 A provision in this agreement that is prohibited by law or unenforceable in whole or in part is only ineffective to the extent it is prohibited or unenforceable. It does not invalidate any other provision. 26.1 A variation of this agreement must be in writing and signed by all of the parties. 27.1 This agreement does not: (a) exclude, modify or restrict any rights or duty given to, or imposed on, us or you under credit legislation; require you to perform an obligation that is prohibited by credit legislation; or give us any right which is prohibited by credit legislation.

26. Variations must be in writing 27. Credit legislation is not excluded

(b) (c)

27.2 But if a term has this effect, then the term must be varied to the extent necessary or, if necessary, limited or omitted to the extent it has that effect.

LawSoft

elawpublishing.com.au

11

Law Institute of Victoria

Guarantee & Indemnity Agreement 28.1 The guarantee and indemnity is governed by and must by interpreted according to Victorian law.

28. Governing law is Victorian

Defining and interpreting this agreement

29. Defined words

29.1 In this agreement, these words and expressions have the following meaning: (a) (b) (c) borrower means the person or persons named as the borrower (set out on page 3); business day means a day when banks are open for business in Melbourne, Victoria; credit contract means any agreement (whether entered into now or in the future) in which we provide the borrower with credit (as defined in the Consumer Credit Code); credit legislation means consumer credit legislation enacted to implement, or contemplated by, the Uniform Credit Laws Agreement 1993; and other legislation that we notify to you is included in this definition;

(d)

(e)

government body means a government, semigovernment, administrative, judicial or statutory body or person able to exercise legislative or administrative powers; law means common law, principles of equity and legislation; legislation includes a law made by parliament, proclamation, ordinance, regulation, or a by law made under legislation; guaranteed money has the meaning in clause 4 and does not exceed any amount to which your liability is limited; right means a right, power, authority, discretion, or remedy given to us by this agreement or under law; and security means an interest in or power over assets given to secure the payment of money or the performance of an obligation. It includes a charge, mortgage, lien, encumbrance, pledge, guarantee, indemnity or guarantee and indemnity.

(f) (g)

(h)

(i)

(j)

30. Interpreting this agreement

30.1 In interpreting this agreement: (a) (b) (c) (d) (e) headings are only for convenience and do not affect interpretation; a word or expression indicating the singular includes the plural, and the other way around; examples are descriptive only and are not exhaustive; reference to any thing includes a part of the thing; reference to a party includes the partys personal representative, successor, transferee, or permitted assign;

LawSoft

elawpublishing.com.au

12

Law Institute of Victoria (f)

Guarantee & Indemnity Agreement if the day on or by which any thing must be done is not a business day, then the thing must be done on or by the next business day; a rule of construction does not disadvantage a party just because that party prepared the agreement; a promise or agreement by two or more persons binds them each individually and together; reference to an agreement, document or instrument includes any legally enforceable arrangement or understanding (whether or not in writing). It also includes an amendment, supplement to, replacement of, or novation of them. reference to a liability or obligation includes a present, future, actual prospective or contingent liability or obligation. It may be incurred alone or with any other person. The amount may or may not be able to be determined; reference to a person includes a body corporate, partnership, unincorporated joint venture, and a government body; and reference to legislation includes all legislation amending, consolidating or replacing it.

(g)

(h) (i)

(j)

(k)

(l)

LawSoft

elawpublishing.com.au

13

Attachment 1

Certificate of independent legal advice

[see clause 1(e)] Part A: To the lender

To: Lenders name: Address: (lender)

This certificate is provided by Solicitors name: Firm: Address: 1. 2. I am a solicitor holding a current practising certificate under the Legal Profession Practice Act 1958. I am not acting for you or for the borrower in this transaction. I have been asked to interview the guarantor/s: (the guarantor). 3. I have been provided with the following documents: guarantee and indemnity agreement between: and and the lender;

Part B: Explanations given by the certifying solicitor

4. I certify that in the absence of the borrower and before the guarantor signed the documents, I explained to the guarantor: the general nature and effects of the documents required to be signed by the guarantor that if the borrower defaults in payment or in other obligations to you the guarantor would be liable to make good the default which could involve all amounts owed by the borrower to you and the substantial arrears of interest that the giving of a guarantee involves considerable risk, including the risk of losing any security, property and other assets, and requires very careful thought.

Part C: Excluded explanations

5. I informed the guarantor in very clear terms that I was not expressing any opinion nor advising on: the viability of the transaction which the borrower was undertaking the borrowers ability to make the required payments to you the clients (guarantors) ability to make payment to you. 6. I further informed the guarantor that if in any doubt on those aspects the guarantor should obtain independent financial advice before signing the documents.

elawpublishing.com.au

LawSoft

Law Institute of Victoria

Attachment 1

Part D: Statements by the persons signing the documents

7. Following the above explanations, the guarantor stated to me: that the guarantor understood the general nature and effect of the documents and the obligations and risks involved in signing those documents. It appeared to me that the guarantor did have such understanding. that the guarantor was signing these documents freely, voluntarily and without pressure from the borrower or any other person.

Part E: Identification of person signing the documents

8. The following evidence of identification was produced to me by the guarantor, viz:

[Optional] Part F: Translation/Interpretation

9. An independent interpreter, was present at this interview with the guarantor and interpreted the statements made by all persons present. A certificate of the interpreter is held by me.

Solicitors certificate

I certify the above information. The borrower was not present during my interview with the guarantor.

Signed: Dated:

.......................................................... ..........................................................

Clients certificate

I certify that: I have been handed a copy of this certificate. I have read this certificate. I am the client named. The above information is true.

Signed:

.....................................................

Signed:

......................................................

Dated:

.....................................................

Dated:

......................................................

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Attachment 1

Form of acknowledgment by a debtor or surety to the certifying solicitor

The guarantor (me)

1. This acknowledgment is provided by me: Name: Address:

Occupation: Name: Address:

Occupation:

The certifying solicitor

2. To the solicitor Name: Firm: Address:

My acknowledgments

3. I acknowledge that the solicitor has signed a certificate at my request my name and address is correctly recorded above and on the certificate given by the solicitor and I have provided proof of my identity in the manner recorded in the certificate I did attend the office of the certifying solicitor on the date recorded in the certificate for the purposes of receiving legal advice on the nature and effect of the documents referred to in the certificate I have received the explanations referred to and have stated to the solicitor that I understand those explanations the matters recorded in the certificate are true and correct I confirm these matters by my signature to this acknowledgment and to the certificate a translator was present and translated all written and spoken words to me and my responses OR a translator was not required by me as I have an adequate command of the English language.

Signed:

.....................................................

Signed:

......................................................

Dated:

.....................................................

Dated:

......................................................

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Attachment 1

Certificate by Translator/Interpreter

This certificate is provided by:

Name: Address: Occupation:

Details:

1. On [insert date] I attended a meeting at the office of:

Present at the meeting were [insert names of people present]

and me. 2. I spoke to:

in the language. 3. 4.

language and I established that it is their customary language, and I

I am fluent in the English language and the am competent to translate between both those languages. In the presence of [insert names of people present]

and before any documents were signed, I translated the explanations by the solicitor and the statements made by:

from the English language to the from the 5. It was stated by:

language; and language to the English language.

that they understood the matters translated and they did appear to me to so understand. 6. I am independent of and not related to:

or to the borrowers

Signed: ......................................................................................

Dated: .....................................................

LawSoft

elawpublishing.com.au

Attachment 2

INFORMATION STATEMENT Things you should know about guarantees

This information tells you about some of the rights and obligations of yourself and the credit provider. It does not state the terms and conditions of your guarantee.

GUARANTEES 1. What is a guarantee?

A promise by you that the person who is getting credit under a credit contract (the debtor) will keep to all the terms and conditions. If that person does not do so, you promise to pay the credit provider all the money owing on the contract (and any reasonable enforcement expenses) as soon as the money is asked for, up to the limit, if any, stated in the guarantee. If you do not pay, then the credit provider can take enforcement action against you which may result in the forced sale of any property owned by you such as your house.

2.

How do I know how much the debtor is borrowing and how the credit charges are worked out?

These details are on the copy of the credit contract or proposed credit contract that you should be given before you sign the guarantee.

3.

What documents should I be given?

Before you sign the guarantee you should get: the document you are reading now; and a copy of the credit contract or proposed credit contract. Your guarantee is not enforceable unless you get a copy of the credit contract or proposed credit contract before you sign. Within 14 days after you sign the guarantee and give it to the credit provider, the credit provider must give you a copy of: the signed guarantee; and the credit contract or proposed credit contract (if you do not already have a copy of the contract).

4.

Can I get a statement of the amount the debtor owes?

Yes. You can ask the credit provider at any time for a statement of the amount the debtor currently owes or any amounts credited or debited during a period you specify or any amounts which are overdue and when they became overdue or any amount payable and the date it became due. The credit provider must give you the requested information: within 14 days if all the information requested related to a period 1 year or less before your request is given; or otherwise within 30 days. This statement must be given to you in writing if you ask for it in writing but otherwise may be given orally. You may be charged a fee for the statement. You are not entitled to more than 1 written statement every 3 months.

5.

How can I find out the payout figure?

You can write to the credit provider at any time and ask for a statement of the amount required to pay out the credit contract as at any date you specify. You can also ask for details of the items that make up the amount. The credit provider must give you the statement within 7 days after you give your request to the credit provider. You may be charged a fee for the statement.

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Attachment 2

6.

What other information can I get?

You can write to the credit provider and ask for a copy of: the guarantee; or any credit-related insurance contract (such as insurance on mortgaged property) the credit provider has; or a notice previously given to you, the debtor or the mortgagor under the Consumer Credit Code. The credit provider must give you the requested copy: within 14 days of your written request if the contract came into existence 1 year or less before the request was given to the credit provider; or otherwise within 30 days. The credit provider may charge you a fee. Your request can be made at any time up to 2 years after the end of the credit contract.

7.

Can I withdraw from my guarantee?

Yes, by written notice to the credit provider, if: you do so before the debtor gets any credit under the credit contract; or at any time if the final credit contract is materially different from the proposed credit contract given to you before you signed the guarantee.

8.

Can I limit my guarantee?

Yes, if it relates to a continuing credit contract (such as a credit card contract or an overdraft). In that case you can give the credit provider a notice limiting the guarantee so that it only applies to: credit previously given to the debtor; and any other amount you agree to guarantee.

9.

Can my guarantee also apply to any future contracts?

No, unless the credit provider has given you a copy of the proposed new credit contract and you have given your written acceptance.

10. If my guarantee says I have to give a mortgage, what does this mean?

A mortgage means that you give the credit provider certain rights over any property you mortgage. If you default under your guarantee, you can lose that property and you might still owe money to the credit provider.

11. Should I get a copy of my mortgage?

Yes. It can be part of your guarantee or, if it is a separate document, you will be given a copy of the mortgage within 14 days after your mortgage is entered into.

12. Is there anything that I am not allowed to do with the property I have mortgaged?

The laws says you cannot assign or dispose of the property unless you have the credit providers, or the courts, permission. You must also look after the property. Read the mortgage document as well. It will usually have other terms and conditions about what you can and cannot do with the property.

13. What can I do if I find that I cannot afford to pay out the credit contract and there is a mortgage over my property?

See the answer to question 22. Otherwise you may: if the mortgaged property is goods give the property back to your credit provider, together with a letter saying you want the credit provider to sell the property for you; OR

LawSoft

elawpublishing.com.au

Law Institute of Victoria sell the property, but only if the credit provider gives you permission first; OR

Attachment 2

give the property to someone who may then pay all amounts owing under the guarantee or give a similar guarantee, but only if the credit provider gives permission first. If the credit provider wont give permission contact your Government Consumer Agency for help. You should understand that you may owe money to the credit provider even after mortgaged property is sold.

14. Can the credit provider take or sell the mortgaged property?

Yes, if you have not carried out all of your obligations under your guarantee.

15. If the credit provider writes asking me where the mortgaged goods are, do I have to say where they are?

Yes. You have 7 days after receiving the credit providers request to tell the credit provider. If you do not have the goods you must give the credit provider all the information you have so they can be traced.

16. When can the credit provider or its agent come into a residence to take possession of mortgaged goods?

The credit provider can only do so if it has the courts approval or the written consent of the occupier which is given after the occupier is informed in writing of the relevant section in the Consumer Credit Code.

17. If the debtor defaults, do I get any warning that the credit provider wants to take action against the debtor?

In most cases both you and the debtor get at least 30 days from the date of a notice in writing to do something about the matter. The notice must advise: why the credit provider wants to take action; and what can be done to stop it (if the default can be remedied); and that if the same sort of default is committed within 30 days of the date of the notice and is not remedied within that period, the credit provider can take action without further notice. You should immediately discuss any warning notice with the debtor and consider getting independent legal advice and/or financial advice. However, there will be no warning notice if: there is good reason to think the debtor committed a fraud to persuade the credit provider to enter into the contract; or the credit provider has been unable to locate the debtor after making reasonable efforts to do so; or the court says so; or there is good reason to think that the debtor has, or will, remove or dispose of mortgaged goods without the credit providers consent, or that urgent action is necessary to protect mortgaged property.

18. When can the credit provider enforce a judgment against me?

When: the credit provider has judgment against the debtor and if the judgment amount has still not been met 30 days after the credit provider has asked the debtor in writing to pay it; or the court says so because recovery from the debtor is unlikely; or the credit provider has been unable to locate the debtor after making reasonable efforts to do so; or the debtor is insolvent.

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Attachment 2

19. If the debtor cannot be found and the credit provider intends to take legal action against me do I get any warning?

You may not. See the answer to question 17.

20. Can the credit provider take action against me without first taking action against the debtor?

Yes, but the credit provider will not be able to enforce any judgment against you except in the circumstances described in the answer to question 18.

21. How much do I have to pay the credit provider if the debtor defaults?

You have to pay what the debtor owes the credit provider, subject to any limit provided in the guarantee, plus the credit providers reasonable expenses in making you honour your contract guarantee. GENERAL

22. What can I do if I am asked to pay out the credit contract and I cannot pay it all at once?

Talk to the credit provider and see if some arrangement can be made about paying. If you cannot come to a suitable arrangement, contact the Government Consumer Agency. There are other people, such as financial counsellors, who may be able to help.

23. If I pay out money for a debtor, is there any way I can get it back?

You can sue the debtor, but remember, if the debtor cannot pay the credit provider, he or she probably cannot pay you back for a while, if at all.

24. What happens if I go guarantor for someone who is under 18 when he or she signs a credit contract?

You are responsible for the full debt if the contract of guarantee has a clear and obvious warning. The warning has to tell you that the courts might not let you sue the debtor if you have to pay out the credit contract for him or her.

25. Do I have any other rights and obligations?

Yes. The law does give you other rights and obligations. You should also read your guarantee careful. If you have any doubts, or you want more information, contact the Government Consumer Agency or get legal advice. Please keep this information statement. You may want some information from it at a later date.

LawSoft

elawpublishing.com.au

Law Institute of Victoria

Instructions for Completion of Guarantee & Indemnity Agreement

WARNING

The Consumer Credit Code and Regulations require each credit contract, guarantee or a notice given by a credit provider under the Code to be easily legible and clearly expressed. The print or type must be not less than 10 point.

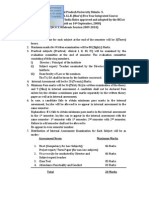

Var V0 V1 V2 V3 V4 V5 V6 V7 V8 V9 V10 V11 V12 V13

What to insert Date of the Guarantee & Indemnity Agreement Name of the lender Address of the lender Name of guarantor 1 Address of guarantor 1 Name of guarantor 2 Address of guarantor 2 Name of borrower 1 Address of borrower 1 Name of borrower 2 Address of borrower 2 Limit on guaranteed money (mark Yes box with a tick) If Yes box ticked, insert amount in words of limit on guaranteed money No stated monetary limit on guaranteed money (mark No box with a tick). Note: If the No box is marked, ensure that each guarantor initials in the space indicated opposite

Attachment 1 Certificate of Independent Legal Advice V14 V15 V16 V17 V18 V19 V20 V21 V22 V23 Name of solicitor giving independent legal advice Firm of solicitor giving independent legal advice Address of solicitor giving independent legal advice Descriptions of relevant credit contract/s and any mortgage documents Descriptions of other relevant documents (if any) Descriptions of relevant documents for identification of guarantor Name of translator translating independent legal advice Address of translator translating independent legal advice Occupation of translator translating independent legal advice Name of language

LawSoft

elawpublishing.com.au

You might also like

- Guarantee Case LawDocument20 pagesGuarantee Case LawJagii Sandhu100% (4)

- Guaranty With No PledgeDocument2 pagesGuaranty With No PledgeKnownUnknowns-XNo ratings yet

- Deskripsi Materi: Pertemuan: 3 Guarantees, Indemnities, Representations and WarrantiesDocument11 pagesDeskripsi Materi: Pertemuan: 3 Guarantees, Indemnities, Representations and WarrantiesDimas PradikaNo ratings yet

- Iwoca Guarantee GBRMHW9PPZAGQ 2380707Document2 pagesIwoca Guarantee GBRMHW9PPZAGQ 2380707justadzzz1No ratings yet

- Guarantee Case LawDocument19 pagesGuarantee Case LawVenugopal MantraratnamNo ratings yet

- Contract Guarantee: As Against The CreditorDocument4 pagesContract Guarantee: As Against The CreditorraaziqNo ratings yet

- Banking Chapter SixDocument15 pagesBanking Chapter SixfikremariamNo ratings yet

- Letter of Guarantee and IndemnityDocument2 pagesLetter of Guarantee and Indemnityrshagautam17621No ratings yet

- CONTRACT ACT 1872 SUMMARYDocument16 pagesCONTRACT ACT 1872 SUMMARYShubhamNo ratings yet

- GuaranteeDocument4 pagesGuaranteeShubham KulkarniNo ratings yet

- Continuing Guarantee AnsDocument5 pagesContinuing Guarantee AnsSwarna LathaNo ratings yet

- Law Insider Loan-Assignment-Agreement Filed 05-10-2021 ContractDocument3 pagesLaw Insider Loan-Assignment-Agreement Filed 05-10-2021 ContractPanki1No ratings yet

- Business Loan Agreement SummaryDocument4 pagesBusiness Loan Agreement Summaryel Capitan2606100% (1)

- Contract of GuaranteeDocument26 pagesContract of GuaranteeSrishti Jain100% (1)

- Continuing GuaranteeDocument13 pagesContinuing GuaranteeKarthik RickyNo ratings yet

- Debt Assignment and Assumption With ReleaseDocument2 pagesDebt Assignment and Assumption With ReleaseJOSE FRANCIANo ratings yet

- Loan Assignment Agreement: Page 1 of 2Document2 pagesLoan Assignment Agreement: Page 1 of 2Panki1No ratings yet

- Security Agreementpledge 2899750 1Document3 pagesSecurity Agreementpledge 2899750 1Shoeiarai Yoshimura PallmallemNo ratings yet

- Personal Guarantee DeedDocument4 pagesPersonal Guarantee DeedFeniNo ratings yet

- Insurance Finals TranscriptDocument25 pagesInsurance Finals TranscriptMichael Francis HubahibNo ratings yet

- Contract of Guarantee ExplainedDocument17 pagesContract of Guarantee Explained78 Harpreet SinghNo ratings yet

- AgreementDocument8 pagesAgreementTajrin ZoarderNo ratings yet

- Docs 4Document2 pagesDocs 4Henry IhedughinukaNo ratings yet

- Contracts Final DraftDocument16 pagesContracts Final DraftAjay KhedarNo ratings yet

- Indemnity Bond ExplainedDocument8 pagesIndemnity Bond Explainedfaareha100% (1)

- Corporate GuaranteeDocument4 pagesCorporate Guaranteesalehin1969No ratings yet

- What Is Contract of Guarantee: Section 126Document6 pagesWhat Is Contract of Guarantee: Section 126MaheshMaheNo ratings yet

- Contract ActDocument24 pagesContract Actdivya1444No ratings yet

- Banking QuestionsDocument15 pagesBanking Questionsaparajita saha100% (1)

- Continuing Guarantee Judicial InterpretationDocument19 pagesContinuing Guarantee Judicial InterpretationAdi 10eoNo ratings yet

- Contract of GuaranteeDocument4 pagesContract of GuaranteeSesa GillNo ratings yet

- Personal GuaranteeDocument2 pagesPersonal Guaranteeclark_tayloruk100% (1)

- All About Contract of Guarantee Just in 5 PagesDocument7 pagesAll About Contract of Guarantee Just in 5 PagesAmanKumarNo ratings yet

- Bid, Payment, and Performance Bonds 091125Document19 pagesBid, Payment, and Performance Bonds 091125JOHNNo ratings yet

- Total Loan Amount and Repayment DetailsDocument10 pagesTotal Loan Amount and Repayment DetailsTestingNo ratings yet

- 20.2 Letter of Intent To Purchase A BusinessDocument5 pages20.2 Letter of Intent To Purchase A BusinessPeeve Kaye BalbuenaNo ratings yet

- Loan Terms & ConditionsDocument10 pagesLoan Terms & ConditionsTestingNo ratings yet

- Dps Custodial Terms Conditions February2021v25 1Document6 pagesDps Custodial Terms Conditions February2021v25 1mexiso3561No ratings yet

- Broker Agreement TemplateDocument4 pagesBroker Agreement Templatetrikflow770% (3)

- Safe Deposit Box Account Rental Agreement Rules and RegulationsDocument6 pagesSafe Deposit Box Account Rental Agreement Rules and RegulationsJohn29999No ratings yet

- Contract of GuaranteeDocument11 pagesContract of GuaranteeShankha Shubhra ChakrabartyNo ratings yet

- Insurance Terms of Business AgreementDocument9 pagesInsurance Terms of Business AgreementGiwrgo SeminiNo ratings yet

- What Is Contract of Guarantee:-: Section 126Document17 pagesWhat Is Contract of Guarantee:-: Section 126Girish KumarNo ratings yet

- Loan Agreement TemplateDocument4 pagesLoan Agreement TemplateElisa DahotoyNo ratings yet

- Loan Agreement Representations and WarrantiesDocument14 pagesLoan Agreement Representations and WarrantiesLinming HoNo ratings yet

- BOFA AddendumDocument6 pagesBOFA AddendumkwillsonNo ratings yet

- SAMPLE Debt Assignment and Assumption With ReleaseDocument2 pagesSAMPLE Debt Assignment and Assumption With ReleaserOSENo ratings yet

- Contract of GuranteeDocument6 pagesContract of GuranteeVikrant ChauhanNo ratings yet

- The Dangers of Personal GuaranteesDocument3 pagesThe Dangers of Personal GuaranteesMJCNo ratings yet

- U.S. Fire Court BondDocument2 pagesU.S. Fire Court Bondanon_529589942No ratings yet

- GM06 Business Law: Assignment No.IDocument11 pagesGM06 Business Law: Assignment No.IManne Jeevan KumarNo ratings yet

- INS 21 Chapter9-Insurance PoliciesDocument27 pagesINS 21 Chapter9-Insurance Policiesvenki_hinfotechNo ratings yet

- Fahd LOIDocument4 pagesFahd LOIestrella guapaNo ratings yet

- law of special contractDocument7 pageslaw of special contractKanishkaNo ratings yet

- Shantanu Agnihotri ContractsDocument34 pagesShantanu Agnihotri ContractsShantanu AgnihotriNo ratings yet

- Acknowledgement: BE2304 Law of Obligation Project Study-Valid ContractDocument16 pagesAcknowledgement: BE2304 Law of Obligation Project Study-Valid ContractLahiru Dananjaya ParanamanaNo ratings yet

- 22 - Pineapple Lva 7 - Filling Out A Document Template - Jonah BucoyDocument8 pages22 - Pineapple Lva 7 - Filling Out A Document Template - Jonah BucoyJonah BucoyNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Short Notes-Legal and Regulatory Aspects of BankingDocument29 pagesShort Notes-Legal and Regulatory Aspects of BankingSai Vaishnav MandlaNo ratings yet

- Tender PagesDocument400 pagesTender PagesSiddhesh JamsandekarNo ratings yet

- J PLUS ASIA DEVELOPMENT CORPORATION v. UTILITY ASSURANCE CORPORATIONDocument30 pagesJ PLUS ASIA DEVELOPMENT CORPORATION v. UTILITY ASSURANCE CORPORATIONroy rebosuraNo ratings yet

- Companies Act 1994 Final PDFDocument7 pagesCompanies Act 1994 Final PDFCryptic LollNo ratings yet

- MH Cet Law Question Paper 2020 96Document84 pagesMH Cet Law Question Paper 2020 96Neha KhushNo ratings yet

- Promissory NoteDocument4 pagesPromissory Noteapi-437528557No ratings yet

- Lloyds Bank Ltd. V BundyDocument15 pagesLloyds Bank Ltd. V BundyNicole YauNo ratings yet

- African Guarantee and Indemnity Co V Thorpe 1933 AD 330Document2 pagesAfrican Guarantee and Indemnity Co V Thorpe 1933 AD 330t.sekwenyane1609No ratings yet

- Munir H. Atalla v. Ahmad H. Abdul-Baki, 976 F.2d 189, 4th Cir. (1992)Document13 pagesMunir H. Atalla v. Ahmad H. Abdul-Baki, 976 F.2d 189, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- BL Notes-Mod-1Document13 pagesBL Notes-Mod-1DevikaNo ratings yet

- Overview of The Protection of Subcontractors Under French Law by Carole Malinvaud Avocat Au Barreau de Paris London 5 September 2006Document22 pagesOverview of The Protection of Subcontractors Under French Law by Carole Malinvaud Avocat Au Barreau de Paris London 5 September 2006M EssamNo ratings yet

- Tanvi ConsignmentDocument11 pagesTanvi ConsignmentnitishNo ratings yet

- Contract MemorialDocument15 pagesContract MemorialPriya100% (1)

- Buyer's CreditDocument27 pagesBuyer's CreditShailesh SangleNo ratings yet

- Draft LOADocument7 pagesDraft LOAMahesh JayawardanaNo ratings yet

- Ballb (Hon's) FiveyearsintegratedcourseDocument81 pagesBallb (Hon's) FiveyearsintegratedcourseShanTanu SahoTaNo ratings yet

- BDO UITFs 2017 PDFDocument4 pagesBDO UITFs 2017 PDFfheruNo ratings yet

- Equal Protection and Reasonable Classification in Philippine LawDocument6 pagesEqual Protection and Reasonable Classification in Philippine LawBarbara MaeNo ratings yet

- Sale Catalog - 2012 Heatwave Featuring The Elite of CrasdaleDocument121 pagesSale Catalog - 2012 Heatwave Featuring The Elite of CrasdaleHolstein PlazaNo ratings yet

- Assets Liabilities Statments - F - 349 For GuarantorDocument8 pagesAssets Liabilities Statments - F - 349 For GuarantorSubbu75% (4)

- Obligations AND Contracts: E O P IIDocument16 pagesObligations AND Contracts: E O P IIYannah HidalgoNo ratings yet

- AFISPRO2Document268 pagesAFISPRO2Cesar Arturo Gutierrez ContrerasNo ratings yet

- SyllabusDocument73 pagesSyllabusAryan Dev PandeyNo ratings yet

- Trinidad and Tobago Water and Sewerage LawsDocument116 pagesTrinidad and Tobago Water and Sewerage LawskbonairNo ratings yet

- MWSS vs. DawayDocument3 pagesMWSS vs. DawayLindsay Mills100% (1)

- Yau Chu v. Court of AppealsDocument2 pagesYau Chu v. Court of AppealsAgee Romero-Valdes100% (2)

- When Vendor Is Not Bound To Deliver The Thing SoldDocument1 pageWhen Vendor Is Not Bound To Deliver The Thing SoldJulrick Cubio EgbusNo ratings yet

- Midterm Law 1Document9 pagesMidterm Law 1Amie Jane MirandaNo ratings yet

- GuidelinesDocument17 pagesGuidelinesLou Corina LacambraNo ratings yet

- Group-B Answer Question No. 5 and Any TWO From The Rest.: Full Marks: 100 Time Allowed: 3 HoursDocument12 pagesGroup-B Answer Question No. 5 and Any TWO From The Rest.: Full Marks: 100 Time Allowed: 3 HoursSayan BiswasNo ratings yet