Professional Documents

Culture Documents

Fundamental Analysis

Uploaded by

Nguyen Tien PhiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Analysis

Uploaded by

Nguyen Tien PhiCopyright:

Available Formats

FUNDAMENTAL ANALYSIS & YOUR TIMING.

Any news that has an effect on the economy, directly or indirectly, is considered fundamental. The news may include the changes in the economy, changes to interest rates, political elections, and natural disasters. I have classified the fundamental news into 4 categories: y y y y economic factors financial factors political factors crisis

The economic data differs from country to country and their importance, timing, and dates of release also differ accordingly. The Economic data release is scheduled well in advance and is easily available on the internet. The political factors are without schedule and vary from country to country. The timing of the elections, govt. instability, fall of the nations, political tensions between countries, all these come under this category and have an huge impact on the forex market. The financial factors are partially timed & predicted. Bank rates, discount rates by the central bank of a country are predictable and the timing of the event is known well in advance. The crisis factors may or may not have an impact on the forex market. We have seen how the USD remained unaffected during the time of Iraq being attacked by the allied forces. If I want to contradict this, North Korea detonated a nuclear weapon which had a direct bearing on the fortunes of the Japanese yen. They are neighbor countries and Yen was just responding to a geopolitical crisis. Economic factors: Traders around the globe watch the release of economic factors with apt attention which occurs in a steady stream, at certain times, and more often. It is very important for the trader to keep himself updated of these economic announcements so as to make informed decisions on entering, exiting, or adjusting the positions. 1. Economic data release: Economic data generally are released on a monthly basis, except the gross domestic product (GDP) and the employment cost index (ECI) which are released quarterly.It is important to remember that most reports are released between 8:30 and 10:00 A.M. (EST). y GNP & GDP

The GNP is said to be the most significant economic indicator but the GDP figures are more popular outside the United States

Consumer spending

Consumer spending is more psychological in nature and measures consumer confidence rather than actual spending. Consumer spending is made possible by personal income and discretionary income,

so consumer confidence is important for those who have discretional income in order to switch to buying from saving. Govt. spending

Government spending is very important in that its sheer size and impact on the economy are tremendous, but it is also very influential in other ways. Due to special expenditures such as military spending, it boosts the unemployment rate and GDP and promotes investment spending. Inflation indicators

The rate of inflation is the rise in overall prices, and gauging inflation is a vital macroeconomic task. Traders watch inflation very closely because one of the ways to fight inflation is by raising interest rates. Higher interest rates tend to support the local currency. Generally, traders use nine economic tools: y Producer Price Index (PPI)

The PPI has been compiled since the beginning of the twentieth century and was called the wholesale price index until 1978. The PPI gauges the average changes in prices received by domestic producers for their output at all stages of processing. Unlike the CPI, which includes imported goods, services, and taxes, the PPI compiles from sectors such as manufacturing, mining, and agriculture. y Purchasing manager s index (PMI)

The National Association of Purchasing Managers (NAPM), now renamed the Institute for Supply Management, releases a monthly composite index of national manufacturing conditions constructed from data on new orders, production, supplier delivery times, backlogs, inventories, prices, employment, export orders, and import orders. y Consumer Price index

The CPI gauges the average change in retail prices for a fixed market of goods and services. The CPI is compiled from a sample of prices for food, shelter, clothing, fuel, transportation, and medical services that people purchase on a daily basis. Both indexes, the PPI and the CPI, are of great help to investors in determining whether the economy is in an inflationary state, and both numbers are announced monthly. y Durable goods

Durable goods orders measure new orders placed with domestic manufacturers for immediate and future delivery of factory hard goods. A durable good is defined as a good that lasts an extended period of time (over 3 years) during which its services are extended. y GNP deflator

There are several GNP deflators, but the most commonly used is the implicit deflator. The implicit deflator is calculated by dividing the current dollar GNP figure by the constant-dollar GNP figure. y GDP deflator

Both the GNP and GDP implicit deflators are released quarterly, along with respective GNP and GDP numbers. The implicit deflators generally are regarded as the most significant measure of inflation.

Commodity Research Bureau s index

The CRB index makes determining inflationary trends easier. The CRB index consists of equally weighted futures prices of 21 commodities. y JoC Industrial price index

The JoC index was designed to signal changes in inflation prior to other price indexes. The JoC index consists of the prices of 18 industrial materials. y Employment indicators:

The employment rate is an economic indicator that is significant in the FOREX because of it importance to forecast in multiple economic areas. The employment rate normally measures the stability and soundness of an economy. In the Forex, the standard indicators studied by traders are the unemployment rate, manufacturing payrolls, nonfarm payrolls, average earnings, and average workweek. y Consumer spending indicators

Retail sales: Retail sales are an important indicator because they show the strength of consumer demand as well as consumer confidence. A higher retail sales figure creates an economic process of forward motion in the manufacturing sector. The first month of the three signifies a back-to-school and back-to work month. November and December are holiday shopping months, and traders look closely at preDecember to post-Christmas data. Consumer sentiment: Consumer sentiment is a survey of households that is designed to measure individuals tendency for spending. The University of Michigan and the National Family Opinion Conference Board conduct the two studies in this area. The index measured by the Conference Board is sensitive to the job market, whereas that of the University of Michigan is not. Housing starts: The housing starts report measures the number of residential units on which construction has begun each month. A start in construction is defined as the beginning of excavation of the foundation for the building, and the measure consists primarily of residential housing. Housing is very interest-rate sensitive and is one of the first sectors to react to changes in interest rates. Automobile sales Although the U.S. economy relies on automobile sales in terms of production and retail sales, the level of automobile sales is not an indicator most Forex traders follow too closely. Industrial production This is a chain-weighted measure of the change in production in the nation s factories, mines, and utilities, as well as a measure of their industrial capacity and of how many available resources among factories, utilities, and mines are being used (commonly known as capacity utilization). The manufacturing sector accounts for one-quarter of the economy.

Leading indicators The leading indicators consist of the following economic indicators: Average workweek of production workers in manufacturing Average weekly claims for state unemployment New orders for consumer goods and materials (adjusted for inflation)

Vendor performance Contract and orders for plant and equipment New building permits issued Change in manufacturers unfilled orders, durable goods Change in sensitive materials prices Index of stock prices Money supply, adjusted for inflation Index of consumer expectations

When to trade: Timing is the key to success. It is crucial for the traders to time their trades failing which they may end up on the losing side. It is always prudent to depend on the empirical data rather than instinct. FxEngines have done a report where they have taken 4 years of historical data and ran it through a rigorous econometric analysis. The report shows the importance of understanding and employing timing in your entry and exit decisions. In the report, it was found that the average range in pips for the 4 majors (Eur/Usd, Gbp/Usd, Usd/Chf, Usd/Jpy) peaked at 10 am EST and slowed down between 4 to 5 pm EST. Session-wise, the average range in pips for the 4 majors was more in U.K session followed by U.S session. If we consider the week days for trading, Tuesdays & Wednesdays offered the highest range of pips movement for the 4 majors. In all the dates, 5th & 6th of every month had more intraday movments in pips and the 1st & 14th had a narrow range of pip movement.

Ace the trading game

Hello everyone. This is my first post so let me introduce myself first and I will outline the structure of my articles. I have been trading demo successfully for a while, then I decided to open a real account with my personal saving. Unfortunately, I lost all of my saving after a couple of weeks. Reasons for my loss are simple: I did not learn enough and I was too confident. I then came back to trade on the demo account however I take it more serious, read more books and did my homework, aka analysis, more carefully. It took me awhile to not losing in the FX market and now I am on my journey to seek for profits.

I just knew about this contest a couple of months ago and I thought it was a great opportunity to share and learn. Therefore I signed up for this contest and I want to write about my own story to help you better understand the market and later on make profits for your self. I was thinking about the structure of my article and I decided to come up with this idea: I will divide my article into 3 parts. The first part of my article is for FX 101 in which I will explain basics of the Fx market, the mechanism of the market and the relationship between FX and other markets. The reason I do this is because we have many readers that have different backgrounds. It would be nice if I leave some space to help you understand the market and then I will take you to the second part which is Tips and Tricks. In Tips and Tricks, I will write about my own experience. No matter how much knowledge you learn from books, if you do not practice and learn from your and others mistakes, you will be less likely beat anyone in the FX market. Therefore I think sharing my own experience is going to help you much more than just telling you the "theory". The third part of my article is my own forecast. I will share my forecast and view about the market. I want to share my own forecast and signal in order to receive feedback and comments about trades that I am taking or will be taking. That will help me learn more and improve myself. Okay, let's moving on to my first article. Part 1: FX 101 In my first article, I want to talk about the fundamental of the FX market. The trading of currencies and banks deposits is what makes up the foreign exchange market. Therefore, transactions conducted in the fx market determine the rates at which currencies are exchanged, which in turn determine the cost of purchasing foreign goods and financial assets. This is the definition of the FX market, however I will keep it short and move into the part that you may be interested in: What factors cause the exchange rates up and down? Factors affect the exchange rate can be classified as short term factors and long term factors. If you are a trader who looks for long term trade opportunity, you should focus on the Domestic Price Level, Productivity and Level of interest for domestic/ foreign goods. I am not trying to bore you with all of these term therefore I will just explain the Price level, one of the most mentioned term in FX. Consumer Price Index (CPI) is the most common price level index. "As prices rise (inflation), or fall (deflation), consumer demand for goods is also affected, which leads broad production measures like gross domestic product (GDP) higher or lower" (Investopedia). Whenever you anticipate a rise in the domestic price level, you should short the domestic currency since it values is depreciate. For instance, if the price level in the U.S rises comparatively to the price level in the Europe, one would buy the EUR/USD. The reason is because if the price level increase, you should pay more in order to buy the same goods as before, therefore the domestic currency will be depreciate. This is one of the most important factors that drive the exchange rate. While in the short term, since the exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits, the fluctuation in the FX market is driven by the expected return. The expected return is driven by the interest rate differential. Does this sound familiar to you? (ie: carry trade.) I guess most of traders in the FX market care about what is the rate in the next FED meeting, right? If the FED announces a 25 basis point hike interest rate, you may predict the USD will rise relatively than other currencies. However, it is not that simple. If the rate hike is because of the rise in the inflation, USD will not appreciate as you may expect. Instead, it may even be depreciate if the FED said that the hike rate is because of the inflation. Therefore, it is important to analyze carefully the reason behind the rate hike. Do not be fooled by the movement right after the announcement. So that is basically what I want to write about the FX 101. I will dig into this topic in later articles.

Part 2: Tips and Tricks My first advice in Tips and Tricks part is: Never ever make a trade just because someone else does it, even that person is a TV guest or she/he is a super star at Goldman Sachs. If you wonder why, let me tell you about this: this market is totally a zero sum game. You got that? It means when you make money, someone will lose money. You and I may be not to be here to hunt for others blood but Investment Banking and Hedge funds out there are doing that everyday. Oh by the way, IBs does issue recommendations frequently but keep in mind that they serve many clients, which have different goal and objective, at the same time. Therefore, a recommendation may be in favor for one client but not for the others, or even just for their favor. It sounds like I am an IB hater but I did lose a lot by just following their recommendation trades blindly. I am not saying that ignore those guys' advices and recommendations, however make sure that you take the advices with your own risk. Therefore, do your homework before you throw your money out. Let me give you an example: Thomas Stolper. This guys is the Goldman Sachs Head of FX Research. Some of his latest recommendation include: longing EURUSD and got stopped out for a 4.2% loss (yeah without leverage, if you take leverage in, it theoretically is 420%); longing EURUSD at 1.3715 and got stopped out at 1.40. You can find out more here. These are just some example how those guys will beat you to dead with their recommendation. Again, before you follow recommendations or advices, make sure that you really do the homework to analyze those trade and assess the risk of that position. If you can not handle the risk, do not follow. Simple and easy. Part 3: Forecast Wait, I just mentioned that do not take anyone's advices or recommendations blindly but I am offering my own forecast here. Right, I want to share what I am thinking about the market or a particular currency pair here so that I can receive feedback from you. That will definitely help me adjust my position or review it for a better outcome or just to minimize my risk. WIN-WIN!!! Today I want to bring you here me forecast for the EUR/USD. The EUR/USD is really choppy since both the US and Europe have their own fundamental problems. Any of their problems can make the headline and drive the market nuts. It may be not the best pair to trade right now however I am quite bearish on this pair since the problem in Europe is not fully solved and in the short term, it seems that there is no solution for the EUR. I suggest you to look carefully the low level at 1.2857. As you can see on my chart, EUR/USD is forming Wave 3 in daily chart and in both hourly chart and 4h chart, when the EUR/USD break the low level of 1.2857, it will confirm a wave 3 or wave c development. I am quite bearish on this setup but the ideal trade is below 1.2857, says 1.2835, I will be short EUR/USD if it travels to the south of that level. My target is above 1.25 figure.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NYC Ll11 Cycle 9 FinalDocument2 pagesNYC Ll11 Cycle 9 FinalKevin ParkerNo ratings yet

- Atf Fire Research Laboratory - Technical Bulletin 02 0Document7 pagesAtf Fire Research Laboratory - Technical Bulletin 02 0Mauricio Gallego GilNo ratings yet

- Room Air Conditioner: Service ManualDocument68 pagesRoom Air Conditioner: Service Manualervin0% (1)

- Ermita Malate Hotel Motel Operators V City Mayor DigestDocument1 pageErmita Malate Hotel Motel Operators V City Mayor Digestpnp bantay100% (2)

- Commercial Dispatch Eedition 6-13-19Document12 pagesCommercial Dispatch Eedition 6-13-19The Dispatch100% (1)

- Article 124-133Document14 pagesArticle 124-133andresjosejrNo ratings yet

- PolygonsDocument23 pagesPolygonsPietrelle Liana PuruggananNo ratings yet

- StratificationDocument91 pagesStratificationAshish NairNo ratings yet

- Mca Lawsuit Details English From 2007 To Feb 2021Document2 pagesMca Lawsuit Details English From 2007 To Feb 2021api-463871923No ratings yet

- Allergens 08242023Document5 pagesAllergens 08242023Maalvika SinghNo ratings yet

- Question Paper Code:: (10×2 20 Marks)Document2 pagesQuestion Paper Code:: (10×2 20 Marks)Umesh Harihara sudan0% (1)

- Easy Trade Manager Forex RobotDocument10 pagesEasy Trade Manager Forex RobotPinda DhanoyaNo ratings yet

- Basic Safety Procedures in High Risk Activities and IndustriesDocument20 pagesBasic Safety Procedures in High Risk Activities and IndustriesMark Goldwyn BlandoNo ratings yet

- Financial Fitness ChecklistDocument4 pagesFinancial Fitness Checklistcoach_22No ratings yet

- Camp High Harbour at Lake LanierDocument3 pagesCamp High Harbour at Lake LaniermetroatlantaymcaNo ratings yet

- Comics Trip MasterpiecesDocument16 pagesComics Trip MasterpiecesDaniel Constantine100% (2)

- Painter Decorator Curriculum Eng l1 2 3 CC 404c.404dDocument100 pagesPainter Decorator Curriculum Eng l1 2 3 CC 404c.404dM.a. KhaderNo ratings yet

- SMEC01 CBRS Guide For NBC Reports - v1.1Document53 pagesSMEC01 CBRS Guide For NBC Reports - v1.1phal sovannarithNo ratings yet

- $RV3E842Document78 pages$RV3E842Dorian VoineaNo ratings yet

- Infor LN Baan - Debugging The BshellDocument26 pagesInfor LN Baan - Debugging The BshellShiva KumarNo ratings yet

- Jurnal Inggris CyberDocument7 pagesJurnal Inggris Cybertamara amandaNo ratings yet

- Features of Contingency Approach To ManagementDocument9 pagesFeatures of Contingency Approach To ManagementSharon AmondiNo ratings yet

- Babylon NaturalDocument31 pagesBabylon NaturalJoana CaeiroNo ratings yet

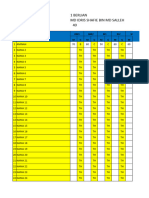

- TEMPLATE Keputusan Peperiksaan THP 1Document49 pagesTEMPLATE Keputusan Peperiksaan THP 1SABERI BIN BANDU KPM-GuruNo ratings yet

- Wolfgang Tillmans - NoticeDocument74 pagesWolfgang Tillmans - NoticeSusana Vilas-BoasNo ratings yet

- 1, Philippine ConstitutionDocument2 pages1, Philippine ConstitutionJasmin KumarNo ratings yet

- Tutorial Letter 101/3/2019: Financial Accounting For CompaniesDocument35 pagesTutorial Letter 101/3/2019: Financial Accounting For CompaniesPhebieon MukwenhaNo ratings yet

- Chen, Y.-K., Shen, C.-H., Kao, L., & Yeh, C. Y. (2018) .Document40 pagesChen, Y.-K., Shen, C.-H., Kao, L., & Yeh, C. Y. (2018) .Vita NataliaNo ratings yet

- Italian Companies Eastern China - JAN 2014Document139 pagesItalian Companies Eastern China - JAN 2014AndresNo ratings yet

- Knock Knock GamesDocument1 pageKnock Knock GamesArsyta AnandaNo ratings yet