Professional Documents

Culture Documents

Employee Declaration Form 11-12

Uploaded by

Amit KhotOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Declaration Form 11-12

Uploaded by

Amit KhotCopyright:

Available Formats

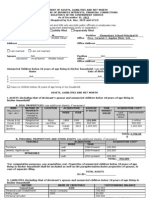

Intrasoft Technologies Limited Individual Declaration For Income Tax Calculation For the Financial Year 2011-12

01. Name (IN BLOCK LETTERS ) 02. Employee Number 03. Department 04. Date of Birth 05. Date of joining: 06. Residential Address : : : : : : STORES 3 June 1986 23 June 2011 MAHADEV PATIL SRA CHS, B WING ROOM NO 410, NR. CONVENT VIEW SOCIETY, GHATLA VILLAGE ROAD,CHEMBUR MUMBAI 400071 07. Permanent Account No. ( PAN) Mandatory : A W B P K 1 6 1 5 J AMIT SHRIKRISHNA KHOT 2080

DESCRIPTION 08. PARTICULARS OF INCOME FROM SOURCES OTHER THAN SALARY FROM INTRASOFT TECHNOLOGIES LTD a. b. c. Previous Employment Salary ( attach payslips/salary certificate/ Form 16) Income / (Loss) from House Property during 2011-12 ( Attach Annexure 1 incase relevant) Income from other sources i. ii. iii. d. e. Interest ( Attach Proof) Taxable Dividends Others (please specify) Nil Nil Amount (Rs.) Nil Nil Nil

Profits and gains of business or profession Capital Gains (will be taxed at normal slab rate)

Aggregate Of (a to e) above

Amount of Tax deducted at source on above income (enclose certificates issued U/s 203) DEDUCTIONS UNDER CHAPTER VI - A 09.

INVESTMENTS FOR DEDUCTION UNDER U/S 80C TO 80CCF:(Capped at Rs.1 lac u/s.80C to 80CCD & Rs.20000/- for 80CCF)

[Attach Proof]

Amount (Rs.) Nil Nil

a. b.

Contribution to Pension Plans Insurance Premium (LIC) deposited during 2011-12:- (For self, Spouse & Children) (Max 20% of sum assured) Sl No. i ii iii iv Policy No. Date of Payment of premium Amount of Premium paid

c. d. e.

Deposit in Public Provident Fund ( For self, Spouce & Children) Investment in U.L.I.P./U.T.I./E.L.S.S. Investment in N.S.C/ N.S.S

Nil Nil Nil

Page 1 of 3

f. g.

Housing Loan Principal Repayment for the FY 2011-12 Tuition Fees paid during 2011-12: (Please attach copies of receipts for tuition fees paid during F Y : 2011-12) i. ii. For 1st Child For 2nd Child Rs._____________________ Rs._____________________

Nil

h. i. j.

Fixed Deposit for a minimum period of five years in a Scheduled Bank made during F.Y.2011-12 Long-term Infrastructure Bonds under section 80CCF for F.Y 2011-12 (Capped at Rs.20000/- p.a) others (Please specify)

Nil Nil Nil

Total Investments u/s.80C to 80CCF (Limited to Rs.1.2 lakhs includes Rs.20,000/- for 80CCF investments) Nil 10 INVESTMENTS FOR DEDUCTION UNDER U/S 80D to 80U a. 80D - Medical Insurance Premium Subject to maximum deduction of Rs.15,000/- for self, spouse and dependent children plus Rs.15,000/- p.a. for parents whether dependent or not. Additional Rs.5,000/- in case of senior citizen Name of insured Relationship Amount Nill Amount (Rs.)

b. c. d. e. f. g.

80DD - Medical Treatment of Dependent suffering from Permanent Disability 80DDB - Expenditure on Medical Treatment for Specified disease 80E- Repayment of Interest against Higher Educational Loan 80U - Permanent Physical Disability

Nil Nil Nil Nil

Medical Expenses (Exempted upto Rs.15,000/- on producing bills) - the medical bills are for self, spouse, children, & Dependant parents, brothers & sisters. Nil others (Please specify) Total Eligible Deductions u/s.80D to 80U Nil Nil Amount (Rs.)

* For the above declared investments, Please attach copies of the proof of investment/payments. 11 HOUSE RENT ALLOWANCE If residing in rented House, the rent paid for the house during the period from 01.04.2011 TO 31.03.2012 :From i. ii. Amount of of rent per month Note : Furnish Original rent receipts and PAN of Landlord To Amount Total Amount

Nil

I ___________________________________hereby declare that all the information provided above are true and correct. I also declare that all documents produced by me as proof are true & orignal and have not been used previously by any person in any form whatsoever. I undertake to notify you immediately of any change in the above facts. I shall indemnify the company for all the cost and consequences arising on account of any incorrect information/documents furnished in this declaration.

(Signature of the Employee) Date : 24th February 2012 Place : Mumbai Name in BLOCK Letters: Mobile No. Email ID: Page 2 of 3 AMIT SHRIKRISHNA KHOT 9833329039 amitkhot11@gmail.com

Annexure 1 STATEMENT SHOWING LOSS FROM HOUSE PROPERTY To Intrasoft Technologies Ltd. Kolkata From Name : Employee No : Department:

Please find attached the computation of my income from house property for the period from 1st April 2011 to 31st March 2012 Particulars Period for which the property was let out (in months) Period for which the property remained vacant ( in months) Actual Rent Received for let out period (attach proof) Gross Annual Value Less: Municipal Tax Paid (attach proof) Net Annual Value (NAV) ----------------- (1) Less: Deductions u/s 24 (a) Standard deduction (30% of NAV) (b) Total interest payable on borrowed capital (attach proof) (i) Interest on post-contruction period (ii) 1/5th of total interest for pre-contruction period

(Note : Interest on pre-contruction period allowed in 5 equal installments. Maximum interest allowed in case of self occupied property is Rs.1,50,000/-. In case of let out property there is no cap)

Let Out/Deemed to be let out

Self Occupied

Total Deduction -------------------------- (2) Net Income / (-) Loss from House Property [1-2]

Date:

Signature of employee In case the house is unoccupied but treated as self occupied under IT Act, then please furnish the following confirmation : I hereby confirm that (i)my residential house could not be occupied owing to my employment and that I am residing at some other place in a building not belonging to me. (ii) my residential house is not let out, and (iii) no other benefit therefrom is derived by me Signature of employee

(put tick)

Note : Any other information relevant for computation of income from house property, please specify.

You might also like

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Income Tax Declaration FormDocument3 pagesIncome Tax Declaration Formnagrat27No ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Rayat Educational & Research TrustDocument2 pagesRayat Educational & Research Trustvijay_2594No ratings yet

- It Declaration Form 2010-2011Document1 pageIt Declaration Form 2010-2011Priyanka KhemkaNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- 1 Section 80CDocument2 pages1 Section 80CcssumanNo ratings yet

- Tax Calcuations 1Document2 pagesTax Calcuations 1G Uday KiranNo ratings yet

- IT Declaration FormDocument6 pagesIT Declaration FormSandeep KatrevulaNo ratings yet

- A Walk Through On The Present Format of Lokpal Declaration Meant For Central Government Employees: 1. Appendix-1Document2 pagesA Walk Through On The Present Format of Lokpal Declaration Meant For Central Government Employees: 1. Appendix-1amitkrayNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Smelter Plant: Nalco Nagar: Angul-759145 Finance DepartmentDocument2 pagesSmelter Plant: Nalco Nagar: Angul-759145 Finance DepartmentrakeshswainNo ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- 2011quiz4-Deferred Tax PDFDocument2 pages2011quiz4-Deferred Tax PDFSandhya91No ratings yet

- For Individual and Other Taxpayers (Other Than Company) : IT-11GADocument9 pagesFor Individual and Other Taxpayers (Other Than Company) : IT-11GAsojol747412No ratings yet

- The Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowDocument1 pageThe Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowindianroadromeoNo ratings yet

- 36 It Declaration Fy1011Document1 page36 It Declaration Fy1011nad1002No ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Noticeb 1633050029Document8 pagesNoticeb 1633050029Vivek GudeNo ratings yet

- It Declaration Year 2011 12Document1 pageIt Declaration Year 2011 12Vijay BokadeNo ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamNo ratings yet

- FPDocument20 pagesFPRadhika ParekhNo ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- DeclarationofassettsformDocument5 pagesDeclarationofassettsformBabarSirajNo ratings yet

- Declaration of Income and Asset ProformaDocument4 pagesDeclaration of Income and Asset ProformaMuhammad Afzal100% (2)

- Investment Declaration Form F.Y. 2016-17Document2 pagesInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- 3application Form - Revised March 20, 2017Document5 pages3application Form - Revised March 20, 2017St. Maximillian DRUG Rehab CenterNo ratings yet

- F1 May 2011Document20 pagesF1 May 2011Shamra KassimNo ratings yet

- IT Declaration Form 2012-13Document1 pageIT Declaration Form 2012-13Suresh SharmaNo ratings yet

- Revised SALNformDocument3 pagesRevised SALNformDan TeenzNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- Declaration of Assets and Liabilities: AS ON DATE/MONTH/YEAR........................Document3 pagesDeclaration of Assets and Liabilities: AS ON DATE/MONTH/YEAR........................ServeX pluSNo ratings yet

- Scanner Ipcc Paper 4Document34 pagesScanner Ipcc Paper 4Meet GargNo ratings yet

- Investment Proof Submission Form - 2017-18Document5 pagesInvestment Proof Submission Form - 2017-18vishalkavi18No ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- MIRA 303 BPT Interim Payment (English) FillableDocument2 pagesMIRA 303 BPT Interim Payment (English) FillableEman MahrynNo ratings yet

- JSK It Returns 2011 12 AuttDocument3 pagesJSK It Returns 2011 12 AuttGobi S Gobi SNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- 2012 Assets Blank FormDocument3 pages2012 Assets Blank Formmark_abad01No ratings yet

- 2012 Marion, Indiana Tax LevyDocument12 pages2012 Marion, Indiana Tax LevyMarionIndiana.netNo ratings yet

- Financial Statement AssignmentDocument16 pagesFinancial Statement Assignmentapi-275910271No ratings yet

- Income Tax Declaration FormDocument2 pagesIncome Tax Declaration FormSrinivas KosuruNo ratings yet

- Investment Declaration Form - F.Y. 2021-2022: A. Deduction U/S 80CDocument1 pageInvestment Declaration Form - F.Y. 2021-2022: A. Deduction U/S 80CPrithwish MukherjeeNo ratings yet

- Draft Formate For Calculating Claimed Amount For Increase of Pennsions and Other Govt Related Benefits For PTCL EmployeesDocument5 pagesDraft Formate For Calculating Claimed Amount For Increase of Pennsions and Other Govt Related Benefits For PTCL EmployeesAdnanRasheedNo ratings yet

- AIL-Investment Declaration Form 2013-2014Document2 pagesAIL-Investment Declaration Form 2013-2014G A PATELNo ratings yet

- Sample Income Tax FormDocument8 pagesSample Income Tax FormSadav ImtiazNo ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- It Declaration Form 2010 11Document3 pagesIt Declaration Form 2010 11maiudayNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Sikkim Tenants and Domestic and Professional Helps CompulsoryDocument5 pagesSikkim Tenants and Domestic and Professional Helps CompulsoryLatest Laws TeamNo ratings yet

- Cash (Popularly Known As Greenbacks) For Safekeeping. The AgreementDocument5 pagesCash (Popularly Known As Greenbacks) For Safekeeping. The AgreementdorianNo ratings yet

- KILPATRICK BROTHERS, INC., Appellant-Cross-Appellee, v. International Business Machines CORPORATION, Appellee-Cross-AppellantDocument5 pagesKILPATRICK BROTHERS, INC., Appellant-Cross-Appellee, v. International Business Machines CORPORATION, Appellee-Cross-AppellantScribd Government DocsNo ratings yet

- A Guide To Louisiana Landlord and Tenant LawsDocument17 pagesA Guide To Louisiana Landlord and Tenant LawsArranee ChotikoNo ratings yet

- 2014 Landlord Symposium Questions and AnswersDocument4 pages2014 Landlord Symposium Questions and AnswersSAHASec8No ratings yet

- TS PreRented 22.3.24Document1 pageTS PreRented 22.3.24riteshNo ratings yet

- Uu No 43 THN 2009Document14 pagesUu No 43 THN 2009Gita ChandradewiNo ratings yet

- Massport v. TuroDocument32 pagesMassport v. TuroJonathan Ng100% (1)

- Secretary's CertDocument1 pageSecretary's CertReselle RegisNo ratings yet

- Blank Residential Lease AgreementDocument7 pagesBlank Residential Lease AgreementJessie JamesNo ratings yet

- NominaDocument38 pagesNominaMonique RamirezNo ratings yet

- Terms and Conditions For Car Hire in KolkataDocument15 pagesTerms and Conditions For Car Hire in KolkataKoushik MondalNo ratings yet

- Times Review Classifieds: Aug. 13, 2015Document7 pagesTimes Review Classifieds: Aug. 13, 2015TimesreviewNo ratings yet

- The Housing Forum Everyone Needs A Home 070411Document40 pagesThe Housing Forum Everyone Needs A Home 070411Myung Nam KimNo ratings yet

- Pet AgreementDocument2 pagesPet Agreementironfist1906No ratings yet

- ObliconDocument3 pagesObliconsofiaqueenNo ratings yet

- Financial Planning ReportDocument75 pagesFinancial Planning ReportAruna Ambastha100% (7)

- PDFDocument2 pagesPDFasadqureshi1510% (1)

- Investment PropertyDocument14 pagesInvestment PropertyJerome BaluseroNo ratings yet

- For DTH Forum India: Chapter 4 - Leasing of Satellite CapacityDocument10 pagesFor DTH Forum India: Chapter 4 - Leasing of Satellite CapacityIndianMascotNo ratings yet

- Non-Payment Notice Lease Agreement 2025Document2 pagesNon-Payment Notice Lease Agreement 2025Jordan FarleyNo ratings yet

- Contract of Lease: Ranilo Jose Sioson Ma. Teresita C. TolentinoDocument1 pageContract of Lease: Ranilo Jose Sioson Ma. Teresita C. TolentinoSharmz SalazarNo ratings yet

- Obligations and Contract Final Exam March 2016 - 2017: InstructionsDocument10 pagesObligations and Contract Final Exam March 2016 - 2017: InstructionsTj Butron BarcenasNo ratings yet

- Riverhead News-Review Classifieds and Service Directory: May 4, 2017Document12 pagesRiverhead News-Review Classifieds and Service Directory: May 4, 2017TimesreviewNo ratings yet

- Pmva Assessment 2: Name: Elaiza Quito CarlosDocument12 pagesPmva Assessment 2: Name: Elaiza Quito CarlosVWSSI Technical TeamNo ratings yet

- 29 Calneggia DRDocument6 pages29 Calneggia DRJohn ReidNo ratings yet

- 01 339 PDFDocument2 pages01 339 PDFvanderbrley100% (1)

- Florentino VS Supervalue PDFDocument20 pagesFlorentino VS Supervalue PDFJohn Dy Castro FlautaNo ratings yet

- Special Events & Wedding Venue ContractDocument3 pagesSpecial Events & Wedding Venue ContractAmisha GoyalNo ratings yet