Professional Documents

Culture Documents

International Development Association: 5.0 Objectives

Uploaded by

Rupeet SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Development Association: 5.0 Objectives

Uploaded by

Rupeet SinghCopyright:

Available Formats

INTERNATIONAL DEVELOPMENT ASSOCIATION

STRUCTURE 5.0 Objectives 5.1 Introduction: International Development Association 5.2 IDA History 5.3 Activities of IDA 5.4 Allocation of IDA resources 5.5 IDA result measurement system 5.6 Practice Questions 5.7 Suggested Readings

5.0 OBJECTIVES After reading this chapter student will be able to: 1. Know about IDA. 2. Understand the Functioning of IDA

5.1 Introduction: International Development Association The International Development Association (IDA) is the part of the World Bank that helps the worlds poorest countries. Established in 1960, IDA aims to reduce poverty by providing

interest-free credits and grants for programs that boost economic growth, reduce inequalities and improve peoples living conditions.IDA complements the World Banks other lending armthe International Bank for Reconstruction and Development (IBRD)which serves middle-income countries with capital investment and advisory services. IBRD and IDA share the same staff and headquarters and evaluate projects with the same rigorous standards.IDA is one of the largest sources of assistance for the worlds 79 poorest countries, 39 of which are in Africa. It is the single largest source of donor funds for basic social services in the poorest countries.IDA lends money (known as credits) on concessional terms. This means that IDA credits have no interest charge and repayments are stretched over 35 to 40 years, including a 10-year grace period. IDA also provides grants to countries at risk of debt distress. Since its inception, IDA credits and grants have totaled US$207 billion, averaging US$12 billion a year in recent years and directing the largest share, about 50 percent, to Africa. 5.2 IDA History The International Bank for Reconstruction and Development (IBRD), better known as the World Bank, was established in 1944 to help Europe recover from the devastation of World War II. The success of that enterprise led the Bank, within a few years, to turn its attention to the developing countries. By the 1950s, it became clear that the poorest developing countries needed softer terms than those that could be offered by the Bank, so they could afford to borrow the capital they needed to grow. With the United States taking the initiative, a group of the Banks member countries decided to set up an agency that could lend to the poorest countries on the most favourable terms possible. They called the agency the "International Development Association." Its founders saw IDA as a way for the "haves" of the world to help the "have-nots." But they also wanted IDA to be run with the discipline of a bank. For this reason, US President Dwight D. Eisenhower proposed, and other countries agreed, that IDA should be part of the World Bank (IBRD). IDA's Articles of Agreement became effective in 1960. The first IDA loans, known as credits, were approved in 1961 to Chile, Honduras, India and Sudan. IBRD and IDA are run on the same lines. They share the same staff and headquarters, report to the same president and evaluate projects with the same rigorous standards. But IDA and IBRD draw on different resources for their lending, and because IDAs loans are deeply concessional, IDAs resources must be periodically replenished (see "IDA Funding" below). A country must be a member of IBRD before it can join IDA; 165 countries are IDA members Purposes In the preamble to the Articles of Agreement, the signatory governments declare their conviction that mutual cooperation for constructive economic purposes, healthy development of the world economy, and balanced growth of international trade foster peace and world prosperity; that higher standards of living and economic and social progress in the less developed countries are desirable not only in the interest of the latter but also for the international community as a whole;

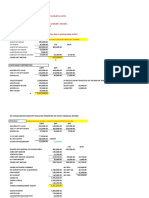

and that achievement of these objectives would be facilitated by an increase in the international flow of capital, public and private, to assist in the development of the resources of less developed countries. As stated in its Articles of Agreement, the purposes of the IDA are "to promote economic development, increase productivity, and thus raise standards of living in the less-developed areas of the world included within the Association's membership, in particular by providing financing to meet their important developmental requirements on terms which are more flexible and bear less heavily on the balance of payments than those of conventional loans, thereby furthering the developmental objectives of the [IBRD] and supplementing its activities." The IDA is administered by the same officers and staff who administer the affairs of the IBRD. The president of the Bank also serves as the president of the IDA, and the governors and the executive directors of the Bank serve in the same capacity in the IDA. As in the IBRD, a member's voting power in the IDA is roughly proportionate to its capital subscription. 5.3 ACTIVITIES OF IDA A. Financial Resources The IDA's funds are obtained from three main sources: members' subscriptions; periodic "replenishments" provided by richer members and certain special contributions; and transfer of income from the IBRD and repayments on IDA credits. The IMF and the World Bank Group have two main income streams. The first derives from their lending operations, charging mainly the borrowing countries; and the second from their income on investments in financial markets. Additionally, the International Development Association (IDA) receives contributions from members. The net income on loans as well as investment returns are used to cover administrative expenses, build up reserves to strengthen balance sheets, and - in the case of the International Bank for Reconstruction and Development (IBRD) and the International Finance Corporation (IFC) - provide annual transfers to the IDA. IMF resources total $363 billion, of which $265 billion are available for lending. When borrowing from the IMF under the General Account, debtor countries pay a refundable commitment fee, service charges and interest on outstanding credit. Interest rates are around one percentage point above the remuneration rate paid to members with deposits at the Fund. Charges and interest payments have added up to $11.2 billion over the past five years. The biggest borrower over the last five years, for example, was Turkey, which paid $3.7 billion in interest and charges between 2004 and 2008.The IMF has paid $5.5 billion in remuneration to members, distributed according to their actual financial position with the IMF. Over the past five years, $3.6 billion of these payments were made to developed countries. Administrative expenses have reached $4.8 billion between 2004 and 2008, and the rest of the $11.2 billion has been used to increase the reserves of the IMF. The reserves, which consist of retained earnings from charges and investments, are currently $8.6 billion.The IMF holds an investment portfolio worth around $9 billion, getting annual net returns adding up to $990 million.

In 2008 the IBRD possessed $41.5 billion in equity, of which $11.5 billion was paid-in capital. For its lending, the IBRD raises money in financial markets by issuing bonds and other financial instruments. To cover borrowing costs and administrative expenses, it charges borrowing countries. These charges paid by developing countries were $24.4 billion between 2004 and 2008. The IBRD refused to provide us with the amount of charges paid by individual countries.The Bank's borrowing costs, mainly the interest paid to private creditors, have been $18.3 billion. Administrative expenses total up to $6 billion. In June 2008, the IBRD's outstanding borrowing from capital markets was about $80.7 billion in total; and $23 billion was invested in cash and liquid assets. Trading in financial markets, it earned $4.4 billion over the past five years. IDA is largely funded by repeated contributions of 45, mostly developed, countries. Every three years its resources are refilled. The IDA15 replenishment 2009-2011 has a total budget of $42 billion, of which donor countries gave $25.2 billion. These donor contributions are complemented by $6.3 billion from prior donor pledges to the Multilateral Debt Relief Initiative (MDRI). Additionally, IDA will receive transfers of $3.9 billion from the IBRD and the IFC combined between 2009 and 2011. These are paid from the net income of these institutions, which partly comes from payments of debtor countries. Thus, they constitute a transfer from one set of developing countries to another. The rest comes from repayments, net charges and investment income. IDA's credits are concessional with a grant element of about 60 percent, and 20 percent of the credits are outright grants. The repayments made by IDA's borrowers, which totalled $5.6 billion between 2006 and 2008, are also used for further lending.Generally, IDA provides credits to its borrowers interest-free. However, it lends a very small proportion of its credits (less than 5 per cent) on a variable rate, which was 4.2 per cent in 2008. Apart from that, it charges an administrative fee of 0.75 per cent against the outstanding balance of credits. There is also a variable commitment fee that is set annually in the range of zero to 0.5 per cent; for the current fiscal year (2009), this fee is set at zero. Over the past three years, these payments by developing countries have added up to $2.5 billion. IDA generated income of $1.6 billion on its investments between 2006 and 2008.

B. Terms of IDA Lending IDA provides credits to its borrowers, interest-free with a 35-to 40-year final maturity and a 10year grace period. Although IDA does not charge interest, it does charge a small administrative fee of 0.75% against the outstanding balance of credits to meet administrative expenses. There is also a commitment fee of 0.5% of 50 basis points, but this has been waived since fiscal year 1989. IDA's credits are thus highly concessional with a grant element of about 85%. C. IDA Operations While the IDA's financial terms are liberal, its economic and technical criteria for development credits are exactly the same as those applied by the IBRD in lending on conventional terms. Each credit must be justified by the borrowing country's economic position, prospects, and policies. Credits are extended only for high-priority purposes that, in the words of the IDA's Articles of Agreement, will "promote economic development, increase productivity, and thus raise standards of living in the less-developed areas of the world."

Since the IDA's resources have been considerably less than the need of developing countries for additional external finance on easy terms, they must be carefully rationed on the basis of need and prospects for their most effective use. Borrowing countries typically have per capita GNPs below an established threshold. Most eligible countries have incomes below US $400 per capita. D. IDA'S Evolving Role IDA has taken an active role in helping governments undertaking structural adjustment to protect and expand social and environmental programs. It supports rural development programs and projects which aim to increase agricultural productivity and ensure adequate food supplies. IDA also finances projects that give special attention to improving women's incomes and status in their communities. The Association has markedly increased its support for population, health, and nutrition projects. Environmental concerns have been integrated into all aspects of IDA's operations. The Association is helping borrowers develop their own Environmental Action Plans to identify the policy changes and investments that are required for environmentally sustainable development. In fiscal 2002, IDA disbursed US $6.6 billion; of this amount, nearly half went to countries in sub-Saharan Africa, one-third to South Asia, 10% to East Asia and the Pacific, 8% to Eastern Europe and Central Asia, and the remainder to poor countries in North Africa and in Latin America. IDA is the largest single source of multilateral concessional funds. Its annual net disbursements of around US$ 6 billion are about 30% of net concessional multilateral disbursements, and 12% of Official Development Assistance. The Association also helps mobilize and coordinate aid from other multilateral organizations and donor countries. IDA's involvement is often a catalyst for other bilateral aid donors and regional development banks to participate in providing assistance. On average, for every dollar IDA commits, 50 cents of cofinancing is mobilized. 5.4 ALLOCATION OF IDA RESOURCES IDA's 79 eligible recipients have very significant needs for concessional funds. But the amount of funds available, which is fixed once contributions are pledged by donor governments, tends to be well below the countries' needs. IDA, therefore, must allocate scarce resources among eligible countries. This is done on the basis of recipients' policy performance and institutional capacity in order to concentrate resources where they are likely to be most helpful in reducing poverty The main factor that determines the allocation of IDA resources among eligible countries is each country's performance in implementing policies that promote economic growth and poverty reduction. This is assessed by the Country Policy and Institutional Assessment (CPIA), which for the purposes of resource allocation is referred to as the IDA Resource Allocation Index (IRAI). The IRAI and portfolio performance together constitute the IDA Country Performance Rating (CPR). In addition to the CPR, population and per capita income also determine IDA allocations.

5.5 IDA RESULT MEASUREMENT SYSTEM IDA seeks to improve the lives of the people living in the worlds poorest countries. To measure the degree to which IDA is helping countries grow and reduce poverty and inform donors about the effectiveness of their contributions, IDA introduced a system for measuring results in 2002. (An enhanced system took effect in July 2005.) An interactive website facilitates the tracking of key indicators and provides links to other relevant sources. The Results Measurement System is designed to show aggregated results across IDA countries. It reflects the priorities and processes of national poverty-reduction strategies, assesses IDA's contribution to development results and is linked to the Millennium Development Goal framework. It measures results on two levels: 1. Aggregate country outcomes The first tier of the system includes indicators grouped in four categories: - Growth and poverty reduction, - Governance and investment climate, - Infrastructure for development, - Human development. 2. IDAs contribution to country outcomes The second tier of the system draws on World Bank self-assessments, analysis of the IDA portfolio, and data from the Independent Evaluation Group (IEG, formerly the Operations Evaluation Department) and the Quality Assurance Group (QAG). Indicators include: the number of country teams that use a results-based Country Assistance Strategy, CAS final outcome ratings as validated by IEG, project-outcome ratings as validated by IEG, and qualityat-entry indicators for IDA projects as assessed by QAG. 5.6 .PRACTICE QUESTIONS 1. How IDA resources are allocated? 2. Explain Result Measurement system of IDA 5.7 SUGGESTED READINGS 1. Edward S. Mason & Robert E. Asher, The World Bank Since Bretton Woods , The Brookings Institution 2. Devesh Kapur, John P Lewis, Richard Web, The World Bank- Its First half century

You might also like

- Accounting Words IDocument1 pageAccounting Words IArnold SilvaNo ratings yet

- Mary Kay Inventory - NSD Diana SumpterDocument6 pagesMary Kay Inventory - NSD Diana SumpterMaryKayVictims0% (1)

- World BankDocument33 pagesWorld Bank1030anNo ratings yet

- World Bank AssignmentDocument16 pagesWorld Bank AssignmentAarzoo Dalal50% (2)

- Multilateral InstnDocument6 pagesMultilateral InstnGada DivyaNo ratings yet

- Rishi Dubey (IBE)Document19 pagesRishi Dubey (IBE)Rishi DubeyNo ratings yet

- International Financial Institutions / Development Banks: by Prof Sameer LakhaniDocument38 pagesInternational Financial Institutions / Development Banks: by Prof Sameer Lakhanimanmeetginni123No ratings yet

- World Ban1finalDocument12 pagesWorld Ban1finalhiteshbohra08No ratings yet

- 10.world BankDocument19 pages10.world BankAdnan NawabNo ratings yet

- Cia 3 IbDocument9 pagesCia 3 IbRakesh SinghNo ratings yet

- International Economic InstitutionsDocument33 pagesInternational Economic InstitutionsRavinder YadavNo ratings yet

- The International Development Association, IDA,: HistoryDocument7 pagesThe International Development Association, IDA,: Historymanojpatel51No ratings yet

- Ida UpscDocument3 pagesIda UpscEmre HpNo ratings yet

- About Us: Who We AreDocument8 pagesAbout Us: Who We AreSuhas JadhavNo ratings yet

- International Monetary FundDocument8 pagesInternational Monetary FundNaruChoudharyNo ratings yet

- Unit 18 Rise and Fall of Bretton Woods Institutions: 18.0 ObjectivesDocument17 pagesUnit 18 Rise and Fall of Bretton Woods Institutions: 18.0 ObjectivesRakesh KumarNo ratings yet

- IdaDocument21 pagesIdaIla Gupta0% (1)

- What Is The World BankDocument4 pagesWhat Is The World BankPrincess KanchanNo ratings yet

- World Bank GroupDocument8 pagesWorld Bank GroupSuvankar NandiNo ratings yet

- IBRDDocument5 pagesIBRDMohsin G100% (1)

- Imf, Ifc, World Bank, Ida, IbrdDocument33 pagesImf, Ifc, World Bank, Ida, IbrdShivaang SangalNo ratings yet

- World Bank GroupDocument8 pagesWorld Bank GroupkarthickNo ratings yet

- The International Bank For Reconstruction and DevelopmentDocument4 pagesThe International Bank For Reconstruction and DevelopmentMehulMotaNo ratings yet

- World BankDocument34 pagesWorld Bankdivyesh_variaNo ratings yet

- Ibrd 24 SlidesDocument26 pagesIbrd 24 SlidesvmktptNo ratings yet

- If Is ButterflyDocument29 pagesIf Is Butterflyicha95bestNo ratings yet

- IdaDocument23 pagesIdaarun_choudhary_9No ratings yet

- Project On International BusinessDocument13 pagesProject On International BusinessShreya JainNo ratings yet

- International Financial InstitutionsDocument29 pagesInternational Financial InstitutionsPaavni SharmaNo ratings yet

- International Development AssociationDocument8 pagesInternational Development AssociationvmktptNo ratings yet

- World Bank Group UPSCDocument5 pagesWorld Bank Group UPSCManoj G ShekarNo ratings yet

- World BankDocument11 pagesWorld BankAnjanette SantosNo ratings yet

- International Financial InstitutionsDocument14 pagesInternational Financial InstitutionsRahul ChaudharyNo ratings yet

- 12-International Institutions and Role in International BusinessDocument13 pages12-International Institutions and Role in International Businessfrediz7971% (7)

- World Bank PPT at Bec Doms Bagalkot MbaDocument50 pagesWorld Bank PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)No ratings yet

- World Bank ReportDocument14 pagesWorld Bank Reportaditya_erankiNo ratings yet

- Skyline Business School Assignment of Role of International Financial Institutions Faculty Mrs Rajni Gupta Subject Code BB0030Document8 pagesSkyline Business School Assignment of Role of International Financial Institutions Faculty Mrs Rajni Gupta Subject Code BB0030Rajat SuriNo ratings yet

- World BankDocument10 pagesWorld Bank777priyankaNo ratings yet

- Unit - VDocument29 pagesUnit - VHarshit SharmaNo ratings yet

- Ifm LessonDocument27 pagesIfm LessonAicha EssNo ratings yet

- The Role of IBRD and IDA - 2011Document2 pagesThe Role of IBRD and IDA - 2011Paromita20130% (1)

- International Bank For Reconstruction and Development (Ibrd)Document4 pagesInternational Bank For Reconstruction and Development (Ibrd)Sai SuryaNo ratings yet

- Industry AnalysisDocument9 pagesIndustry AnalysisRahul SinghNo ratings yet

- Presentation On World Bank: Giridhar KattiDocument22 pagesPresentation On World Bank: Giridhar KattindtNo ratings yet

- AnkitDocument24 pagesAnkitAnkit MalhotraNo ratings yet

- IBRDDocument3 pagesIBRDRajjan PrasadNo ratings yet

- International Bank For Reconstruction and Development (IBRD)Document2 pagesInternational Bank For Reconstruction and Development (IBRD)Van Anh NguyenNo ratings yet

- World BankDocument19 pagesWorld Bankrajan20202000100% (1)

- Coffee Industries of IndiaDocument24 pagesCoffee Industries of IndiaDebarshiDuttaNo ratings yet

- World BankDocument23 pagesWorld BankjudithNo ratings yet

- International Finanacial InstitutionsDocument7 pagesInternational Finanacial InstitutionsMufāsir MusthāfƛNo ratings yet

- Lecture 10.odtDocument3 pagesLecture 10.odtRaza AliNo ratings yet

- What Is IDADocument2 pagesWhat Is IDAMark Cesar VillanuevaNo ratings yet

- Presented by Muhammad Abdullah Waqas Hussain Saqib-ur-Rehman Muhammad Rizwan YounasDocument23 pagesPresented by Muhammad Abdullah Waqas Hussain Saqib-ur-Rehman Muhammad Rizwan Younasch_rizwanyounasNo ratings yet

- Ifc & IdaDocument12 pagesIfc & Idanavneet_sahota05100% (4)

- Poorest Fund: For TheDocument23 pagesPoorest Fund: For Theares_aguilarNo ratings yet

- Find Again in Details) : Unit 2 World Bank History (Document8 pagesFind Again in Details) : Unit 2 World Bank History (MamtaNo ratings yet

- World BankDocument37 pagesWorld BankShivang UnadkatNo ratings yet

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsFrom EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsNo ratings yet

- ElectroluxDocument3 pagesElectroluxRupeet Singh100% (1)

- Ticket 3rd JanDocument6 pagesTicket 3rd JanRupeet SinghNo ratings yet

- 1st SemDocument7 pages1st SemRupeet SinghNo ratings yet

- RupeetDocument84 pagesRupeetRupeet SinghNo ratings yet

- Accounting For Manufacturing FirmDocument13 pagesAccounting For Manufacturing Firmnadwa dariahNo ratings yet

- Compare Voltas With Blue Star - EquitymasterDocument12 pagesCompare Voltas With Blue Star - Equitymasteratul.jha2545No ratings yet

- Associated Bank Vs CADocument1 pageAssociated Bank Vs CATine TineNo ratings yet

- CSIT Problem QuestionsDocument3 pagesCSIT Problem QuestionsQweku TeyeNo ratings yet

- BA 421-Feasibility StudyDocument14 pagesBA 421-Feasibility StudyMary Ann Jacolbe BaguioNo ratings yet

- Banks - Sector Update - 22 Dec 21Document86 pagesBanks - Sector Update - 22 Dec 21Kaushal ShahNo ratings yet

- Lecture3 Sem2 2023Document35 pagesLecture3 Sem2 2023gregNo ratings yet

- Break Even Point, Forecasting, and DecisionDocument23 pagesBreak Even Point, Forecasting, and DecisionidnodNo ratings yet

- AccDocument7 pagesAccALLIA AHMADNo ratings yet

- Trent's Mortgage & Finance BrokingDocument10 pagesTrent's Mortgage & Finance BrokingTrent FetahNo ratings yet

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- Lira District Report of The Auditor General 2015 PDFDocument59 pagesLira District Report of The Auditor General 2015 PDFlutos2No ratings yet

- Canara Bank ProjectDocument20 pagesCanara Bank ProjectSarika Sharma100% (1)

- Nepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Document61 pagesNepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Aditya VermaNo ratings yet

- CA51024 - Quiz 2 (Solutions)Document6 pagesCA51024 - Quiz 2 (Solutions)The Brain Dump PHNo ratings yet

- Investment Environment and Investment Management Process-1Document1 pageInvestment Environment and Investment Management Process-1CalvinsNo ratings yet

- Tax PresentationDocument40 pagesTax PresentationAshrafulIslamNo ratings yet

- deeganAFA 7e ch28 ReducedDocument19 pagesdeeganAFA 7e ch28 Reducedmail2manshaaNo ratings yet

- AFM Assignment 3Document6 pagesAFM Assignment 3Zuhair NasirNo ratings yet

- 4 - Problem SolvingDocument8 pages4 - Problem SolvingKlenida DashoNo ratings yet

- Summer Training Report at "Financial Performance Analysis With Ratio Analysis With Reference To South Eastern Coal Fields Limited" Bilaspur (C.G.)Document35 pagesSummer Training Report at "Financial Performance Analysis With Ratio Analysis With Reference To South Eastern Coal Fields Limited" Bilaspur (C.G.)Sanskar YadavNo ratings yet

- Chapter 11 Quiz Sect 903 SolutionsDocument4 pagesChapter 11 Quiz Sect 903 Solutionsamu_scribdNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Investment Wisdom From The Super AnalystsDocument6 pagesInvestment Wisdom From The Super Analystsautostrada.scmhrdNo ratings yet

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Document10 pagesCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNo ratings yet

- Bank Reconciliation StatementDocument39 pagesBank Reconciliation StatementinnovativiesNo ratings yet

- Mcq-Income TaxesDocument7 pagesMcq-Income TaxesRandy Manzano100% (1)