Professional Documents

Culture Documents

Review Session

Uploaded by

Karina De La RosaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review Session

Uploaded by

Karina De La RosaCopyright:

Available Formats

What Should You Know

1. The purpose and the elements of financial statements 2. Analysis of financial statements using ratios 3. Determining the impact of specific business transactions and/or errors on the financial statements 4. Basic principles governing the preparation of the financial statements 5. Cost terminology and Manufacturing costs 6. Cost-Volume Profit Analysis 7. Budgeting 8. Performance Evaluation Using Standard Costing and ROI

Entrance Exam Review Problems

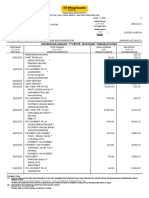

Q1. Shield Company is a merchandising company. The following is the balance of accounts as of December 31, 2005 in random order. Accounts Accumulated Depreciation-Store Equp. Accounts Payable Salaries Payable Interest Payable Cash Accounts Receivable Notes Receivable (5-month) Office Supplies Expense Interest Revenue Interest Expense Miscellaneous Expense Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equp. Store Equipment Sales Discounts Cost of Merchandise Sold Allowance for Doubtful Accounts Interest Receivable Bonds Payable (due 2010) Capital Stock (Par $1 per share) Retained Earnings-Jan. 1 Dividends Sales Sales Returns Advertising Expense Depreciation Expense Rent Expense Insurance Expense Merchandising Inventory Office Supplies Sales Salaries Expense Debit Credit 34,200 55,600 2,400 4,200

33,750 125,000 120,000 1,300 11,000 6,000 3,200 3,400 90,000 17,800 175,000 21,900 775,000 4,000 2,200 56,000 95,000 395,750 35,000 1,275,000 23,100 43,800 19,100 31,350 3,900 175,000 5,600 257,350 1,950,950

1,950,950

Requirements: a. Prepare a multiple-step income statement b. Prepare a retained earnings statement c. Prepare a classified balance sheet. The current portion of the bonds payable to be paid during the upcoming year is $7,500. d. The following displays the selected industry ratios for Shield Company for 2005. Compute similar ratios for Shield Company based upon your prepared financial statements. Carry up to two decimal points. The balance of accounts receivable, merchandise inventory, and total assets as of Jan. 1, 2005 were $100,000, $185,000, and $600,000, respectively. Ratios Industry Shield Company

Current Ratio Times Interest Earned Earnings Per Share Number of Days in Inventory Number of Days in Receivable/AVG Collection Period Rate of Return on Assets Solution a. Shield Company Income Statement For the Year Ended December 31, 2005 Revenue from sales: Sales.................................................................... Less: Sales returns and allowances............... Sales discounts....................................... Net sales....................................................... Cost of merchandise sold......................................... Gross profit............................................................... Operating expenses: Salaries expense........................................... Advertising expense..................................... Depreciation expense................................... Miscellaneous expense................................. Rent expense.................................................. Insurance expense....................................... Office supplies expense............................... Total operating expenses......................................... Income from operations........................................... Other income: Interest revenue................................................. Other expense: Interest expense................................................. Net income................................................................

6 5 times $1.45 80 days 30 days 18%

$1,275,000 $ 23,100 21,900 45,000 $1,230,000 775,000 $ 455,000 $257,350 43,800 19,100 3,200 31,350 3,900 1,300 $ $ 11,000 6,000 $ 5,000 100,000 360,000 95,000

b.

Shield Company Retained Earnings Statement For the Year Ended December 31, 2005 Retained earnings, Jan 1, 2005.......................................................... Net income for the year..................................................................... Less dividends.................................................................................... Increase in retained earnings............................................................ Retained earnings, December 31, 2005............................................. $395,750 $100,000 35,000 65,000 $460,750

c.

Shield Company

Balance Sheet December 31, 2005 Assets Current assets: Cash.............................................................................. Accounts receivable..................................................... Less: Allowance for Doubtful Accounts..................... Interest Receivable...................................................... Notes receivable........................................................... Merchandise inventory............................................... Office supplies.............................................................. Prepaid insurance........................................................ Total current assets............................................... Property, plant, and equipment: Office equipment......................................................... Less accumulated depreciation............................ Store equipment............................................................ Less accumulated depreciation................................... Total property, plant, and equipment................. Total assets......................................................................... Liabilities Current liabilities: Accounts payable......................................................... Bonds payable (current portion)................................ Salaries payable........................................................... Interest Payable........................................................... Total current liabilities......................................... Long-term liabilities: Bonds payable (final payment due 2010)................... Total liabilities.................................................................... Stockholders Equity Capital stock....................................................................... Retained earnings.............................................................. Total liabilities and stockholders equity......................... d. Ratios Current Ratio = Current assets Current Liability Times Interest Earned = (Net Income + Interest Expense + Tax Expense) Interest Expense Earnings Per Share = Net Income # of shares of C.S. outstanding When there are only common stockholders Days In Inventory = 365 Inventory Turnover Ratio Inventory Turnover Ratio = Cost of Goods Sold Average Inventory Average Collection Period = 365 Accounts Receivable Turnover Ratio Accounts Receivable Turnover Ratio = Net Sales Average Accounts Receivable Return on Assets Ratio = Net Income Average Total Assets Ratio Acid-Test Ratio Industry 6 Shield Company 460950 69700 = 6.61 Result Better position

$ 125,000 4,000

33,750 121,000 2,200 120,000 175,000 5,600 3,400 $460,950

90,000 17,800 $175,000 34,200

72,200 140,800 213,000 $673,950

55,600 7,500 2,400 4,200 $ 69,700 48,500 $118,200

95,000 460,750

555,750 $673,950

Times Interest Earned Earnings Per Share Number of Days in Inventory Number of Days in Receivable/AVG Collection Period Rate of Return on Assets

5 times $1.45 80 days

(100000 + 6000) 6000 = 17.66 times 100000 95000 = $1.05 365 4.3 = 85 days (175000 + 185000) 2 = 180000 775000 180000 = 4.3 365 11.13 = 33 days (100000 + 121000) 2 = 110,500 1230000 110500 = 11.13 100000 636975 = 16% (600000 + 673950) 2 = 636,975

than avg. industry Better position than avg. industry Less profitable than avg. industry Less effective than avg. industry Less effective than avg. industry Less effective/profitable than avg. industry

30 days

18%

Q2. The balance of Revenues, Expenses, Assets, Liabilities, and Stockholders Equity before recording the impact of transactions a to e are $80,000, $25,000, $150,000, $60,000, and $90,000, respectively. Reflect net impact of each transaction on these items in the space provided and compute new balances after a reflecting the impact of the transactions. Company is using accrual basis of accounting. Balances Before Transactions a. Purchased $1000 of supplies in cash b. Collected $5000 from customers in advance for future services c. Provided $4000 customers on account services to Revenues $80,000 Expenses $25,000 Assets $150,00 0 Liabilities $60,000 Stockholders Eq. $90,000

d. Paid $2000 for rent and utilities e. Purchased $15,000 equipment, paid $5000 cash, the rest was on account. f. $600 of supplies purchased in a was used g. The money in item c was collected h. $2000 of services in item b was provided to customers i. Borrowed $4000 from bank J. Company received the $200 utilities bill for the month. But is not paid yet. K. Purchased $3000 equipment with a note payable. Balances After Transactions

Solution Revenues Expenses Assets Balances Before Transactions a. Purchased $1000 of supplies in cash b. Collected $5000 from customers in advance for future services c. Provided $4000 customers on account services to $80,000 0 0 +4000 0 0 0 0 +2000 0 0 0 $86000 $25,000 0 0 0 +2000 0 +600 0 0 0 +200 0 $27,800 $150,00 0 0 +5000 +4000 -2000 +10000 -600 0 0 +4000 0 +3000 $173,40 0 Liabilities Stockholders Eq. $60,000 $90,000 0 +5000 0 0 +10000 0 0 -2000 +4000 +200 +3000 $80,200 0 0 +4000 -2000 0 -600 0 +2000 0 -200 0 $93,200

d. Paid $2000 for rent and utilities e. Purchased $15,000 equipment, paid $5000 cash, the rest was on account. f. $600 of supplies purchased in a was used g. The money in item c was collected h. $2000 of services in item b was provided to customers i. Borrowed $4000 from bank J. Company received the $200 utilities bill for the month. But is not paid yet. K. Purchased $3000 equipment with a note payable. Balances After Transactions

Q3. The cost of rent for a manufacturing plant is generally considered to be a: A) B) C) D) Conversion Cost Yes Yes No Yes Manufacturing cost Yes Yes Yes Yes Prime cost No Yes Yes No Product Cost No Yes No Yes

Q4. An increase in the activity level within the relevant range results in: A) an increase in fixed cost per unit. B) a proportionate increase in total fixed costs. C) an unchanged fixed cost per unit. D) a decrease in fixed cost per unit.

Q5. Sun Company has developed the following income statement using a contribution margin format. Sun Company is manufacturing and selling a product called SOOB. Sun Company Projected Income Statement For the Year Ending December 31, 2003 Sales................................................................................. Less variable costs: Variable manufacturing................................................ $100,000 Variable selling (commission) ..................................... 50,000 Total variable costs.................................................. Contribution margin......................................................... Less fixed costs: Fixed manufacturing.................................................... $80,000 Fixed selling, general, and administrative.................... 100,000 Total fixed costs....................................................... Net income.......................................................................

$410,000

150,000 $260,000

180,000 $80,000

The projected income statement is based upon sales of 100,000 units. Sun has the capacity to produce 150,000 units during the year. Answer the following independent cases. Requirements: 1. Compute break-even sales in units and dollars. 2. Company desires a profit of $120,000. Compute required sales to achieve this goal in units and dollars. 3. Management of Sun wants to know the amount by which sales can drop before losses begin to be incurred (margin of safety). Compute Suns Margin of Safety in dollar and percentage. Solution 1. Compute break-even sales in units and dollars. Sp = 410000/100000 = $4.10 Selling price per unit v = 150000/100000 = $1.50 Variable cost per unit CM = sp v = 4.10 1.50 = $2.60 contribution margin per unit U = (F + P)/CM = (180000 + 0)/(2.60) = 69,231 breakeven in units x $4.10 = $283,847 breakeven in $ 2. Company desires a profit of $120,000. Compute required sales to achieve this goal in units and dollars. U = (F + P)/CM = (180000 + 120000)/(2.60) = 115,385 in units x $4.10 = $473,079 in dollars 3. Management of Sun wants to know the amount by which sales can drop before losses begin to be incurred (margin of safety). Compute Suns Margin of Safety in dollar and percentage. MS $ = Current or planned sales breakeven sales = 410000 283847 = $126,153 MS % = 126153/410000 = 30.8% or 31%

Q6. Modesto Company produces and sells Product Alpha. To guard against stock outs, the company requires that 20% of the next month's sales be on hand at the end of each month. Budgeted sales of Product Alpha over the next four months are: Budgeted sales in units June 30,000 July 40,000 August 60,000 September 50,000

Compute budgeted production for July. Solution: Production Budget (July) Budgeted Sales Add: Desired Ending Inventory (20% x 60000) Total Needs Less: Beginning Inventory (20% x 40000) Required Production 40,000 12,000 52,000 8,000 44,000

Q7. Parlee Company's sales are 30% in cash and 70% on credit. Sixty percent of the credit sales are collected in the month of sale, 25% in the month following sale, and 12% in the second month following sale. The remainder is uncollectible. The following are budgeted sales data: Total sales January $60,000 February $70,000 March $50,000 April $30,000

Compute total budgeted cash receipts for April. Solution: Aprils cash sales (30% x 30000) 60% of Aprils credit sales (60% x 70%x 30000) 25% of March credit sales (25% x 70% x 50000) 12% of February credit sales (12% x 70% 70000) Total cash collections in April $ 9,000 $12,600 $ 8,750 $ 5,880 $36,230

Q8. ABC Company has a cash balance of $9,000 on April 1. The company must maintain a minimum cash balance of $6,000. During April expected cash receipts are $45,000. Expected cash disbursements during the month total $52,000. During April how much the company will need to borrow? Solution: Cash balance, beginning Add collections from customers Total cash available Less disbursements: Excess (deficiency) of cash available over disbursements Borrowing Cash balance, ending $ 9,000 $45,000 $54,000 $52,000 $ 2,000 $ 4,000 $ 6,000

Q9. Sun Company is manufacturing a product called SOOB. Currently, each unit of SOOB is selling at $12.50 per unit. Management of Sun just completed the study of the behavior of its total expenses. According to the results, Suns monthly fixed expenses are $180,000 and variable expense is $8 per unit. Currently company is selling 50,000 units of SOOB per month. Management of Sun Company has a number of independent questions as follow: Requirements: 1) How many units Sun must sell each month in order to break even? 2) In order to have $81,000 of profit for a month, how many units Sun must sell? 3) Suns marketing manager has suggested an increase of $10,000 in monthly budget for advertising. It is expected that the additional promotion would increase sales by 3000 units per month. Should Sun adopt the increase in advertising? Why? Solution: CM = Selling price variable expense per unit = 12.5 8 = $4.5 contribution margin per unit QUESTION 1) How many units Sun must sell each month in order to break even? 2) In order to have $81,000 of profit for a month, how many units Sun must sell? 3) Suns marketing manager has suggested an increase of $10,000 in monthly budget for advertising. It is expected that the additional promotion would increase sales by 3000 units per month. Should Sun adopt the increase in advertising? Why? ANSWER U = (180000 + 0)/4.5 = 40000 units U = (180000 + 81000)/4.5= 261000/4.5 = 58000 units Increase in CM = $4.5 * 3000 = $13500 Increase in fixed expenses = $10000 Increase in profit = 13500 10000 = $3,500 Units Sales -Var. Exp. -Fixed Exp Profit 50000 $625,000 400,000 180,000 $45,000 53000 $662,500 424,000 190,000 $48,500

Increase = 48500 45000 = $3,500 Increase % = Increase/Cur Profit = = 3500/45000 = 7.8%

Q10. The following overhead data are for a department in a large company. Actual costs incurred 250 $8,745 $2,065 $1,560 $7,210 Static budget 220 $7,634 $1,738 $1,600 $7,300

Activity level (in units) Variable costs: Indirect materials Power Fixed costs: Supervision Rent

Required: Prepare a report that would be useful in assessing how well costs were controlled in this department. Solution: Static budget is a budget based on planned activity level and planned costs per unit. Normally it is prepared prior to the start of the year based upon planned activity level for the year. Flexible budge is a budget based upon actual activity level but planned cost per unit. Normally it is prepared at the end of year for measurement of performance comparison of the flexible budget to actual costs. Cost formula per unit of activity Variable costs: Indirect materials Power Total variable cost Fixed costs: Supervision Rent Total fixed cost Total cost $34.70 7.90 $42.60 Actual costs incurred $ 8,745 2,065 10,810 1,560 7,210 8,770 $19,580 Flexible Budget based on actual activity $ 8,675 1,975 10,650 1,600 7,300 8,900 $19,550

Variance $ 70 U 90 U $160 U 40 F 90 F 130 F $ 30 U

10

Q11. The following information is provided: Project A B C Operating Income $44,000 70,000 30,000 Average Operating Investment $400,000 800,000 600,000

Assume the divisions current ROI is 10 percent and the firms minimum required rate of return is 8 percent. If you were the division manager and you were evaluated based on ROI, which projects would you accept? a. Projects A, B, and C b. Projects A and C c. Projects A and B d. Project A only Solution: Answer = D SUPPORTING CALCULATIONS: Project A: ROI = $44,000/$400,000 = 11.0% Project B: ROI = $70,000/$800,000 = 8.75% Project C: ROI = $30,000/$600,000 = 5.0% The division manager would want to accept only the projects with a ROI that exceeds the divisions current ROI of 10 percent; therefore, only Project A would be accepted. Q12. What is the main purpose of having Standard Costs in a company? The main reason is to measure the performance of the production department and control of costs (significant cost variances are investigated to find the cause). Other reasons may include: facilitating management planning of resources needed for production, make employees more cost-conscious, and setting selling prices. Essentially managements want to know whether the production department was efficient and effective in purchase and use of inputs (i.e., DM, DL, and MOH) in production. Performance in the area of purchases is measured by calculating Price Variances. And performance in the area of usage of inputs is measured by calculating the Quantity/Efficiency Variances. Q13. What is the difference between Ideal and Practical standards? Ideal standards allow for no machine breakdowns or work interruptions, and can be attained only by working at peak effort 100% of the time. Such standards: often discourage workers, and shouldnt be used for decisionmaking. Practical standards allow for normal down time, employee rest periods, and the like. Such standards: are felt to motivate employees, since the standards are tight but attainable, and are useful for decision-making purposes, since variances from standard will contain only abnormal elements. Q14. A Standard Cost System requires setting of standards for both the quantity and price of inputs (such materials and labor) used in manufacturing goods or providing services.

11

a. Name three items that go into the price standard for direct materials. This standard is based on the purchasing departments best estimate of the cost of raw materials. This standard also includes an amount for related costs such as taxes, receiving, storing, and handling.

b. Name three items that go into the quantity standard for direct materials. The direct materials quantity standard is the quantity of direct materials that should be used per unit of finished goods. It is the amount of material going into each unit of finished product, as well as an allowance for unavoidable waste, spoilage, and other normal inefficiencies. Q15. Graves Company has developed the following standard costs for its product for 2001: GRAVES COMPANY Standard Cost Card Product A Cost Element Standard Quantity Direct materials 4 pounds Direct labor 3 hours Var. Manufacturing overhead 3 hours Standard Cost $12 24 12 $48 The company was expecting to produce 25,000 units of Product A in 2001 and work 75,000 direct labor hours. Actual results for 2001 are as follows: 26,000 units of Product A were produced. Actual direct labor costs were $627,000 for 76,000 direct labor hours worked (. Actual direct materials purchased and used during the year cost $283,500 for 105,000 pounds (. Actual variable overhead incurred was $300,000. Instructions Compute direct material and direct labor variances. Indicate whether the variances are favorable or unfavorable. Solution: Direct Material Cost Variance: Question: Did company spend more money than what was expected on DM? Company has produced 26000 units and has pent $283,500 for DM. The expectation was to spend $12 for the material of each unit. Given this, Expected/Budget (Flexible) = 26000 x $12 = $312,000 Actual 283,500 Total DM Variance $28,500 F Answer: Company has spent $28,500 less than what was expected for DM. This saved company $28,500 in total. Now we have to find how much of the total variance ($28,500) was caused by price and how much was caused by quantity. Standard Price $3 $8 $4 per DLH =

12

Question: Did company pay higher or lower prices than what was expected? How much was the overall impact on company? DM Price Variance = (Actual Price - Standard Price) x Qty Purchased = = ($2.70 - $3) x 105000 = $31,500 F Answer: Company paid lower price for the purchase of DM and that saved company $31,500. Question: Did company use more or less materials than what was expected? How much was the overall impact on company? DM Qty Variance = (Actual Qty used standard Qty allowed) x Standard Price = = (105,000 26000 units x 4 lbs) x $3 = (105000 104000) x 3 = = 1000 x $3 = $3000 U Answer: Company used more DM than what was expected and that cost company $3,000.

Check Your Work: DM Price Variance DM Qty Variance Total DM Variance

$31,500 F 3,000 U $28,500 F

Direct Labor Cost Variances: Question: Did company spend more money than what was expected on DL? Company has produce 26000 units and has pent $627,000 for DL. The expectation was to spend $24 for the DL of each unit. Given this, Expected/Budget (Flexible) = 26000 x $24 = $624,000 Actual 627,000 Total DL Variance $3,000 U Answer: Company spent $3000 more than what was expected on DL. Question: Did we pay higher or lower prices (for direct labor) than what was expected? How much was overall impact on company? DL Price Variance = (Actual Price - Standard Price) x Qty Purchased = = ($8.25 - $8 ) x 76000 hrs = ).25 x 76000 = $19,000 U Answer: Company paid higher price for DL than what was expected and this cost company $19,000 in total. Question: Did we use more or less labor than what was expected? How much was the overall impact on the company? DL Qty Variance = (Actual Qty used standard Qty allowed) x Standard Price = = (76000 26000 x 3 ) x 8 = (76000 78000) x $8 = = -2000 x $8 = -$16,000 F

13

Answer: Company use less DL than what was expected for the production of 26000 units and that saved company $16,000. Check Your Work: DL Price Variance DL Qty Variance Total DM Variance $19,000 U 16,000 F $3,000 U

Q16. Labor efficiency variances may be caused by a. the use of highly skilled workers b. frequent machinery breakdowns c. the use of marginally skilled workers d. all of the above Q17. Which of the following is NOT true about currently attainable standards? a. They are based on an efficiently operating work force. b. They are based on ideal conditions. c. They allow for downtime and rest periods. d. They are based on present production processes and technology. Q18. Which statement about the selection of standards is true? a. Ideal standards tend to extract higher performance levels since they give employees something to live up to. b. Currently attainable standards may encourage operating inefficiencies. c. Currently attainable standards discourage employees from achieving their full performance potential. d. Ideal standards demand maximum efficiency, which may leave workers frustrated, thus causing a decline in performance. Q19. Variances indicate a. the cause of the variance b. who is responsible for the variance c. that actual performance is not going according to plan d. when the variance should be investigated Q20. Which of the following is a disadvantage of adopting a standard costing system? a. to improve planning and control b. to facilitate product costing and pricing c. to help establish the quality and safety of products d. All of the above are advantages. Q21. An unfavorable materials price variance may be caused by a. excessive rework b. a special price offered by suppliers c. use of experienced workers d. none of the above

14

Q22. A favorable materials price variance may be caused by a. excessive rework b. a special price offered by suppliers c. use of experienced workers d. none of the above Q23. The purchase of inferior direct materials at a lower price might affect which of the following variances? a. materials price variance b. materials usage variance c. labor efficiency variance d. all of the above Q24. An unfavorable materials usage variance may be caused b a. excessive rework b. a special price offered by suppliers c. use of experienced workers d. none of the above Q25. A favorable materials usage variance may be caused by a. excessive rework b. a special price offered by suppliers c. use of experienced workers d. none of the above Q26. For a manufacturing company, which of the following is an example of direct labor cost? A) Wages of plant supervisor. B) Wages of salespersons. C) Wages of machine operators. D) Wages storeroom clerk.

15

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Financial Analysis For Business PlanDocument15 pagesFinancial Analysis For Business PlanHeart SeptNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Dhampur Sugar MillsDocument27 pagesDhampur Sugar MillsSuneel SinghNo ratings yet

- Product Development and InnovationDocument25 pagesProduct Development and InnovationKimber Palada71% (7)

- Market Entry CasesDocument7 pagesMarket Entry CasesSylvester StanisNo ratings yet

- Lester Source Prelim Quiz 1Document83 pagesLester Source Prelim Quiz 1Sherina Manlises100% (1)

- Roles & Responsibilities of Business DevelopmentDocument7 pagesRoles & Responsibilities of Business DevelopmentRavi BhardwajNo ratings yet

- Main Project ReportDocument61 pagesMain Project ReportVasudha BerryNo ratings yet

- Newsvendor ProblemDocument24 pagesNewsvendor ProblemNestor Diaz LunaNo ratings yet

- Harley DavidsoncustomerrelationshipDocument7 pagesHarley DavidsoncustomerrelationshipSachin GolherNo ratings yet

- Group 7 - Morrissey ForgingsDocument10 pagesGroup 7 - Morrissey ForgingsVishal AgarwalNo ratings yet

- Business Plan: Presented By: Umar Masood, AqibullahDocument11 pagesBusiness Plan: Presented By: Umar Masood, AqibullahUmar MasoodNo ratings yet

- Overview of MARKETING PLANDocument27 pagesOverview of MARKETING PLANjoanne riveraNo ratings yet

- Impact of GST FMCG and Retail SectorDocument11 pagesImpact of GST FMCG and Retail SectorSunoop BalaramanNo ratings yet

- Task: Assume That You Are The MARKETING STRATEGIST of Your Assigned BRAND: Propose ONEDocument5 pagesTask: Assume That You Are The MARKETING STRATEGIST of Your Assigned BRAND: Propose ONEMeskat Hassan KhanNo ratings yet

- Ibs Bachok SC 1 28/02/23Document4 pagesIbs Bachok SC 1 28/02/23Sabariah MansoorNo ratings yet

- Case SudyDocument2 pagesCase SudyAyra BernabeNo ratings yet

- An Empirical Analysis of The Influence of Perceived Attributes of Publics On Public Relations Strategy Use and EffectivenessDocument51 pagesAn Empirical Analysis of The Influence of Perceived Attributes of Publics On Public Relations Strategy Use and EffectivenessmadhurendrahraNo ratings yet

- S3 BAFS Mock PaperDocument13 pagesS3 BAFS Mock Paperharis RehmanNo ratings yet

- How To Start Fruit Juice Production Business in NigeriaDocument61 pagesHow To Start Fruit Juice Production Business in NigeriaDele Awosile0% (1)

- Cindy Severino-ResumeDocument1 pageCindy Severino-Resumeapi-400985497No ratings yet

- MICA Digital Marketing Gen AI Brochure PDFDocument32 pagesMICA Digital Marketing Gen AI Brochure PDFsaraswat9531No ratings yet

- Entrep1 Prelim ReviewerDocument7 pagesEntrep1 Prelim ReviewerJoseph John SarmientoNo ratings yet

- Measuring The Bullwhip Effect in The Supply ChainDocument13 pagesMeasuring The Bullwhip Effect in The Supply ChainEurico NetoNo ratings yet

- Amway's Non-Conventional Communication ModelDocument11 pagesAmway's Non-Conventional Communication ModelmoneyproNo ratings yet

- Measuring and Delivering Marketing Performance: Mcgraw-Hill/IrwinDocument11 pagesMeasuring and Delivering Marketing Performance: Mcgraw-Hill/Irwinmuhammad yusufNo ratings yet

- Bang On in Network MarketingDocument4 pagesBang On in Network MarketingZara AsrarNo ratings yet

- Nestle Marketing StrategiesDocument28 pagesNestle Marketing StrategiesMuneeb AbbasiNo ratings yet

- Nutrition Club Rules India-Sep 2010Document12 pagesNutrition Club Rules India-Sep 2010Prateek BatraNo ratings yet

- Gefco GroupDocument2 pagesGefco GroupJesús RenteriaNo ratings yet

- Digitalentrepreneurship 161027101629Document49 pagesDigitalentrepreneurship 161027101629Andhi PrionoNo ratings yet