Professional Documents

Culture Documents

Alter-Eu To Barnier 13 July 2010 0

Uploaded by

Ultimo NezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alter-Eu To Barnier 13 July 2010 0

Uploaded by

Ultimo NezCopyright:

Available Formats

The Alliance for Lobbying Transparency and Ethics Regulation in the EU (ALTER-EU) Brussels, July 13 2010 To: Re:

Michel Barnier, European Commissioner for Internal Market and Services Securing balanced representation in expert groups dealing with financial issues

Dear Commissioner Michel Barnier, MEP Sven Giegold informed us about the meeting you had on July 9 th to discuss the issue of Commission expert groups on financial market regulation issues. We are very encouraged to hear that you will improve transparency around these expert groups and ensure a balanced representation within the groups, including rebalancing expert groups suffering from a biased composition. With this letter we would like to present a list of expert groups on financial issues that we consider to be unbalanced as well as some specific proposals for solving these problems. There are currently at least eleven expert groups on financial market issues with an unbalanced composition in favour of the (financial) business sector (companies and trade associations). In our view, the composition of these expert groups does not respect the Commission's Principles and Guidelines on the Collection and Use of Expertise or the General Principles and Minimum Standards for Consultation of Interested Parties. Nine of these groups were covered in our report A Captive Commission: the role of financial industry in shaping EU regulation (November 2009).1 The eleven groups are the following:

1. Clearing and Settlement Advisory and Monitoring Expert Group 2 (31 industry representatives) http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=2194

2. Clearing and Settlement Code of Conduct Monitoring Group (62 industry and 4 government

representatives) - http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=1926

3. EU Clearing and Settlement: Fiscal Compliance group (9 industry, 3 government, 1 academic, and 1 4. 5. 6. 7. 8. 9.

1

private expert representatives) - http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=1445 EU Clearing and Settlement: Legal Certainty group (22 industry, 6 government, 7 academic, and 1 private expert representatives) - http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=1444 European Securities Markets Expert Group (21 industry representatives) 2 http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=1816 Payment Systems Market Group (35 industry, 2 government, and 3 NGO representatives) http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=655 Payment Systems Market Expert Group (43 industry, 2 government, 1 academic, 1 trade union, and 3 NGO representatives) - http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=2287 The Expert Group on Financial Education (14 industry representatives, and 5 private experts) http://ec.europa.eu/internal_market/finservices-retail/docs/capability/members_en.pdf Expert group on credit histories (10 industry, 2 public data protection bodies, 3 from consumer

A Captive Commission: the role of financial industry in shaping EU regulation, ALTER-EU, November 2009. http://www.greenpeace.org/raw/content/eu-unit/press-centre/reports/a-captive-commission-5-11-09.pdf The ESME Group has been removed from the Register of Expert Groups. However the minutes of its last meeting clearly state that it is to be consulted on issues reaching far out into the future. It should be clarified whether this group has been dissolved or not and if not then it should be re-included in the Register. http://ec.europa.eu/internal_market/securities/docs/esme/agenda_20091210_en.pdf

organisations, 4 credit information companies, one representative of the thinktank CEPS) http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=2191 10. Derivatives Expert Group (34 industry and 10 government representatives) http://ec.europa.eu/transparency/regexpert/detail.cfm?ref=2299 11. Group of Experts in Banking Issues (37 industry, two academics and one NGO) http://ec.europa.eu/internal_market/bank/docs/list-gebi-members_en.pdf For each of these and other unbalanced expert groups we recommend a far-reaching rebalancing: changing the composition by including more consumer groups, independent academics, civil society organisations and trade unions. Considering their unbalanced composition, a wider change in the mandate and work programme of these groups should be considered as well in order to ensure that societal impacts of financial market policies are included. In addition it is our strong opinion that experts working for corporations, industry associations, NGOs or trade unions with financial interests in the issues dealt with by the expert group, cannot be members of such expert groups in a personal capacity. As they have a clear interest, it should be clear that they act on behalf of that interest. More generally, we would like to make the following recommendations: 1: Disclose the full membership (names and organisations) and all relevant documents (reports and minutes) for all groups that advise the Commission on financial regulation in the register for expert groups (including ad-hoc working groups). 2: Initiate a broad critical review of the Commission's practices regarding expert groups on financial regulation over the last years, including an assessment of topics and mandates (as the tendency has been to establish expert groups on issues mainly of interest to industry, while ignoring societal interests) 3: The Commission must ensure a balanced representation of all its expert groups, through open and fair processes around the application for and selection of membership, seeking a diversity of views. These rules must apply to all expert groups, including those dealing with technical issues. Steps to achieve this should include: full online transparency around the launch of new Expert Groups, and broad outreach for calls for expertise safeguards against unbalanced composition of expert groups. No expert group should be dominated by industry representatives (representatives of commercial interests should never make up more than half of non-governmental participants) These measures should not just be applied to new groups, but to existing groups as well. 4: Representatives of firms and organisations should not be in expert groups in a personal capacity 5: The Commission must offer sufficient financial compensation to enable non-industry experts (academics, civil society groups and other public interest groups) to participate in expert groups, including for building up independent expertise We look forward to your response to our proposals. Yours sincerely, The steering committee of ALTER-EU Paul de Clerck (Friends of the Earth Europe); William Dinan (Strathclyde University & Spinwatch); Marc Gruber (European Federation of Journalists); Gildas Jossec, AITEC; Monika Kosinska, European Public Health Alliance (EPHA); Ulrich Mller (LobbyControl); Jorgo Riss (Greenpeace European Unit); Erik Wesselius (Corporate Europe Observatory).

You might also like

- OXERA - Quantifying Antitrust DamagesDocument179 pagesOXERA - Quantifying Antitrust DamagesJavo IgnacioNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Related LiteratureDocument3 pagesRelated LiteratureCharles Adrian100% (2)

- TQM Multiple Choice QuestionsDocument14 pagesTQM Multiple Choice Questionskandasamykumar67% (3)

- Mediation GuideDocument36 pagesMediation Guidecomposiacredula4444No ratings yet

- Oecd Principle For Integrity in Public ProcurementDocument142 pagesOecd Principle For Integrity in Public ProcurementNatika_IndieLVNo ratings yet

- TEMPLATE - Proposal For Legal Service - Due DiligenceDocument7 pagesTEMPLATE - Proposal For Legal Service - Due Diligencekamal100% (3)

- Alternatives in Todays Capital MarketsDocument16 pagesAlternatives in Todays Capital MarketsjoanNo ratings yet

- Trust and CommitmentDocument11 pagesTrust and CommitmentdjumekenziNo ratings yet

- FMC Plug Valve Manifolds Prices Not Current FC PVMCDocument16 pagesFMC Plug Valve Manifolds Prices Not Current FC PVMCSUMSOLCA100% (1)

- Export Procedure GuideDocument128 pagesExport Procedure GuidePrateek SinghNo ratings yet

- DO 193 s2016Document13 pagesDO 193 s2016khraieric16No ratings yet

- Standard Operating Procedure For Customer ServiceDocument8 pagesStandard Operating Procedure For Customer ServiceEntoori Deepak ChandNo ratings yet

- Corpolaw Outline 2 DigestDocument24 pagesCorpolaw Outline 2 DigestAlexPamintuanAbitanNo ratings yet

- Investment DecisionsDocument39 pagesInvestment DecisionsQwertyNo ratings yet

- Weather As A Force Multiplier, Owning The Weather in 2025Document52 pagesWeather As A Force Multiplier, Owning The Weather in 2025TODOESTARELACIONADO.WORDPRESS.COM100% (1)

- Comparative Analysis On Competition Policy USA Vs EUDocument56 pagesComparative Analysis On Competition Policy USA Vs EUDiana EnacheNo ratings yet

- Hedge Funds enDocument250 pagesHedge Funds enPhuong Phan100% (1)

- Deed of Absolute Sale of A Motor VehicleDocument2 pagesDeed of Absolute Sale of A Motor VehicleFroilan FerrerNo ratings yet

- Studie Crookedcounsel 05052014 1446 FinalDocument36 pagesStudie Crookedcounsel 05052014 1446 Finalwanema22No ratings yet

- Financial Institutions Center: Financial Market Regulation: The Case of Italy and A Proposal For The Euro AreaDocument29 pagesFinancial Institutions Center: Financial Market Regulation: The Case of Italy and A Proposal For The Euro Areasudeep_dwhNo ratings yet

- Financial Lobby Report PDFDocument24 pagesFinancial Lobby Report PDFalcoma67No ratings yet

- DG Markt G2 MET/OT/acg D (2010) 768690: Egislation On Legal Certainty of Securities Holding and DispositionsDocument37 pagesDG Markt G2 MET/OT/acg D (2010) 768690: Egislation On Legal Certainty of Securities Holding and DispositionspisterboneNo ratings yet

- A Matter of JusticeDocument44 pagesA Matter of JusticeJose Carlos Thissen MogrovejoNo ratings yet

- Discussion Paper: An Overview of The Proxy Advisory Industry. Considerations On Possible Policy OptionsDocument40 pagesDiscussion Paper: An Overview of The Proxy Advisory Industry. Considerations On Possible Policy OptionsMarketsWikiNo ratings yet

- Stock Market Consolidation and Security Markets Regulation in EuropeDocument6 pagesStock Market Consolidation and Security Markets Regulation in EuropeFistonNo ratings yet

- Πορισμα ΣοφώνDocument65 pagesΠορισμα ΣοφώνDimitris TsoukasNo ratings yet

- CBT Eu PDFDocument95 pagesCBT Eu PDFGourav GoyelNo ratings yet

- Feedback Statement enDocument18 pagesFeedback Statement enMarketsWikiNo ratings yet

- Dawn Mark Panel DiscussionDocument1 pageDawn Mark Panel DiscussionKryzel Lho Baclaan EspañaNo ratings yet

- General Questionnaire C L R R: Ivil AW Ules On OboticsDocument30 pagesGeneral Questionnaire C L R R: Ivil AW Ules On OboticsAnushree VinuNo ratings yet

- Competition in Professional Services New Light and New ChallengesDocument13 pagesCompetition in Professional Services New Light and New ChallengesdmaproiectNo ratings yet

- Ioscobn03 11Document3 pagesIoscobn03 11MarketsWikiNo ratings yet

- Speech of MR Vinod Dhall, Member, Competition Commission of IndiaDocument7 pagesSpeech of MR Vinod Dhall, Member, Competition Commission of IndiaNandita SatputeNo ratings yet

- Andrea Enria's Speech On FinTech at Copenhagen Business School 090318Document11 pagesAndrea Enria's Speech On FinTech at Copenhagen Business School 090318GHrsNo ratings yet

- Esma Guidelines Ucits Etfs and Structured UcitsDocument40 pagesEsma Guidelines Ucits Etfs and Structured UcitsMarketsWikiNo ratings yet

- Mario Monti's Report on Re-launching the Single MarketDocument2 pagesMario Monti's Report on Re-launching the Single MarketMirela MărcuțNo ratings yet

- Consumer ProtectionDocument63 pagesConsumer Protectionsakthi dasanNo ratings yet

- Industrial Organization: Marc BourreauDocument15 pagesIndustrial Organization: Marc Bourreauheh92No ratings yet

- Ruggie Report 7 Apr 2008Document28 pagesRuggie Report 7 Apr 2008karthikshazNo ratings yet

- Europe Can Do Better: How EU Policymakers Can Strengthen The Corporate Sustainability Due Diligence DirectiveDocument12 pagesEurope Can Do Better: How EU Policymakers Can Strengthen The Corporate Sustainability Due Diligence DirectiveFIDH FIDHNo ratings yet

- Hedge Funds and Private Equity - A Critical AnalysisDocument21 pagesHedge Funds and Private Equity - A Critical AnalysisGeorge SatlasNo ratings yet

- Smart Textiles For Sports: Report On Promising Kets-Based Products Nr. 1Document24 pagesSmart Textiles For Sports: Report On Promising Kets-Based Products Nr. 1Amna FarooquiNo ratings yet

- Class NotesDocument6 pagesClass Notesbubububu17No ratings yet

- Preventive Legal Measures Against Organised Crime: Council of EuropeDocument28 pagesPreventive Legal Measures Against Organised Crime: Council of EuropeAmit ThokeNo ratings yet

- Report Consultation FinalDocument11 pagesReport Consultation FinalAlbino DoctorNo ratings yet

- Scale Scope and Survival-A Comparison of Cooperative and Capitalist Modes of ProductionDocument24 pagesScale Scope and Survival-A Comparison of Cooperative and Capitalist Modes of ProductionMiguel Villareal-DiazNo ratings yet

- Europe's Next Leaders - The Start-Up and Scale-Up InitiativeDocument12 pagesEurope's Next Leaders - The Start-Up and Scale-Up InitiativeDicky ChandraNo ratings yet

- Lecture Notes On Eu Law Competition PDFDocument47 pagesLecture Notes On Eu Law Competition PDFNahmyNo ratings yet

- The Importance of The Financial Services Industry:: Check Against DeliveryDocument7 pagesThe Importance of The Financial Services Industry:: Check Against DeliveryRuchier NirvanNo ratings yet

- Travail DemandéDocument2 pagesTravail DemandéAlbert IsaacNo ratings yet

- The French Duty of Vigilance Law-Lessons For An EU Directive On Due Diligence in Multinational Supply Chains-2021Document5 pagesThe French Duty of Vigilance Law-Lessons For An EU Directive On Due Diligence in Multinational Supply Chains-2021Adel EdjarNo ratings yet

- Advocacy Toolkit 2011Document39 pagesAdvocacy Toolkit 2011wilder resurreccionNo ratings yet

- RelatedDocument3 pagesRelatedJivica SmithNo ratings yet

- Germany Legal Framework Analysis ReportDocument21 pagesGermany Legal Framework Analysis ReportAndoniAlvzNo ratings yet

- Enel's DocumnentDocument12 pagesEnel's DocumnentSunit BhalshankarNo ratings yet

- Dg-4-Afco Et (2003) 329438 enDocument68 pagesDg-4-Afco Et (2003) 329438 enEdited By MENo ratings yet

- Comm CAST QuestionsDocument14 pagesComm CAST Questionsdsadsa sddsaNo ratings yet

- Vertical Alliances For Origin Labelled FDocument19 pagesVertical Alliances For Origin Labelled Fyana arsyadiNo ratings yet

- CNECT CallHighLevelGrouponAIpdfDocument29 pagesCNECT CallHighLevelGrouponAIpdfAleksandar PetrovNo ratings yet

- Industrial Policy and Economic Reforms Papers 2Document59 pagesIndustrial Policy and Economic Reforms Papers 2Alberto LucioNo ratings yet

- Choice in The Uk Audit Market: Nicolas VéronDocument7 pagesChoice in The Uk Audit Market: Nicolas VéronBruegelNo ratings yet

- Class 2Document7 pagesClass 2Cristina StanNo ratings yet

- Responsabilidad Solidaria y mancomunada de las ETNsDocument5 pagesResponsabilidad Solidaria y mancomunada de las ETNsUday Ssaddan LopezNo ratings yet

- The Changing Nature of International Business: Growth, Deregulation, and TechnologyDocument10 pagesThe Changing Nature of International Business: Growth, Deregulation, and TechnologyBruniscaNo ratings yet

- Oiml B 15: Asic UblicationDocument10 pagesOiml B 15: Asic Ublicationsanta3No ratings yet

- Tradoc 153399Document9 pagesTradoc 153399Eric WhitfieldNo ratings yet

- Lamfalussy Report Calls for Urgent Reform of EU Securities Markets RegulationDocument5 pagesLamfalussy Report Calls for Urgent Reform of EU Securities Markets RegulationAndreea IvanNo ratings yet

- Economic Analysis and Policies: AssignmentDocument8 pagesEconomic Analysis and Policies: AssignmentMuhammad Shahzad IjazNo ratings yet

- 2004 - Forum Group On Mortgage Credit - The Integration of The Eu Mortgage Credit MarketsDocument70 pages2004 - Forum Group On Mortgage Credit - The Integration of The Eu Mortgage Credit MarketsdontfollowmeNo ratings yet

- Making Europe's Businesses Future-Ready: A New Industrial Strategy For A Globally Competitive, Green and Digital EuropeDocument3 pagesMaking Europe's Businesses Future-Ready: A New Industrial Strategy For A Globally Competitive, Green and Digital EuropeluiNo ratings yet

- The Regulatory Environment: Part Two of The Investors' Guide to the United Kingdom 2015/16From EverandThe Regulatory Environment: Part Two of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- October 19, 2018 Approval Letter - VarivaxDocument2 pagesOctober 19, 2018 Approval Letter - VarivaxUltimo NezNo ratings yet

- NasaDocument108 pagesNasaVelibor MinićNo ratings yet

- Tracing Anthropogenic Carbon Dioxide and Methane Emissions To Fossil Fuel and Cement Producers, 1854 - 2010Document13 pagesTracing Anthropogenic Carbon Dioxide and Methane Emissions To Fossil Fuel and Cement Producers, 1854 - 2010Ley EscalNo ratings yet

- 14 January 1999 - European Parliament - REPORT On The Environment, Security and Foreign Policy Committee On Foreign Affairs, Security and Defence PolicyDocument35 pages14 January 1999 - European Parliament - REPORT On The Environment, Security and Foreign Policy Committee On Foreign Affairs, Security and Defence PolicyGeorg ElserNo ratings yet

- Declaration and Order Arrest Order Against The Slavery System One People S Public TrustDocument3 pagesDeclaration and Order Arrest Order Against The Slavery System One People S Public TrustUltimo NezNo ratings yet

- Manifest 2Document1 pageManifest 2abcmaster3No ratings yet

- Weath - Mod .Act 05 Senate Bill SDocument4 pagesWeath - Mod .Act 05 Senate Bill SUltimo NezNo ratings yet

- LicenseDocument3 pagesLicenseUltimo NezNo ratings yet

- Dr. Jignesh R: TrivediDocument3 pagesDr. Jignesh R: Triveditrivedi jigsNo ratings yet

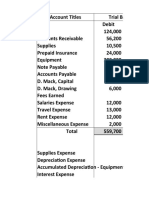

- Trial Balance Accounting RecordsDocument8 pagesTrial Balance Accounting RecordsKevin Espiritu100% (1)

- Case Study Notes Threshold SportsDocument1 pageCase Study Notes Threshold SportsHenry Hu0% (1)

- Unit 32 QCF Quality Management in BusinessDocument6 pagesUnit 32 QCF Quality Management in BusinessdrakhtaraliNo ratings yet

- Project ManagementDocument2 pagesProject ManagementLsrc Lala RamosNo ratings yet

- Naguiat V NLRCDocument9 pagesNaguiat V NLRCArJanNo ratings yet

- Assignment1 10%Document3 pagesAssignment1 10%Felicia ChinNo ratings yet

- Union Voices: Tactics and Tensions in UKDocument3 pagesUnion Voices: Tactics and Tensions in UKLalit ModiNo ratings yet

- "Analysis of Brand Equity of Videocon", in The City of BhubaneswarDocument68 pages"Analysis of Brand Equity of Videocon", in The City of BhubaneswarDK LohiaNo ratings yet

- Digital Finance and Its Impact On Financial InclusDocument51 pagesDigital Finance and Its Impact On Financial InclusHAFSA ASHRAF50% (2)

- Modern Systems Analysis and Design: The Sources of SoftwareDocument39 pagesModern Systems Analysis and Design: The Sources of SoftwareNoratikah JaharudinNo ratings yet

- Generational Personality Quiz HandoutDocument2 pagesGenerational Personality Quiz HandoutPnp KaliboNo ratings yet

- 26Document31 pages26Harish Kumar MahavarNo ratings yet

- LTL Panel Track Shipment DetailsDocument3 pagesLTL Panel Track Shipment DetailsAlok Kumar BiswalNo ratings yet

- Chapter 3 - Food ProductionDocument14 pagesChapter 3 - Food ProductionjohanNo ratings yet

- LW Renovations statement of accountDocument1 pageLW Renovations statement of accountaleksNo ratings yet

- Philippine Government Electronic Procurement System GuideDocument11 pagesPhilippine Government Electronic Procurement System GuideDustin FormalejoNo ratings yet

- Audit Practice Manual - IndexDocument4 pagesAudit Practice Manual - IndexIftekhar IfteNo ratings yet

- ICCFA Magazine January 2016Document116 pagesICCFA Magazine January 2016ICCFA StaffNo ratings yet